Escolar Documentos

Profissional Documentos

Cultura Documentos

CAPCON ChartBook

Enviado por

CreditTraderDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CAPCON ChartBook

Enviado por

CreditTraderDireitos autorais:

Formatos disponíveis

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

IG credit spreads broke above their 200DMA

HY credit spreads broke above their 200DMA

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

Each time rolling HY-IG beta has dropped below 3x, we have seen notable decompression.

HY-IG differential at six month wides. Interesting that demand not stepped back in given multiple expansion of last few months in HY over IG ratio.

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

HY realized vol finally breaking upwards will tend to reduce appetite further from reach-foryield perspective.

We warned of risk appetite changes in Match and switched to outright negative in April. Dramatically more downside in credit still just from QE2.

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

We warned of a rising dispersion in HY in Q1 as investors stopped buying everything. Discrimination has picked up and now is reaching IG also.

HY curves were very steep anyway. Hedging recently has over-extended the 5Y alone and last week or so we saw major flattening as 3Y underperformed crowded trade!

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

The preferred trade for HY derisking was Short IG Insurers relative to IG corporates. This is working very well as Insurers are nothing more than levered portfolios of HY debt.

One unique insight is the shift in internal correlations among index components. We warned when we saw HY rise notably and now equity and IG credit has joined it as systemic selling is under way.

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

The credit market (both IG and HY) trade cheap to equity/vol implied levels credit anticipates and equity confirms credit is leading the way.

We strongly suggested that we would see HY realized vol rising quicker than S&P 500 realized vol. This highly meanreverting relationship is playing out as we expected.

www.capitalcontext.com @capitalcontext Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

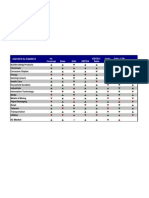

Credit Market Performance since 5/31 3Y close.

IG16 5Y

99.81 +10.31 96.13 +7.97 110.38 +7.88 114.55 +9.53 408.75 +38.75 397.77 +42.22 506.26 +59.80 487.23 +58.65 230.00 +33.50 223.19 +31.02 134.45 +11.35 126.08 +12.50 56.98 +4.93 46.78 +5.81 114.98 +17.90 113.19 +17.30 172.63 +15.88 171.96 +20.26 62.25 +8.00 57.42 +10.73 160.75 +21.75 159.12 +20.72 305.50 +46.00 290.92 +43.72 179.87 +14.48 178.80 +15.95 54.09 +6.28 49.49 +7.06 180.21 +20.62 179.05 +19.08 185.28 +12.56 188.77 +16.17 48.78 +4.62 47.99 +7.15 194.08 +20.70 193.13 +18.59

7Y

114.52 +6.33 119.49 +7.36 125.78 +8.20 129.32 +8.89 436.80 +36.79 427.95 +41.91

10Y

128.67 +5.93 135.58 +6.54 136.51 +7.94 140.78 +9.02 448.69 +35.46 440.67 +40.70

IG Cheap to FV in 3Y & 5Y, Rich to 7Y & 10Y

Main15

Main FV cheap due to FINLs

XOver15

HY16

3Y underperformed relatively

SovX

FINLs

FINLs-Main

HiVol15

FINSUB

Index Chg FV Chg Index Chg FV Chg Index Chg FV Chg Index Chg FV Chg Index Chg FV Chg Index Chg FV Chg Index Chg FV Chg Index Chg FV Chg Index Chg FV Chg

61.30 +5.77 56.03 +5.30 77.47 +6.42 79.30 +6.69 298.34 +27.29 289.11 +29.91 367.98 +55.98 353.39 +44.17

SovX liquidity premium

FIN Sub index liquidity premium

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

Contextual Cycle is reverting back to fair-value.

Last week saw Consumer Staples diverge from fair-value but Materials and Healthcare converge.

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

Financials equities underperforming credit the most. Energy credits outperforming equities the most in the last week.

Less credit underperformance as we move up in quality. Equity underperforming credit. Bottomline -> Up-In-Quality and Up-In-Capital-Structure preference is very clear recently.

www.capitalcontext.com

@capitalcontext

Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

Normalized performance of credit and equities last week. Utilities and Capital Goods stand out.

The normalized Volatility performance relative to Credit notice how much better behaved this is than stocks Vol is rising and will continue to do so as it was low relative to credit anyway.

www.capitalcontext.com @capitalcontext Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

The change in implied vol rises very notably across quality and as the relative credit performance (x-axis) over stocks.

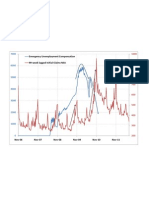

Financial Systemic Risk near oneyear highs. +100% from Q4/09 lows

www.capitalcontext.com @capitalcontext Capital Context LLC, 2011

A UNIQUE SERVICE FOR INDIVIDUAL INVESTORS

US and European risk rising rapidly relative to Asian bank risk.

US bank CDS starting to catch up to US bank bond spreads and equities not a good sign at all!

www.capitalcontext.com @capitalcontext Capital Context LLC, 2011

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Reynolds Public Health Proclamation - 2020.04.06Documento5 páginasReynolds Public Health Proclamation - 2020.04.06Shane Vander HartAinda não há avaliações

- USD TLGP MaturitiesDocumento1 páginaUSD TLGP MaturitiesCreditTraderAinda não há avaliações

- Fifth Circuit Decision Against FDA in Apter CaseDocumento24 páginasFifth Circuit Decision Against FDA in Apter CaseAssociation of American Physicians and Surgeons100% (1)

- IG Fundamentals Q22010Documento1 páginaIG Fundamentals Q22010CreditTraderAinda não há avaliações

- Weaponization Committee: HOW A "CYBERSECURITY" AGENCY COLLUDED WITH BIG TECH AND "DISINFORMATION" PARTNERS TO CENSOR AMERICANSDocumento37 páginasWeaponization Committee: HOW A "CYBERSECURITY" AGENCY COLLUDED WITH BIG TECH AND "DISINFORMATION" PARTNERS TO CENSOR AMERICANSJim Hoft100% (2)

- SPX Now and ThenDocumento1 páginaSPX Now and ThenCreditTraderAinda não há avaliações

- Credit ContractionDocumento1 páginaCredit ContractionCreditTraderAinda não há avaliações

- IG-HY Vs Stocks Relative-ValueDocumento1 páginaIG-HY Vs Stocks Relative-ValueCreditTraderAinda não há avaliações

- HY-IG Vs StocksDocumento1 páginaHY-IG Vs StocksCreditTraderAinda não há avaliações

- SPL 20101019Documento1 páginaSPL 20101019CreditTraderAinda não há avaliações

- HY Vs IG DurationDocumento1 páginaHY Vs IG DurationCreditTraderAinda não há avaliações

- EUC and 99-Week-Lagged Initial ClaimsDocumento1 páginaEUC and 99-Week-Lagged Initial ClaimsCreditTraderAinda não há avaliações

- CDR Csa 201007Documento1 páginaCDR Csa 201007CreditTraderAinda não há avaliações

- IG Over TSYDocumento1 páginaIG Over TSYCreditTraderAinda não há avaliações

- HY-IG Vs EquityDocumento1 páginaHY-IG Vs EquityCreditTraderAinda não há avaliações

- EUR Vs GDP-Weighted CDSDocumento1 páginaEUR Vs GDP-Weighted CDSCreditTraderAinda não há avaliações

- C&I Loans + ABCP - Aggregate CreditDocumento1 páginaC&I Loans + ABCP - Aggregate CreditCreditTraderAinda não há avaliações

- CDR Csa Aug2010Documento1 páginaCDR Csa Aug2010CreditTraderAinda não há avaliações

- CDR Csa Scatter Aug10Documento1 páginaCDR Csa Scatter Aug10CreditTraderAinda não há avaliações

- FSB30 IntrinsicsDocumento1 páginaFSB30 IntrinsicsCreditTraderAinda não há avaliações

- IG Range CompressionDocumento1 páginaIG Range CompressionCreditTraderAinda não há avaliações

- CDR Csa 20100813Documento1 páginaCDR Csa 20100813CreditTraderAinda não há avaliações

- IG Weekly RangeDocumento1 páginaIG Weekly RangeCreditTraderAinda não há avaliações

- Exchange Rate Regime Analysis For The Chinese YuanDocumento10 páginasExchange Rate Regime Analysis For The Chinese YuanCreditTraderAinda não há avaliações

- Spread Leverage ComparisonDocumento1 páginaSpread Leverage ComparisonCreditTraderAinda não há avaliações

- CDR Csa 20100716Documento1 páginaCDR Csa 20100716CreditTraderAinda não há avaliações

- IG Vs TSY CycleDocumento1 páginaIG Vs TSY CycleCreditTraderAinda não há avaliações

- JUN Roll by SectorDocumento1 páginaJUN Roll by SectorCreditTraderAinda não há avaliações

- Implied CorrelationDocumento1 páginaImplied CorrelationCreditTraderAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- AC330 Class2 CascinoDocumento18 páginasAC330 Class2 Cascino2c_adminAinda não há avaliações

- Financial Planning of IndividualsDocumento70 páginasFinancial Planning of Individualstanvi100% (1)

- 15 The Functioning of Financial MarketsDocumento23 páginas15 The Functioning of Financial Marketsrajeshaisdu009Ainda não há avaliações

- Contrarian Investment ExtrapolationDocumento11 páginasContrarian Investment ExtrapolationB.C. MoonAinda não há avaliações

- Auto Trender PPT SMCDocumento14 páginasAuto Trender PPT SMCMithil Doshi100% (1)

- Fin 383 Final Cheat SheetDocumento1 páginaFin 383 Final Cheat SheetAnonymous ODAZn6VL6Ainda não há avaliações

- QUIZDocumento74 páginasQUIZmabelpal4783100% (2)

- English For Accounting A - Z Word List: Email - Wordlist Copy - QXD 4/4/07 3:40 PM Page 1Documento8 páginasEnglish For Accounting A - Z Word List: Email - Wordlist Copy - QXD 4/4/07 3:40 PM Page 1Do NguyenAinda não há avaliações

- Stopper v. Kestel, 4th Cir. (2001)Documento5 páginasStopper v. Kestel, 4th Cir. (2001)Scribd Government DocsAinda não há avaliações

- Finalchapter 21Documento9 páginasFinalchapter 21Jud Rossette ArcebesAinda não há avaliações

- Stock StrategiesDocumento29 páginasStock StrategiesHans CAinda não há avaliações

- The Upper Doab Sugar Mills LimitedDocumento96 páginasThe Upper Doab Sugar Mills LimitedAgam MittalAinda não há avaliações

- A Project Report: "Equity Analysis"Documento103 páginasA Project Report: "Equity Analysis"Sampath SanguAinda não há avaliações

- Kraft HeinzDocumento43 páginasKraft HeinzAnonymous 6f8RIS6Ainda não há avaliações

- Building A Holistic Capital Management FrameworkDocumento16 páginasBuilding A Holistic Capital Management FrameworkCognizantAinda não há avaliações

- Bain and CompanyDocumento10 páginasBain and CompanyRahul SinghAinda não há avaliações

- CURRENT PRICING OF IPOs: Is It Investor-Friendly?Documento53 páginasCURRENT PRICING OF IPOs: Is It Investor-Friendly?Sayam RoyAinda não há avaliações

- GHCL Limited - : 1 P - (FaxDocumento30 páginasGHCL Limited - : 1 P - (FaxShyam SunderAinda não há avaliações

- Accounting For PartnershipsDocumento58 páginasAccounting For PartnershipsAmy MurphyAinda não há avaliações

- CFA Tai Lieu On TapDocumento100 páginasCFA Tai Lieu On Tapkey4onAinda não há avaliações

- Interest Rate CollarDocumento3 páginasInterest Rate Collarinaam mahmoodAinda não há avaliações

- 2015 Narra Nickel Mining v. Redmont Consolidated MinesDocumento1 página2015 Narra Nickel Mining v. Redmont Consolidated MinesMarioneMaeThiamAinda não há avaliações

- Aimr - Investing Separately Alpha and Beta PDFDocumento102 páginasAimr - Investing Separately Alpha and Beta PDFAnonymous Mgq9dupCAinda não há avaliações

- Jpmorgan's 129 Page Internal Report On Whale Jan 16 2013Documento132 páginasJpmorgan's 129 Page Internal Report On Whale Jan 16 201383jjmackAinda não há avaliações

- Predicting Movement of Stock of Y Using Sutte IndicatorDocumento11 páginasPredicting Movement of Stock of Y Using Sutte Indicatoransari1621Ainda não há avaliações

- Financial InnovationDocumento19 páginasFinancial InnovationSiva ShankarAinda não há avaliações

- Statement of Cashflows SlidesDocumento48 páginasStatement of Cashflows SlidesAnita KhanAinda não há avaliações

- Dividend Decision ICICI by ImtiazaliDocumento26 páginasDividend Decision ICICI by ImtiazaliImtiyazMoverAinda não há avaliações

- Principles of Finance - 2101Documento14 páginasPrinciples of Finance - 2101Noel MartinAinda não há avaliações

- Threshold Heteroskedastic Models: Jean-Michel ZakoianDocumento25 páginasThreshold Heteroskedastic Models: Jean-Michel ZakoianLuis Bautista0% (1)