Escolar Documentos

Profissional Documentos

Cultura Documentos

About Cimb

Enviado por

Shahmin HalimiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

About Cimb

Enviado por

Shahmin HalimiDireitos autorais:

Formatos disponíveis

PROFILE CIMB Group is ASEAN's leading universal banking franchise.

We offer a full range of financial products and services covering consumer banking, corporate and investment banking, Islamic banking, asset management, wealth management, insurance and takaful, and private banking. With over 37,000 employees, CIMB Group reaches 81% of the ASEAN population, representing 89% of the regions gross domestic product. Our retail network of over 1,000 branches is the widest in the region. Headquartered in Kuala Lumpur, CIMB Group's main markets are Malaysia, Indonesia, Singapore, Thailand and Cambodia. Our presence in 13 countries covers ASEAN and major global financial centres, as well as countries in which our customers have significant business and investment dealings. In addition, we extend our reach and range of products and services through strategic partnerships. Our partners include the Principal Financial Group, Aviva plc, Bank of TokyoMitsubishi UFJ, Standard Bank plc, Daishin Securities and the Kanoo Group, among others. HISTORY Yyear

Historical Event

1924 Bian Chiang Bank established in Kuching, Sarawak, Malaysia Bian Chiang Bank was established in Kuching by Wee Kheng Chiang in 1924. In its early days, the bank's activities were mainly related to business financing and the issuance of bills of exchange. The prominent Wee family soon became famous as founding members of the United Overseas Bank (UOB) in Singapore in 1971. 1935 Ban Hin Lee Bank established in Penang, Malaysia Ban Hin Lee Bank Bhd, founded by "Towkay" Yeap Chor Ee, was formally incorporated as a private limited company on 17 September 1935. The bank's original business focus was to serve local businesses in their trade and merchant activities. In the 1960s, it also branched into real estate and home financing. By the 1990s, the bank had become a modern and thriving financial institution, with its headquarters in Penang and operations throughout Malaysia and Singapore. It became a public-listed company on the Kuala Lumpur Stock Exchange (KLSE) on 7 January 1991. 1955 Bank Niaga founded in Indonesia Established as a national private bank, Bank Niaga gained a great deal of trust from its costumers and expanded to become a full service bank in 1974. Bank Lippo, had also been founded in 1948 with headquarters in Tangerang, Indonesia. 1965 Southern Bank Bhd was founded as Southern Banking Ltd Founded in 1965 from humble roots in Penang, Southern Banking Ltd quickly expanded to other parts of Malaysia.

It was later renamed Southern Bank Bhd and gained recognition as an important player in wealth management products, credit cards and SME lending. The bank was the first in Malaysia to set up the MEPS/ATM system. 1965 Bank Bumiputra Malaysia Bhd incorporated in 1965 Bank Bumiputra was established in 1965, in line with government initiatives to increase Bumiputra participation in the Malaysian economy. By the 1980s, it had become the largest bank in the country in terms of assets. Its infrastructure provided access to banking facilities where there was none before, contributing to the growth of small-scale enterprises and assisting the flow of investment into rural areas. It was the first Malaysian bank to have operations in New York, London, Tokyo, Bahrain and Hong Kong. In 1982, it was listed as the largest bank in Southeast Asia by Asian Finance magazine. 1972 United Asian Bank Bhd established in Kuala Lumpur United Asian Bank started as a banking joint-venture between Malaysia and India, as a result of the merger of three Indian-owned banks Indian Overseas Bank Ltd, Indian Bank Ltd and United Commercial Bank Ltd. United Asian Bank took over the operations of the Malaysian branches of these Indian banks in 1972. The bank's business was mainly directed at small businesses and individuals. In its time, it established a reputation for encouraging enterprise amongst the less prosperous sections of the community. 1974 Pertanian Baring Sanwa Multinational Bhd incorporated Pertanian Baring Sanwa Multinational was founded in April 1974 by Bank Pertanian of Malaysia, Baring Brothers and Multinational Bank of the UK, and Sanwa Bank of Japan. Under the management of Baring Brothers, Pertanian Baring Sanwa Multinational provided corporate advisory and funding services to multinationals, and undertook corporate restructuring and merger and acquisition activities for Malaysian companies. Practising a conservative and prudent approach, with a strict credit culture that limited its trading activities, the merchant bank remained relatively small compared to others. 1979 Bian Chiang Bank renamed Bank of Commerce Bhd The purchase of Bian Chiang Bank by Fleet Group led to the formation of Bank of Commerce Bhd in November 1979. Retaining the initials BCB, the new bank had a strong focus on systems and transparency from the very beginning, reflecting the management style of co-shareholder JP Morgan. An aggressive, performance-driven work culture pushed the bank forward, contributing to its emergence as one of the most progressive banks in the industry. In 1982, just three years since incorporation, what started out as a one-branch bank worth MYR8 million had become an institution with the total assets of MYR367 million and total shareholders' funds of MYR12.8 million.

1986 Pertanian Baring Sanwa Multinational renamed Commerce International Merchant Bankers Bhd In 1986, Bank of Commerce replaced Bank Pertanian as the controlling shareholder of Pertanian Baring Sanwa Multinational, following which its name was changed to Commerce International Merchant Bankers Bhd (CIMB). The new shareholders retained its focus on corporate finance and IPOs and in 1989, it emerged as Malaysia's top advisor for new listings. CIMB soon added stockbroking to complement its advisory and listings expertise, establishing an award-winning reputation as an equities broker and IPO house. This positioned the firm to enjoy high profits during the early 1990s equities "bull run". At the height of the buoyant era in equities, CIMB took a major strategic decision to build its capabilities in fixed income in anticipation of future market opportunities. This placed CIMB in an excellent position to reap rewards from the exponential bond market growth in the late 1990s. 1991 Bank of Commerce merges with United Asian Bank Bank of Commerce Bhd acquired United Asian Bank in November 1991, which resulted in a new entity named Bank of Commerce (M) Bhd. Meanwhile, Bank of Commerce Bhd, the listed holding company, was renamed Commerce-Asset Holdings Bhd. The acquisition was the starting point for more significant expansion to come. The Bank of Commerce branch network increased almost fourfold, complementing its established reputation in the corporate lending market. Formation of Bumiputra-Commerce Bank In October 1999, Bank Bumiputra emerged from the Asian financial crisis and other financial problems to merge with Bank of Commerce, resulting in the biggest merger in Malaysia's banking history. They formed Bumiputra-Commerce Bank, under the control of Commerce-Asset Holdings Bhd, and became the bank of choice to many multinational and local corporations, government organisations and individuals. Southern Bank acquires Ban Hin Lee Bank On 1 July 2000, Southern Bank acquired Ban Hin Lee Bank, along with United Merchant Finance Bhd (renamed Southern Finance Bhd), Perdana Finance Bhd and Cempaka Finance Bhd. This was part of the government-initiated banking consolidation plan. Commerce Asset-Holding Berhard became the majority shareholders in Bank Niaga Commerce Assest-Holding Berhard (CAHB) completed the acquisition of 51% of P.T Bank Niaga from the Indonesian Government via the Indonesian Bank Restructuring Agency (BRA). It is part of the series of strategic policies taken by the Indonesian government in response to the banking and economic crisis which befell the country following the onset of Asian monetary crisis mid-1997. The acquisition provided a rare opportunity for CAHB to acquire a majority stake in an Indonesian banking franchise which excels in customer service and technology innovation. CIMB Bhd lists on KLSE The listing of CIMB on the Main Board of the Kuala Lumpur Stock Exchange in January 2003 exceeded the expectations of investors and employees alike.

1999

2000

2002

2003

As it turned out, CIMB's listing lasted only about three years due to upcoming developments, but not before delivering returns of 340% to its shareholders. 2003 Launch of CIMB Islamic CIMB Islamic was officially launched by Malaysias Bank Negara Governor Tan Sri Dato' Dr Zeti Akhtar Aziz in June 2003. Since then, CIMB Islamic has won numerous accolades for its innovative Shariah-compliant solutions. In April 2005, Commerce-Tijari Bank Bhd was launched as the Islamic banking subsidiary of Bumiputra-Commerce Bank, providing the consumer market with an Islamic alternative for deposit accounts and financing. 2004 Formation of CIMB-Principal CIMB acquired 70% of Commerce Trust Bhd and Commerce Asset Fund Managers Sdn Bhd from Commerce Assets Holdings Bhd. The acquisition led to the formation of CIMB-Principal Asset Management Bhd, involving a joint venture with the Principal Group of USA. This marked the entry of a new player to Malaysia's burgeoning asset management sector. It was not long before CIMB-Principal made a decisive impact, winning numerous accolades for the returns from innovative products, such as the Global Titans Fund, Malaysia's first global equity investment fund. 2005 CIMB acquires G K Goh Securities Pte Ltd The acquisition of Singapore-based GK Goh Securities in June 2005 led to the formation of CIMB-GK Securities Pte Ltd, CIMB's international investment banking operations. G K Goh was founded in Singapore in 1979, evolving into a reputable pan-Asian stockbroking franchise with operations in Singapore, Indonesia, Hong Kong, the UK and the US. 2005 CIMB announces acquisition of Bumiputra-Commerce Group The acquisition of the Bumiputra-Commerce Group by CIMB was announced in June 2005, following the strategic decision by Commerce Asset Holdings Bhd (CAHB) to create a universal bank by combining its consumer and investment banks. As part of the exercise, CIMB was delisted from the KLSE and CAHB was renamed Bumiputra-Commerce Holdings Bhd. 2006 CIMB Groups restructuring exercise January 2006 marked the birth of the new CIMB Group as a universal bank. Complemented by the resources and reach of Bumiputra Commerce Bank, one of Malaysia's foremost retail banking providers, CIMB Group made the transition to a full-service banking provider, serving a range of customers, from corporates to individuals. Encapsulating investment banking, consumer banking, asset management and Islamic products and services, CIMB Group was now poised to make a stronger mark on the Malaysian financial landscape. 2006 CIMB Group acquires Southern Bank After months of negotiations, CIMB Group acquired Southern Bank in March 2006, adding a valued niche player in consumer banking to the Group.

2006

2007

2007

2008

2008

2008

2008

The merger combined the extensive resources and reach of Bumiputra Commerce Bank with the expertise and agility of Southern Bank, making CIMB Group a force to be reckoned with in the banking industry. Launch of CIMB Group as a Regional Universal Bank The new CIMB Group was launched by the then Prime Minister of Malaysia, Dato Seri Abdullah Ahmad Badawi, in September 2006, signifying the culmination of the 3-way merger of Commerce International Merchant Bankers, Bumiputra Commerce Bank and Southern Bank to form a universal banking group. As a universal bank, CIMB Group has the full range of banking and financial services conventional and Islamic to serve everyone from the smallest retail client to the largest companies and institutions. In line with the vision, To be Southeast Asias Most Valued Universal Bank, the Group embarked on a rebranding exercise and unveiled a new logo and a new tagline, Forward Banking, reflecting its promise to create value for customers through forward thinking. CIMB-GK Securities (Thailand) Ltd and CIMB-GK Securities (USA) Inc CIMB Group launched its flagship presence in Thailand and USA, adding on to the Groups already strong investment banking, stockbroking and institutional sales franchise in Kuala Lumpur, Singapore, Jakarta, Bangkok and Hong Kong. Launch of CIMB Foundation CIMB Foundation is a non-for profit organisation launched in November 2007 to carry out the Groups corporate social responsibility and philanthropic initiatives. Its focus is on sustainable programmes in community development, sports and education. In support of its commitment, CIMB Group pledged an initial sum of MYR100 million to CIMB Foundation. Strategic investment in the Bank of Yingkou, China CIMB Group entered into an agreement for a 19.99% stake in the Bank of Yingkou, adding mainland China to the Groups network, which comprises Southeast Asia, global financial centres and large economies that have strong economic, trade and investment linkages with ASEAN. Merger of PT Bank Niaga Tbk and PT Bank Lippo Tbk CIMB Group created the 6th largest bank in Indonesia at the point of the merger between PT Bank Niaga Tbk with PT Bank Lippo Tbk. This was an initiative of Khazanah Nasional Bhd, the ultimate shareholder of CIMB Group and the banks, to comply with Bank Indonesias Single Presence Policy (SPP). The merger marked the first major consolidation of private banks under the SPP. The merged bank was rebranded as CIMB Niaga. CIMB-Principal Islamic Asset Management launched CIMB Group and the Principal Financial Group strengthened their partnership with the launch of CIMB-Principal Islamic Asset Management. The 50:50 joint venture serves as the global Shariah funds management arm of both entities, and is located in Kuala Lumpur to leverage the infrastructure of the Malaysia International Islamic Financial Centre. Acquisition of BankThai CIMB Group entered into an agreement with the Financial Institutions Development Fund to purchase a 42.13% stake in BankThai Pcl. The Groups ensuing tender offer for the remaining shares in BankThai, and a rights issue, resulted in the stake increasing to 93%. The acquisition of BankThai strengthened CIMB Groups universal banking

2009

2009

2009

2010

platform across major ASEAN markets Malaysia, Indonesia, Singapore and Thailand and made the Groups retail network the widest in ASEAN, with over 1,100 branches. BankThai was rebranded as CIMB Thai when it was officially launched in 2009. Opening of a New Headquarters of CIMB Bank and CIMB Islamic The 39-storey Menara Bumiputra-Commerce houses and the consumer banking franchises of CIMB Group- CIMB Bank and CIMB Islamic. Officiated by the Seri Paduka Baginda Yang di- Pertuan Agong Tuanku Mizan Zainal Abidin Ibni AlMahrum Sultan Mahumd Al-Muktafi Billah Shah and Seri Paduka Baginda Raja Permaisuri Agong Tuanku Nur Zahirah, the building site was partly chosen to preserve the Banks historical links to the area where the headquarters of the Banks predecessors, Bank Bumiputra and the United Asian Bank, were located. CIMB Thai officially launched CIMB Thais new brand and logo was unveiled to the public in May by Khun Korn Chatikavanji, Thailands Minister of Finance. The rebranding launch, which was also attended by Dr. Tarisa Watanagese, Governor of Bank of Thailand, was part of CIMB Thais transformation into becoming a financial institution that offers innovative products and service offerings to the Thai market, backed by the resources of a leading regional universal banking group. Launch of CIMB Bank Singapore CIMB Group set up retail banking services in Singapore in September 2009. Through its strong service propositions, CIMB Bank Singapore has brought innovative products that maximise value for money in a competitive environment. The retail banking component complements CIMB Groups existing securities, advisory and corporate lending businesses in Singapore. CIMB Group expands to Cambodia CIMB Group spreads its wings to Cambodia through the fully-owned subsidiary CIMB Bank Plc. The first branch, which also serves as the headquarters, was officially launched in Phnom Penh on 19 Nov 2010.

At CIMB Group, we believe foresight is the key to capturing latent opportunities. It is this conviction that drives us to think ahead and look beyond the obvious, allowing our customers to benefit first from emerging developments. We strive to look for value where others do not: to see beyond the present, beyond the obvious, beyond the norm. With our capabilities now extending into more areas, CIMB Group, as a universal bank today, is now primed to create value for all types of customers across ASEAN. Bank on us to see beyond. Forward Banking CIMB Group The CIMB Group brand architecture across the region is united in our commitment to creating value, concentrating our offerings in order to best serve the needs of different customers. "CIMB Group" represents our universal banking franchise. "CIMB" represents our leading investment banking services, asset management and private banking franchise.

"CIMB Bank" represents our consumer bank and corporate banking franchise in Malaysia, Singapore and Cambodia. "CIMB Niaga " represents our consumer and corporate banking franchise in Indonesia. "CIMB Thai " represents our consumer and corporate banking franchise in Thailand. "CIMB Islamic" is our Islamic banking franchise, incorporating products and services in compliance with Shariah principles.

Tan Sri Dato' Md Nor Yusof Chairman / Non-Independent Non-Executive Director

Tan Sri Dato Md Nor graduated with a Bachelors Degree in Commerce from the University of Otago, New Zealand and is a qualified Chartered Accountant. Tan Sri Dato Md Nor has spent 18 years of his working career with the Group as a Director of CIMB Group and more notably as President and Chief Executive Officer of Bank of Commerce (M) Berhad (now known as CIMB Bank). Tan Sri Dato Md Nor had completed his term as Executive Chairman of the Securities Commission on 31 March 2006. Prior to that, he was the Managing Director of Malaysian Airline System Berhad after serving a period as advisor to the Ministry of Finance. Tan Sri Dato Md Nor is also a Director and Chairman of the Executive Committee of Khazanah Nasional Berhad. He sits on the boards of several companies and institutions including Malaysian Agrifood Corporation Berhad, Pelaburan Hartanah Berhad and is a Trustee of Yayasan Khazanah. He is also a Trustee of CIMB Foundation. He does not have any conflict of interest with the Company, except by virtue of being a representative of Khazanah Nasional Berhad.

Você também pode gostar

- Rajesh - SM 1 FinalDocumento19 páginasRajesh - SM 1 FinalDanish Iqbal100% (1)

- Vision and MissionDocumento10 páginasVision and MissionMun YeeAinda não há avaliações

- History Bank RakyatDocumento6 páginasHistory Bank Rakyathafis82Ainda não há avaliações

- Holy Borrowers: Equipping Church Leaders for Building FinanceNo EverandHoly Borrowers: Equipping Church Leaders for Building FinanceNota: 4 de 5 estrelas4/5 (1)

- Bangsa Malaysia: Perdana Discourse Series 8No EverandBangsa Malaysia: Perdana Discourse Series 8Ainda não há avaliações

- Kingdom International PresentationDocumento18 páginasKingdom International PresentationNouman PrinceAinda não há avaliações

- CIMB BANK Strategic ManagementDocumento34 páginasCIMB BANK Strategic ManagementRehan FarhatAinda não há avaliações

- CIMB BANK Strategic ManagementDocumento34 páginasCIMB BANK Strategic ManagementcarmenAinda não há avaliações

- History of RHB Capital BHDDocumento7 páginasHistory of RHB Capital BHDMohamad QayyumAinda não há avaliações

- Historical Background of RHB Bank PDFDocumento5 páginasHistorical Background of RHB Bank PDFtuan nasiruddinAinda não há avaliações

- Canara BankDocumento18 páginasCanara BankparkarmubinAinda não há avaliações

- 1.0 Background of The Institution 1.1 RHB Islamic Bank: OSK Holdings BHDDocumento15 páginas1.0 Background of The Institution 1.1 RHB Islamic Bank: OSK Holdings BHDSaidatul AzellaAinda não há avaliações

- Malayan Banking BerhadDocumento28 páginasMalayan Banking Berhadmarcie pieAinda não há avaliações

- MDM Chuah Evolution Msian Banking Industry 130411 ABM PDFDocumento37 páginasMDM Chuah Evolution Msian Banking Industry 130411 ABM PDFtcngaiAinda não há avaliações

- Swot AnalysisDocumento2 páginasSwot AnalysisChe Engku Misri80% (5)

- 1.1history of BankingDocumento18 páginas1.1history of BankingHarika KollatiAinda não há avaliações

- Maybank 2Documento5 páginasMaybank 2pavitra pavitraAinda não há avaliações

- Annual Report PT Bank Mandiri 2005Documento132 páginasAnnual Report PT Bank Mandiri 2005zaazmiAinda não há avaliações

- Malayan Banking BHDDocumento3 páginasMalayan Banking BHDNOR MIMI AZURA BINTI HUZAIMI MoeAinda não há avaliações

- Assignment 2 InterviewDocumento17 páginasAssignment 2 InterviewMUHAMMAD ZUL HELMI BIN ABD RAHIMAinda não há avaliações

- A Brief Profile of The Bank Widely Known For CustomerDocumento4 páginasA Brief Profile of The Bank Widely Known For CustomerMayank RajAinda não há avaliações

- MCB Can Be Divided Into Three Phases: University of Central PunjabDocumento39 páginasMCB Can Be Divided Into Three Phases: University of Central PunjabAhmed RiiazAinda não há avaliações

- Services Overseas Filipino ServicesDocumento2 páginasServices Overseas Filipino ServicesFlorie Ann AguilarAinda não há avaliações

- Part A: Internship Experience: Chapter OneDocumento2 páginasPart A: Internship Experience: Chapter OneMD.JASHIM HASAN RIPONAinda não há avaliações

- Final OutputDocumento6 páginasFinal OutputSiena KaleiAinda não há avaliações

- Metropolitan Bank and Trust CompanyDocumento5 páginasMetropolitan Bank and Trust CompanyRyan BoneoAinda não há avaliações

- Gapol, Rach Au C. Pantia, Patrik Oliver E. Pasaol, Devvie Mae ADocumento3 páginasGapol, Rach Au C. Pantia, Patrik Oliver E. Pasaol, Devvie Mae APatrik Oliver PantiaAinda não há avaliações

- Vision, Mission & ValuesDocumento21 páginasVision, Mission & ValuesadilroseAinda não há avaliações

- CritDocumento4 páginasCritMikhail Ayman MasturaAinda não há avaliações

- Bbbm4103 Bank Management - May Semester 2020Documento25 páginasBbbm4103 Bank Management - May Semester 2020VithiaAinda não há avaliações

- Ific BankDocumento95 páginasIfic BankAl AminAinda não há avaliações

- Ar 1112Documento280 páginasAr 1112Weezenn EeAinda não há avaliações

- MCB Internship ReportDocumento31 páginasMCB Internship ReportShakeel QureshiAinda não há avaliações

- Component CompaDocumento7 páginasComponent CompaRena Jocelle NalzaroAinda não há avaliações

- MCB Bank Limited Formerly Known As Muslim Commercial Bank Limited Was Incorporated by The Adamjee Group On July 9Documento6 páginasMCB Bank Limited Formerly Known As Muslim Commercial Bank Limited Was Incorporated by The Adamjee Group On July 9Imdad Ali JokhioAinda não há avaliações

- MCBDocumento84 páginasMCBTari Baba100% (2)

- Customer Satisfaction of Prime BankDocumento42 páginasCustomer Satisfaction of Prime BankShuvro DattaAinda não há avaliações

- History: BeginningsDocumento3 páginasHistory: Beginningsrobloxian MobiAinda não há avaliações

- Canara BankDocumento6 páginasCanara Bankannu priyaAinda não há avaliações

- Chapter - 1: 1.1 Background of The StudyDocumento21 páginasChapter - 1: 1.1 Background of The StudyAlokAinda não há avaliações

- Banco de Oro: Corporate ProfileDocumento6 páginasBanco de Oro: Corporate ProfileNilo Palsic CampoAinda não há avaliações

- Change - MGT Case - Study Bank - Islam.bhdDocumento24 páginasChange - MGT Case - Study Bank - Islam.bhdashbak2006#zikir#scribd#2009Ainda não há avaliações

- Acknowledgement: MR Shishir Shrivastava Faculty GuideDocumento87 páginasAcknowledgement: MR Shishir Shrivastava Faculty GuideManjeet SinghAinda não há avaliações

- Meezan Bank ProjectDocumento38 páginasMeezan Bank Projectnaqash1111100% (1)

- Stratma PaperDocumento20 páginasStratma PaperManny LopezAinda não há avaliações

- Credit Analysis Report - FinalDocumento84 páginasCredit Analysis Report - FinalVinod NagappanAinda não há avaliações

- BDO UnibankDocumento7 páginasBDO UnibankJana Kryzl DibdibAinda não há avaliações

- Chapter-3 Canara Bank Profile Origin of Canara BankDocumento6 páginasChapter-3 Canara Bank Profile Origin of Canara BankSubramanya DgAinda não há avaliações

- General Banking Southeast BankDocumento40 páginasGeneral Banking Southeast BankRasadul Hasan RaselAinda não há avaliações

- AXIS BANK Company ProfileDocumento7 páginasAXIS BANK Company ProfileAnjali Angel ThakurAinda não há avaliações

- Oseko Jescah Kerubo JKC-BO1-0028/2009 Bachelor of Science in Information TechologyDocumento11 páginasOseko Jescah Kerubo JKC-BO1-0028/2009 Bachelor of Science in Information TechologyAnn StacyAinda não há avaliações

- State Bank of IndiaDocumento12 páginasState Bank of IndiapreetighAinda não há avaliações

- Assignment On Risk Management (CIMB Bank)Documento19 páginasAssignment On Risk Management (CIMB Bank)Jahid HasanAinda não há avaliações

- Alliance Bank BackgroundDocumento3 páginasAlliance Bank BackgroundnikxxzaniAinda não há avaliações

- Customer Relationship Management On Retail Banking. On ING BANKDocumento63 páginasCustomer Relationship Management On Retail Banking. On ING BANKNilesh SahuAinda não há avaliações

- Khalil Ullah - Report FinalDocumento87 páginasKhalil Ullah - Report FinalKhalil UllahAinda não há avaliações

- History: Late Sri Ammembal Subbarao PaiDocumento13 páginasHistory: Late Sri Ammembal Subbarao PaiurmiAinda não há avaliações

- A Study On Attrition Rate in Standard Chartered BankDocumento55 páginasA Study On Attrition Rate in Standard Chartered BankAjay RohillaAinda não há avaliações

- Microfinance for Bankers and Investors: Understanding the Opportunities and Challenges of the Market at the Bottom of the PyramidNo EverandMicrofinance for Bankers and Investors: Understanding the Opportunities and Challenges of the Market at the Bottom of the PyramidAinda não há avaliações

- Saadiyat Rotana ResortDocumento11 páginasSaadiyat Rotana ResortZubairLiaqatAinda não há avaliações

- Challenges of Digital SME Finance Innovation in Viet NamDocumento15 páginasChallenges of Digital SME Finance Innovation in Viet NamADBI EventsAinda não há avaliações

- Band Partnership AgreementDocumento7 páginasBand Partnership AgreementAustin Salisbury100% (1)

- SNL Fundamentals of Peer AnalysisDocumento44 páginasSNL Fundamentals of Peer AnalysisBilal AhmadAinda não há avaliações

- Chevron Annual Report SupplementDocumento68 páginasChevron Annual Report SupplementLaurentiu CiobotaricaAinda não há avaliações

- 03 LasherIM Ch03Documento47 páginas03 LasherIM Ch03Maryam Bano100% (5)

- FM-06 Performance Task 1 Answer KeyDocumento1 páginaFM-06 Performance Task 1 Answer Keyyamamotoakemi24Ainda não há avaliações

- Pom AssignmentDocumento13 páginasPom AssignmentParth SharmaAinda não há avaliações

- NAPS PresentationDocumento7 páginasNAPS PresentationDiwakar DwivediAinda não há avaliações

- Year 11-Business Management, Slides, Unit 2, AoS 3, Staffing A BusinessDocumento82 páginasYear 11-Business Management, Slides, Unit 2, AoS 3, Staffing A BusinessNicholas OngkoAinda não há avaliações

- Program Budgetary Needs AssessmentDocumento3 páginasProgram Budgetary Needs Assessmentapi-578727511100% (1)

- Economics: Paper 2281/01 Multiple ChoiceDocumento6 páginasEconomics: Paper 2281/01 Multiple Choicemstudy123456Ainda não há avaliações

- Schulich School of Business: Course DescriptionDocumento10 páginasSchulich School of Business: Course DescriptionRashmi Ranjan MohantyAinda não há avaliações

- Country Programme Antigua and Barbuda Green Climate FundDocumento46 páginasCountry Programme Antigua and Barbuda Green Climate FundVeronicaSanJoséAinda não há avaliações

- LAW Compiler 5.0 by CA Ravi AgarwalDocumento692 páginasLAW Compiler 5.0 by CA Ravi Agarwalenila upretiAinda não há avaliações

- Scor Model in Supply ChainDocumento25 páginasScor Model in Supply ChainGopikrishna S Nair100% (1)

- Documented Essay Final Draft WeeblyDocumento6 páginasDocumented Essay Final Draft Weeblyapi-241798291Ainda não há avaliações

- Your August 2022 Bill: $102.30 $84.40 Summary of Current ChargesDocumento3 páginasYour August 2022 Bill: $102.30 $84.40 Summary of Current ChargesMarissa RempilloAinda não há avaliações

- Professional Profile: Page 1 of 2Documento2 páginasProfessional Profile: Page 1 of 2mansiAinda não há avaliações

- Encyclopedia Central Banking Louis Philippe Rochon 514mUhKazmLDocumento4 páginasEncyclopedia Central Banking Louis Philippe Rochon 514mUhKazmLNuwan Tharanga LiyanageAinda não há avaliações

- 2015 SALN Form BlankDocumento3 páginas2015 SALN Form BlankMathew Angelo Perez GamboaAinda não há avaliações

- Session 1 NPF Overview & Introduction PDFDocumento32 páginasSession 1 NPF Overview & Introduction PDFRico SamuelAinda não há avaliações

- Kalleberg Precarious WorkDocumento22 páginasKalleberg Precarious WorkAlejandro Valle BaezaAinda não há avaliações

- 09 Social Science Key Notes Eco ch3 Poverty As A ChallengeDocumento2 páginas09 Social Science Key Notes Eco ch3 Poverty As A ChallengePrem KukrejaAinda não há avaliações

- Introduction To Vat in The GulfDocumento9 páginasIntroduction To Vat in The GulfJORGESHSSAinda não há avaliações

- OmniCard ECMSDocumento7 páginasOmniCard ECMSmeisheilAinda não há avaliações

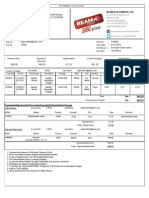

- Beam Telecom PVT LTD.: 8-2-610/A, Road No.10, Banjara Hills, Hyderabad-500034 Tel: +91-40-66272727Documento2 páginasBeam Telecom PVT LTD.: 8-2-610/A, Road No.10, Banjara Hills, Hyderabad-500034 Tel: +91-40-66272727Raghav Reddy NelloreAinda não há avaliações

- FM DJB - ICAI Mat Additional QuestionsDocumento69 páginasFM DJB - ICAI Mat Additional QuestionsRoshan KumarAinda não há avaliações

- Deposit - WithdrawalDocumento2 páginasDeposit - WithdrawalMuhd K AsyrafAinda não há avaliações

- Loyola College (Autonomous), Chennai - 600 034Documento3 páginasLoyola College (Autonomous), Chennai - 600 034Harish KapoorAinda não há avaliações