Escolar Documentos

Profissional Documentos

Cultura Documentos

ADB Solar Power Guarantee Facility

Enviado por

Ashok Kumar ThanikondaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ADB Solar Power Guarantee Facility

Enviado por

Ashok Kumar ThanikondaDireitos autorais:

Formatos disponíveis

India Solar Power Generation Projects Proposed ADB Solar Power Guarantee Facility

This is a summary presentation. A full term sheet may be made available to prospective partner banks. Any implementation is dependant on full compliance with all ADB policies, including environmental and social safeguards and Approval by ADBs management and board.

ADBs Private Sector Operations Department And Office of Cofinancing Operations April 2011

Background on the Opportunity

Government of Indias National Solar Mission (NSM) will soon allocate to private sector developers a total of 1,100 MW of solar PV and solar thermal capacity, to be commissioned by FY2012 NVVN, NTPCs power trading arm, will be the single buyer of all solar power under the NSM, blend this with uncontracted thermal power and sell it to the state electricity boards / discoms Draft PPAs and Eligibility Criteria have been proposed by MNRE; projects for migration into NSM have very recently signed PPAs NSM allocations in December 2010; 6 months to close financing after signing PPAs (July 2011) In addition, several states in India are directly contracting with solar power developers under their own Solar Projects (e.g., Gujarat has given allocations / signed PPAs in 2 phases for 960 MW outside the NSM) These programs will initially generate a large number of small solar projects in the range of 2-15 MW (project costs of $650 million)

ADBs Participation and Role

ADB has been providing technical assistance to MNRE on the NSM, the PPA structure and eligibility criteria ADB has launched its Asian Solar Energy Initiative whereby it will finance 3,000 MW by mid 2013 in developing Asia India, Thailand and China are the near term opportunities

The first wave of solar projects in India are likely too small for direct funding by ADB (average size of 5 MW)

ADB wants to build technical due diligence capacity in commercial banks for lending to solar projects in Asia

ADB is proposing a risk sharing scheme through partial credit guarantees (PCGs) to commercial banks to support such projects

Addresses lenders concerns both on credit risks and long tenors required for viability of solar power projects

Partial Credit Guarantee (PCG)

Covers lenders against any non payment by the project on the guaranteed portion of scheduled principal and interest payments

Can be denominated in USD or INR Beneficiaries: both local and international banks

Replace half of lenders project risk (e.g., B-BB) with ADB credit risk (AAA); extend loan tenors >12 years

Addresses lenders capital constraints, single borrower limit, sector and country limit

Allows ADB to leverage support for projects too small for typical project financing

ADB Board approval expected 19 April 2011; first partner bank endorsed by investment committee (NORD/LB, Singapore branch)

Parallel Technical Assistance

ADB will provide technical support to partner commercial banks to complete technical DD of these projects seeking guarantees Scope of work to include:

Review of insolation data, site risks Commercial assessment of proposed solar technology Assessment of PV panel manufacturer and experience analysis of performance warranties, etc. Sensitivity analysis of energy yields and revenue variability

Grant of $1.25 million administered directly by ADB guarantee team, partly funded by the Government of Japan International solar engineers to be on board by May 2011 Program will also include regular solar training programs in India for commercial bankers (next scheduled for June in New Delhi)

Proposed Mechanics (for due diligence)

ADB will rely primarily on commercial banks due diligence on sponsors, financial viability, EPC contracts, O&M arrangements. Minimum eligibility criteria for sponsors credit-worthiness and experience, and commercially proven solar PV or thermal technology Sponsors must provide cost overrun undertaking; have sufficient performance warranties from credible PV manufacturers and latent defects cover from contractors Borrower must have signed PPA with NVVN (NSM scheme) or acceptable PPA with selected states e.g., Gujarat (ADB to review others case-by-case) Covered Lenders must screen projects according to ADBs Safeguard Policies, comply with corporate governance and anti-corruption policies (some ADB help on environmental and social elements)

ADB Guarantee Limits

The guarantee can cover principal and accrued interest up to a maximum aggregate liability (MAL) amount

The present value of the debt service obligations guaranteed by ADB cannot exceed 50% of the projects debt (e.g., 50/50 risk sharing with the commercial bank)

This allows the structuring guarantees to meet different banks needs, higher levels of guarantee cover in latter years of the loan tenor (see examples) Door-to-door tenors of guaranteed loans will be limited to 15 years for NSM projects, 12 years for GUVNL projects

Other limits no more than 5 guarantees per sponsor group; a single partner bank cannot consume more than 40% of the facility; limits on direct SEB exposure

Option 1: Back-Ended Cover

No cover in years 0-7; 95% in yrs 8-11; 100% in yrs 12-15

Principal + Interest

PCG terminated if payment default / insolvency

Commercial Loan Tenor: COD: 1st P&I Repayment : ADB PCG Cover Year 1-7: 0% Year 8-11: 95%

PCG becomes effective provided no EoD exists

15 years 1 year 6 months after COD

Years 12-15: 100%

95% PROJECT RISK

ADB PCG

YR 1 YR 3 YR 7 YR 9 YR 11

100%

YR 15

Standby Fee

8

On-risk Guarantee Fee

Option 2: Straight Cover

50% PCG Cover for all years

Commitment Fee

Principal + Interest

Commercial Loan Tenor: COD: 1st P&I Repayment : ADB PCG Cover Years 1-15: 50%

15 years 1 year 6 months after COD

50%

PROJECT RISK

SBL / Solvency Exempt YR 1 YR 3

ADB PCG

YR 6 YR 9 YR 12 YR 15

On-risk Guarantee Fee

9

Timeline (for making a demand)

Borrower Defaults Due Date Day 0 Demand Payment Day 90

Day [45]

Day 75

Day 120

Waiting Period

Determination Period

Payment Period

Demand Service Period

Lender / sponsor considerations

Domestic lenders

Single borrower limit constraints Power sector exposure Constraints on long-term lending Pressure for lending to priority sectors (not solar)

International lenders

Keen to fund renewable / GHG mitigation in countries like India Capital constraints Tenor/risk constraints (e.g., SEB offtake) Country limit constraints for India

Guarantees facilitate raising of INR and USD debt at longer tenors than otherwise would have been available

Improved debt service capacity (especially in critical early years) Improves equity IRR (in light of challenging environment on capital costs) Reduce refinancing risk Sharing of technical risks on solar power technology

11

ADB Contacts for Solar Guarantee Program

Don Purka Private Sector Operations Department dpurka@adb.org +63-2-632-6882

Bart Raemaekers Office of Cofinancing Operations braemaekers@adb.org +63-2-632-6918 Sujata Gupta ADB Resident Mission in India sgupta@adb.org +91-11-2410-7200

Você também pode gostar

- Gunturgraduates-Draft1 10 12 3501-4000Documento500 páginasGunturgraduates-Draft1 10 12 3501-4000Ashok Kumar ThanikondaAinda não há avaliações

- BESCOM ENERGY CONSERVATION EFFORTSDocumento25 páginasBESCOM ENERGY CONSERVATION EFFORTSAshok Kumar ThanikondaAinda não há avaliações

- Chapter 2Documento47 páginasChapter 2Ashok Kumar ThanikondaAinda não há avaliações

- Chapter - 3: Rationale For Expected Revenue From Charges (Erc)Documento2 páginasChapter - 3: Rationale For Expected Revenue From Charges (Erc)Ashok Kumar ThanikondaAinda não há avaliações

- DVR College Student Details ReportDocumento66 páginasDVR College Student Details ReportAshok Kumar Thanikonda0% (1)

- Chapter 4Documento34 páginasChapter 4Ashok Kumar ThanikondaAinda não há avaliações

- Chapter - 1: Bescom in BriefDocumento6 páginasChapter - 1: Bescom in BriefAshok Kumar ThanikondaAinda não há avaliações

- Samoa Solar PVDocumento47 páginasSamoa Solar PVAshok Kumar ThanikondaAinda não há avaliações

- Biomass Power Insurance Feasibility Study FinalDocumento40 páginasBiomass Power Insurance Feasibility Study FinalAshok Kumar Thanikonda100% (1)

- 5 MW Solar PV Power Project in Sivagangai Village, Sivaganga District, Tamil NaduDocumento32 páginas5 MW Solar PV Power Project in Sivagangai Village, Sivaganga District, Tamil NaduAshok Kumar Thanikonda60% (5)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Annex A-RMC 26-2018Documento2 páginasAnnex A-RMC 26-2018Anonymous LC5kFdtc100% (1)

- An Overview On Digital Payments 4Documento12 páginasAn Overview On Digital Payments 4DS DebasisAinda não há avaliações

- PayPal Transaction History Feb-Mar 2015Documento1 páginaPayPal Transaction History Feb-Mar 2015dnbinhAinda não há avaliações

- Project Report On United India Insurance CoDocumento25 páginasProject Report On United India Insurance CoKaviya KaviAinda não há avaliações

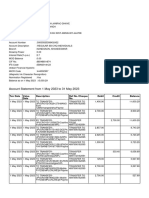

- Account Statement From 1 May 2023 To 31 May 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento10 páginasAccount Statement From 1 May 2023 To 31 May 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceavinashdeshmukh7027Ainda não há avaliações

- In Savings Account SoscDocumento9 páginasIn Savings Account SoscAbhishek MitraAinda não há avaliações

- Constitution of Mutungo Community AssociationDocumento9 páginasConstitution of Mutungo Community AssociationRobert Baguma MwesigwaAinda não há avaliações

- Lafarge Zambia 2015 Annual ReportDocumento60 páginasLafarge Zambia 2015 Annual Reportimbo9100% (1)

- Ecoclub Finallist2010-11 PDFDocumento176 páginasEcoclub Finallist2010-11 PDFVikram SinghAinda não há avaliações

- IIFL - Rollover Action - Feb-21 T Expiry DayDocumento6 páginasIIFL - Rollover Action - Feb-21 T Expiry DayRomelu MartialAinda não há avaliações

- POR7 Voting Results 0812229120213000000000026Documento389 páginasPOR7 Voting Results 0812229120213000000000026joeMcoolAinda não há avaliações

- A Research Study of Plastic Money Among HousewivesDocumento34 páginasA Research Study of Plastic Money Among HousewivesNainaAinda não há avaliações

- IDBI Bank mulls merger of home loan unit to consolidate businessDocumento5 páginasIDBI Bank mulls merger of home loan unit to consolidate businessprajuprathuAinda não há avaliações

- 08-Timesheet FORKLIFTDocumento14 páginas08-Timesheet FORKLIFTahmad AinurAinda não há avaliações

- Super Care Pharma Bank Statement-July-2021Documento4 páginasSuper Care Pharma Bank Statement-July-2021AKM Anwar SadatAinda não há avaliações

- 21.) UCPB V Samuel and BelusoDocumento2 páginas21.) UCPB V Samuel and BelusojoyceAinda não há avaliações

- Zimbabwe Stock Exchange Listed Companies Ranking 2016Documento2 páginasZimbabwe Stock Exchange Listed Companies Ranking 2016kajtheviroAinda não há avaliações

- Skrill Payment Gateway Integration ManualDocumento44 páginasSkrill Payment Gateway Integration ManualSamir JunaidAinda não há avaliações

- Insured Cargo Dispute Over Spillage LossesDocumento6 páginasInsured Cargo Dispute Over Spillage LossesLolph ManilaAinda não há avaliações

- Liability of Co-Maker as Surety in Loan AgreementDocumento5 páginasLiability of Co-Maker as Surety in Loan AgreementStefan Salvator100% (1)

- Birla Sun Life Insurance: Soumya Katiyar JN180245 PGDM-SMDocumento17 páginasBirla Sun Life Insurance: Soumya Katiyar JN180245 PGDM-SMSupriyo BiswasAinda não há avaliações

- Public Notice02082018Documento1 páginaPublic Notice02082018Anonymous FnM14a0Ainda não há avaliações

- List of Breach FirmsDocumento819 páginasList of Breach FirmsSufyan AshrafAinda não há avaliações

- Voucher and VRET Format For Payment 12.06.19Documento2 páginasVoucher and VRET Format For Payment 12.06.19RahulAinda não há avaliações

- RBI Grade B 2023 Guide Book Updated SyllabusDocumento22 páginasRBI Grade B 2023 Guide Book Updated SyllabusPunith kumarAinda não há avaliações

- Insurance Recit Questions (Atty. Bathan)Documento6 páginasInsurance Recit Questions (Atty. Bathan)Aaron ViloriaAinda não há avaliações

- No Broker HoodDocumento2 páginasNo Broker HoodKRISHNA VIKAS GARLAPATIAinda não há avaliações

- 15 30Documento2 páginas15 30James AdhikaramAinda não há avaliações

- Construction Project Controlled Insurance Program CIP FlyerDocumento8 páginasConstruction Project Controlled Insurance Program CIP FlyerMark DodsonAinda não há avaliações

- Special power attorney documentDocumento3 páginasSpecial power attorney documentJessa Damian100% (1)