Escolar Documentos

Profissional Documentos

Cultura Documentos

Stock Research Report For LLY As of 6/23/11 - Chaikin Power Tools

Enviado por

Chaikin Analytics, LLCTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Stock Research Report For LLY As of 6/23/11 - Chaikin Power Tools

Enviado por

Chaikin Analytics, LLCDireitos autorais:

Formatos disponíveis

LILLY ELI & CO (LLY)

Industry: Drugs

LLY

LILLY ELI & CO

Price: $37.68

Chaikin Power Gauge Report | Generated: Thu Jun 23 13:39 EDT 2011

$37.68

Power Gauge Rating

LLY - Very Bullish

The Chaikin Power Gauge Rating for LLY is very bullish due to very attractive financial metrics, very positive expert opinions and bullish price/volume activity. The rating also reflects weak earnings performance. LLY's financial metrics are excellent due to a high return on equity and low price to sales ratio.

TM

Financial Metrics

Earnings Performance

Price/Volume Activity

Expert Opinions

News Sentiment Rating

Neutral

LLY LILLY ELI & CO June 22, 2011

Chaikin Sentiment Gauge for LLY is neutral. Stories concerning LLY have a balanced or neutral sentiment.

TM

News Sentiment :Neutral

Power Trend - 5 Year Chart

The Power Gauge distills a 20 factor model into a concise picture of a stock's potential.

High Potential

Neutral

Low Potential

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

Financials & Earnings

Financial Metrics

Financial Metrics Rating

LT Debt/Equity Ratio

Very Bullish

LLY's financial metrics are excellent. The company yields a high return on shareholder's equity and has high revenue per share. The rank is based on a high long term debt to equity ratio, high price to book value ratio, high return on equity, low price to sales ratio and relatively high cash flow.

Price to Book Value

Return on Equity

Price to Sales Ratio

Business Value

Assets and Liabilities

Ratio Current Ratio LT Debt/Equity TTM 2.01 0.55

Valuation

Ratio Price/Book Price/Sales TTM 3.13 1.89

Returns

Ratio Return on Invest Return on Equity TTM 28.5% 43.4%

Earnings Performance

Earnings Performance Rating

Earnings Growth

Bearish

LLY's earnings performance has been weak. The company is priced relatively high compared to next year's projected EPS and has an erratic 5 year earnings trend. The rank is based on high earnings growth over the past 3-5 years, a relatively high projected P/E ratio and inconsistent earnings over the past 5 years.

Earnings Surprise

Earnings Trend

Projected P/E Ratio

Earnings Consistency

5 Year Revenue and Earnings Growth

12/06 Revenue(M) Rev % Growth EPS EPS % Growth 15,691.00 7.14% $2.45 34.62% 12/07 18,633.50 18.75% $2.71 10.61% 12/08 20,378.00 9.36% $-1.89 -169.74% 12/09 21,836.00 7.15% $3.94 308.47% 12/10 23,076.00 5.68% $4.58 16.24%

EPS Estimates

Factor Quarterly EPS Yearly EPS Factor 3-5 year EPS Actual EPS Prev $1.22 $4.58 Actual EPS Growth 9.62% EST EPS Current $1.17 $4.27 Est EPS Growth -4.38% Change -0.05 -0.31 Change -14.00

EPS Surprise

Estimate Latest Qtr 1 Qtr Ago 2 Qtr Ago 3 Qtr Ago $1.17 $1.10 $1.15 $1.11 Actual $1.24 $1.11 $1.21 $1.24 Difference $0.07 $0.01 $0.06 $0.13 % Difference 5.98 0.91 5.22 11.71

EPS Quarterly Results

FY 12/09 12/10 12/11 Qtr 1 $1.20 $1.13 $0.95 Qtr 2 $1.06 $1.22 Qtr 3 $0.86 $1.18 Qtr 4 $0.83 $1.05 Total $3.95 $4.58 -

Fiscal Year End Month is December.

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

Price Trend & Expert Opinions

Price/Volume Activity

Price/Volume Activity Rating

Relative Strength vs Market

Bullish

Price and volume activity for LLY is bullish. LLY has outperformed the S&P 500 over 26 weeks and has a rising price trend. The rank for LLY is based on its price strength versus the market, a positive Chaikin price trend and a negative Chaikin price trend ROC.

Chaikin Money Flow

Price Trend

Price Trend ROC

Volume Trend

Relative Strength vs S&P500 Index

Chaikin Money Flow

Chart shows whether LLY is performing better or worse than the market.

Chaikin Money Flow analyzes supply and demand for a company's stock.

Price Activity

Factor 52 Week High 52 Week Low % Change YTD Rel S&P 500 Value 39.15 33.12 5.37%

Price Activity

Factor % Change Price - 4 Weeks % Change Price - 24 Weeks % Change Price - 4 Wks Rel to S&P % Change Price - 24 Wks Rel to S&P Value -1.64% 8.34% 0.90% 7.45%

Volume Activity

Factor Average Volume 20 Days Average Volume 90 Days Chaikin Money Flow Persistency Value 6,527,498 7,134,977 58%

Expert Opinions

Expert Opinions

Earnings Estimate Revisions

Very Bullish

Expert opinions about LLY are very positive. Insiders are net buyers of LLY's stock and analysts's opinions on LLY have been more positive recently. The rank for LLY is based on analysts revising earnings estimates upward, a low short interest ratio, insiders purchasing stock, optimistic analyst opinions and price strength of the stock versus the Drugs industry group.

Short Interest

Insider Activity

Analyst Opinions

Relative Strength vs Industry

Earnings Estimate Revisions

Current Current Qtr Next Qtr 1.17 1.08 Current Current FY 4.27 7 Days Ago % Change 1.17 1.08 0.00% 0.00%

Analyst Recommendations

Factor Mean this Week Mean Last Week Change Mean 5 Weeks Ago Value Hold Hold 0.00 Hold

EPS Estimates Revision Summary

Last Week Up Curr Qtr Curr Yr Next Qtr 0 0 0 0 Down 0 0 0 0 Last 4 Weeks Up 0 1 0 1 Down 0 0 0 1

30 Days Ago % Change 4.27 0.00

Next Yr

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

The Company & Its Competitors

LLY's Competitors in Drugs

Company LLY MRK JNJ NVS PFE GSK Power Gauge Historic EPS growth 9.62% 18.19% 4.21% 9.55% 6.66% 3.26% Projected EPS growth -4.38% 3.34% 6.03% 4.92% 3.06% 4.10% Profit Margin 20.82% 3.48% 19.77% 18.64% 12.51% 6.89% PEG -2.02 2.87 2.22 2.25 2.97 2.70 PE 7.85 10.10 13.71 11.84 9.09 14.24 Revenue(M) 23,076 45,987 61,587 50,624 67,809 45,905

News Headlines for LLY EU approves Lilly's weekly diabetes drug Bydureon - Jun 21, 2011 Lilly for Better Health Launches Enhanced Multi-Channel Patient Education Platform - Jun 14, 2011 Judge orders drug company to pay SC $327 million - Jun 3, 2011 Peregrine Appoints Jeffrey Masten as Vice President - May 31, 2011 Lilly USA, LLC Launches TruAssist for Patients May 16, 2011

Company Details LILLY ELI & CO LILLY CORPORATE CTR INDIANAPOLIS, IN 46285 USA Phone: 3172762000 Fax: 317-276-4878 Website: http://http://www.lilly.com Full Time Employees: 38,350 Sector: Medical

Company Profile Eli Lilly and Company discovers, develops, manufactures, and sells products in one significant business segment -pharmaceutical products. The company directs its research efforts primarily toward the search for products to diagnose, prevent and treat human diseases. The company also conducts research to find products to treat diseases in animals and to increase the efficiency of animal food production.

Power Gauge Ratings are created using a relative ranking system that assigns a rank of 0 to 100 (100 being the highest) to each stock in the universe. Rank is calculated by evaluating each of the stocks factors and combining them into a single number using a weighting formula. A stock's rank ranges from 100-0, where 100 is the strongest, and a rank of 95 indicates the stock is better than 95% of the stocks in the universe. Chaikin Stock Research(CSR) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority. CSR is not responsible for trades executed by users of this research report, our web site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1) includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct, complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin Power Tools. This report from Chaikin Power Tools is for informational purposes only and is not a recommendation to buy or sell securities.

LM 2.3 DS 3.0 LS 2.1

Data Provided by ZACKS Investment Research, Inc., www.zacks.com

Special offers to trade stocks from optionsXpress: www.chaikinpowertools.com

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Eli Lilly in India - Rethinking The Joint Venture Strategy - Case Study PaperDocumento7 páginasEli Lilly in India - Rethinking The Joint Venture Strategy - Case Study PaperHafi DisoAinda não há avaliações

- What Would You DoDocumento4 páginasWhat Would You DoNicolas GiraldoAinda não há avaliações

- Rachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsDocumento26 páginasRachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsChaikin Analytics, LLC0% (1)

- Pick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsDocumento14 páginasPick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsChaikin Analytics, LLCAinda não há avaliações

- Eli Lilly Ranbaxy Joint Venture Case StudyDocumento21 páginasEli Lilly Ranbaxy Joint Venture Case StudyAnil Jadli100% (2)

- Eli Lilly Case Study SummaryDocumento2 páginasEli Lilly Case Study SummaryMohsin AliAinda não há avaliações

- Investing in The Stock Market When It Is BearishDocumento61 páginasInvesting in The Stock Market When It Is BearishChaikin Analytics, LLCAinda não há avaliações

- Pick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsDocumento14 páginasPick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsChaikin Analytics, LLCAinda não há avaliações

- Stock Market Tips From Marc ChaikinDocumento4 páginasStock Market Tips From Marc ChaikinChaikin Analytics, LLCAinda não há avaliações

- How To Start Investing and Trading in 5 Simple StepsDocumento63 páginasHow To Start Investing and Trading in 5 Simple StepsChaikin Analytics, LLCAinda não há avaliações

- Combining Fundamental and Technical Analysis To Increase Trading ProfitsDocumento56 páginasCombining Fundamental and Technical Analysis To Increase Trading ProfitsChaikin Analytics, LLCAinda não há avaliações

- Stock Market Tips From Marc ChaikinDocumento4 páginasStock Market Tips From Marc ChaikinChaikin Analytics, LLCAinda não há avaliações

- Find The Best Stocks and ETFs To BuyDocumento56 páginasFind The Best Stocks and ETFs To BuyChaikin Analytics, LLCAinda não há avaliações

- 5 Simple Steps For Investing SmarterDocumento66 páginas5 Simple Steps For Investing SmarterChaikin Analytics, LLCAinda não há avaliações

- When To Sell and Short StocksDocumento44 páginasWhen To Sell and Short StocksChaikin Analytics, LLCAinda não há avaliações

- Stock Research With Fundamental and Technical AnalysisDocumento59 páginasStock Research With Fundamental and Technical AnalysisChaikin Analytics, LLCAinda não há avaliações

- How To Buy Options Using Cash-Secured PutsDocumento36 páginasHow To Buy Options Using Cash-Secured PutsChaikin Analytics, LLCAinda não há avaliações

- Find Best Stocks To Invest in With Stock Investing ToolsDocumento29 páginasFind Best Stocks To Invest in With Stock Investing ToolsChaikin Analytics, LLC100% (1)

- Stock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For APA As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For APA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For MDR As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For MDR As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsDocumento4 páginasStock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For STX As of 2/29/12 - Chaikin Power ToolsDocumento4 páginasStock Research Report For STX As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For A As of 3/26/2012 - Chaikin Power ToolsDocumento4 páginasStock Research Report For A As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsDocumento4 páginasStock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Chaikin Power Gauge Report GMCR 29feb2012Documento4 páginasChaikin Power Gauge Report GMCR 29feb2012Chaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsDocumento4 páginasStock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Stock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsDocumento4 páginasStock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCAinda não há avaliações

- Chaikin Power Gauge Report GILD 29feb2012Documento4 páginasChaikin Power Gauge Report GILD 29feb2012Chaikin Analytics, LLCAinda não há avaliações

- MBC Forum 5-2019: Chito Zulueta On Innovation and Execution CultureDocumento1 páginaMBC Forum 5-2019: Chito Zulueta On Innovation and Execution CultureMakati Business ClubAinda não há avaliações

- Insulin Injection Sites and Insulin InfoDocumento2 páginasInsulin Injection Sites and Insulin InfoRaffy A. FrancoAinda não há avaliações

- Economics For Managers: Mcguigan, Moyer, & HarrisDocumento18 páginasEconomics For Managers: Mcguigan, Moyer, & HarrisfizalazuanAinda não há avaliações

- TheEconomist 2024 03 09Documento321 páginasTheEconomist 2024 03 09wen wenAinda não há avaliações

- Corporate Integrity Agreement Between OIG HHS and Eli LillyDocumento67 páginasCorporate Integrity Agreement Between OIG HHS and Eli LillyBeverly TranAinda não há avaliações

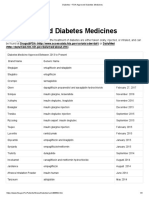

- Diabetes - FDA-Approved Diabetes MedicinesDocumento3 páginasDiabetes - FDA-Approved Diabetes MedicinesArunAinda não há avaliações

- Regional Director VP Sales in Dallas FT Worth TX Resume Wesley SackruleDocumento2 páginasRegional Director VP Sales in Dallas FT Worth TX Resume Wesley SackruleWesleySackruleAinda não há avaliações

- HMM OutputDocumento3.770 páginasHMM OutputbiodinesAinda não há avaliações

- MTI Eli Lilly and Company: Drug Development StrategyDocumento28 páginasMTI Eli Lilly and Company: Drug Development Strategymahtaabk100% (2)

- Revisi OyyDocumento2 páginasRevisi OyyNiken MelaAinda não há avaliações

- Insulina HUmana 1982Documento6 páginasInsulina HUmana 1982Daniel Alonso De Gracia SantiagoAinda não há avaliações

- 1996 September - David Hall - Privatisation in Health Services in Central and Eastern EuropeDocumento11 páginas1996 September - David Hall - Privatisation in Health Services in Central and Eastern EuropeSusanne Namer-WaldenstromAinda não há avaliações

- AttachmentDocumento62 páginasAttachmentlevely rizkiAinda não há avaliações

- Market Research On InsulinDocumento53 páginasMarket Research On InsulinRajat OberoiAinda não há avaliações

- Insulin Types: According To Mode of Action: Rapid Acting Insulin Intermediate Acting Insulin Biphasic InsulinsDocumento1 páginaInsulin Types: According To Mode of Action: Rapid Acting Insulin Intermediate Acting Insulin Biphasic InsulinsAssem Ashraf Khidhr100% (1)

- Strama 1Documento13 páginasStrama 1Rebecacel PalattaoAinda não há avaliações

- Eli LillyDocumento11 páginasEli LillyvemaAinda não há avaliações

- MCC Case Study - Lilly Vs Quintiles - ECG MetricsDocumento12 páginasMCC Case Study - Lilly Vs Quintiles - ECG MetricsSophiaAinda não há avaliações

- Economics For Managers: Mcguigan, Moyer, & HarrisDocumento18 páginasEconomics For Managers: Mcguigan, Moyer, & Harrisconnie-lee06Ainda não há avaliações

- BPJS Apotek Kimia Farma KetanggunganDocumento8 páginasBPJS Apotek Kimia Farma KetanggunganputriAinda não há avaliações

- Eli Lilly Thesis AwardDocumento6 páginasEli Lilly Thesis Awardashleygomezalbuquerque100% (2)

- I-Bytes Healthcare February Edition 2021Documento109 páginasI-Bytes Healthcare February Edition 2021IT ShadesAinda não há avaliações

- Global Pharmaceutical GrowthDocumento24 páginasGlobal Pharmaceutical GrowthPaola8082Ainda não há avaliações

- Eli Lilly in IndiaDocumento1 páginaEli Lilly in IndiaAslam KhanAinda não há avaliações

- Eli Lilly and CompanyDocumento3 páginasEli Lilly and CompanyFoong Chee HengAinda não há avaliações

- Eli Lilly in India:: Rethinking The Joint Venture StrategyDocumento21 páginasEli Lilly in India:: Rethinking The Joint Venture StrategyPinky100% (1)