Escolar Documentos

Profissional Documentos

Cultura Documentos

Hunt Competitive Power Markets Study 2005

Enviado por

ghunt94526Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Hunt Competitive Power Markets Study 2005

Enviado por

ghunt94526Direitos autorais:

Formatos disponíveis

Putting Competitive Power Markets to the Test

The Benefits of Competition in Americas Electric Grid: Cost Savings and Operating Efficiencies

Released JULY 2005 Gary L. Hunt, President, Global Energy Advisors

Quantify Consumers Benefits from Wholesale Competition in the Eastern Interconnection 19992003

Sask Power

Manitoba

MAPP

DAKOTAS

NPCC

MINNESOTA WUMS NEPOOL Hydro Quebec Maritimes MECS ALTW NY West NY East IOWA CE_NI Ontario IEMO

Compare actual competitive market results with expected results under traditional ratebase regulated market. Global Energy simulated precompetitive market conditions. Eastern Interconnect modeled across 29 market zones

NEBRASKA

WECC

MAIN ECAR

W-ECAR

AEP

FIRST ENERGY

PJMWX

PJMEX

SPP

SPPN AECI

SMAIN APS

MAAC

KENTUCKY

VP

TVA SPPC

ENTERGY LA Other

SERC

Carolina Southern Company GridFlorida

ERCOT FRCC

Global Energys approach to the Study

1. Global Energy assessed the Eastern Interconnection wholesale electric power markets as they occurred in the 1999-2003 study period (With Wholesale Competition Case) comparing those results to a simulated study case which excluded the regulatory changes, tariff protocols and market rules that enabled wholesale competition (Without Wholesale Competition Case). 2. The Study used the Global Energy Reference Case, a widely accepted independent analysis of power market fundamentals. 3. Simulations were performed using Global Energys STRATEGIC PLANNING software (formerly called Midas Gold Analyst) 4. Results in the PJM case study were derived from replicating the findings of the PJM Market Monitor. 5. Full Study results can be downloaded at www.globalenergy.com

Two Study Cases: Regulated and Competitive Introduction

Regulated:

Without Wholesale Competition

Operating Expenses Fuel + Variable O&M + Fixed O&M + Depreciation + Property Taxes + Income Taxes + Operating Income New Generation Built by Regulated Sector

Competitive:

Operating Expenses Fuel + Variable O&M + Energy Purchases + Capacity Purchases

With Wholesale Competition

Competitive Sector Revenues

Global Energys Market Analysis Introduction Competitive Case Topology*

Sask Power

Manitoba

ComEd integrated on May 1, 2004

MAPP

DAKOTAS

NPCC

MINNESOTA WUMS New England MECS ALTW NY West NY East IOWA CE_NI Ontario IEMO

NEBRASKA

AEP/DPL integrated on Oct. 1, 2004

WECC

MAIN SPP

SPPN AECI SMAIN

ECAR

W-ECAR KENTUCKY

AEP

FIRST ENERGY

PJMWX

PJMEX

APS

MAAC

VP

TVA SPPC

ENTERGY

SERC

SOUTHERN

CAROLINAS

PJM MISO MAPP (Non MISO) SPP RTO

ERCOT

LA OTHER

FRCC

GRID FLORIDA

*PJM as of Oct. 1, 2004

Global Energys Market Analysis Introduction Non-Competitive Case Topology

Sask Power

Manitoba

MAPP

DAKOTAS

NPCC

MINNESOTA WUMS New England MECS ALTW NY West NY East IOWA CE_NI Ontario IEMO

NEBRASKA

WECC

ComEd, AEP, DPL modeled outside of PJM

MAIN

SMAIN

ECAR

W-ECAR KENTUCKY

AEP

FIRST ENERGY

PJMWX

PJMEX

SPP

SPPN AECI

APS

MAAC

VP

TVA SPPC

ENTERGY

SERC

SOUTHERN

CAROLINAS

PJM MISO MAPP (Non MISO) SPP RTO

ERCOT

LA OTHER

FRCC

GRID FLORIDA

How Two Study Cases Differ

Competitive Plants

Without Wholesale Competition case: no merchant plants would be built but qualifying facilities built under PURPA were included.

Regional Transmission Organization (RTO)

Without Wholesale Competition case assumed FERC Orders 888 and 2000 never occurred and that RTOs were not formed, and RTO transmission rates are replaced with pancaked transmission rates, which traditionally existed in these areas.

Market-Based Rates for Wholesale Energy

Without Wholesale Competition case assumed marginal cost-based contracts replace market-based wholesale energy.

Study Findings at a Glance

Consumer Value from Competition Energy Efficiency Gains

Consumers realized $15.1 billion in annual savings in 1999-2003 study period from competitive forces Nuclear plant efficiency gains enough to supply energy required for 10 million homes for one year. Coal plant efficiency gains enough to supply 25 million homes for one year

Opening PJM to competition from Midwest power plants

$84.5 million in annualized savings from wholesale price reductions and lower transmission costs.

Consumers realized $15.1 billion in value from wholesale electric competition

Cumulative Consumer Benefit 20 15 10 5 0 1999 2000 2001 2002 2003

88,686 MW Competitive Plant Additions 1999-2003

$ Billions

Without Competition: More coal and higher O&M

Capital Expenditures

Combustion Turbine (9,225 MW)

$50 $38 $31 Billions $ $25

Combined Cycle (7,380 MW)

Pulverized Coal (20,295 MW)

$0 Traditional

Without Wholesale Competition

Competitive

With Wholesale Competition

Electricity Consumer Benefit

With Wholesale Competition Fuel (Fossil and Nuclear) + Variable O&M + Competitive Energy Purchase + Competitive Capacity Value + Fixed O&M + Depreciation + Property Taxes + Income Taxes + Operating Income Operating Expenses (millions $) 156,971 19,515 11,495 2,220 190,200 Without Wholesale Competition 160,979 21,902 7,610 2,670 931 3,289 7,960 205,342

Consumer Benefit (4,008) (2,387) 11,495 2,220 (7,610) (2,670) (931) (3,289) (7,960) (15,141)

Wholesale Competition Dramatically Improved Efficiency of Power Plants

10,000,000 homes served by nuclear efficiency gains

13% savings in nuclear plant refueling time since 1999 8% lower nuclear O&M costs 17% improved nuclear plant capacity factors1995-2004

25,000,000

homes served by coal plant efficiency gains

4% gains in coal plants heat rates since 1999. 14% lower coal plant O&M costs 16% improved coal plant capacity factors 1995-2004

% Improvement in Refueling Outage Length

29% 15%

Traditional

Competitive

SOURCE: Global Energy

Nuclear O&M Improvements*

33%

1%

Traditional

Competitive

SOURCE: Global Energy

*After adjusting for inflation

Nuclear Plant Capacity Factors

88% 78%

91%

1995

1999

2004

SOURCE: Global Energy

Coal-Fueled Generation Heat Rate Improvements

13,000 12,500 Btu/kWh 12,000 11,500 11,000 10,500 10,000

1999 1999 2004 2004

Traditional

Competitive

Environmental impact of heat rate improvement is 12.3 million fewer tons of coal burned each year for the competitive fleet.

SOURCE: Global Energy

Coal Plant Capacity Factors

71% 67% 61%

1995

1999

2004

SOURCE: Global Energy

Coal Plant O&M Improvements*

% improvement since 1999

15%

13%

Traditional

Competitive

SOURCE: Global Energy

*After adjusting for inflation

Case Study: PJM Market Opening Impacts

AEP

PJM 2003

ComEd DPL AEP

October 2004

10

Expanding PJM in 2004 produced $85.4 million in annualized cost savings from competition

Global Energy compared integration of ComEd, AEP and DPL into PJM with a simulated 2004 market case in which they did not join PJM. Finding: 4.2 percent decline in load-weighted spot market power prices in PJM confirming PJM Market Monitor report Finding: Expanding PJM in 2004 produced $85.4 million in annualized cost savings from competition

Introduction PJM Case Study Summary

In 2004, ComEd, AEP and DPL joined the PJM, resulting in:

Increased access between all markets in the eastern interconnect RTO-wide management of transmission and reserve markets.

Analysis Summary:

PJMs 2004 State of the Market Report Conclusion: The integration of ComEd, AEP and DPL resulted in changes to supply-demand fundamentals and a 4.2% decrease in PJM power prices from 2003 2004, when adjusted for fuel price increases. Global Energys Independent Analysis: Confirmed PJMs findings and quantified savings in 2004 from the integration of ComEd, AEP, DPL & PJM supply & demand at $29.5MM for PJM and $36.4 MM for the Eastern Interconnect. Because ComEd integrated in May 2004 and AEP/DPL in Oct 2004, benefits not realized over entire year 2004. Global Energy estimated annualized savings at $69.8 MM for PJM and $85.4 MM for the Eastern Interconnect for 2004.

11

Significance of ComEd, AEP and DPLs Introduction Integration into PJM

Resulted in major growth in PJMs market size: Installed Capacity: 77,800 MW to 144,000 MW (85% increase) Peak Load:

80,000 70,000 60,000 Load (MW) 50,000 40,000 30,000 20,000 10,000 Jan Feb Mar Apr 2003 PJM May Jun 2004 PJM Jul Aug Sep Oct Nov Dec

61,499 MW to 81,992 MW* (33% increase) PJM average load, 2003 & 2004

ComEd integration, May 2004 AEP & DPL integration, October 2004

PJM minus COMED, AEP, DPL

* 81,992 MW is the 2004 coincident peak load of COMED, AEP, DPL and PJM.

Introduction PJMs Analysis of Supply & Demand

PJM showed that the integration resulted in a shift in supply/demand fundamentals which benefited PJM customers - comparatively more new supply in PJM than new demand.

2003

2004

Source: PJM 2004 SOM Report

12

Global Energys Market Analysis Introduction Simulation Results

Results confirm PJMs conclusions that the changes to supply/demand fundamentals resulting from the integration of ComEd, AEP & DPL into PJM in 2004 benefited PJM. Global Energys estimated benefits:

2004 Production Cost Savings

Market Area Saving based on 2004 PJM Integration Timeline (Comed in May 04 & AEP/DPL in Oct. 04) Annualized Savings (Simulates Integration of ComEd, AEP, DPL on 1/1/04)

PJM Eastern Interconnect

$29.5 MM $36.4 MM

$69.8 MM $85.4 MM

Other benefits of PJM membership not analyzed. Such benefits could be captured in a comprehensive, LMP-based market simulation and cost benefit analysis.

Global Energys PJM Market Analysis Introduction Annualized Simulation Results

$85.4 Million Rest of Eastern Interconnection Production Cost Savings $15.6 Million

PJM Production Cost Savings $69.8 Million

13

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Ssa 1170 KitDocumento6 páginasSsa 1170 Kitkruno.grubesicAinda não há avaliações

- The Ery Systems of South India: BY T.M.MukundanDocumento32 páginasThe Ery Systems of South India: BY T.M.MukundanDharaniSKarthikAinda não há avaliações

- MANUU UMS - Student DashboardDocumento1 páginaMANUU UMS - Student DashboardRaaj AdilAinda não há avaliações

- ARI - Final 2Documento62 páginasARI - Final 2BinayaAinda não há avaliações

- Zero Trust Deployment Plan 1672220669Documento1 páginaZero Trust Deployment Plan 1672220669Raj SinghAinda não há avaliações

- Environmental Change and ComplexityDocumento7 páginasEnvironmental Change and ComplexityIffah Nadzirah100% (2)

- KALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)Documento9 páginasKALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)neven81Ainda não há avaliações

- Basic Fortigate Firewall Configuration: Content at A GlanceDocumento17 páginasBasic Fortigate Firewall Configuration: Content at A GlanceDenisa PriftiAinda não há avaliações

- 24 BL-BK SP List (2930130900)Documento56 páginas24 BL-BK SP List (2930130900)CapricorniusxxAinda não há avaliações

- SwingDocumento94 páginasSwinggilles TedonkengAinda não há avaliações

- DomOrlando Corporate Resume000Documento3 páginasDomOrlando Corporate Resume000domorlando1Ainda não há avaliações

- Unit 3: This Study Resource WasDocumento9 páginasUnit 3: This Study Resource WasAnanda Siti fatimah100% (2)

- The River Systems of India Can Be Classified Into Four GroupsDocumento14 páginasThe River Systems of India Can Be Classified Into Four Groupsem297Ainda não há avaliações

- University of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramDocumento10 páginasUniversity of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramRoldan TalaugonAinda não há avaliações

- Tribunal Judgment On QLASSIC in MalaysiaDocumento14 páginasTribunal Judgment On QLASSIC in Malaysiatechiong ganAinda não há avaliações

- Employee Self Service ESS User Manual: Enterprise Resource Planning (ERP) ProjectDocumento57 páginasEmployee Self Service ESS User Manual: Enterprise Resource Planning (ERP) ProjectJorge CadornaAinda não há avaliações

- Classification and Use of LandDocumento5 páginasClassification and Use of LandShereenAinda não há avaliações

- Cat 178 BooksDocumento35 páginasCat 178 BooksXARIDHMOSAinda não há avaliações

- Health CertsxDocumento2 páginasHealth Certsxmark marayaAinda não há avaliações

- City Development PlanDocumento139 páginasCity Development Planstolidness100% (1)

- Education Rules 2012Documento237 páginasEducation Rules 2012Veimer ChanAinda não há avaliações

- Charlotte BronteDocumento4 páginasCharlotte BronteJonathan BorlonganAinda não há avaliações

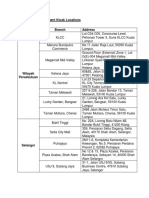

- Debit Card Replacement Kiosk Locations v2Documento3 páginasDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Local Labor Complaint FormDocumento1 páginaLocal Labor Complaint FormYVONNE PACETEAinda não há avaliações

- Oxford University Colleges' ProfilesDocumento12 páginasOxford University Colleges' ProfilesAceS33Ainda não há avaliações

- The Power of GodDocumento100 páginasThe Power of GodMathew CookAinda não há avaliações

- Trends and Challenges Facing The LPG IndustryDocumento3 páginasTrends and Challenges Facing The LPG Industryhailu ayalewAinda não há avaliações

- 04 Chapter 3Documento13 páginas04 Chapter 3Danica Marie Baquir PadillaAinda não há avaliações

- Economia - 2018-03Documento84 páginasEconomia - 2018-03Hifzan ShafieeAinda não há avaliações

- Compromise Pocso Delhi HC 391250Documento9 páginasCompromise Pocso Delhi HC 391250Iasam Groups'sAinda não há avaliações