Escolar Documentos

Profissional Documentos

Cultura Documentos

IPM Project - Private Equity Ver 3

Enviado por

Nikki ManekDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IPM Project - Private Equity Ver 3

Enviado por

Nikki ManekDireitos autorais:

Formatos disponíveis

INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT PROJECT

PRIVATE EQUITY

Project by: Vishesh Dalal (790) Saumya Singhal (851) Samarth Taneja (853) Akshay Tatke (855)

Investment Analysis and Portfolio Management Project Private Equity

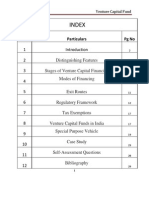

Table of Contents

1. INTRODUCTION. .3 1.1LEVERAGED BUYOUTS3 1.2 VENTURE CAPITAL...............4 1.3GROWTH CAPITAL4 1.4 DISTRESSED AND SPECIAL SOLUTIONS. ...5 1.4MEZZANINE CAPITAL. ...5 2. 6 HISTORY................................

2.1 EARLY HISTORY OF PRIVATE EQUITY..6 2.2 EARLY VENTURE CAPITAL.. ................6 2.3 PRIVATE EQUITY IN THE 1980s. 6 2.4THE BOOM IN 2002-2007. ..7 2.5 THE MEGA BUYOUTS OF 2005 2007................16 3 4 INVESTMENTS IN PRIVATE EQUITY......................18 REGULATORY FRAMEWORK........................20 Page 2 of 38

Investment Analysis and Portfolio Management Project Private Equity 5 6 7 8 9 PRIVATE EQUITY INTERNATIONAL INDEX (PEI) .......................25 PRIVATE EQUITY DEALS FACING DELAYS....................35 PRIVATE EQUITY SPACE INDIA..36 FUTURE OF PRIVATE EQUITY..37 RECENT DEALS ..38

10 BIBLIOGRAPHY. .42

Page 3 of 38

Investment Analysis and Portfolio Management Project Private Equity

1. INTRODUCTION

Private Equity can be defined as Money invested in firms which have not 'gone public' and therefore are not listed on any stock exchange. Private equity is highly illiquid because sellers of private stocks (called private securities) must first locate willing buyers. Investors in private equity are generally compensated when: (1) the firm goes public, (2) it is sold or merges with another firm, or (3) it is recapitalized. In finance, private equity is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange. Investments in private equity most often involve either an investment of capital into an operating company or the acquisition of an operating company. Capital for private equity is raised primarily from institutional investors. There is a wide array of types and styles of private equity and the term private equity has different connotations in different countries. Among the most common investment strategies in private equity include:1.1 Leveraged buyouts 1.2 Venture capital 1.3 Growth capital 1.4 Distressed investments 1.5 Mezzanine capital

1.1 LEVERAGED BUYOUTS

Leveraged buyout, LBO or Buyout refers to a strategy of making equity investments as part of a transaction in which a company, business unit or business assets is acquired from the current shareholders typically with the use of financial leverage. Leveraged buyouts involve a financial sponsor agreeing to an acquisition without itself committing all the capital required for the acquisition. To do this, the financial sponsor will raise acquisition debt which ultimately looks to the cash flows of the acquisition target to make interest and principal payments. Acquisition debt in an LBO is often non-recourse to the financial sponsor and has no claim on other investment managed by the financial sponsor. Therefore, an LBO transaction's financial structure is particularly attractive to a fund's limited partners, allowing them the benefits of leverage but greatly limiting the degree of recourse of that leverage. This kind of financing structure leverage benefits an LBO's financial sponsor in two ways: (1) the investor itself only needs to provide a fraction of the capital for the acquisition, and (2) the returns to the investor will be enhanced (as long as the return on assets exceeds the cost of the debt).

Page 4 of 38

Investment Analysis and Portfolio Management Project Private Equity

Diagram of the basic structure of a generic leveraged buyout transaction

1.2 VENTURE CAPITAL

Venture capital is a broad subcategory of private equity that refers to equity investments made, typically in less mature companies, for the launch, early development, or expansion of a business. Venture investment is most often found in the application of new technology, new marketing concepts and new products that have yet to be proven. Entrepreneurs often develop products and ideas that require substantial capital during the formative stages of their companies' life cycles. Many entrepreneurs do not have sufficient funds to finance projects themselves, and they must therefore seek outside financing. The venture capitalist's need to deliver high returns to compensate for the risk of these investments makes venture funding an expensive capital source for companies. Venture capital is most suitable for businesses with large up-front capital requirements which cannot be financed by cheaper alternatives such as debt. Although venture capital is often most closely associated with fast-growing technology and biotechnology fields, venture funding has been used for other more traditional businesses.

Page 5 of 38

Investment Analysis and Portfolio Management Project Private Equity

1.3 GROWTH CAPITAL

Growth capital refers to equity investments, most often minority investments, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a major acquisition without a change of control of the business. Companies that seek growth capital will often do so in order to finance a transformational event in their life cycle. These companies are likely to be more mature than venture capital funded companies, able to generate revenue and operating profits but unable to generate sufficient cash to fund major expansions, acquisitions or other investments. Growth capital can also be used to affect a restructuring of a company's balance sheet, particularly to reduce the amount of leverage (or debt) the company has on its balance sheet.

1.4 DISTRESSED AND SPECIAL SOLUTIONS

Distressed or Special Situations is a broad category referring to investments in equity or debt securities of financially stressed companies. The "distressed" category encompasses two broad sub-strategies including:"Distressed-to-Control" or "Loan-to-Own" strategies where the investor acquires debt securities in the hopes of emerging from a corporate restructuring in control of the company's equity; "Special Situations" or "Turnaround" strategies where an investor will provide debt and equity investments, often "rescue financing" to companies undergoing operational or financial challenges.

1.5 MEZZANINE CAPITAL

Mezzanine capital refers to subordinated debt or preferred equity securities that often represent the most junior portion of a company's capital structure that is senior to the company's common equity. This form of financing is often used by private equity investors to reduce the amount of equity capital required to finance a leveraged buyout or major expansion. Mezzanine capital, which is often used by smaller companies that are unable to access the high yield market, allows such companies to borrow additional capital beyond the levels that traditional lenders are willing to provide through bank loans. In compensation for the increased risk, mezzanine debt holders require a higher return for their investment than secured or other more senior lenders.

Page 6 of 38

Investment Analysis and Portfolio Management Project Private Equity

2. HISTORY

2.1 EARLY HISTORY OF PRIVATE EQUITY

The private equity industry was founded in 1946 with the founding of two venture capital firms: American Research and Development Corporation (ARDC) and J.H. Whitney & Company. Before World War II, venture capital investments (originally known as "development capital") were primarily the domain of wealthy individuals and families. ARDC was founded by Georges Doriot, the "father of venture capitalism" and founder of INSEAD, with capital raised from institutional investors, to encourage private sector investments in businesses run by soldiers who were returning from World War II. ARDC is credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's initial public offering in 1968.

2.2 EARLY VENTURE CAPITAL

During the 1960s and 1970s, venture capital firms focused their investment activity primarily on starting and expanding companies. More often than not, these companies were exploiting breakthroughs in electronic, medical or data-processing technology. As a result, venture capital came to be almost synonymous with technology finance.It is commonly noted that the first venture-backed startup was Fairchild Semiconductor (which produced the first commercially practicable integrated circuit), funded in 1959 by what would later become Venrock Associates. It was also in the 1960s that the common form of private equity fund, still in use today, emerged. Private equity firms organized limited partnerships to hold investments in which the investment professionals served as general partner and the investors, who were passive limited partners, put up the capital. Throughout the 1970s, a group of private equity firms, focused primarily on venture capital investments, were founded that became the model for later leveraged buyout and venture capital investment firms. In 1973, with the number of new venture capital firms increasing, leading venture capitalists formed the National Venture Capital Association (NVCA). The NVCA was to serve as the industry trade group for the venture capital industry. Venture capital firms suffered a temporary downturn in 1974, when the stock market crashed and investors were naturally wary of this new kind of investment fund. It was not until 1978 that venture capital experienced its first major fundraising year, as the industry raised approximately $750 million.

Page 7 of 38

Investment Analysis and Portfolio Management Project Private Equity

2.3 PRIVATE EQUITY IN THE 1980s

During the 1980s, constituencies within acquired companies and the media ascribed the "corporate raid" label to many private equity investments, particularly those that featured a hostile takeover of the company, perceived asset stripping, major layoffs or other significant corporate restructuring activities. Among the most notable investors to be labeled corporate raiders in the 1980s included Carl Icahn, Victor Posner, Nelson Peltz, Robert M. Bass, T. Boone Pickens, Harold Clark Simmons, Kirk Kerkorian amongst others. Carl Icahn developed a reputation as a ruthless corporate raider after his hostile takeover of TWA in 1985. One of the final major buyouts of the 1980s proved to be its most ambitious and marked both a high water mark and a sign of the beginning of the end of the boom that had begun nearly a decade earlier. In 1989, KKR closed in on a $31.1 billion takeover of RJR Nabisco. It was, at that time and for over 17 years, the largest leverage buyout in history. At $31.1 billion of transaction value, RJR Nabisco was by far the largest leveraged buyouts in history. In 2006 and 2007, a number of leveraged buyout transactions were completed that for the first time surpassed the RJR Nabisco leveraged buyout in terms of nominal purchase price. However, adjusted for inflation, none of the leveraged buyouts of the 20062007 period would surpass RJR Nabisco.

2.4 The boom in 2002-2007

The PE market surged between 2002 and 2007. Buyouts are financed with a mix of equity and debt. PE firms set up funds which raise capital from investors (fundraising). This capital represents the equity component of a PE investment. However, a large part of the investments are financed with debt, e.g. LBO loans. During the boom years the development of these two components diverged considerably. While the equity contribution to PE investments grew comparatively moderately by an average of 11% between 2002 and 2007, the sums that PE funds raised from investors (+32% p.a.) and the sums taken on in the form of LBO loans (+59% p.a.) exploded. As a result, the leverage in PE deals increased and the funds raised a lot more money than they used for investments (see table). The strong interest in private equity from investors (both equity and debt) can be explained by the prolonged phase of growth of the world economy during this period. Gushing corporate earnings and historically low default rates made the risks appear small. Moreover, the banks were able to place an ever larger proportion of their LBO loans in the capital market and thus reduce their own exposures.

Page 8 of 38

Investment Analysis and Portfolio Management Project Private Equity

Money chases deals

The high returns at a time of low interest rates encouraged many investors to increase their allocations to alternative forms of investment. This holds especially for traditional PE investors such as insurance companies, pension funds, trusts and high-net-worth individuals. At the height of the boom in spring 2007 China also decided to invest part of its foreign exchange reserves in PE. The glut of capital held by PE funds fuelled competition for the most promising investment opportunities. In Europe, for instance, purchase multiples rose between 2002 and 2007 from 6.7 to 9.3 times operating cash flow (see chart 5).9 This figure even understates the explosion in acquisition prices. Many companies had already strong growth in cash flows anyway as a result of the good business situation. In other words, the valuation multiples were not only higher but were often also applied to a much inflated base. While PE funds typically acquire underperforming companies, it is plausible to assume that these companies also profited from the good business situation and earned higher profits than in leaner times.

Good for sellers

The winners in this development were above all the sellers because they were able to obtain high prices for their firms. Many former owners sold off their firm or parts of it at good terms. Among the sellers who profited from the good times were also many PE funds that sold on their portfolio companies to other financial investors. During the boom years sales to other PE funds acquired ever greater importance as an exit channel. In 2007 they accounted for over 30% of the exits in Europe (see chart 6). The elevated prices were therefore both a bane and a boon for the industry. High purchase prices typically mean declining returns on new investments. In a study conducted by Jerry Cao and Josh Lerner a strong negative correlation was found to exist between fundraising volumes and private equity returns. After all, high fundraising increases the pressure to invest and drives up prices. However, the funds that exited their investments during the boom years profited from the price trend. They were able to realize potentially high profits and, with this performance, attract new funds.

Page 9 of 38

Investment Analysis and Portfolio Management Project Private Equity

Leverage has to compensate for declining earnings expectations

Rising earnings typically lead to declining earnings expectations. The higher earnings rise, the more difficult it becomes to hold this level. A mean reversion to lower, long-term averages is probable. Declining earnings expectations should therefore have come to be reflected in lower purchase multiples. This was obviously not the case because the development was distorted by other factors. One factor especially was the exuberant capital market environment. An ever greater proportion of the buyouts were financed with debt. The banks were competing fiercely for clients, so loans were extended at low rates of interest and on lighter covenants. The average equity contribution to European buyouts fell from 38.6% in 2002 to 33.6% in 2007.

The chart on Interest rates and lending shows the close correlation between financing costs (expressed in terms of the spreads on LBO loans) and the level of leverage. However, the lower level of equity financing helped to keep purchase prices rising because it enabled PE funds to still earn high returns on equity despite the elevated price tag. The creditors were able in turn to offload part of the credit risk by securitising the loans and placing them in the capital market (originate and distribute). Here, too, there was growing demand for products offering higher yields. By 2007 the share of European LBO loans held by European banks had fallen to 30% as shown by the chart showing Percentage of European LBO loans held by European banks

The boom ended in summer 2007

The crisis with subprime loans led to a general flight out of risky assets. The sharply increased risk aversion has hit the private equity segment hard because its credits belong to the riskier financings. The market prices for outstanding LBO loans or the structured products packaged from them have plunged. Banks and other providers of debt capital have had to make heavy write-downs on their portfolios. New exposures are difficult to place in the market, i.e. only at high interest spreads. This crisis is having numerous effects on the PE industry:

Page 10 of 38

Investment Analysis and Portfolio Management Project Private Equity 1. The volume of new acquisitions has contracted sharply. In June 2007 buyouts worth over USD 120 billion were announced. In June 2009 the figure was only USD 9 billion (see chart 10). In the financial market there is skepticism especially towards large and highly leveraged acquisitions. 2. On the other hand, small and mid-sized buyouts by PE funds are still taking place. The number of acquisitions has not fallen by far as strongly as volume. 3. Banks currently have to keep a larger proportion of the LBO loans on their own books again: in Europe the proportion rose from just less than 30% in 2007 to 56% in the first three quarters of 2008. 4. The level of leverage in new buyouts has come down appreciably. The average equity component in European buyouts rose to 45% in 2008. That is a jump of over 10%points year over year and an historical high for the industry. 5. The credit squeeze also affects PE deals that have already been completed because a large part of the loans extended on these deals will have to be refinanced in the next few years. The Bank for International Settlements estimates that around USD 500 billion needs to be refinanced between 2008 and 2010. It is to be expected that the volumes will be smaller, the covenants stricter and the costs higher. 6. The sale of investments (exit) is also very difficult in times of high uncertainty and sharply falling valuations. Collapsing equity markets make IPOs unattractive. Moreover, many buyers are waiting to see whether prices might fall further. The growing importance of strategic investors is likely to continue. According to provisional figures, their share of exits in Europe rose from 28% in 2007 to 39% in 2008.

Page 11 of 38

Investment Analysis and Portfolio Management Project Private Equity

Economic crisis hits portfolio companies

The crisis, which began as a financial crisis, rapidly spilled over to the real economy. Global growth slowed appreciably in 2008 and the world economy will see a considerable contraction in real terms this year. We currently forecast a decline of about 2.8% in GDP in the USA and about 3.0% worldwide. The economic crisis is also hurting companies in the portfolios of PE funds. Especially buyouts of the boom phase acquired at high prices and highly leveraged face difficult times because consistently strong cash flows are needed to service the capital. If revenues fall short, it becomes increasingly probable that the debt service obligations cannot be met. This assessment is also reflected in the trend on the secondary market. The average price for leveraged loans collapsed dramatically, especially in autumn 2008. Besides the higher probability of defaults, the sharply increased risk aversion among investors and the low market liquidity were other factors contributing to this price fall. It is not only the providers of debt capital that are affected. PE firms and their investors bear the brunt of the burden first as potential losses reduce a companys equity. These losses in value imply the expectation of declining returns for PE funds and PE firms. A marked drop in returns was to be seen at the end of 2008. The internal rate of return (IRR) for European buyout funds fell to -26% in 2008. The long-term average is a good 14% p.a. It needs to be borne in mind, however, that the past year was a difficult year for most asset classes. Equity markets suffered even stronger setbacks in some cases: the S&P 500 in the USA, for instance, lost about 40% in value in 2008. Another factor to consider is that the average returns for private equity conceal strong differences between individual funds. For instance, the best performing top quartile buyout and venture capital funds in Europe have achieved a return of 22.7% since their launch, while the worst performing quartile made losses for investors with an internal rate of return of -18.6%.

Page 12 of 38

Investment Analysis and Portfolio Management Project Private Equity

Fundraising dries up but reserves not yet exhausted

The dismal economic outlook makes it difficult for PE funds to raise new funds. Some institutional investors have to reduce their allocations for private equity owing to their internal guidelines. Global fundraising volume had already stabilised at a very high level in the years 2006 and 2007. In the course of 2008 capital flows then became a good deal tighter; especially funds for mega buyouts hardly find new investors. However, thanks to the high starting level and the relatively strong start to the year, 2008 still counted among the good fundraising years: global fundraising was down by a comparatively moderate 11% year over year. This illustrates that it is becoming increasingly difficult for PE funds to find investors. However, the current reluctance displayed by investors is also an opportunity for new investors to subscribe to funds that would normally be filled entirely by existing investors. This not only gives them access to investment opportunities that would otherwise not be available; it also means they can rise in rank and participate in future fundraising rounds.

Dry powder of USD 500 to 1,000 billion

However, the coffers of many PE funds are still well filled because in the past years the industry raised a lot more funds than it invested. A considerable reserve of uncommitted funds has thus accumulated. It is estimated that PE funds have capital reserves in the region of USD 500 to 1,000 billion as dry powder. These funds can be used, on the one hand, to inject capital into troubled portfolio companies and help them through the recession. On the other hand, PE funds can use the reserves for new investments and thus benefit from favorable entry prices.

Page 13 of 38

Investment Analysis and Portfolio Management Project Private Equity

Private equity will adjust to new conditions

As discussed at the beginning, the success of PE investments derives from earnings enhancements through the more efficient management of the portfolio companies, the valuation gains achieved through the skilful anti-cyclical timing of the investments, and leverage. The importance of these different return components shifts in response to changing framework conditions. In the 1980s the financial leverage delivered most of the profit as it was only during this period that broad and deep markets for high-yield corporate bonds evolved. This period peaked with the RJR Nabisco takeover in 1988. Since then leverage has declined in importance as a component of PE return. Given the continued difficult capital market environment the importance of leverage is likely to decline further as debt capital will likely be in short supply and expensive for the time being. The refinancing of existing credit lines alone will be a challenge for many portfolio companies. The picture for valuation gains is mixed. PE funds that invested heavily at high prices at the height of the boom face write-downs. On the other hand, those that used the boom for fundraising but invested little can now benefit from favourable entry prices provided the economy quickly moves back onto a growth path. As the funds are positioned very differently in this regard, this will probably contribute to a further widening of the spread of returns for PE funds.

2.5 THE MEGA BUYOUTS OF 2005 2007

The combination of decreasing interest rates, loosening lending standards and regulatory changes for publicly traded companies set the stage for the largest boom private equity had seen. Marked by the buyout of Dex Media in 2002, large multi-billion dollar U.S. buyouts could once again obtain significant high yield debt financing and larger transactions could be completed. By 2004 and 2005, major buyouts were once again becoming common, including the acquisitions of Toys "R" Us, The Hertz Corporation, Metro-Goldwyn-Mayer and SunGard in 2005. As 2005 ended and 2006 began, new "largest buyout" records were set and surpassed several times with nine of the top ten buyouts at the end of 2007 having been announced in an 18month window from the beginning of 2006 through the middle of 2007. In 2006, private equity firms bought 654 U.S. companies for $375 billion, representing 18 times the level of transactions closed in 2003. Additionally, U.S. based private equity firms raised $215.4 billion in investor commitments to 322 funds, surpassing the previous record set in 2000 by 22% and 33% higher than the 2005 fundraising total. The following year, despite the onset of turmoil in the credit markets in the summer, saw yet another record year of fundraising with $302 billion of investor commitments to 415 funds. Among the mega-buyouts completed during the 2006 to 2007 boom were: Equity Office Properties, HCA, Alliance Boots and TXU. In July 2007, turmoil that had been affecting the mortgage markets, spilled over into the leveraged finance and high-yield debt markets. The markets had been highly robust during the first six months of 2007, with highly issuer friendly developments including PIK (interest is "Payable In Kind") and covenant light debt widely available to finance large leveraged buyouts. Page 14 of 38

Investment Analysis and Portfolio Management Project Private Equity July and August saw a notable slowdown in issuance levels in the high yield and leveraged loan markets with few issuers accessing the market. Uncertain market conditions led to a significant widening of yield spreads, which coupled with the typical summer slowdown led many companies and investment banks to put their plans to issue debt on hold until the autumn. However, the expected rebound in the market after Labor Day 2007 did not materialize and the lack of market confidence prevented deals from pricing. By the end of September, the full extent of the credit situation became obvious as major lenders including Citigroup and UBS AG announced major writedowns due to credit losses. The leveraged finance markets came to a near standstill. As 2007 ended and 2008 began, it was clear that lending standards had tightened and the era of "mega-buyouts" had come to an end. Nevertheless, private equity continues to be a large and active asset class and the private equity firms, with hundreds of billions of dollars of committed capital from investors are looking to deploy capital in new and different transactions.

Page 15 of 38

Investment Analysis and Portfolio Management Project Private Equity

3.

INVESTMENTS IN PRIVATE EQUITY

Although the capital for private equity originally came from individual investors or corporations, in the 1970s, private equity became an asset class in which various institutional investors allocated capital in the hopes of achieving risk adjusted returns that exceed those possible in the public equity markets. For most institutional investors, private equity investments are made as part of a broad asset allocation that includes traditional assets (e.g., public equity and bonds) and other alternative assets (e.g., hedge funds, real estate, commodities). Most institutional investors do not invest directly in privately held companies, lacking the expertise and resources necessary to structure and monitor the investment. Instead, institutional investors will invest indirectly through a private equity fund. Certain institutional investors have the scale necessary to develop a diversified portfolio of private equity funds themselves, while others will invest through a fund of funds to allow a portfolio more diversified than one a single investor could construct.

Diagram of the structure of a Private Equity Fund

Returns on private equity investments are created through one or a combination of three factors that include: debt repayment or cash accumulation through cash flows from operations, operational improvements that increase earnings over the life of the investment and multiple expansion, selling the business for a higher multiple of earnings than was originally paid. A key component of private equity as an asset class for institutional investors is that investments are Page 16 of 38

Investment Analysis and Portfolio Management Project Private Equity typically realized after some period of time, which will vary depending on the investment strategy. Private equity investments are typically realized through one of the following avenues: an Initial Public Offering (IPO) - shares of the company are offered to the public, typically providing a partial immediate realization to the financial sponsor as well as a public market into which it can later sell additional shares; a merger or acquisition - the company is sold for either cash or shares in another company; a Recapitalization - cash is distributed to the shareholders (in this case the financial sponsor) and its private equity funds either from cash flow generated by the company or through raising debt or other securities to fund the distribution.

Page 17 of 38

Investment Analysis and Portfolio Management Project Private Equity

4. REGULATORY FRAMEWORK:

SEBI had earlier amended Clause 49 of the Equity Listing Agreement to include in it a provision stating that if the Non-executive chairman is a promoter or is related to promoters or persons occupying management positions at the board level or at one level below the board, at least one half of the board of the company should consist of independent directors. On receiving queries about implications in the context of promoter being a corporate entity, SEBI has now clarified that: If the promoter is a listed entity, its directors, other than independent directors, employees or nominees shall be deemed to be related to it; If the promoter is an unlisted entity, its directors, employees or nominees shall be deemed to be related to it. The amendments made in Chapter XIII-A of the SEBI Disclosure and Investor Protection (DIP) Guidelines, 2000 on Guidelines for Qualified Institutional Placements (QIP) enable a listed company to make a combined offering of Non- Convertible Debentures (NCDs) with warrants. Qualified Institutional Buyers can subscribe to the offering of NCDs with warrants or to individual instruments where separate books are run for NCDs / warrants. However, the company is required to obtain relaxation from the applicability of the provisions of Rule 19(2)(b), read with Rule 19(4) of the Securities Contracts (Regulation) Rules, 1957 for listing/ trading of warrants. The RBI, as a temporary measure, has permitted Systematically Important Non-Deposit taking NBFCs (NBFC-ND-SI) to raise foreign currency short term borrowings under the approval route subject to subject to certain conditions. On review, the Reserve Bank of India (RBI) modified some aspects of the External Commercial Borrowings (ECB) policy: ECB up to USD 500 million per borrower per financial year would be permitted for Rupee expenditure and/or foreign currency expenditure for permissible end uses under the Automatic Route. In order to further develop the telecom sector in the country, payment for obtaining license/ permit for 3G Spectrum will be considered an eligible end-use for the purpose of ECB ECB proceeds are currently required to be parked overseas, with certain restrictions on their investment, until actual requirement in India. Henceforth the borrowers of ECBs will be extended the flexibility to either keep the borrowed funds off- shore or keep it with the overseas branches / subsidiaries of Indian banks abroad or to remit these funds to India for credit to their Rupee accounts with Authorized Dealer Category I banks in India, pending utilization for permissible end uses. Rupee funds continue to not be permitted for capital market or real estate investment or inter-corporate lending. Page 18 of 38

Investment Analysis and Portfolio Management Project Private Equity In view of the tight liquidity conditions in the International financial markets, the allincost ceilings have been rationalized as follows:

Further liberalization in relation to ECBs on 2 January 2009: Dispensing with the requirement of all-in-cost ceiling (indicated above) till June 30 2009. ECBs beyond these all-in-cost ceilings will be under the Approval Route Development of integrated township had been withdrawn as a permissible end-use of ECBs in May 2007. Now, corporates engaged in development of integrated township defined in PN 3(2002) can avail ECBs under Approval Route NBFCs exclusively involved in financing of infrastructure sector can now avail ECBs from multilateral / regional financial institutions and Government owned development financial institutions for on-lending to infrastructure sector borrowers under Approval Route Service sector entities (i.e hotels, hospitals and software) can now avail ECB upto USD 100 million per financial year under Automatic Route as opposed to Approval Route earlier. ECBs may be raised for foreign currency and / or Rupee capital expenditure for permissible end-use but not for acquisition of land. The RBI has reviewed the existing policy on the premature buyback of Foreign Currency Convertible Bonds (FCCB) and has liberalised the procedure to consider applications for buyback of FCCBs by Indian companies both under automatic and approval routes subject to fulfillment of certain conditions under both routes.

Automatic Route

Designated Authorised Dealer (AD) Category I banks may allow Indian companies to prematurely buyback FCCBs, subject to the following: The buyback value of the FCCB shall be at a minimum discount of 15% on book value The funds used for the buyback shall be out of existing foreign currency funds held either in India or abroad and / or out of fresh ECB raised in conformity with the current ECB norms

Page 19 of 38

Investment Analysis and Portfolio Management Project Private Equity Where the fresh ECB is co-terminus with the outstanding maturity of the original FCCB and is for less than 3 years, the all-in-cost ceiling should not exceed 6 months Libor plus 200 basis points as applicable to short term borrowings. In other cases, the all-in-cost for the relevant maturity of the ECB as previously laid down shall apply.

Approval Route

The RBI will consider applications for buyback of FCCBs subject to the following: The buyback value of the FCCB shall be at a minimum discount of 25% on book value The funds used for the buyback shall be out of internal accrual, to be evidenced by Statutory Auditor and designated AD Category I banks certificate The total amount of buyback shall not exceed USD 50 million of the redemption value per company. This facility came into force on December 8, 2008 and the entire procedure of buyback should be completed by March 31, 2009. The Government had constituted the J.J. Irani Committee in December 2004 for a comprehensive revision of the existing Companies Act. On the Committee's recommendation and on detailed consultations with various Ministries, Departments and Government Regulators, the Companies Bill, 2008 was introduced in the Parliament on 23 October, 2008. The bill proposes changes in the statutory and regulatory framework and seeks to address the business and investor community's desire for a more contemporary and effective regulatory environment by reducing government control, imparting transparency, focusing on corporate governance and stricter compliance requirements and greater accountability to stakeholders. It has also sought to modernize compliance processes, augment shareholders democracy with increased investor protection, recognizing insider trading as an offence and offering a simpler compliance regime for smaller companies. Among other things it also proposes cross-border mergers and faster processes for approval of M&A. The Securities and Exchange Board of India (SEBI) issued a clarification on the meaning of secondary market in relation to Foreign Institutional Investment in Infrastructure companies in Securities markets (stock exchanges, depositories and clearing corporations) to the effect that, In respect of exchanges that are not listed, FIIs purchase of shares of such exchanges can be through transactions outside of the exchange provided it is not an initial allotment. However, if the exchange is listed, transactions by FIIs should be done through the exchange.

RBI Concerns

Dr Reddy, governor RBI expressed concerns regarding private equity flows while dwelling on the issue of setting up a currency stabilization fund and sovereign wealth fund. We have been seeking comfort in the nature of investment associated with capital inflows through hedge fund channels and participatory notes. Similar issues could also be relevant to private equity flows, said governor, Y V Reddy, in his address at the golden jubilee function of Foreign Exchange Dealers Association of India.

Page 20 of 38

Investment Analysis and Portfolio Management Project Private Equity The objective of establishing a stabilization fund is to smoothen revenue flows arising out of volatility in commodity export proceeds. A wealth fund is generally created amid current account surpluses by using a part of the foreign currency assets. Reddy said that a large part of the capital flows into India were portfolio investments, while a significant part of foreign direct investment (FDI) was in the form of private equity and geared towards brownfield projects rather than greenfield investments. So, capital account shocks, which would be independent of the countrys economic fundamentals or domestic macroeconomic environment, cannot be fully ruled out, he added. India witnessed FDI inflows of $19.53 billion and portfolio investments of $7.3 billion in 2006-07. In his concluding remarks, the RBI governor stressed on the increasingly important role of stabilization funds and wealth funds in global capital flows. The operations of these funds have generated considerable interest among the policy makers and central banks. India has a stake in the on-going debate by virtue of its increasing importance in the global capital flows. While it is essential to recognize the public sector nature of the stabilisation and wealth funds investing in India, it is also useful to study the evolving global practices in the approach of investee countries. The private equity firms entering India would also have to seek approval from SEBI.

Big Examples, Sectors benefitting and High FDI is now allowed:

Examples include the retail sector, where 50 percent FDI is now allowed in single brand products; the telecoms services sector, where the FDI limit has been raised from 49 percent to 74 percent; and selected infrastructure sectors, such 1as the development of new airports, laying of natural gas pipelines, petroleum infrastructure, captive mining of coal and lignite, mining of diamonds and precious stones, as well as the development of townships where complete foreign ownership is now welcome. The strong interest in India has resulted in very bullish stock market conditions, with trading volumes increasing substantially. This has eased exit possibilities, with most of the early domestic and foreign entrants such as Actis Partners, Warburg Pincus, Citigroup Venture Capital, Barings and Westbridge Capital reaping significant multiples on their investments. It is little wonder that other global private equity players such as 3i, Blackstone and Goldman Sachs have been setting up shop in India, each with deep pockets. How successful these firms will perform in the big league of high stakes private equity plays over the long run could depend heavily on one key factor their teams of professionals. A recent global survey by McKinsey & Company revealed that Indian business leaders are much more optimistic about the future than their international peers are. Yet Indian business leaders see the high cost and low availability of talent as the single greatest constraint on their companies its a problem that worries them much more than it does their counterparts around the world. Similarly, top on the agenda of Indias private equity firms is finding the right leadership teams to drive business.

Page 21 of 38

Investment Analysis and Portfolio Management Project Private Equity

5. Private Equity International Index (PEI)

The PEI index a ranking of private equity firms globally by size. It is the only apples-to-apples comparison of dedicated, direct-investment private equity programmes. The ranking began in 2007 as the PEI 50 and was expanded to the PEI 300 in 2009 due to demand for more information about private equity firms globally. The PEI 300 is not a performance ranking, nor does it constitute investment recommendations. The PEI 300 includes private equity firms with varying structures and strategies around the world. While the list is mostly made up of private equity firms that manage private equity limited partnerships, it also includes firms with multiple strategies and business lines, and firms with publicly traded vehicles. The PEI 2009 marks the debut of the PEI 300. PEI 300 based its rankings on this measure: the amount of private equity direct-investment capital raised or created over the past five years. The PEI 300 are ranked based on the amount of private equity direct-investment capital each have raised or formed over a roughly five-year period beginning 1 January 2004 and ending 15 April 2009. The current year PEI 300 of 2009 and movements in the listing as compard to PEI 50 in 2008 are as below:

Page 22 of 38

Investment Analysis and Portfolio Management Project Private Equity

Page 23 of 38

Investment Analysis and Portfolio Management Project Private Equity

Page 24 of 38

Investment Analysis and Portfolio Management Project Private Equity

Page 25 of 38

Investment Analysis and Portfolio Management Project Private Equity

Page 26 of 38

Investment Analysis and Portfolio Management Project Private Equity

Page 27 of 38

Investment Analysis and Portfolio Management Project Private Equity

Page 28 of 38

Investment Analysis and Portfolio Management Project Private Equity A Comparative analysis: PE 300, 2009 Versus PEI 50, 2008 How the PEI 300 firms relate to each other, to last years list and to the broader deal economy

Page 29 of 38

Investment Analysis and Portfolio Management Project Private Equity

Page 30 of 38

Investment Analysis and Portfolio Management Project Private Equity

6. PE deals facing delays

Typically known for providing the much-needed capital to entrepreneurs when almost no other avenue for funding is left, PE investors seemed to pull back in certain cases in 2008. The last quarter of 2008 saw some high profile deals being called off. The global credit turmoil has resulted in PE players playing safe and taking more time for negotiations than usual. It was observed that PE firms were renegotiating on the already announced deals. During this quarter, Blackstones deal with Nagarjuna Construction and Temasek-India Equity Partners deal with the Maharashtra-based media group, Lokmat, were being called off. For Lokmat, the deal sheet was signed a year ago, but now, the company and the investors decided to renegotiate the deal from the beginning. Similarly, Blackstone that picked up a 9% stake in Nagarjuna Constructions a year ago, now decided not to infuse the second tranche into the company. Earlier in January 2008, CVCI called off its deal with Akruti city on the back of the global market crash. Such an environment of deals being delayed or called off is likely to pose as a challenge for the companies that are in middle of their capex programs which in turn may impact their future growth plans. Prominent PE deals that fell apart in 2008 Target name Acquirer name Deal value (INR cr) Jaypee Infratech Akruti City DishTV Essar Power Nagarjuna Construction Lokmat ICICI Venture Citi Venture Capital and AIG Future Capital General Atlantic Partners Blackstone Temasek-India Equity Partners 3,200 1,500 250 NA NA NA

Page 31 of 38

Investment Analysis and Portfolio Management Project Private Equity

7. Private Equity Space India

Name of the firm Blackstone Group Address Blackstone Advisors India Private Ltd. Express Towers, 5th Floor Nariman Point, Mumbai 400 021, India Quadrant 'A', The IL&FS Financial Centre Bandra-Kurla Complex Bandra (East), Mumbai 400 051 India 153, Maker Chamber VI Nariman Point Mumbai 400 02 India Goldman Sachs (India) Securities Private Limited Rational House 951-A, Appasaheb Marathe Marg Prabhadevi, Mumbai 400 025 India KKR India Advisors Private Limited Trident Nariman Point Suite 1201 Nariman Point, Mumbai 400021, India Bain Capital Advisors (India) Private Limited 2nd Floor, Free Press House, Nariman Point, Mumbai 400 021 Warburg Pincus India Pvt. Ltd., 7th Floor, Express Towers, Nariman Point, Mumbai 400 021 Apax Partners India Advisers Private Limited, 2nd Floor, Devchand House, Shivsagar Estate ,Dr Annie Besant Road, Worli, Mumbai 400 018 Room 151 - 152, 15th Floor Maker Chambers VI 220 Nariman Point, Mumbai 400 021 4th Floor Thapar House, Dr. Annie Besant Road , Worli, Mumbai 400 030 FCH House, Ground Floor, Peninsula Corporate Park, G. K. Marg, Lower Parel, Mumbai - 400 013 Contact no Phone:+91 (0)22 67528500 Fax:+91 (0)22 6752 8531 P +91 22 6647 0800 F +91 22 6647 0803

The Carlyle Group

Texas Pacific Group (TPG)

+(91-22) 4039-1000 phone +(91-22) 4039-1002 fax

Goldman Sachs

Tel: +91 22 6616 9000 Fax: +91 22 6616 9001

Kohlberg Kravis Roberts (KKR)

+91 22 4355-1300

Bain Capital

Tel No: +91 22 6752 8000 Fax: +91 22 6752 8010 Tel No:+91 22 6650 0000 Fax:+91 22 6650 0001 Tel No:+91 22 4050 8400 Fax:+91 22 4050 844

Warburg Pincus Apax Partners

General Atlantic Partners

Tel: +91 (22) 6656-1400 Fax: +91 (22) 6631-7893 Tel: +91 22 6146 7900 Fax: +91 22 2423 1549 Tel : 022 - 40930211 - 40930215

Actis AIG Investments

Page 32 of 38

Investment Analysis and Portfolio Management Project Private Equity

8. Future of PE

The real GDP growth in the country is calculated in the range of 7.5-8.0 per cent during the year 2006-07. Presently the Indian Economy is coming across various risks both in the domestic scenario as well as in the international scenario. The global economy suffers from the problem of record level of international crude oil prices, overall inflationary pressures and rising international interest rates. In the same direction, the Indian economy also suffers from the problem of monsoon, infrastructure bottlenecks, and fiscal imbalances. Though there are a larger number of on-going imbalances continuing over the world, still to what extent different sectors in the Indian economy have responded in the period of 2006-07. The main reasons for the increasing trend of VC and PE investment in India can be attributed to the following reasons: Knowledge-based industries growing fast and mostly global; less affected by domestic issues;World class engineers, professionals, entrepreneurs their success is evident in the US as well 2nd largest English speaking population; India has advanced rapidly in the 90s, catching up with global markets in many sectors; 25% of small IT companies in the US have Indian founders ;Large presence of Indians in the US Software Sector The equity investor today has a very wide choice of investment vehicles with a menu of alternatives.

Page 33 of 38

Investment Analysis and Portfolio Management Project Private Equity

9. Recent Deals

Citibank sells Bharti stake to JPMorgan

Citibank has sold its stake in the telecom tower arm of Bharti Airtel to JPMorgan, exiting without any gain from the $50 million investment it made over two years ago, two persons aware of the development told ET NOW. The deal, described as a distress sale, values Bharti Infratel at a little over $10 billion (Rs 47,000 crore). The troubled US lender purchased an undisclosed minority stake in Bharti Infratel in 2007 through a unit called the Special Situations Group, a proprietary investment arm that specialised in investing in high-yield debt and distressed assets. The division is now being closed. Representatives for Citibank, JPMorgan and Bharti declined to comment. Sanjay Chawla, senior vice-president and telecom analyst at Mumbai-based Anand Rathi Securities, said valuations of tower companies have come off over the past two years and any seller who has been able to exit without a loss in the value of their holding has made a good deal. A banker close to the transaction said the deal valued Bharti Infratels tower assets at a 15-20% premium over the valuation at which recent tower deals have been concluded. In March this year, Nasdaq-listed American Tower Corporation (ATC) announced a deal to buy Xcel Telecom, founded by former BPL Mobile CEO Sandip Basu. ATC is estimated to have paid nearly Rs 800 crore to acquire Xcels portfolio of 1,700 towers, valuing each tower at a little over Rs 45 lakh. GTL Infrastructures imminent purchase of Aircels towers values each tower at Rs 48.5 lakh. A Bharti executive said the tower arm had been able to maintain high valuations, attributing it to higher tenancy ratios compared to rival firms. Indias largest phone firm set up Bharti Infratel in November 2006 as a provider of telecom towers and related infrastructure. At the end of March last year, Bharti Intratel had over 53,000 towers in 23 telecom circles. It sold a 9% stake for around $1 billion to a consortium of financial investors led by Singapores Temasek Holdings in 2007, valuing the company at $10-12 billion. None of the other investors in the company are looking to exit now, it is learnt. Bharti Infratel has announced a plan to launch an initial public offering, but has not set a date yet. It also owns a 42% stake in Indus Towers Limited, billed as the worlds largest tower company with over 100,000 towers. Vodafone Essar and Aditya Birla Telecom are the other shareholders in Indus Towers. Source: Economic Times

Page 34 of 38

Investment Analysis and Portfolio Management Project Private Equity

Bharti to buy controlling stake in Warid Telecom

Bharti Airtel is looking to buy a controlling stake in Bangladeshs fourth-biggest mobile phone operator Warid Telecom, pressing ahead with its international ambitions just two months after it failed in its second attempt to merge with South Africas MTN. Indias largest phone company, by both revenues and subscribers, has applied to the Bangladesh Telecommunications Regulatory Commission (BTRC) for permission to buy a 70% stake from the Abu Dhabi group, the owner of Warid, the regulatory bodys chairman Zia Ahmed told news agencies in Dhaka. He declined to say how much the stake was worth, but added that Bharti Airtel initially intended to invest $300 million. A Warid Telecom executive said Bharti Airtel and Warid are in exclusive discussions on similar lines as the deal between Essar and the Abu Dhabi group. Warid expects to command premium valuations since Bangladesh is an emerging market and the Dhabi group will remain significant minority investors, the executive added. The Essar group announced last month that it is investing in Warid Telecoms operations in Uganda and the Republic of Congo, valuing them at a total of $318 million. Bharti Enterprises deputy group CEO and MD Akhil Gupta reiterated that it is interested in the SAARC region, especially Bangladesh. Bangladeshs Daily Star reported the deal could be worth $900 million, but this could not be independently verified. Warid has just under 3 million customers, or about 5.5% of the countrys 52 million cellular subscribers. A Reuters report from Dubai, citing Dhabi group chief commercial officer Ali Tahir, said Warid expects to seal a deal by mid-January 2010. Analysts said that mobile phone density in Bangladesh is only about 33% and the market is primed for rapid growth. The number of cellphone users is projected to double to 100 million by 2013. Urban India is close to reaching saturation as teledensity in cities, towns and metros has crossed 100% and revenues and profits of all Indian telcos are under severe pressure as they engage in a savage price war. With about 115 million users, Bharti accounts for about a quarter of Indias wireless subscribers. It has overseas operations in Sri Lanka, Seychelles and British Channel Islands and had bid for licences across several markets in Africa and West Asia, an indicator that it views these regions as offering the most potential for growth. The bid for Warid also signals its intention to expand overseas through smaller buys across Asia and Africa. Luca Ferro, managing partner with consultancy firm Value Partners India, said the fair enterprise valuation for Warid would be around $600 million. In June 2008, Japans NTT DoCoMo purchased 30% in TM International (Bangladesh), at a valuation of 18 times the EBITDA, or core earnings, of that company.

Page 35 of 38

Investment Analysis and Portfolio Management Project Private Equity Warids revenues for CY09 are estimated at $80 million. If we apply an EBITDA margin of 29% (that of Aktel), that provides us an EBITDA of $23.5 million for Warid. Assuming a valuation of 18 times the EBITDA on the lines of DoCoMo deal, Warid would be valued at $445 million. Add to it a control premium for 70% stake, and the valuation will be $580 million to $600 million, he said. He added that average monthly revenue per user (ARPU) in Bangladesh is low, with Warids at $2.1 in June 2009. The lower penetration implies a high growth potential. However, the sharp decline in ARPU is a concern, Mr Ferro said. PricewaterhouseCoopers telecom advisor and associate director Arpita Pal Agrawal said there are natural synergies in the proposed deal because Bangladeshs market dynamics are largely similar to India. Bangladesh is an under-penetrated market by global standards and there remains growth potential. A telecom industry executive said that the deal with Warid is unlikely to extend to its operations in Pakistan due to security concerns. The Dhabi group owns 70% in Warid Telecom Pakistan and Sing Tel, a majority investor in Bharti Airtel, the rest. India has in the past refused to clear telecom deals involving companies with a presence in Pakistan, but in the change of stance, the Centre recently approved Norways Telenor to acquire a controlling stake in Unitech Wireless. Telenor has operations in both Pakistan and Bangladesh. Source: Economic Times

Page 36 of 38

Investment Analysis and Portfolio Management Project Private Equity

SIDBI picks up 11% more in Bandhan

Small Industries Development Bank of India (SIDBI) on Wednesday raised its stake in the country's leading microfinance institution, Bandhan, to 12.23% from the existing 1.31%, underscoring the growing role of such institutions that lend to the poor. The additional 10.92% stake will cost SIDBI Rs 50 crore. Accordingly, the paid-up capital of Bandhan-which lends only to women-will rise to Rs 118 crore from Rs 68 crore, and its net worth to Rs 165 crore (Rs 115 crore). At present, SIDBI is the lone institutional stakeholder in Bandhan. Both Bandhan and SIDBI confirmed the development to ET. "This is a significant development for us. Not only does our capital adequacy ratio improve to 17.83% from 13.23% earlier, fresh equity will help our business grow," Bandhan managing director Chandra Shekhar Ghosh said. Bandhan's principal shareholder is Financial Inclusion Trust (FIT), a trustee created by the MFI as the vehicle for CSR activities. With SIDBI enhancing its stake, FIT's holding now stands at 58% while the promoters and associates hold about 2%, and the balance is with employees. Mr Ghosh said FIT is an independent trust and the dividend it earns from the holding is used for CSR activities, primarily in the health sector. In just seven years of its existence, Bandhan has created an outstanding asset portfolio of Rs 1,080 crore and it is targeting to take this to Rs 1,200 crore by March 2010. In November 2009 alone, it disbursed Rs 250 crore of loans. In 2009, the MFI added 506 branches, taking the tally to 1008, across 14 states. It will soon open a branch in Arunachal Pradesh. Bandhan is incorporated as Bandhan Financial Services Pvt Ltd (BFSPL) under the Companies Act, 1956, and also registered as a non-banking financial company with the Reserve Bank of India (RBI). Source: Economic Times

Page 37 of 38

Investment Analysis and Portfolio Management Project Private Equity

10. BIBLIOGRAPHY

Economic times Internet research Newspaper articles Magazine articles & reports.

Page 38 of 38

Você também pode gostar

- Startup VC - Guide: Everything Entrepreneurs Need to Know about Venture Capital and Startup FundraisingNo EverandStartup VC - Guide: Everything Entrepreneurs Need to Know about Venture Capital and Startup FundraisingAinda não há avaliações

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingNo EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingAinda não há avaliações

- Presentation On: Private EquityDocumento45 páginasPresentation On: Private EquityKetan BhatiaAinda não há avaliações

- Venture Capital Fund ProjectDocumento29 páginasVenture Capital Fund ProjectAdii AdityaAinda não há avaliações

- Venture Capital (VC) Is Financial Capital Provided To Early-Stage, High-Potential, HighDocumento5 páginasVenture Capital (VC) Is Financial Capital Provided To Early-Stage, High-Potential, Highroshanaditya4Ainda não há avaliações

- Definition and Basics of Venture Capital (ASHLEY)Documento5 páginasDefinition and Basics of Venture Capital (ASHLEY)Steffanie DarlenyAinda não há avaliações

- Final - Welingkar - Private Equity CompaniesDocumento60 páginasFinal - Welingkar - Private Equity Companiessam coolAinda não há avaliações

- 8 Pe, VC, AfDocumento15 páginas8 Pe, VC, AfShyam TomerAinda não há avaliações

- Private Equity Interview GuideDocumento35 páginasPrivate Equity Interview Guide萧霄100% (1)

- CAPITALDocumento52 páginasCAPITALAjay ChahalAinda não há avaliações

- FMR ProjectDocumento17 páginasFMR ProjectaryanAinda não há avaliações

- Venture Capital - FINDocumento5 páginasVenture Capital - FINclaudiaAinda não há avaliações

- Venture capital текстDocumento3 páginasVenture capital текстАнполп ПнщааAinda não há avaliações

- Chapter 2Documento49 páginasChapter 2Naveen gupiAinda não há avaliações

- Unit - Iv - NVP-1Documento47 páginasUnit - Iv - NVP-1Pruthvi RajAinda não há avaliações

- Private EquityDocumento42 páginasPrivate EquitySahitha KusumaAinda não há avaliações

- Presentation For VivaDocumento17 páginasPresentation For Vivaakshata sunil masrankarAinda não há avaliações

- Session 15, 16 VCDocumento35 páginasSession 15, 16 VCdakshaangelAinda não há avaliações

- Capital StructureDocumento23 páginasCapital StructureksdAinda não há avaliações

- Venture CapitalDocumento24 páginasVenture CapitalBipinAinda não há avaliações

- Venture CapitalDocumento30 páginasVenture Capitalmeenakshi383Ainda não há avaliações

- Private Placement & Venture CapitalDocumento18 páginasPrivate Placement & Venture Capitalshraddha mehtaAinda não há avaliações

- Venture Capital FundsDocumento95 páginasVenture Capital FundsEsha ShahAinda não há avaliações

- Ê, in Finance, Is AnDocumento11 páginasÊ, in Finance, Is AnJome MathewAinda não há avaliações

- 1.intro To PEDocumento61 páginas1.intro To PEsashaathrgAinda não há avaliações

- Chapter Six: Venture Capital 6.1. Meaning of Venture Capital InvestmentDocumento15 páginasChapter Six: Venture Capital 6.1. Meaning of Venture Capital InvestmenttemedebereAinda não há avaliações

- Priva Te EqDocumento34 páginasPriva Te EqRaksha KamatAinda não há avaliações

- Shri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Documento21 páginasShri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Mohit ZaveriAinda não há avaliações

- About Venture CapitalDocumento8 páginasAbout Venture CapitalKishor YadavAinda não há avaliações

- Report On Venture Capital in IndiaDocumento60 páginasReport On Venture Capital in IndiaShubham More CenationAinda não há avaliações

- Project Report On Venture Capital in IndiaDocumento61 páginasProject Report On Venture Capital in IndiaNina Bhelley75% (16)

- Venture Capital FinancingDocumento31 páginasVenture Capital FinancingkumbharnehaAinda não há avaliações

- Venture CapitalDocumento20 páginasVenture CapitalAshika Khanna 1911165Ainda não há avaliações

- Venture Capitalist FirmDocumento5 páginasVenture Capitalist Firmkishorepatil8887Ainda não há avaliações

- Unit 6 Venture CapitalDocumento39 páginasUnit 6 Venture CapitalNtinginya Iddi rajabuAinda não há avaliações

- A Beginners Guide To PE and VCDocumento21 páginasA Beginners Guide To PE and VCflux1Ainda não há avaliações

- About Venture Capital (VC)Documento16 páginasAbout Venture Capital (VC)Shalini JaiswalAinda não há avaliações

- Private Equity Part 1Documento5 páginasPrivate Equity Part 1Paolina NikolovaAinda não há avaliações

- 2023 CFA© Program Curriculum Level I Volume 5 Private EquityDocumento8 páginas2023 CFA© Program Curriculum Level I Volume 5 Private EquityRuffin MickaelAinda não há avaliações

- Introduction To Venture Capital: I L'tiiiire (Apiial Manaf Emeni Indian ExperienceDocumento13 páginasIntroduction To Venture Capital: I L'tiiiire (Apiial Manaf Emeni Indian Experienceashwin thakurAinda não há avaliações

- Concept of Venture CapitalDocumento19 páginasConcept of Venture CapitalyangdolAinda não há avaliações

- Startup Long-Term Growth Venture CapitalDocumento7 páginasStartup Long-Term Growth Venture CapitalNiño Rey LopezAinda não há avaliações

- Tushar Nivruttinath HatimDocumento42 páginasTushar Nivruttinath Hatimtushar nivruttinath hatimAinda não há avaliações

- HTBFM143 Yash Vanigotta Alternative InvestmentsDocumento14 páginasHTBFM143 Yash Vanigotta Alternative InvestmentsYashAinda não há avaliações

- Definition of 'Venture Capital'Documento3 páginasDefinition of 'Venture Capital'Adarsh UttarkarAinda não há avaliações

- Venture Capital: Debt Finance Term LoanDocumento4 páginasVenture Capital: Debt Finance Term LoanmansionerAinda não há avaliações

- What Is Private EquityDocumento10 páginasWhat Is Private EquityAli NadafAinda não há avaliações

- S 1 - Introduction To Private Equity and Venture Capital: B B Chakrabarti Professor of FinanceDocumento174 páginasS 1 - Introduction To Private Equity and Venture Capital: B B Chakrabarti Professor of FinanceSiddhantSinghAinda não há avaliações

- Private Equity Typically Refers To: Bloomberg BusinessweekDocumento4 páginasPrivate Equity Typically Refers To: Bloomberg BusinessweekfunmastiAinda não há avaliações

- Venture FinancingDocumento57 páginasVenture FinancingZakir AliAinda não há avaliações

- Venture Capital in India: Merchant Banking AssignmentDocumento23 páginasVenture Capital in India: Merchant Banking AssignmentSanjay YadavAinda não há avaliações

- The Origin of Venture CapitalDocumento26 páginasThe Origin of Venture CapitalTejal GuptaAinda não há avaliações

- CC C CCCCCC C: O C CCCC CCCCC (C C C CCCDocumento5 páginasCC C CCCCCC C: O C CCCC CCCCC (C C C CCCBadri NarayananAinda não há avaliações

- Module 7 - ED - 14MBA26Documento15 páginasModule 7 - ED - 14MBA26Uday GowdaAinda não há avaliações

- Role of Capital Market in Developing Economy: Sakshi TomarDocumento18 páginasRole of Capital Market in Developing Economy: Sakshi Tomarsakshi tomarAinda não há avaliações

- Private Equity Introduction - 2020 - V2Documento22 páginasPrivate Equity Introduction - 2020 - V2Jiarong ZhangAinda não há avaliações

- Lesson 19: Venture Capital - Theoretical ConceptDocumento4 páginasLesson 19: Venture Capital - Theoretical ConceptAkshay SareenAinda não há avaliações

- Venture CapitalDocumento12 páginasVenture Capitalmtasci100% (1)

- Venture Capital Industry in BangladeshDocumento8 páginasVenture Capital Industry in BangladeshUzzal AhmedAinda não há avaliações

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersNo EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersAinda não há avaliações

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocumento9 páginasMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarAinda não há avaliações

- Horizontal Balance Sheet: Total Equity&LiabilitiesDocumento7 páginasHorizontal Balance Sheet: Total Equity&LiabilitiesM.TalhaAinda não há avaliações

- Decentralize Smart Contract PlatformDocumento12 páginasDecentralize Smart Contract PlatformSindhu ThomasAinda não há avaliações

- Study On Npa With Special Reference To ICICI Bank, by Swaroop DhariwalDocumento102 páginasStudy On Npa With Special Reference To ICICI Bank, by Swaroop Dhariwalswaroopdhariwal83% (30)

- Last Will and Testament: - 1. RecitalDocumento4 páginasLast Will and Testament: - 1. RecitalSalomeAinda não há avaliações

- MeetFounders NYC May 2021 Handout FINAL v2Documento13 páginasMeetFounders NYC May 2021 Handout FINAL v2Andrew BottAinda não há avaliações

- Adani PowerDocumento17 páginasAdani Powerनिशांत मित्तलAinda não há avaliações

- eDocumentFile 2Documento2 páginaseDocumentFile 29z8925bxm8Ainda não há avaliações

- Top Ten Pharma Financials 2011Documento136 páginasTop Ten Pharma Financials 2011Harjyot RandhawaAinda não há avaliações

- Semi Detailed Lesson Plan in Applied Economics Quarter 1Documento5 páginasSemi Detailed Lesson Plan in Applied Economics Quarter 1Lyka Curammeng CarvajalAinda não há avaliações

- Managerial Accounting:: An Introduction To Concepts, Methods, and UsesDocumento22 páginasManagerial Accounting:: An Introduction To Concepts, Methods, and UsesamitbaggausAinda não há avaliações

- Tax Compliance December 2020Documento10 páginasTax Compliance December 2020abdullahsaleem91Ainda não há avaliações

- Atma Nirbhar BharatDocumento4 páginasAtma Nirbhar BharatJayraj ShahAinda não há avaliações

- Project Appraisal MethodsDocumento15 páginasProject Appraisal MethodsAndrew GomezAinda não há avaliações

- 01 - FS AnalysisDocumento17 páginas01 - FS AnalysisRyzel Borja0% (1)

- JP Morgan - Indonesia Coal Mining 2011Documento39 páginasJP Morgan - Indonesia Coal Mining 2011KJPP ASRAinda não há avaliações

- Lloyds Bank : Town of Cherry Creek 6845 Main Street Cherry Creek NY 14 723Documento4 páginasLloyds Bank : Town of Cherry Creek 6845 Main Street Cherry Creek NY 14 723maxAinda não há avaliações

- 1.1 Spartan QuestionDocumento1 página1.1 Spartan QuestionMohammed Akhtab Ul HudaAinda não há avaliações

- Student Loan Forgiveness For Frontline Health WorkersDocumento20 páginasStudent Loan Forgiveness For Frontline Health WorkersKyle SpinnerAinda não há avaliações

- SMEDA Research Journal 2015Documento60 páginasSMEDA Research Journal 2015Hamid RehmanAinda não há avaliações

- Experienced CFO in Multi-Entity Environments. Seventeen Years' Experience in Executive Financial Roles Including VP, FD and CFO DesignationsDocumento4 páginasExperienced CFO in Multi-Entity Environments. Seventeen Years' Experience in Executive Financial Roles Including VP, FD and CFO DesignationsVikram Raj SinghAinda não há avaliações

- Private Equity Investment ThesisDocumento4 páginasPrivate Equity Investment ThesisBrandi Gonzales100% (2)

- About IdbiDocumento42 páginasAbout IdbiNitesh SinghAinda não há avaliações

- Act No. 3135 (Regulating The Sale of Property Under Special Powers Inserted in or Annexed To Real Estate Mortgages)Documento1 páginaAct No. 3135 (Regulating The Sale of Property Under Special Powers Inserted in or Annexed To Real Estate Mortgages)Reuben MercadoAinda não há avaliações

- Rocks and Minerals The Definitive Visual GuideDocumento31 páginasRocks and Minerals The Definitive Visual Guideoriginalevicky0% (1)

- Microfinance India Summit 2010: 23 Nov, 2010, 01.33PM IST, Gayatri Nayak, ET BureauDocumento9 páginasMicrofinance India Summit 2010: 23 Nov, 2010, 01.33PM IST, Gayatri Nayak, ET BureauMansi ShahAinda não há avaliações

- CaseStudy Group01Documento3 páginasCaseStudy Group01Nishshanka SenevirathneAinda não há avaliações

- KSR in A Nut Shell PDFDocumento16 páginasKSR in A Nut Shell PDFtheorytidingsAinda não há avaliações

- 0504 PDFDocumento22 páginas0504 PDFAnonymous VwHMX3ZAinda não há avaliações

- Commercial Law - Negotiable Instruments LawDocumento31 páginasCommercial Law - Negotiable Instruments LawJeremias CusayAinda não há avaliações