Escolar Documentos

Profissional Documentos

Cultura Documentos

MSD 2011/12 Draft Budget - Second Revision F195-2ndDRAFTVersion3

Enviado por

Debra KolrudTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

MSD 2011/12 Draft Budget - Second Revision F195-2ndDRAFTVersion3

Enviado por

Debra KolrudDireitos autorais:

Formatos disponíveis

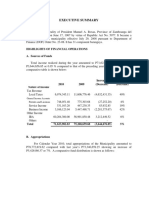

F-195 TABLE OF CONTENTS Fiscal Year 2011-2012 REPORT TITLE Budget and Excess Levy Certification Budget and

Excess Levy Summary General Fund Budget Financial Summary Enrollment and Staff Counts Summary of General Fund Revenues and Other Financing Sources Expenditure by Program Program Summary by Object of Expenditure Program Matrices Salary Exhibits: Salary Exhibits: Activity Summary Revenue Worksheet: Local Excess Levies and Timber Excise Tax Long-Term Financing: Conditional Sales Contract Certificated/Classified Staff Counts by Activity Associated Student Body Fund Budget Summary of Associated Student Body Fund Debt Service Fund Budget Summary of Debt Service Fund Revenues and Other Financing Sources Revenue Worksheet: Local Excess Levies and Timber Excise Tax Detail of Outstanding Bonds Capital Projects Fund Budget Summary of Capital Projects Fund Revenues and Other Financing Sources Revenue Worksheet: Local Excess Levies and Timber Excise Tax Description of Projects Salary Exhibt: Salary Exhibit: Certificated Employees Classified Employees CP1 CP3 CP5 CP6 CP7 CP8 CP9 TVF1 TVF3 TVF4 DS1 DS2 DS3 DS4 ASB1 Certificated Employees Classified Employees Budget Summary GF1 GF2 GF4 GF8 GF9 GF9-XX GF9-201-XX GF9-301-XX GF10 GF11 GF13 GF14 GF15 PAGE NUMBER Certification Page Fund Summary

Objects of Expenditure

Long-Term Financing: Conditional Sales Contracts Transportation Vehicle Fund Budget Summary of Transportation Vehicle Fund Revenue Worksheet: Local Excess Levies and Timber Excise Tax Long-Term Financing: Condition Sales Contract

FY 2011-2012 Monroe School District No.103 BUDGET AND EXCESS LEVY SUMMARY Associated Student Body Fund

Run: 7/17/2011 9:42:00 PM

General Fund SECTION A: BUDGET SUMMARY 64,431,323 64,484,915 0 0

Debt Service Fund

Capital Projects Fund

Transportation Vehicle Fund

Total Revenues and Other Financing Sources Total Appropriation (Expenditures) Other Financing Uses--Transfers Out (G.L. 536) Other Financing Uses (G.L. 535) Excess of Revenues/Other Financing Sources Over/(Under) Expenditures and Other Financing Uses Beginning Total Fund Balance Ending Total Fund Balance SECTION B: COLLECTION EXCESS LEVIES FOR 2012

1,076,805 1,111,462 XXXX XXXX

5,879,348 5,434,210 0 0

48,000 551,787 0 0

686,901 530,000 0 0

-53,592 4,385,590 4,331,998

-34,657 429,138 394,481

445,138 2,951,000 3,396,138

-503,787 1,021,460 517,673

156,901 530,500 687,401

Excess levies approved by voters for 2012 collection Rollback mandated by school district Board of Directors 1/ Net excess levy amount for 2012 collection after rollback

14,600,000 0 14,600,000

0 0 XXXX

0 0 6,323,000

0 0 0

0 0 400,000

1/ Rollback of levies needs to be certified pursuant to RCW 84.52.020.

Please do NOT include such resolution as part of this document.

Form F-195

Page 1 of 1

Fund Summary

FY 2011-2012 Monroe School District No.103 GENERAL FUND FINANCIAL SUMMARY (1) Actual 2009-2010 ENROLLMENT AND STAFFING SUMMARY Total K-12 FTE Enrollment Counts FTE Certificated Employees FTE Classified Employees FINANCIAL SUMMARY Total Revenues and Other Financing Sources Total Expenditures Total Beginning Fund Balance Total Ending Fund Balance EXPENDITURE SUMMARY BY PROGRAM GROUPS Regular Instruction Federal Stimulus Special Education Instruction Vocational Instruction Skills Center Instruction Compensatory Education Other Instructional Programs Community Services Support Services Total - Program Groups EXPENDITURE SUMMARY BY ACTIVITY GROUPS Teaching Activities Teaching Support Other Supportive Activities Building Administration Central Administration Total - Activity Groups EXPENDITURE SUMMARY BY OBJECTS Certificated Salaries Classified Salaries Form F-195 29,033,908 9,215,649 45.50 14.44 30,176,670 9,456,676 Page 1 of 2 45.45 14.24 28,989,695 9,160,821 41,574,496 5,353,250 9,592,078 3,378,441 3,908,382 63,806,648 65.16 8.39 15.03 5.29 6.13 100.00 43,538,063 5,144,464 10,370,194 3,535,763 3,810,831 66,399,315 65.57 7.75 15.62 5.32 5.74 100.00 41,799,505 5,276,805 10,450,519 3,147,504 3,810,582 64,484,915 37,598,137 1,509,532 6,820,014 2,725,594 0 1,902,498 1,230,823 112,841 11,907,208 63,806,648 58.93 2.37 10.69 4.27 0.00 2.98 1.93 0.18 18.66 100.00 39,153,424 1,278,726 6,750,874 2,585,078 0 1,757,130 2,161,922 88,984 12,623,177 66,399,315 58.97 1.93 10.17 3.89 0.00 2.65 3.26 0.13 19.01 100.00 37,509,067 0 7,238,214 3,022,391 0 1,818,628 2,121,005 77,760 12,697,850 64,484,915 65,229,166 63,806,648 3,507,374 4,575,138 66,272,302 66,399,315 3,600,000 3,472,987 64,431,323 64,484,915 4,385,590 4,331,998 7,547.88 399.645 188.851 7,600.00 403.930 189.671 7,316.00 377.668 188.662 (3) Budget 2010-2011 (5) Budget 2011-2012

Run: 7/17/2011 9:42:01 PM

(2)\n% of Total1

(4) % of Total2

(6) % of Total3

58.17 0.00 11.22 4.69 0.00 2.82 3.29 0.12 19.69 100.00

64.82 8.18 16.21 4.88 5.91 100.00 44.96 14.21 Budget Summary

FY 2011-2012 Monroe School District No.103 GENERAL FUND FINANCIAL SUMMARY (1) Actual 2009-2010 Employee Benefits and Payroll Taxes Supplies, Instructional Resources and Noncapitalized Items Purchased Services Travel Capital Outlay Total - Objects 11,717,145 2,184,733 (3) Budget 2010-2011 12,376,416 2,721,420 (4) % of Total2 18.64 4.10 (5) Budget 2011-2012 12,925,276 3,298,429

Run: 7/17/2011 9:42:01 PM

(2)\n% of Total1 18.36 3.42

(6) % of Total3 20.04 5.12

11,507,390 90,116 57,706 63,806,648

18.03 0.14 0.09 100.00

11,634,263 33,870 0 66,399,315

17.52 0.05 0.00 100.00

10,071,654 39,040 0 64,484,915

15.62 0.06 0.00 100.00

Form F-195

Page 2 of 2

Budget Summary

FY 2011-2012 Monroe School District No.103 FY ENROLLMENT AND STAFF COUNTS Average 1/ 2009-2010 A. FTE ENROLLMENT COUNTS (calculate to two decimal places) /5 196.17 523.76 473.58 508.13 514.85 524.54 465.79 500.04 521.20 753.10 778.56 635.82 1,046.06 7,441.59 106.29 7,547.88 399.645 188.851 196.00 472.00 502.00 477.00 515.00 519.00 532.00 473.00 507.00 674.00 770.00 747.00 1,116.00 7,500.00 100.00 7,600.00 403.930 189.671 197.00 456.00 466.00 473.00 465.00 491.00 513.00 495.00 464.00 625.00 719.00 678.00 1,159.00 7,201.00 115.00 7,316.00 377.668 188.662 1. Kindergarten 2. Grade 1 3. Grade 2 4. Grade 3 5. Grade 4 6. Grade 5 7. Grade 6 8. Grade 7 9. Grade 8 10. Grade 9 11. Grade 10 12. Grade 11 (excluding Running Start) 13. Grade 12 (excluding Running Start) 14. SUBTOTAL 15. Running Start 16. TOTAL K-12 B. STAFF COUNTS (calculate to three decimal places) 1. General Fund FTE Certificated Employees /4 2. General Fund FTE Classified Employees /4 Budget 2/ 2010-2011 Budget 3/ 2011-2012

Run: 7/17/2011 9:42:02 PM

1/ Enrollment are the average counts at school year?s end as reported in the P-223 system. These counts do not include Ancillary and Non-Standard (summer) data. 2/ Enrollment and staff counts are entered in the budget for the school year. These counts remain constant and are not subject to change with subsequent updates to the P-233 and S-275 system, respectively. 3/ Enrollment should include special ed., part-time private, home-based, and summer students eligible for BEA funding, as reflected in the F-203.

4/ The staff counts for the prior year are the actual counts reported on Form S-275 and the current fiscal year are budgeted counts reported on Form F-195. 5/ Beginning in 2011-2012 kindergarten is considered full day and basic education. Beginning with 2011-2012, kindergarten enrollment counts should include any additional FTE attributable to the state funded full day kindergarten allocation based on total kindergarten enrollment, as reflected in the F-203.

Form F-195

Page 1 of 1

GF1

FY 2011-2012 Monroe School District No.103 SUMMARY OF GENERAL FUND BUDGET

Run: 7/17/2011 9:42:03 PM

(1) Actual 2009-2010 REVENUES AND OTHER FINANCING SOURCES 1000 | Local Taxes 2000 | Local Nontax Support 3000 | State, General Purpose 4000 | State, Special Purpose 5000 | Federal, General Purpose 6000 | Federal, Special Purpose 7000 | Revenues from Other School Districts 8000 | Revenues from Other Entities 9000 | Other Financing Sources A. TOTAL REVENUES AND OTHER FINANCING SOURCES EXPENDITURES 00 | Regular Instruction 10 | Federal Stimulus 20 | Special Education Instruction 30 | Vocational Education Instruction 40 | Skills Center Instruction 50 and 60 | Compensatory Education Instruction 70 | Other Instructional Programs 80 | Community Services 90 | Support Services B. C. D. TOTAL EXPENDITURES OTHER FINANCING USES--TRANSFERS OUT (G.L.536) OTHER FINANCING USES (G.L.535) 2/ 1/ 37,598,137 1,509,532 6,820,014 2,725,594 0 1,902,498 1,230,823 112,841 11,907,208 63,806,648 354,755 0 1,067,763 12,129,309 1,820,616 39,067,162 6,830,327 59,019 4,520,204 83,559 718,579 391 65,229,166

(2) Budget 2010-2011 13,029,530 2,256,021 39,238,463 6,480,938 65,000 4,130,503 125,000 946,847 0 66,272,302 39,153,424 1,278,726 6,750,874 2,585,078 0 1,757,130 2,161,922 88,984 12,623,177 66,399,315 0 0 -127,013

(3) Budget 2011-2012 13,968,704 2,185,350 37,339,796 7,000,574 53,000 2,800,899 138,000 945,000 0 64,431,323 37,509,067 0 7,238,214 3,022,391 0 1,818,628 2,121,005 77,760 12,697,850 64,484,915 0 0 -53,592

E. EXCESS OF REVENUES/OTHER FINANCING SOURCES OVER (UNDER) EXPENDITURES AND OTHER FINANCING USES (A-B-C-D) BEGINNING FUND BALANCE G.L.810 G.L.815 G.L.821 G.L.830 G.L.835 G.L.840 Restricted for Other Items Restricted for Unequalized Deductible Revenue Restricted for Carryover of Restricted Revenues Restricted for Debt Service Restricted for Arbitrage Rebate Nonspendable Fund Balance-Inventory & Prepaid Items

364,668 0 XXXXX 0 0 95,000 Page 1 of 2

0 0 68,250 0 0 50,000

0 0 120,540 0 0 50,000 GF2

Form F-195

FY 2011-2012 Continued Monroe School District No.103 SUMMARY OF GENERAL FUND BUDGET (1) Actual 2009-2010 G.L.845 G.L.850 G.L.870 G.L.872 G.L.875 G.L.884 G.L.888 G.L.890 F. G. Restricted for Self-Insurance Restricted for Uninsured Risks Committed to Other Purposes Committed to Minimum Fund Balance Policy Assigned to Contingencies Assigned to Other Capital Projects Assigned to Other Purposes Unassigned Fund Balance XXXXX 0 381,449 XXXXX 0 XXXXX XXXXX 3,874,946 3,507,374 XXXXX 99,743 0 XXXXX 0 0 75,000 XXXXX 0 381,449 XXXXX 144,000 XXXXX XXXXX 3,874,946 3/ 4,575,138 (2) Budget 2010-2011 0 0 0 1,959,888 0 0 242,630 1,279,232 3,600,000 XXXXX 0 0 48,250 0 0 50,000 0 0 0 1,987,824 0 0 212,209 1,174,704 3,472,987 (3) Budget 2011-2012 0 0 0 3,313,615 0 0 225,650 675,785 4,385,590 XXXXX 0 0 120,540 0 0 50,000 0 0 0 3,313,615 0 0 225,650 622,193 4,331,998

Run: 7/17/2011 9:42:03 PM

TOTAL BEGINNING FUND BALANCE G.L.898 PRIOR YEAR CORRECTIONS OR RESTATEMENTS(+ OR -) Restricted for Other Items Restricted for Unequalized Deductible Revenue Restricted for Carryover of Restricted Revenues Restricted for Debt Service Restricted for Arbitrage Rebate Nonspendable Fund Balance-Inventory & Prepaid Items Restricted for Self-Insurance Restricted for Uninsured Risks Committed to Other Purposes Committed to Minimum Fund Balance Policy Assigned to Contingencies Assigned to Other Capital Projects Assigned to Other Purposes Unassigned Fund Balance

ENDING FUND BALANCE G.L.810 G.L.815 G.L.821 G.L.830 G.L.835 G.L.840 G.L.845 G.L.850 G.L.870 G.L.872 G.L.875 G.L.884 G.L.888 G.L.890 H.

TOTAL ENDING FUND BALANCE (E+F, +OR-G)

1/

G.L. 536 is an account that is used to summarize actions for other financing uses--transfers out.

2/ G.L.535 is an account that is used to summarize actions for other financing uses such as long-term financing and debt extingishments. Nonvoted debts may be serviced in the Debt Service Fund (DSF) rather than in the fund that received the debt proceeds. In order to provide the resources to retire the debt, a transfer is used by the General Fund, Capital Projects Fund, or Transportation Vehicle Fund to transfer resources to the DSF. Refer to Page DS4 for detail of estimated outstanding nonvoted bond detail information. 3/ Line H must be equal to or greater than all reserved fund balances. Page 2 of 2 GF2

Form F-195

FY 2011-2012 Monroe School District No.103 GENERAL FUND BUDGET--REVENUES AND OTHER FINANCING SOURCES

Run: 7/17/2011 9:42:04 PM

(1) Actual 2009-2010 LOCAL TAXES 1100 | Local Property Tax 1300 | Sale of Tax Title Property 1400 | Local in lieu of Taxes 1500 | Timber Excise Tax 1600 | County-Administered Forests 1900 | Other Local Taxes 1000 | TOTAL LOCAL TAXES LOCAL SUPPORT NONTAX 2100 | Tuitions and Fees, Unassigned 2131 | Secondary Vocational Education Tuition 2145 | Skills Center Tuitions and Fees 2171 | Traffic Safety Education Fees 2173 | Summer School Tuition and Fees 2186 | Community School Tuition and Fees 2188 | Day Care Tuitions and Fees 2200 | Sales of Goods, Supplies, and Services, Unassigned 2231 | Secondary Voc. Ed., Sales of Goods, Supplies, and Services 2245 | Skills Center, Sales of Goods, Supplies and Services 2288 | Day Care, Sales of Goods, Supplies and Services 2289 | Other Community Services, Sales of Goods, Supplies and Services 2298 | School Food Services, Sales of Goods, Supplies and Services 2300 | Investment Earnings 2400 | Interfund Loan Interest Earnings 2500 | Gifts and Donations 2600 | Fines and Damages 2700 | Rentals and Leases 2800 | Insurance Recoveries 2900 | Local Support Nontax, Unassigned 2910 | E-Rate 2000 | TOTAL LOCAL SUPPORT NONTAX Form F-195 Page 1 of 6 428,652 0 0 0 27,897 28,660 0 22,574 16,315 0 0 0 723,904 13,288 0 134,971 12,776 80,263 1,889 329,428 0 1,820,616 12,125,009 0 0 4,301 0 0 12,129,309

(2) Budget 2010-2011 13,026,304 0 0 3,226 0 0 13,029,530 486,672 0 0 0 30,000 35,000 0 15,000 0 0 0 0 900,000 15,000 0 250,000 0 68,000 5,000 411,349 40,000 2,256,021

(3) Budget 2011-2012 13,962,827 0 0 5,877 0 0 13,968,704 428,500 0 0 0 20,000 25,000 0 30,250 0 0 0 55,000 800,000 15,000 0 280,000 10,000 68,000 8,000 445,600 0 2,185,350 GF4

FY 2011-2012 Continued Monroe School District No.103 GENERAL FUND BUDGET--REVENUES AND OTHER FINANCING SOURCES (1) Actual 2009-2010 STATE, GENERAL PURPOSE 3100 | Apportionment 3121 | Special Education--General Apportionment 3300 | Local Effort Assistance 3600 | State Forests 3900 | Other State General Purpose, Unassigned 3000 | TOTAL STATE, GENERAL PURPOSE STATE, SPECIAL PURPOSE 4100 | Special Purpose, Unassigned 4121 | Special Education 4126 | State Institutions, Special Education 4134 | Middle School Career and Technical Education 4155 | Learning Assistance 4156 | State Institutions, Centers, and Homes, Delinquent 4158 | Special and Pilot Programs 4159 | Institutions-Juveniles in Adult Jails 4165 | Transitional Bilingual 4166 | Student Achievement 4174 | Highly Capable 4188 | Day Care 4198 | School Food Services 4199 | Transportation--Operations 4300 | Other State Agencies, Unassigned 4321 | Special Education--Other State Agencies 4326 | State Institutions--Special Education--Other State Agencies 4356 | State Institutions, Centers, Homes, Delinquent--Other State Agencies 4358 | Speical and Pilot Programs--Other State Agencies 4365 | Transitional Bilingual--Other State Agencies 4388 | Day Care--Other State Agencies 4398 | School Food Services--Other State Agencies 4399 | Transportation--Operations--Other State Agencies Form F-195 Page 2 of 6 363,421 3,499,665 0 8,676 467,986 0 145,055 XXXXX 373,274 196,794 71,108 0 34,038 1,670,310 0 0 0 0 0 0 0 0 0 250,000 3,424,076 0 8,000 503,154 0 135,500 0 389,800 0 70,402 0 32,504 1,667,502 0 0 0 0 0 0 0 0 0 250,000 3,839,522 0 89,331 564,926 0 125,500 0 375,751 0 68,465 0 24,025 1,663,054 0 0 0 0 0 0 0 0 0 37,804,050 874,269 388,844 0 0 39,067,162 37,147,331 882,309 1,203,823 5,000 0 39,238,463 34,749,222 972,507 1,618,067 0 0 37,339,796 (2) Budget 2010-2011 (3) Budget 2011-2012

Run: 7/17/2011 9:42:04 PM

GF4

FY 2011-2012 Continued Monroe School District No.103 GENERAL FUND BUDGET--REVENUES AND OTHER FINANCING SOURCES (1) Actual 2009-2010 4000 | TOTAL STATE, SPECIAL PURPOSE FEDERAL, GENERAL PURPOSE 5200 | General Purpose Direct Federal Grants, Unassigned 5300 | Impact Aid, Maintenance and Operation 5329 | Impact Aid, Special Education Funding 5400 | Federal in lieu of Taxes 5500 | Federal Forests 5600 | Qualified Bond Interest Credit - Federal 5000 | TOTAL FEDERAL, GENERAL PURPOSE FEDERAL, SPECIAL PURPOSE 6100 | Special Purpose, OSPI, Unassigned 6111 | Federal Stimulus--Title I 6112 | Federal Stimulus--School Improvement 6113 | Federal Stimulus--State Fiscal Stabilization Fund 6114 | Federal Stimulus--IDEA 6118 | Federal Stimulus--Competitive Grants 6119 | Federal Stimulus--Other 6121 | Special Education--Medicaid Reimbursement 6124 | Special Education--Supplemental 6138 | Secondary Vocational Education 6146 | Skills Center 6151 | ESEA Disadvantaged, Federal 6152 | Other Title Grants under ESEA, Federal 6153 | ESEA Migrant, Federal 6154 | Reading First, Federal 6157 | Institutions, Neglected and Delinquent 6161 | Head Start 6162 | Math & Science--Professional Development 6164 | Limited English Proficiency (formerly Bilingual) 6167 | Indian Education JOM 6168 | Indian Education, ED 6176 | Targeted Assistance 6178 | Youth Training Programs Form F-195 Page 3 of 6 52,592 130,129 0 1,002,317 508,960 1,189 0 0 1,245,380 28,177 0 433,934 216,071 0 0 0 0 0 76,740 0 0 0 0 46,765 142,105 0 415,949 752,410 5,000 1,496 0 1,255,000 23,281 0 415,801 190,774 0 0 0 0 0 73,776 0 0 0 0 0 0 0 0 0 0 0 0 1,256,944 20,000 0 486,064 167,066 0 0 0 0 0 77,967 0 0 0 0 0 0 0 0 59,019 0 59,019 0 0 0 0 65,000 0 65,000 0 0 0 0 53,000 0 53,000 6,830,327 (2) Budget 2010-2011 6,480,938 (3) Budget 2011-2012 7,000,574

Run: 7/17/2011 9:42:04 PM

GF4

FY 2011-2012 Continued Monroe School District No.103 GENERAL FUND BUDGET--REVENUES AND OTHER FINANCING SOURCES (1) Actual 2009-2010 6188 | Day Care 6189 | Other Community Services 6198 | School Food Services 6199 | Transportation--Operations 6200 | Direct Special Purpose Grants 6211 | Federal Stimulus--Title I 6212 | Federal Stimulus--School Improvement 6213 | Federal Stimulus--State Fiscal Stabilization Fund 6214 | Federal Stimulus--IDEA 6218 | Federal Stimulus--Competitive Grants 6219 | Federal Stimulus--Other 6221 | Special Education--Medicaid Reimbursement 6224 | Special Education--Supplemental 6238 | Secondary Vocational Education 6246 | Skills Center 6251 | ESEA Disadvantaged, Federal 6252 | Other Title Grants under ESEA, Federal 6253 | ESEA Migrant, Federal 6254 | Reading First, Federal 6257 | Institutions, Neglected and Delinquent 6261 | Head Start 6262 | Math & Science--Professional Development 6264 | Limited English Proficiency (formerly Bilingual) 6267 | Indian Education JOM 6268 | Indian Education, ED 6276 | Targeted Assistance 6278 | Youth Training, Direct Grants 6288 | Day Care 6289 | Other Community Services 6298 | School Food Services 6299 | Transportation--Operations 6300 | Federal Grants Through Other Agencies, Unassigned 6310 | Medicaid Administrative Match Form F-195 Page 4 of 6 0 0 641,107 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 28,991 0 0 0 0 0 0 14,540 0 (2) Budget 2010-2011 0 0 636,735 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 29,910 0 0 0 0 0 0 9,001 0 (3) Budget 2011-2012 0 0 635,000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 32,858 0 0 0 0 0 0 0 0

Run: 7/17/2011 9:42:04 PM

GF4

FY 2011-2012 Continued Monroe School District No.103 GENERAL FUND BUDGET--REVENUES AND OTHER FINANCING SOURCES (1) Actual 2009-2010 6311 | Federal Stimulus--Title I 6312 | Federal Stimulus--School Improvement 6313 | Federal Stimulus--State Fiscal Stabilization Fund 6314 | Federal Stimulus--IDEA 6318 | Federal Stimulus--Competitive Grants 6319 | Federal Stimulus--Other 6321 | Special Education--Medicaid Reimbursement 6324 | Special Education--Supplemental 6338 | Secondary Vocational Education 6346 | Skill Center 6351 | ESEA Disadvantaged, Federal 6352 | Other Title Grants under ESEA, Federal 6353 | ESEA Migrant, Federal 6354 | Reading First, Federal 6357 | Institutions, Neglected and Delinquent 6361 | Head Start 6362 | Math & Science--Professional Development 6364 | Limited English Proficiency (formerly Bilingual) 6367 | Indian Education JOM 6368 | Indian Education, ED 6376 | Targeted Assistance 6378 | Youth Training 6388 | Day Care 6389 | Other Community Services 6398 | School Food Services 6399 | Transportation--Operations 6998 | USDA Commodities 6000 TOTAL FEDERAL, SPECIAL PURPOSE REVENUES FROM OTHER SCHOOL DISTRICTS 7100 | Program Participation, Unassigned 7121 | Special Education 7131 | Vocational Education 7145 | Skills Center Form F-195 Page 5 of 6 90 83,469 0 0 0 125,000 0 0 13,000 125,000 0 0 0 0 0 0 0 0 40,958 0 0 0 0 0 0 0 0 0 2,690 0 0 0 0 0 0 0 0 0 96,429 4,520,204 (2) Budget 2010-2011 0 0 0 0 0 0 20,000 0 0 0 0 0 0 0 0 0 2,500 0 0 0 0 0 0 0 0 0 110,000 4,130,503 (3) Budget 2011-2012 0 0 0 0 0 0 25,000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 100,000 2,800,899

Run: 7/17/2011 9:42:04 PM

GF4

FY 2011-2012 Continued Monroe School District No.103 GENERAL FUND BUDGET--REVENUES AND OTHER FINANCING SOURCES (1) Actual 2009-2010 7189 | Other Community Services 7197 | Support Services 7198 | School Food Services 7199 | Transportation 7301 | Nonhigh Participation 7000 | TOTAL REVENUES FROM OTHER SCHOOL DISTRICTS REVENUES FROM OTHER ENTITIES 8100 | Governmental Entities 8188 | Day Care 8189 | Community Services 8198 | School Food Services 8199 | Transportation 8500 | Nonfederal, ESD 8000 TOTAL REVENUES FROM OTHER ENTITES OTHER FINANCING SOURCES 9100 | Sale of Bonds 9300 | Sale of Equipment 9400 | Compensated Loss of Fixed Assets 9500 | Long-Term Financing 9900 | Transfers 9000 TOTAL OTHER FINANCING SOURCES TOTAL REVENUES AND OTHER FINANCING SOURCES 0 391 0 0 0 391 65,229,166 0 0 0 0 0 0 66,272,302 0 0 0 0 0 0 64,431,323 4,373 0 0 0 0 714,206 718,579 250,000 0 0 0 0 696,847 946,847 250,000 0 0 0 0 695,000 945,000 0 0 0 0 0 83,559 (2) Budget 2010-2011 0 0 0 0 0 125,000 (3) Budget 2011-2012 0 0 0 0 0 138,000

Run: 7/17/2011 9:42:04 PM

Form F-195

Page 6 of 6

GF4

FY 2011-2012 Monroe School District No.103 EXPENDITURE BY PROGRAM (1) Actual 2009-2010 REGULAR INSTRUCTION 01 | Basic Education 02 | Alternative Learning Experience 00 | TOTAL REGULAR INSTRUCTION FEDERAL STIMULUS 11 | Federal Stimulus - Title I 12 | Federal Stimulus - School Improvement 13 | Federal Stimulus - Fiscal Stabilization and Education Jobs (formerly SFSF) 13 | Federal Stimulus - State Fiscal Stabilization Fund 14 | Federal Stimulus - IDEA 18 | Federal Stimulus - Competitive Grants 19 | Federal Stimulus - Other 10 | TOTAL FEDERAL STIMULUS SPECIAL EDUCATION INSTRUCTION 21 | Special Education, Supplemental, State 24 | Special Education, Supplemental, Federal 26 | Special Education, Institutions, State 29 | Special Education, Other, Federal 20 | TOTAL SPECIAL EDUCATION INSTRUCTION VOCATIONAL EDUCATION INSTRUCTION 31 | Vocational, Basic, State 34 | Middle School Career and Technical Education, State 38 | Vocational, Federal 39 | Vocational, Other Categorical 30 | TOTAL VOCATIONAL EDUCATION INSTRUCTION SKILLS CENTER INSTRUCTION 45 | Skills Center, Basic, State 46 | Skills Center, Federal 40 | TOTAL SKILLS CENTER INSTRUCTION COMPENSATORY EDUCATION INSTUCTION 51 | ESEA Disadvantaged, Federal 52 | Other Title Grants under ESEA, Federal 53 | ESEA Migrant, Federal 54 | Reading First, Federal Form F-195 Page 1 of 3 417,613 199,419 0 0 0 0 0 2,688,292 9,070 28,232 0 2,725,594 5,604,548 1,215,467 0 0 6,820,014 489,008 1,142 9,616 1,509,532 125,027 0 884,738 37,598,137 XXXXX 37,598,137

Run: 7/17/2011 9:42:05 PM

(2) Budget 2010-2011 31,231,105 7,922,319 39,153,424 142,483 0 XXXXX 408,662 721,496 4,794 1,291 1,278,726 5,577,026 1,173,848 0 0 6,750,874 2,506,460 55,337 23,281 0 2,585,078 0 0 0 399,542 182,801 0 0

(3) Budget 2011-2012 31,789,177 5,719,890 37,509,067 0 0 0 0 0 0 0 5,989,804 1,248,410 0 0 7,238,214 2,913,060 89,331 20,000 0 3,022,391 0 0 0 469,858 161,520 0 0 GF8

FY 2011-2012

Continued Monroe School District No.103 EXPENDITURE BY PROGRAM (1) Actual 2009-2010 (2) Budget 2010-2011 502,756 0 0 176,025 0 0 2,692 0 73,543 389,861 0 0 29,910 0 1,757,130 0 29,633 70,253 0 0 0 2,062,036 2,161,922 0 35,000 0 53,984 88,984 7,850,814 1,537,923 3,234,440 0 0 151,889 XXXXX 0 2,695 0 76,740 360,657 201,804 0 28,991 0 1,902,498 0 2,781 61,920 102,040 0 0 1,064,082 1,230,823 0 30,408 0 82,433 112,841 7,726,083 1,430,663 2,750,463 Page 2 of 3

Run: 7/17/2011 9:42:05 PM

(3) Budget 2011-2012 544,413 0 0 158,909 0 0 0 76,408 375,753 0 0 31,767 0 1,818,628 0 19,863 68,465 0 0 0 2,032,677 2,121,005 0 25,000 0 52,760 77,760 7,933,862 1,537,813 3,226,175 GF8

55 | Learning Assistance Program (LAP), State 56 | State Institutions, Centers and Homes, Delinquent 57 | State Institutions, Neglected and Delinquent, Federal 58 | Special and Pilot Programs, State 59 | Institutions - Juveniles in Adult Jails 61 | Head Start, Federal 62 | Math and Science, Professional Development, Federal 63 | Promoting Academic Success 64 | Limited English Proficiency, Federal 65 | Transitional Bilingual, State 66 | Student Achievement, State 67 | Indian Education, Federal, JOM 68 | Indian Education, Federal, ED 69 | Compensatory, Other 50 and 60 | TOTAL COMPENSATORY EDUCATION INSTRUCTION OTHER INSTRUCTIONAL PROGRAMS 71 | Traffic Safety 73 | Summer School 74 | Highly Capable 75 | Professional Development, State 76 | Targeted Assistance, Federal 78 | Youth Training Programs, Federal 79 | Instructional Programs, Other 70 | TOTAL OTHER INSTRUCTIONAL PROGRAMS COMMUNITY SERVICES 81 | Public Radio/Television 86 | Community Schools 88 | Day Care 89 | Other Community Services 80 | TOTAL COMMUNITY SERVICES SUPPORT SERVICES 97 | Districtwide Support 98 | School Food Services 99 | Pupil Transportation Form F-195

462,690

FY 2011-2012

Continued Monroe School District No.103 EXPENDITURE BY PROGRAM (1) Actual 2009-2010 (2) Budget 2010-2011 12,623,177 66,399,315

Run: 7/17/2011 9:42:05 PM

(3) Budget 2011-2012 12,697,850 64,484,915

90 | TOTAL SUPPORT SERVICES TOTAL PROGRAM EXPENDITURES

11,907,208 63,806,648

Form F-195

Page 3 of 3

GF8

FY 2011-2012 Monroe School District No.103 PROGRAM SUMMARY BY OBJECT OF EXPENDITURE Total Object 31,789,177 5,719,890 37,509,067 0 (0) Debit Transfer 110,067 0 110,067 0 0 0 (1) Credit Transfer (2) Cert. Salaries 19,051,508 3,150,374 22,201,882 0 (3) Class. Salaries 2,383,920 237,385 2,621,305 0 (4) Employee Benefits 6,627,119 1,042,829 7,669,948 0 (5) Supplies / Materials 1,236,660 157,256 1,393,916 0

Run: 7/17/2011 9:42:06 PM

Program 01 | Basic Education 02 | ALE TOTAL REGULAR INSTRUCTION 11 | Federal Stimulus - Title I 12 | Federal Stimulus - School Improvement 13 | Federal Stimulus - SFSF and Education Jobs 14 | Federal Stimulus - IDEA 18 | Federal Stimulus Competitive Grants 19 | Federal Stimulus - Other TOTAL FEDERAL STIMULUS 21 | Sp Ed, Sup, St 24 | Sp Ed, Sup, Fed 26 | Sp Ed, Inst, St 29 | Sp Ed, Oth, Fed TOTAL SPECIAL EDUCATION INSTRUCTION 31 | Voc, Basic, St

(7) Purchased Services 2,370,203 1,132,046 3,502,249 0

(8) Travel 9,700 0 9,700 0

(9) Capital Outlay 0 0 0 0

0 0

0 0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0 5,989,804 1,248,410 0 0 7,238,214

0 0 0 0 0 0 0

0 0

0 0 2,493,053 938,995 0 0 3,432,048

0 0 1,287,487 0 0 0 1,287,487

0 0 1,463,614 308,915 0 0 1,772,529

0 0 52,850 0 0 0 52,850

0 0 685,400 500 0 0 685,900

0 0 7,400 0 0 0 7,400

0 0 0 0 0 0 0

2,913,060

1,061,466

60,529

357,689

408,263

1,025,113

Form F-195

Page 1 of 4

GF9

FY 2011-2012

Continued Monroe School District No.103 PROGRAM SUMMARY BY OBJECT OF EXPENDITURE Total Object 89,331 20,000 0 3,022,391 (0) Debit Transfer 0 0 0 0 (1) Credit Transfer (2) Cert. Salaries 56,219 0 0 1,117,685 (3) Class. Salaries 0 0 0 60,529 (4) Employee Benefits 16,703 0 0 374,392 (5) Supplies / Materials 16,409 5,045 0 429,717 (7) Purchased Services 0 14,955 0 1,040,068

Run: 7/17/2011 9:42:06 PM

Program 34 | MidSchCar/Tec 38 | Voc, Fed 39 | Voc, Other TOTAL VOCATIONAL EDUCATION INSTRUCTION 45 | Skil Cnt, Bas, St 46 | Skill Cntr, Fed TOTAL SKILLS CENTER INSTRUCTION 51 | ESEA Disadvantaged, Federal 52 | Other Title Grants under ESEA, Federal 53 | ESEA Migrant, Federal 54 | Read First, Fed 55 | LAP 56 | St In, Ctr/Hm, D 57 | St In, N/D, Fed 58 | Sp/Plt Pgm, St 59 | I-JAJ 61 | Head Start, Fed 62 | MS, Pro Dv, Fed 64 | LEP, Fed Form F-195

(8) Travel 0 0 0 0

(9) Capital Outlay 0 0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

469,858

207,968

16,374

77,161

6,176

154,179

8,000

161,520

83,477

25,443

33,312

19,288

0 0 544,413 0 0 158,909 0 0 0 76,408

0 0 0 0 0 0 0 0 0 0

0 0 342,855 0 0 96,470 0 0 0 48,188

0 0 40,226 0 0 30,733 0 0 0 0 Page 2 of 4

0 0 126,664 0 0 31,706 0 0 0 14,316

0 0 21,407 0 0 0 0 0 0 4,500

0 0 13,261 0 0 0 0 0 0 8,104

0 0 0 0 0 0 0 0 0 1,300

0 0 0 0 0 0 0 0 0 0 GF9

FY 2011-2012

Continued Monroe School District No.103 PROGRAM SUMMARY BY OBJECT OF EXPENDITURE Total Object 375,753 0 0 31,767 0 1,818,628 (0) Debit Transfer 0 0 0 0 0 0 0 (1) Credit Transfer (2) Cert. Salaries 145,922 0 0 0 0 924,880 (3) Class. Salaries 117,285 0 0 14,265 0 218,883 (4) Employee Benefits 109,439 0 0 7,218 0 391,947 (5) Supplies / Materials 2,086 0 0 6,524 0 74,005 (7) Purchased Services 0 0 0 1,491 0 196,323

Run: 7/17/2011 9:42:06 PM

Program 65 | Tran Biling, St 66 | Stu Achvmnt, St 67 | Ind Ed, Fd, JOM 68 | Ind Ed, Fd, ED 69 | Comp, Othr TOTAL COMPENSATORY EDUCATION INSTRUCTION 71 | Traffic Safety 73 | Summer School 74 | Highly Capable 75 | Prof Dev, State 76 | Target Asst, Fed 78 | Yth Trg Pm, Fed 79 | Inst Pgm, Othr TOTAL OTHER INSTRUCTIONAL PROGRAMS 81 | Public Radio/TV 86 | Comm Schools 88 | Day Care 89 | Othr Comm Srv TOTAL COMMUNITY SERVICES Form F-195

(8) Travel 1,021 0 0 2,269 0 12,590

(9) Capital Outlay 0 0 0 0 0 0

0 19,863 68,465 0 0 0 2,032,677 2,121,005

0 0 0 0 0 0 0 0

0 0 39,549 0 0 0 843,188 882,737

0 0 0 0 0 0 303,053 303,053

0 0 12,889 0 0 0 293,580 306,469

0 1,250 0 0 0 0 275,604 276,854

0 18,613 16,027 0 0 0 317,252 351,892

0 0 0 0 0 0 0 0

0 0 0 0 0 0 0 0

0 25,000 0 52,760 77,760

0 0 0 0 0 0 0

0 0 0 0 0

0 5,421 0 37,829 43,250 Page 3 of 4

0 2,292 0 13,372 15,664

0 7,287 0 0 7,287

0 10,000 0 1,559 11,559

0 0 0 0 0

0 0 0 0 0 GF9

FY 2011-2012

Continued Monroe School District No.103 PROGRAM SUMMARY BY OBJECT OF EXPENDITURE Total Object 7,933,862 1,537,813 3,226,175 12,697,850 64,484,915 (0) Debit Transfer 8,583 0 0 8,583 118,650 (1) Credit Transfer 0 0 -118,650 -118,650 -118,650 (2) Cert. Salaries 430,463 0 0 430,463 28,989,695 (3) Class. Salaries 2,946,673 0 1,679,641 4,626,314 9,160,821 (4) Employee Benefits 1,415,193 0 979,134 2,394,327 12,925,276 (5) Supplies / Materials 415,350 110,000 538,450 1,063,800 3,298,429 (7) Purchased Services 2,709,250 1,427,813 146,600 4,283,663 10,071,654

Run: 7/17/2011 9:42:06 PM

Program 97 | Distwide Suppt 98 | Schl Food Serv 99 | Pupil Transp TOTAL SUPPORT SERVICES OBJECT TOTALS

(8) Travel 8,350 0 1,000 9,350 39,040

(9) Capital Outlay 0 0 0 0 0

Form F-195

Page 4 of 4

GF9

FY 2011-2012

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 01 - Basic Education OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0

(2) Cert. Salaries 427,688 586,205 1,436,345 667,150 0 240,761 15,623,896 55,023 14,440 19,051,508 246.870

(3) Class. Salaries 192,725 0 553,774 189,419 232,451 125,783 634,867 454,901 0 0 2,383,920 42.985

(4) Employee Benefits 158,698 171,570 592,504 320,305 123,314 132,926 5,009,741 113,557 4,504 0 6,627,119

(5) Supplies / Materials 3,346 20,598 1,655 0 3,000 1,800 1,080,049 11,212 0 115,000 1,236,660

(7) Purchased Services 14,636 25,378 31,400 0 38,300 3,500 2,192,389 64,600 0 0 0 2,370,203

(8) Travel 100 0 0 0 900 0 3,600 5,100 0 0 9,700

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0 0

Total 797,193 803,751 2,615,678 1,176,874 397,965 504,770 24,547,142 811,860 0 18,944 115,000 31,789,177

Transfer

21 22 23 24 25 26 27 28 29 31 32 Total

Supv Inst Lrn Resrc Princ Off Guid/Coun Pupil M/S Health Teaching Extracur Pmt to SD InstProDev Inst Tech

2,600 107,467 0 0 110,067

FTE PROGRAM STAFF

Form F-195

Page 1 of 22

GF9- 01

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 02 - Alternative Learning Experience OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 5,000 0 116,219 342,404 0 3,662 2,683,089 0 0 0 3,150,374 45.106

(3) Class. Salaries 0 0 157,269 0 0 0 80,116 0 0 0 0 237,385 5.585

(4) Employee Benefits 835 0 101,795 104,491 0 1,656 834,052 0 0 0 0 1,042,829

(5) Supplies / Materials 0 0 0 0 0 1,252 156,004 0 0 0 0 157,256

(7) Purchased Services 0 0 2,450 0 0 0 1,129,596 0 0 0 0 0 1,132,046

(8) Travel 0 0 0 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0 0 0

Total 5,835 0 377,733 446,895 0 6,570 4,882,857 0 0 0 0 0 5,719,890

Transfer

21 22 23 24 25 26 27 28 29 31 32 72 Total

Supv Inst Lrn Resrc Princ Off Guid/Coun Pupil M/S Health Teaching Extracur Pmt to SD InstProDev Inst Tech Info Sys

FTE PROGRAM STAFF

Form F-195

Page 2 of 22

GF9- 02

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 21 - Special Education, Supplemental, State OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 163,015 0 0 0 0 1,058,179 1,271,859 0 0 2,493,053 34.650

(3) Class. Salaries 73,890 0 0 0 0 36,575 1,177,022 0 0 0 1,287,487 33.808

(4) Employee Benefits 75,830 0 0 0 0 334,392 1,053,392 0 0 0 1,463,614

(5) Supplies / Materials 9,000 0 0 0 0 9,350 34,500 0 0 0 52,850

(7) Purchased Services 25,800 0 0 0 8,700 4,300 606,600 0 40,000 0 0 685,400

(8) Travel 1,000 0 0 0 0 3,400 3,000 0 0 0 7,400

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0 0

Total 348,535 0 0 0 8,700 1,446,196 4,146,373 0 40,000 0 0 5,989,804

Transfer

21 22 23 24 25 26 27 28 29 31 32 Total

Supv Inst Lrn Resrc Princ Off Guid/Coun Pupil M/S Health Teaching Extracur Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 3 of 22

GF9- 21

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 24 - Special Education, Supplemental, Federal OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 56,239 0 0 882,756 0 938,995 13.500

(3) Class. Salaries 0 0 0 0 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 19,877 0 0 289,038 0 0 308,915

(5) Supplies / Materials 0 0 0 0 0 0 0 0 0

(7) Purchased Services 0 0 0 0 0 500 0 0 0 500

(8) Travel 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0

Total 0 0 76,116 0 0 1,172,294 0 0 0 1,248,410

Transfer

21 22 24 25 26 27 29 31 32 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Health Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 4 of 22

GF9- 24

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 31 - Vocational, Basic, State OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 65,695 0 54,619 0 941,152 0 0 1,061,466 14.550

(3) Class. Salaries 5,421 0 0 0 55,108 0 0 0 60,529 1.426

(4) Employee Benefits 15,137 0 17,494 0 325,058 0 0 0 357,689

(5) Supplies / Materials 0 0 0 0 408,263 0 0 0 408,263

(7) Purchased Services 0 0 0 0 1,025,113 0 0 0 0 1,025,113

(8) Travel 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0

Total 86,253 0 72,113 0 2,754,694 0 0 0 0 2,913,060

Transfer

21 22 24 25 27 28 29 31 32 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Teaching Extracur Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 5 of 22

GF9- 31

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 34 - Middle School Career and Technical Education, State OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 56,219 0 0 56,219 0.700

(3) Class. Salaries 0 0 0 0 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 0 0 16,703 0 0 0 16,703

(5) Supplies / Materials 0 0 0 0 16,409 0 0 0 16,409

(7) Purchased Services 0 0 0 0 0 0 0 0 0 0

(8) Travel 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0

Total 0 0 0 0 89,331 0 0 0 0 89,331

Transfer

21 22 24 25 27 28 29 31 32 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Teaching Extracur Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 6 of 22

GF9- 34

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 38 - Vocational, Federal OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 0 0 0 0 0.000

(3) Class. Salaries 0 0 0 0 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 0 0 0 0 0 0 0

(5) Supplies / Materials 0 0 0 0 5,045 0 0 0 5,045

(7) Purchased Services 14,955 0 0 0 0 0 0 0 0 14,955

(8) Travel 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0

Total 14,955 0 0 0 5,045 0 0 0 0 20,000

Transfer

21 22 24 25 27 29 31 32 63 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Teaching Pmt to SD InstProDev Inst Tech Oper Bldg

FTE PROGRAM STAFF

Form F-195

Page 7 of 22

GF9- 38

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 51 - ESEA Disadvantaged, Federal OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 19,781 0 0 0 0 188,187 0

(3) Class. Salaries 0 1,815 0 2,594 0 0 11,965 0 0 0 0

(4) Employee Benefits 0 6,383 0 1,130 0 0 69,648 0 0 0 0 77,161

(5) Supplies / Materials 0 0 0 0 0 0 6,176 0 0 0 0 0 6,176

(7) Purchased Services 0 0 0 0 0 0 154,179 0 0 0 0 0 0 154,179

(8) Travel 0 0 0 0 0 0 8,000 0 0 0 0 8,000

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0 0 0 0

Total 0 27,979 0 3,724 0 0 438,155 0 0 0 0 0 0 469,858

Transfer

15 21 22 24 25 26 27 29 31 32 63 64 65 Total

Pblc Rltn Supv Inst Lrn Resrc Guid/Coun Pupil M/S Health Teaching Pmt to SD InstProDev Inst Tech Oper Bldg Maintnce Utilities

207,968 3.165

16,374 0.387

FTE PROGRAM STAFF

Form F-195

Page 8 of 22

GF9- 51

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 52 - Other Title Grants under ESEA, Federal OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 0 0 0 40,156 43,321

(3) Class. Salaries 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 0 0 0 0 0 11,931 13,512 0 0 0 0 25,443

(5) Supplies / Materials 0 0 0 0 0 0 0 33,312 0 0 0 0 0 0 33,312

(7) Purchased Services 0 0 0 0 0 0 0 19,288 0 0 0 0 0 0 0 19,288

(8) Travel 0 0 0 0 0 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total 0 0 0 0 0 0 0 104,687 0 56,833 0 0 0 0 0 161,520

Transfer

15 21 22 23 24 25 26 27 29 31 32 63 64 65 91 Total

Pblc Rltn Supv Inst Lrn Resrc Princ Off Guid/Coun Pupil M/S Health Teaching Pmt to SD InstProDev Inst Tech Oper Bldg Maintnce Utilities Publ Actv

83,477 1.100

FTE PROGRAM STAFF

Form F-195

Page 9 of 22

GF9- 52

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 55 - Learning Assistance Program (LAP), State OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 21,266 0 0 0 0 321,589 0 342,855 4.500

(3) Class. Salaries 4,235 0 0 0 0 35,991 0 0 40,226 1.027

(4) Employee Benefits 7,939 0 0 0 0 118,725 0 0 126,664

(5) Supplies / Materials 21,407 0 0 0 0 0 0 0 21,407

(7) Purchased Services 0 0 0 0 0 13,261 0 0 0 13,261

(8) Travel 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0

Total 54,847 0 0 0 0 489,566 0 0 0 544,413

Transfer

21 22 24 25 26 27 29 31 32 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Health Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 10 of 22

GF9- 55

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 58 - Special and Pilot Programs, State OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 0 0 96,470 0 96,470 0.000

(3) Class. Salaries 0 0 0 0 30,733 0 0 0 0 30,733 0.646

(4) Employee Benefits 0 0 0 0 14,837 0 16,869 0 0 31,706

(5) Supplies / Materials 0 0 0 0 0 0 0 0 0 0

(7) Purchased Services 0 0 0 0 0 0 0 0 0 0 0

(8) Travel 0 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0

Total 0 0 0 0 45,570 0 113,339 0 0 0 158,909

Transfer

21 22 23 24 25 26 27 29 31 32 Total

Supv Inst Lrn Resrc Princ Off Guid/Coun Pupil M/S Health Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 11 of 22

GF9- 58

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 64 - Limited English Proficiency, Federal OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 48,188 0 48,188 0.600

(3) Class. Salaries 0 0 0 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 0 0 14,316 0 0 14,316

(5) Supplies / Materials 0 0 0 0 4,500 0 0 4,500

(7) Purchased Services 0 0 0 0 8,104 0 0 0 8,104

(8) Travel 0 0 0 0 1,300 0 0 1,300

(9) Capital Outlay 0 0 0 0 0 0 0 0

Total 0 0 0 0 76,408 0 0 0 76,408

Transfer

21 22 24 25 27 29 31 32 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 12 of 22

GF9- 64

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 65 - Transitional Bilingual, State OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0

(2) Cert. Salaries 21,266 0 0 0 124,656 0 145,922 2.200

(3) Class. Salaries 0 0 31,139 0 86,146 0 0 117,285 3.150

(4) Employee Benefits 5,692 0 13,558 0 90,189 0 0 109,439

(5) Supplies / Materials 0 0 0 0 2,086 0 0 2,086

(7) Purchased Services 0 0 0 0 0 0 0 0 0

(8) Travel 0 0 0 0 1,021 0 0 1,021

(9) Capital Outlay 0 0 0 0 0 0 0 0

Total 26,958 0 44,697 0 304,098 0 0 0 375,753

Transfer

21 22 24 25 27 29 31 32 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 13 of 22

GF9- 65

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 68 - Indian Education, Federal, ED OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 0 0 0.000

(3) Class. Salaries 0 0 0 14,265 0 0 14,265 0.318

(4) Employee Benefits 0 0 0 7,218 0 0 7,218

(5) Supplies / Materials 0 0 0 6,524 0 0 6,524

(7) Purchased Services 0 0 0 1,491 0 0 0 1,491

(8) Travel 0 0 0 2,269 0 0 2,269

(9) Capital Outlay 0 0 0 0 0 0 0

Total 0 0 0 31,767 0 0 0 31,767

Transfer

21 24 25 27 29 31 32 Total

Supv Inst Guid/Coun Pupil M/S Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 14 of 22

GF9- 68

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 73 - Summer School OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 0 0 0 0.000

(3) Class. Salaries 0 0 0 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 0 0 0 0 0 0

(5) Supplies / Materials 0 0 0 0 1,250 0 0 1,250

(7) Purchased Services 0 0 0 0 18,613 0 0 0 18,613

(8) Travel 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0

Total 0 0 0 0 19,863 0 0 0 19,863

Transfer

21 23 25 26 27 29 31 32 Total

Supv Inst Princ Off Pupil M/S Health Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 15 of 22

GF9- 73

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 74 - Highly Capable OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 0 39,549 0 39,549 0.400

(3) Class. Salaries 0 0 0 0 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 0 0 0 12,889 0 0 12,889

(5) Supplies / Materials 0 0 0 0 0 0 0 0 0

(7) Purchased Services 0 0 0 0 0 16,027 0 0 0 16,027

(8) Travel 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0

Total 0 0 0 0 0 68,465 0 0 0 68,465

Transfer

21 22 24 25 26 27 29 31 32 Total

Supv Inst Lrn Resrc Guid/Coun Pupil M/S Health Teaching Pmt to SD InstProDev Inst Tech

FTE PROGRAM STAFF

Form F-195

Page 16 of 22

GF9- 74

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 79 - Instructional Programs, Other OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 90,514 0 0 40,156 712,518 0 0

(3) Class. Salaries 0 0 28,515 0 0 0 258,179 0 0 0 0 16,359 0

(4) Employee Benefits 0 0 34,564 0 0 11,931 237,556 0 0 0 0 9,529 0

(5) Supplies / Materials 0 0 0 0 0 0 268,604 0 0 0 0 7,000 0 0

(7) Purchased Services 0 0 500 0 0 0 203,974 0 0 0 0 0 0 101,258 8,400 3,120 0 317,252

(8) Travel 0 0 0 0 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total 0 0 154,093 0 0 52,087 1,680,831 0 0 0 0 0 32,888 101,258 8,400 3,120 0 2,032,677

Transfer

21 22 23 24 25 26 27 28 29 31 32 62 63 64 65 68 91 Total

Supv Inst Lrn Resrc Princ Off Guid/Coun Pupil M/S Health Teaching Extracur Pmt to SD InstProDev Inst Tech Grnd Mnt Oper Bldg Maintnce Utilities Insurance Publ Actv

0 843,188 7.327

0 303,053 2.524

0 293,580

0 275,604

FTE PROGRAM STAFF

Form F-195

Page 17 of 22

GF9- 79

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 86 - Community Schools OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0 0 0

(3) Class. Salaries 5,421 0 0 0 0 0 0 0

(4) Employee Benefits 2,292 0 0 0 0 0 0 0

(5) Supplies / Materials 0 0 0 7,287 0 0 0 0 0

(7) Purchased Services 0 0 0 10,000 0 0 0 0 0 0 0 0 10,000

(8) Travel 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0

Total 7,713 0 0 17,287 0 0 0 0 0 0 0 0 25,000

Transfer

21 23 25 27 28 29 31 32 63 65 68 91 Total

Supv Inst Princ Off Pupil M/S Teaching Extracur Pmt to SD InstProDev Inst Tech Oper Bldg Utilities Insurance Publ Actv

0 0 0.000

0 5,421 0.109

0 2,292

0 7,287

0 0

0 0

FTE PROGRAM STAFF

Form F-195

Page 18 of 22

GF9- 86

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 89 - Other Community Services OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0 0 0

(3) Class. Salaries 0 0 3,541 0 0 0 34,288 0 0 0 0 37,829 0.591

(4) Employee Benefits 0 0 1,902 0 0 0 11,470 0 0 13,372

(5) Supplies / Materials 0 0 0 0 0 0 0 0 0 0 0

(7) Purchased Services 0 0 0 0 0 0 0 0 1,559 0 0 0 1,559

(8) Travel 0 0 0 0 0 0 0 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0

Total 0 0 5,443 0 0 0 0 0 47,317 0 0 0 52,760

Transfer

21 27 28 29 31 32 42 44 63 65 68 91 Total

Supv Inst Teaching Extracur Pmt to SD InstProDev Inst Tech Food Operation Oper Bldg Utilities Insurance Publ Actv

FTE PROGRAM STAFF

0.000

Form F-195

Page 19 of 22

GF9- 89

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 97 - Districtwide Support OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 100

(2) Cert. Salaries 205,047 0 119,788 0 0 0

(3) Class. Salaries 0 109,136 488,097 233,297 70,860 0 158,146 102,601 1,267,374

(4) Employee Benefits 0 80,257 168,871 107,277 22,265 0 46,774 47,515 697,532 81,686 0 0 163,016 0 0 0

(5) Supplies / Materials 1,500 2,300 15,750 11,450 7,700 0 2,800 11,450 169,000 147,400 0 10,000 0 32,000 0 0 4,000

(7) Purchased Services 104,550 8,946 37,650 55,900 26,700 0 6,300 0 1,000 243,600 1,468,600 4,000 425,000 327,004 0 0 0 0 0 0

(8) Travel 1,500 1,500 1,500 2,500 600 0 250 0 0 0 0 200 300 0 0 0

(9) Capital Outlay 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total 107,550 407,286 713,080 530,312 128,125 0 214,270 161,566 2,134,906 665,185 1,468,600 14,200 425,000 959,782 0 0 4,000 0 0 0 7,933,862

Transfer

11 12 13 14 15 25 61 62 63 64 65 67 68 72 73 74 75 83 84 85 Total

Bd of Dir Supt Off Busns Off HR Pblc Rltn Pupil M/S Supv Bldg Grnd Mnt Oper Bldg Maintnce Utilities Bldg Secu Insurance Info Sys Printing Warehouse Mtr Pool Interest Principal Debt Expn

1,212 100 0 0 0 0 0 7,171 0 0 0 0 0 0 0 0 0 0 0 0 0

185,328 0 0 105,628 0 0 0 331,834 0 0 0

8,583

430,463 3.000

2,946,673 60.796

1,415,193

415,350

2,709,250

8,350

FTE PROGRAM STAFF

Form F-195

Page 20 of 22

GF9- 97

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 98 - School Food Services OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 0 0 0

(2) Cert. Salaries 0 0

(3) Class. Salaries 0 0 0 0 0 0.000

(4) Employee Benefits 0 0 0 0

(5) Supplies / Materials 0 0 110,000 0 110,000

(7) Purchased Services 0 0 2,900 40,000 1,384,913 1,427,813

(8) Travel 0 0 0 0

(9) Capital Outlay 0 0 0 0

Total 0 0 2,900 150,000 1,384,913 0 1,537,813

Transfer

25 29 41 42 44 49 Total

Pupil M/S Pmt to SD Supervisn Food Operation Transfers

FTE PROGRAM STAFF

0.000

Form F-195

Page 21 of 22

GF9- 98

FY 2011-2012

Continued

Run 7/17/2011 9:42:08 PM

Monroe School

No. 103

PROGRAM 99 - Pupil Transportation OBJECTS OF EXPENDITURE (0) Debit

Activity

(1) Credit Transfer 0 0 0 0 -118,650 0 -118,650

(2) Cert. Salaries 0 0

(3) Class. Salaries 0 227,610 1,246,401 205,630

(4) Employee Benefits 0 95,181 782,147 101,806

(5) Supplies / Materials 0 6,000 418,200 114,250

(7) Purchased Services 0 0 7,500 19,800 39,300 80,000

(8) Travel 0 500 500 0

(9) Capital Outlay 0 0 0 0

Total 0 0 336,791 2,467,048 460,986 80,000 -118,650 3,226,175

Transfer

25 29 51 52 53 56 59 Total

Pupil M/S Pmt to SD Supervisn Operation Maintnce Insurance Transfers

0 0.000

1,679,641 35.310

979,134

538,450

146,600

1,000

FTE PROGRAM STAFF

Form F-195

Page 22 of 22

GF9- 99

FY 2011-2012 Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 01 - Basic Education ACTIVITY CODE TITLE OF POSITION FTE 1/, 3/ HIGH ANNUAL RATE 0 0 129,931 0 119,609

Run: 7/17/2011 9:42:10 PM

LOW ANNUAL RATE 0 0 129,931 0 106,329

AVERAGE ANNUAL RATE 0.00 0.00 129,930.67 0.00 111,058.00

TOTAL ANNUAL SALARY 2/ 60,000 60,000 97,448 3,450 206,790 427,688

01-21-001 01-21-004 01-21-120 01-21-121 01-21-130

SICK LEAVE VACATION PAYOFF DEPUTY/ASSISTANT SUPERINTENDENT DEPUTY/ASSISTANT SUPERINTENDENT SUPPLEMENTAL NOT TIME OTHER DISTRICT ADMINISTRATOR

0.000 0.000 0.750 0.000 1.862 2.612 0.000 7.700 0.000 0.000 7.700 0.000 0.000 0.000 5.000 0.000 3.000 0.000 4.700 0.000 12.700 9.200 0.000 Page 1 of 26

ACTIVITY CODE 21 TOTAL 01-22-005 01-22-410 01-22-411 01-22-412 OTHER SALARY ITEMS LIBRARY MEDIA SPECIALIST LIBRARY MEDIA SPECIALIST SUPPLEMENTAL NOT TIME LIBRARY MEDIA SPECIALIST SUPPLEMENTAL DAYS & HOURS

0 62,955 0 0

0 56,597 0 0

0.00 59,887.14 0.00 0.00

1,587 461,131 118,987 4,500 586,205

ACTIVITY CODE 22 TOTAL 01-23-001 01-23-002 01-23-004 01-23-210 01-23-211 01-23-230 01-23-231 01-23-240 01-23-241 SICK LEAVE SUBSTITUTE PAY VACATION PAYOFF ELEMENTARY PRINCIPAL ELEMENTARY PRINCIPAL SUPPLEMENTAL NOT TIME SECONDARY PRINCIPAL SECONDARY PRINCIPAL SUPPLEMENTAL NOT TIME SECONDARY VICE PRINCIPAL SECONDARY VICE PRINCIPAL SUPPLEMENTAL NOT TIME

0 0 0 108,240 0 122,252 0 109,395 0

0 0 0 102,828 0 113,495 0 102,384 0

0.00 0.00 0.00 107,157.60 0.00 116,414.00 0.00 105,552.98 0.00

27,956 6,500 15,000 535,788 1,920 349,242 1,440 496,099 2,400 1,436,345

ACTIVITY CODE 23 TOTAL 01-24-420 01-24-421 Form F-195 COUNSELOR COUNSELOR SUPPLEMENTAL NOT TIME

62,955 0

44,384 0

55,666.74 0.00

512,134 139,516

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 01 - Basic Education

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 0

LOW ANNUAL RATE 0

AVERAGE ANNUAL RATE 0.00

TOTAL ANNUAL SALARY 2/ 15,500 667,150

01-24-422

COUNSELOR SUPPLEMENTAL DAYS & HOURS

0.000 9.200 0.500 0.000 3.600 0.000 4.100 0.000 0.000 0.000 0.000 116.955 0.000 90.733 0.000 2.670 0.000 210.358 0.000 0.000 0.000 0.200

ACTIVITY CODE 24 TOTAL 01-26-460 01-26-461 01-26-470 01-26-471 PSYCHOLOGIST PSYCHOLOGIST SUPPLEMENTAL NOT TIME NURSE NURSE SUPPLEMENTAL NOT TIME

62,955 0 54,081 0

62,955 0 36,620 0

62,954.00 0.00 43,936.39 0.00

31,477 8,679 158,171 42,434 240,761

ACTIVITY CODE 26 TOTAL 01-27-001 01-27-002 01-27-004 01-27-005 01-27-310 01-27-311 01-27-320 01-27-321 01-27-330 01-27-331 SICK LEAVE SUBSTITUTE PAY VACATION PAYOFF OTHER SALARY ITEMS ELEMENTARY TEACHER ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME SECONDARY TEACHER SECONDARY TEACHER SUPPLEMENTAL NOT TIME OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

0 0 0 0 62,955 0 62,955 0 62,955 0

0 0 0 0 35,153 0 17,358 0 54,081 0

0.00 0.00 0.00 0.00 52,928.68 0.00 52,083.82 0.00 59,348.69 0.00

124,021 542,500 59,995 359,547 6,190,274 1,906,285 4,725,721 1,426,521 158,461 130,571 15,623,896

ACTIVITY CODE 27 TOTAL 01-28-321 01-28-511 SECONDARY TEACHER SUPPLEMENTAL NOT TIME EXTRACURRICULAR SUPPLEMENTAL NOT TIME

0 0

0 0

0.00 0.00

54,523 500 55,023

ACTIVITY CODE 28 TOTAL 01-31-330 OTHER TEACHER

56,597

56,597

56,595.00

11,319

Form F-195

Page 2 of 26

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 01 - Basic Education

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 0

LOW ANNUAL RATE 0

AVERAGE ANNUAL RATE 0.00

TOTAL ANNUAL SALARY 2/ 3,121 14,440 19,051,508

01-31-331

OTHER TEACHER SUPPLEMENTAL NOT TIME

0.000 0.200 246.870

ACTIVITY CODE 31 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 3 of 26

GF9-201-01

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 02 - Alternative Learning Experience

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 0

LOW ANNUAL RATE 0

AVERAGE ANNUAL RATE 0.00

TOTAL ANNUAL SALARY 2/ 5,000 5,000

02-21-251

OTHER SCHOOL ADMINISTRATOR SUPPLEMENTAL NOT TIME

0.000 0.000 0.000 1.000 0.000 1.000 5.100 0.000 5.100 0.100 0.100 0.000 4.048 0.000 32.608 0.000 2.250 0.000 38.906 45.106

ACTIVITY CODE 21 TOTAL 02-23-001 02-23-250 02-23-251 SICK LEAVE OTHER SCHOOL ADMINISTRATOR OTHER SCHOOL ADMINISTRATOR SUPPLEMENTAL NOT TIME

0 113,495 0

0 113,495 0

0.00 113,495.00 0.00

2,244 113,495 480 116,219

ACTIVITY CODE 23 TOTAL 02-24-420 02-24-421 COUNSELOR COUNSELOR SUPPLEMENTAL NOT TIME

55,836 0

46,652 0

52,699.80 0.00

268,769 73,635 342,404

ACTIVITY CODE 24 TOTAL 02-26-470 NURSE

36,620

36,620

36,620.00

3,662 3,662

ACTIVITY CODE 26 TOTAL 02-27-005 02-27-310 02-27-311 02-27-320 02-27-321 02-27-330 02-27-331 OTHER SALARY ITEMS ELEMENTARY TEACHER ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME SECONDARY TEACHER SECONDARY TEACHER SUPPLEMENTAL NOT TIME OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

0 62,955 0 62,955 0 62,955 0

0 38,748 0 34,279 0 40,490 0

0.00 52,133.40 0.00 53,657.78 0.00 54,724.00 0.00

12,428 211,036 47,345 1,749,673 502,560 123,129 36,918 2,683,089 3,150,374

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. Form F-195 Page 4 of 26 GF9-201-02

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES

Run: 7/17/2011 9:42:10 PM

2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 5 of 26

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 21 - Special Education, Supplemental, State

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 120,437

LOW ANNUAL RATE 106,445

AVERAGE ANNUAL RATE 116,439.29

TOTAL ANNUAL SALARY 2/ 163,015 163,015

21-21-130

OTHER DISTRICT ADMINISTRATOR

1.400 1.400 1.000 0.000 3.800 0.000 4.700 0.000 6.000 0.000 15.500 2.600 0.000 2.400 0.000 12.750 0.000 17.750 34.650

ACTIVITY CODE 21 TOTAL 21-26-400 21-26-401 21-26-430 21-26-431 21-26-450 21-26-451 21-26-460 21-26-461 OTHER SUPPORT PERSONNEL OTHER SUPPORT PERSONNEL SUPPLEMENTAL NOT TIME OCCUPATIONAL THERAPIST OCCUPATIONAL THERAPIST SUPPLEMENTAL NOT TIME COMMUNICATIONS DISORDER SPECIALIST COMMUNICATIONS DISORDER SPEC SUPPLEMENTAL NOT TIME PSYCHOLOGIST PSYCHOLOGIST SUPPLEMENTAL NOT TIME

62,955 0 62,955 0 62,955 0 62,955 0

62,955 0 47,339 0 41,363 0 44,384 0

62,955.00 0.00 56,652.37 0.00 50,801.28 0.00 51,852.83 0.00

62,955 17,358 215,279 61,328 238,766 66,131 311,117 85,245 1,058,179

ACTIVITY CODE 26 TOTAL 21-27-310 21-27-311 21-27-320 21-27-321 21-27-330 21-27-331 ELEMENTARY TEACHER ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME SECONDARY TEACHER SECONDARY TEACHER SUPPLEMENTAL NOT TIME OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

62,955 0 61,721 0 62,955 0

40,938 0 40,938 0 39,279 0

51,142.31 0.00 49,774.58 0.00 50,586.59 0.00

132,970 71,256 119,459 100,573 644,979 202,622 1,271,859 2,493,053

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate.

Form F-195

Page 6 of 26

GF9-201-21

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES

Run: 7/17/2011 9:42:10 PM

3/ Use three decimal places.

Form F-195

Page 7 of 26

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 24 - Special Education, Supplemental, Federal

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 43,594 0

LOW ANNUAL RATE 43,594 0

AVERAGE ANNUAL RATE 43,594.00 0.00

TOTAL ANNUAL SALARY 2/ 43,594 12,645 56,239

24-24-440 24-24-441

SOCIAL WORKER SOCIAL WORKER SUPPLEMENTAL NOT TIME

1.000 0.000 1.000 2.350 0.000 2.650 0.000 7.500 0.000 12.500 13.500

ACTIVITY CODE 24 TOTAL 24-27-310 24-27-311 24-27-320 24-27-321 24-27-330 24-27-331 ELEMENTARY TEACHER ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME SECONDARY TEACHER SECONDARY TEACHER SUPPLEMENTAL NOT TIME OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

54,081 0 62,955 0 62,955 0

34,720 0 34,720 0 35,153 0

45,308.09 0.00 56,029.43 0.00 49,546.93 0.00

106,474 28,549 148,478 125,140 371,602 102,513 882,756 938,995

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 8 of 26

GF9-201-24

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 31 - Vocational, Basic, State

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 129,931 0 106,874

LOW ANNUAL RATE 129,931 0 106,874

AVERAGE ANNUAL RATE 129,932.00 0.00 106,873.33

TOTAL ANNUAL SALARY 2/ 32,483 1,150 32,062 65,695

31-21-120 31-21-121 31-21-130

DEPUTY/ASSISTANT SUPERINTENDENT DEPUTY/ASSISTANT SUPERINTENDENT SUPPLEMENTAL NOT TIME OTHER DISTRICT ADMINISTRATOR

0.250 0.000 0.300 0.550 0.600 0.000 0.600 13.400 0.000 13.400 14.550

ACTIVITY CODE 21 TOTAL 31-24-420 31-24-421 COUNSELOR COUNSELOR SUPPLEMENTAL NOT TIME

62,955 0

45,740 0

54,016.67 0.00

32,410 22,209 54,619

ACTIVITY CODE 24 TOTAL 31-27-320 31-27-321 SECONDARY TEACHER SECONDARY TEACHER SUPPLEMENTAL NOT TIME

62,955 0

33,851 0

55,001.94 0.00

737,026 204,126 941,152 1,061,466

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 9 of 26

GF9-201-31

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 34 - Middle School Career and Technical Education, State

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 62,955 0

LOW ANNUAL RATE 62,955 0

AVERAGE ANNUAL RATE 62,954.29 0.00

TOTAL ANNUAL SALARY 2/ 44,068 12,151 56,219 56,219

34-27-320 34-27-321

SECONDARY TEACHER SECONDARY TEACHER SUPPLEMENTAL NOT TIME

0.700 0.000 0.700 0.700

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 10 of 26

GF9-201-34

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 38 - Vocational, Federal

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION **** NO CERTIFICATED SALARY DATA FOR THIS PROGRAM ****

FTE 1/, 3/

HIGH ANNUAL RATE

LOW ANNUAL RATE

AVERAGE ANNUAL RATE

TOTAL ANNUAL SALARY 2/

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 11 of 26

GF9-201-38

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 51 - ESEA Disadvantaged, Federal

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 119,609

LOW ANNUAL RATE 119,609

AVERAGE ANNUAL RATE 119,884.85

TOTAL ANNUAL SALARY 2/ 19,781 19,781

51-21-130

OTHER DISTRICT ADMINISTRATOR

0.165 0.165 2.000 0.000 1.000 0.000 3.000 3.165

ACTIVITY CODE 21 TOTAL 51-27-310 51-27-311 51-27-330 51-27-331 ELEMENTARY TEACHER ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

48,768 0 62,955 0

36,127 0 62,955 0

42,447.50 0.00 62,955.00 0.00

84,895 22,979 62,955 17,358 188,187 207,968

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 12 of 26

GF9-201-51

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 52 - Other Title Grants under ESEA, Federal

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 62,955 0

LOW ANNUAL RATE 62,955 0

AVERAGE ANNUAL RATE 62,954.00 0.00

TOTAL ANNUAL SALARY 2/ 31,477 8,679 40,156

52-27-330 52-27-331

OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

0.500 0.000 0.500 0.600 0.000 0.600 1.100

ACTIVITY CODE 27 TOTAL 52-31-330 52-31-331 OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

56,597 0

56,597 0

56,596.67 0.00

33,958 9,363 43,321 83,477

ACTIVITY CODE 31 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 13 of 26

GF9-201-52

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 55 - Learning Assistance Program (LAP), State

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 106,329

LOW ANNUAL RATE 106,329

AVERAGE ANNUAL RATE 106,330.00

TOTAL ANNUAL SALARY 2/ 21,266 21,266

55-21-130

OTHER DISTRICT ADMINISTRATOR

0.200 0.200 0.700 0.000 2.200 0.000 1.400 0.000 4.300 4.500

ACTIVITY CODE 21 TOTAL 55-27-310 55-27-311 55-27-320 55-27-321 55-27-330 55-27-331 ELEMENTARY TEACHER ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME SECONDARY TEACHER SECONDARY TEACHER SUPPLEMENTAL NOT TIME OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

60,279 0 62,955 0 62,955 0

60,279 0 49,295 0 40,490 0

60,280.00 0.00 59,476.36 0.00 56,536.43 0.00

42,196 11,634 130,848 36,313 79,151 21,447 321,589 342,855

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 14 of 26

GF9-201-55

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 58 - Special and Pilot Programs, State

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 0 0 0

LOW ANNUAL RATE 0 0 0

AVERAGE ANNUAL RATE 0.00 0.00 0.00

TOTAL ANNUAL SALARY 2/ 4,850 45,810 45,810 96,470 96,470

58-27-005 58-27-311 58-27-321

OTHER SALARY ITEMS ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME SECONDARY TEACHER SUPPLEMENTAL NOT TIME

0.000 0.000 0.000 0.000 0.000

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 15 of 26

GF9-201-58

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 64 - Limited English Proficiency, Federal

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 62,955 0

LOW ANNUAL RATE 62,955 0

AVERAGE ANNUAL RATE 62,955.00 0.00

TOTAL ANNUAL SALARY 2/ 37,773 10,415 48,188 48,188

64-27-330 64-27-331

OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

0.600 0.000 0.600 0.600

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 16 of 26

GF9-201-64

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 65 - Transitional Bilingual, State

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 106,329

LOW ANNUAL RATE 106,329

AVERAGE ANNUAL RATE 106,330.00

TOTAL ANNUAL SALARY 2/ 21,266 21,266

65-21-130

OTHER DISTRICT ADMINISTRATOR

0.200 0.200 1.300 0.000 0.000 0.700 0.000 2.000 2.200

ACTIVITY CODE 21 TOTAL 65-27-310 65-27-311 65-27-321 65-27-330 65-27-331 ELEMENTARY TEACHER ELEMENTARY TEACHER SUPPLEMENTAL NOT TIME SECONDARY TEACHER SUPPLEMENTAL NOT TIME OTHER TEACHER OTHER TEACHER SUPPLEMENTAL NOT TIME

54,081 0 0 62,955 0

38,050 0 0 54,081 0

41,749.23 0.00 0.00 61,688.57 0.00

54,274 15,264 1,521 43,182 10,415 124,656 145,922

ACTIVITY CODE 27 TOTAL PROGRAM TOTAL

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 17 of 26

GF9-201-65

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 68 - Indian Education, Federal, ED

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION **** NO CERTIFICATED SALARY DATA FOR THIS PROGRAM ****

FTE 1/, 3/

HIGH ANNUAL RATE

LOW ANNUAL RATE

AVERAGE ANNUAL RATE

TOTAL ANNUAL SALARY 2/

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 18 of 26

GF9-201-68

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 73 - Summer School

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION **** NO CERTIFICATED SALARY DATA FOR THIS PROGRAM ****

FTE 1/, 3/

HIGH ANNUAL RATE

LOW ANNUAL RATE

AVERAGE ANNUAL RATE

TOTAL ANNUAL SALARY 2/

1/ The number of full-time days per contract year is determined by the district, with a minimum of 180 days. The length of a full work day is determined by the district. To determine partial FTE, divide the part of the day worked by the full day as determined by the district and then multiply the result by the ratio of work days contracted for to 180. No employee can be more than 1.000 FTE. Include state institutions staff. 2/ Except for subtotals and totals, total annual salary must equal FTE times average annual salary rate. 3/ Use three decimal places.

Form F-195

Page 19 of 26

GF9-201-73

FY 2011-2012

Continued Monroe School District No.103 SALARY EXHIBIT -- CERTIFICATED EMPLOYEES PROGRAM 74 - Highly Capable

Run: 7/17/2011 9:42:10 PM

ACTIVITY CODE

TITLE OF POSITION

FTE 1/, 3/

HIGH ANNUAL RATE 55,523 0 55,523 0

LOW ANNUAL RATE 49,295 0 55,523 0