Escolar Documentos

Profissional Documentos

Cultura Documentos

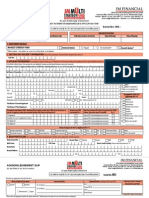

Sukhi Jeevan Flyer

Enviado por

Drashti InvestmentsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sukhi Jeevan Flyer

Enviado por

Drashti InvestmentsDireitos autorais:

Formatos disponíveis

Ek sahi faisla. Ek sahi shuruvaat.

ADVANTAGES

Fulfill your children’s dreams or

plan your retirement

Small savings to meet your

varying needs

Regular bonuses

Easy application:

Simple documentation

No medical tests*

Hassle–free sign-up

Premium payment options:

Yearly

Half-yearly

Monthly (through ECS only)

* Conditions apply

Life is unpredictable, but the earlier you start planning for your future, the more likely are you and your

family to reap the rewards.

Sukhi Jeevan is a long-term savings and protection plan that keeps pace with your changing needs at

every step of life - be it saving for your kids’ future, or your retirement. This plan helps you prepare for

important milestones in your life. And, most importantly, it ensures your family is secure when life dishes

up harsh misfortunes.

Zindagi se ek kadam aagey

Savings for your needs

Save small amounts regularly each year and accumulate a sizeable lump sum.

Enjoy bonuses

Bonus will be declared each year and would be paid on maturity of the policy or in the event of death.

Interim Bonus, in case of a death claim during the course of the year.

Special Bonus (Terminal Bonus) may be paid by way of a reward for loyalty, if you have paid all your premiums regularly

for 15 or more years.

On maturity

You will receive the sum assured along with all the bonuses declared on the policy.

For your kids’ dreams

For your children’s needs of higher education, career and marriage, you can take your maturity proceeds by way of

half-yearly installments over a 5 year period. The guaranteed amount of each half-yearly installment would be Rs. 108

per thousand maturity benefit and would be increased depending on prevailing interest rates. You can also choose to

withdraw the entire maturity proceeds and the policy would terminate.

Enjoy your retirement

As the years roll on, you may choose to cease working or slow down your business activities, and there may be expenses

that need to be met. If you decide to use this money for planning your retirement, you may avail of a cash component

of 1/3rd of your total maturity proceeds and utilize the balance to avail of an annuity (pension).

Protection for your loved ones

In the event of death of the life insured during the policy term, from the second year onwards, the beneficiaries will receive

the full sum assured along with the bonus declared and interim bonus, if any.

If you wish to know more, please contact our Life Advisor or email us at: lifeexpert@kotak.com

Kotak Mahindra Old Mutual Life Insurance Ltd. Regn. No.: 107. Regd. Office: 6th Floor, Peninsula Chambers, Peninsula Corporate Park, Ganpatrao Kadam Marg, Lower Parel (W), Mumbai - 400 013.

Website: www.kotaklifeinsurance.com Form No.: SJ01.

Insurance is the subject matter of the solicitation. The leaflet gives only the salient features of the plan. Please refer to the specific product brochure / policy document for details on all terms and conditions.

Você também pode gostar

- Tax Saving OptionsDocumento14 páginasTax Saving OptionsDrashti Investments100% (3)

- Wealth Builder Fund App FormDocumento4 páginasWealth Builder Fund App FormDrashti InvestmentsAinda não há avaliações

- Bharti Axa FlyerDocumento1 páginaBharti Axa FlyerDrashti InvestmentsAinda não há avaliações

- ICICI Prudential SMART FundDocumento2 páginasICICI Prudential SMART FundDrashti Investments100% (1)

- ING OptiMix Global Commodities FundDocumento2 páginasING OptiMix Global Commodities FundDrashti InvestmentsAinda não há avaliações

- HDFC FMP IX - 90D August 2008 (1) & 20M August 2008Documento2 páginasHDFC FMP IX - 90D August 2008 (1) & 20M August 2008Drashti Investments100% (1)

- JP Morgan India Alpha FundDocumento3 páginasJP Morgan India Alpha FundDrashti Investments100% (1)

- SIP LetterDocumento2 páginasSIP LetterDrashti Investments100% (1)

- Reliance Fixed Horizon Fund IX - Series 6Documento2 páginasReliance Fixed Horizon Fund IX - Series 6Drashti InvestmentsAinda não há avaliações

- Bharti AXA Equity FundDocumento3 páginasBharti AXA Equity FundDrashti Investments100% (1)

- JM Multi Strategy FundDocumento3 páginasJM Multi Strategy FundDrashti InvestmentsAinda não há avaliações

- ICICI Prudential Banking and Financial Services Final PresentationDocumento25 páginasICICI Prudential Banking and Financial Services Final PresentationDrashti Investments100% (3)

- HDFC FMP One PagerDocumento1 páginaHDFC FMP One PagerDrashti Investments100% (1)

- Sahara Banking & Financial Services FundDocumento2 páginasSahara Banking & Financial Services FundDrashti InvestmentsAinda não há avaliações

- Fidelity Fixed Maturity Plan Series 1 - Plan ADocumento2 páginasFidelity Fixed Maturity Plan Series 1 - Plan ADrashti InvestmentsAinda não há avaliações

- Mirae Asset Global Commodity Stocks Fund LeafleatDocumento2 páginasMirae Asset Global Commodity Stocks Fund LeafleatDrashti InvestmentsAinda não há avaliações

- Mirae Asset Global Commodity Stocks Fund Application FormDocumento4 páginasMirae Asset Global Commodity Stocks Fund Application FormDrashti Investments100% (1)

- ICICI Prudential Banking and Financial Services FundDocumento3 páginasICICI Prudential Banking and Financial Services FundDrashti Investments100% (3)

- Mirae Asset Global Commodity Stocks Fund Application FormDocumento4 páginasMirae Asset Global Commodity Stocks Fund Application FormDrashti Investments100% (1)

- Reliance SIP Insure Application FormDocumento24 páginasReliance SIP Insure Application FormDrashti Investments100% (6)

- Kotak Star Kid Facility1Documento6 páginasKotak Star Kid Facility1Drashti InvestmentsAinda não há avaliações

- Commodity Basic Mirae AssetDocumento2 páginasCommodity Basic Mirae AssetDrashti Investments100% (1)

- Sundaram BNP Paribas Entertainment Opportunities FundDocumento6 páginasSundaram BNP Paribas Entertainment Opportunities FundDrashti Investments100% (3)

- Birla Sun Life Century SIP PresentationDocumento42 páginasBirla Sun Life Century SIP PresentationDrashti Investments100% (7)

- NFO UTI Long Term Advantage Fund - Series IIDocumento4 páginasNFO UTI Long Term Advantage Fund - Series IIDrashti Investments100% (1)

- NFO DSPML Natural Resources and New Energy FundDocumento8 páginasNFO DSPML Natural Resources and New Energy FundDrashti Investments100% (1)

- Birla Sun Life Pure Value FundDocumento8 páginasBirla Sun Life Pure Value FundDrashti Investments100% (1)

- AIG World Gold FundDocumento8 páginasAIG World Gold FundDrashti Investments100% (1)

- Principal Tax Savings Plan Application FormDocumento2 páginasPrincipal Tax Savings Plan Application FormDrashti Investments100% (1)

- NFO Mirae Asset India Opportunities FundDocumento3 páginasNFO Mirae Asset India Opportunities FundDrashti Investments100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Rule 11-Time To File Responsive PleadingsDocumento6 páginasRule 11-Time To File Responsive PleadingsAnne DemAinda não há avaliações

- Book Shop Automation SystemDocumento36 páginasBook Shop Automation SystemThe Tech ExpertAinda não há avaliações

- Kantian vs Utilitarian Ethics in BusinessDocumento2 páginasKantian vs Utilitarian Ethics in BusinessChris Connors67% (3)

- Huawei Switch Configuration CommandDocumento10 páginasHuawei Switch Configuration CommandMohamed Khalil RouissiAinda não há avaliações

- The Puppet Masters: How The Corrupt Use Legal Structures To Hide Stolen Assets and What To Do About ItDocumento284 páginasThe Puppet Masters: How The Corrupt Use Legal Structures To Hide Stolen Assets and What To Do About ItSteve B. SalongaAinda não há avaliações

- Course 1 Introduction To SIMS: Student Information Management System (SIMS) Office of The RegistrarDocumento28 páginasCourse 1 Introduction To SIMS: Student Information Management System (SIMS) Office of The RegistrarWeijia WangAinda não há avaliações

- Leak Proof Engineering I PVT LTDDocumento21 páginasLeak Proof Engineering I PVT LTDapi-155731311Ainda não há avaliações

- Master I M Lab ManualDocumento44 páginasMaster I M Lab ManualwistfulmemoryAinda não há avaliações

- Danh sách đ tài Đ c nglunvăn ề ề ươ ậ HK1/19-20Documento47 páginasDanh sách đ tài Đ c nglunvăn ề ề ươ ậ HK1/19-20LONG Trương MinhAinda não há avaliações

- 131b0314 - Im Danffos VLT ManualDocumento108 páginas131b0314 - Im Danffos VLT ManualMery Helen Barraza DelgadoAinda não há avaliações

- Design InfographicDocumento1 páginaDesign InfographicHarAinda não há avaliações

- Berklee Blues Progression in SongwritingDocumento4 páginasBerklee Blues Progression in SongwritingTC Ahmet Ayhan Altunoğlu100% (1)

- Negligence PRIMA FACIE CASEDocumento107 páginasNegligence PRIMA FACIE CASEHarry KastenbaumAinda não há avaliações

- Oracle Database Performance: Vmware Cloud On AwsDocumento14 páginasOracle Database Performance: Vmware Cloud On Awscatelor419Ainda não há avaliações

- Grader 14 M Caterpillar BrouchorDocumento2 páginasGrader 14 M Caterpillar Brouchorjude tallyAinda não há avaliações

- 1 ST QTR MSlight 2023Documento28 páginas1 ST QTR MSlight 2023Reynald TayagAinda não há avaliações

- G.R. No. 173637 - Speedy TRial and Double JeopardyDocumento3 páginasG.R. No. 173637 - Speedy TRial and Double Jeopardylr dagaangAinda não há avaliações

- LGDocumento5 páginasLGPreetham Kiran RodriguesAinda não há avaliações

- North American Series 4762 Immersion Tube Burners 4762 - BULDocumento4 páginasNorth American Series 4762 Immersion Tube Burners 4762 - BULedgardiaz5519Ainda não há avaliações

- Service 31200800 11-13-13 CE-AUS English PDFDocumento262 páginasService 31200800 11-13-13 CE-AUS English PDFduongpn100% (1)

- Effect of Organization Climate On Innovative Work BehaviourDocumento8 páginasEffect of Organization Climate On Innovative Work BehaviourRaja .SAinda não há avaliações

- Ruskin Bond's Haunting Stories CollectionDocumento5 páginasRuskin Bond's Haunting Stories CollectionGopal DeyAinda não há avaliações

- Knowledge Mgmt in BPO: Capturing & Sharing Valuable InsightsDocumento3 páginasKnowledge Mgmt in BPO: Capturing & Sharing Valuable InsightsameetdegreatAinda não há avaliações

- Immobilizer System - KIADocumento26 páginasImmobilizer System - KIAAhmed Alsheikh100% (1)

- University of BelizeDocumento6 páginasUniversity of BelizeMartin and JennyAinda não há avaliações

- Grasshopper VB Scripting Primer IntroductionDocumento28 páginasGrasshopper VB Scripting Primer Introductionfagus67Ainda não há avaliações

- Philippines Islands Judiciary Torrens System Title in Rem - BLP FoundationDocumento2 páginasPhilippines Islands Judiciary Torrens System Title in Rem - BLP FoundationBLP CooperativeAinda não há avaliações

- Advanced Accounting 1: Accounting Lab Module Uph Business SchoolDocumento36 páginasAdvanced Accounting 1: Accounting Lab Module Uph Business SchoolDenisse Aretha LeeAinda não há avaliações

- New Form 2550 M Monthly VAT Return P 1 2 1Documento3 páginasNew Form 2550 M Monthly VAT Return P 1 2 1The ApprenticeAinda não há avaliações

- Domestic Ro Price List 2021Documento6 páginasDomestic Ro Price List 2021den oneAinda não há avaliações