Escolar Documentos

Profissional Documentos

Cultura Documentos

International Economics - Absolute Advantage and Factor Proportions

Enviado por

blancheetaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

International Economics - Absolute Advantage and Factor Proportions

Enviado por

blancheetaDireitos autorais:

Formatos disponíveis

Chapter Three Why Everybody Trades: Comparative Advantage and Factor Proportions

International Economics by: Thomas Pugel

1|Page

I. ADAM SMITHs THEORY OF ABSOLUTE ADVANTAGE Adam Smith compared the nations to households. The Absolute Advantage theory of Adam Smith uses labor to determine and measure the value of trade products. The benefits of free trade are displayed in the efficiency of global production by allowing each country exploit its absolute advantage in producing some products. The theory says that at least one country is better off with trade, and this countrys gain is not at the expense of the other country. Trading countries gain by splitting the benefits of global production. Labor productivity the number of units of output that a worker can produce in one hour. Example: If our country can produce some set of goods at lower cost than a foreign country, and if the foreign country can produce some other set of goods at a lower cost than we can produce them, then clearly it would be best for us to trade our relatively cheaper goods for their relatively cheaper goods. In this way both countries may gain from trade. (Steven Suranovic)

Country Philippines Vietnam

Sacks of rice produced per day 20 16

No. of farmers 4 4

2|Page

II. RICARDOs THEORY OF COMPARATIVE ADVANTAGE

The law of comparative advantage refers to the ability of an individual, firm, or a country to produce a particular good or service at a lower opportunity cost than another product or service. It is the ability to produce a product with the highest relative efficiency given all the other products that could be produced. It can be contrasted with absolute advantage which refers to the ability of a party to produce a particular good at a lower absolute cost than another. Comparative advantage explains how trade can create value for both parties even when one can produce all goods with fewer resources than the other. The net benefits of such an outcome are called gains from trade. It is the main concept of the pure theory of international trade. The key word here is comparative, meaning relative and not necessarily absolute. Even if one country is absolutely more productive at producing everything and the other country is absolutely less productive, they can gain by trading with each other as long as their relative advantages in making different goods are different. Each of these countries can benefit from trade by exporting products in which it has greatest relative advantage. Example: Using wheat and cloth in the US and the rest of the world: US Productivity: Yard of cloth per labor hour Bushels of wheat per labor hour Labor Hours to make: 1 Yard of cloth 1 Bushels of wheat 0.25 0.5 4.0 2.0 < < > > Rest of the World 1.0 0.67 1.0 1.5

In this illustration, one country has inferior productivity in both goods. The US has absolute disadvantages in both good. What products (if any) will the US export or import? Can trade bring net national gains to both countries?

3|Page

Each country will have to produce both products to meet local demands for the two products. What will the product prices be in each country? Without trade, the prices of the two products within each country will be determined by conditions within each country. We must try to ignore money for as long as it takes. Instead we will use the relative price - the ratio of one product price to another product price. By using this in the example and with no trade, 4 hours of labor in the US could produce either 2 bushels of wheat or 1 yard of cloth. The price of 1 yard of cloth is then 2 bushels of wheat in the US. The opportunity cost in this is the 2 bushels of wheat in producing cloth in the US. While in the rest of the world, 1 hour of labor could produce 1 yard of cloth or 2/3 of wheat. The price of cloth is .67 bushels of wheat in the rest of the world. US With no international trade: Price of cloth Price of wheat 2.0 bushel/yard 0.5 yard/bushel Rest of the World 0.67 bushel/yard 1.5 yard/bushel

Let trade be possible between the US and the rest of the world. Somebody will notice the different national prices for each goods and will try to profit from this difference. As long as prices differ in two places, there is way to profit through arbitrage - buying at the low price in one place and selling at the high price in the other place. If a person acquires cloth in the rest of the world, giving up 0.67 bushel of wheat for each yard and then ships it to the US and sells it there for 2.0 bushel per yard. Then he can make an arbitrage profit of 1.33 bushel of wheat each yard of cloth that he exports from the rest of the world. And so with wheat, selling it to the rest of the world. The opening of profitable international trade will start pushing the two separate national price ratios toward a new worldwide equilibrium. As people remove cloth from the rest of the world and exporting it, cloth become more expensive relative to wheat in the res of the world.

4|Page

VI. PRODUCTION AND CONSUMPTION TOGETHER a. With no trade

With no trade, a country must be self-sufficient and must find the combination of domestically produced wheat and cloth that will maximize community well-being.

5|Page

b. With trade INDIFFERENCE CURVES

6|Page

PRODUCTION POSSIBILITY CURVE

7|Page

DEMAND CURVE

SUPPLY CURVE

8|Page

VII. THE GAINS FROM TRADE There is a gain in trade if we view more consumption as desirable. The idea in trade gain is when a country receives a higher price for its exports, relative to the price it pays for its imports. There is a term we call terms of trade wherein the price the country receives from foreign buyers for its export products is relative to the price the country pays foreign sellers for its imported products.

VIII. TRADE AFFECTS PRODUCTION AND CONSUMPTION

The opening has two types of implications for production. First, within each country output expands for the product in which the country has a comparative advantage - more wheat in the US and more cloth in the rest of the world. Second, the shift from no trade to free trade results in more efficient world production as each country expands output of the product in which it is initially the low-cost producer.

IX. WHAT DETERMINES TRADE PATTERN

The immediate basis for the pattern of international trade that we see here is that relative product prices would differ between the two countries if there was no trade. But why would products prices differ with no trade? They can differ because: - Production Condition differ. - Consumption Condition differ. - Some combination of these two differences. In the US basis to import cloth could be that the US has a high demand for cloth, perhaps due to harsh climate or fashion consciousness. Production-side differences can be a basis for the international trade pattern when the relative shapes of the PPC differ. The second reason that the relative shapes of the PPC can differ is more subtle but has become the basis for the orthodox modern theory of comparative advantage. The H-O theory based on (1) differences across countries in the availability of factor resources and (2) differences across products in the use of these factors in producing the products.

9|Page

X. THE HECKSCHER-OHLIN (H-O) THEORY : FACTOR PROPORTIONS ARE KEY

A capital-abundant country will export the capital-intensive good, while the labor-abundant country will export the labor-intensive good. The critical assumption on the H-O model is that the two countries are identical, except for the difference in resource endowments. This also implies that the aggregate preferences are the same. The relative abundant in capital will cause the capital-abundant to produce the capital-intensive good cheaper than the labor-abundance country and vice versa. When the countries are not trading" - the price of capital-intensive good in capital-abundant country will be bid down relative to the price of the good in the other country. - the price of labor-intensive good in labor-abundant country will be bid down relative to the price of the good in the other country. Once trade is allowed, profit-seeking firms will move their products to the markets that have higher price. As a result - the capital-abundant country will export the capital-intensive good. - the labor-abundant country will export the labor-intensive good. The H-O explanation of trade patterns begins with a specific hunch as to why products might differ between countries before they open trade. If cloth costs 2 bushels a yard in the US and less than a bushel a yard elsewhere, it must be primarily because the US has relatively less of the factors that cloth uses intensively, and relatively more of the factors that wheat uses intensively, than does the rest of the world. Let land be the factor that wheat uses more intensively and labor be the factor that cloth uses more intensively. Therefore, the H-O theory predicts that the US exports wheat and imports cloth because wheat is land-intensive and cloth is labor-intensive. Under this conditions with no international trade, lande should rent more cheaply in the US than elsewhere, and labor should command higher wage rate in the US than elsewhere. The cheapness of land cuts costs more in wheat farming than in cloth making. And the theory predicts, it is the difference in relative factor and the pattern of factor intensities that make the US export wheat instead of cloth.

10 | P a g e

Você também pode gostar

- Essays on Some Unsettled Questions on Political EconomyNo EverandEssays on Some Unsettled Questions on Political EconomyAinda não há avaliações

- The Theory of Comparative Advantage: Why specialisation is the key to successNo EverandThe Theory of Comparative Advantage: Why specialisation is the key to successAinda não há avaliações

- Chapter Three - NotesDocumento6 páginasChapter Three - Notessouhad.abouzakiAinda não há avaliações

- Comparative Advantage: What Happens When A Country Has An Absolute Advantage in All GoodsDocumento4 páginasComparative Advantage: What Happens When A Country Has An Absolute Advantage in All Goodsparamita tuladharAinda não há avaliações

- International TradeDocumento43 páginasInternational TradeAshwani SinghAinda não há avaliações

- IT Final Ch.1.2023Documento16 páginasIT Final Ch.1.2023Amgad ElshamyAinda não há avaliações

- International Trade Theories ExplainedDocumento11 páginasInternational Trade Theories Explainedesha bansalAinda não há avaliações

- IE reviseDocumento15 páginasIE reviseĐặng DươngAinda não há avaliações

- Lecture Notes On Absolute and Comparative Advantage-Chapter 6Documento3 páginasLecture Notes On Absolute and Comparative Advantage-Chapter 6Clebson CostaAinda não há avaliações

- International Trade.Documento22 páginasInternational Trade.punte77Ainda não há avaliações

- Module 5Documento18 páginasModule 5vaseem aktharcpAinda não há avaliações

- Basics of International TradeDocumento8 páginasBasics of International TradeFaysal HaqueAinda não há avaliações

- Theories of Internatinal TradeDocumento8 páginasTheories of Internatinal TradejijibishamishraAinda não há avaliações

- Theories of International BusinessDocumento17 páginasTheories of International BusinessNeha SinghAinda não há avaliações

- Causes of The Wealth of Nations Proposed The Theory of Absolute Advantage - TheDocumento8 páginasCauses of The Wealth of Nations Proposed The Theory of Absolute Advantage - ThePatrickAinda não há avaliações

- Comparative Advantage ExampleDocumento3 páginasComparative Advantage ExamplekhushiYAinda não há avaliações

- AssignmentDocumento4 páginasAssignmentJaalali A Gudeta100% (1)

- In EconomicsDocumento7 páginasIn EconomicsSk. ShadAinda não há avaliações

- Praktice 3.abs - Com.advDocumento20 páginasPraktice 3.abs - Com.advСофи БреславецAinda não há avaliações

- EPRG FrameworkDocumento18 páginasEPRG FrameworkMd Arif ImamAinda não há avaliações

- 01 Basis of International TradeDocumento6 páginas01 Basis of International TradeDev Prosad DAinda não há avaliações

- The Basics of Foreign Trade and Exchange - Economic Education..Documento30 páginasThe Basics of Foreign Trade and Exchange - Economic Education..William FanAinda não há avaliações

- International EconomicsDocumento125 páginasInternational EconomicsAbbah DanielAinda não há avaliações

- Factor-Proportions Theory ExplainedDocumento34 páginasFactor-Proportions Theory ExplainedZaira PanganibanAinda não há avaliações

- Absolute Advantade Theory of TradeDocumento4 páginasAbsolute Advantade Theory of TradePallavi SainiAinda não há avaliações

- Trade Surplus Is The Term Used When A Country Exports More Than It ImportsDocumento1 páginaTrade Surplus Is The Term Used When A Country Exports More Than It ImportsMarisa LeeAinda não há avaliações

- Comparative Advantage: Examples Example 1Documento8 páginasComparative Advantage: Examples Example 1Alex LeeAinda não há avaliações

- International Trade TheoryDocumento7 páginasInternational Trade Theoryrumman_farazAinda não há avaliações

- 3 Traditional Trade TheoriesDocumento6 páginas3 Traditional Trade TheoriesOlga LiAinda não há avaliações

- International Trade TheoriesDocumento6 páginasInternational Trade TheoriesQueenie Gallardo AngelesAinda não há avaliações

- MODULE 2 - International MarketingDocumento10 páginasMODULE 2 - International MarketingVera Ann CalusinAinda não há avaliações

- Theories of Intl trade3GROUPB 1Documento13 páginasTheories of Intl trade3GROUPB 1ElektROW GameSTReamerAinda não há avaliações

- Comparative Vs Absolute AdvantageDocumento15 páginasComparative Vs Absolute AdvantageRingle JobAinda não há avaliações

- Lecture 3 Factor Proportion TheoryDocumento27 páginasLecture 3 Factor Proportion TheoryRoite BeteroAinda não há avaliações

- IT Final Ch.2.2024Documento22 páginasIT Final Ch.2.2024Amgad ElshamyAinda não há avaliações

- International EconomicsDocumento15 páginasInternational EconomicsKathy MorrisAinda não há avaliações

- INTERNATIONAL TRADE EDITED NEWDocumento16 páginasINTERNATIONAL TRADE EDITED NEWNaomi NyambasoAinda não há avaliações

- International Trade TheoriesDocumento5 páginasInternational Trade Theoriesnandini swamiAinda não há avaliações

- Gohram Baloch 1Documento11 páginasGohram Baloch 1Gwahram BalochAinda não há avaliações

- Global Trade and Investment.Documento20 páginasGlobal Trade and Investment.Chintan RamnaniAinda não há avaliações

- Module 3 Why Everybody Trades.Documento7 páginasModule 3 Why Everybody Trades.kyle markAinda não há avaliações

- IT ch.1 A.2023Documento3 páginasIT ch.1 A.2023Amgad ElshamyAinda não há avaliações

- EIT3771 Assignment 1Documento10 páginasEIT3771 Assignment 1Lavinia Naita EeluAinda não há avaliações

- Trade PDFDocumento11 páginasTrade PDFNarsayya RajannaAinda não há avaliações

- 15international TradeDocumento10 páginas15international TradeShinelle FrancoisAinda não há avaliações

- Why Comparative Cost Theory Improved Absolute Cost TheoryDocumento22 páginasWhy Comparative Cost Theory Improved Absolute Cost TheoryajeetAinda não há avaliações

- Chapter 5 SummaryDocumento6 páginasChapter 5 SummaryWindhea VendanovaAinda não há avaliações

- International Trade TheoryDocumento28 páginasInternational Trade TheorySajeebrs SajeebAinda não há avaliações

- Comparitive Advantage Theory FullDocumento10 páginasComparitive Advantage Theory FullaakashsinghsolankiAinda não há avaliações

- Who Gain and Who Loses From Trade?Documento22 páginasWho Gain and Who Loses From Trade?Praba Vettrivelu100% (1)

- Explanation:: Chapter 2 Study QuestionsDocumento14 páginasExplanation:: Chapter 2 Study QuestionsChi Iuvianamo0% (1)

- International Trade Part - 1: Dr. M. Imran Malik April 14, 2020Documento32 páginasInternational Trade Part - 1: Dr. M. Imran Malik April 14, 2020SHAMRAIZKHANAinda não há avaliações

- International TradeDocumento9 páginasInternational TradeParvesh Geerish100% (1)

- Theories Explaining Patterns of National TradeDocumento3 páginasTheories Explaining Patterns of National Trademirasolbanlaygas715Ainda não há avaliações

- International Economics LDocumento19 páginasInternational Economics LTeddy DerAinda não há avaliações

- Teori Hekscher Ohlin KLP 5.id - enDocumento7 páginasTeori Hekscher Ohlin KLP 5.id - enOhh Begitu YahAinda não há avaliações

- International Trade TheoryDocumento7 páginasInternational Trade TheoryFiremandeheavenly InamenAinda não há avaliações

- Unit 3 International Trade TheoryDocumento10 páginasUnit 3 International Trade TheoryleyonrajAinda não há avaliações

- International Trade LawDocumento7 páginasInternational Trade LawAnkush JadaunAinda não há avaliações

- AS Level Ch.4 International Trade - All Sub-ConceptsDocumento32 páginasAS Level Ch.4 International Trade - All Sub-ConceptsEhtesham UmerAinda não há avaliações

- University of Cebu-Main Campus Entrepreneurship 100 Chapter 11 QuizDocumento3 páginasUniversity of Cebu-Main Campus Entrepreneurship 100 Chapter 11 QuizAnmer Layaog BatiancilaAinda não há avaliações

- An-7004 IGBT Driver Calculation Rev00Documento8 páginasAn-7004 IGBT Driver Calculation Rev00Raghuram YaramatiAinda não há avaliações

- Constitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Documento3 páginasConstitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Mukesh ShuklaAinda não há avaliações

- CXS 310-2013 - PomegranateDocumento5 páginasCXS 310-2013 - PomegranateFranz DiazAinda não há avaliações

- Desarmado y Armado de Transmision 950BDocumento26 páginasDesarmado y Armado de Transmision 950Bedilberto chableAinda não há avaliações

- Soil Nailing and Rock Anchors ExplainedDocumento21 páginasSoil Nailing and Rock Anchors ExplainedMark Anthony Agnes AmoresAinda não há avaliações

- MACROECONOMICSDocumento95 páginasMACROECONOMICSClaudine Jeanne NillamaAinda não há avaliações

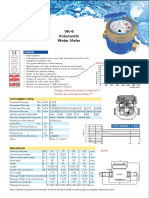

- Baylan: VK-6 Volumetric Water MeterDocumento1 páginaBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaAinda não há avaliações

- WebquestDocumento3 páginasWebquestapi-501133650Ainda não há avaliações

- Encore HR PresentationDocumento8 páginasEncore HR PresentationLatika MalhotraAinda não há avaliações

- NSTP 1: Pre-AssessmentDocumento3 páginasNSTP 1: Pre-AssessmentMaureen FloresAinda não há avaliações

- Delem: Installation Manual V3Documento73 páginasDelem: Installation Manual V3Marcus ChuaAinda não há avaliações

- PSC Single SpanDocumento99 páginasPSC Single SpanRaden Budi HermawanAinda não há avaliações

- Daftar Pustaka Marketing ResearchDocumento2 páginasDaftar Pustaka Marketing ResearchRiyan SaputraAinda não há avaliações

- Linde E18P-02Documento306 páginasLinde E18P-02ludecar hyster100% (4)

- Ab Initio Interview Questions - HTML PDFDocumento131 páginasAb Initio Interview Questions - HTML PDFdigvijay singhAinda não há avaliações

- Virtual Content SOPDocumento11 páginasVirtual Content SOPAnezwa MpetaAinda não há avaliações

- Wasbi Bank AnalysisDocumento18 páginasWasbi Bank AnalysisHamadia KhanAinda não há avaliações

- Capital Asset Pricing ModelDocumento11 páginasCapital Asset Pricing ModelrichaAinda não há avaliações

- Examples 5 PDFDocumento2 páginasExamples 5 PDFskaderbe1Ainda não há avaliações

- Machine Problem 6 Securing Cloud Services in The IoTDocumento4 páginasMachine Problem 6 Securing Cloud Services in The IoTJohn Karlo KinkitoAinda não há avaliações

- HOS Dials in The Driver App - Samsara SupportDocumento3 páginasHOS Dials in The Driver App - Samsara SupportMaryAinda não há avaliações

- E4PA OmronDocumento8 páginasE4PA OmronCong NguyenAinda não há avaliações

- TSM V5.3 Technical GuideDocumento456 páginasTSM V5.3 Technical GuideparifsAinda não há avaliações

- E85001-0646 - Intelligent Smoke DetectorDocumento4 páginasE85001-0646 - Intelligent Smoke Detectorsamiao90Ainda não há avaliações

- 2019-03-30 New Scientist PDFDocumento60 páginas2019-03-30 New Scientist PDFthoma leongAinda não há avaliações

- FINC 301 MQsDocumento40 páginasFINC 301 MQsMichael KutiAinda não há avaliações

- Superelement Modeling-Based Dynamic Analysis of Vehicle Body StructuresDocumento7 páginasSuperelement Modeling-Based Dynamic Analysis of Vehicle Body StructuresDavid C HouserAinda não há avaliações

- Chapter FiveDocumento12 páginasChapter FiveBetel WondifrawAinda não há avaliações

- ID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFDocumento11 páginasID Analisis Persetujuan Tindakan Kedokteran Informed Consent Dalam Rangka Persiapan PDFAmelia AmelAinda não há avaliações