Escolar Documentos

Profissional Documentos

Cultura Documentos

P3 Bonar Question

Enviado por

Rohail AmjadDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

P3 Bonar Question

Enviado por

Rohail AmjadDireitos autorais:

Formatos disponíveis

Bonar Paint

Introduction Bonar Paint is a medium-sized paint manufacturer set up by two brothers, Jim and Bill Bonar. Turnover has been static for some years and both brothers are now wanting to retire from the business. The brothers have created a loyal workforce and feel that this loyalty will be strengthened if they sell the business to the three senior managers: Roy Crawford, production manager; Tony Edmunds, sales and marketing manager and Vernon Smith, chief accountant. The three managers recognise that this is a major opportunity for them to change the direction and growth of the company, but one that will involve the raising of significant loan and equity finance to buy the business. Equally significant are the equity stakes of 100,000 from each of them, which the banks will require to show the senior managers personal commitment. Company product range and processes Bonar Paint makes high quality specialist paints for a range of industrial customers. Its major customers include car manufacturers, steel makers and the oil companies investing heavily in offshore oil rigs. Bonar Paint also supplies many smaller industrial customers. Raw materials are sourced from large chemical companies. Jim Bonar has the necessary chemical expertise and Bill has the complementary sales skills to meet the specialised paint needs of their demanding customers. Bonar Paint has a good reputation for product innovation and its product range of over 200 paints include paints able to tolerate harsh and demanding conditions. The small research and development team, headed by Jim, has an excellent track record of meeting the technical demands and timescales for developing new high performance paints. New paints are normally developed in response to customer demand and, consequently, there is no formal process for new product development. Replacing Jims technical skills and leadership will undoubtedly create problems for the senior management buyout team. Jim and Bill have taken all the key strategic decisions to date with little reference to the senior management team. Bonar Paints product innovation success has come at a price. Its product range is far too extensive to sustain with the majority of the paints produced infrequently and in small batches. As a consequence customers often experience long lead times when ordering a particular paint. This results in higher than necessary stock levels, much of which is unlikely to be bought. Paints are supplied directly to each and every customer. Unfortunately, its management information systems fail to show the profitability or otherwise of individual paints and the future demand for the paint. There is little communication between sales and the research and development part of the business. Roy Crawford has consistently argued for the benefits of reducing the product range and increasing the size of the batches produced. Such a policy would give him more control over production, and lower costs. Higher volumes would also justify investment in new production technology, which would bring labour savings with fewer and less skilled workers needed to operate the new machinery. There has been little recent investment in new plant or machinery. Simplifying the product range would also improve quality and reduce expensive warranty claims when paints fail to perform in a hostile environment. Such claims require extensive investigation to determine where the responsibility lies. Competitive environment Tony Edmunds, as sales and marketing manager, is very resistant to any attempt to reduce the product range. Such a move, he feels, would upset customers and lead to their defection to competitors. The UK paint industry is very fragmented at the top end of the industry are large international paint manufacturers with significant brands and supplying both industrial and domestic paint customers. They produce in high volumes and offer a comprehensive but limited range of paints. At the bottom end of the industry are many small and medium-sized paint makers. Many have chosen to produce own label paints of the large Do-ItYourself (DIY) retailers. Specialist paint makers, such as Bonar Paint, are finding it increasingly difficult to survive with neither the sales volumes nor brands to compete with their larger competitors. The industry as a whole is seen as mature and lacking in innovation. There is increased environmental concern about the toxic by-products of lead-based paints and the development of less toxic water-based paints is only slowly emerging. Even more worrying is the increased usage of plastics and other materials, which do not require painting. The DIY market is dominated by the same large international paint makers and the market for industrial paint is vulnerable to the usage of alternative materials and entry into the UK market by large European paint makers.

For latest course notes updates, free audio & video lectures and support and forums please visit

Future strategy Each of the prospective buyout managers has a different view of how Bonar Paints should develop after the buyout takes place. Roy Crawford sees his proposed reduction of the product range and increased investment in new production technology as a means of reducing costs, improving margins and focusing on getting a larger share of their current large industrial paint customers needs. Product innovation should only come when there is a clear and profitable need for a new paint. He argues for a critical review of their smaller customers, believing them to be unprofitable. Tony Edmunds, however, sees an extension of the customer base as a necessary step in securing the future of the firm. The product range should be extended to meet the needs of the professional painters and decorators looking for high performance paints for use in both domestic and industrial applications. Tony also feels they should begin to make their paints available to the general public. He has seen the success of factory shops in other industries, whereby manufacturers sell unwanted and outdated stock to customers at heavily discounted prices at an outlet on the firms premises. Such as shop would be relatively simple and inexpensive to set up and bring Bonar Paints products to a wider public. It would require either the production, or buying in, of a range of the most popular paint colours used in home decoration. Finally, Vernon Smith is anxious that the internal control systems be improved to establish which paints are, or are not, making money. Investment in new paint ranges or technology should be resisted until the buyout has been successfully completed. In the longer term he feels that Bonar Paint is vulnerable because of its small size and that increasing size through merger and acquisition of similar sized firms is a sensible strategy. Vernon is also anxious that a fair valuation is made of the business and that the sales forecasts for 2007 and 2008, made by Bill Bonar, are realistic. Table 1: Financial information on Bonar Paint (000) 2004 Sales Cost of sales Gross profit Marketing Distribution Administration Research and Development Net profit Return on sales (%) Net assets Inventory Warranty costs Employees Product range (units) 10,500 5,250 5,250 100 1,575 2,100 105 1,370 130 2,500 1,450 100 250 204 2005 10,250 5,400 4,850 100 1,650 2,150 100 850 83 2,350 1,750 150 264 210 2006 10,000 5,500 4,500 100 1,700 2,200 100 400 40 2,200 2,000 150 262 212 2007 (estimate) 10,500 5,460 5,040 150 1,785 2,250 105 750 71 2,200 1,650 125 275 220 2008 (forecast) 11,000 5,500 5,500 150 1,650 2,200 110 1,390 126 2,200 1,200 100 280 230

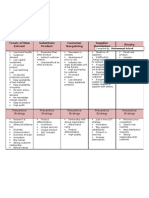

Customer analysis: Sales to large industrial companies 75% Sales to small industrial companies 25% Required: The senior management team has asked for your advice in evaluating the current position of Bonar Paint and its attractiveness for a management buyout. (a) Using models where appropriate, provide the senior management team at Bonar Paint with an assessment of its strategic position and its attractiveness, or otherwise, for a management buyout. (20 marks)

Roy Crawford has argued for a reduction in both the product range and customer base to improve company performance.

For latest course notes updates, free audio & video lectures and support and forums please visit

(b)

Assess the operational advantages and disadvantages to Bonar Paint of choosing such a strategy. (10 marks)

The senior management team is aware of your success in implementing necessary change following a change in ownership and control. (c) Identify and explain the key areas of change likely to be needed in Bonar Paint in order to implement a successful buyout. (12 marks)

Bonar Paint to date has had no formal strategic planning process. (d) What are the advantages and disadvantages of developing a formal mission statement to guide Bonar Paints future direction after the buyout? (8 marks) (50 marks)

For latest course notes updates, free audio & video lectures and support and forums please visit

Você também pode gostar

- Summary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisNo EverandSummary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisAinda não há avaliações

- Model Answer: Launch of a laundry liquid detergent in Sri LankaNo EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaAinda não há avaliações

- SBL - Further Question and Practice 2022Documento48 páginasSBL - Further Question and Practice 2022Mazni HanisahAinda não há avaliações

- P3 Bonar AnswerDocumento3 páginasP3 Bonar AnswerFrank WangAinda não há avaliações

- Paint Industry ReportDocumento17 páginasPaint Industry ReportUtkarsh PandeyAinda não há avaliações

- Group 5 Pintura Corporation The Lena Launch Decision PDFDocumento7 páginasGroup 5 Pintura Corporation The Lena Launch Decision PDFARNAV MEHTAAinda não há avaliações

- Asian Paints Marketing StrategyDocumento5 páginasAsian Paints Marketing Strategyalokjain1987Ainda não há avaliações

- Brighto PaintsDocumento10 páginasBrighto Paintscall me natural beauty loverAinda não há avaliações

- Coatings Word September 2013Documento108 páginasCoatings Word September 2013sami_sakrAinda não há avaliações

- IIM Shillong Enigma Pushpak MaggoDocumento3 páginasIIM Shillong Enigma Pushpak Maggopushpak maggoAinda não há avaliações

- Business Proposal For Paint Production BDocumento20 páginasBusiness Proposal For Paint Production BMahmoud Muh'd Sardauna100% (1)

- Michael Porter's 5 Forces Model: Asian PaintsDocumento4 páginasMichael Porter's 5 Forces Model: Asian PaintsrakeshAinda não há avaliações

- Business Plan For 5star PaintDocumento20 páginasBusiness Plan For 5star Paintracecomedy4lifeAinda não há avaliações

- Paint Industry - UpdatedDocumento47 páginasPaint Industry - Updatedsudeep khandelwalAinda não há avaliações

- Chapter Two The Marketing PlanDocumento22 páginasChapter Two The Marketing PlanAbigail JeronoAinda não há avaliações

- Jones Blair Company Case StudyDocumento4 páginasJones Blair Company Case StudyAmeen AlmohsenAinda não há avaliações

- Coatings Word August 2012Documento52 páginasCoatings Word August 2012sami_sakrAinda não há avaliações

- To Study The Difference Between Organizational and Consumer Selling in Case of Berger PaintsDocumento13 páginasTo Study The Difference Between Organizational and Consumer Selling in Case of Berger Paintssachi_gupta_10% (1)

- Strengths in The SWOT Analysis of Berger PaintsDocumento9 páginasStrengths in The SWOT Analysis of Berger Paintsaditya100% (1)

- Pidilite Investment Presentation - RKDocumento26 páginasPidilite Investment Presentation - RKRohit KadamAinda não há avaliações

- Coatings Word March 2012Documento83 páginasCoatings Word March 2012sami_sakrAinda não há avaliações

- Coatings Word September 2010Documento68 páginasCoatings Word September 2010sami_sakrAinda não há avaliações

- SDM - Submission 2 - Group 13Documento11 páginasSDM - Submission 2 - Group 13Suchitam TirkeyAinda não há avaliações

- Industry Analysis: Presented by D.Dilip Kumar 18R21E0024 Mba "A" SecDocumento31 páginasIndustry Analysis: Presented by D.Dilip Kumar 18R21E0024 Mba "A" SecVurkonda SureshAinda não há avaliações

- 1janmar Coatings Inc PresentationDocumento17 páginas1janmar Coatings Inc Presentationmrchard0% (1)

- Coatings Word September 2011Documento84 páginasCoatings Word September 2011sami_sakrAinda não há avaliações

- Asian PaintsDocumento26 páginasAsian PaintsAjinkya Nikam100% (1)

- Business Proposal For PaintproductionbyDocumento11 páginasBusiness Proposal For PaintproductionbyChij DhakalAinda não há avaliações

- Asian PaintsDocumento35 páginasAsian PaintsAishAinda não há avaliações

- LieratureDocumento5 páginasLieratureSapna SharmaAinda não há avaliações

- Case 4 - Curled MetalDocumento4 páginasCase 4 - Curled MetalSravya DoppaniAinda não há avaliações

- 81-Strategy Formulation For Decorative Segment of Indian Paint IndustryDocumento14 páginas81-Strategy Formulation For Decorative Segment of Indian Paint IndustryPrashant SinghAinda não há avaliações

- HG Ceramic CaseDocumento11 páginasHG Ceramic CaseMubashir1985Ainda não há avaliações

- Operations Group Assignment 1 - 468911-54Documento10 páginasOperations Group Assignment 1 - 468911-54jaclynnzAinda não há avaliações

- University of The Thai Chamber of Commerce: Janmar Coatings, IncDocumento3 páginasUniversity of The Thai Chamber of Commerce: Janmar Coatings, IncIzabela Campos100% (2)

- Paint Industry Analysis - SIMCON BlogDocumento10 páginasPaint Industry Analysis - SIMCON BlogVishnu KanthAinda não há avaliações

- Distribution and Channel Management: Berger Paints India Ltd. (BPIL)Documento19 páginasDistribution and Channel Management: Berger Paints India Ltd. (BPIL)ANKIT GUPTAAinda não há avaliações

- Business Strategy Tutorial 3 QuestionDocumento3 páginasBusiness Strategy Tutorial 3 QuestionYeeWern WongAinda não há avaliações

- Coatings Word October 2011Documento84 páginasCoatings Word October 2011sami_sakrAinda não há avaliações

- Dow Corning Success in ChinaDocumento24 páginasDow Corning Success in ChinaAnonymous lSeU8v2vQJ100% (1)

- Asian PaintsDocumento3 páginasAsian PaintsMukesh ParmarAinda não há avaliações

- Marketing Strategy and Marketing Mix of BergerDocumento12 páginasMarketing Strategy and Marketing Mix of Bergerborhan70% (2)

- Overall Business EnvironmentDocumento5 páginasOverall Business EnvironmentRohitAinda não há avaliações

- C5 AsianPaints FINALDocumento15 páginasC5 AsianPaints FINALLalit A PoddarAinda não há avaliações

- Ambit - Disruption - Vol-1 - Asian PaintsDocumento7 páginasAmbit - Disruption - Vol-1 - Asian PaintsamitAinda não há avaliações

- Marketing Management Paper 2Documento29 páginasMarketing Management Paper 2Maxwell PeterAinda não há avaliações

- Jones Blair Company: Topic: Brand Management/Segmentation Dani ChessonDocumento8 páginasJones Blair Company: Topic: Brand Management/Segmentation Dani ChessonSaad HamdanAinda não há avaliações

- Coatings Word August 2010Documento52 páginasCoatings Word August 2010sami_sakrAinda não há avaliações

- C A S E 28 Inner-City Paint Corporation (Revised)Documento9 páginasC A S E 28 Inner-City Paint Corporation (Revised)Masud RanaAinda não há avaliações

- Filmore Furniture ExDocumento11 páginasFilmore Furniture ExLou100% (1)

- Final Analysis of Paint IndustryDocumento54 páginasFinal Analysis of Paint IndustryRishikesh Mishra100% (1)

- Porter's Five Force Analysis:: Economies of Scale: The Cost Per Unit Will Be Lower When Firms Produce at Larger VolumesDocumento3 páginasPorter's Five Force Analysis:: Economies of Scale: The Cost Per Unit Will Be Lower When Firms Produce at Larger VolumesVishnu KanthAinda não há avaliações

- Swot, Segmentation, Branding of ICI DuluxDocumento7 páginasSwot, Segmentation, Branding of ICI Duluxgaurav0211987Ainda não há avaliações

- 10 January 2022 09:20: Notes Page 1Documento5 páginas10 January 2022 09:20: Notes Page 1ANSHUL AGRAWAL MBA 2021-23 (Delhi)Ainda não há avaliações

- Voltas Limited KishoreDocumento8 páginasVoltas Limited Kishorekishore26190Ainda não há avaliações

- Asian Paints Marketing StrategyDocumento23 páginasAsian Paints Marketing StrategyYash SoniAinda não há avaliações

- My Marketing Sip ProjectDocumento55 páginasMy Marketing Sip ProjectNidhi BaranwalAinda não há avaliações

- To Explore The Potential of Paints in Projects and Maintenance in Mumbai and To Share Plan For Increasing The Market Share in Kansai Nerolac Paints LimitedDocumento76 páginasTo Explore The Potential of Paints in Projects and Maintenance in Mumbai and To Share Plan For Increasing The Market Share in Kansai Nerolac Paints Limitedharish_100_inAinda não há avaliações

- Growing Sealants - PidiliteDocumento5 páginasGrowing Sealants - PidiliteJanhabi SethAinda não há avaliações

- Berger PaintsDocumento70 páginasBerger PaintsAnisa_RaoAinda não há avaliações

- Investment AppraisalDocumento4 páginasInvestment AppraisalRohail AmjadAinda não há avaliações

- Yahoo Inc!: Financial Statement For The Year Ended As atDocumento16 páginasYahoo Inc!: Financial Statement For The Year Ended As atRohail AmjadAinda não há avaliações

- Plain Grip SilkDocumento2 páginasPlain Grip SilkRohail AmjadAinda não há avaliações

- RAPDocumento48 páginasRAPRohail Amjad100% (1)

- General Ledger (Summary)Documento1 páginaGeneral Ledger (Summary)Rohail AmjadAinda não há avaliações

- 5 Forces OverviewDocumento1 página5 Forces OverviewRohail AmjadAinda não há avaliações

- Virtues of LazinessDocumento2 páginasVirtues of LazinessAbhishek SrivastavaAinda não há avaliações

- Abul Ala Maududi - Jihad in IslamDocumento30 páginasAbul Ala Maududi - Jihad in IslamLuis Dizon100% (2)

- Supply Chain Assignment: Itc FoodsDocumento4 páginasSupply Chain Assignment: Itc FoodsHardeep Singh BhatiaAinda não há avaliações

- Design Folio: Shubhangi ChoudharyDocumento44 páginasDesign Folio: Shubhangi ChoudharyShubhangi ChoudharyAinda não há avaliações

- Simple Process - Consumer Decision-MakingDocumento58 páginasSimple Process - Consumer Decision-MakingNew_EricAinda não há avaliações

- 2023 - 06 - 04 Nidhi Patel Swiss Chocolate Challenge SwissOne Vs TobleroneDocumento12 páginas2023 - 06 - 04 Nidhi Patel Swiss Chocolate Challenge SwissOne Vs TobleroneBTS Forever100% (3)

- BR Casestudy Adidas v2Documento3 páginasBR Casestudy Adidas v2sandeep_londheAinda não há avaliações

- Project OneDocumento97 páginasProject OneShaheen tajAinda não há avaliações

- Logo Design. Global Brands PDF, Epub, EbookDocumento4 páginasLogo Design. Global Brands PDF, Epub, EbookJoão RodriguesAinda não há avaliações

- Injoy Dealership Application FormV2Documento4 páginasInjoy Dealership Application FormV2Ej RafaelAinda não há avaliações

- Discuss Role & Importance of Marketing Department With Other Functional AreasDocumento3 páginasDiscuss Role & Importance of Marketing Department With Other Functional Areassasithar jaisankaranAinda não há avaliações

- Affect of Branding On Consumer Purchase Decision in FMCG Goods and Durable GoodsDocumento6 páginasAffect of Branding On Consumer Purchase Decision in FMCG Goods and Durable GoodsDheeraj ParmarAinda não há avaliações

- Seaworld Final Report-2-3Documento25 páginasSeaworld Final Report-2-3api-338644443Ainda não há avaliações

- Unit 2: International Markets (Homework)Documento8 páginasUnit 2: International Markets (Homework)Hoài My Lê ThịAinda não há avaliações

- Efas Sfas Tow IfasDocumento5 páginasEfas Sfas Tow IfasFatima EhsanAinda não há avaliações

- 10 1108 - Ijppm 12 2019 0595Documento18 páginas10 1108 - Ijppm 12 2019 0595Ratna KartikaAinda não há avaliações

- Group Assignment: Analyzing of Trung Nguyen LegendDocumento14 páginasGroup Assignment: Analyzing of Trung Nguyen LegendYến HảiAinda não há avaliações

- Emarketer Brand Interactions On Social NetworksDocumento22 páginasEmarketer Brand Interactions On Social NetworksJose LazaresAinda não há avaliações

- Mckinsey - CPG PDFDocumento16 páginasMckinsey - CPG PDFAnushka GulatiAinda não há avaliações

- Nestle Multinational CompanyDocumento3 páginasNestle Multinational CompanyShebel AgrimanoAinda não há avaliações

- TC Op y No TC Op Y: Camper: Imagination Is Not ExpensiveDocumento20 páginasTC Op y No TC Op Y: Camper: Imagination Is Not ExpensivePrasad GantiAinda não há avaliações

- IntelDocumento10 páginasIntelvarudhinich0% (1)

- To Redesign The Social Media Marketing Strategy at Jamhuriya Technology Solutions (Mogadishu - Somalia)Documento46 páginasTo Redesign The Social Media Marketing Strategy at Jamhuriya Technology Solutions (Mogadishu - Somalia)JING YOU YAPAinda não há avaliações

- NTB 2Documento53 páginasNTB 2Sujeewa LakmalAinda não há avaliações

- BURBERRY (Consumer's Behaviour Report)Documento19 páginasBURBERRY (Consumer's Behaviour Report)Valerie100% (4)

- Haleeb Ice CreamDocumento44 páginasHaleeb Ice CreamAzadar H. ZaidiAinda não há avaliações

- Mont Gras CaseDocumento10 páginasMont Gras CaseFernando HealyAinda não há avaliações

- Lecture 2 Social MediaDocumento74 páginasLecture 2 Social MediaShalmy RosaliaAinda não há avaliações

- Rin 120118173657 Phpapp02Documento10 páginasRin 120118173657 Phpapp02coolhotingAinda não há avaliações

- End of Chapter QuestionDocumento3 páginasEnd of Chapter Questioncharles03281991100% (3)

- Iapex PresDocumento19 páginasIapex PresAamirSaghirAinda não há avaliações

- Lego-Case-Study Ans 2Documento3 páginasLego-Case-Study Ans 2VK100% (2)