Escolar Documentos

Profissional Documentos

Cultura Documentos

MNGOP 2011 Points Budget

Enviado por

Cory MerrifieldDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

MNGOP 2011 Points Budget

Enviado por

Cory MerrifieldDireitos autorais:

Formatos disponíveis

FY2012-13

Budget: Limiting Spending and Achieving Long-Term Reform

Spending FY2012-13: Forecast: $39 billion Gov Dayton: $37 billion Final Agreement: $34.3 billion

Spending:

$1.8 billion General Fund appropriation, $20 million less than the Governor proposed Resolves a 2009 DFL accounting failure and correctly accounts for a $27 million hole in the Dept of Corrections fund Funds at a level to maintain core services within the courts

Reforms:

Prioritizes the use of state funds on state cases over federal cases Specifies that funding increases are used to alleviate caseloads and pay for specified operations costs Prohibits additional funding for increased employee salaries Requires a co-payment for prison inmate initiated healthcare Saves counties money through lower reimbursement rates for medical services to local prisoners

Spending:

$4.7 billion total appropriation (Dedicated and General Fund) for state and local roads, public safety and transit $125.7 million General Fund appropriation, $55 million less than the Governor proposed Cuts spending by $42 million from current levels Provides over $2.5 billion for jobs related to the construction and maintenance of Minnesota's trunk highway system

Reforms:

Creates a Trunk Highway Economic Development Account to promote economic development, improvement and relieve growing traffic congestion Improves transit financing and public transparency Requires development planners to disclose both capital and long-term operating expenses highway

Spending:

$4.1 BILLION in DFL and Gov. Dayton TAX HIKES BLOCKED $600 million (17 percent) reduction in projected FY2012-13 state aids and credits $750 million (20 percent) reduction in future spending, achieved through permanent

long-term

spending

cuts

Reforms:

Provides $30 million in net tax relief, including estate tax relief for farms and small businesses, sales tax exemption for townships, sales tax exemption for public safety water, and sales tax exemption for resale ticket purchases Freezes city and county aid at 2010 levels, providing budget and funding stability to local officials Modifies county maintenance of effort (MaE) requirements to allow for greater flexibility and cost savings in delivering local services Increases homeowner's property tax refund program and provides more direct property tax relief to middle and lower income homeowners Includes federal tax conformity to simplify taxpayer filing and tax administration Replaces the current broken market value homestead credit program and converts it to a comparable exclusion on

homeowners' property tax Suspends the Political Contribution Program is suspended for two years Includes federal taxes in the Tax Incidence Study, allowing for a more accurate portrait of the burden on MN taxpayers

Spending: $13.6 billion General Fund appropriation, $600 million less than the Governor proposed and $2 billion less than projected FY2012-13 spending NOTE:An extension and expansion of the education aid "shift" is induded in this measure pursuant to an overarching budget agreement between legislative leaders and the governor o As in the past, existing law provides that the shift will be bought back when the economy recovers and state revenues increase enough to build up a budget surplus o After taking the effect of the shift into account, the bilI appropriates $13.6 billion over FY2012-13 ($6.3 billion in FY2012 and $7.3 billion in FY2013) $50 increase in per pupil funding allowance Special education funding increased according to current law growth factors

Extends by two-years the relief from requiring local districts to spend 2 percent of their basic revenue on staff development Ends the inefficient and uneven Integration Revenue after FY2013.to be replaced with a yet undetermined program and spending distribution Repeals the state's authority to borrow from school districts with reserves during a fiscal year (the payment shift is different because that splits payments over two different fiscal years)

Requires school districts to "earn" Literacy Incentive Aid funds through student reading test scores in the early elementary grades Creates Early Graduation Scholarships, aJIowing academically capable and hard-working students to complete their high school education early and to take the funds to the college of their choice Requires regular evaluations of principals and teachers: student test scores must be connected with the rating of the teacher

Spending:

$2.57 billion General Fund appropriation, $180 million less than the Governor proposed and Cuts spending by $246 million from current levels $21 million increase for the State Grant program to improve and expand choice in higher education Increases funding for the Work Study program to allow more students to work their way through college

Reforms: Enacts tuition limitation at MnSeU's two year institutions, forcing systematic reform and efficiency

Requires the U of MN and MnSCU schools to meet performance benchmarks to receive a portion of their funding Utilizes need-based State Grant program and Work Study programs to drive expanded choice in higher education, employment opportunities for students, and minimizes student loan debt

Spending: $11.3 billion General Fund appropriation, $700 million less than the Governor proposed projected spending Future spending (tails) reduced from a projected 11.5 percent increase to a significantly increase No increased surcharges are included in the final agreement There are no rate reductions to nursing homes in this bill and $1 billion less than lower 4.8 percent

Reforms: Bends the curve on health care spending to slow the massive growth in the fastest growing part of the state budget Creates a defined contribution to privatize public health care for some MinnesotaCare recipients Controls the number of people allowed on the waiver programs through limits on Elderly and Developmental Disability Waivers Repeals the provider tax Provides tax relief from the MinnesotaCare provider tax with a blink-on or off depending on the financial structure of the Health Care Access Fund. Prevents welfare fraud by strengthening welfare eligibility requirements and placing greater photo ID requirements and restrictions on the use of EST cards for alcohol or tobacco purchases Includes County Service Delivery Authority, allowing counties to consolidate human service departments into delivery authorities Repeals entirely the nursing facility and hospital rebasing, drastically reducing falsely inflated forecasted spending for health and human services Limits the Medicaid fee-for-service spending for the next 4 years 1& Increases funding to small, rural nursing homes and rural pharmacies Modifies MFIP requirements and makes changes for recipients Accepts the Governor's Medical Assistance early enrollment program, but also ensures that reforms and cost containment efforts would be done to serve the adults without children below 75 percent FPG Accepts the Governor's proposal to ask the federal government for a series of waivers but seeks accompanying reforms: o Promoting personal responsibility and encouraging and rewarding healthy outcomes, encouraging utilization of high quality, cost effective care through Medicaid and MinnesotaCare enrollee cost sharing o Redesign home and community based services for people with disability in order to ensure a more sustainable system o Changes to the Elderly Waiver to improve access to housing, redesign of assessment tools, transition and relocation efforts, refinancing of Alternative Care and Essential Community Supports, and providing Medigap coverage for those not eligible for MA o Health Care Delivery Demonstration Projects to test alternative payment service and delivery models for Minnesota Health Care Plan fee-far-services recipients and managed care enrollees and support an improved primary care coordination model for recipients

Spending: $237 million General Fund appropriation, $39 million less than the Governor proposed Cuts spending by $75 million from current levels No fee increases No tax increases Reforms: Provides budget flexibility to maintain outdoors

and deal with critical issues such as aquatic invasive species and

chronic wasting disease Requires review of state agency water management to streamline and consolidate among all agencies that have water programs Reforms state tree nursery program to devise along-term business plan for sustainability without competing with the private sector

Spending: $154 million General Fund appropriation, $11 million less than the Governor proposed Cuts spending by $41.4 million from current levels Prioritizes spending on private sector jobs and business programs, not earmarks and special interests Reforms: Ends DFLpractice of pass-through grants and legislative earmarking for special interests Creates three competitive grants programs in the Department of Employment and Economic Development Encourages small-business expansion through newly created loan guarantee program Cuts funding to the MN Trade Office at an ongoing rate of 5 percent per year Minimizes the use of fees

Spending: $76.8 million General Fund appropriation, $1 million less than the Governor proposed Cuts spending by $9.9 million from current levels Prioritizes spending on the livestock and grain industries, the health and safety of our food supply system, and our ever-increasing export programs Reforms: Ends ethanol subsidies by making the final ethanol producer deficiency payment in 2012

Spending: $818.9 million General Fund appropriation, $53.6 million less than the Governor proposed Cuts spending by $68 million from current levels Reduces funding for constitutional offices, the legislature, and state agencies by 5 percent Increases spending for Veterans Affairs and Military Affairs by 2.7 and 6 percent respectively Reforms: Consolidates Office of Enterprise Technology services throughout government Requires E-Verify status check to be used by all businesses that contract with the state Establishes a Sunset Advisory Commission to review state agencies, improve operations, and consolidate programs Calls for strategic sourcing with private firms to ensure efficiencies in state buildings and vehicle fleet management Requires the Department of Revenue to seek tax fraud prevention measures and increase delinquent collections Links state employee pay to performance, with salary increases subject to sufficient ratings Issues up to $10 million in appropriated bonds through MNManagement & Budget in a "pay for performance" pilot project with cost efficient non-profits

Você também pode gostar

- Obama's Proposed Cuts 2011-14Documento10 páginasObama's Proposed Cuts 2011-14RJohansen1Ainda não há avaliações

- 2019 Operating Budget HighlightsDocumento3 páginas2019 Operating Budget HighlightsKHQA NewsAinda não há avaliações

- The Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketNo EverandThe Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketAinda não há avaliações

- SubHB59 ChangesDocumento9 páginasSubHB59 ChangesJosephAinda não há avaliações

- Rinciples Riorities: Options BookDocumento43 páginasRinciples Riorities: Options BookJohnCarneyDEAinda não há avaliações

- Sub HB 110 HighlightsDocumento6 páginasSub HB 110 HighlightsKaren KaslerAinda não há avaliações

- Legislative Session Wrap June 6Documento25 páginasLegislative Session Wrap June 6Roxi MackensAinda não há avaliações

- U of A 2011 Financial StatementsDocumento40 páginasU of A 2011 Financial StatementsSarabjot Singh SamraAinda não há avaliações

- 02008-Factsheet State LocalDocumento3 páginas02008-Factsheet State LocallosangelesAinda não há avaliações

- FOMB Letter Legislative Assembly FY24 Budget Notice of ViolationDocumento15 páginasFOMB Letter Legislative Assembly FY24 Budget Notice of ViolationHyderlis Pérez OrtizAinda não há avaliações

- FY 13 Budget Meeting 3-6-12 FINALDocumento30 páginasFY 13 Budget Meeting 3-6-12 FINALGerrie SchipskeAinda não há avaliações

- 2023 03 07 CPRAC Draft Report Executive Budget 1Documento4 páginas2023 03 07 CPRAC Draft Report Executive Budget 1Capitol PressroomAinda não há avaliações

- The Future of Public PensionDocumento23 páginasThe Future of Public PensionNational Press FoundationAinda não há avaliações

- 2011 Budget ReformsDocumento8 páginas2011 Budget ReformsSenatorNienowAinda não há avaliações

- Jindal FY16 Proposed BudgetDocumento48 páginasJindal FY16 Proposed BudgetRepNLandryAinda não há avaliações

- 2017 Session Highlights UpdateDocumento90 páginas2017 Session Highlights UpdateNew York Senate100% (1)

- NA Testimony On FY 2011 Gap Closing Plan (11 30 10)Documento5 páginasNA Testimony On FY 2011 Gap Closing Plan (11 30 10)Susie CambriaAinda não há avaliações

- Deficit Committee PaperDocumento5 páginasDeficit Committee PaperRyan DeCaroAinda não há avaliações

- MBPC's Preliminary Analysis of The House Ways and Means FY 2008 BudgetDocumento6 páginasMBPC's Preliminary Analysis of The House Ways and Means FY 2008 BudgetjrodascAinda não há avaliações

- Major Features of HB1300-HB1301 Conference Agreement - 04!05!12Documento4 páginasMajor Features of HB1300-HB1301 Conference Agreement - 04!05!12Julie CoggsdaleAinda não há avaliações

- FINAL BOCC Accomplishments 09 12 2012 - 201209121111531266Documento4 páginasFINAL BOCC Accomplishments 09 12 2012 - 201209121111531266Valerie DaleAinda não há avaliações

- Monroe County 2023 BudgetDocumento3 páginasMonroe County 2023 BudgetKeegan TrunickAinda não há avaliações

- 2023 Monroe County BudgetDocumento3 páginas2023 Monroe County BudgetKeegan TrunickAinda não há avaliações

- Fact Sheet - Health Care - FINALDocumento6 páginasFact Sheet - Health Care - FINALsarahkliffAinda não há avaliações

- Roadmap To Renewal - BrochureDocumento2 páginasRoadmap To Renewal - BrochureZachary JanowskiAinda não há avaliações

- Budget Summary - HB 5001 Conference ReportDocumento16 páginasBudget Summary - HB 5001 Conference ReportDeanna GugelAinda não há avaliações

- Connecticut General Assembly: Office of Fiscal AnalysisDocumento16 páginasConnecticut General Assembly: Office of Fiscal AnalysisJordan FensterAinda não há avaliações

- Lausd BudgetDocumento14 páginasLausd BudgetR SternAinda não há avaliações

- University of Alberta Financial StatementsDocumento41 páginasUniversity of Alberta Financial StatementsEmily MertzAinda não há avaliações

- 2022 Backgrounder 1 SocialDocumento4 páginas2022 Backgrounder 1 SocialPatrick D HayesAinda não há avaliações

- Healthcare Trans From at Ion WaiverDocumento34 páginasHealthcare Trans From at Ion WaiverGovtfraudlawyerAinda não há avaliações

- 01935-Budget Discipline-2008Documento2 páginas01935-Budget Discipline-2008losangelesAinda não há avaliações

- State Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionDocumento11 páginasState Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionCara MatthewsAinda não há avaliações

- Burgum BudgetDocumento3 páginasBurgum BudgetRob PortAinda não há avaliações

- The Impact of The Economic Recovery Act of 2009 On HealthcareDocumento31 páginasThe Impact of The Economic Recovery Act of 2009 On Healthcareasg_akn8335Ainda não há avaliações

- Final Budget 2011Documento25 páginasFinal Budget 2011Ubaid KhanAinda não há avaliações

- 2013 Session AccomplishmentsDocumento10 páginas2013 Session AccomplishmentsLegitSlaterAinda não há avaliações

- CLLR Thornber Budget OverviewDocumento4 páginasCLLR Thornber Budget Overviewdan_kerinsAinda não há avaliações

- Senate Major Action June 8th - CA Senate Budget CommitteeDocumento13 páginasSenate Major Action June 8th - CA Senate Budget CommitteeRichard Costigan IIIAinda não há avaliações

- IBA Review of The Fiscal Year 2013 Proposed BudgetDocumento30 páginasIBA Review of The Fiscal Year 2013 Proposed Budgetapi-63385278Ainda não há avaliações

- A Bipartisan Plan To Reduce Our Nation'S Deficits Executive SummaryDocumento5 páginasA Bipartisan Plan To Reduce Our Nation'S Deficits Executive SummaryMarkWarnerAinda não há avaliações

- Budget HighlightsDocumento30 páginasBudget HighlightsNews 6 WKMG-TVAinda não há avaliações

- Finance Bill 2011Documento12 páginasFinance Bill 2011aparajithakAinda não há avaliações

- Part Two: BudgetingDocumento44 páginasPart Two: BudgetingYabe MohammedAinda não há avaliações

- LAO RecommendationsDocumento9 páginasLAO RecommendationsLouis FreedbergAinda não há avaliações

- A Recovery Update For Michigan's Citizens (Benton Harbor)Documento19 páginasA Recovery Update For Michigan's Citizens (Benton Harbor)Jennifer Granholm100% (1)

- Paul Ryan TableDocumento3 páginasPaul Ryan TableCommittee For a Responsible Federal BudgetAinda não há avaliações

- Administration For Children and Families, Payments To States For Home Visitation (2010)Documento7 páginasAdministration For Children and Families, Payments To States For Home Visitation (2010)Rick ThomaAinda não há avaliações

- Department of Health and Human Services: The President's 2009 Budget WillDocumento6 páginasDepartment of Health and Human Services: The President's 2009 Budget Willapi-19777944Ainda não há avaliações

- Gregoire's 2013-2015 Budget ProposalDocumento5 páginasGregoire's 2013-2015 Budget ProposalMatt DriscollAinda não há avaliações

- Housing and Urban Development Funding 2011Documento6 páginasHousing and Urban Development Funding 2011Kim Hedum100% (1)

- 2014-2018 Jackson County Capital Improvement ProgramDocumento59 páginas2014-2018 Jackson County Capital Improvement ProgramLivewire Printing CompanyAinda não há avaliações

- SFY 2011-2012 Subcommittee On Education Report To The General Conference CommitteeDocumento3 páginasSFY 2011-2012 Subcommittee On Education Report To The General Conference CommitteeJ EddyAinda não há avaliações

- Paul Ryan Comparison TableDocumento3 páginasPaul Ryan Comparison TableCommittee For a Responsible Federal BudgetAinda não há avaliações

- City of Fort St. John - Annual Remuneration For Members of CouncilDocumento12 páginasCity of Fort St. John - Annual Remuneration For Members of CouncilAlaskaHighwayNewsAinda não há avaliações

- Resident's Guide: Volume 1 FY2013Documento15 páginasResident's Guide: Volume 1 FY2013ChicagoistAinda não há avaliações

- Summary of The Medicare and Medicaid Extenders Act of 2010Documento3 páginasSummary of The Medicare and Medicaid Extenders Act of 2010api-25909546Ainda não há avaliações

- Memo On Daugaard's Education PlanDocumento4 páginasMemo On Daugaard's Education PlanDana FergusonAinda não há avaliações

- Corporate Mobile Readiness ReportDocumento62 páginasCorporate Mobile Readiness ReportCory MerrifieldAinda não há avaliações

- HKS Implementation PresentationDocumento27 páginasHKS Implementation PresentationCory MerrifieldAinda não há avaliações

- Stakeholder Experience Committee: Cory Merrifield Founder/Fan AdvocateDocumento18 páginasStakeholder Experience Committee: Cory Merrifield Founder/Fan AdvocateCory MerrifieldAinda não há avaliações

- Vikings Final Conference Committee Bill 5-9-12Documento88 páginasVikings Final Conference Committee Bill 5-9-12Cory MerrifieldAinda não há avaliações

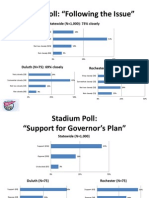

- Statewide Poll Results 03-22-12Documento10 páginasStatewide Poll Results 03-22-12Cory MerrifieldAinda não há avaliações

- Vikings Stadium Poll Summary 3-23-12Documento3 páginasVikings Stadium Poll Summary 3-23-12Cory MerrifieldAinda não há avaliações

- Farmers Market Plan-The Corridor - 11-03-2011Documento88 páginasFarmers Market Plan-The Corridor - 11-03-2011Cory MerrifieldAinda não há avaliações

- Vikings Stadium Footprint - TCAAPDocumento1 páginaVikings Stadium Footprint - TCAAPCory MerrifieldAinda não há avaliações

- The People's Stadium Bill: Cory Merrifield Founder/Fan AdvocateDocumento41 páginasThe People's Stadium Bill: Cory Merrifield Founder/Fan AdvocateCory MerrifieldAinda não há avaliações

- Five Kingdom ClassificationDocumento6 páginasFive Kingdom ClassificationRonnith NandyAinda não há avaliações

- BS en Iso 06509-1995 (2000)Documento10 páginasBS en Iso 06509-1995 (2000)vewigop197Ainda não há avaliações

- Stewart, Mary - The Little BroomstickDocumento159 páginasStewart, Mary - The Little BroomstickYunon100% (1)

- Student Exploration: Digestive System: Food Inio Simple Nutrien/oDocumento9 páginasStudent Exploration: Digestive System: Food Inio Simple Nutrien/oAshantiAinda não há avaliações

- LKG Math Question Paper: 1. Count and Write The Number in The BoxDocumento6 páginasLKG Math Question Paper: 1. Count and Write The Number in The BoxKunal Naidu60% (5)

- 3M 309 MSDSDocumento6 páginas3M 309 MSDSLe Tan HoaAinda não há avaliações

- Distribution BoardDocumento7 páginasDistribution BoardmuralichandrasekarAinda não há avaliações

- ULANGAN HARIAN Mapel Bahasa InggrisDocumento14 páginasULANGAN HARIAN Mapel Bahasa Inggrisfatima zahraAinda não há avaliações

- The Piano Lesson Companion Book: Level 1Documento17 páginasThe Piano Lesson Companion Book: Level 1TsogtsaikhanEnerelAinda não há avaliações

- LG Sigma+EscalatorDocumento4 páginasLG Sigma+Escalator강민호Ainda não há avaliações

- Schneider Contactors DatasheetDocumento130 páginasSchneider Contactors DatasheetVishal JainAinda não há avaliações

- Eng21 (Story of Hamguchi Gohei)Documento9 páginasEng21 (Story of Hamguchi Gohei)Alapan NandaAinda não há avaliações

- Timetable - Alton - London Timetable May 2019 PDFDocumento35 páginasTimetable - Alton - London Timetable May 2019 PDFNicholas TuanAinda não há avaliações

- DIFFERENTIATING PERFORMANCE TASK FOR DIVERSE LEARNERS (Script)Documento2 páginasDIFFERENTIATING PERFORMANCE TASK FOR DIVERSE LEARNERS (Script)Laurice Carmel AgsoyAinda não há avaliações

- Powerwin EngDocumento24 páginasPowerwin Engbillwillis66Ainda não há avaliações

- CoSiO2 For Fischer-Tropsch Synthesis Comparison...Documento5 páginasCoSiO2 For Fischer-Tropsch Synthesis Comparison...Genesis CalderónAinda não há avaliações

- Bushcraft Knife AnatomyDocumento2 páginasBushcraft Knife AnatomyCristian BotozisAinda não há avaliações

- Adime 2Documento10 páginasAdime 2api-307103979Ainda não há avaliações

- Formal Letter LPDocumento2 páginasFormal Letter LPLow Eng Han100% (1)

- Bài Tập Từ Loại Ta10Documento52 páginasBài Tập Từ Loại Ta10Trinh TrầnAinda não há avaliações

- Advent Wreath Lesson PlanDocumento2 páginasAdvent Wreath Lesson Planapi-359764398100% (1)

- Acampamento 2010Documento47 páginasAcampamento 2010Salete MendezAinda não há avaliações

- Freshers Jobs 26 Aug 2022Documento15 páginasFreshers Jobs 26 Aug 2022Manoj DhageAinda não há avaliações

- Cad Data Exchange StandardsDocumento16 páginasCad Data Exchange StandardskannanvikneshAinda não há avaliações

- Better Photography - April 2018 PDFDocumento100 páginasBetter Photography - April 2018 PDFPeter100% (1)

- N2 V Operare ManualDocumento370 páginasN2 V Operare Manualramiro0001Ainda não há avaliações

- Centrifuge ThickeningDocumento8 páginasCentrifuge ThickeningenviroashAinda não há avaliações

- Product Specifications Product Specifications: LLPX411F LLPX411F - 00 - V1 V1Documento4 páginasProduct Specifications Product Specifications: LLPX411F LLPX411F - 00 - V1 V1David MooneyAinda não há avaliações

- Practical Cs Xii Mysql 2022-23 FinalDocumento9 páginasPractical Cs Xii Mysql 2022-23 FinalHimanshu GuptaAinda não há avaliações

- Functions: Var S AddDocumento13 páginasFunctions: Var S AddRevati MenghaniAinda não há avaliações

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsAinda não há avaliações

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonNo EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonNota: 5 de 5 estrelas5/5 (9)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantNo EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantNota: 4 de 5 estrelas4/5 (104)

- How To Budget And Manage Your Money In 7 Simple StepsNo EverandHow To Budget And Manage Your Money In 7 Simple StepsNota: 5 de 5 estrelas5/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassAinda não há avaliações

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsAinda não há avaliações

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationNo EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationNota: 4.5 de 5 estrelas4.5/5 (18)

- The Best Team Wins: The New Science of High PerformanceNo EverandThe Best Team Wins: The New Science of High PerformanceNota: 4.5 de 5 estrelas4.5/5 (31)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessNo EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessNota: 4.5 de 5 estrelas4.5/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyNo EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyNota: 5 de 5 estrelas5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherNo EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherNota: 5 de 5 estrelas5/5 (14)

- How to Save Money: 100 Ways to Live a Frugal LifeNo EverandHow to Save Money: 100 Ways to Live a Frugal LifeNota: 5 de 5 estrelas5/5 (1)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.No EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Nota: 5 de 5 estrelas5/5 (89)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)No EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Nota: 3.5 de 5 estrelas3.5/5 (9)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsNo EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsNota: 4 de 5 estrelas4/5 (4)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitAinda não há avaliações

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouNo EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouNota: 4 de 5 estrelas4/5 (2)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestNo EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestNota: 5 de 5 estrelas5/5 (1)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayNo EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayNota: 3.5 de 5 estrelas3.5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesNo EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesNota: 4.5 de 5 estrelas4.5/5 (30)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationNo EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationNota: 4.5 de 5 estrelas4.5/5 (5)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyNo EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyNota: 4 de 5 estrelas4/5 (4)