Escolar Documentos

Profissional Documentos

Cultura Documentos

Sears Vs Walmart - v01

Enviado por

chansjoyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sears Vs Walmart - v01

Enviado por

chansjoyDireitos autorais:

Formatos disponíveis

PROFITABILITY RATIOS a) Rate of Return on Assets Return on Assets (ROA) = Net Income + Interest Expense (net of tax) Avg

Total Assets during period Net Income + Interest Expense (net of tax) Sales Various Income statement items sales Sales Avg Total Assets during period Sales Avg. A/R during period COGS Avg. Inventory during period Sales Avg fixed assets during period

Profit Margin for ROA

Common Size Income Statement

Total Asset Turnover Ratio

Accounts Receivable turnover Ratio =

Inventory Turnover Ratio

Fixed Asset Turnover Ratio

b) Rate of Return on Common Shareholder's Equity Return on Common Equity (ROE) = Net Income - Preferred Dividend Avg Common S.E. during period Profit Margin for ROE = Net Income - Preferred Dividend Sales Average total assets during period Avg Common S.E. during period

Capital Structure Leverage Ratio

c) Earnings per Share of Common Stock EPS of common stock =

Net Income - Prefered Stock Dividends number of common shares outstanding Market Price per Share Earnings per Share

Price-Earnings Ratio

RISK RATIOS (Short-term) a) Liquity Current ratio = Current Assets Current Liabilities Liquid Assets current liabilities

Quick ratio

b) Operating Cash Flow to Current Liabilities

Cash Flow Operations to Current liabilities ratio c) Working Capital Accounts Payable Turnover ratio

Cash flow from operations Average Current Liabilities during period

Purchases Avg A/P during period 365 days Accounts Receivable turnover Ratio 365 days Inventory Turnover Ratio 365 days Accounts Receivable turnover Ratio

Days Accounts receivable outstanding=

Days Inventories Held

Days A/ P outstanding

RISK RATIOS (Long-term) a) Debt Ratios Long-term Debt Ratio

Total Long Term Debt Total Long Term Debt + Shareholders equity Total Liabilities Total Liabilities + Shareholders equity

Debt-Equity Ratio

b) Cash Flow from Operations to total liabilities ratio Cash Flow Operations to = Cash flow from operations Total liabilities ratio Avg Total Liabilities during period b) Interest Coverage Interest Coverage Ratio (TIE)

EBIT interest expense

Net Profit: net income / net sales

Income statements REVENUES Merch. Sales revenues Credit revenues Total revenues COSTS AND EXPENSES COGS expenses Gross Profit (margin) Selling and admin exp Provision for uncollectible accounts EBIT (operating profit) depreciation expense interest expense reaffirmation charge Operating Income other income EBT (before tax) Income taxes Income from Continuing operations Discontinued Operations Net Income

sears In millions ($US), end Dec 31 1995 31,133 3,702 34,835 (23,160) 11,675 (7,428) (589) 3,658 (580) (1,373) 1,705 23 1,728 (703) 1,025 776 1,801 1996 33,751 4,313 38,064 (24,889) 13,175 (8,059) (971) 4,145 (697) (1,365) 2,083 22 2,105 (834) 1,271 1,271 1997 36,371 4,925 41,296 (26,769) 14,527 (8,331) (1,532) 4,664 (786) (1,409) (475) 1,994 106 2,100 (912) 1,188 1,188

Retained Earnings Statements 1995 Retained Earnings Beg. Net Income Dividends preferred Dividends common Retained earnings end Income Statements 1,801 xxxxxx 1996 xxxxxx 1,271 #VALUE! 3,330 1997 3,330 1,188 (360) 4,158

Trend Horizontal Merch. Sales revenues Credit revenues ### Total revenues COSTS AND EXPENSES COGS expenses Gross Profit (margin) Selling and admin exp Provision for uncollectible accounts EBIT (operating profit) depreciation expense interest expense reaffirmation charge Operating Income other income EBT (before tax) Income taxes Income from Continuing operations Discontinued Operations Net Income ### 1995 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1996 1.08 1.17 1.09 1.07 1.13 1.08 1.65 1.13 1.20 0.99 1.22 0.96 1.22 1.19 1.24 0.71 1997 1.17 1.33 1.19 1.16 1.24 1.12 2.60 1.28 1.36 1.03 4.75 1.17 4.61 1.22 1.30 1.16 0.66 TREND

###

TREND Ratio Analysis 1995 tax rate = 1996 39.6% 1997 43.4%

Overall returns ROA (Return on Assets) ROE (Return on Equity) Disaggregation of ROA Profit Margin for ROA (NI / Sales) Total Assets Turnover (Sales / Avg TA) Disaggregation of ROE Proft Margin for ROE (NI / Sales) Total Assets Turnover (Sales / Avg TA) Capital structure leverage (Avg (L + SE) / Avg SE)

1.2% 25.7%

1.0% very low margin, got even sma 22.0% benefited from leverage - ROE

1.3% 0.93

1.1% 0.97

3.8% 0.93 7.31

3.3% decreased slightly 0.97 increased slightly 6.93 decreased leverage

Profitability ratios: Common Size Income statements (% of sales) - Profitability ratios Merch. Sales revenues Credit revenues COGS expenses Gross Profit (margin) Selling and admin exp Provision for uncollectible accounts EBIT (operating profit) depreciation expense interest expense reaffirmation charge Operating Income other income EBT (before tax) Income taxes Income from Continuing operations Discontinued Operations Net Income ### ### 1995 100.0% 11.9% -74.4% 37.5% -23.9% -1.9% 11.7% -1.9% -4.4% 0.0% 5.5% 0.1% 5.6% -2.3% 3.3% 2.5% 5.8% 1996 100.0% 12.8% -73.7% 39.0% -23.9% -2.9% 12.3% -2.1% -4.0% 0.0% 6.2% 0.1% 6.2% -2.5% 3.8% 0.0% 3.8% 1997 100.0% 13.5% -73.6% 39.9% -22.9% -4.2% 12.8% -2.2% -3.9% -1.3% 5.5% 0.3% 5.8% -2.5% 3.3% 0.0% 3.3%

worse better better better worse better worse better up then down up then down up then down worse

Turnover Ratios: Total Assets Turnover (Sales / Avg TA) A/R turnover (Sales / Average A/R) days AR outstanding (365 / AR turnover) Inventory turnover (COGS / Average inventory) days to turn inventory avg. (365 / Inventory turnover) PPE turnover (Sales / Average PPE) Leverage ratios:

0.93 1.54 236.82 5.36 68.13 5.74

0.97 1.60 227.76 getting better 5.53 66.06 getting better 5.92

Solvency ratios: Debt/equity (L/SE) Debt/equity (L / L + SE) Times interest earned (EBIT/Interest expense) Liquidity ratios: Current ratio (CA / CL) Quick (acid-test) ratio ( (Cash + MS + AR) / CL) Cash from Operations / current liabilities

2.66

6.31 0.86 3.04

5.60 0.85 3.31 getting better

1.90 1.51

1.94 getting better 1.51

Trend Common Size Balance Sheets (% of assets) 1995 Cash & equivalents Retained interest ccard receivables Credit card receivables less: uncollectibles Other receivables Inventory(merchandise) prepaid expenses & deferred charges deferred income taxes Total Current Assets Long term Assets Plant and Equipment accum depr. Total Non-Current Assets deferred income taxes other assets Total Assets Current Liabilities Short term borrowings Current portion of LT debt Accounts payable Unearned revenues Other taxes Total current liabilities Long term debt Long term debt & capitalized lease obligations Postretirement benefits Minority interest and other liabilities Total long term Liabilities Total Liabilities Common Shares ($0.75 par) Capital in excess of par Retained Earnings Treasure stock at cost Minimum pension liability 10% 8% 20% 2% 2% 41% 0% 34% 8% 4% 45% 86% 1% 10% 9% -5% -1% 13% increased 7% 17% decreased 2% 1% 41% 0% 34% 7% 4% 44% 85% 1% 9% 11% -4% -1% 1996 2% 6% 56% -2% 1% 13% 1% 2% 79% 0% 28% -12% 16% 3% 3% 100% 1997 1% worse 9% 54% -3% 1% 13% 2% 2% 79% 0% 29% -13% 17% 2% 2% 100%

Deferred ESOP expense Cumulative translation adjustments Total S.E. equity Total Liab + SE equity

-1% 0% 14% 100%

-1% 0% 15% 100%

Balance sheets Assets:

sears In millions ($US), end Dec 31 1995 1996 1997 660 2,260 20,104 (801) 335 4,646 348 895 28,447 10,237 (4,359) 5,878 905 937 36,167 358 3,316 20,956 (1,113) 335 5,044 956 830 30,682 11,324 (4,910) 6,414 666 938 38,700

Current Assets Cash & equivalents 660 Retained interest ccard receivables 2,260 Credit card receivables 20,104 less: allowance uncollectibles (801) Other receivables 335 Inventory(merchandise) 4,646 prepaid expenses & deferred charges 348 deferred income taxes 895 Total Current Assets 28,447 Long term Assets Plant and Equipment 10,237 accucmulated depr. (4,359) Total Non-Current Assets 5,878 deferred income taxes 905 other assets 937 Total Assets 36,167 Equities: Current Liabilities Short term borrowings 3,533 Current portion of LT debt 2,737 Accounts payable 7,225 Unearned revenues 840 Other taxes 615 Total current liabilities 14,950 Long term debt Long term debt & capitalized lease12,170 obligations Postretirement benefits 2,748 Minority interest and other liabilities 1,354 Total long term Liabilities 16,272 Total Liabilities 31,222 Shareholders Equity Common Shares ($0.75 par) 323 Capital in excess of par 3,618 Retained Earnings xxxxxx Treasure stock at cost (1,655) Minimum pension liability (277) Deferred ESOP expense (230) Cumulative translation adjustments (164) Total S.E. equity 4,945 Total Liab + SE equity 36,167 Trend Horizontal

3,533 2,737 7,225 840 615 14,950 12,170 2,748 1,354 16,272 31,222 323 3,618 3,330 (1,655) (277) (230) (164) 4,945 36,167

5,208 2,561 6,637 830 554 15,790 13,071 2,564 1,413 17,048 32,838 323 3,598 4,158 (1,702) (217) (204) (94) 5,862 38,700

Balance sheets 1995 1996 1997 TREND Current Assets Cash & equivalents 1.00 Retained interest ccard receivables 1.00 Credit card receivables 1.00 1.00 Other receivables 1.00 Inventory(merchandise) 1.00 prepaid expenses & deferred charges 1.00 deferred income taxes 1.00 Total Current Assets 1.00 Long term Assets Plant and Equipment 1.00 1.00 Total Non-Current Assets 1.00 deferred income taxes 1.00 other assets 1.00 Total Assets 1.00 Current Liabilities Short term borrowings 1.00 Current portion of LT debt 1.00 Accounts payable 1.00 Unearned revenues 1.00 Other taxes 1.00 Total current liabilities 1.00 Long term debt Long term debt & capitalized lease obligations1.00 Postretirement benefits 1.00 Minority interest and other liabilities 1.00 Total long term Liabilities 1.00 Total Liabilities 1.00 Shareholders Equity Common Shares ($0.75 par) 1.00 Capital in excess of par 1.00 Retained Earnings 1.00 Treasure stock at cost 1.00 Minimum pension liability 1.00 Deferred ESOP expense 1.00 Cumulative translation adjustments 1.00 Total S.E. equity 1.00 Total Liab + SE equity 1.00

0.54 DECREASED 1.47 1.04 1.39 1.00 1.09 2.75 0.93 1.08 1.11 1.13 1.09 0.74 1.00 1.07

1.47 0.94 0.92 0.99 0.90 1.06 1.07 0.93 1.04 1.05 1.05 1.00 0.99 1.25 1.03 0.78 0.89 0.57 1.19 1.07

Level

ery low margin, got even smaller enefited from leverage - ROE = Bigger than ROA = very good

ecreased slightly ncreased slightly ecreased leverage

roe decreased because of decreased profit margin + decreased leverage, but increased because of faster asset t

COGS decreased as % of sales. Should have increased profitiblity

SG&A are down in comparison to sales. This should have increased the profit margin

p then down

p then down

p then down probably would have been up then down, but 2006 skewed by discontinued operations

high high

Accounts receivables turn VERY slowly Inventory turnover is improving, but overall level seems high

danger low

The amount of leverage seems to be excessive. The safe range of 0.40-1.20. The trend, however, is in the right d with 85% of total SE in debt, they seem to be overly leveraged, especially for a retailer this ratio should be over 7. The trend is good, however.

low ok

The safe range for the current ratio is 2:1. In the short term, however, they should be capable of paying their short A safe range would be more than 1.0, and with 1.5, they seem very able to pay for current liabilities

Level

Cash Flow statements 1995 1996 1997

Cash flow from operating activities

cash flow from investing activities

cash flow from financing activities Net Change in Cash

Compared to sales slower FASTER slower FASTER slower slower FASTER slower slower slower slower slower slower slower slower

FASTER slower slower slower slower slower slower slower slower slower slower slower slower FASTER slower slower slower slower FASTER slower

ncreased because of faster asset turnover

The trend, however, is in the right direction

ld be capable of paying their short term debts for current liabilities

Income statements REVENUES Merch. Sales revenues Other income net Total revenues COSTS AND EXPENSES COGS expenses Gross Profit (margin) Selling and admin exp Provision for uncollectible accounts EBIT (operating profit) depreciation expense interest expense reaffirmation charge Operating Income other income EBT (before tax) Income taxes Income from Continuing operations Discontinued Operations Minority Interest & equity in unconsolidated subs Net Income

Walmart In millions ($US), end JAN 31 1996 93,627 1,146 94,773 (74,505) 20,268 (15,021) 5,247 (888) 4,359 4,359 (1,606) 2,753 (13) 2,740 1997 104,859 1,319 106,178 (83,510) 22,668 (16,946) 5,722 (845) 4,877 4,877 (1,794) 3,083 (27) 3,056 1998 117,958 1,341 119,299 (93,438) 25,861 (19,358) 6,503 (784) 5,719 5,719 (2,115) 3,604 (78) 3,526

Retained Earnings Statements 1996 Retained Earnings Beg. Net Income Dividends preferred Dividends common Retained earnings end Income Statements Trend Horizontal Merch. Sales revenues 2,740 xxxxxx 1997 xxxxxx 3,056 #VALUE! 16,768 1998 16,768 3,526 (2,127) 18,167

1996 1.00

1997 1.12

1998 1.26

TREND

Other income net ### Total revenues COSTS AND EXPENSES COGS expenses Gross Profit (margin) Selling and admin exp Provision for uncollectible accounts EBIT (operating profit) depreciation expense interest expense reaffirmation charge Operating Income other income EBT (before tax) Income taxes Income from Continuing operations Discontinued Operations Minority Interest & equity in unconsolidated subs Net Income ### ###

1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

1.15 1.12 1.12 1.12 1.13 1.09 0.95 1.12 1.12 1.12 1.12 2.08 1.12

1.17 1.26 1.25 1.28 1.29 1.24 0.88 1.31 1.31 1.32 1.31 6.00 1.29

###

TREND Ratio Analysis 1996 tax rate = Overall returns ROA (Return on Assets) 1997 36.8% 1998 37.0%

6.4%

7.1% trend is positive

ROE (Return on Equity) Disaggregation of ROA Profit Margin for ROA (NI / Sales) Total Assets Turnover (Sales / Avg TA) Disaggregation of ROE Proft Margin for ROE (NI / Sales) Total Assets Turnover (Sales / Avg TA) Capital structure leverage (Avg (L + SE) / Avg SE)

17.8%

19.8% positive

2.4% 2.65

2.6% 2.78

2.9% 2.65 2.31

3.0% increased 2.78 increased 2.38 increased

Profitability ratios: Common Size Income statements (% of sales) - Profitability ratios Merch. Sales revenues Other income net ### COSTS AND EXPENSES COGS expenses Gross Profit (margin) Selling and admin exp Provision for uncollectible accounts EBIT (operating profit) depreciation expense interest expense reaffirmation charge Operating Income other income EBT (before tax) Income taxes Income from Continuing operations Discontinued Operations Minority Interest & equity in unconsolidated subs Net Income Turnover Ratios: Total Assets Turnover (Sales / Avg TA) A/R turnover (Sales / Average A/R) days AR outstanding (365 / AR turnover) Inventory turnover (COGS / Average inventory) days to turn inventory avg. (365 / Inventory turnover) PPE turnover (Sales / Average PPE) Leverage ratios: Solvency ratios: Debt/equity (L/SE) Debt/equity (L / L + SE) 1996 100.0% 1.2% 1997 100.0% 1.3% 1998 100.0% 1.1%

-79.6% 21.6% -16.0% 5.6% -0.9% 4.7% 4.7% -1.7% 2.9%

-79.6% 21.6% -16.2% 5.5% -0.8% 4.7% 4.7% -1.7% 2.9%

-79.2% 21.9% -16.4% 5.5% -0.7% 4.8% 4.8% -1.8% 3.1%

2.9%

2.9%

3.0%

2.65 124.09 2.94 5.16 70.78 5.72

2.78 129.55 2.82 improved 5.66 64.53 improved 5.93

1.31 0.57

1.45 getting worse 0.59

Times interest earned (EBIT/Interest expense) Liquidity ratios: Current ratio (CA / CL) Quick (acid-test) ratio ( (Cash + MS + AR) / CL) Cash from Operations / current liabilities

5.91

6.77

8.29 getting better

1.64 0.16

1.34 getting worse 0.17

Trend Common Size Balance Sheets (% of assets) 1996 Cash & equivalents Receivables Inventory(at replacement cost) less LIFO reserve Inventories at LIFO cost prepaid expenses & deferred charges Total Current Assets Long term Assets Plant and Equipment Net PPE Property under capital lease: Net Property under cap.lease other assets & deferred charges Total Assets Current Liabilities Accounts payable Accrued Liabilities Accrued Income taxes Long term debt due in 1 year Obligations under capital leases due in 1 year Total current liabilities Long term debt long term debt long term obligations under capital leases deferred income taxes and other Minority interest Total long term Liabilities Total Liabilities Shareholders Equity Common Shares ($0.10 par) Capital in excess of par Retained Earnings Foreign Currency translation adjustment Total S.E. equity Total Liab + SE equity 19% 6% 1% 1% 0% 28% 0% 19% 6% 1% 3% 29% 57% 0% 1% 1% 42% -1% 43% 100% 20% 8% 1% 2% 0% 32% 0% 16% 5% 2% 4% 27% 59% 0% 0% 1% 40% -1% 41% 100% increased increased 5% 3% 100% 5% 5% 100% 46% 7% 47% 7% 1997 2% 2% 41% -1% 40% 1% 45% 0% 59% 1998 3% better 2% 37% less -1% 36% less 1% 43% 0% 60%

increased decreased

decreased

decreased

Balance sheets Assets: Current Assets Cash & equivalents Receivables Inventory(at replacement cost) less LIFO reserve Inventories at LIFO cost prepaid expenses & deferred charges Total Current Assets Long term Assets Plant and Equipment accucmulated depr. Net PPE Property under capital lease: accucmulated depr. Net Property under cap.lease other assets & deferred charges Total Assets

Walmart In millions ($US), end JAN 31 1996 1997 1998 883 845 16,193 883 845 16,193 (296) 15,897 368 17,993 23,182 (4,849) 18,333 2,782 (791) 1,991 1,287 39,604 1,447 976 16,845 (348) 16,497 432 19,352 27,376 (5,907) 21,469 3,040 (903) 2,137 2,426 45,384

368 17,993 23,182 (4,849) 18,333

1,287 39,604

Equities: Current Liabilities Accounts payable 298 Accrued Liabilities 2,413 Accrued Income taxes Long term debt due in 1 year 523 Obligations under capital leases due in 1 year 95 Total current liabilities 10,957 Long term debt long term debt 7,709 long term obligations under capital leases 2,307 deferred income taxes and other 463 Minority interest 1,025 Total long term Liabilities 11,504 Total Liabilities 22,461 Shareholders Equity Common Shares ($0.10 par) 228 Capital in excess of par 547 Retained Earnings xxxxxx Foreign Currency translation adjustment (400) Total S.E. equity 17,143 Total Liab + SE equity 39,604

7,628 2,413 298 523 95 10,957 7,709 2,307 463 1,025 11,504 22,461 228 547 16,768 (400) 17,143 39,604

9,126 3,628 565 1,039 102 14,460 7,191 2,483 809 1,938 12,421 26,881 224 585 18,167 (473) 18,503 45,384

Trend Horizontal Balance sheets 1996 Current Assets 1997 1998

Cash & equivalents Receivables Inventory(at replacement cost) less LIFO reserve Inventories at LIFO cost prepaid expenses & deferred charges Total Current Assets Long term Assets Plant and Equipment Net PPE Property under capital lease: Net Property under cap.lease other assets & deferred charges Total Assets Current Liabilities Accounts payable Accrued Liabilities Accrued Income taxes Long term debt due in 1 year Obligations under capital leases due in 1 year Total current liabilities Long term debt long term debt long term obligations under capital leases deferred income taxes and other Minority interest Total long term Liabilities Total Liabilities Shareholders Equity Common Shares ($0.10 par) Capital in excess of par Retained Earnings Foreign Currency translation adjustment Total S.E. equity Total Liab + SE equity

1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

1.64 1.16 1.04 1.18 1.04 1.17 1.08 1.18 1.22 1.17 1.09 1.14 1.07 1.89 1.15

1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00

1.20 1.50 1.90 1.99 1.07 1.32 0.93 1.08 1.75 1.89 1.08 1.20 0.98 1.07 1.08 1.18 1.08 1.15

Level

level is acceptable

good

COGS decreased as % of sales. Should have increased profitiblity SG&A are up a little comparison to sales.

up slightly

up slightly

low high Inventory turnover is improving, but overall level seems high

danger

slightly above safe range of 0.40-1.20.

ok

this ratio should be over 7. The trend is good, however.

low low

The safe range for the current ratio is 2:1. In the short term, however, they should be capable of paying their short A safe range would be more than 1.0. They need to sell inventory to pay for short term liabilities

Level

Cash Flow statements 1996 1997 1998

Cash flow from operating activities

cash flow from investing activities

cash flow from financing activities Net Change in Cash

TREND

Compared to sales

FASTER slower slower slower slower slower slower slower slower slower slower slower slower FASTER slower

slower FASTER FASTER FASTER slower FASTER slower slower FASTER FASTER slower slower slower slower slower slower slower slower

r, they should be capable of paying their short term debts o pay for short term liabilities

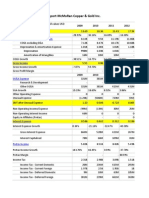

Total revenues Net Income ROA (Return on Assets) ROE (Return on Equity) Disaggregation of ROE Proft Margin for ROE (NI / Sales) Total Assets Turnover (Sales / Avg TA) Capital structure leverage (Avg (L + SE) / Avg SE) Disaggregation of Total Assets Turnover ratio A/R turnover (Sales / Average A/R) days AR outstanding (365 / AR turnover) Inventory turnover (COGS / Average inventory) days to turn inventory avg. (365 / Inventory turnover) PPE turnover (Sales / Average PPE) Disaggregation of Capital Structure leverage ratio Solvency ratios: Debt/equity (L/SE) Debt/equity (L / L + SE) Times interest earned (EBIT/Interest expense) Liquidity ratios: Current ratio (CA / CL) Quick (acid-test) ratio ( (Cash + MS + AR) / CL) Cash from Operations / current liabilities

1997 US$ Millions sears Walmart $41,296 $106,178 $1,188 $3,056 1.04% 6.37% 21.99% 17.83%

3.27% 0.97 6.93

2.91% 2.65 2.31

1.60 227.76 5.53 66.06 5.92

124.09 2.94 5.16 70.78 5.72

5.60 0.85 3.31

1.31 0.57 6.77

1.94 1.51 -

1.64 0.16 -

comments Net income over sales is approximately the same for both companies disconsidering the effect of leverage, Walmart is more profitable Sears is much higher leveraged and is using the financial leverage to increase ROE

Walmart is much more efficient in generating sales out of their assets Sears has much higher % of leverage (more debt vs equity)

Walmart relies much less on credit sales than does Sears, and benefits by receiving cash quicker On average, Sears waits almost 3/4 of a year to receive their cash from sales, but Walmart receives in 3 days approx. the same approx. the same approx. the same

Sears seems to have too much debt (leverage). The safe range of debt equity ratio is normally = 0.40-1.20. Sears has 85% of total SE in debt, they seem to be overly leveraged, Walmart is much "safer" by this measure. Rule of thumb is that TIE should be above 7:1

Sears current ratio is better Walmarts Quick ratio seems too low. They will have to continue to sell inventory to pay for current liabilities

2.57 2.57

Você também pode gostar

- Sears Vs Wal-Mart Case ExhibitsDocumento8 páginasSears Vs Wal-Mart Case ExhibitscharlietoneyAinda não há avaliações

- Tire City 1997 Pro FormaDocumento6 páginasTire City 1997 Pro FormaXRiloXAinda não há avaliações

- Sears Vs WalmartDocumento7 páginasSears Vs Walmarts-693795Ainda não há avaliações

- Sears, Roebuck and Co. vs. Wal-Mart Stores, Inc - Book ReportDocumento2 páginasSears, Roebuck and Co. vs. Wal-Mart Stores, Inc - Book ReportSudindravr Vr100% (1)

- Walmart Vs SearsDocumento4 páginasWalmart Vs SearsChintan Shah100% (1)

- Sears Vs WalmartDocumento4 páginasSears Vs WalmartMohamed Ghalwash100% (1)

- Retailing Strategies Sears Vs WalmartDocumento4 páginasRetailing Strategies Sears Vs WalmartRohan Samria100% (1)

- SearsvswalmartDocumento7 páginasSearsvswalmartXie KeyangAinda não há avaliações

- Sears, Roebuck and Co. Vs Wal-Mart StoresDocumento11 páginasSears, Roebuck and Co. Vs Wal-Mart StoresSanjoy Sarkar100% (1)

- RETAIL STRATEGY SEARS VS WALMARTDocumento8 páginasRETAIL STRATEGY SEARS VS WALMARTAbhishek Maheshwari100% (2)

- SearsDocumento1 páginaSearsMohamed GhalwashAinda não há avaliações

- What Ratios Are Most Important in Assessing Current and Predicting Future Value Creation For SearsDocumento1 páginaWhat Ratios Are Most Important in Assessing Current and Predicting Future Value Creation For SearsMichelle Ang100% (2)

- Financial Ratio Analysis of Sears and WalmartDocumento7 páginasFinancial Ratio Analysis of Sears and WalmartSameer TripathyAinda não há avaliações

- Walmart Vs SearsDocumento4 páginasWalmart Vs SearspeeyushmangalAinda não há avaliações

- Sampa VideoDocumento24 páginasSampa VideodoiAinda não há avaliações

- Dell CaseDocumento3 páginasDell CaseJuan Diego Vasquez BeraunAinda não há avaliações

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocumento5 páginasCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashAinda não há avaliações

- Sears Case ExcelDocumento27 páginasSears Case ExcelMichaelKelleherAinda não há avaliações

- Winfield Refuse Management Inc. Raising Debt vs. EquityDocumento13 páginasWinfield Refuse Management Inc. Raising Debt vs. EquitynmenalopezAinda não há avaliações

- Back of The Envelope Calculation: Ferrari Ipo: Jiri Tresl, PHD Cfa CaiaDocumento32 páginasBack of The Envelope Calculation: Ferrari Ipo: Jiri Tresl, PHD Cfa CaiaNiel LachicaAinda não há avaliações

- Box IPO Financial ModelDocumento42 páginasBox IPO Financial ModelVinAinda não há avaliações

- Ford Moto Company Ratio AnalysisDocumento7 páginasFord Moto Company Ratio AnalysisEmon hassanAinda não há avaliações

- Sneaker Excel Sheet For Risk AnalysisDocumento11 páginasSneaker Excel Sheet For Risk AnalysisSuperGuyAinda não há avaliações

- Discounted Cash Flow Analysis of NvidiaDocumento27 páginasDiscounted Cash Flow Analysis of NvidiaLegends MomentsAinda não há avaliações

- BEA Associates - Enhanced Equity Index FundDocumento17 páginasBEA Associates - Enhanced Equity Index FundKunal MehtaAinda não há avaliações

- Shimano 3Documento14 páginasShimano 3Tigist AlemayehuAinda não há avaliações

- Gemini Electronics: US LCD TV Giant's Growth & Financial AnalysisDocumento1 páginaGemini Electronics: US LCD TV Giant's Growth & Financial AnalysisSreeda PerikamanaAinda não há avaliações

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocumento12 páginasBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneAinda não há avaliações

- Book1Documento6 páginasBook1Bharti SutharAinda não há avaliações

- Sampa Video Financials 2000-2006 Home Delivery ProjectionsDocumento1 páginaSampa Video Financials 2000-2006 Home Delivery ProjectionsOnal RautAinda não há avaliações

- Wells Fargo CaseDocumento58 páginasWells Fargo CaseMeenaAinda não há avaliações

- Case Analysis - Compania de Telefonos de ChileDocumento4 páginasCase Analysis - Compania de Telefonos de ChileSubrata BasakAinda não há avaliações

- Valuation Final ProjectDocumento31 páginasValuation Final ProjectsidchorariaAinda não há avaliações

- Tire City Spreadsheet SolutionDocumento8 páginasTire City Spreadsheet SolutionsuwimolJAinda não há avaliações

- Harley DavidsonDocumento4 páginasHarley DavidsonExpert AnswersAinda não há avaliações

- Diageo PLCDocumento13 páginasDiageo PLCRitika BasuAinda não há avaliações

- Clarkson Lumber - Cash FlowDocumento1 páginaClarkson Lumber - Cash FlowSJAinda não há avaliações

- Sears Case AnalysisDocumento2 páginasSears Case AnalysisAakash Shaw83% (6)

- Tire City Case AnalysisDocumento10 páginasTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Ainda não há avaliações

- NATL Financial ModelDocumento38 páginasNATL Financial ModelKrishna Moorthy0% (1)

- Finance Simulation Valuation ExerciseDocumento7 páginasFinance Simulation Valuation ExerciseAdemola Adeola0% (2)

- Asian Paints - Financial Modeling (With Solutions) - CBADocumento47 páginasAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745Ainda não há avaliações

- Anandam Manufacturing CompanyDocumento9 páginasAnandam Manufacturing CompanyAijaz AslamAinda não há avaliações

- This Study Resource Was: 1 Hill Country Snack Foods CoDocumento9 páginasThis Study Resource Was: 1 Hill Country Snack Foods CoPavithra TamilAinda não há avaliações

- Marriott CaseDocumento3 páginasMarriott Casem_hugesAinda não há avaliações

- DYOD Financial AnalysisDocumento13 páginasDYOD Financial AnalysisSabyasachi Sahu100% (1)

- Marriott Cost of Capital Analysis for Lodging DivisionDocumento3 páginasMarriott Cost of Capital Analysis for Lodging DivisionPabloCaicedoArellanoAinda não há avaliações

- Tata Motors ValuationDocumento38 páginasTata Motors ValuationAkshat JainAinda não há avaliações

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocumento5 páginasIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenAinda não há avaliações

- 3 Statement Model - BlankDocumento6 páginas3 Statement Model - BlankAina MichaelAinda não há avaliações

- Tire City IncDocumento12 páginasTire City Incdownloadsking100% (1)

- Vertical Analysis Financial Statement SampleDocumento13 páginasVertical Analysis Financial Statement SamplemayjoycuteAinda não há avaliações

- Sterling Student ManikDocumento23 páginasSterling Student ManikManik BajajAinda não há avaliações

- Estimating Walmart's Cost of CapitalDocumento11 páginasEstimating Walmart's Cost of CapitalArslan HafeezAinda não há avaliações

- Copia de FCXDocumento16 páginasCopia de FCXWalter Valencia BarrigaAinda não há avaliações

- Rosario Acero S.A - LarryDocumento12 páginasRosario Acero S.A - LarryStevano Rafael RobothAinda não há avaliações

- Fundamental Analysis RatiosDocumento23 páginasFundamental Analysis RatiosThomasNailAinda não há avaliações

- Case AnalysisDocumento29 páginasCase AnalysisLiza NabiAinda não há avaliações

- Tire City Spreadsheet SolutionDocumento6 páginasTire City Spreadsheet Solutionalmasy99100% (1)

- Pricing ApproachesDocumento22 páginasPricing Approachesjoann121887Ainda não há avaliações

- Chapter 14: Long Term LiabilitiesDocumento30 páginasChapter 14: Long Term LiabilitiesMohammed Akhtab Ul HudaAinda não há avaliações

- CZ ChurnopediaGuide 8.5x11 FINALDocumento21 páginasCZ ChurnopediaGuide 8.5x11 FINALRevati TilokaniAinda não há avaliações

- Exercise 2Documento24 páginasExercise 2yu yuAinda não há avaliações

- Business ProposalDocumento6 páginasBusiness ProposalErms Delos Santos BurgosAinda não há avaliações

- TCHE442 Tran Ngoc Anh Thu Factors Impact On Stock PriceDocumento15 páginasTCHE442 Tran Ngoc Anh Thu Factors Impact On Stock Pricenhi xuanAinda não há avaliações

- Assignment: Empowerment and Participative ManagementDocumento9 páginasAssignment: Empowerment and Participative ManagementMohit YadavAinda não há avaliações

- CHP 2 SolDocumento17 páginasCHP 2 SolZakiah Abu KasimAinda não há avaliações

- Trading of GapsDocumento3 páginasTrading of GapsAnonymous 2HXuAeAinda não há avaliações

- Quiz 14 q1Documento4 páginasQuiz 14 q1Максим НовакAinda não há avaliações

- BA500 MarketingDocumento32 páginasBA500 Marketingarshdeep1990Ainda não há avaliações

- Economics Workbook AnswersDocumento20 páginasEconomics Workbook Answerslaukol100% (1)

- Incremental Analysis: Relevant Costs and Decision MakingDocumento43 páginasIncremental Analysis: Relevant Costs and Decision MakingRosario Diaz100% (2)

- Management accounting reports for internal decision makingDocumento2 páginasManagement accounting reports for internal decision makingcara0925100% (1)

- Trading Hub 3.0Documento36 páginasTrading Hub 3.0Báu Lương Văn100% (12)

- Supply Chain Metrics That Matter:: A Focus On The Automotive Industry - 2015Documento31 páginasSupply Chain Metrics That Matter:: A Focus On The Automotive Industry - 2015KeerthiAinda não há avaliações

- Inducement Cycle V2 @ict - Leaked - CoursesDocumento48 páginasInducement Cycle V2 @ict - Leaked - CourseswomekedAinda não há avaliações

- Evolution of Marketing: From Barter to Societal EraDocumento4 páginasEvolution of Marketing: From Barter to Societal Eraamol-gadgikar-1854Ainda não há avaliações

- How Much Money Do You Need to Be a Successful Day TraderDocumento3 páginasHow Much Money Do You Need to Be a Successful Day TraderChukwuebuka Okechukwu (KingNebx)Ainda não há avaliações

- Cambridge International Examinations: Business Studies 7115/22 May/June 2017Documento12 páginasCambridge International Examinations: Business Studies 7115/22 May/June 2017emiyaAinda não há avaliações

- Ford Motor Co.Documento72 páginasFord Motor Co.AlpeshAinda não há avaliações

- Chapter Six: Social Cost Benefit Analysis (Scba)Documento47 páginasChapter Six: Social Cost Benefit Analysis (Scba)yimer100% (1)

- Walmart's Cost of Capital and Investment DecisionsDocumento1 páginaWalmart's Cost of Capital and Investment Decisionskessa thea salvatoreAinda não há avaliações

- Audit Market Concentration and Audit Quality of Listed Industrial Firms in NigeriaDocumento13 páginasAudit Market Concentration and Audit Quality of Listed Industrial Firms in NigeriaResearch ParkAinda não há avaliações

- Bai Tap Chap 7-8Documento3 páginasBai Tap Chap 7-8SonAinda não há avaliações

- Dividend Growth ModelDocumento4 páginasDividend Growth ModelRichardDanielAinda não há avaliações

- Technical Analysis MACDDocumento6 páginasTechnical Analysis MACDSIightlyAinda não há avaliações

- CRM ProjctDocumento81 páginasCRM ProjctHardik Kinhikar100% (2)

- Issuance of Share and DebenturesDocumento5 páginasIssuance of Share and DebentureshamdanAinda não há avaliações

- FMS 5,6Documento19 páginasFMS 5,6Upen DudiAinda não há avaliações