Escolar Documentos

Profissional Documentos

Cultura Documentos

Jerry Hogan Balanced Budget For Rockwall Countty

Enviado por

TEA_Party_RockwallTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Jerry Hogan Balanced Budget For Rockwall Countty

Enviado por

TEA_Party_RockwallDireitos autorais:

Formatos disponíveis

Published on 24 July 2011 at 1311 hours

Just as the debate in Washington intensifies, so does the debate in Rockwall. State statutes require the County Judge to prepare the initial draft of the yearly budget for the County. Once this is done, it then goes to the Commissioners Court where it is examined in detail by each Commissioner and then the Court debates the differences between the budget submitted by the Judge and issues any Commissioner may have with any part of the budget. It takes three votes out of the five votes on the Court to actually pass the final budget. Compare this with the similarities you see in what is happening in Washington with the debate over raising the debt ceiling. There the argument centers on an associated raise in new taxes to pay for the new debt limits, versus the argument on the other side of the political aisle that calls for a reduction in entitlements and no new taxes. It is the classic debate of one side saying don t raise taxes while the other side says don t take away entitlements. We also saw about the same thing in Austin where the legislators were faced with the task of balancing the budget for the State when expenditures far exceeded revenues to support all the programs. In both the State and the National solutions to this classic debate, some groups are not happy with the outcome. But the important point is that a solution is reached that meets the goals of the majority of the citizens. In the case of the issues in Washington, clearly the American people want a change in our economic direction. Rampant piling on of the debt, high unemployment, and an increasing cost of living is counter to what the citizens demand. In the State, we have a Balanced Budget requirement. By law, we cannot develop a budget that spends more than the generated revenue. Unfortunately, just like at the National level, we do not have a balanced budget requirement at the County level. When the initial budget for the County was prepared this year, the starting point was the projected revenue the County would receive over the next twelve months. Eightythree percent of this revenue comes from the property taxes generated throughout the

county. The remainder comes from fees, fines, and grants that may be received. Our property tax revenue forecast comes from the Central Appraisal District office. The other information comes from historical data trends we maintain in the County. Our property tax forecast for 2012 is the same as this year; no growth. Our fees, fines, and grants show a declining amount being collected over the past several years. We are also seeing more evidence that State grants that we received in the past are being stopped as the State struggles with their balanced budget. Our property tax forecast not only shows no growth this coming year, but it also shows no more than one percent growth for each of the following three years. There is no data that shows we will be growing our revenue over the next year even though some insist it will be better than forecast. In my opinion, this is simply wishful thinking not backed up by any hard data. We must prepare our budget based upon the realistic forecasts provided. After the revenue is established, the next step in the preparation of the budget is determining the costs of operating the County. About $5 million is required to pay our debt service. Of the remaining approximately $25 million, 68.5% is used to pay employee salaries and benefits; the largest single category of expense. 73% of our total funds, excluding debt service, are used to pay for mandated judicial services in the county, e.g., Sheriff, Jail, District and Court of Laws, JP s, District Clerk, District Attorney. Other mandated requirements, such as the Tax Assessor and County Clerk offices, leave little room for discretionary spending on other projects or organizations within the County. Discussions are held with each organization in the preparation of the initial budget. From these discussions come the anticipated needs of the county. Totals are then made of requested budgets versus affordable dollars. And, to no one s surprise, unfortunately requested budgets exceed affordable dollars UNLESS you pull funds from the County Reserve Fund to make up the differences and forget about a balanced budget. This is a feasible alternative, however, in my view; it is not a prudent alternative. The Reserve Fund is a fund that has been built up over the past ten or so years when the growth in the County was ranging between 7-15% per year. Our financial policy for the County calls for us to maintain 4-6 months of emergency funds that are available and can be used if needed for unanticipated events, e.g., natural disasters, law judgments, etc. The remainder of the fund can be used for special one-time expenditures, e.g., buying furniture for a new county building. It can also be used any way the Commissioners Court votes, but its intention is not to supplement operating costs of the County. And, since the forecast for revenue does not show appreciable

growth for the next four years, continuing to supplement the operating budget with Reserve funds is simply not prudent or accepted financial practice. The budget prepared for next year and submitted to the Commissioners Court is a balanced budget. To make it a balanced budget, it was necessary to reduce the budget of the library by $250,000 versus going to an outsourcing contractor who committed to operate the library providing all the same services and hours for $300,000 less than our current cost. The Sheriff had asked for nine additional people, but the budget only allowed two additional. We also went to outsourcing for cleaning of all of the County buildings, outsourced the health care for inmates in our jail, and eliminated five building facilities now being used by the County. Each department in the county also reduced their budget from last year. As in the debate in both Washington and Austin, there is considerable lobbying and opposition to this balanced budget. I understand the reason for this, but to me, the basic issue is very simple: do we have a balanced budget with all of its corresponding advantages, or do we continue deficit spending with all of its corresponding disadvantages? What do you think? Please let your Commissioners know your thoughts. It takes three votes to pass a budget and two of them come from the Commissioners. Jerry Jerry Hogan is the Rockwall County Judge. He can be reached at 972-204-6000 or 214-394-4033. His email addresses are jhogan@rockwallcountytexas.com or jerryhogan@sbcglobal.net

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

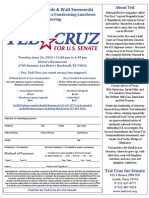

- Cruz in Rockwall June 26 2012Documento1 páginaCruz in Rockwall June 26 2012TEA_Party_RockwallAinda não há avaliações

- Conference Policy News - Regulation Nation 29 Nov 2011Documento2 páginasConference Policy News - Regulation Nation 29 Nov 2011TEA_Party_RockwallAinda não há avaliações

- Legislative Digest - The Middle Class Tax Relief Job Creation Act of 2011 - FinalDocumento7 páginasLegislative Digest - The Middle Class Tax Relief Job Creation Act of 2011 - FinalTEA_Party_RockwallAinda não há avaliações

- County Judge Jerry Hogan-New Courthouse Now in UseDocumento3 páginasCounty Judge Jerry Hogan-New Courthouse Now in UseTEA_Party_RockwallAinda não há avaliações

- Price Statement On The Protect Life ActDocumento1 páginaPrice Statement On The Protect Life ActTEA_Party_RockwallAinda não há avaliações

- Conference Policy News - The Obama AgendaDocumento2 páginasConference Policy News - The Obama AgendaTEA_Party_RockwallAinda não há avaliações

- Kr8: Next MiddleEast WarDocumento25 páginasKr8: Next MiddleEast WarshaulcAinda não há avaliações

- The Reponse USA - 8-6-11 Reliant StadiumDocumento2 páginasThe Reponse USA - 8-6-11 Reliant StadiumTEA_Party_RockwallAinda não há avaliações

- Transformational President Kabuki Dancer 7-25-11Documento3 páginasTransformational President Kabuki Dancer 7-25-11TEA_Party_RockwallAinda não há avaliações

- Profiling Gone Wrong: Changing Tone of Tsa Flyersrights Helps With Eu Claim What Kate'S Saying CorrectionDocumento5 páginasProfiling Gone Wrong: Changing Tone of Tsa Flyersrights Helps With Eu Claim What Kate'S Saying CorrectionTEA_Party_RockwallAinda não há avaliações

- Speaker Straus What Happened To The Will of The HouseDocumento1 páginaSpeaker Straus What Happened To The Will of The HouseTEA_Party_RockwallAinda não há avaliações

- Restoring Courage Viewing Party 9-25-2011Documento1 páginaRestoring Courage Viewing Party 9-25-2011TEA_Party_RockwallAinda não há avaliações

- Rockwall City Council Agenda July 11 2011Documento1 páginaRockwall City Council Agenda July 11 2011TEA_Party_RockwallAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Legal Opinion Letter - CockfigthingDocumento3 páginasLegal Opinion Letter - CockfigthingPring SumAinda não há avaliações

- PublicadministrationinthephilippinesDocumento29 páginasPublicadministrationinthephilippinesGorby ResuelloAinda não há avaliações

- New Student: Enrolment RequirementsDocumento3 páginasNew Student: Enrolment RequirementsAriel Jane LoquiasAinda não há avaliações

- JSW Paints Private LTDDocumento2 páginasJSW Paints Private LTDAshvin Krish RAinda não há avaliações

- Kalinga Government DirectoryDocumento2 páginasKalinga Government DirectoryMark100% (1)

- Tuto Evi W5 Opinion EviDocumento2 páginasTuto Evi W5 Opinion EvisyaAinda não há avaliações

- Richard Cardali, Libellant-Appellant v. A/s Glittre, D/s I/s Garonne, A/s Marina, A/s Standard and International Terminal Operating Company, Respondents-Appellees-Appellants, and Hooper Lumber Company, Respondent-Impleaded-Appellee, 360 F.2d 271, 2d Cir. (1966)Documento6 páginasRichard Cardali, Libellant-Appellant v. A/s Glittre, D/s I/s Garonne, A/s Marina, A/s Standard and International Terminal Operating Company, Respondents-Appellees-Appellants, and Hooper Lumber Company, Respondent-Impleaded-Appellee, 360 F.2d 271, 2d Cir. (1966)Scribd Government DocsAinda não há avaliações

- Memo3 Meva Devi Vs JagannathDocumento11 páginasMemo3 Meva Devi Vs JagannathTaruna ShandilyaAinda não há avaliações

- Mojca Mps Fy 2016-17Documento737 páginasMojca Mps Fy 2016-17Namamm fnfmfdnAinda não há avaliações

- 20 - The US Congress Role and FunctionsDocumento7 páginas20 - The US Congress Role and Functionsasad100% (1)

- Umedsinh Chavda Vs UOIDocumento3 páginasUmedsinh Chavda Vs UOIPramodKumarAinda não há avaliações

- Michigan Senate Bill 0044 (2023)Documento2 páginasMichigan Senate Bill 0044 (2023)WDIV/ClickOnDetroitAinda não há avaliações

- Morocco Embassy Email Address - Google SearchDocumento1 páginaMorocco Embassy Email Address - Google SearchJack MallouliAinda não há avaliações

- CAS 560 Subsequent EventsDocumento11 páginasCAS 560 Subsequent EventszelcomeiaukAinda não há avaliações

- School District of Palm Beach CountyDocumento86 páginasSchool District of Palm Beach CountyGary DetmanAinda não há avaliações

- Valeroso V PeopleDocumento1 páginaValeroso V PeopleKarminnCherylYangotAinda não há avaliações

- ILO ConstitutionDocumento21 páginasILO ConstitutionLester LeeAinda não há avaliações

- Common-Law Marriage Live-In Relationships in The Philippines Philippine E-Legal ForumDocumento11 páginasCommon-Law Marriage Live-In Relationships in The Philippines Philippine E-Legal ForumDelos Santos JojoAinda não há avaliações

- Water Way ComplaintDocumento32 páginasWater Way ComplaintToast da MostAinda não há avaliações

- MIRANDA or Custodial InvestigationDocumento2 páginasMIRANDA or Custodial InvestigationThiird JagolinoAinda não há avaliações

- 20-Enrico Santos v. NSO G.R. No. 171129 April 6, 2011Documento7 páginas20-Enrico Santos v. NSO G.R. No. 171129 April 6, 2011Jopan SJAinda não há avaliações

- Medical Profession and Consumer Law: 4.1.1 Prior To The Operation of Consumer Protection ActDocumento32 páginasMedical Profession and Consumer Law: 4.1.1 Prior To The Operation of Consumer Protection ActSoumiki GhoshAinda não há avaliações

- Definitio of OfficeDocumento9 páginasDefinitio of OfficeadlesdAinda não há avaliações

- Power of BoardDocumento14 páginasPower of BoardShivam saketAinda não há avaliações

- Legal Forms - Case DoctrinesDocumento20 páginasLegal Forms - Case DoctrinesJosh PabustanAinda não há avaliações

- SAN Prop B Enforcement Lawsuit CombinedDocumento16 páginasSAN Prop B Enforcement Lawsuit CombinedThe TexanAinda não há avaliações

- Workmen Compensation Act, 1923Documento23 páginasWorkmen Compensation Act, 1923Harnam kaurAinda não há avaliações

- G.R. No. 158239 January 25, 2012 PRISCILLA ALMA JOSE, Petitioner, RAMON C. JAVELLANA, ET AL., Respondents. Bersamin, J.Documento2 páginasG.R. No. 158239 January 25, 2012 PRISCILLA ALMA JOSE, Petitioner, RAMON C. JAVELLANA, ET AL., Respondents. Bersamin, J.Tetris BattleAinda não há avaliações

- Personal Accident Insurance Reply Form pMzYOhRAje PDFDocumento3 páginasPersonal Accident Insurance Reply Form pMzYOhRAje PDFDoren John BernasolAinda não há avaliações

- Hill v. Harvey, Et Al.Documento19 páginasHill v. Harvey, Et Al.D Brown100% (1)