Escolar Documentos

Profissional Documentos

Cultura Documentos

Company Updates

Enviado por

Amit KumarDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Company Updates

Enviado por

Amit KumarDireitos autorais:

Formatos disponíveis

04 May 2011 Update | Sector: Information Technology

Infosys Technologies

BSE SENSEX S&P CNX

18,535

5,565

CMP: Rs2,911

TP: Rs3,400

Buy

Infosys 3.0 - Positioning for the future

Leadership changes to help bring focus back to external environment

With the launch of 'Infosys 3.0', Infosys aims to become more relevant to customers - in helping them build tomorrow's enterprise. Along with the changes in leadership, the company has recast its verticals into four industry groups, and added one vertical; the service lines have been regrouped into three categories. We believe the change is a step in the right direction, as Infosys continues to think ahead of competition, positioning itself to take advantage of trends that may shape the industry in the future.

Bloomberg Equity Shares (m) 52-Week Range (Rs) 1,6,12 Rel. Perf. (%) M.Cap. (Rs b) M.Cap. (US$ b)

INFO IN 571.2 3,494/2,485 -5/6/3 1,662.7 37.4

Y/E March 2011E 2012E 2013E Sales (Rs b) 275 333 394 EBITDA (Rs b) 90 103 121 NP (Rs b) 68 80 97 EPS (Rs) 119.4 140.6 169.5 EPS Gr. (%) 11.2 17.7 20.6 BV/Sh. (Rs) 454.1 547.2 669.8 P/E (x) 24.4 20.7 17.2 P/BV (x) 6.4 5.3 4.4 EV/EBITDA (x) 17.0 14.2 11.7 RoE (%) 27.8 28.0 27.8 RoCE (%) 33.1 32.6 31.7

Infosys 3.0 formally launched: Infosys has formally launched 'Infosys 3.0', under which it intends to transform from a technology solutions company to a business solutions company. It intends to make itself more relevant to its clients and proactively help them in 'Building Tomorrow's Enterprise'. Leadership changes announced: Mr KV Kamath, the former CEO and now Non-Executive Chairman of ICICI Bank, has been appointed Chairman of the Board to replace Mr Narayan Murthy. Mr S Gopalkrishnan will be Executive Co-Chairman and Mr SD Shibulal will take over as CEO. The trio will assume their respective responsibilities from 21 August 2011. Mr Murthy will be Chairman Emeritus.

Leadership for Infosys 3.0

Shareholding pattern % (Mar-10)

Others, 20.4 Promoter 16.0 Domestic Inst., 9.0

Narayan Murthy, Chairman Emeritus

S Gopalkrishnan, Co-Chairman

KV Kamath, Chairman

Vertical Heads

SD Shibulal, CEO & MD

Ashok Vemuri BFSI

BG Srinivas Manufacturing

Foreign 54.6

Prasad Thrikutam UB Pravin Rao Energy, Utilities & Telecom Retail, CPG, Life Sciences

Eric Paternoster Public Services & Healthcare

Our view

Stock performance (1 year)

Infosys Sensex - Rebased 3,600 3,250 2,900 2,550 2,200 May-10 Nov-10 Feb-11 May-11 Aug-10

Steps in right direction: We see the formulation of the new strategy and leadership changes as steps in the right direction. Infosys is thinking ahead of the competition in identifying the trends that may shape the industry and is positioning itself to take advantage of these trends early. Focus back on external environment: With the leadership announcements and corporate reorganization behind, all resources can focus on the external environment (clients, delivery, etc.) rather than the internal environment. Leadership changes appropriate: We believe that Mr Kamath will bring an unbiased outsider's perspective, whereas Mr Gopalkrishnan, who knows the company's workings inside out, will be the hands-on person on the Board. Mr Kamath has also headed the succession planning and restructuring activities at ICICI Bank and we believe his experience would come in handy.

Kuldeep Koul (Kuldeep.Koul@MotilalOswal.com); +91 22 3982 5521 / Ashish Chopra (Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Infosys Technologies

Infosys 3.0 - transforming into a business solutions company

The Evolution Infosys 1.0 (1981 - 2001)

Establishing a Global

Leadership changes to help bring focus back to external environment

Delivery Model (GDM)

Helping clients economize

costs by moving technology work to different geographies where talent is abundantantly and cheaply available

Positioning for the future We see Infosys as being far ahead of the curve and competition in terms of positioning for the future. The strategy of having one-third of revenue from each of Transformation and Innovation, and just one-third of revenue from Operations is the right one, even if it may entail some investments and some sacrifice on the margins in the near term. Eventually, if Infosys is successful, its margin profile will be far better than it is currently. Margins on initiatives like Cloud, Analytics, Social Media, Products and IP would be ~50% higher than the margins on traditional IT services. Traditional IT services are fast getting commoditized, with the pricing and margins on Application Development and Maintenance (ADM) being significantly lower today than they were five years ago. Though companies can seek comfort in chasing volumes in commoditized services for now, made possible given the nascence of offshoring within IT services, the eventual winners will be companies that think and act ahead. Infosys is undoubtedly the value leader in the space and we would prefer it that way (instead of necessarily chasing low-end volumes, just for the sake of growth). Margin strategy shift? What shift? We do not agree with the view that Infosys is shifting on its margin strategy. There is no evidence to that as yet. The evidence has to come either from declines in pricing or rampup in lateral workforce; the exact opposite is happening on both counts.

Infosys 2.0 (2001 - 2011)

Creating end to end service

capabilities both up and down the value chain

Become an integral partner

to customers by servicing as many of their requirements as possible

Infosys 3.0 (2011 onwards)

Become a strategic partner

for clients

Innovation layer added on

top of operations/ transformation

Engage in innovation

co-creation with clients

Establishing New models of

Infosys saw 0.5% increase in constant currency pricing in 3QFY11 and 2.1% increase in 4QFY11, with a large part in each of the quarters being driven by standalone liketo-like price increases and not business mix. Even on new contracts, Infosys is able to get pricing increases of 5-10%. On lateral additions, the management expects freshers to constitute a higher proportion of employee additions in FY12 (~80% of gross adds in FY12). We believe this should settle the debate on any changes being made to the margin strategy. The management has clearly stated that it will continue to focus on achieving industry leading margins with above average industry growth.

Laterals to revert near historical average in FY12

Gross Lateral Additions (LHS) 2.5 2.1 0.5 Laterals as a % of Total adds (RHS) 25.9 25.7 17.7 4,895 15,883 20.5 20.0 36.8

Engagement.

Despite muted commentary on pricing, productivity increased for the 3rd consecutive quarter

Productivity improvement - QoQ (%) 1.4 0.2

(1.8) 2QFY09 3QFY09

(2.1) 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11

5,796

(0.9) (1.1)

(0.7) (0.6)

8,023

8,523

Source: Company/MOSL 4 May 2011

FY12E

FY07

FY08

FY09

FY10

FY11

Infosys Technologies

Mr KV Kamath appointed Chairman, Mr S Gopalkrishnan, Executive Co-Chairman, and Mr SD Shibulal, CEO & MD

Leadership/organizational changes - in line with expectations As was widely expected, Mr KV Kamath has been appointed Chairman of the Board, with Mr S Gopalkrishnan relinquishing the role of CEO to become Executive Co-Chairman. Mr SD Shibulal, the current COO, has been named as the CEO and Managing Director. The trio will assume their new responsibilities from 21 August 2011. Mr Narayan Murthy will be the Chairman Emeritus. We see the leadership changes as appropriate. Mr Kamath will bring an unbiased outsider's perspective to the organization, whereas Mr Gopalkrishnan, who knows the workings of the company inside out, will be the hands-on person on the Board, having additional responsibility of driving C-suite relationships with key clients. Mr Kamath has also headed the succession planning and restructuring activities at ICICI Bank and we believe his experience would come in handy as Infosys makes way for the next wave of predominantly non-founder leadership. We believe that though it is painful when people of the stature of Mr TV Mohandas Pai (and some others) leave, an organization like Infosys, with a 3-tiered leadership structure with leaders groomed over years, should be able to take such one-off surprises in its stride. The issue is when the exits are systemic as in the case of Wipro, where 40+ mid and senior level management personnel left post the appointment of the new CEO and organizational restructuring, including Mr Mark Fleming, who had just been roped last year from Accenture to drive the Telecom practice.

Mr Kamath will bring an unbiased outsider's perspective, while Mr Gopalkrishnan will be the hands-on person on the Board

Though some portfolios may have changed, the core leadership has remained the same at Infosys, which we believe will help ensure lower management defections

The subtle difference between restructuring at Infosys and Wipro is that, at Wipro, the simplification of the structure meant that responsibilities were taken away from a number of people and consolidated just with vertical heads (e.g., P&L responsibilities taken away from service lines, geographies, etc.). At Infosys, though some portfolios may have changed, the core leadership has remained the same (e.g., though Mr Subhash Dhar no longer heads the Telecom vertical, he would be heading the all-important Innovation Initiatives). This should help ensure lower management defections at Infosys. Reorganization is an ongoing process and it is but natural that the old order makes way for the new especially as the business landscape is changing, with technologies like Cloud , for example, presenting both opportunities and threats for the industry. Infosys has had a risk-averse culture that needed to change to address the shifting landscape. We believe the current structure just does that through more delegation to business heads.

4 May 2011

Infosys Technologies

Infosys will be structuring service lines into three categories, with the goal to achieve 1/3rd of overall revenue from each of these

Mechanics of Infosys 3.0 The key elements of Infosys 3.0 are: Structuring service lines into three key categories Under Infosys 3.0, the company will be structuring service lines into three categories: 1. Transformation (will include 'change the business' initiatives like Package Implementation, Consulting, etc.) 2. Innovation (will include products, IP, Cloud, non-linear initiatives, etc.) 3. Business Operations (will include 'run the business' kind of initiatives like ADM, testing, IMS, BPO, etc.) The goal is to have each of these contributing around 1/3rd of revenue in the next 5-7 years (from the current contribution of ~25% from Transformation, ~12% from Innovation, and ~63% from Operations). This will require the company to make more investments upfront, especially on the Innovation side (to be headed by Mr Subhash Dhar) but we believe the magnitude will be manageable within the overall cost structure (impact on margins unlikely to be higher than 50bp per year).

Infosys is not averse to taking the inorganic route to grow the Innovation side of the business

Infosys is not averse to taking the inorganic route to grow the Innovation side of the business, though it has effectively ruled out making any acquisitions in the commoditized business operations space. It could even look at co-creating an intellectual property (IP) with a client, wherein it later can have the flexibility to use that IP elsewhere as well. Potential targets might be companies that provide access to product, platforms, smaller verticals (we believe Healthcare) and/or new geographies (we believe Germany or Japan).

Structuring service lines into three categories, with the goal of attaining 1/3rd contribution from each in the next 5-7 years (%)

Service Lines - Existing Structure

New Service Lines Structure Existing Share Innovation 12% New Service Lines Structure Targeted Share Innovation 33% Business Operations 34%

23.0 16.0 6.3 Development Maintainence Infrastructure Management 5.4

25.5 7.5 Consulting + Package Testing 2.4 Engg Services 5.6 Business process 3.4 Others 4.9 Products

System Integration

Transformation 25%

Business Operations 63%

Transformation 33%

Source: Company/MOSL

4 May 2011

Infosys Technologies

The new vertical, Public Services and Healthcare, will focus on garnering share of government contracts

Consolidation of existing verticals and creation of a new one The second major change is the consolidation of verticals into four key verticals and the creation of one additional vertical. The verticals would be: 1. BFSI - to be headed by Mr Ashok Vemuri 2. Manufacturing - to be headed by Mr BG Srinivas 3. Energy, Utilities and Telecom - to be headed by Mr Prasad Thrikutam 4. Retail, CPG, Logistics and Life Sciences - to be headed by Mr UB Pravin Rao 5. Public Services and Healthcare - to be headed by Mr Eric Paternoster The new vertical, Public Services and Healthcare, will focus on garnering share of government contracts, where Indian vendors are largely non-existent. Public services is a big opportunity, with government spends at various levels constituting nearly 20% of aggregate spends on outsourcing.

Identification of seven pervasive business trends as key focus areas The company has identified seven trends or themes, which are expected to have a pervasive impact on tomorrow's business models. These are: (1) Digital Consumer, (2) Healthcare Economy, (3) New Commerce, (4) Sustainable Tomorrow, (5) Pervasive Computing, (6) Smarter Organizations, and (7) Emerging Economies. The vertical heads will have the independence to choose which of these trends are most relevant to them and focus just on those. Some of the examples of what Infosys is already doing around some of these themes are: (1) Flypp - a mobile applications platform for telecom service providers and handset vendors (Digital Consumer), (2) iTransform - a comprehensive platform for the healthcare vertical to address HIPAA and ICD-10 regulations (Healthcare Economy). Valuation and view Infosys is our top pick within the IT sector. We expect the company to post US$ revenue CAGR of 21.8% over FY11-13 and an EPS CAGR of 19.1% during the same period. The stock trades at 20.8x FY12E and 17.2x FY13E earnings. Maintain Buy, with a price target of Rs3,400 (20x FY13E EPS) - an upside of 16.3%.

Maintain Buy, with a price target of Rs3,400

4 May 2011

Infosys Technologies

Financials and Valuation

Income Statement

Y/E March Sales Change (%) 2009 30.0 2010 4.8 2011E 20.9

(Rs Million)

2012E 21.2 2013E 18.3 216,930 227,420 275,010 333,234 394,154

Ratios

Y/E March Basic (Rs) EPS Cash EPS Book Value DPS Payout % (excl.div.tax) Valuation (x) P/E Cash P/E EV/EBITDA EV/Sales Price/Book Value Dividend Yield (%) Profitability Ratios (%) RoE RoCE Turnover Ratios Debtors (Days) Fixed Asset Turnover (x) 2009 102.5 116.1 319.1 23.5 22.9 2010 107.4 123.1 403.0 25.1 23.3 2011E 119.4 134.2 454.1 60.3 50.5 2012E 140.6 156.9 547.2 40.0 28.4 2013E 169.5 187.7 669.8 40.0 23.6

Software Develop. Exp.117,650 120,710 150,620 186,666 222,767 Selling and Mktg. Exp. Administration Exp. EBITDA % of Net Sales Depreciation Interest Other Income PBT Tax Rate (%) Adjusted PAT Extraordinary Items Reported PAT Change (%) 11,040 11,840 15,320 20,085 22,861 27,591

16,290 16,260 19,510 23,648

71,950 78,610 89,560 102,834 120,936 33.2 7,610 0 4,730 34.6 9,050 0 9,430 32.6 8,540 0 30.9 9,432 0 30.7 10,514 0 19,580 28.4 25.1 21.8 7.2 9.1 0.8 27.1 23.7 19.4 6.7 7.2 0.9 24.4 21.8 17.0 5.5 6.4 2.1 20.7 18.5 14.2 4.4 5.3 1.4 17.2 15.6 11.7 3.6 4.4 1.4

12,110 15,154

69,070 78,990 93,130 108,556 130,002 10,270 17,650 24,900 28,225 14.9 22.3 26.7 26.0 33,150 25.5 96,851 0 96,851 20.6

58,800 61,340 68,230 80,332 -1,080 -1,320 0 0

36.7 40.2

29.7 33.7

27.8 33.1

28.0 32.6

27.8 31.7

59,880 62,660 68,230 80,332 28.5 4.6 8.9 17.7

Balance Sheet

Y/E March Share Capital Reserves Net Worth Capital Employed 2009 2,860 2010 2,860 2011E 2,860

(Rs Million)

2012E 2,860 2013E 2,860

74 5.5

70 4.9

62 5.6

74 6.4

74 7.3

179,680 227,630 256,900 310,165 380,286 182,540 230,490 259,760 313,025 383,146 182,540 230,490 259,760 313,025 383,146

Cash Flow Statement

(Rs Million)

Y/E March 2009 2010 2011E 2012E 2013E CF from Operations 67,420 70,880 75,560 89,824 107,365 Cash for Working Capital-12,020 -1,470 -14,300 -446 -13,761 Net Operating CF 55,400 69,410 61,260 89,378 93,604 Net Purchase of FA -13,380 -9,060 -12,590 -12,070 -12,800 Net Purchase of Invest. 720 -37,030 35,680 -9,340 0 Net Cash from Invest.-12,660 -46,090 23,090 -21,410 -12,800 Proceeds from Equity 440 2,014 1,170 -337 0 Dividend Payments -15,730 -16,724 -40,130 -26,730 -26,730 Cash Flow from Fin. -15,290 -14,710 -38,960 -27,067 -26,730 Net Cash Flow Opening Cash Bal. Add: Net Cash Closing Cash Bal. 27,450 8,610 45,390 40,901 54,074

Gross Block Less : Depreciation Net Block CWIP Investments

70,930 78,390 85,010 102,160 114,960 24,160 28,930 32,660 46,272 46,770 49,460 52,350 55,888 6,770 4,090 5,250 4,350 56,786 58,174 4,350 10,780

0 37,120

1,440 10,780

Curr. Assets Debtors Cash & Bank Balance Loans & Advances Other Current Assets

167,720 184,370 253,890 300,114 374,952 44,220 43,350 46,530 67,550 79,899

96,950 105,560 150,950 191,851 245,925 25,290 33,460 53,200 37,563 1,260 2,000 3,210 3,150 45,978 3,150

69,500 96,950 105,560 150,950 191,851 27,450 8,610 45,390 40,901 54,074 96,950 105,560 150,950 191,851 245,925

Current Liab. & Prov 38,720 44,550 53,170 58,107 Current Liabilities Provisions 20,040 23,430 26,770 33,155 18,680 21,120 26,400 24,952

65,110 39,316 25,794

Net Current Assets 129,000 139,820 200,720 242,007 309,842

Application of Funds182,540 230,490 259,760 313,025 383,146 E: MOSL Estimates

4 May 2011

Infosys Technologies

N O T E S

4 May 2011

Infosys Technologies

For more copies or other information, contact Institutional: Navin Agarwal. Retail: Manish Shah Phone: (91-22) 39825500 Fax: (91-22) 22885038. E-mail: reports@motilaloswal.com

Motilal Oswal Securities Ltd, 3rd Floor, Hoechst House, Nariman Point, Mumbai 400 021

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon such. MOSt or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MOSt and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Group/Directors ownership of the stock 3. Broking relationship with company covered 4. Investment Banking relationship with company covered Infosys Technologies No No No No

This information is subject to change without any prior notice. MOSt reserves the right to make modifications and alternations to this statement as may be required from time to time. Nevertheless, MOSt is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

4 May 2011

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Trading Wti and Brent 101Documento7 páginasTrading Wti and Brent 101venkateswarant0% (1)

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDocumento8 páginasTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotAinda não há avaliações

- Xerox Case StudyDocumento19 páginasXerox Case StudyPrachi Jain100% (2)

- Godrej Case StudyDocumento2 páginasGodrej Case StudyMeghana PottabathiniAinda não há avaliações

- An International Business PlanDocumento2 páginasAn International Business Planishwar_chheda75% (4)

- Cim SyllabuDocumento3 páginasCim SyllabuAmit KumarAinda não há avaliações

- PronounDocumento2 páginasPronounAmit KumarAinda não há avaliações

- Mark DeviationDocumento10 páginasMark DeviationAmit KumarAinda não há avaliações

- Political Quiz QuestionsDocumento5 páginasPolitical Quiz QuestionsAmit KumarAinda não há avaliações

- 36 Balance SheetDocumento4 páginas36 Balance Sheetaknirmal1Ainda não há avaliações

- Decision MakingDocumento4 páginasDecision MakingAmit KumarAinda não há avaliações

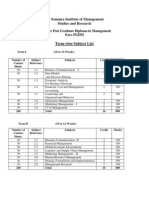

- List of Subjects Exec PGDM11Documento3 páginasList of Subjects Exec PGDM11Amit KumarAinda não há avaliações

- Carpe DiemDocumento1 páginaCarpe DiemAmit KumarAinda não há avaliações

- Theresa Martin v. Shaw's Supermarkets, Inc., 105 F.3d 40, 1st Cir. (1997)Documento8 páginasTheresa Martin v. Shaw's Supermarkets, Inc., 105 F.3d 40, 1st Cir. (1997)Scribd Government DocsAinda não há avaliações

- Engineering Economics & Project ManagementDocumento88 páginasEngineering Economics & Project ManagementabdiqanibareAinda não há avaliações

- Human Resource Department: Subject: General PolicyDocumento19 páginasHuman Resource Department: Subject: General PolicyAhmad HassanAinda não há avaliações

- Philippine Government Electronic Procurement System GuideDocumento11 páginasPhilippine Government Electronic Procurement System GuideDustin FormalejoAinda não há avaliações

- Tax Invoice SummaryDocumento1 páginaTax Invoice SummaryAkshay PatilAinda não há avaliações

- Us Lisega Catalog 2020 PDFDocumento289 páginasUs Lisega Catalog 2020 PDFozkanhasan100% (1)

- LTL Panel Track Shipment DetailsDocumento3 páginasLTL Panel Track Shipment DetailsAlok Kumar BiswalAinda não há avaliações

- Taxation Management AssignmentDocumento12 páginasTaxation Management AssignmentJaspreetBajajAinda não há avaliações

- Measuring The Efficiency of Decision Making Units: CharnesDocumento16 páginasMeasuring The Efficiency of Decision Making Units: CharnesnnleAinda não há avaliações

- Eleanor Shaw CVDocumento1 páginaEleanor Shaw CVEllie JeanAinda não há avaliações

- Business Practices of CommunitiesDocumento11 páginasBusiness Practices of CommunitiesKanishk VermaAinda não há avaliações

- The Accounting ReviewDocumento34 páginasThe Accounting ReviewShahibuddin JuddahAinda não há avaliações

- New TeDocumento9 páginasNew Tephillip19wa88Ainda não há avaliações

- Catalog Labu ScaffoldDocumento4 páginasCatalog Labu ScaffoldLabu ScaffoldAinda não há avaliações

- Leadership: Chapter 12, Stephen P. Robbins, Mary Coulter, and Nancy Langton, Management, Eighth Canadian EditionDocumento58 páginasLeadership: Chapter 12, Stephen P. Robbins, Mary Coulter, and Nancy Langton, Management, Eighth Canadian EditionNazish Afzal Sohail BhuttaAinda não há avaliações

- ImagePRESS C850 C750 Brochure MDocumento12 páginasImagePRESS C850 C750 Brochure MSanjay ArmarkarAinda não há avaliações

- Powell 3543Documento355 páginasPowell 3543Ricardo CaffeAinda não há avaliações

- Types of TaxesDocumento6 páginasTypes of TaxesRohan DangeAinda não há avaliações

- ARIA Telecom Company - DialerDocumento9 páginasARIA Telecom Company - DialerAnkit MittalAinda não há avaliações

- 70 Important Math Concepts Explained Simply and ClearlyDocumento41 páginas70 Important Math Concepts Explained Simply and ClearlyDhiman NathAinda não há avaliações

- ME - Assignment 2 - Shivakumar SRDocumento2 páginasME - Assignment 2 - Shivakumar SRNagendra PattiAinda não há avaliações

- Brittany Resume Alston FinalDocumento2 páginasBrittany Resume Alston Finalapi-350414146Ainda não há avaliações

- International Monetary SystemsDocumento27 páginasInternational Monetary SystemsArun ChhikaraAinda não há avaliações

- P - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaDocumento8 páginasP - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaNurul SyafitriiAinda não há avaliações

- Designorate Business Model Canvas1qDocumento1 páginaDesignorate Business Model Canvas1qMunkhsoyol GanbatAinda não há avaliações