Escolar Documentos

Profissional Documentos

Cultura Documentos

Insurance Industry Current Trends and Directions

Enviado por

Cheong Yook HarDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Insurance Industry Current Trends and Directions

Enviado por

Cheong Yook HarDireitos autorais:

Formatos disponíveis

Insurance Industry Current Trends and Directions

SLIDE01

Today we're going to look at the key insurance trends and directions for 2010, and talk a little bit about trends in the marketplace and how those impact insurance imperatives and insurance spend in the coming year. SLIDE2 IBM leadership in the global industry is intended to convey to customers that we are experts not just in technology but in business issues as well. And we use this as a credentialization point with customers to remind them we don't just build mainframes. But In fact, our largest portion of our business is providing services to customers. So we talk about individuals that were are working in the industry today. We mention GBS. We mention outsourcing and we also mention some key thought leadership that we have developed as an industry team. And the words are pretty small to read here on the slides, but these are some of the studies we've done over the last couple of years looking at the insurance industry and looking really at business issues. They talk about things like how do insurers create value? How do insurers create substantial performance? Which insurers are doing what in terms of insurance distribution? It's a fairly detailed set of business studies. And we can talk to insurers about any of those issues. SLIDE03 Moving on to the agenda, we're going to talk briefly about sort of the industry overall trends and what we're seeing in the insurance market space in 2010, and then talk about what implications does that have for insurance companies. What strategies are they trying to execute against -- in that marketplace? And in turn what does that imply? What do insurers actually need to do in 2010 to build competitive capability? SLIDE04 What's going on in the insurance industry right now? First off, the financial crisis to a certain extent is old news. Now, insurers actually got hit harder than banking, which got all the press I think during the financial crisis. But in effect banks were bailed out by governmental entities and insurers generally were not, with the obvious exception of AIG. So the insurance industry had a little bit more of a trough in 2009, in terms of IT spend in general, revenue. We think their IT drop has been dropped about 5% in 2009, but things appear to be easing up and insurers are once again starting to think about not just cutting costs, not just outsourcing, not just taking out capital requirements, but they're starting to cautiously move forward with top line expansion projects. How do we start expanding market share? How do we look at the new markets? How do we improve our analytical capabilities, do a better job of identifying risks and pricing risks? There is still some concern in the life space just about overall investment returns and 1

things, but on the whole the insurance industry looks relatively healthy and the relatively cautious approach to risk in the '90s has paid off in the current financial crisis. They, on the whole, are in decent shape. There is a backdrop of international standards and international regulation that is important to think about as well. Clearly there are going to be changes on the regulatory front that are going to effect insurers around the world. Solvency 2 is one major regulatory initiative you should be aware of. That is a European initiative led to strengthen the capital requirements for insurance companies. Insurers have a whole lot of things to do to get ready for that major piece of regulatory change. We think that there will be similar change led in the United States over the next year or two as comprehensive financial regulatory reform takes place. So what does that imply for insurance companies? Well, at a top level they've got to invest in regulatory compliance. They have to handle enterprise risk more effectively. ERM, Enterprise Risk Management, is going to be hopping. They're still focused on cost reduction and process optimization and they're beyond the short-term, well, we've got to quickly get rid of some employees to shore up our position. We're now into, how do we lock down those benefits for the long term? How do we automate processes? How do we consolidate infrastructure. How do we consolidate vendors? How do we offshore or automate the lower value processes and concentrate our expensive labor pool on the stuff that truly has value? Companies are in market expansion mode because demographic growth is going to happen in emerging markets more than it is going to in US markets and European markets. There clearly is emphasis on how do we expand internationally. Strong emphasis on analytic has become a competitive battleground for insurers these days and a lot of emphasis on pulling together data, pulling insights out of the data, and moving forward with additional data analysis. And taking an analysis, improving the customer situation or improving the risk coverage. And the last is customer experience with the increasing migration of customers into direct channels and sort of to third party channels like bank insurance. It becomes very important for insurers to be able to operate in that sort of multichannel world. And the pool of insurance experts, agents and brokers who insurers have traditionally relied on, that pool is shrinking and getting older. And putting in systems that will serve sort of the next generation of insurers is vitally important for insurance companies. SLIDE05 So, stepping back and looking at the market as a whole, there are really two groups of insurers. There are survivors and thrivers. You know, the thrivers tend to be the bigger players that were global to begin with that are in strong capital positions during the financial crisis. They are really trying to move on offense, improve their business agility, speed up their product introduction capabilities. They are cautiously looking at some mergers or some acquisitions. And they are focused on revenue growth improved distribution channels, new sets of products. Really trying to grow on that one. Most companies are still in this cautious expansion mode. Still thinking about things like risk mitigation. They're still thinking about expense control. They're still thinking about 2

how I automate my operation to make them more efficient. It's important to think about which mind-set is my insurer in because that will drive what projects they're most interested in. SLIDE06 Now looking at broad scale insurance trends, we did a piece of work called the Insurance 2020 Study. That study established four megatrends that were really intended to be long-term trends and not trends that drift around quite a bit. When we talk to customers we do try to frame up, hey, look, this is an insurance industry. That's a long-term industry. And the short-term gyrations of the financial market in the past years and the big picture. Don't change what you need to do as an insurance company to be successful over the next five, ten, 15 years. The nice thing about insurance companies, they think in those kind of time frames. So this sort of discussion does help. I'm going to briefly review 2020 trends for those of you that aren't familiar with them. Active informed consumers, virtualization of the value change, dynamic products and coordinated regulation around the world. And I'll go through each one of those. SLIDE07 So our first trend, active informed consumers, when you think about the consumer base, there clearly are some changes in what older consumers are looking for versus what younger consumers are looking for. The older consumers, many of whom in mature markets are sort of the baby boom generation; they've got a lot of assets and relatively traditional needs. They have fairly complex financial lines. They're looking for agents. They're looking for reputation. They're looking for good advice. But the younger generation has some very different expectations. And as they grow and mature, they're going to take on an increasing portion of the asset pool, so this is an important generation to start thinking about now. They don't care about insurance agents. Agency represents somebody that I have to go to an office and they're open 9 to 5. It's kind of a pain. I don't want to go through that channel. I want to pay my bills at 2 o'clock in the morning on Saturday because, hey, that's when I have time to do it. And you better be online and available to me to handle my insurance needs at that time. They are looking for more collaborative approaches. They're looking at Web 2.0 technologies and wondering why insurance companies aren't there yet. And they really have some very different expectations about how to interface with companies. Those are driven outside the insurance companies. They're driven by companies like Apple and American Airlines and Nike and Reebok. All the consumer retail firms are driving a lot of those expectations. Customers bring those expectations to insurance. The younger segment is going to be increasingly important but there are other ways to segment consumers as well. Many of those ways aren't necessarily traditional to insurance companies. So thinking about how do I segment my customers and their different needs is important for insurers. SLIDE08 Insurers have been forced by financial conditions lately to start thinking more openly 3

about process sourcing and about infrastructure and about IT outsourcing. You think about the way the world works these days. There is no reason I can't source some of my marketing needs activities to experts in another country. There is no reason I can't, you know, use Cloud Computing to handle some of my underwriting analytical needs. There is no reason I can't take advantage of education and low labor costs to move some of my claims handling or claims analysis to a market like India. You look at the auto industry and 20 years ago, you know, autos were made by one company and most of the work was done in house. You look at the industry now, 80 or 90% of the work is done by subcontractors and the auto manufacturers essentially become final assembly and a lot of design and marketing skills. Those are the skills that insurance companies, that sort of virtualization need to start thinking about over the coming years. SLIDE09 The third area is dynamic product. Clearly insurers are going to need to do a better job of meeting the customer's needs with a flexible or configurable set of insurance products. To understand this you need to look at the broader branch of services industry and who insurers are competing against. They're competing against each other but they're also competing against the E trade to the world and the bank channels who are providing alternate financial services that clearly are having some traction with some large segments of the insurance market. So how do we provide products that can customize themselves to meet the insured's financial risk profile? How do we get enough advice in the hands of customers that they can wade their way through all the various product options; to pick the thing that best meets their needs? You know, focus on advice capabilities and the customization of products is going to be important over the coming years. SLIDE10 The fourth area is regulation, and I already touched on this some with Solvency 2, and what is going on in the United States. If you look worldwide, there clearly is a trend there is lots of local regulation. Our industry is highly regulated. It's different from market to market. It creates barriers to entry because the regulations are different from place to place. But those barriers are slowly lowering. And the financial crisis we think may accelerate that a little bit. You are starting to see markets move towards a more unified approach to insurance regulation. And when that happens, insurers are clearly going to be playing on a much broader playing field and a much more open playing field. And the global players are going to be competing everywhere. The access and the alliances of the world and maybe the China lifes and the Panongs (phonetic) of the world will increasingly be looking to be competing in multiple markets as global players. SLIDE11 The reason behind that is covered briefly on our next slide about demographic economic shifts. When you look at the insurance industry, all the big companies live in 4

those red countries there, right? They are large, mature insurance companies in large, mature insurance markets. Those markets are slow growth demographically and in those markets insurances establish itself as a portion of the economy. There aren't a lot of new insurance customers coming out in those markets. You know, where the actions are going to be is in the developing countries where they have both demographic trends going for them and economic trends going for them because those are emerging markets. They built out the manufacturing sector. They're still building out the financial services sector. So there is huge opportunity in places like China, in India and Taiwan and Russia and Brazil in terms of being able to move forward and build entire new insurance markets and customers. There is evidence to support that. If you look at the top 40 insurers over the last couple of years, they have had double the growth rate outside their domestic market than they have experienced in the home market. Clearly some companies are figuring out how to take advantage of this new global marketplace. SLIDE12 So let's talk a little bit about some backdrop, you know, strategic factors that come into play in insurance companies that aren't necessarily market trends or what's going on in the marketplace. SLIDE13 This is a study we've done in-house relative to our last global insurance executive conference. Looking at the notion that there is economy of scale in the insurance industry: Are bigger companies better? We looked at all the financial factors you see here. The gist of the entire study was this: Being bigger isn't better. And in many cases the niche specialist insurance companies out-performed the big guys in terms of policy growth, quality of business, by any of a number of different financial measures. There is strong evidence that there is going to be advantage to insurers in operating in a niche market and being sort of a category killer. SLIDE14 And to expand on that, looking at premium growth and looking at, you know, the quality of business. And no matter which market you look at, the companies that tend to perform the best over a sustained period of time tend to be category killers, tend to be focused on a channel, geography, line of business and demographic market and they go and be number one in that marketplace to the exclusion of everybody else. And, you know, that tends to generate the best return. It's not just us saying that. Have some study material here from Bain that supports that point of view that companies that can grow revenue quickly by focusing in on a market or channel tend to be the strongest performers. And for large companies the implication is pretty simple. You have to run like a bunch of small companies. There are some scale benefits in terms of efficiency of being big, but you have to balance that with the ability to make local market decisions. 5

SLIDE15 And I talked a little bit earlier about the automotive sector. And they've already gone down this path. They've essentially determined which components are the biggest value add for our industry, and we're going to own those. And the rest of them we're going to go find somebody else who can do them more efficiently and we're going to let them do that. SLIDE16 We have used this as sort of an intro to some big picture thoughts that IBM has about technology and our industry. We talked about technology revolutions, whether you look at railways or you look at steel or you look at automobiles or you look at the information age, there is some pretty clear commonality in terms of the business cycle. There is an expansion phase where lots of folks try and do a lot of different things, a lot of innovation, tons of investment money flows in and then there is a shake out. There is a crash. The investors realize not everybody is going to make a profit in this business. They start trying to gravitate to winners and there is sort of -- the bottom sort of falls out financially. But what happens after that is really the interesting part. You start seeing more standardization and you start seeing the benefits of that particular technology change becoming available to the rest of the economy. So, you know, you look at railroads. Before 1847 there wasn't any standardization on the gauge, the width between the rails so trains weren't inoperable. You had to take one local network to another place, change trains, go to your next stop, change trains, go to your next stop. It wasn't very efficient. But after the shake out there was, that shake out forced the standardization of rail gauge on the industry. And all of a sudden it became possible to take a train across the United States and across Europe. So that really opened up the benefits of rail travel as an efficient means of transportation to broad sectors of the economy. And there was a broad economic growth pattern that happened after that time based on that technology innovation. We're in that stage right now in the information revolution. And IBM feels that there are three major components to that sort of implementation phase, deployment phase of technology. SLIDE17 It's the three Is: Instrumentation, interconnectedness and intelligence. Let's talk about instrumentation. We of course have the ability to measure and sense and see the condition of everything. RFID tags, digital cameras, just the sheer amount of digital transistors, digital data processing going on in the world is growing exponentially and it has implications for the insurance industry. 85% of new automobiles will have some kind of on board event data recorder capability by this year. RFID tags are being used today to track insured containers all around the world. We're finding out interesting things about where insured goods go that we didn't 6

necessarily know. Long story, but a very expensive cache of art work that was lost en route from a home in New York to an art show in Miami. You know, it turned out the driver had stopped off to see his mother and had $85 million worth of paintings sitting in a driveway in Kentucky. So, you know, you learn things through this instrumentation that is pretty interesting. That can be extended to the health side as well. You think about home health monitoring and what that might do to the health insurance and life insurance sectors, if they can measure blood pressure on a periodic basis, if they can measure blood sugar count on a periodic basis. SLIDE18 And of course to have access to that instrumentation data, you need to be interconnected. And the Web is an obvious point of interconnection. But there are some points potentially beyond that as well in terms of how money is now connectable across the world. Money is now an electronic item where it used to be a paper item. You know, mobile devices clearly a huge emerging area with implications for the insurance industry. You think about how that interconnection impacts insurance, and you think about things like Ford Motor, who had introduced a program where your teenager gets a different key for your car than you do and the teenagers key restricts the automobile activities in ways that are appropriate for his experience level in driving. So speed might be restricted, seat belt usage might be enforced, radio won't play too loudly so the teenager can't be distracted. It might even be the car won't drive after a certain period at night, enforce some kind of curfew to look out for drunk driving. And, you know, you can find instances today where insurers are providing insurance via mobile phone, via SmartCard and that interconnectedness impacts sort of the risk remediation as well. It's become possible to do surgery remotely. It's become possible to improve some of these risk situations through remote care. SLIDE19 You look at intelligence and obviously the insurance industry has always been a fairly data intensive industry. But the sheer volume of data is overwhelming even insurance companies who typically are pretty strong in this area. You know, the amount of video content. The amount of instrumentation data that is coming into insurance companies is just growing beyond exponential rates. SLIDE20 Insurers understand that. They're trying to improve their business analytics capabilities, business intelligence capabilities. They are starting to get pretty sophisticated in their analysis. We can now predict weather in a two kilometer square block with one day's lead time. That doesn't sound that exciting until you are the insurer who insures the car, but if you insure the car dealership in that area, and you find out that a hail storm has a high probability of striking a car dealership, that has an immediate financial impact on 7

the insurer to be able to take advantage of that sort of knowledge. SLIDE21 So you bring together the three Is and obviously it gives insurers the opportunity to think and act in new ways. You know, we're an industry that is a little resistent to change. So it's good for insurers to kind of step back and maybe for us to shake up the landscape thinking a little bit. We have three main thoughts that kind of fall out of the Smarter Planet thinking for insurers. One is informed interaction. Capturing the data is all well and good. Bringing it together, yes, we need to do that. Yes, we need to do analysis and insurers have lots of actuaries around to do that sort of analysis. But until you take that information and change the customer process or change risk, you haven't really done much. And the whole thought behind informed interaction is you have got to connect up the data coming in where the action is going out, and make sure you actually have a customer impact or risk impact at the end of the day. Streamlined operations is the opportunity to radically rethink insurance sort of internal operations that today are sort of a mess of duplicate systems, of processes that aren't terribly automated that are a source of pain for insurers worldwide. And we have some thoughts about how to fundamentally reorganize those insurance companies to be much more flexible and much more efficient. When we talk about flexibility, that, too, is an important smarter insurance point. Your enterprise needs to build in resiliency and flexibility. You need to be able to adapt to regulatory changes. You need to be able to move into new markets. You need to be able to move into new product sets. Because you know what? Your competitors are going to be able to do that as well. So the flexibility is vitally important for insurers going forward. SLIDE22 NO AUDIO SLIDE23 Those are some strategic thoughts around technology and around smarter insurance. But what does that imply for what insurance companies need to do? There is a 24% point gap between when CEOs tell you they need change and when CEOs tell you they successfully submitted change in the past. So they know change is coming and they are not quite sure how to implement. SLIDE24 Well, IBM's point of view is that there are a specific set of target capabilities that you are going to need to compete today and to prepare for the broader scale changes coming down the pike. So that informed interaction, streamlined operations, that resilient enterprise really, when insurers think about those sorts of thoughts they think about them at a business domain level, right? They think about them in large part as a VP of sales, or as a VP of product, or as a VP -- or as a chief risk officer or as a VP of claims. 8

So we have a point of view that's in each of those areas that says, here is what you need to do as an insurance company to take advantage of these smarter insurance broad scale strategic thoughts. So smarter insurance is really aimed at a C-level conversation It will be interesting to lower levels of the organization but they won't see necessarily how to make that real for them. So we're trying to get to, hey, here is how you make it real in distribution. Here is how you make it real in marketing. Here is how you make it real in product development. SLIDE25 You know, in each of these six sort of business domains that we consider to be important battle grounds for insurers as they try to compete against other companies in their marketplace. You know, and we'll go through each of these in a little bit more detail in upcoming slides. But at a very high level, channel blending. Can you effectively manage your messaging, manage your rates, manage your customer interactions across multiple channels? Product tailoring. Can I roll out new products to the marketplace quickly? Can I build flexibility into my product set? Customer flexibility. Can I understand the customer's needs? Can I do a good job of identifying products and services that meet those needs? And can I adapt as customer needs change? Can I adapt as customer risk change. Can I adapt as the regulations around how we cover those change? And risk mitigation itself is an area of strategic importance for insurers. Can I manage my risks across the enterprise in a way that's transparent to everybody in the enterprise? Do I have a risk metric or metrics and does everybody in the enterprise understand that risk metric or metrics just like they do understand premium and claims today? Do I intelligently step back and plan for long-tail risks? How do I plan for risks where I'm not sure if there is a risk or not? Do cell phones cause cancer? We're not sure, but I need to have some thought on how that question impacts my risk portfolio. Core agility. Big point for a lot of insurance companies today. Their core systems are still a chain around the ankle. And how do we build in flexibility into those systems? How do we build automation into those systems? And underneath all that there is a set of infrastructure capabilities that start with SOA but align very well with our software group frameworks. How do we build an architecture that enables you to build flexibility into these other areas? How do we take advantage of virtualization and how do we take advantage of automated load balancing? How do we consolidate data centers into more efficient structures? How do we leverage Cloud Computing? SLIDE26 9

Now, as a follow-on to smarter insurance, we did a best in class study looking at the best financial performers around in the insurance industry and simply identified who is growing faster than average and who is writing better business on average and providing better return on assets on average. That's a little bit different metrics for life and nonlife because those industries, or those lines are measured differently. We clearly identified a subset of the insurance industry that is demonstrating strong financial performance. Then we went out and talked to those folks and we said, all right, you as a group, profitability at 50% better than average or you are writing business 7 points better than average on a combined ratio? What are you doing? What are you focusing on? What is the secret? They came back with three points: Focus on the customer, optimize my internal processes, and continually leverage new business models, continually innovate. And to give you a little more insight at a functional level as to the differences between the best companies and the rest of the companies, the differences between the thrivers and the survivors, we looked at some specific questions in best in class versus average. SLIDE27 We asked the best in class insurers how much do each of these areas matter to you and how good do you think you are at doing those? We asked the same question of a selection of the rest of the insurers around the world. Some interesting differences emerged. The best companies clearly didn't think that core and infrastructure were that important and they clearly thought that they were much better at it than the average insurance company. The best in class insurers were focused more on how do I distribute better? How do I build flexibility in my products? How do I expand in the new markets? It's interesting that the core insurance and core systems are sort of a very common discussion point in insurance companies. You can ask CEOs around the world what is one of your biggest problems with IT and they'll say my core systems. I have these legacy systems, they're on old technologies, I can't get anybody to maintain them. It takes forever to make a change, blah, blah. But if you talk to the best insurers you don't hear that. The best insurers have already figured that out. They have taken advantage of SOA. They've taken advantage of componentization and they've built that flexibility in already and are focusing on what is going to make them most successful in the marketplace. SLIDE28 NO AUDIO

10

Você também pode gostar

- Barbara Stewart - Insurance Underwriting Cycles - 1980Documento7 páginasBarbara Stewart - Insurance Underwriting Cycles - 1980leaguer450% (2)

- Bain Report-Customer Behavior and Loyalty in Insurance 2018Documento48 páginasBain Report-Customer Behavior and Loyalty in Insurance 2018Nathanael SiagianAinda não há avaliações

- ShawString Quarterly LetterDocumento28 páginasShawString Quarterly LetterTimothyNgAinda não há avaliações

- The INSURTECH Book: The Insurance Technology Handbook for Investors, Entrepreneurs and FinTech VisionariesNo EverandThe INSURTECH Book: The Insurance Technology Handbook for Investors, Entrepreneurs and FinTech VisionariesAinda não há avaliações

- K53 Heavy Motor Vehicles Volume 2 Code C1, C, EC1 EC Part1 PDFDocumento45 páginasK53 Heavy Motor Vehicles Volume 2 Code C1, C, EC1 EC Part1 PDFPearl MphahleleAinda não há avaliações

- Swot - Bancassurance Viet NamDocumento6 páginasSwot - Bancassurance Viet NamAnh Vy NguyễnAinda não há avaliações

- Progressive Final PaperDocumento16 páginasProgressive Final PaperJordyn WebreAinda não há avaliações

- 2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFDocumento136 páginas2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFBayside BlueAinda não há avaliações

- Denso PDFDocumento12 páginasDenso PDFbruttus139Ainda não há avaliações

- 34 Moving Moulds PDFDocumento68 páginas34 Moving Moulds PDFAlexAinda não há avaliações

- Life Essay 2009Documento33 páginasLife Essay 2009reesusriAinda não há avaliações

- Business Intelligence and InsuranceDocumento15 páginasBusiness Intelligence and InsuranceNeelam_Mohanty4214Ainda não há avaliações

- Bii Insurtech 2016Documento19 páginasBii Insurtech 2016Jake Seip100% (1)

- The Role of Data Analytics in Insurance SectorDocumento4 páginasThe Role of Data Analytics in Insurance SectorIIM Indore Management Canvas100% (2)

- Life Insurance 28 SepDocumento11 páginasLife Insurance 28 Sepvivek10491Ainda não há avaliações

- CRM in Insurance SectorDocumento2 páginasCRM in Insurance SectorKaran Singh ParmarAinda não há avaliações

- 800 Assignment MethodologyofresearchDocumento7 páginas800 Assignment Methodologyofresearchrgaherwal098Ainda não há avaliações

- Embedded Insurance-2Documento25 páginasEmbedded Insurance-2Anjani KumarAinda não há avaliações

- Fundamentals of Business: Reference ManualDocumento53 páginasFundamentals of Business: Reference ManualprakruthiAinda não há avaliações

- Report On Customer Relationship ManagementDocumento19 páginasReport On Customer Relationship ManagementjerthAinda não há avaliações

- Speech by Ferguson, B., Head of Department, Strategy & Competition DivisionDocumento5 páginasSpeech by Ferguson, B., Head of Department, Strategy & Competition DivisionRentonAinda não há avaliações

- Insurance 4.0: Benefits and Challenges of Digital TransformationNo EverandInsurance 4.0: Benefits and Challenges of Digital TransformationAinda não há avaliações

- 7 P's of Services MarketingDocumento169 páginas7 P's of Services MarketingZulejha IsmihanAinda não há avaliações

- A Study On The Perception of Investors Investing in Life InsuranceDocumento37 páginasA Study On The Perception of Investors Investing in Life Insuranceanisha jaiswalAinda não há avaliações

- Indian Insurance SectorDocumento18 páginasIndian Insurance SectorSaket KumarAinda não há avaliações

- Thesis On Insurance SectorDocumento4 páginasThesis On Insurance Sectordeborahquintanaalbuquerque100% (2)

- Current LIC ProjDocumento4 páginasCurrent LIC ProjAmit VinerkarAinda não há avaliações

- Valuation Thesis: Target Corp.: Corporate Finance IIDocumento22 páginasValuation Thesis: Target Corp.: Corporate Finance IIagusAinda não há avaliações

- MINOR PROJECT On InsuranceDocumento53 páginasMINOR PROJECT On InsurancedivyaAinda não há avaliações

- Article: A. View As A BBF StudentDocumento10 páginasArticle: A. View As A BBF StudentDonnaFaithCaluraAinda não há avaliações

- CotlerDocumento6 páginasCotlergaurav20587Ainda não há avaliações

- Banking 2020: Transform yourself in the new era of financial servicesNo EverandBanking 2020: Transform yourself in the new era of financial servicesAinda não há avaliações

- Market Research and Customer Satisfaction at Kotak Mahindra Life Insurance Co. LTD by RJ - MarketingDocumento58 páginasMarket Research and Customer Satisfaction at Kotak Mahindra Life Insurance Co. LTD by RJ - MarketingGaurav ChhabraAinda não há avaliações

- POWER RANKING: The 10 Best Industries in 2020 For Entrepreneurs To Start Million-Dollar Businesses Despite The PandemicDocumento6 páginasPOWER RANKING: The 10 Best Industries in 2020 For Entrepreneurs To Start Million-Dollar Businesses Despite The PandemicTung NgoAinda não há avaliações

- Mid Term Test1Documento7 páginasMid Term Test1Trang NguyễnAinda não há avaliações

- Effect of Globalization, Liberalization, Privatization: Has Globalization Helped or Hurt The Insurance Industry?Documento4 páginasEffect of Globalization, Liberalization, Privatization: Has Globalization Helped or Hurt The Insurance Industry?mansi_shah_15Ainda não há avaliações

- Sales and Distribution Management: Group Assignment-IDocumento10 páginasSales and Distribution Management: Group Assignment-IAkash LohiAinda não há avaliações

- Literature Review On Customer Perception On InsuranceDocumento7 páginasLiterature Review On Customer Perception On InsuranceafdtuslbbAinda não há avaliações

- Insurance SellingDocumento74 páginasInsurance SellingRohit Atkale0% (1)

- Deloitte Uk Insurance Trends 2019 PDFDocumento16 páginasDeloitte Uk Insurance Trends 2019 PDFRaghav RawatAinda não há avaliações

- Don't Be Misled by Investment Advertising: InvestorsDocumento4 páginasDon't Be Misled by Investment Advertising: InvestorsZain ParkarAinda não há avaliações

- Key RatiosDocumento5 páginasKey RatiosShreevathsaAinda não há avaliações

- CRM in Public Sector General Insurance CompaniesDocumento6 páginasCRM in Public Sector General Insurance Companiesb_1980b2148Ainda não há avaliações

- India Insurance MarketDocumento4 páginasIndia Insurance MarketparimittalAinda não há avaliações

- Marketing 7 P's of InsuranceDocumento169 páginasMarketing 7 P's of InsuranceVinit Poojary75% (4)

- At Capital OneDocumento36 páginasAt Capital OnesumeetpatnaikAinda não há avaliações

- Oliver Wyman Insurance Insights Edition 15 EnglishDocumento7 páginasOliver Wyman Insurance Insights Edition 15 EnglishChiara CambriaAinda não há avaliações

- Financial Services, Leasing, Merchant Banking, FactoringDocumento21 páginasFinancial Services, Leasing, Merchant Banking, Factoringsrishtipurohit954Ainda não há avaliações

- Covid-19 Effect On BusinessDocumento3 páginasCovid-19 Effect On BusinessOWAISAinda não há avaliações

- Turnaround ManagementDocumento8 páginasTurnaround ManagementaimyAinda não há avaliações

- Groupon Inc Case AnalysisDocumento8 páginasGroupon Inc Case Analysispatrick wafulaAinda não há avaliações

- Strategies For Small Business: Surviving and Thriving in The Era of COVID-19Documento6 páginasStrategies For Small Business: Surviving and Thriving in The Era of COVID-19Ahad SultanAinda não há avaliações

- 1.1) Explain The Various Elements of The Marketing ProcessDocumento14 páginas1.1) Explain The Various Elements of The Marketing ProcessKasim MalikAinda não há avaliações

- Innovation in INsurance SectorDocumento7 páginasInnovation in INsurance SectorNisha NairAinda não há avaliações

- InsurtechDocumento25 páginasInsurtechrahul bhutraAinda não há avaliações

- Insurance Innovation Report 2021Documento12 páginasInsurance Innovation Report 2021Rajiv MalhanAinda não há avaliações

- The Future of The Accounting FirmDocumento6 páginasThe Future of The Accounting Firmomohammed20071477Ainda não há avaliações

- Ravshan Suyunov Final EnterpreneurshipDocumento5 páginasRavshan Suyunov Final EnterpreneurshipzazaAinda não há avaliações

- Intuit-Corp Banking2020 FINALDocumento14 páginasIntuit-Corp Banking2020 FINALSRGVPAinda não há avaliações

- StrengthsDocumento2 páginasStrengthsAkhilesh JainAinda não há avaliações

- MGT415 - Assignment 1 Moksh Pachisia 1004506466 Part 1: Information About The FirmDocumento7 páginasMGT415 - Assignment 1 Moksh Pachisia 1004506466 Part 1: Information About The FirmMokshAinda não há avaliações

- The Broker's Bible: The Way Back to Profit for Today’S Real-Estate CompanyNo EverandThe Broker's Bible: The Way Back to Profit for Today’S Real-Estate CompanyAinda não há avaliações

- Game-Changing Strategies: How to Create New Market Space in Established Industries by Breaking the RulesNo EverandGame-Changing Strategies: How to Create New Market Space in Established Industries by Breaking the RulesNota: 4.5 de 5 estrelas4.5/5 (1)

- Catalog NacDocumento28 páginasCatalog Nacud90117Ainda não há avaliações

- Application of Ramsis in Passenger Aircraft Seat Development at Recaro Aircraft SeatingDocumento25 páginasApplication of Ramsis in Passenger Aircraft Seat Development at Recaro Aircraft SeatingEducation formeAinda não há avaliações

- 13132FA - DBA-NBO-Assignment Brief - 1807Documento8 páginas13132FA - DBA-NBO-Assignment Brief - 1807Iqtidar KhanAinda não há avaliações

- Design Report On ATVDocumento11 páginasDesign Report On ATVInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Basic Equipment Wiring AGY EngineDocumento20 páginasBasic Equipment Wiring AGY EnginemasterbfishAinda não há avaliações

- CB Insights - Electric Car RaceDocumento36 páginasCB Insights - Electric Car RaceShaleenAinda não há avaliações

- Lean Conversion of An Assmbly Line - A Case StudyDocumento115 páginasLean Conversion of An Assmbly Line - A Case Studysharif Russel100% (3)

- Luojia Tricycles CatalogueDocumento10 páginasLuojia Tricycles CatalogueHussien Roushdy MohamedAinda não há avaliações

- Case Study On Maruti Suzuki ConflictDocumento21 páginasCase Study On Maruti Suzuki ConflictAnuj Kumar BajpaiAinda não há avaliações

- FI-0083 Toyota Land Cruiser 79 Series Tub Body External ROPS Rev BDocumento26 páginasFI-0083 Toyota Land Cruiser 79 Series Tub Body External ROPS Rev BUN533N100% (1)

- 2011 Consumer Action HandbookDocumento161 páginas2011 Consumer Action HandbookabfibAinda não há avaliações

- Curriculum Vitae: Sumeet Sourabh Phone-+91 9312068821 EmailDocumento3 páginasCurriculum Vitae: Sumeet Sourabh Phone-+91 9312068821 Emailsumeet sourabhAinda não há avaliações

- Operating Manual: Optimus, Sprint, Euro-Sprint, SprintiDocumento26 páginasOperating Manual: Optimus, Sprint, Euro-Sprint, SprintiCarpen Mircea AdrianAinda não há avaliações

- Sponsorship Proposal: Jaipur Street Karting CupDocumento5 páginasSponsorship Proposal: Jaipur Street Karting CupGaurav sharmaAinda não há avaliações

- Acc Ign1Documento4 páginasAcc Ign1screwyouregAinda não há avaliações

- A Study On Consumer's Perception Towards Honda Activa in Muzaffarpur CityDocumento34 páginasA Study On Consumer's Perception Towards Honda Activa in Muzaffarpur CityabhaybittuAinda não há avaliações

- Electric Car Future Prediction - tcm27-67440Documento10 páginasElectric Car Future Prediction - tcm27-67440quantumflightAinda não há avaliações

- Volkswagen Final ProjectDocumento34 páginasVolkswagen Final ProjectAman Garg50% (2)

- Advanced Accounting Drill ProblemsDocumento6 páginasAdvanced Accounting Drill ProblemsiajycAinda não há avaliações

- Industrial Sickness in India & Case StudyDocumento35 páginasIndustrial Sickness in India & Case StudyNeha Singh100% (4)

- PolicySoftCopy 102426488 PDFDocumento3 páginasPolicySoftCopy 102426488 PDFAnbarasu sAinda não há avaliações

- The Inventors Bible, 3rd Edition, by Ronald Louis Docie, Sr. - ExcerptDocumento18 páginasThe Inventors Bible, 3rd Edition, by Ronald Louis Docie, Sr. - ExcerptCrown Publishing Group83% (6)

- BMW M3 Exhaust SystemDocumento12 páginasBMW M3 Exhaust SystemIvan Evtimov100% (1)

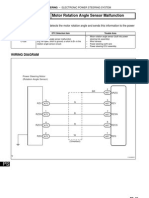

- DTC C1528 Motor Rotation Angle Sensor Malfunction: DescriptionDocumento4 páginasDTC C1528 Motor Rotation Angle Sensor Malfunction: DescriptiondiemnganAinda não há avaliações

- WWW - Carfax.com VehicleHistory P Report - CFX Partner DLR 3 PDFDocumento9 páginasWWW - Carfax.com VehicleHistory P Report - CFX Partner DLR 3 PDFJuan GarciaAinda não há avaliações