Escolar Documentos

Profissional Documentos

Cultura Documentos

Banking Sector January 2011

Enviado por

Sharon ManziniDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Banking Sector January 2011

Enviado por

Sharon ManziniDireitos autorais:

Formatos disponíveis

Total assets and gross loans and advances

3500 3000 2500 2000 1500 1000 500 0 -500 -1000 Jan Feb Mar Apr May Jun Jul 2010 Total assets Growth in total assets (right-hand scale) Aug Sep Oct Nov Dec Jan 2011 R billions Per cent 35 30 25 20 15 10 5 0 -5 -10

Bank Supervision Department

Gross loans and advances Growth in gross loans and advances (right-hand scale)

Capital adequacy

15,50 Per cent

14,25

13,00

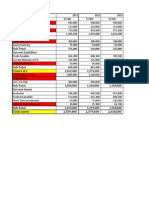

Selected South African banking sector trends

January 2011

11,75

10,50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan 2010 2011 Capital-adequacy ratio Tier 1 capital-adequacy ratio

Impaired advances

R billions 150 125 100 4 75 3 50 25 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan 2010 2011 Impaired advances Impaired advances to gross loans and advances (right-hand scale) 2 1 0 Per cent 7 6 5

Number of banks in South Africa

Registered banks Mutual banks Local branches of foreign banks Foreign banks with approved local representative offices 19 2 13 41

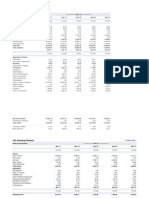

January 2010 2011 % Rbn Rbn Growth1

January 2010 2011 % %

Profitability2

Return on equity Return on assets Cost-to-income ratio Net interest income to interest-earning assets Non-interest revenue to total assets Operating expenses to total assets Profit/Loss (12 months) (Rbn) Net interest income (12 months) (Rbn) Non-interest income (12 months) (Rbn) Operating expenses (12 months) (Rbn)

15,28 0,92 51,84 3,13 2,44 2,54 26,19 74,64 74,14 77,13

14,56 0,97 56,59 3,12 2,61 2,88 29,89 75,83 80,17 88,29

Balance sheet items

Selected assets

Total assets Loans and advances Homeloans Commercial mortgages Credit cards Lease and instalment debtors Overdrafts Term loans Redeemable preference shares Factoring accounts, trade and other bills and BAs Loans granted/deposits placed under resale agreements Bank intra-group balances Other Investment and trading positions Derivative financial instruments Short-term negotiable securities

2 971 2 262 790 218 56 237 105 380 56 8 77 142 193 187 258 163

3 055 2 312 818 227 57 243 105 368 55 9 85 96 249 217 216 168

2,9 2,2 3,6 4,2 1,5 2,8 -0,4 -3,1 -3,1 19,1 9,3 -32,3 28,9 16,3 -16,1 3,0

Liquidity

Liquid assets held to liquid-asset requirement Short-term liabilities to total liabilities Short-term ten largest depositors to total liabilities

146,83 51,93 6,62

170,79 53,23 8,10

Credit risk

Impaired advances (Rbn) Impaired advances to gross loans and advances Specific credit impairments to impaired advances Specific credit impairments to gross loans and advances

3

132,65 5,86 30,14 1,77

134,56 5,82 32,57 1,90

Capital adequacy Selected liabilities

Deposits, current accounts and other creditors Current Savings Call Fixed and notice NCDs Repos Other Derivate financial instruments and other trading liabilities Capital-adequacy ratio Tier 1 capital-adequacy ratio

14,25 11,05

15,14 12,03

2 365 392 118 425 648 435 94 253 266

2 464 431 124 389 715 434 94 277 220

4,2 9,9 5,2 -8,6 10,4 -0,3 0,3 9,8 -17,4

Financial leverage

Financial leverage ratio (times)

4

15,51

14,28

1. Differences may occur due to rounding. 2. All ratios based on income statement information are smoothed i.e. 12 months moving average. 3. Advances in respect of which a specific impairment was raised. 4. Formula: Total liabilities and equity divided by total equity attributable to equity holders. * Please note this information is subject to change without notice

Equity

Total equity

200

223

11,6

Off-balance sheet items

Total off-balance sheet activities 410 848 106,9

Você também pode gostar

- Fitch RatingsDocumento7 páginasFitch RatingsTareqAinda não há avaliações

- RHB CapitalDocumento93 páginasRHB CapitalJames WarrenAinda não há avaliações

- SAMP - 1H2013 Earnings Note - BUY - 27 August 2013Documento4 páginasSAMP - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkAinda não há avaliações

- Ravi 786Documento23 páginasRavi 786Tatiana HarrisAinda não há avaliações

- Balance Sheet - in Rs. Cr.Documento9 páginasBalance Sheet - in Rs. Cr.Ashwin KumarAinda não há avaliações

- Financial Status-Siyaram Silk Mills LTD 2011-12Documento15 páginasFinancial Status-Siyaram Silk Mills LTD 2011-12Roshankumar S PimpalkarAinda não há avaliações

- Balance Sheet of Reliance IndustriesDocumento2 páginasBalance Sheet of Reliance IndustriesPavitra SoniaAinda não há avaliações

- CHAP - 04 - Financial Statements of Bank - For StudentDocumento87 páginasCHAP - 04 - Financial Statements of Bank - For Studentkhanhlmao25252Ainda não há avaliações

- Balance Sheet of LIC Housing Finance - in Rs. Cr.Documento10 páginasBalance Sheet of LIC Housing Finance - in Rs. Cr.Rohit JainAinda não há avaliações

- Samba Statements 11 +12Documento46 páginasSamba Statements 11 +12Shyair GanglaniAinda não há avaliações

- Financial Performance of Dhaka BankDocumento6 páginasFinancial Performance of Dhaka Bankdiu_diptoAinda não há avaliações

- Patriculars Equity and LiabilitiesDocumento12 páginasPatriculars Equity and LiabilitiesSanket PatelAinda não há avaliações

- Horizontal Analysis: Particulars Equity and Liabilities Equity Regular SizeDocumento4 páginasHorizontal Analysis: Particulars Equity and Liabilities Equity Regular SizeRizwan AhmadAinda não há avaliações

- Financial PlanDocumento15 páginasFinancial PlanIshaan YadavAinda não há avaliações

- Chapter Six & More: Measuring and Evaluating The Performance of Banks BBK As A CaseDocumento33 páginasChapter Six & More: Measuring and Evaluating The Performance of Banks BBK As A CaseHanno MuhammadAinda não há avaliações

- Q4 Aggregate NumbersDocumento4 páginasQ4 Aggregate NumbersAdam BelzAinda não há avaliações

- Financial Position of The Engro FoodsDocumento2 páginasFinancial Position of The Engro FoodsJaveriarehanAinda não há avaliações

- BSISDocumento61 páginasBSISMahmood KhanAinda não há avaliações

- Bank Balance Sheets and Income StatementsDocumento61 páginasBank Balance Sheets and Income StatementsAniket BardeAinda não há avaliações

- TVS Balance SheetDocumento6 páginasTVS Balance SheetNihal LamgeAinda não há avaliações

- Dubai Islamic Bank Results Update 16 AugustDocumento4 páginasDubai Islamic Bank Results Update 16 AugustEmran Lhr PakistanAinda não há avaliações

- Tata Motors LTD Industry:Automobiles - Lcvs/HcvsDocumento2 páginasTata Motors LTD Industry:Automobiles - Lcvs/HcvssumitpruthiAinda não há avaliações

- Balance Sheet Common Size AnalysisDocumento34 páginasBalance Sheet Common Size AnalysisFarhat BukhariAinda não há avaliações

- Projected Cash FlowDocumento5 páginasProjected Cash FlowSaif Muhammad SazinAinda não há avaliações

- State Bank of India: Total IncomeDocumento2 páginasState Bank of India: Total IncomeRahul ReinAinda não há avaliações

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Documento4 páginasNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkAinda não há avaliações

- GMR Prowess Income STMTDocumento53 páginasGMR Prowess Income STMTMurugan MuthukrishnanAinda não há avaliações

- FY 2011-12 Third Quarter Results: Investor PresentationDocumento34 páginasFY 2011-12 Third Quarter Results: Investor PresentationshemalgAinda não há avaliações

- Citi OBSDocumento25 páginasCiti OBSVince PaganoAinda não há avaliações

- Balance Sheet As at September 30, 2011: Habib Sugar Mills LimitedDocumento2 páginasBalance Sheet As at September 30, 2011: Habib Sugar Mills LimitedAli Tariq ButtAinda não há avaliações

- Financial StatementDocumento115 páginasFinancial Statementammar123Ainda não há avaliações

- RATIOSDocumento136 páginasRATIOSAadiSharmaAinda não há avaliações

- Financial PlanningDocumento26 páginasFinancial PlanningKevinVdKAinda não há avaliações

- RBS Holdings NV Annual ReportDocumento256 páginasRBS Holdings NV Annual ReportIskandar IsAinda não há avaliações

- CHAP - 02 - Financial Statements of BankDocumento72 páginasCHAP - 02 - Financial Statements of BankTran Thanh NganAinda não há avaliações

- Tut 4 - Reliance Financial StatementsDocumento3 páginasTut 4 - Reliance Financial StatementsJulia DanielAinda não há avaliações

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Documento17 páginasRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillAinda não há avaliações

- Bank of KhyberDocumento30 páginasBank of KhyberMuhammad HamadAinda não há avaliações

- Book 1Documento2 páginasBook 1Shoaib QuddusAinda não há avaliações

- FMfinancial Statement AnalysisDocumento29 páginasFMfinancial Statement AnalysisApratim BhaskarAinda não há avaliações

- ADIBDocumento5 páginasADIBMohamed BathaqiliAinda não há avaliações

- Financial Status Sesa Goa 2011-12Documento13 páginasFinancial Status Sesa Goa 2011-12Roshankumar S PimpalkarAinda não há avaliações

- PanasonicDocumento17 páginasPanasonicAzmi Abdullah KhanAinda não há avaliações

- Ratios Analysis: Lahore Leads UniversityDocumento24 páginasRatios Analysis: Lahore Leads UniversityZee ShanAinda não há avaliações

- Balance Sheet of Raymond - in Rs. Cr.Documento3 páginasBalance Sheet of Raymond - in Rs. Cr.Bhavdeep SinghAinda não há avaliações

- LBO Analysis TemplateDocumento11 páginasLBO Analysis TemplateBobby Watkins75% (4)

- Monthly - Statistics 2073 06 (Mid Oct, 2016)Documento49 páginasMonthly - Statistics 2073 06 (Mid Oct, 2016)prabindraAinda não há avaliações

- Income Statement: Altus Honda Cars Pakistan LimitedDocumento23 páginasIncome Statement: Altus Honda Cars Pakistan LimitedTahir HussainAinda não há avaliações

- Investor PresentationDocumento23 páginasInvestor PresentationRabekanadarAinda não há avaliações

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocumento18 páginasInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjAinda não há avaliações

- Tata Consultancy Services LTD.: LiabilitiesDocumento2 páginasTata Consultancy Services LTD.: LiabilitiesAditya RaiAinda não há avaliações

- Appendix 2 No - TitleDocumento14 páginasAppendix 2 No - Titlebirjunaik23Ainda não há avaliações

- Tutorial 1: Chapter 1 The Financial Statements of BanksDocumento6 páginasTutorial 1: Chapter 1 The Financial Statements of BanksKanchelskiTehAinda não há avaliações

- Paid Up Capital (Rs 10 Shares) Share Premium: Long Term LoansDocumento2 páginasPaid Up Capital (Rs 10 Shares) Share Premium: Long Term LoansMushtaq Hussain KhanAinda não há avaliações

- FY 2012-13 First Quarter Results: Investor PresentationDocumento31 páginasFY 2012-13 First Quarter Results: Investor PresentationSai KalyanAinda não há avaliações

- Tute3 Reliance Financial StatementsDocumento3 páginasTute3 Reliance Financial Statementsvivek patelAinda não há avaliações

- 5ead0financial RatiosDocumento3 páginas5ead0financial RatiosGourav DuttaAinda não há avaliações

- Excel Solutions To CasesDocumento38 páginasExcel Solutions To CaseselizabethanhdoAinda não há avaliações

- Goals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesNo EverandGoals-Based Wealth Management: An Integrated and Practical Approach to Changing the Structure of Wealth Advisory PracticesAinda não há avaliações