Escolar Documentos

Profissional Documentos

Cultura Documentos

Focus: A Uitp Position Paper

Enviado por

Grandcherokee PtDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Focus: A Uitp Position Paper

Enviado por

Grandcherokee PtDireitos autorais:

Formatos disponíveis

Union Internationale des Transports Publics International Association of Public Transport Internationaler Verband fr ffentliches Verkehrswesen

April 2003

FOCUS

A UITP POSITION PAPER

The Financing of Public Transport Operations

Financing Public Introduction Transport may be The financing of Public Transport operations is based, in general, on a combination of: considered under two - the fares collected broad headings: on one - other commercial revenue (advertising, property rentals etc.) - specific compensation for concessionary fares and social/regional obligations, and hand the financing of - any further remuneration required from the public authority to enable the required the infrastructure and levels of service to be achieved. on the other hand, the In general, the financing of the operation (still less of investment) of Public Transport financing of the cannot be fully covered by the revenue from fares. The amount of public transport expenditure covered by fares may differ greatly from one situation to another. The operation. This paper of the charged to the operating focuses primarily on the same applies to the content whetherexpenditure that isowns the infrastructure, the companies, depending e.g. on or not the operator financing of Public treatment of depreciation, the allocation of financing costs, whether charges are applied for the use of such assets as bus stations. As a result there are wide differences Transport operations.

in the requirements for and shape of public funding. The fact that outside financial support is required to fill the gap between income from passenger fares and costs of operation does not in itself mean that a company is inefficient or non-viable. It only reflects the fact that fares and service levels are set with specific policy objectives in mind. Governments, local authorities and other bodies, including the private sector, thus make finance available to public transport for economic, social, transport and environmental reasons. The purpose of this Focus Paper is to outline the different forms which external funding may take, to consider the measures required to ensure that the maximum benefit is obtained from such funding, and to make recommendations about future funding policy.

Reasons for supplementary Financing of Operations

Operational Support may be designed to allow higher levels of service or specific additional services (night services, services for handicapped persons, rural services, etc.) and/or lower fares than would otherwise be possible This is an official position of UITP, the International Association of Public Transport. UITP has over 2000 members in 80 countries throughout the world and represents the interests of key players in this sector. Its membership includes transport authorities, operators, both private and public, in all modes of collective passenger transport, and the industry. UITP addresses the economic, technical, organisation and management aspects of passenger transport, as well as, the development of policy for mobility and public transport world-wide.

A Focus Paper is an official UITP position

English version

Such measures may be intended to: (a) redress the competitive balance between public transport and private motoring (the free use of the road network, external costs, etc.) and thus to encourage a shift of demand away from the private car; (b) facilitate access to essential services (shopping, education, health, etc.) by those who do not have access to a car. This includes concessionary travel, either free or discounted, for deserving groups of people such as the elderly, people with physical disabilities or learning difficulties and children.

Alternative Sources of Funding

The alternatives to direct funding by the user can be considered under three main headings: Polluter Pays: those who cause a problem compensate for the cost imposed on the community. The compensation paid may then be used to fund alternative, less polluting forms of transport - e.g. use of the proceeds of the German Mineral Oil Tax (Mineraloelsteuer) to fund public transport, environmental taxes on the use and ownership of cars and parking charges (if they are used to fund public transport). Beneficiary Pays: those who gain benefit from a service meet its costs. Thus employers and retailers both gain from the provision of public transport services which give them access to a wider labour-markets and retail markets respectively. The French Transport Tax (Versement Transport) requires employers with more than nine staff to contribute towards the cost of public transport investment and operation (and in addition, in the Paris area, they also reimburse to their employees half the cost of the public transport season tickets). In Hong-Kong, the construction of new metro infrastructure is partly funded from the rents and sale values of property erected adjacent to metro stations General Public Pays: through national and local taxation, whether or not they are public transport users. This is normally the principal source of external funding. Within these general mechanisms, a wide variety of possible sources of funding can be identified. Central, regional and local governments may each be involved in financing public transport. Each country tends to have its specific grants and funds. In practice, funding of public transport may involve a combination of mechanisms. Thus it may only be possible to capture the benefits to other parties through tax measures (for example the Versement Transport). Road Pricing schemes may contain elements of both the Polluter Pays and Beneficiary Pays principles. The vehicles that cause congestion pay a fee to use the roads. They also benefit from less congested roads. The proceeds of road pricing may increasingly provide a source of income for investment in transport. They also offer the benefit of providing a push measure helping to encourage modal shift to public transport and thus increasing public transport fares income. The explicit use of cross-subsidy from other sectors to support public transport has become rare - only in Germany is it still common. It is principally achieved by the internal transfer of profits from other public services, such as electricity, gas and water, where these and public transport are provided by a single City Public Services undertaking (Stadtwerke). Cross-subsidy within public transport networks is however commonplace. It may indeed be essential in order to allow an integrated network to be maintained. Contributory revenue and commercial cross-subsidy are essential components of a public transport network and indeed of operations in many major industries. Public Transport operators should be allowed to maintain such activities. Public Transport operators should also be allowed to benefit from profitable supplementary activities, such as tourist transport, real estate, advertising, etc. In Taipei, 10% of the Taipei Rapid Transit Corporation income come from supplementary commercial activities.

Contributions from Employers may include the Versement Transport (see above), assistance to employees for the purchase of season tickets (in France, Belgium and elsewhere) and the development of Green Travel Plans, under which companies sponsor inter alia developments such as service increases, publicity campaigns, and improved public transport access. Private sector financial support for public transport operation is most likely to be attracted in respect of a specific benefit received, e.g. to sponsor stops or services or to extend a service to an employers or retailers premises. Public-private partnerships, under which construction and/or operation risks are shared between public authorities and the private sector, are becoming an accepted way of sharing the commercial risks of public transport and of raising project capital in many countries. Such deals however require the debt borne by the private sector to be funded, typically through an annual service charge, whose size will be determined by the private undertakings cost of capital and assessment of the risk. Such deals will only be beneficial if the additional costs thus incurred by the private sector are outweighed by e.g. construction cost savings, performance gains or improvements in productivity. In general terms, there are major advantages in sources of income which are not subject to large variations with changes in the political climate or national budget considerations (e.g. dedicated taxes).

Maximising Value from external Funding

A prime concern of authorities and operators must be to ensure that any external funding is to be used to maximum effect. Clearly defined and understood structures must be put in place for the payment and receipt of financial support. The main basic principles are: Where costs are incurred for policy reasons, such as higher service levels or lower fares than would be justified on exclusively commercial grounds, those responsible for them must assume responsibility for their payment. So-called subsidies should therefore be considered and calculated as payments for services rendered, for which the operator should be fully remunerated in order to meet the policy objectives established, to the extent that they involve expenditure and risk over and above that which can be funded from fares income. This includes the remuneration required to incentivise the service provider and to allow facilitate appropriate investment. Funding levels must be agreed in advance between authorities and operators. This is greatly preferable to the situation where deficits are incurred on an unplanned basis and occasionally written off. The use of service contracts, which define clearly the responsibilities of each party. They should allow for inflation and specify that operators may be compensated for justified price rises - for example increases in fuel or wage costs that could not reasonably have been anticipated and other major unforeseeable cost increases on which the operator has no influence. This will help to avoid unplanned fare rises or deficits, or reductions in quality of service. Such contracts should include financial incentives, in the form of a bonus/penalty system, in order to provide an inducement to increase the number of passengers and the quality of service provided. In this way operators are encouraged to offer the best service at the lowest cost and authorities to ensure better conditions for the operation of public transport. A good understanding is required of where profits are earned and losses incurred, although the separation of profitable from loss-making services must not be to the detriment of policy or commercial objectives . Measures should be taken to demonstrate clearly that the authority is receiving value for money. These may include benchmarking, tendering or outsourcing.

CONCLUSION AND RECOMMENDATIONS

UITP does not recommend a specific ratio of financial support to fare revenue. It does however draw attention to the fact that, in most cases public transport requires external finance in order to provide a level and quality of service at a price which could not otherwise be achieved, for two principal reasons: Encourage a shift in demand from the private car to public transport, thus reducing congestion and environmental damage caused by the former. Assist in avoiding the exclusion from normal social and economic life of those without access to a car. In order to allow public transport to fulfil its potential to facilitate movement, to improve the urban environment, and to avoid social exclusion, UITP makes the following recommendations: The need for public funding in most cases should be clearly recognised. Public transport should not be regarded as an inefficient activity on that account. The full potential of public transport to contribute to mobility, to the functioning of urban economies, to the urban environment, and to combating social exclusion, should be recognised in the objectives set for providers of public transport. Public transport should be funded in order to meet those policy objectives. The funding required is not a subsidy, but a payment for a service rendered to the community. The payment should be sufficient to fund the provision of those services, to the extent that they involve expenditure over and above that which can be funded from fares income. It should include the remuneration required to incentivise the service provider and to facilitate appropriate investment. The full range of possible funding sources should be considered. Sources of funding such as congestion charging which also help to discourage use of the private car are particularly to be recommended. For supporting operating expenditure, dedicated taxes such as the Versement Transport are also to be favoured because of their relative stability. Measures should be taken to ensure that maximum value for money is obtained from the external funding provided. These include: - the contractualisation/formalisation of relations between operators and authorities, - provisions for incentivising operators and for adjustments to contracts to meet changes in costs outside the control of the operator, - measures (e.g. benchmarking) to demonstrate that value for money is being obtained.

This UITP Focus Paper has been prepared by the General Commission on Transport Economics. UITP, International Association of Public Transport rue Sainte Marie 6 B-1080 Brussels Belgium Tel +32 2 673 61 00 Fax +32 2 660 10 72

Você também pode gostar

- Infrastructure User ChargesDocumento12 páginasInfrastructure User ChargesMunesu Innocent DizamuhupeAinda não há avaliações

- PPIAF ExecBrief TollingPrinciples PDFDocumento7 páginasPPIAF ExecBrief TollingPrinciples PDFNia MagdalenaAinda não há avaliações

- A. Should The Government Subsidise Public Transport? Justify Your AnswerDocumento6 páginasA. Should The Government Subsidise Public Transport? Justify Your AnswerHarpreet SinghAinda não há avaliações

- Pub Vs PVT TransportDocumento6 páginasPub Vs PVT TransportjunaidAinda não há avaliações

- Transportation and Economic Development (Done)Documento10 páginasTransportation and Economic Development (Done)sooraj_c_nAinda não há avaliações

- Advantages of Economics Scale in TransportationDocumento3 páginasAdvantages of Economics Scale in TransportationAhmad HafizAinda não há avaliações

- Transport Economics Ide 2018Documento4 páginasTransport Economics Ide 2018vincentAinda não há avaliações

- Public Private Partnerships Main Types of PPPDocumento10 páginasPublic Private Partnerships Main Types of PPPAnonymous soN3iqwKFAAinda não há avaliações

- Hand OutDocumento17 páginasHand Outasdf789456123Ainda não há avaliações

- Public Revenue ch-2Documento76 páginasPublic Revenue ch-2yebegashetAinda não há avaliações

- 1 FH5 Full Cost RecoDocumento16 páginas1 FH5 Full Cost RecoImprovingSupportAinda não há avaliações

- A Paradigm Shift Toward Sustainable TransportDocumento66 páginasA Paradigm Shift Toward Sustainable Transportmurphycj25Ainda não há avaliações

- TransportationDocumento3 páginasTransportationdotaa9718Ainda não há avaliações

- Public Private Partnership in Urban Services: - Special Reference To Tamilnadu On Solid Waste Management ProjectsDocumento50 páginasPublic Private Partnership in Urban Services: - Special Reference To Tamilnadu On Solid Waste Management ProjectskailasasundaramAinda não há avaliações

- Introducing ITS in Unsubsidised Public TransportDocumento15 páginasIntroducing ITS in Unsubsidised Public TransportKoos Van ZylAinda não há avaliações

- Bla18632 ch09Documento34 páginasBla18632 ch09jackAinda não há avaliações

- Planning of Road Construction Projects With A ViewDocumento7 páginasPlanning of Road Construction Projects With A Viewmasood hassanAinda não há avaliações

- Sources and Expenditure of Government RevenueDocumento5 páginasSources and Expenditure of Government RevenueCharles100% (1)

- Thompson SummaryDocumento18 páginasThompson SummaryjsmnjasminesAinda não há avaliações

- Annex 9Documento6 páginasAnnex 9Nitish JhaAinda não há avaliações

- Week 10 Investment in Transportation InfrastructureDocumento31 páginasWeek 10 Investment in Transportation InfrastructureOtabek AbdusamatovAinda não há avaliações

- Position Paper On Dotr'S Puv Modernization Program: Posted: October 19, 2017Documento2 páginasPosition Paper On Dotr'S Puv Modernization Program: Posted: October 19, 2017Krisha FayeAinda não há avaliações

- Tumangan Ma. Estela Leonor Angela P As2m1Documento6 páginasTumangan Ma. Estela Leonor Angela P As2m1Mela TumanganAinda não há avaliações

- ReportDocumento8 páginasReportNoor ul emanAinda não há avaliações

- Tee-Unit 2 RDocumento23 páginasTee-Unit 2 RMilindJambleAinda não há avaliações

- MDS 529 - Handout 1Documento7 páginasMDS 529 - Handout 1faruque.ddsAinda não há avaliações

- 001 - THE BASIC PUBLIC FINANCE OF - Engel FisherDocumento30 páginas001 - THE BASIC PUBLIC FINANCE OF - Engel FisherAlumnoAinda não há avaliações

- Road User TaxationDocumento83 páginasRoad User TaxationDonny Dwi SaputroAinda não há avaliações

- WCTR 04Documento12 páginasWCTR 04Andrianto SetiawanAinda não há avaliações

- OECD Tax and Company Cars Policy HighlightsDocumento16 páginasOECD Tax and Company Cars Policy HighlightsOECD_env100% (4)

- Article Review Assignment-1Documento19 páginasArticle Review Assignment-1Yimer MesheshaAinda não há avaliações

- Introduction To Public ProcurementDocumento24 páginasIntroduction To Public Procurementsharkfinmike100% (1)

- GRP 9Documento2 páginasGRP 9dominiquelaine6Ainda não há avaliações

- LFIG Road Pricing FinalDocumento6 páginasLFIG Road Pricing Finalalanwenbansmith7543Ainda não há avaliações

- Multi-Criteria Analysis of The Alternative Mode of TransportDocumento8 páginasMulti-Criteria Analysis of The Alternative Mode of TransportZaid FutlooAinda não há avaliações

- Public-Private Partnerships inDocumento6 páginasPublic-Private Partnerships inMarhadi LeonchiAinda não há avaliações

- PPPsuccess StoriesDocumento114 páginasPPPsuccess StoriesRoberto Gonzalez BustamanteAinda não há avaliações

- Operational CostsDocumento5 páginasOperational CostspercyAinda não há avaliações

- 42 Cronberry, Logan and Lugar Community CouncilDocumento2 páginas42 Cronberry, Logan and Lugar Community CouncilIain Gray MSPAinda não há avaliações

- Travel Demand Management - Measures, Behavioural Impact and User ResponseDocumento21 páginasTravel Demand Management - Measures, Behavioural Impact and User ResponsePranav MishraAinda não há avaliações

- Chapter Three Principles of Accounting and Financial Reporting For State and Local Governments (SLGS)Documento40 páginasChapter Three Principles of Accounting and Financial Reporting For State and Local Governments (SLGS)shimelisAinda não há avaliações

- Operational StandardDocumento6 páginasOperational StandardJonela Adil MustapaAinda não há avaliações

- Operating CostingDocumento7 páginasOperating CostingARCPMAinda não há avaliações

- The Market Mechanism: SA. Quimbo 27 January 2015Documento14 páginasThe Market Mechanism: SA. Quimbo 27 January 2015alexAinda não há avaliações

- PPP - Advantages & DisadvantagesDocumento33 páginasPPP - Advantages & DisadvantagesJohn Prashanth Vadlapati88% (8)

- 10 - Chapter 3 PDFDocumento17 páginas10 - Chapter 3 PDFMallikarjunReddyObbineniAinda não há avaliações

- Public PVT PartnershipDocumento1 páginaPublic PVT PartnershipAbu BasharAinda não há avaliações

- 167 Network Rail Using PESTEL To Design Effective Strategies1Documento5 páginas167 Network Rail Using PESTEL To Design Effective Strategies1Dude ShowaiterAinda não há avaliações

- Overview: Important Features of Infrastructure:: Jazzie'SDocumento3 páginasOverview: Important Features of Infrastructure:: Jazzie'SJazzie PabloAinda não há avaliações

- Transport Assignment 2023Documento8 páginasTransport Assignment 2023Blessing MapokaAinda não há avaliações

- Chapter Two Principles of Accounting and Financial Reporting For State and Local Governments (SLGS)Documento40 páginasChapter Two Principles of Accounting and Financial Reporting For State and Local Governments (SLGS)Gabi MamushetAinda não há avaliações

- The Corporate Performance Measurement and Its Importance For The Pricing in A Transport EnterpriseDocumento17 páginasThe Corporate Performance Measurement and Its Importance For The Pricing in A Transport EnterpriseRober NunezAinda não há avaliações

- Public-Private Relationships.Documento11 páginasPublic-Private Relationships.Elijah KiruguAinda não há avaliações

- PPP MappingDocumento11 páginasPPP Mappingasdf789456123Ainda não há avaliações

- Contribution of Transport To Economic Development Economic Development and Transport ProjectDocumento19 páginasContribution of Transport To Economic Development Economic Development and Transport Projectstaff college prepAinda não há avaliações

- TeaDocumento6 páginasTeaVķ MãħëšħAinda não há avaliações

- Government Consumption - Government: Income DistributionDocumento1 páginaGovernment Consumption - Government: Income DistributionSemih EminiAinda não há avaliações

- Public/Private Partnerships (PPP) : How Does A PPP Work?Documento4 páginasPublic/Private Partnerships (PPP) : How Does A PPP Work?DipPaulAinda não há avaliações

- Elite Choice: Variable AnnuitiesDocumento2 páginasElite Choice: Variable AnnuitiesMelony LiangAinda não há avaliações

- Sa 510Documento14 páginasSa 510Narasimha Akash100% (1)

- ZTBLDocumento52 páginasZTBLSheikh Aqeel50% (2)

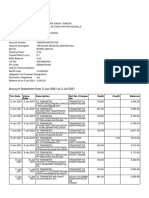

- Account Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento8 páginasAccount Statement From 3 Jan 2021 To 3 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanatan ThakurAinda não há avaliações

- Balikbayan Box Companies Accredited by DTI in 2016 - NewsDocumento15 páginasBalikbayan Box Companies Accredited by DTI in 2016 - NewsEdward OropezaAinda não há avaliações

- Summary of Preferred Hedge Fund Terms: OverviewDocumento4 páginasSummary of Preferred Hedge Fund Terms: OverviewsmasarikAinda não há avaliações

- Digital WalletDocumento22 páginasDigital WalletPriyankaGuruswamy100% (1)

- Arusha Women in Business SaccosDocumento4 páginasArusha Women in Business SaccosJaphary ShaibuAinda não há avaliações

- Business Contacts OctoberDocumento15 páginasBusiness Contacts OctoberDurban Chamber of Commerce and IndustryAinda não há avaliações

- Foreign Exchange Investment Department Bangladesh Bank Head Office DhakaDocumento2 páginasForeign Exchange Investment Department Bangladesh Bank Head Office Dhakamirmuiz2993Ainda não há avaliações

- 2016 2017 PDFDocumento44 páginas2016 2017 PDFHay Jirenyaa100% (1)

- The Role of Ceo in The Strategic PlanningDocumento18 páginasThe Role of Ceo in The Strategic PlanningmanofhonourAinda não há avaliações

- Aipost Eng PresentationDocumento25 páginasAipost Eng PresentationNurainaa BalqisAinda não há avaliações

- Detailed Lesson Plan in ABMDocumento5 páginasDetailed Lesson Plan in ABMAnonymous QZsOxQsJAinda não há avaliações

- 2020 MDCN Remita LicenseDocumento1 página2020 MDCN Remita LicenseFavour MichaelAinda não há avaliações

- Journey Towards CashlessDocumento89 páginasJourney Towards CashlessKatherine Valiente100% (1)

- Employee HandbookDocumento32 páginasEmployee HandbookKarl LabagalaAinda não há avaliações

- Credit CardDocumento15 páginasCredit Cardsrdagpnt100% (1)

- Panafrican Daily Market Report 24-June-2014)Documento1 páginaPanafrican Daily Market Report 24-June-2014)Oladipupo Mayowa PaulAinda não há avaliações

- STARTRADE RO - Comisioane Si Taxe STARTRADE RO - Fees and CommissionsDocumento3 páginasSTARTRADE RO - Comisioane Si Taxe STARTRADE RO - Fees and CommissionsAzi NuAinda não há avaliações

- Oceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Documento1 páginaOceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Oceanic Bank International PLC50% (2)

- CBSR - Review&LearningAssessmentDocumento26 páginasCBSR - Review&LearningAssessmentmohanp716515Ainda não há avaliações

- Research Paper On Banker As An Agent: Critical Study: Banking and Insurance LawDocumento16 páginasResearch Paper On Banker As An Agent: Critical Study: Banking and Insurance LawGyanendra kumarAinda não há avaliações

- A Policyholder's Primer On Commercial InsuranceDocumento211 páginasA Policyholder's Primer On Commercial Insurancepauljosephwhiteyahoo.comAinda não há avaliações

- TRAIN Law BriefingDocumento30 páginasTRAIN Law BriefingJoselito PabatangAinda não há avaliações

- ITIL MALC Case Study 1 v1.1 PDFDocumento7 páginasITIL MALC Case Study 1 v1.1 PDFGrzegorz Urbanowicz100% (2)

- Habib Bank LimitedDocumento64 páginasHabib Bank Limitedviper959550% (2)

- Cooperative Feasibility Study GuideDocumento24 páginasCooperative Feasibility Study GuideHabib Jummon IslamAinda não há avaliações

- LIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentDocumento11 páginasLIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentSaravanan DuraiAinda não há avaliações

- What Is A Continuing Guarantee and What Are Its Modes of RevocationDocumento4 páginasWhat Is A Continuing Guarantee and What Are Its Modes of RevocationNitya Nand Pandey100% (1)