Escolar Documentos

Profissional Documentos

Cultura Documentos

Superannuation

Enviado por

eliesenthilDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Superannuation

Enviado por

eliesenthilDireitos autorais:

Formatos disponíveis

SUPERANNATION PENSION The superannuation age in respect of CG enrolled personnel is 57 years.

Pension is admissible, if superannuated after rendering 10 years qualifying service. For less than 10 years qualifying service (incase of re-employed), only service gratuity is admissible. Linkage of full pension with 33 years of qualifying service shall be dispensed with. Once a Government servant has rendered the minimum qualifying service of 20 years, pension shall be paid at 50% of the emolument or average emoluments received during the last 10 months, whichever is more beneficial to him. The day of retirement on superannuation will be deemed as a working day. Retirement is effective from the afternoon of the last day of the month in which age of superannuation is attained. An employee whose birth date is the first of the month shall retire on the after noon of the last day of the preceding month. 1. Endorsement/Cancellation of Family Pension of ex-Military Pensioners: (a) The ex-military pensioners whose family pension has not been endorsed in the Pension Payment Order for ex-military pension should obtain a certificate for nonendorsement of family pension from their records office and same may be intimated to The Officer-in-Charge, Bureau of Naviks for taking up case for sanction of family pension along with individual pension case. (b) The ex-military pensioner whom family pension has been sanctioned for his exmilitary pension, may opt to sanction family pension for Coast Guard Service, if it is more favorable, under the provision of CCS (P) Rules, 1972. This option will be exercised with Sub Rule 13-A of Rules 54 of CCS (P) Rules 1972. The pensioner opting family pension for Coast Guard Service may apply well in advance for cancellation of family pension for ex-military service as per appendix D and a copy of corrigendum Pension Payment Order for cancellation of family pension may be forwarded to The Officer-in-Charge, Bureau of Naviks for taking up case for sanction of family pension along with individual pension case. 2. Procedure for sanction of superannuation pension: (a) Superannuation serial is published by the Bureau 24-30 months prior to attaining the age of superannuation.

(b) The requisite forms are forwarded to the individual for completion about 08 months prior to retirement. After completion of forms the following documents should reach Bureau at least (c) 06 months prior to retirement. (i) The audited service book (ii) Duly completed pension forms (iii) A fresh set of nomination forms with declaration of handicapped children along with relevant medical documents. (iv) In case spouse is not alive, the nomination in respect of minor children be declared under guardianship of a family member/near relative. The attested copy of death certificate in respect of the spouse may also be forwarded to Bureau. Contd2/-

-2(v) Option certificate of the individual along with the copy of NOC issued by the military service regarding cancellation of family pension for military service and grant of family pension for Indian Coast Guard Service (format laid down along with other forms on superannuation). (vi) 02 each photographs in civil cloth of self and joint photographs with spouse in addition to the photographs affixed in prescribed forms. (d) The pension papers are completed by the Bureau on the basis of the service book and forms submitted by the individual and then forwarded to PCDA(P), Allahabad through PCDA(N), Mumbai about five months prior to retirement and the service book is returned to unit. (e) Normally the PPO along with Pension Book is received from the O/o PCDA(P), Allahabad prior to retirement of the individual. (f) The individual being released on due date. Following document being issued on retirement:(i) (ii) (iii) (iv) (v) Service & Discharge Certificate. Pensioner Identity Card. Pension Book Individual copy of Pension Payment Order. Payment on account of GPF final settlement.

(g) On retirement on attaining the age of superannuation following benefits will be granted:(i) (ii) (iii) (iv) (v) (vi) (vii) Pension Retirement Gratuity Family Pension Notification (Enhanced/normal rate) Commutation of Pension Individual Pay Account and Leave encashment (If any) Survival benefits from NGIS GPF

(h) The quantum of pension available to the old pensioners shall be increased as follows:Age of Pensioner From 80 years to less than 85 years From 85 years to less than 90 years From 90 years to less than 95 years From 95 years to less than 100 years 100 years or more Additional quantum of pension 20% of basic pension 30% of basic pension 40% of basic pension 50 % of basic pension 100 % of basic pension

CALCULATION SHEET Superannuation/Retiring/Pro-rata/Invalid/Compensation/Compulsory retirement Pension/ Compassionate Allowance/Retirement Gratuity/Family Pension 1. (a) Name : AB, P/Adhikari (RP),No. 09679-W (b) Appointment held : Pradhan Adhikari (RP) (c) Office from which retired : Indian Coast Guard Station Chennai (d) Date of birth : 13 Apr 1952 (e) Date of appointment : 20 Feb 1986 (f) Date of Retirement : 30 Apr 2009 (g) Class of Pension : Superannuation Pension (h) Pension rules by which governed : CCS (Pension) Rules, 1972 2. Qualifying Service From To Years Months Days (a) Regular/Pmt service 20.02.1986 30.04.2009 23 02 09

(b) Military Service 23 02 09 Total qualifying service 3. Less non-qualifying Service From To Year Month Days Non-qualifying service as ---00 00 00 4. 23 Years 02 Months 09 Days Net qualifying service 5. Rates of pay and allowances drawn during last 10 months of qualifying service viz From To Rates of pay drawn Total Eml. Pay in Band Stg./ Inc. R/ Pay Grade Pay Others 01.07.08 -(b) 30.04.2009 17730 ------4800 -Total: --22,530.00 -2,25,330.00

Average Emoluments = 2,25,300 = Rs.22,530/10 6. Emoluments for retirement Gratuity- Amount of last pay drawn From Pay in Band Stg. Inc. R/Pay Grade Pay NPA DA@16% Total Emol. 30.04.2009 17,730 --4800 -3,605 26,135.00 7. Emoluments for Family Pension Amount Last pay drawnPay in Band Stg. Inc. Rank Pay Grade Pay NPA Total 17,730 --4800 -22,530.00 8. Calculation of Pension/ Gratuity(a) Pension : 50% of the average emoluments received during the last 10 months OR pay last drawn, whichever is more beneficial to the retiree government servant. (i) 50% of the average emoluments = Rs. 22,530 OR 50 % of Last Pay Drawn = Rs. 22,530 2 = Rs. 11,265/2

(ii)

= Rs. 11,265/Contd2/-

-2Note: In case of individuals invalided out of service, the Invalid Pension admissible under Rule 38 of CCS (AE) Rules, 1972 should not be less than ordinary rate of family pension. (iii) Pension should not be less than 50% of minimum of revised band introduced w.e.f. 01.01.2006. (iv) Pension should be rounded off to the next higher rupee. (v) Minimum Pension Rs.3500/- w.e.f. 01.01.2006. (b) Retirement Gratuity: (i) 26,135 X 46 = Rs.3,00,552.50, R/O=Rs. 3,00,553/4 Note: Subject to maximum of RS. 10,00,000/- or 16 time of emoluments, whichever is less, in respect of those, who retire on or after 01.01.2006. (ii) DemandRs._-Nil(to be recovered from Gratuity) Family pension under New Family Pension Scheme 1964 for joint notification 22,530 X 30 = Rs. 6,759/100 Note: Minimum Family Pension subject tp minimum Rs. 3,500/- and maximum of 30% of the highest pay in the Government w.e.f. 01 Jan 2006. Enhance rate of family pension: (i) 50% of the last emoluments = 50% of Rs. 23,630/: Rs.11,265/or (ii) Restricted to authorised pension on retirement which ever is less :Rs.11,265/Duration of enhanced rate of family pension: Enhanced rate of family pension will be payable for a period of 7 years from the date following the date of death of Government servant or for a period upto the date on which the deceased Government servant would have attained the age of 65 years (67 Years from 13.05.1998) had he survived, whichever is less (d.) Commutation of pension: Commuted portion of pension = 11,265 x 40%(Subject to max. of 40%)=Rs. 4,506/Commuted value of pension = 4506 x 12 x 8.446 = Rs.4,56,692.11, R/o= Rs. 4,56,693/Note: For purchase value age taken on next birthday.

(c)

Date :-

Nov 2008 COUNTERSIGNED

Staff Officer (Release Center) for Officer-in-Charge

Sr. AO (Navy)

FORM 5 Particulars to be obtained by the Head of the Office from the retiring Govt servant. Name ____________________ Rank ______________ No. _______________. 1. 2. 3. 4. : ___________________________ : ___________________________ : ___________________________ : ___________________________ ___________________________ ___________________________ ___________________________ Particulars of ex-Military service : From ______________________ To ________________________ Total period _________________ Whether Family Pension is endorsed While/after retirement from Military Service. : ___________________________ Amount of pension/Gratuity/Family Pension sanction. : Gratuity ____________________ Pension _____________________ Family Pension _______________ PPO No. _____________________ dated ______________. 7. Date of last increment and pay after Increment. : ____________________________ Name of wife and address Date of Birth Fathers Name Religion/Nationality Residence(Pmt address after retirement).

5.

6.

8.

: ____________________________ _____________________________ _____________________________ _____________________________ 9. Name and Ages of the surveying kindred, & details of handicapped children if any, copy of relevant medical documents be enclosed:Serial No. a) b) c) d) e) f) g) h) Relation Wife Sons Name Date of Birth ____________ ____________ ____________ ____________ ____________ ____________ ____________ ____________ ____________ ____________ If Handicapped Child- Yes/No ____________ ____________ ____________

______________ ______________ ______________ Unmarried ______________ daughter ______________ Father ______________ Mother ______________ Brothers ______________ Unmarried sisters ______________ Married daughters ______________

Date:

Signature of EP/SO

NOTE: Sl. 5 & 6 ARE TO BE COMPLETED/ FILLED BY RE-EMPLOYED PENSIONERS ONLY.

Appendix D OPTION CERTIFICATE I, Name ................................. Rank.................... No........................... ex-pensioner of Indian Navy/Army/Air Force Rank.................................. No................... do hereby opt ot retain the military pension for the past military service in terms of Sub Rule (1)(a) of Rule 19 of CCS (Pension) Rules, 1972. 2. I, further do hereby opt for the family pension which may be admissible to my of Family Pension sanctioned for ex-military service vide PPO

family under the provision of CCS(Pension) Rules for the Coast Guard Service and cancellation No........................................................... This option is exercised by me in accordance with Sub Rule 13-A(iii) opt Rule 54 of CCS(P) Rules, 1972.

Signature.................................. Name : .................................... Rank :...................................... No : ........................................ Date ................. Countersigned

NOTE: THIS FORM IS TO BE COMPLETED/ FILLED BY RE-EMPLOYED PENSIONERS ONLY.

PLACE OF PAYMENT FOR PENSION

I, Shri/Smt ________________________________________________________________ ________________________________________ would like to draw Pension, Death Gratuity, retirement gratuity from the under mentioned bank :(1) Paying Branch (a) Name of Bank with branch ___________________________ name and code number with full ___________________________ postal address of bank with PIN. __________________________ ___________________________ (b) Account No. (for Pension purpose) (c) Ledger No. (2)

__________________________ _________________________

The link branch of the above bank is as under :(To be Completed by _________________________ Bureau of Naviks) _________________________ _________________________ _________________________ _______________________

Signature ____________________________ Name _______________________________ Address __________________________ __________________________ __________________________ __________________________

COUNTERSIGNED

Bureau of Naviks Cheetah Camp Mankhurd Mumbai 400 088 Date : ______________ Staff Officer (Release Center) for Officer-in-Charge

PARTICULARS OF HEIGHT AND PERSONAL IDENTIFICATION MARKS OF NAME __________________________ RANK ____________________ NO. ______________ (a) (b) Height _________________________ Identification Marks: (i) __________________________________________________________ (ii) (c) __________________________________________________________

Date of Birth __________________________________.

Claimants Signature __________ PARTICULARS OF HEIGHT AND PERSONAL IDENTIFICATION MARKS OF SMT. ______________________________ WIFE OF NAME ___________________________ RANK ______________________________________ NO. ____________________________ (a) (b) Height _________________________ Identification Marks (Visible marks only): (i) _______________________________________________________ (ii) (c) _______________________________________________________

Date of Birth __________________________________.

Claimants (wife) Signature ___________ ATTESTED

(to be attested under Rubber Seal COUNTERSIGNED

Staff Officer (Release Center) for Officer-in-Charge Date : ______________

1.

SPECIMEN SIGNATURES LEFT HAND THUMB AND FINGERS IMPRESSION _OF NAME ___________________ RANK ______ a) Specimen Signature : NO._____________________

___________________ b)

____________________

__________________

LEFT Hand thumb and fingers impression :

Thumb

Fore finger

Middle Finger

Ring finger

Little finger

2. SPECIMEN SIGNATURES RIGHT HAND THUMB AND FINGERS IMPRESSION OF SMT _______________ _ WIFE OF ______________ RANK ____________ NO. _______ (a) Specimen Signature : _________________ (b) ____________________ _________________

RIGHT Hand thumb and fingers impression:

Thumb

Fore finger

Middle Finger

Ring finger

Little finger

Joint Photograph (self & wife only) In Civil Dress

(Photograph to be attested under rubber Seal) COUNTERSIGNED

Bureau of Naviks Cheetah Camp Mankhurd Mumbai 400 088 Date: __________________ Staff Officer (Release Center) for Officer-in-Charge

FORM OF APPLICATION FOR COMMUTATION OF FRACTION OF PENSION WITHOUT / AFTER MEDICAL EXAMINATION COMMUTATION OF PENSION WITHOUT MEDICAL EXAMINATION Sir, I desire to commute a fraction of my pension as indicated below with the provisions of the CCS (Commutation of Pension) Rules, 1981. The necessary particulars are furnished below : 1. 2. 3. Name (in block letters) Fathers name : :

Rank at the time of retirement and Number : Name of Office/Department/ Ministry in which employed Date of birth Date of retirement Class of Pension under which Retired Amount of pension authorized (Indicate final pension or Provisional)

4.

: : :

5. 6. 7.

: :

8.

9.

Fraction of pension proposed to be Commuted : Designation of the accounts Officer Who authorised the pension Along with PPO No. : Place of payment for pension with Full postal address and Account No.: __________________________________ __________________________________ __________________________________ __________________________________ __________________________________

10.

11.

Signature of applicant ___________________ Name ________________________________ Rank ________________ No. _____________ Date ___________ Contd..2/-

-2-

PART-II

Received from Name____________________Rank_______________No.____________ application in part-I of 1A for the commutation of a fraction of pension without medical examination.

Staff Officer (Release Center) for Officer-in-Charge Date : ______________ PAR T-III

1.

Forwarded to the Principal CDA (Pension), Allahabad with the remarks that :i) the particulars furnished by the applicant in part-I have been verified and are correct. the applicant is eligible to get a fraction of his pension commuted without medical examination. The commuted value of pension determined with reference to the table applicable at present comes Rs _______________. The amount of residual pension after commutation will be Rs___________

ii)

iii)

iv)

2. It is requested that further action to authorise the payment of commuted value of pension may be taken as in Rule 15 of the CCS (Commutation of Pension) Rules, 1981. 3. The receipt of part-I of the Form has been acknowledged in Part-II which has been forwarded separately to the applicant. 4. The commuted value of pension is debitable to Coast Guard.

Staff Officer (Release Center) for Officer-in-Charge Date;__________________

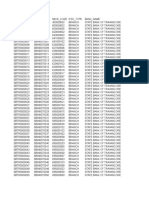

LIST OF AUTHORISED BANKS FOR PENSION DISTRICT : ________________________

Sir/Madam, Please open your pension account in one of the following banks, which ever is nearest to your home/residence. Intimate the Bank officer that this account will be operated for pension purpose. This pension account should not be the same account by which you are drawing military pension.

(a) (b) (c) (d) (e) (f) (g) (h) (j) (k) (l) (n) (p) (q) (r) (s) (t) (u)

Bank of India Punjab National Bank State Bank of India Canara Bank Punjab & Sind Bank Central Bank of India Syndicate Bank Bank of Baroda Allahabad Bank Union Bank of India State Bank of Travancore State Bank of Patiala Oriental Bank of Commerce UCO Bank Corporation Bank Andhra Bank Vijaya Bank State Bank of Bikaner & Jaipur

(v) (w) (x) (y) (z) (aa) (ab) (ac) (ad) (ae) (af) (ag)

Dena Bank Indian Overseas Bank Bank of Maharashtra Indian Bank State Bank of Mysore State Bank of Indore State Bank of Saurashtra United Bank of India ICICI Ltd Bank HDFC Bank IDBI BANK UTI Bank

Pension Section-in-Charge

Annexure A BANK DETAILS

1.

Name (s) of account holder:

2.

Link Bank Name and address:

3.

Link Bank BSR No.:

(BSR-Basic Statical Return No.) 4. Paying Bank Branch Name & Address:

5.

Paying Bank Branch BSR Code: (BSR-Basic Statical Return No.)

6.

Bank Account No. :

Certified that this branch is authorised for making payment of Pension to Defence Pensioners.

Signature & Seal of Bank Manager

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Bank statement summary and transactions for Mr. Chennupati ManikantaDocumento36 páginasBank statement summary and transactions for Mr. Chennupati Manikantavfs admin100% (1)

- Sensex HistoryDocumento15 páginasSensex HistoryrakeshAinda não há avaliações

- Rtgs LetterDocumento4 páginasRtgs LetterSanjay ShindeAinda não há avaliações

- Fossil ASP - ACP ListDocumento9 páginasFossil ASP - ACP ListHarshit AgrawalAinda não há avaliações

- UV Plastic Manufacturing: Estimate/QuotationDocumento1 páginaUV Plastic Manufacturing: Estimate/QuotationManoj EmmidesettyAinda não há avaliações

- Mahesh Matta Sanda WellnessDocumento7 páginasMahesh Matta Sanda Wellnessmaheshmatta sanda wellnessAinda não há avaliações

- Gate Pass FormatDocumento29 páginasGate Pass FormatSan BadwalAinda não há avaliações

- Electoral ListDocumento53 páginasElectoral Listbatsy4evAinda não há avaliações

- Dynamic DTR Sheet (Nimblr TA)Documento9 páginasDynamic DTR Sheet (Nimblr TA)Sharad TaterAinda não há avaliações

- GSTINs for L&T ConstructionDocumento11 páginasGSTINs for L&T ConstructionNur Mahammad KhandakarAinda não há avaliações

- India's Macroeconomic Indicators 2009-2017Documento1 páginaIndia's Macroeconomic Indicators 2009-2017Hemant SharmaAinda não há avaliações

- Renewal Premium Receipt: Har Pal Aapke Sath!!Documento1 páginaRenewal Premium Receipt: Har Pal Aapke Sath!!Ritu SoniAinda não há avaliações

- Case Study On DFCDocumento18 páginasCase Study On DFCPriyank SrivastavAinda não há avaliações

- Globalization's Impact on the Indian EconomyDocumento95 páginasGlobalization's Impact on the Indian EconomyZoya ShabbirhusainAinda não há avaliações

- Niti Aayog - 31TDocumento107 páginasNiti Aayog - 31TSidharth MaheshAinda não há avaliações

- Badiki Vastha - Free Bicycle Scheme For Girl StudentsDocumento1 páginaBadiki Vastha - Free Bicycle Scheme For Girl StudentsChaddi MootaAinda não há avaliações

- Pharma Companies IndiaDocumento15 páginasPharma Companies Indiaganesh kondikire100% (1)

- TDS Placement The United Group: Top ConsultantsDocumento7 páginasTDS Placement The United Group: Top ConsultantsamandeepAinda não há avaliações

- Pradhan Mantri Aawas YojanaDocumento13 páginasPradhan Mantri Aawas YojanaShivam ShanuAinda não há avaliações

- Nifty Midcap 100 ListDocumento6 páginasNifty Midcap 100 ListRoyal Moktan0% (1)

- Kansai Nerolac Paints Limited: Corporate PresentationDocumento42 páginasKansai Nerolac Paints Limited: Corporate PresentationAshish KohliAinda não há avaliações

- State Bank of India Presentation for Batch Number-PAT01IC1921Documento23 páginasState Bank of India Presentation for Batch Number-PAT01IC1921DIWAKAR KUMARAinda não há avaliações

- CBSLM00285200000003131 New PDFDocumento6 páginasCBSLM00285200000003131 New PDFkarthikeyan PAinda não há avaliações

- Industrial and Labor Economics For TYBA Paper VI Sem V - 2019Documento65 páginasIndustrial and Labor Economics For TYBA Paper VI Sem V - 2019Jaga SwainAinda não há avaliações

- Last 5 Months Expected Banking Questions From Current AffairsDocumento9 páginasLast 5 Months Expected Banking Questions From Current AffairsAnuj KumarAinda não há avaliações

- List of BanksDocumento5 páginasList of Banksramu3131Ainda não há avaliações

- Indian Economic Development PDFDocumento206 páginasIndian Economic Development PDFChiragDahiyaAinda não há avaliações

- GJEPC FinalDocumento21 páginasGJEPC FinalVishal RamrakhyaniAinda não há avaliações

- SBT Ifsc DetailsDocumento125 páginasSBT Ifsc DetailsPanruti S Sathiyavendhan0% (1)

- Caso La IndiaDocumento21 páginasCaso La IndiaVanessa Flores QuispeAinda não há avaliações