Escolar Documentos

Profissional Documentos

Cultura Documentos

Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read More

Enviado por

rryan123123Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2011 Read More

Enviado por

rryan123123Direitos autorais:

Formatos disponíveis

29 August 2011

onsumer price inflation in Hong Kong, China quickened to 7.9% year-on-year (y-o-y) in July due to increasing food prices and a low base effect resulting from the timing difference of government's public housing relief measures. Japan's core consumer price index rose slightly in July to 0.1% y-o-y as energy prices increased. Singapore's consumer price inflation accelerated to 5.4% y-o-y in July from 5.2% in June on the back of higher costs for transportation, accommodation, and food. Consumer price inflation in Viet Nam rose to its highest level since December 2008, reaching 23.1% y-o-y in August from 22.2% in July as costs for food surged. The Bank of Thailand last week raised its 1day repurchase rate by another 25 basis points to 3.5%. This was the sixth consecutive rate hike since January. Heightened concerns over inflation outweighed the risks to growth as domestic consumption and investment are expected to remain robust. Moody's Investors Service lowered Japan's credit rating to Aa3 from Aa2. The outlook on the ratings is stable. Standard and Poor's affirmed its AAA sovereign credit rating and stable outlook for the Singapore government's long-term debt. On 24 August, the Japan Credit Rating Agency (JCR) affirmed Indonesia's ratings for long-term FCY and LCY senior debt at BBBand BBB, respectively. The outlook for both ratings was stable. The People's Bank of China (PBOC) announced the expansion of the existing crossborder trade renminbi settlement program to include the entire country. During the first half of the year, the People's Republic of China's (PRC) total renminbi settlement in cross-border trade increased 13.3 times to reach RMB957.6 billion. The Republic of Korea's external debt position rose to USD398.0 billion in June. The country's outstanding household loans grew 8.7% y-o-y in July to reach KRW826 trillion. Finally, the credit default swap (CDS) spread for 5-year FCY-denominated government bonds widened to 149.2 basis points. LCY corporate bond issuance in the Republic of Korea was down 29.5% month-on-month (m-om) to KRW8.1 trillion in July. However, the cumulative corporate bond issuance over the January-July period stood at KRW75.1 trillion, which was up 9.3% y-o-y. Last week, KT Corporation of the Republic of Korea raised KRW600 billion from a tripletranche bond sale. In Malaysia, YTL Power

Key Developments in Asian Local Currency Markets

asianbondsonline.adb.org

Asia Bond Monitor March 2011

10-Year Selected LCY Government Security Yields

Markets

read more

Close of 26 August 2011

basis point change from Latest Closing Previous Day* Previous Week* 1-Jan-11*

2.19 2.16 1.04 3.95 1.76 8.30 6.84 3.65 3.87 5.77 1.63 3.49 12.72 -3.87 -2.90 0.10 0.00 -0.20 6.50 -1.30 -0.20 3.00 0.78 0.00 1.20 14.60 12.76 -110.36 12.76 5.20 -80.60 5.30 -8.50 5.30 4.00 1.00 1.00 13.9013.90 -109.90 3.90 3.90 38.40 -10.10 -76.40 0.80 0.80 -39.30 3.00 3.00 -65.00 8.09 8.09 -12.01 4.00 4.00 -108.00 1.90 1.90 -23.20 17.70 17.70 96.70

5.20

US EU Japan PR C H ong Kong, C hina In dia Indones ia Malays ia Korea, R ep. of Philippines Singapore Thailand Viet N am

-10.10

Selected Government Security Yields Benchmark Yield Curves - Local Currency Government Bonds 2-versus-10 Yield Spread Chart Policy Rate versus Inflation Rate Charts Credit Default Swap Spreads & Exchange Rate Indexes Selected Debt Security Issuances Selected Asia Data Releases

International sold MYR2.2 billion worth of 7-year notes with a coupon of 4.35%. In the Philippines, United Coconut Planters Bank issued PHP3.15 billion of LTNCD (long-term negotiable certificates of time deposit), which carry a coupon of 6.0% (payable quarterly) and have a maturity of 5 years and 3 months. Thai property developer Quality Houses raised a total of THB3 billion in bonds. Meanwhile, the State Railway of Thailand issued THB1 billion of 12-year bonds at a coupon of 3.99%. Government bond yields fell last week for most tenors in Indonesia, Malaysia, and the Philippines, while yields rose for all tenors in Viet Nam and for most tenors in Hong Kong, China; and Singapore. Yield movements were mixed in the PRC, the Republic of Korea and Thailand. Yield spreads between 2- and 10- year maturities widened in Hong Kong, China; the Republic of Korea; Malaysia; the Philippines; Singapore; and Viet Nam, while spreads narrowed in the rest of emerging East Asian markets. What's New: The next edition of the Asia Bond Monitor will be launched on 1 September. 1

....

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles

.......................................................................................................................

Consumer Price Inflation Accelerates in Hong Kong, China; Japan; Singapore; and Viet Nam

Consumer price inflation in Hong Kong, China rose to 7.9% year-on-year (y-o-y) in July. According to the Census and Statistics Department, the large increase was partly due to a low base effect resulting from the difference in the timing of the waiving of public housing rentals that took effect in July-September in 2010 and in August-September in 2011. Netting out the effect of the government's one-off relief measures, consumer price inflation rose to 5.8% y-o-y in July from 5.6% in June, due to higher food prices and private residential rentals. In Japan, consumer price inflation climbed slightly to 0.2% y-o-y in July from a decline of 0.4% in June, mostly on increases in energy costs. The core consumer price index (CPI)-which includes oil products but excludes volatile prices of fresh fruit, vegetables, and seafood-was up 0.1% y-o-y in July against a forecasted -0.1% decline. The government sharply revised this year's CPI data downward earlier this month after changing the base year and the components that comprise the index to better reflect trends in consumer spending. The government revises the base year for the data once every 5 years. Singapore's consumer price inflation accelerated to 5.4% y-o-y in July from 5.2% in June as a result of higher costs for transportation, accommodation, and food. Transportation costs rose 11.5% y-o-y in July from 10.4% in June, while housing costs increased 9.5% in July from 8.8% in June. Food price increases eased slightly to 3.0% y-o-y in July from 3.1% in June. On a month-on-month (m-o-m) basis, consumer price inflation rose 1.5% in July. Core inflation rose 2.2% y-o-y and 0.5% q-o-q. Consumer price inflation in Viet Nam in August rose to its highest level since December 2008, reaching 23.1% y-o-y from 22.2% in July. Prices for food and foodstuff surged 34.1% y-o-y in August, while the cost of education increased 25.2%. Costs for construction materials and transportation increased 23.8% and 21.5% y-o-y, respectively. On a m-o-m basis, consumer price inflation rose 0.9%. For historical trends on Hong Kong, China's consumer price inflation, refer to this link: http://asianbondsonline.adb.org/hongkong/data/marketwatch.php?code=policy_rate_and_inflation_trends For historical trends on Japan's consumer price inflation, refer to this link: http://asianbondsonline.adb.org/japan/data/marketwatch.php?code=policy_rate_and_inflation_trends For historical trends on Singapore's consumer price inflation, refer to this link: http://asianbondsonline.adb.org/singapore/data/macroeconomic_credit.php For historical trends on Vietnam's consumer price inflation, refer to this link: http://asianbondsonline.adb.org/vietnam/data/marketwatch.php?code=policy_rate_and_inflation_trends

.......................................................................................................................

Thailand Raises Repurchase Rate 25 bps to 3.5%

The Bank of Thailand (BOT) raised its 1-day repurchase rate by another 25 basis points (bps) last week for the sixth consecutive rate hike since January. The Monetary Policy Committee of the BOT voted 5 to 2 to increase the policy rate 25 bps to 3.5%, citing the heightened risk of inflation as the primary reason. Inflationary pressure is becoming an increasing concern as domestic consumption and investment are expected to expand. Favorable employment conditions, improved consumer confidence, strong growth in credit, and fiscal stimulus are expected to boost domestic demand. Thailand's policy rate is likely to be raised again in November to 4.0%, according to analysts. For historical trends on Thailand's policy rate, refer to this link: http://asianbondsonline.adb.org/thailand/data/marketwatch.php?code=policy_rate_and_inflation_trends

.......................................................................................................................

Japan Credit Rating Agency Affirms Indonesia's BBB- Rating; Moody's Lowers Japan's Credit Rating to Aa3; S&P Affirms AAA Credit Rating for Singapore

On 24 August, Japan Credit Rating Agency (JCR) affirmed Indonesia's ratings for long-term FCY senior debt at BBBand long-term LCY senior debt at BBB. The outlook for both ratings was stable. According to JCR, its ratings reflect Indonesia's sustainable economic growth outlook, which is underpinned by solid domestic demand, a reduced public debt burden, and reinforced resilience to external shocks.

.......

2

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles Japan Credit Rating Agency Affirms Indonesia's BBB- Rating; Moody's Lowers Japan's Credit Rating to Aa3; S&P Affirms AAA Credit Rating for Singapore (cont)

.......................................................................................................................

Moody's Investors Service (Moody's) lowered Japan's credit rating to Aa3 from Aa2 on 24 August. The outlook on the rating is stable. According to Moody's, the rating downgrade was prompted by large budget deficits and the build-up of Japanese government debt since the 2008/09 global recession. Moody's identified several factors that are making it difficult for Japan to slow the growth of its debt-to-GDP ratio, including frequent changes in administrations over the past 5 years that have prevented the government from implementing long-term economic and fiscal strategies. This latest rating action, however, does not affect Moody's Aaa ratings for Japan's country and bank deposit ceilings. Standard and Poor's (S&P) announced that it had affirmed its AAA sovereign credit rating and stable outlook for the Singapore government's long-term debt. The reaffirmation reflects Singapore's "extensive fiscal and external strengths, and its solid record of prudent macroeconomic management," according to S&P. Singapore is the only country in Asia to hold S&P's AAA credit rating. For statistics on Indonesia's sovereign ratings, refer to this link: http://asianbondsonline.adb.org/indonesia.php For statistics on Japan's sovereign ratings, refer to this link: http://asianbondsonline.adb.org/japan.php For statistics on Singapore's sovereign ratings, refer to this link: http://asianbondsonline.adb.org/singapore.php

.......................................................................................................................

PBOC's Cross-Border Trade Renminbi Settlement Program Expands Nationwide

The People's Bank of China (PBOC) announced the expansion of the existing cross-border trade renminbi settlement program to include the entire country. When the program was launched in July 2009, only 365 enterprises in Shanghai, Guangzhou, Shenzhen, Zhuhai, and Dongguan were allowed to use renminbi to settle their trade with partners in Hong Kong, China; Macau; and Association of Southeast Asian Nations (ASEAN) member countries. In June 2010, the program was expanded to cover 20 additional provincial regions, municipalities, and autonomous regions in the People's Republic of China (PRC). During the first half of this year, the People's Republic of China's (PRC) total crossborder trade renminbi settlement increased 13.3 times to reach RMB957.6 billion.

.......................................................................................................................

Republic of Korea's External Debt Rises to USD398 Billion in June, Household Loans Climb 8.7% in 2Q11, CDS Premiums Surge and Consumer Confidence Falls in August

The Republic of Korea's external debt position rose to USD398.0 billion in June from USD382.6 billion in March. This was led by a USD14.1 billion quarter-on-quarter (q-o-q) increase in long-term external debt, which stood at USD248.2 billion at end-June. Short-term external debt rose USD1.3 billion to USD149.7 billion. Banks remained as the largest holder of external debt, accounting for 49.4% of the total. Meanwhile, the country's outstanding amount of household loans at end-July stood at KRW826.0 trillion, up 8.7% y-o-y. The outstanding household loans of commercial and specialized banks' rose KRW9.2 trillion in 2Q11 to KRW444.3 trillion, while loans extended by non-bank depository corporations and other financial corporations increased KRW6.4 trillion to KRW173.6 trillion and KRW2.2 trillion to KRW208.2 trillion, respectively. Last week, the credit default swap (CDS) spread on the Republic of Korea's FCY-denominated government bonds jumped amid worries over United States (US) and European financial institutions. The CDS spread on the country's 5year FCY-denominated government bonds widened to 149 bps on 24 August, the highest level since it reached 153 bps in May 2010. Lastly, the Republic of Korea's composite consumer sentiment index fell 3 points in August to 99 amid a significant weakening of confidence in current domestic economic conditions.

...

3

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.........

Summary Text of News Articles

.......................................................................................................................

Issuance in the Republic of Korea, Malaysia, Philippines, and Thailand

In the Republic of Korea, LCY corporate bond issuance was down 29.5% month-on-month (m-o-m) to KRW8.1 trillion in July, compared with KRW11.5 trillion in June, based on Financial Supervisory Service data. This was partly due to a 62.0% monthly drop in bank debentures, which amounted to KRW1.2 trillion for the month, as domestic banks registered higher deposits, resulting in lower demand for funding. Bonds issued by financial companies fell 11.2% m-om to KRW2.7 trillion and issuance of asset-backed securities plunged 84.0% m-o-m to KRW213 billion in July. Issuance by non-financial companies in July remained about the same from the previous month at KRW4.0 trillion. However, cumulative corporate bond issuance in January-July stood at KRW75.1 trillion, which was up 9.3% y-o-y. Meanwhile, KT Corporation raised KRW600 billion from a triple-tranche bond sale last week. These bonds include a 5year tenor worth KRW260 billion with a coupon rate of 4.06%, a KRW250 billion 10-year tenor issued at a coupon rate of 4.19%, and a KRW90 billion 7-year tenor at a coupon rate of 4.11%. In Malaysia, YTL Power International issued MYR2.2 billion worth of 7-year notes under its newly established MYR5 billion Medium-Term Notes Programme. The issuance, rated AA1 by RAM Ratings, carries an annual coupon of 4.35%. In the Philippines, United Coconut Planters Bank raised PHP3.15 billion from its issuance of LTNCD (long-term negotiable certificates of time deposit), which carry a coupon of 6% (payable quarterly) and have a maturity of 5 years and 3 months. The proceeds from the offering will be used to expand the bank's consumer lending operations. Citicorp Capital Philippines Inc. was the lead arranger for the issue. Thai property developer Quality Houses raised a total of THB3 billion in two tranches last week. Its 4-year bonds have an issue size of THB1.6 billion and carry a 4.7% coupon, while the 5-year bonds have an issue size of THB1.4 billion at a coupon of 5.0%. Meanwhile, the State Railway of Thailand issued THB1 billion of 12-year bonds at a coupon of 3.99%.

...

4

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Selected Government Security Yields

Tip: Zoom-in on the table using the Acrobat zoom tool

3-Month Selected LCY Government Security Yields

Latest Closing -0.01 0.57 0.10 3.24 0.10 8.30 2.95 3.27 0.81 0.13 3.35 basis point change from Previous Previous 1-Jan-11* Day* Week* -0.51 0.00 -0.51 -12.48 -12.40 0.90 -12.40 17.40 0.00 0.00 0.00 -2.40 0.00 0.00 0.00 6.00 2.00 0.00 2.00 -18.00 0.00 0.00 0.00 120.00 -0.10 0.00 -0.10 16.70 -1.00 0.00 -1.00 76.00 -4.29 -103.71 -103.71 -38.21 2.00 0.00 2.00 -26.00 3.86 1.71 3.86 138.00

Markets US EU Japan PRC Hong Kong, China India Malaysia Korea, Rep. of Philippines Singapore Thailand

Close of 26 August 2011

10-Year Selected LCY Government Bond Yields

Latest Closing 2.19 2.16 1.04 3.95 1.76 8.30 6.84 3.65 3.87 5.77 1.63 3.49 12.72 basis point change from Previous Previous 1-Jan-11* Day* Week* -3.87 12.76 12.76 -110.36 -2.90 5.20 -80.60 5.20 0.10 5.30 -8.50 5.30 0.00 1.00 4.00 1.00 -0.20 13.90 13.90 -109.90 3.90 6.50 3.90 38.40 -1.30 -10.10 -10.10 -76.40 0.80 -0.20 0.80 -39.30 3.00 3.00 3.00 -65.00 0.78 8.09 8.09 -12.01 4.00 0.00 4.00 -108.00 1.90 1.20 1.90 -23.20 17.70 96.70 14.60 17.70

Markets US EU Japan PRC Hong Kong, China India Indones ia Malays ia Korea, Rep. of Philippines Singapore Thailand Viet Nam

Close of 26 August 2011

Source: Based on data from Bloomberg, LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

Indonesia

.......

Benchmark Yield Curves Local Currency Government Bonds

Tip: Zoom-in on the table using the Acrobat zoom tool

China, Peoples Rep. of

4.25 4.00 3.75

Yield (%)

Yield (%)

Hong Kong, China

3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0

Yield (%)

12.0 11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 0 2 4 6 8 10 12 14 16 0 3 6 9 12 15 18 21 24 27 30 33

3.50 3.25 3.00 2.75 2.50 2.25 0 1 2 3 4 5 6 7 8 9 10 11 12

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Korea, Republic of

6.00 5.50 5.00

Yield (%)

Yield (%)

Malaysia

4.8 4.6 4.4 4.2 4.0 3.8 3.6 3.4 3.2 3.0 2.8 2.6 0 2 4 6 8 10 12 14 16 18 20 22 10.0 9.0 8.0 7.0

Yield (%)

Philippines

4.50 4.00 3.50 3.00 2.50 0 2 4 6 8 10 12 14 16 18 20 22

6.0 5.0 4.0 3.0 2.0 1.0 0.0 0 3 6 9 12 15 18 21 24 27

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Singapore

4.5

Thailand

13.0 4.3 4.0 3.8

Yield (%)

Viet Nam

3.5 3.0 2.5

Yield (%)

12.8

Yield (%)

3.5 3.3 3.0 2.8 2.5 2.3 2.0

2.0 1.5 1.0 0.5 0.0 0 3 6 9 12 15 18 21

12.5

12.3

12.0 0 2 4 6 8 10 12 14 16 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

US

5.0 4.5 4.0 3.5

Yield (%)

4.5 4.0 3.5 3.0

EU

2.5 2.3 2.0 1.8

Yield (%)

Japan

Yield (%)

3.0 2.5 2.0 1.5 1.0 0.5 0.0 0 4 8 12 16 20 24 28 32

2.5 2.0 1.5 1.0 0.5 0.0 0 5 10 15 20 25 30

1.5 1.3 1.0 0.8 0.5 0.3 0.0 0 4 8 12 16 20 24 28 32 36 40

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Time to maturity (years)

26-Aug-11 19-Aug-11 12-Aug-11

Source: Based on data from Bloomberg.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

2-versus-10 Yield Spread Chart

Tip: Zoom-in on the table using the Acrobat zoom tool

Yield Spread between the Two- and Ten-Year Government Bonds

China, People's Rep. of Hong Kong, China Indonesia Korea, Rep. of Malaysia Philippines Singapore Thailand Viet Nam U.S. E.U. Japan 0 50 100 150 200 basis points 250 300 350

26-Aug-11 19-Aug-11 12-Aug-11

Source: Based on data from Bloomberg LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

India

.......

Policy Rate versus Inflation Rate Charts

Tip: Zoom-in on the table using the Acrobat zoom tool

China, Peoples Rep. of

10 8 6 4 2 2 0 0 -2 -4 Jan-05 Sep-05 Jun-06 Mar-07 Dec-07 Aug-08 May-09 Feb-10 Nov-10 Aug-11 Inflation Rate -2 -4 1-year Lending Rate 6.56 6.50 8 6 4

Hong Kong, China

7.9 12 10 HKMA Base Rate Inflation Rate x 8 6 4 Inflation Rate 2 0 -2 Repurchase Cut-off Yield

9.22 8.00

0.5

Jan-05 Sep-05 Jun-06 Mar-07 Dec-07 Aug-08 May-09 Feb-10 Nov-10 Aug-11

Jan-05 Sep-05 Jun-06 Mar-07 Dec-07 Aug-08May-09 Feb-10 Nov-10 Aug-11

PRC uses 1-year lending rate as one of its policy rates. Source: Bloomberg LP.

The Hong Kong Monetary Authority maintains a Discount Window Base Rate. Source: Bloomberg LP.

The Reserve Bank of India uses the repurchase (repo) cutoff yield as its policy rate. Source: Bloomberg LP.

Indonesia

20 18 8

Korea, Republic of

10

c

Malaysia

8 6 4.70 4 2 0

16 14 12 10 8 6 4 2 0

BI Rate

7-Day Repo Rate

Overnight Policy Rate

3.40 3.00

4 3.25 6.75 4.61 Inflation Rate 0 Jan-05 Sep-05 Jun-06 Mar-07 Dec-07 Aug-08 May-09 Feb-10 Nov-10Aug-11 2 Inflation Rate

-2 -4

Inflation Rate

Jan-05 Sep-05Jun-06 Mar-07 Dec-07 Aug-08May-09 Feb-10 Nov-10 Aug-11

Jan-05 Sep-05 Jun-06 Mar-07 Dec-07Aug-08 May-09 Feb-10 Nov-10 Aug-11

Bank Indonesia uses its reference interest rate (BI rate) as its policy rate. Source: Bloomberg LP.

The Bank of Korea shifted its policy rate from the overnight repurchase (repo) rate to the 7-day repo rate in March 2008. Source: Bloomberg LP.

Bank Negara Malaysia uses the overnight policy rate (OPR) as its policy rate. Source: Bloomberg LP.

Philippines

12 10 8 6 5.10 4 2 0 Jan-05 Sep-05 Jun-06 Mar-07 Dec-07Aug-08 May-09 Feb-10 Nov-10 Aug-11 4.50 0 -2 Overnight Reverse Repo Rate 10 8 Inflation Rate 6

Thailand

30 Inflation Rate 27 24 21 4 2 1-Day Repo Rate 4.08 3.50 15 12 9 6 -4 -6 Jan-05 Sep-05 Jun-06 Mar-07 Dec-07 Aug-08May-09 Feb-10 Nov-10 Aug-11 3 0 18 Prime Lending Rate

Viet Nam

Inflation Rate 22.16

9.00

Jan-05 Sep-05 Jun-06 Mar-07 Dec-07Aug-08May-09Feb-10 Nov-10Aug-11

Bangko Sentral uses the Philippine overnight reverse repurchase agreement rate as one of its policy instruments. Source: Bloomberg LP.

The Bank of Thailand replaced the 14-day repurchase rate with the 1-day repurchase rate in January 2007 as its policy rate. Source: Bloomberg LP.

The State Bank of Viet Nam uses a benchmark prime lending rate as its policy rate. Source: Bloomberg LP.

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Credit Default Swap Spreads & Exchange Rate Indexes

Tip: Zoom-in on the table using the Acrobat zoom tool

Credit Default Swap Spreads - Senior 5-year*

1,400

C hina , P e ople 's R e p. of

H ong K ong, C hina

1,200

Indone s ia

K ore a , R e p. of

1,000

Mid spread in basis points

J a pa n

M a la ys ia

800

P hilippine s

600

Tha ila nd

400

200

* In USD currency and based on sovereign bonds Source: Thomson Reuters

0 Dec-07 Ju n -08 No v-08 M ay-09 O ct-09 M ar-10 S ep -10 F eb -11 Au g -11

Exchange Rate Indexes (vis--vis US$, 2 January 2007=100)

130 130

China , P e ople 's R e p. of

Indone s ia

120

120

Ma la ys ia

P hilippine s

110

110

Tha ila nd

100

100

S inga pore

Kore a , Re p. of

90

90

V ie t N a m

80

80

70

70

60

60

Source: ADB-OREI staff calculations based on Bloomberg data.

50 Jan - 07 A u g -07 A p r-08 D ec-08 A u g -09 A p r- 10 D ec-10 A u g - 11

50

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

Selected Debt Security Issuances (22 26 August 2011)

Tip: Zoom-in on the table using the Acrobat zoom tool

Mark ets

PRC

A u c tio n D ate

23-Aug 24-Aug 25-Aug

T y p e o f S ec u rity

1-year PBOC Notes 7-year China Government Bonds 3-month PBOC Notes 91-day Exchange Fund Bills 182-day Exchange Fund Bills 15-year Exchange Fund Notes

A v erag e C o u p o n A m o u n t O ffered A m o u n t Is s u ed (in % ) Y ield (% ) L C Y B illio n s L C Y B illio n s

3.58 3.70 3.16 0.10 0.11 2.01 4.15 8.35 0.10 1.86 3.35 3.53 3.94 2.92 2.88 2.90 2.92 2.91 2.89 0.98 1.00 1.50 0.06 3.26 3.38 3.46 1.80 2.07 3.00 30.00 3.00 25.29 8.00 0.60 1,000.00 4,800.00 1,100.00 1,000.00 1,000.00 800.00 2.00 1.50 2.00 2.00 2.00 2.00 2.00 3.00 4.00 3.90 15.00 18.00 15.00 3.00 30.00 3.00 25.29 8.00 0.60 330.00 500.00 4,759.89 1,099.10 1,000.00 1,010.00 808.00 2.00 1.50 2.00 1.50 2.00 2.00 2.80 3.00 4.00 3.90 12.39 18.00 15.00

HK

23-Aug

ID JP KR

23-Aug 24-Aug 25-Aug 22-Aug

6-month Islamic Treasury Bills 25-year Islamic Treasury Bonds 3-month Treasury Discount Bills 20-year Japan Government Bonds 91-day Monetary Stabilization Bonds 1-year Monetary Stabilization Bonds 20-year Treasury Bonds

MY

22-Aug

86-day BNM Islamic Notes 168-day BNM Notes 364-day BNM Notes

24-Aug

56-day BNM Islamic Notes 82-day BNM Notes 210-day BNM Notes

PH

22-Aug

91-day Treasury Bills 182-day Treasury Bills 364-day Treasury Bills

SG TH

22-Aug 23-Aug

91-day Treasury Bills 28-day BOT Bills 91-day BOT Bills 182-day BOT Bills

Sources:LocalmarketsourcesandBloomberg,LP.

10

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

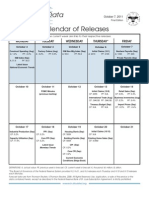

Selected Asia Data Releases (30 August 5 September 2011)

Tip: Zoom-in on the table using the Acrobat zoom tool

C o u n tr y / a r ia b le V

Japan Joble s s Rate y-o-y, % JUL Japan Indus tr ial Pr oduction y-o-y, % JUL Philippine s Re al GDP y-o-y, % 2Q11 Thailand Expor ts y-o-y, % JUL Indone s ia CPI y-o-y, % A UG Re public of Kore a CPI y-o-y, % A UG Re public of Kore a Exports y-o-y, % A UG Thailand CPI y-o-y, % A UG Pe ople s Re public of China PM I M anufactur ing Index A UG Japan M one tary Bas e y-o-y, % A UG Hong Kong, China Pur chas ing M anage rs Inde x Index A UG Indone s ia Exports y-o-y, % A UG Singapor e Pur chas ing M anage rs Inde x Index A UG

R e le a s e D a te

08/30

H is to r ic a l D a ta

06/10: 5.2% 07/10: 5.1% 05/11: 4.5% 06/11: 4.6% 06/10: 16.6% 07/10: 14.6% 05/11: 5.5% 06/11: 1.7% 1Q10: 8.4% 2Q10: 8.9% 4Q10: 6.1% 1Q11: 4.9% 06/10: 47.1% 07/10: 21.1% 05/11: 17.3% 06/11: 16.4% 07/10: 6.2% 08/10: 6.4% 06/11: 5.5% 07/11: 4.6% 07/10: 2.6% 08/10: 2.6% 06/11: 4.4% 07/11: 4.7% 07/10: 26.7% 08/10: 26.0% 06/11: 11.2% 07/11: 25.2% 07/10: 3.4% 08/10: 3.3% 06/11: 4.06% 07/11: 4.08% 07/10: 51.2 08/10: 51.7 06/11: 50.9 07/11: 50.7 07/10: 6.1% 08/10: 5.4% 06/11: 17.0% 07/11: 15.0% 07/10: 51.3 08/10: 52.3 06/11: 50.3 07/11: 51.4 06/10: 31.4% 07/10: 28.9% 05/11: 44.9% 06/11: 49.3% 07/10: 52.2 08/10: 49.4 06/11: 50.4 07/11: 49.3

R ec en t T ren d s

The unemployment rate in Japan climbed to 4.6% year-on-year (y-o-y) in June f rom 4.5% in May.

08/31

Japans industrial production contracted 1.7% y-o-y in Junean improvement f rom the 5.5% decline in May.

08/31

Grow th in the Philippines gross domestic product (GDP) slow ed to 4.9% y-o-y in 1Q11 f rom 6.1% in 4Q10.

08/31

Thailands export grow th rate slow ed to a 20-month low of 16.4% y-o-y in June f ollow ing 17.3% grow th in May.

09/01

Consumer price inf lation in Indonesia eased f or a sixth consecutive month in July to 4.6% y-o-y.

09/01

Consumer price inf lation in the Republic of Korea accelerated to 4.7% y-o-y in July f rom 4.4% in June.

09/01

The export grow th rate of the Republic of Korea surged to 25.2% y-o-y in July f rom 11.2% in the previous month.

09/01

Thailands consumer price inf lation rose marginally to 4.08% y-o-y in July af ter posting 4.06% in June.

09/01

The manuf acturing purchasing managers index (PMI) in the Peoples Republic of China f ell slightly to 50.7 points in July f rom 50.9 points in June.

09/02

Japans monetary base grew 15.0% y-o-y in July, dow n slightly f rom grow th in June of 17.0%.

09/05

Hong Kong, Chinas PMI rose to 51.4 points in July f rom 50.3 in June.

09/05

Exports f rom Indonesia grew 49.3% y-o-y to USD18.4 billion in June af ter rising 44.9% in May.

09/05

Singapores PMI f ell to 49.3 points in July f rom 50.4 in June.

Source: AsianBondsOnline, Bloomberg LP, and Reuters.

11

ASIANBONDSONLINE

asianbondsonline.adb.org

DEBT HIGHLIGHTS

.......

News Articles: Sources for Further Reading

Tip: Click on link to open a new browser (Acrobat Reader 8); for lower versions right-click to open a new browser) Consumer Price Inflation Accelerates in Hong Kong, China; Japan; Singapore; and Viet Nam Consumer price indices for July 2011 Census and Statistics Department (22 August 2011) UPDATE 1-Japan CPI rises slightly but deflation to persist Reuters (25 August 2011) Singapore Consumer Price Index Singapore Department of Statistics (23 August 2011) Consumer price index, gold and USD price indexes, July 2011 General Statistics Office of Vietnam (23 August 2011) Vietnam's August CPI increases 0.93pct Intellasia (24 August 2011) Issuance in the Republic of Korea, Malaysia, Philippines, and Thailand Low rates lure Malaysian utilities back to bonds Reuters (24 August 2011) UCPB raises P3.15B from LTNCD issuance Philippine Star (24 August 2011) Data for KT Corp and Thailand's Quality Houses and State Railway of Thailand were extracted from Bloomberg terminal.

Thailand Raises Repurchase Rate 25 bps to 3.5% Monetary Policy Committee's Decision on 24 August 2011 Bank of Thailand (24 August 2011)

Japan Credit Rating Agency Affirms Indonesia's BBBRating; Moody's Lowers Japan's Credit Rating to Aa3; S&P Affirms AAA Credit Rating for Singapore Japan Credit Rating Agency , Ltd (JCR) Affirm Indonesia Sovereign Rating Bank Indonesia (24 August 2011) Moody's lowers Japan's government rating to Aa3; outlook stable Moody's (24 August 2011) S&P affirms 'AAA' credit rating for S'pore govt debt Channel News Asia (25 August 2011)

PBOC's Cross-Border Trade Renminbi Settlement Program Expands Nationwide China expands cross-border trade RMB settlement to whole nation China Knowledge (25 August 2011)

Republic of Korea's External Debt Rises to USD398 Billion in June, Household Loans Climb 8.7% in 2Q11, CDS Premiums Surge and Consumer Confidence Falls in August International Investment Position (end of June 2011) The Bank of Korea (23 August 2011) Household Credit in Q2 2011 The Bank of Korea (22 August 2011) S. Korea's CDS Premium Hits 15-Month High YONHAP News (25 August 2011) Consumer Survey Index, August 2011 The Bank of Korea (25 August 2011) Analysis of Direct Corporate Financing for July 2011 Financial Supervisory Service (23 August 2011)

12

Disclaimer: AsianBondsOnline Newsletter is available to users free of charge. The ADB provides no warranty or undertaking of any kind in respect to the information and materials found on, or linked to, AsianBondsOnline Newsletter. The ADB accepts no responsibility for the accuracy of the material posted or linked to the publication, or the information contained therein, or for any consequences arising from its use and does not invite or accept reliance being placed on any materials or information so provided. Views expressed in articles marked with AsianBondsOnline are those of the authors, and not ADB. This disclaimer does not derogate from, and is in addition to, the general terms and conditions regarding the use of the AsianBondsOnline Web Site, which also apply.

Você também pode gostar

- Asian Weekly Debt HighlightsDocumento12 páginasAsian Weekly Debt Highlightsrryan123123Ainda não há avaliações

- Asian Development Bank - Weekly HighlightsDocumento13 páginasAsian Development Bank - Weekly Highlightsrryan123123Ainda não há avaliações

- Asia Bonds - Debt Highlights - August 08, 2011Documento12 páginasAsia Bonds - Debt Highlights - August 08, 2011rryan123123Ainda não há avaliações

- Asian Development Bank - Weekly Debt HighlightsDocumento13 páginasAsian Development Bank - Weekly Debt Highlightsrryan123123Ainda não há avaliações

- Asian Bonds - Weekly Debt HighlightsDocumento12 páginasAsian Bonds - Weekly Debt Highlightsrryan123123Ainda não há avaliações

- Asia Bonds Weekly Highlights - August 15, 2011Documento12 páginasAsia Bonds Weekly Highlights - August 15, 2011rryan123123Ainda não há avaliações

- Asian Weekly Debt Highlights - September 05, 2011Documento12 páginasAsian Weekly Debt Highlights - September 05, 2011rryan123123Ainda não há avaliações

- Asia - Weekly Debt HighlightsDocumento13 páginasAsia - Weekly Debt Highlightsrryan123123Ainda não há avaliações

- Asian Bonds - Weekly Debt HightlightsDocumento11 páginasAsian Bonds - Weekly Debt Hightlightsrryan123123Ainda não há avaliações

- Viet Nam-Update: Yield MovementsDocumento3 páginasViet Nam-Update: Yield Movementscrazyfrog1991Ainda não há avaliações

- VOF VNL VNI: Capital MarketsDocumento6 páginasVOF VNL VNI: Capital Marketsflocke2Ainda não há avaliações

- Main Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationDocumento5 páginasMain Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationUrtaBaasanjargalAinda não há avaliações

- Bandhan Debt-Market-Monthly-Outlook-Nov-2023Documento3 páginasBandhan Debt-Market-Monthly-Outlook-Nov-2023Shivani NirmalAinda não há avaliações

- Vietnam Endofcreditcrunch 10092013 AsDocumento9 páginasVietnam Endofcreditcrunch 10092013 AsabbdealsAinda não há avaliações

- Daily Report 20141125Documento3 páginasDaily Report 20141125Joseph DavidsonAinda não há avaliações

- BIDV - Vietnam Stock Market 2009Documento39 páginasBIDV - Vietnam Stock Market 2009Nhàn PhanAinda não há avaliações

- VN Market Summary 201403Documento3 páginasVN Market Summary 201403Giang Khả LinhAinda não há avaliações

- LinkDocumento12 páginasLinkManali KambleAinda não há avaliações

- Study of Macroeconomic Policies and Their Impact On Major Macro-Indicators of ChinaDocumento10 páginasStudy of Macroeconomic Policies and Their Impact On Major Macro-Indicators of ChinaRatnesh MishraAinda não há avaliações

- The World Economy ... - 11/03/2010Documento2 páginasThe World Economy ... - 11/03/2010Rhb InvestAinda não há avaliações

- IR Apirl2011Documento92 páginasIR Apirl2011Nat UdomlertsakulAinda não há avaliações

- Eadlines: Saturday, September 24, 2011Documento16 páginasEadlines: Saturday, September 24, 2011Seema GusainAinda não há avaliações

- Employment Trends Survey - MaFoi Consultancy 2011Documento24 páginasEmployment Trends Survey - MaFoi Consultancy 2011MTC Global TrustAinda não há avaliações

- Employment Trends Survey: Ma Foi RandstadDocumento24 páginasEmployment Trends Survey: Ma Foi RandstadNavneet GuptaAinda não há avaliações

- The World Economy - 12/03/2010Documento2 páginasThe World Economy - 12/03/2010Rhb InvestAinda não há avaliações

- News 11th Jul 2008Documento3 páginasNews 11th Jul 2008DeepakJadhavAinda não há avaliações

- Key Indices 30-Sep-11 31-Aug-11 % Change: FII MFDocumento30 páginasKey Indices 30-Sep-11 31-Aug-11 % Change: FII MFshah_aditkAinda não há avaliações

- CPI, Dec 2011: MalaysiaDocumento7 páginasCPI, Dec 2011: Malaysiamhaidar_6Ainda não há avaliações

- The World Economy... - 11/6/2010Documento3 páginasThe World Economy... - 11/6/2010Rhb InvestAinda não há avaliações

- The World Economy - 29/06/2010Documento2 páginasThe World Economy - 29/06/2010Rhb InvestAinda não há avaliações

- Principles of Management - Group 3Documento6 páginasPrinciples of Management - Group 3dgtk1604Ainda não há avaliações

- The World Economy... - 31/5/2010world 20100531Documento2 páginasThe World Economy... - 31/5/2010world 20100531Rhb InvestAinda não há avaliações

- Conomic: The Impending Signs of Global UncertaintyDocumento16 páginasConomic: The Impending Signs of Global UncertaintyS GAinda não há avaliações

- China Monetary Policy Report Quarter Four, 2008: (February 23, 2009)Documento60 páginasChina Monetary Policy Report Quarter Four, 2008: (February 23, 2009)mavvenAinda não há avaliações

- An Smu Economics Intelligence Club ProductionDocumento14 páginasAn Smu Economics Intelligence Club ProductionSMU Political-Economics Exchange (SPEX)Ainda não há avaliações

- Vietnam Outlook 5-17-2011Documento5 páginasVietnam Outlook 5-17-2011Thao Nhu HoAinda não há avaliações

- The World Economy... - 01/04/2010Documento3 páginasThe World Economy... - 01/04/2010Rhb InvestAinda não há avaliações

- Total E Oct08Documento76 páginasTotal E Oct08Tien DangAinda não há avaliações

- WeeklyDocumento16 páginasWeeklySeema GusainAinda não há avaliações

- ScotiaBank JUL 16 Asia - Oceania Weekly OutlookDocumento3 páginasScotiaBank JUL 16 Asia - Oceania Weekly OutlookMiir ViirAinda não há avaliações

- The World Economy - 08/03/2010Documento3 páginasThe World Economy - 08/03/2010Rhb InvestAinda não há avaliações

- The World Economy... - 20/08/2010Documento3 páginasThe World Economy... - 20/08/2010Rhb InvestAinda não há avaliações

- Key Developments in Asian Local Currency Markets: Asia Bond Monitor March 2010 Read MoreDocumento12 páginasKey Developments in Asian Local Currency Markets: Asia Bond Monitor March 2010 Read Moreapi-26045138Ainda não há avaliações

- Fundamentals Dec 2014Documento40 páginasFundamentals Dec 2014Yew Toh TatAinda não há avaliações

- Major Developments: December 2011Documento9 páginasMajor Developments: December 2011Kajal SarkarAinda não há avaliações

- Hong Kong 2011 Economic OutlookDocumento11 páginasHong Kong 2011 Economic OutlookKwok TaiAinda não há avaliações

- Tracking The World Economy.... - 01/10/2010Documento3 páginasTracking The World Economy.... - 01/10/2010Rhb InvestAinda não há avaliações

- Current Macroeconomic SituationDocumento9 páginasCurrent Macroeconomic SituationMonkey.D. LuffyAinda não há avaliações

- Case StudyDocumento16 páginasCase StudyDisha PuriAinda não há avaliações

- OPEC - Monthly Oil Market ReportDocumento75 páginasOPEC - Monthly Oil Market Reportrryan123123Ainda não há avaliações

- Monthly Monetary Trends (St. Louis Fed)Documento20 páginasMonthly Monetary Trends (St. Louis Fed)rryan123123Ainda não há avaliações

- IEA - Monthly Oil Market ReportDocumento67 páginasIEA - Monthly Oil Market Reportrryan123123Ainda não há avaliações

- FullDocumento65 páginasFullAraldqAinda não há avaliações

- R qt1112Documento93 páginasR qt1112Lyubomir SirkovAinda não há avaliações

- Asia - Weekly Debt HighlightsDocumento13 páginasAsia - Weekly Debt Highlightsrryan123123Ainda não há avaliações

- European Comission 2011 6 enDocumento248 páginasEuropean Comission 2011 6 enEGUVAinda não há avaliações

- EIA - Short Term Energy OutlookDocumento43 páginasEIA - Short Term Energy Outlookrryan123123Ainda não há avaliações

- US Financial Data Weekly - St. Louis FedDocumento24 páginasUS Financial Data Weekly - St. Louis Fedrryan123123Ainda não há avaliações

- Swiss National Bank Quarterly Bulletin - September 2011Documento54 páginasSwiss National Bank Quarterly Bulletin - September 2011rryan123123Ainda não há avaliações

- Bank of International Settlements Quorterly Review, September 2011 - Public DocumentDocumento74 páginasBank of International Settlements Quorterly Review, September 2011 - Public DocumentARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanAinda não há avaliações

- Asian Bonds - Weekly Debt HightlightsDocumento11 páginasAsian Bonds - Weekly Debt Hightlightsrryan123123Ainda não há avaliações

- CreditMetrics (Technical Document) 1Documento106 páginasCreditMetrics (Technical Document) 1Angel Gutiérrez ChambiAinda não há avaliações

- Chapter 4 Credit Risk PDFDocumento53 páginasChapter 4 Credit Risk PDFSyai GenjAinda não há avaliações

- Prospectus Sidomuncul 2013Documento384 páginasProspectus Sidomuncul 2013JarjitUpinIpinJarjit100% (1)

- Moodys Impuesto TamaulipasDocumento5 páginasMoodys Impuesto TamaulipasPedro Mentado100% (1)

- Hutchison Whampoa Case ReportDocumento6 páginasHutchison Whampoa Case ReporttsjakabAinda não há avaliações

- The Credit Rating Agencies of Bangladesh and Around The World and Their FunctionDocumento6 páginasThe Credit Rating Agencies of Bangladesh and Around The World and Their FunctionMd. Mustafezur Rahaman BhuiyanAinda não há avaliações

- Chapter 09 PPT - Holthausen & Zmijewski 2019Documento103 páginasChapter 09 PPT - Holthausen & Zmijewski 2019royAinda não há avaliações

- American Bar Association Members, OPERATING NORTHERN TRUSTDocumento152 páginasAmerican Bar Association Members, OPERATING NORTHERN TRUSTDUTCH551400Ainda não há avaliações

- FIN625 SovedMCQsLesson145Documento48 páginasFIN625 SovedMCQsLesson145adeelali849714Ainda não há avaliações

- Nikil Kapoor 1 - For MergeDocumento76 páginasNikil Kapoor 1 - For MergeNikhil KapoorAinda não há avaliações

- Wa0000 (1) 2 2Documento112 páginasWa0000 (1) 2 2Aisha rashidAinda não há avaliações

- Topic: Credit Rating Agencies Section: H and I Year: 3 RD, 6 SemesterDocumento29 páginasTopic: Credit Rating Agencies Section: H and I Year: 3 RD, 6 SemesterShama parbinAinda não há avaliações

- Retail Banking at HDFC BankDocumento59 páginasRetail Banking at HDFC BankHardip MatholiyaAinda não há avaliações

- Case BBBYDocumento7 páginasCase BBBYgregordejong100% (1)

- Public Asset ManagementDocumento294 páginasPublic Asset ManagementyudisantosoAinda não há avaliações

- 1G - NR Ma'am - TELUS CorporationDocumento13 páginas1G - NR Ma'am - TELUS CorporationAkash GuptaAinda não há avaliações

- Risk Management Practices of Conventional and Islamic Banks in BahrainDocumento26 páginasRisk Management Practices of Conventional and Islamic Banks in BahrainRaudah HalimAinda não há avaliações

- Business Terms and GlossaryDocumento31 páginasBusiness Terms and GlossaryRavi ManiyarAinda não há avaliações

- US Debt CeilingDocumento4 páginasUS Debt CeilingHEYAinda não há avaliações

- Lecture 3 Overview of Bond Sectors and InstrumentsDocumento98 páginasLecture 3 Overview of Bond Sectors and InstrumentsAsadAinda não há avaliações

- Lecture 4 - The Term Structure of Interest RatesDocumento14 páginasLecture 4 - The Term Structure of Interest RatesDung ThùyAinda não há avaliações

- Moody's Investor DayDocumento44 páginasMoody's Investor Daymaxbg91Ainda não há avaliações

- FI CB PrivateCBListDocumento2 páginasFI CB PrivateCBListSao_bienAinda não há avaliações

- 2023 12 23current - PDFDocumento14 páginas2023 12 23current - PDFvanshikaarya3101Ainda não há avaliações

- CREDIT RISK GRADING MANUAL BangladeshDocumento45 páginasCREDIT RISK GRADING MANUAL BangladeshIstiak Ahmed100% (1)

- Venture Capital and Credit RatingDocumento25 páginasVenture Capital and Credit RatingMinhaz AlamAinda não há avaliações

- Dhaka Bank LTD - 2009Documento4 páginasDhaka Bank LTD - 2009Sagor SahabuddinAinda não há avaliações

- Bolt Jun 201598705281117 PDFDocumento113 páginasBolt Jun 201598705281117 PDFaaryangargAinda não há avaliações

- Banking Awareness PDFDocumento4 páginasBanking Awareness PDFhemanthpeekaAinda não há avaliações

- Credit Rating of BanksDocumento3 páginasCredit Rating of BankshinaAinda não há avaliações