Escolar Documentos

Profissional Documentos

Cultura Documentos

The Brazil Energy Market Report

Enviado por

Zorge77Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The Brazil Energy Market Report

Enviado por

Zorge77Direitos autorais:

Formatos disponíveis

The Brazil Oil and Gas Sector

Introduction

This report on the Brazil Oil and Gas Sector begins with a summary of Brazil's important social, political and economic characteristics and their impact on the energy sector, which must be considered by private investors. The report then identifies potential barriers and uncertainties affecting the energy industry as well as the Brazilian government's position on deregulation. This report:

Describes the main features of the Brazilian energy environment as well as reviewing existing opportunities and the remaining barriers to private investment Considers the balance of risks and opportunities in the country, looking at economic and political developments, as well as summarizing the potential for the demand and supply of different energy sources and their effect on the future for energy investors Recognizes Brazil's central role in regional activities Analyzes the relationship between Brazil and other countries in the Southern Cone of South America, as well as Brazil's increasing role in the global energy industry and its impact on the environment Summarizes the questions frequently asked of the Brazilian National Petroleum Agency and tries to identify the government's position on energy deregulation and other aspects of the country's energy industry.

The report concludes with the present situation of the Brazilian energy industry and makes some projections for its future development.

Published December 2001, 185 Pages Available for $1195 USD Acrobat/PDF version, $895 USD in print

Phone : +1 202 337 2627 Phone : +1 202 337 2860 Email: services@emerging-markets.com

1

http://www.emerging-markets.com

The Brazil Oil and Gas Sector Executive Summary

This report begins with a summary of Brazil's important social, political and economic characteristics and their impact on the energy sector, all of which must be considered by private investors. The report identifies potential barriers to entry and uncertainties affecting the energy industry as well as reviewing the Brazilian government's position on energy deregulation and other issues. It describes the present situation of the Brazilian energy industry and makes some projections for its future development. Since 1997, when Brazil started the process of opening up its oil and gas industry, then a national monopoly, the country has been developing a reputation as an attractive place for foreign investment. This process followed the stabilization of Brazilian inflation, achieved through a broad macroeconomic programmed, the Real Plan of 1994, and the consolidation of Brazil's new democracy. The new political and economic landscape tempted foreign investors back to the country and opened it up for globalization. Brazil offers a well-developed infrastructure, considerable potential for increasing energy demand, a reasonable command of leading technologies and a continuing deregulation process, which together create an interesting climate for energy investment and activities. The deregulation process is not evenly spread over the whole energy sector. While some areas have opened up faster and have already attracted private capital - both foreign and national there are still segments where state owned companies maintain a strong presence, competition is absent and it is difficult for Brazil to bring in private investors because of the lack of an appropriate regulatory framework. As a result of the lack of investment, energy supply has been tightening up and major energy disruptions are threatened. In 2001 the electricity sector was the first to suffer such disarray, with important economic, political and social consequences. The old, centralized, self-sufficient and nationalistic model for electricity supply was exhausted, while new opportunities were springing up for enthusiastic investors eager to take risks in a large, emerging country. New energy supply alternatives will materialize as Brazil inexorably dives into ultra-deepwaters for offshore oil and natural gas production. Energy integration with neighboring countries such as Argentina, Bolivia or Venezuela also creates new options for gas and electricity supply. The speeding up of gas/electricity convergence is likely to be the major outcome from the electricity shortage in 2001. Brazil may anticipate the introduction of new technologies for distributed energy generation with growing efficiency and flexibility. The country will also review the role of renewable energies as biomass, solar and wind become more competitive choices. A diversified mix of opportunities is available for investors, whether they are small or large, traditional or

Phone : +1 202 337 2627 Phone : +1 202 337 2860 Email: services emerging-markets.com @

2

http://www.emerging-markets.com

creative. Energy demand is expected to keep growing at a high rate as the country's economy recovers, increasing the impact of energy deficiencies. Consequently, risks as well as opportunities may increase and Brazil will probably become even more attractive to investors with a broad, strategic perception of the energy business. This report describes the main features of the Brazilian energy environment as well as reviewing existing opportunities and the remaining barriers to private investment. It considers the balance of risks and opportunities in the country, looking at economic and political developments, as well as summarizing the potential for the demand and supply of different energy sources and their effect on the future for energy investors. Although this report focuses on Brazil, it recognizes that Brazil is likely to play a central role in regional energy activities and thus analyses the relationship between Brazil and other countries in the Southern Cone of South America, as well as Brazil's increasing role in the global energy industry and its impact on the environment. Finally, this report summarizes the questions frequently asked of the Brazilian National Petroleum Agency and tries to identify the government's position on energy deregulation and other aspects of the country's energy industry.

Phone : +1 202 337 2627 Phone : +1 202 337 2860 Email: services@emerging-markets.com

3

http://www.emerging-markets.com

The Brazil Oil and Gas Sector Table of Contents

Executive Summary

Chapter 1: The Economic, Social and Political Situation

Brazil's history and population mix History Population Figure 1.1: Population, 1500-2000 Table 1.1: Population by state, 1996 and 2000 Figure 1.2: Population share and annual growth rate by state, 1996-2000 Table 1.2: Population share of the states and their capitals, 2000 Political and economic framework The political outlook Table 1.3: Final results of the 2000 municipal elections Table 1.4: Growth of the Labor Party, 1996-2000 The abuse of provisory instruments Power shortage Outcome of the 2002 election Table 1.5: Elections in Latin America, 2001-06 The economic outlook Table 1.6: Social data, 1993 and 2000 Table 1.7: Economic data, 1993 and 2000 Table 1.8: Economic growth, 2000-01 Table 1.9: Sources of external capital in emerging countries, 1999-2001

Phone : +1 202 337 2627 Phone : +1 202 337 2860 Email: services@emerging-markets.com

4

http://www.emerging-markets.com

Chapter 2: The Energy Outlook

The energy balance Figure 2.1: Total primary energy supply by fuel type, 1940-1998 Figure 2.2: Total primary energy supply by fuel type, international data, 1970-2020 Figure 2.3: Electricity generation by fuel type, 1995-2000 Renewable resources Coal Nuclear power Hydroelectricity and the electricity shortage Figure 2.4: Medium capacity factor in the hydroelectricity system, 1970-1990 Table 2.1: Elasticity of energy use, 1970-1999 Table 2.2: Growth in electricity consumption, electricity supply and GDP, 1970-2004 Figure 2.5: Water levels in the south, south-east and mid-west regions, 1997-2001 Figure 2.6: Water levels in the north-east and mid-west regions, 1997-2001 Figure 2.7: Water levels in the north region, 1997-2001 Figure 2.8: Water levels in the south region, 1997-2001 Figure 2.9: Medium capacity factor in the hydroelectricity system, 1970-2000 Table 2.3: Installed and required generation capacity, 1990-2000 Privatization

Chapter 3: The Oil Outlook

History of the oil industry Nationalization The birth of a major upstream operator Table 3.1: The development of Petrobras as a downstream company, 1955-1975 Table 3.2: Petrobras's downstream achievements, 1975-1998 The development of a prolific world class oil basin Figure 3.1: The evolution of proven natural gas reserves, 1938-2000 Table 3.3: Main fields in the Campos basin Changes in the regulatory environment The National Petroleum Agency Upstream activities Downstream activities

Phone : +1 202 337 2627 Phone : +1 202 337 2860 Email: services@emerging-markets.com

5

http://www.emerging-markets.com

Chapter 4: The Gas Outlook

The history of gas use in Brazil Regional market Figure 4.1: Proven natural gas reserves, 1970-2000 Figure 4.2: Natural gas production, 1970-2000 Figure 4.3: Gas imports from Bolivia and Argentina, 1999-2001 Table 4.1: Probable natural gas transport pipeline projects Figure 4.4: Prospects for gas infrastructure development in the Southern Cone Gas-fired power generation The Gas-Fired Priority Power Generation Plan Figure 4.5: Gas-Fired Priority Power Generation Plan, 2000-03 (north and north-east) Figure 4.6: Gas-Fired Priority Power Generation Plan, 2000-03 (south, south-east and mid-west) Gas versus hydropower The decentralized use of gas Table 4.2: Sales of natural gas by segment, May 2001 Figure 4.7: Natural gas transportation infrastructure, July 2001 Figure 4.8: Technology content in Brazilian industry Figure 4.9: Natural gas regulation in Brazil

Chapter 5: Conclusions

Phone : +1 202 337 2627 Phone : +1 202 337 2627 Email: services@emerging-markets.com

6

http://www.emerging-markets.com

Who Should Buy This Report?

This report is essential reading for those who are interested in an insight into Brazil's energy sector. Professor Edmilson Moutinho dos Santos provides fresh views and in depth contribution to the understanding of the country in terms of:

Population trends Political perspectives and risk appraisal Oil reserves data and energy consumption figures Past and present macroeconomic stabilization measures - the external dependence of the Brazilian economy and the need for further reforms

The Brazilian oil and gas sector in the context of the global industry The potential for growth and key investment prospects but warns of the numerous pitfalls that are ahead

The impact of current economic, political and legal issues on the future development of the sector and the effect on the investment climate

Current and projected upstream and downstream activity Projected market trends.

The report, published in an easy to use format, is essential reading for:

Oil and gas exploration and production companies Government and regulatory organizations Risk managers Project finance specialists Equipment manufacturers and suppliers Investment banks Specialist advisors, including law firms, management consultants and consulting engineers Firms offering energy services.

Phone : +1 202 337 2627 Phone : +1 202 337 2627 Email: services@emerging-markets.com

7

http://www.emerging-markets.com

Order Form The Brazil Oil and Gas Sector

To order, select an electronic or print version of the report below and fax this form to +1 713 349 8380

Formats Available

Electronic Version in PDF Acrobat (available within 24hrs) [ ] Single User License [ ] Unlimited User License Print Version (allow 5-10 days delivery) [ ] Print Version

$1195 USD $3950 USD

$895 USD

Deliver to

Name ___________________________________ Position_______________________________________

Organization _____________________________________________________________________________ Address _________________________________________________________________________________ City _____________________________________ Postal Code_______________________________ Phone: __________________________________ State/Province_________________________________ Country_______________________________________ Fax: _________________________________________

Email: ___________________________________________________________________

Payment Method [ ] Credit Card:

[ ] AMEX [ ] MC [ ] VISA

Card Number_____________________________________________ Expiration _______________ Name on Card _______________________________ Signature _____________________________

[ ] Bank Transfer Information:

Emerging Markets Online Citibank: Account Number 6672-9361 Routing (ABA) Number: 2540-7011-6

Citibank NW Washington, DC Branch

[ ] By Check:

Make Checks Payable to: Emerging Markets Online 7171 Buffalo Speedway #632 Houston, TX 77025 USA

Phone : +1 202 337 2627 Fax: +1202 337 2860 Email: services@emerging-markets.com

8

http://www.emerging-markets.com

Contact Info Update

Since this document was published, Emerging Markets Online has moved. Please refer to the following contact details to call, email of fax

TEL: +1 202 337 2627 (Washington, DC) FAX +1 202 742 2813

EMAIL: services @emerging-markets.com

MAILING ADDRESS:

Emerging Markets Online 4858 Macarthur Blvd NW #202 Washington, DC 20007 USA

1

Phone : +1 202 337 2627 Fax: +1 202 742 2813 Email: services@emerging-markets.com

4858 Macarthur Blvd NW #202 Washington, DC 20007 USA http://www.emerging-markets.com

Customized Consulting Services

Introduction

Emerging Markets Online specializes in market research support for international business development executives.

Emerging Markets Online (EMO) provides customized market research and consulting services for the energy, telecommunications and utilities sectors worldwide. EMO specializes in providing each customer with personalized market research and business development support. Our global team of consultants specializes in management consulting, marketing and distribution strategies, project finance, tender and bid support, supplier strategies, and partner facilitation.

Research and Consulting Services

When you are preparing for a specific project, EMO's team can help. We will work with you to identify and assess emerging market opportunities and challenges. EMO helps clients to: Develop research initiatives with direct surveys of markets, competitors, prospective suppliers and government regulatory and procurement entities;

Emerging Markets Online provides targeted research solutions to help you reach your business development goals.

Perform due diligence and investigative research on specific companies; Identify new business opportunities in regional and local markets; Facilitate Joint Venture activities and identify prospective partners; Provide assessments of sales and distribution channels; Track competitors activities; Forecast market growth potential for products and services; Analyze new trends in the industry; Acquire strategic information on utility markets deregulation, liberalization and privatization initiatives; Develop strategies for competitive tenders and bidding scenarios For more information, send a Request for Proposal with your specific information requirements, scope of work, and deadline to services@emerging-markets.com

Emerging Markets Online Phone: +1 202 337 2627 Fax: +1 202 742 2813

Email: services@ Emerging-markets.com Online: www.emerging-markets.com

Customized Consulting Services

Recent Consulting Projects

Emerging Markets Online helps clients achieve project research requirements within budget, and on time.

EMO has helped dozens of clients worldwide assess emerging market challenges and identify new growth opportunities. Here are a few examples of recent projects EMO has completed for our clients: EMO advised the M&A director for a major multinational E&P corporation on how current LNG projects are structured and financed. This included an analysis of the mix of private finance, commercial finance, ECA and multilateral finance, and engineering finance in current projects. The assignment included a matrix of how current LNG projects are financed by participant and percentage. EMO also provided details of how key LNG projects were structured and financed in Egypt, Trinidad, Qatar, Oman, Baja Mexico, and Nigeria. Finally, we identified three major trends in the financing of LNG projects. Consulted a major Russian oil and gas company on the practices of U.S. refinery operating companies. Performed a survey of refinery companies, detailing management practices, investment and purchasing activities, refinery manager roles and responsibilities, and downstream operations. Produced a report of recommendations for applying western practices in refinery management and operations to Russian firm. Supported a major law firm with an in-depth assessment of South Africa's natural gas market. Produced a survey and a report of key players, existing operations, exploration activities, pipeline developments, major contracts, pricing mechanisms, and the outlook for downstream natural gas markets Consulted a major U.S. pipeline company in its transition from an energy utility to a broadband telecom services and trading company. Activities include due diligence, competitor assessments, supplier surveys, and regulatory analysis. Produced a due diligence assessment on a major electric and natural gas company's operations in Latin America

Emerging Markets Online specializes in market research support for international business development executives.

Emerging Markets Online Phone: +1 202 337 2627 Fax: +1 202 742 2813

Created a market assessment for a major European utility regarding the market for power generation, transmission and distribution in eastern Europe Identified prospective buyers for a cellular license for a Latin American country in support of a big-five consulting firm's representation of a Latin telecommunications operating company

Email: services@ Emerging-markets.com Online: www.emerging-markets.com

Proposal Requests

For more information, send a Request for Proposal with your specific requirements, scope of work, and deadline to services@emerging-markets.com

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Financial Services in IndiaDocumento3 páginasFinancial Services in IndiamargetAinda não há avaliações

- The Anglosphere Challenge: Why The English-Speaking Nations Will Lead The Way in The Twenty-First CenturyDocumento30 páginasThe Anglosphere Challenge: Why The English-Speaking Nations Will Lead The Way in The Twenty-First CenturyRaouia ZouariAinda não há avaliações

- The Changing Structure of The Nigerian Economy Second EditionDocumento34 páginasThe Changing Structure of The Nigerian Economy Second EditionSamuel ObajiAinda não há avaliações

- Theory of DecentralizationDocumento36 páginasTheory of DecentralizationIqbal SugitaAinda não há avaliações

- Worldcom ScandalDocumento70 páginasWorldcom ScandalRavi PrabhatAinda não há avaliações

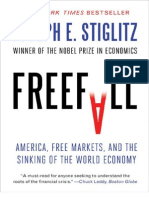

- Freefall - Joseph E. StiglitzDocumento172 páginasFreefall - Joseph E. StiglitzAbel Elorza92% (12)

- Admin Law Case DigestDocumento19 páginasAdmin Law Case Digestellemig123Ainda não há avaliações

- Business and Society Stakeholders Ethics Public Policy 14Th Edition Lawrence Solutions Manual Full Chapter PDFDocumento41 páginasBusiness and Society Stakeholders Ethics Public Policy 14Th Edition Lawrence Solutions Manual Full Chapter PDFjaniceglover2puc6100% (16)

- Global Logistics and Supply Chain Management 2nd Edition Mangan Solutions ManualDocumento4 páginasGlobal Logistics and Supply Chain Management 2nd Edition Mangan Solutions ManualHeatherHayescwboz100% (17)

- Australia in The Global Shopping Centre IndustryDocumento28 páginasAustralia in The Global Shopping Centre IndustrySơn BadGuyAinda não há avaliações

- Transportation Laws - (Digest)Documento9 páginasTransportation Laws - (Digest)Carlo LandichoAinda não há avaliações

- Ar009Documento16 páginasAr009IrenataAinda não há avaliações

- Marketing in The Aeronautics IndustryDocumento27 páginasMarketing in The Aeronautics IndustryManish SrivastavaAinda não há avaliações

- The Sun Is Not OursDocumento125 páginasThe Sun Is Not OursLoraine HamblyAinda não há avaliações

- Batangas Catv vs. CADocumento7 páginasBatangas Catv vs. CARustom IbañezAinda não há avaliações

- Tatad CaseDocumento2 páginasTatad CaseMaan LucsAinda não há avaliações

- The Caribbean Air Transport IndustryDocumento26 páginasThe Caribbean Air Transport IndustryShelly Ann Charles-RamnarineAinda não há avaliações

- Unit 14Documento10 páginasUnit 14Pavan KAinda não há avaliações

- Barriers To Entry and Market StrategyDocumento15 páginasBarriers To Entry and Market Strategyrobri0Ainda não há avaliações

- Power Sector Moving Towards DeregulationDocumento88 páginasPower Sector Moving Towards DeregulationsachinAinda não há avaliações

- Tatad Vs Secretary of Department of Energy (Case Digest)Documento3 páginasTatad Vs Secretary of Department of Energy (Case Digest)Dario Naharis100% (3)

- Inaugural Lecture Justice Onu FinalDocumento59 páginasInaugural Lecture Justice Onu FinalAnonymous 8kEtuDKFJyAinda não há avaliações

- Comparison of Incentives For Distribution System Reliability in Performance-Based RegulationDocumento6 páginasComparison of Incentives For Distribution System Reliability in Performance-Based Regulationapi-3697505Ainda não há avaliações

- BhapChak - Liquidising Energy in A Peer-to-Peer NetworkDocumento8 páginasBhapChak - Liquidising Energy in A Peer-to-Peer NetworkAnshul BawriAinda não há avaliações

- Sherman R. - The Future of Market RegulationDocumento20 páginasSherman R. - The Future of Market RegulationmzhagcAinda não há avaliações

- Segmenting The Energy Market Problems and SuccesseDocumento16 páginasSegmenting The Energy Market Problems and SuccesseChethana MunasingheAinda não há avaliações

- Segmenting The Energy Market: Problems and SuccessesDocumento13 páginasSegmenting The Energy Market: Problems and SuccessesNaveen AmarasingheAinda não há avaliações

- Decentralization and Deregulation Is The Solution To Loadshedding Issue in PakistanDocumento3 páginasDecentralization and Deregulation Is The Solution To Loadshedding Issue in PakistanTajmeer KhanAinda não há avaliações

- A Framework For Reforming Urban Land Policies in Developing CountriesDocumento66 páginasA Framework For Reforming Urban Land Policies in Developing CountriesHoang HongAinda não há avaliações

- 3.land Use Planning System in Japan PDFDocumento16 páginas3.land Use Planning System in Japan PDFJawed AmirAinda não há avaliações