Escolar Documentos

Profissional Documentos

Cultura Documentos

01 Income and Expenditure Account

Enviado por

Prateek ⎝⏠⏝⏠⎠ Gupta ヅDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

01 Income and Expenditure Account

Enviado por

Prateek ⎝⏠⏝⏠⎠ Gupta ヅDireitos autorais:

Formatos disponíveis

Accounts Of Non-trading Entities Income & Expenditure A/c for the year ended ____________ Expenditure Amt Income

To Salaries xxxx By Subscriptions To Rent xxxx By Interest on Investments To Printing & Stationery xxxx By Grants from Government To Electricity Charges xxxx By Hire of Hall To Telephone Expenses xxxx By Tennis Court Receipts To Newspapers & Periodicals xxxx By Billiard Fees To Repairs & Maintenance xxxx By Tennis Fees To Office Expenses xxxx By Miscellaneous Receipts To Gardening xxxx By Drama Receipts To Insurance Premium xxxx By Proceeds from Charity To Tennis Expenses xxxx Show To Billiard Expenses xxxx By Subscription for Annual To Bar Expenses xxxx Dinner To Purchase of Medicines xxxx By Proceeds from To Miscellaneous Expenses xxxx Entertainment To Wages xxxx By Deficit-Excess of To Lecturers Fees xxxx Expenditure over Income To Refreshment Expenses xxxx To Depreciation on Assets xxxx To Bad Debts xxxx To Magazine Expenses xxxx To Annual Dinner xxxx To Loss on Sale of Old Assets xxxx To Drama Expenses xxxx To Surplus-Excess of Income over xxxx Expenditure xxxx Balance Sheet as on _________ Liabilities Amt Assets Capital Fund xxxxx Cash in Hand Add: Entrance fees xxxxx Cash at Bank Add: Surplus xxxxx Debtors Less: Deficit xxxxx xxxxx Stock of Stationery Other Earmarked Funds xxxxx Investments Building Funds xxxxx Books Tournament Funds xxxxx Sports Material Charity Funds xxxxx Furniture Loan from Others xxxxx Motor Vehicles Sundry Creditors xxxxx Buildings Outstanding Expenses xxxxx Grounds

Amt xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Incomes received in Advance

xxxxx xxxxx

Outstanding Income Prepaid Expenses

xxxxx xxxxx xxxxx

Special Treatment Of Certain Items 1. Subscriptions 8. Sale of old newspapers, periodicals 2. Life Membership Fees 9. Specific Collections and Expenses 3. Legacies 10. Sale of old sports material 4. Entrance Fees 11. Purchase of Sports material 5. Donations 12. Sale of Fixed Assets and Investments 6. Government Grants 13. Payment of Honorarium 7. Special Fund 14. Proceeds of Concerts and Lectures Q1.The Accountant of Jaihind School has given the following information:Balance Sheet as on 1.1.2006 Liabilities Amt Assets Amt General Fund 83,600 Land 64,000 Entrance Fees (capitalized) 6,000 Library 14,000 Library Fund 31,200 Furniture 11,500 Liabilities for Expenses : Laboratory Equipment 8,700 for Salaries 2,300 Investments 25,000 for Rent 1,900 Cash at Bank 14,950 for Sundry Expenses 750 Outstanding Tuition Fees 900 Tuition Fees in Advance 1,200 Stock of Stationery 200 Loan 15,000 Cash on Hand 2,700 1,41,950 1,41,950 Receipts and Payments Account for the year ended on 31.12.2006 Receipts Amt Payments Amt To Opening Balance By Salaries 82,600 Cash 2,700 By Rent 14,900 Bank 14,950By Paid for Furniture on A/c 9,000 To Term Fees To Tuition Fees To Government Grant To Donation for Library To Int. on Investments To Sale of Old Furniture To Sale of old magazines To Closing Bank Balance 1,76,720 Adjustments: a) Fees for current year still receivable Rs.4,800 Salaries payable RS. 4,300 6,700 By Stationery 1,09,000By Annual Day Expenses 16,000 By Sundry Expenses 15,000 1995 500 2,400 1996 4,850 3,000 By Investments 1,250By 9% Loan repaid on 1st Jan. 2006 5,720By Ground Development Exp By Cash on Hand 7,800 2,100

xxxx Amt xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

5,350 35,000 12,000 4,800 3,170 1,76,720

b)

c)

d) e) f) g) Q2.

Depreciate Library , Laboratory & Furniture at 10% on Closing Balance Donation for Library promised by Ms. Karishma Rs.5,000 was not received till 31st Dec 2006 Closing Stock of stationery Rs.350, Sundry Expenses outstanding for 2006 Rs.350. Write off 1/3 of Ground Development Expenses in this year Furniture of Rs.15,000 was purchased from Real Furnitures on credit on 1.7.2006 During the year Mr.Saurav Ganguly donated Sports material worth Rs.9,500

Additional information a) Total members 450. Annual Subscription of Rs.10 per head; Rs.90 is in arrears for 2006. b) Stock of Stationery on 31.12.2006 was Rs.100 and on 31.12.2007 was RS.180. c) A quarters charge for telephone is outstanding amounting to RS.70 for the year ended 31.12.2007. Sundry expenses accruing on 31.12.2006 were RS.140. d) On 31.12.2006 Building stood in the Books at RS.20,000. It is required to write off depreciation at 5% p.a. Investments on 31.12.2006 were RS.40,000. Prepare an Income & Expenditure A/c for .2007 & Balance Sheet as on that date. Q4.The Receipts & Payments A/c of Good Health Club for the year ended 31.12.2009 Receipts Amt Payments Amt Cash in Hand & at Bank 1,500 Expenses Paid 2,100 Subscriptions: Newspapers & Periodicals 3,100 2008 300 Investment 6,000 (purchased on 31st Dec. ) 2009 20,500 Furniture 2,400 2010 200 Salaries 8,200 Entertainment Receipts 2,700 Stationery & Printing 900 Prize Fund Income 1,800 Entertainment Expenses 1,000 Interest on Securities 2,250 Prizes distributed 1,600 Sale Proceeds of old chairs 300 Closing Balance (book value Rs.500 on 1st Jan.) Cash in Hand 1,000 Entrance Fees received 750 Cash at Bank 4,000 30,300 30,300 Prepare Income & Expenditure Account of the Club for 2009 and the Balance Sheet as on that date having regard to the following additional information. a) The Club has 180 members on 31.12.2009, Annual subscription Rs.100 per head. b) Subscriptions of Rs. 500 were in arrears on 31.12.2008, out of that Rs.100 are to be written off as bad because members are no more in this world. c) Stock of Stationery on 31.12.2008 was Rs.200 and on 31.12.2009 Rs.100. d) Entrance Fees are to be capitalized e) As on 31.12.2008, premises stood in the books at Rs.40,000 , Furniture Rs.6,000, Prize Fund Rs.20,600, Prize Fund Investment Rs.18,000 and 9% Government Bonds (Face Value Rs.25,000) Rs.22,000. f) Depreciate Premises and Furniture by 10%. Q5. Prepare the Income and Expenditure Account and Balance Sheet of Dr. Shah from the following information for the year 2009. Receipts & Payments A/c of Dr. Shah for the year ended 31st December, 2009 Receipts Amt Payments Amt To Cash Introduced 2,500 By Furniture 5,000 To Visit Fees 34,000 By Equipment 6,000 To Receipts from 20,000 By Medicines 4,500 Dispensary By Salaries 6,000 To Bank Interest 150 By Rent 2,200 By Conveyance 3,000

National Library showed the following position on 1.1.2005 Balance Sheet Liabilities Amt(Rs) Assets Amt(Rs) Outstanding Expenses 350 Furniture 2,500 Capital Fund 39,650 Books account 20,000 Investments 15,000 Cash at Bank 2,500 40,000 40,000 Receipts and Payments Account for the year ended 31.12.2005 To Balance 2,500 By Electric Charges 360 To Entrance Fees 1,500 By Postage & Stationery 250 To Subscriptions 10,000 By Telephone Charges 250 To Life Membership Fees 3,600 By Hon. To Secretary 600 To Sale of old news papers 75 By Books Account 3,000 To Hire of Lecture Hall 1,000 By Outstanding Expenses 350 To Interest on Investments 400 By Salaries Account 3,300 To Donation: New Bldg Fund 20,000 By Rent Account 4,400 To Govt Grant: New Bldg Fund 10,000 By New Bldg Account 32,000 By Balance 4,565 46,075 46,075 Prepare an Income & Expenditure Account of the Library for the year ended 31.12.2005 and a Balance Sheet as on that date after making the following adjustments : a) Subscriptions includes Rs.500 received in advance. b) Provide for outstanding liabilities Rent Rs.400 ; Salaries Rs.300. c) Books A/c to be depreciated at 10 % p.a. excluding any additions during the year. d) 50 % of the Entrance Fees are to be capitalized Q3.The Receipts & Payments of the Cricket Club of India for the year ended 31.12.2007 Receipts Amt Payments Amt To Opening Balance 2,050 By Salaries 4,160 To Subscription By Stationery 800 2006 80 By Rates 1,200 2007 4,220 By Telephones 200 2008 160 4,460 By 4% Investments at par 2,500 To Sports Meeting Profit 3,100 By Sundry Expenses 1,850 To Dividend on Investment 2,000 By Closing Balance 900 11,610 11,610

By By By By By

Stationery Lighting Journals Drawings Balance c/f

56,650 Adjustments: 1. Receipts in arrears are visit fees Rs.2,000 and dispensary RS.1,800. 2. Salaries outstanding: Rs.500 and Rs.600 outstanding for expenses on medicines. 3. 33 1/3% amount of the conveyance was for domestic use. 4. Stock of medicines in hand as at close was RS.2,000. 5. Depreciate Furniture & Equipments at 10%.

300 225 375 24,000 5,050 56,650

Q6. From the following trial Balance of the Pardi Education Society as at 31st December, 2009 prepare an Income and Expenditure Account and a Balance Sheet : Particulars Dr (Amt) Particulars Cr (Amt) Furniture 10,000 Investment Fluctuation 20,000 Additions during the year 2,500 Fund Library books 15,700 Sundry Creditors 12.500 Additions during the year 3,500 Entrance Fees 4,600 Society's Building 75,000 Examination Fees 2,200 General Investment 200,000 Subscription Received 18,000 Sundry Debtors 3,000 Certificate Fees 600 Printing, Stationery & Advertising 1,100 Hire on Hall 5,600 Staff Salaries 12,800 Interest on Investments 7,300 Taxes , & Insurance 900 Sundry Receipts 400 Examination Expenses 750 Rent from subletting of 3,600 Periodicals 1,200 Building Prize Trust Investment 17,875 Prize Trust Fund 18,000 Bank Balance 375 Prize Trust income 850 General Expenses 475 Donations Received 16,000 Cash at Bank 7,000 (to be capitalized) Cash in Office 700 Capital Fund 243,825 353,475 353,475 The further information is supplied. Make necessary adjustments :Subscription to be received 2,400 Subscription to received in advance 350 Interest on General Investment accrued 950 Taxes & Insurance paid in advance 250 Staff salaries outstanding 1,200 Depreciate Library books @ 15%, Furniture & Fitting @ 5%, Building @1.5% (Calculate depreciation on the assets on the Opening balance only.) Q7.The Income and Expenditure of Sunday Samsad for the year 2009 is as follows:

Amt Income Amt 9,500 By Subscription 15,000 1,000 By Entrance Fees 500 500 By Contributions to Annual 2,000 1,500 Dinner 900 By Annual Sports Meet 1,000 3,000 300 600 1,200 18,500 18,500 This account has been prepared after the following adjustments Opening Closing Subscription outstanding 1,200 1,500 Subscription received in advance 900 540 Salaries Outstanding 800 900 General expenses include prepaid Insurance Rs.120. Audit Fee for current year is as yet unpaid. During the year, Audit Fee paid for last year was Rs.400. Sunday Samsad owned a freehold lease of ground valued at Rs.20,000. It had Sports Equipment worth Rs.5,200 at the start of year. At the end of the year after depreciation this equipment was worth Rs.5,400. Last year, the Samsad had raised a Bank Loan of Rs. 4,000. This was outstanding throughout current year. Closing Cash in Hand was Rs. 3,200. Prepare Receipts & Payments Account for 2009 & Balance Sheet as at 31.12.2009. To To To To To To To To To Q8. Income and Expenditure Account of Bombay Gymkhana for the year 2009 Amt To Remuneration to Coach 4,500 By Donations & Subscriptions To Wages 5,000By Bar Room: To Rent 2,500By Receipts 3,000 To Printing and Stationery 2,600By Payments (-) 2,500 To Repairs 4,500By Interest on Savings A/c To Honorarium (Secretary) 6,000By Proceeds of Clubs: To Dep. on Equipment 4,700By Receipts 8,800 To Surplus 1,500By Expenses (-) 4,000 31,300 Balance Sheet as at 31.12.2009. Pr Yr Liabilities Amt Pr Yr Assets 28,000 Capital Funds 28,000 1,000 Cash in Hand Entrance Fees 2,500 3,000 Cash at Bank Surplus 1,500 20,300 Savings Bank 32,000 1,500 O/S Subscription Expenses Unpaid : 8,000 Equipment 1,000 Printing & Stationery 800 Wages 2,000 4,000 Honorarium (Secy.) 6,000 Amt 25,500 500 500 4,800 31,300 Amt 500 1,000 21,100 1,000 17,500

Expenditure Salaries General Expenses Audit Fees Secretarys Honorarium Printing and Stationery Annual Dinner Expenses Bank Charges Depreciation Surplus For The Year

800

Subscriptions in Advance

300 41,100 Liabilities General Fund Crs. for Provision

33,800 41,100 33,800 Prepare Receipts and Payments Account of the Gymkhana for 2009.

Q9.From the Receipts & Payments A/c and Income & Expenditure A/c of Sunder Club for the year ended 31st Dec 2004, prepare the Opening and Closing Balance Sheets. Receipts and Payments Account for the year ended 31st December, 2004. Receipts Amt Payments Amt To Balance b/d 4,000 By Salaries 6,000 To Endowment Fund 2,000 By Advertisement 1,200 To Subscription 10,200 By Provisions 6,800 To Entrance Fee 800 By Printing & Stationery 700 To Donation for Books 1,300 By Deposit Bank 1,000 To Entertainment 4,000 By Sports Material 2,800 To Sale of Furniture 700 By Creditors (2003) 1,300 (Cost price rs.800) By Investments @ Rs. 96 1,920 (Purchased on 1.1.04 Int .@ 4%) 1,280 23,000 23,000 Income and Expenditure Account for the year ended 31st December, 2004 Expenditure Amt Income Amt Sale of Furniture (Loss) 100 By Subscription 10,000 Salaries 6,700 By Entrance Fees 400 Advertisement 1,000 By Interest on Investments 80 Audit Fees 300 (@ 4% on Rs.2,000) Provision 6,000 By Entertainment 4,000 Printing and Stationery 750 By Excess of Expenditure 2,370 Sports Material 2,000 over Income 16,850 16,850 By Balance c/d

Balance Sheets As On 31st March 2005 2006 Assets 47,000 93,000 Equipment (at WDV) 8,000 10,000 Stock of Provisions Subscription Receivable Cash & Bank Balances 55,000 1,03,000

2005 10,000 10,000 5,000 55,000

2006 15,000 5,000 20,000 1,03,000

To To To To To To To

Q10.From the Income and Expenditure Account and Balance Sheets of Miss Fit Club. Prepare the Receipts and Payments Account for the year ending 31st March 2006. Income and Expenditure Account for the year ended 31st March, 2006 Expenditure Amt Income Amt To O/Stock of Provisions 10,000 By Subscriptions 26,000 To Purchase of Provisions 40,000 By Donations 38,000 To Salaries 15,000 By Entrance Fee 8,000 To Printing and Stationery 5,000 By Sale of Provisions 43,000 To General Expenses 3,000 By C/Stock of Provisions 5,000 To Depn. on Equipments 1,000 To Surplus For the Year 46,000 1,20,000 1,20,000

Você também pode gostar

- FIN322 Week4 TutorialDocumento4 páginasFIN322 Week4 Tutorialchi_nguyen_100Ainda não há avaliações

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Documento9 páginas11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Trust DeedDocumento18 páginasTrust Deedsivaganesh_7100% (2)

- FORM 16 TITLEDocumento5 páginasFORM 16 TITLEPunitBeriAinda não há avaliações

- Production of I.V. Fluids (Saline and Dextrose) - Intravenous Solution (IV) Manufacturing Business With Blow-Fill-Seal (BFS) Technology.-412392 PDFDocumento80 páginasProduction of I.V. Fluids (Saline and Dextrose) - Intravenous Solution (IV) Manufacturing Business With Blow-Fill-Seal (BFS) Technology.-412392 PDFBon Joey Bernesto100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocumento6 páginasCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavAinda não há avaliações

- Journalize transactions and prepare financial statementsDocumento8 páginasJournalize transactions and prepare financial statementsAlok Biswas100% (1)

- Financial Accounting11Documento14 páginasFinancial Accounting11AleciafyAinda não há avaliações

- Collins TCPA Fee ContestDocumento229 páginasCollins TCPA Fee ContestDaniel FisherAinda não há avaliações

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionAinda não há avaliações

- Stock Market Gaps TradingDocumento21 páginasStock Market Gaps TradingneagucosminAinda não há avaliações

- 3D: Designing Competitive Advantage.Documento9 páginas3D: Designing Competitive Advantage.Bruno GraneroAinda não há avaliações

- How To Calculate ERP ROIDocumento13 páginasHow To Calculate ERP ROImnazihAinda não há avaliações

- Finance for IT Decision Makers: A practical handbookNo EverandFinance for IT Decision Makers: A practical handbookAinda não há avaliações

- NPO accounting questionsDocumento4 páginasNPO accounting questionscoonyu1Ainda não há avaliações

- Accountancy HOTSDocumento47 páginasAccountancy HOTSYash LundiaAinda não há avaliações

- Accounts For Non-Trading Concerns Problem: 1Documento3 páginasAccounts For Non-Trading Concerns Problem: 1KaliyapersrinivasanAinda não há avaliações

- Exercise (Final Accounts)Documento14 páginasExercise (Final Accounts)Abhishek BansalAinda não há avaliações

- PCC 2008 NPO QuestionDocumento10 páginasPCC 2008 NPO QuestionVaibhav MaheshwariAinda não há avaliações

- Accounting For Managers 1Documento43 páginasAccounting For Managers 1nivedita_h424040% (1)

- NPODocumento3 páginasNPOkanika_mcseAinda não há avaliações

- IA3 Cash Basis VALIXDocumento18 páginasIA3 Cash Basis VALIXHafie DiranggarunAinda não há avaliações

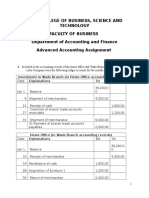

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocumento6 páginasHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleAinda não há avaliações

- 11 CaipccaccountsDocumento19 páginas11 Caipccaccountsapi-206947225Ainda não há avaliações

- Class Exercise: Cash Flow StatementDocumento2 páginasClass Exercise: Cash Flow StatementAbhi SinghAinda não há avaliações

- Quest 1Documento7 páginasQuest 1btetarbeAinda não há avaliações

- Accountancy June 2008 EngDocumento8 páginasAccountancy June 2008 EngPrasad C MAinda não há avaliações

- Final AcctsDocumento7 páginasFinal AcctsSyed ShabirAinda não há avaliações

- Final AccountsDocumento12 páginasFinal Accountsanandm1986100% (1)

- Not-for-profit accounts problemsDocumento4 páginasNot-for-profit accounts problemsHigi SAinda não há avaliações

- Adv AccountssumsDocumento419 páginasAdv Accountssumsmasdram_91849140750% (2)

- Answer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)Documento15 páginasAnswer The Following: 4 Marks) 3 Marks) 3 Marks) 3.75 Marks) (Note: Detailed Ledger Accounts Are Not Required)shashank saxenaAinda não há avaliações

- Week 3 Individual AssignmentDocumento15 páginasWeek 3 Individual AssignmentMadmaxxdxxAinda não há avaliações

- Cash flow statement problemsDocumento12 páginasCash flow statement problemsAnjali Mehta100% (1)

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Documento17 páginasAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Mahalaxmi RamasubramanianAinda não há avaliações

- CBA112 Practice SetDocumento4 páginasCBA112 Practice SetMichael SanchezAinda não há avaliações

- Particulars Amount (RS.)Documento3 páginasParticulars Amount (RS.)parth raithathaAinda não há avaliações

- Ch-1 (All Math)Documento5 páginasCh-1 (All Math)Mohammad Jakirul IslamAinda não há avaliações

- Non-Profit Organisations AccountsDocumento2 páginasNon-Profit Organisations AccountsMasood Ahmad AadamAinda não há avaliações

- 2012Documento21 páginas2012Mohammad Salim HossainAinda não há avaliações

- Subject: Financial Accounts: Topic: Financial Statements of Not For Profit OrganizationsDocumento5 páginasSubject: Financial Accounts: Topic: Financial Statements of Not For Profit OrganizationsQuestionscastle FriendAinda não há avaliações

- 05mba14 July 07Documento4 páginas05mba14 July 07nitte5768Ainda não há avaliações

- Journal Entries for Accounting TransactionsDocumento9 páginasJournal Entries for Accounting TransactionsMukta MattaAinda não há avaliações

- Accountancy March 2008 EngDocumento8 páginasAccountancy March 2008 EngPrasad C M100% (2)

- Paper II Financial Accounting IIDocumento7 páginasPaper II Financial Accounting IIPoonam JainAinda não há avaliações

- 438Documento6 páginas438Rehan AshrafAinda não há avaliações

- Advanced Accounting Pre-final Question PaperDocumento4 páginasAdvanced Accounting Pre-final Question PaperKarthikeya PeddhaboinaAinda não há avaliações

- ACCOUNT ThoeryDocumento2 páginasACCOUNT ThoeryKoladeAinda não há avaliações

- Accy 517 HW PB Set 1Documento30 páginasAccy 517 HW PB Set 1YonghoChoAinda não há avaliações

- ICMA Questions Aug 2011Documento57 páginasICMA Questions Aug 2011Asadul Hoque100% (1)

- Accounting For Non Profit Making OranisationsDocumento5 páginasAccounting For Non Profit Making Oranisationsmarkmott39Ainda não há avaliações

- CFM 100-Introduction To Taxation DAYDocumento4 páginasCFM 100-Introduction To Taxation DAYDan StephenAinda não há avaliações

- Accounting For Not-For-Profit Organisation: G.Vijaya Kumar 9866003883Documento36 páginasAccounting For Not-For-Profit Organisation: G.Vijaya Kumar 9866003883Yashwant RaoAinda não há avaliações

- Accounts of Banking CompaniesDocumento9 páginasAccounts of Banking Companieskunjap0% (1)

- Accounts Paper Ii PDFDocumento6 páginasAccounts Paper Ii PDFAMIN BUHARI ABDUL KHADERAinda não há avaliações

- Rule of Debit and CreditDocumento6 páginasRule of Debit and CreditPrafulla Man PradhanAinda não há avaliações

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocumento25 páginasCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghAinda não há avaliações

- Study Note - 7: Accounting For Non-Profit Making OrganisationsDocumento143 páginasStudy Note - 7: Accounting For Non-Profit Making OrganisationsharonsimithAinda não há avaliações

- T323 FA (Students)Documento7 páginasT323 FA (Students)Cassandra AnneAinda não há avaliações

- Answers S3T1P1Documento7 páginasAnswers S3T1P1mananleo88Ainda não há avaliações

- Final Individual Assignment - 4 Nov 2022Documento6 páginasFinal Individual Assignment - 4 Nov 2022Vernice CuffyAinda não há avaliações

- Account MOCK Test - 1Documento6 páginasAccount MOCK Test - 1CA ASPIRANTAinda não há avaliações

- Creating and Delivering ValueDocumento74 páginasCreating and Delivering ValuePrateek ⎝⏠⏝⏠⎠ Gupta ヅAinda não há avaliações

- Creating and Delivering ValueDocumento74 páginasCreating and Delivering ValuePrateek ⎝⏠⏝⏠⎠ Gupta ヅAinda não há avaliações

- Introduction To MarketingDocumento55 páginasIntroduction To Marketingaashikajain9Ainda não há avaliações

- Me, Inc.: Become The CEO of Your Career Using Personal Branding For AlumniDocumento35 páginasMe, Inc.: Become The CEO of Your Career Using Personal Branding For AlumniWaqar AhmedAinda não há avaliações

- Improve Teaching at PIONEER with New Books and NotesDocumento1 páginaImprove Teaching at PIONEER with New Books and NotesPrateek ⎝⏠⏝⏠⎠ Gupta ヅAinda não há avaliações

- Application FormDocumento2 páginasApplication FormPrateek ⎝⏠⏝⏠⎠ Gupta ヅAinda não há avaliações

- EBMP - Write UpDocumento4 páginasEBMP - Write UpPrateek ⎝⏠⏝⏠⎠ Gupta ヅAinda não há avaliações

- December, 2010Documento70 páginasDecember, 2010Prateek ⎝⏠⏝⏠⎠ Gupta ヅAinda não há avaliações

- Papad NamkeenDocumento9 páginasPapad NamkeenSneha Dudhe YadavAinda não há avaliações

- Yes! You CAN Do A Research Study in Your LibraryDocumento43 páginasYes! You CAN Do A Research Study in Your LibraryPrateek ⎝⏠⏝⏠⎠ Gupta ヅAinda não há avaliações

- Monopoly: Prepared By: Jamal HuseinDocumento26 páginasMonopoly: Prepared By: Jamal Huseinsaad_hjAinda não há avaliações

- Portfolio Management and Mutual Fund Analysis PDFDocumento53 páginasPortfolio Management and Mutual Fund Analysis PDFRenuprakash Kp75% (4)

- Afm PDFDocumento26 páginasAfm PDFcf34Ainda não há avaliações

- 01 Equity MethodDocumento41 páginas01 Equity MethodAngel Obligacion100% (1)

- Hue Cosmetics BPDocumento26 páginasHue Cosmetics BPDennis ZaldivarAinda não há avaliações

- The Global Economic Crisis and The Nigerian Financial SystemDocumento35 páginasThe Global Economic Crisis and The Nigerian Financial SystemKing JoeAinda não há avaliações

- John Keells Holdings PLC AR 2017 18 CSEDocumento208 páginasJohn Keells Holdings PLC AR 2017 18 CSEnizmiAinda não há avaliações

- 2023 UBS AC Prep MaterialDocumento6 páginas2023 UBS AC Prep MaterialNora PetruțaAinda não há avaliações

- Risk Profiler Form IndividualsDocumento4 páginasRisk Profiler Form IndividualsBharathi 3280Ainda não há avaliações

- Comparison of Two CompaniesDocumento12 páginasComparison of Two CompaniesJose SermenoAinda não há avaliações

- Far430 Group Project Sept 2015 QsDocumento9 páginasFar430 Group Project Sept 2015 QsNina ZamzulyanaAinda não há avaliações

- Chapter9 - FinalDocumento17 páginasChapter9 - FinalbraveusmanAinda não há avaliações

- East West University: Final Assignment + Term PaperDocumento5 páginasEast West University: Final Assignment + Term PaperHossain Mohamod IbrahimAinda não há avaliações

- Fiscal PolicyDocumento13 páginasFiscal PolicyAakash SaxenaAinda não há avaliações

- Chapter 2Documento43 páginasChapter 2Truely MaleAinda não há avaliações

- Orion Systems Case Study01Documento3 páginasOrion Systems Case Study01rinaz1Ainda não há avaliações

- TransCentury Ltd. - Notice of Conversion of Bonds Into Ordinary SharesDocumento2 páginasTransCentury Ltd. - Notice of Conversion of Bonds Into Ordinary SharesAnonymous JQZgPmAinda não há avaliações

- TUGAS MANAJEMEN STRATEGIDocumento8 páginasTUGAS MANAJEMEN STRATEGIDani Yustiardi MunarsoAinda não há avaliações

- Global Construction 2030 PDFDocumento13 páginasGlobal Construction 2030 PDFAjay Kathuria100% (1)

- What Are Intangibles?: Tugas Tutorial Ke-3 Program Studi Ekonomi PembangunanDocumento3 páginasWhat Are Intangibles?: Tugas Tutorial Ke-3 Program Studi Ekonomi PembangunanyunitaAinda não há avaliações

- Corporation: Advantages DisadvantagesDocumento27 páginasCorporation: Advantages DisadvantagesRoy Kenneth LingatAinda não há avaliações

- Ind Nifty RealtyDocumento2 páginasInd Nifty RealtyParth AsnaniAinda não há avaliações