Escolar Documentos

Profissional Documentos

Cultura Documentos

Africa Weekly 20052011

Enviado por

skywalker4uDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Africa Weekly 20052011

Enviado por

skywalker4uDireitos autorais:

Formatos disponíveis

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

African Alliance Securities is a leading African institutional-focused securities firm, and is able to transact for clients in 18 markets across Africa. We provide agency-only equity and bond trading, sales and in-depth, independent research to local, regional and international clients. Key to our value proposition is an on-the-ground presence with exchange membership licenses in 11 African countries which allows us to provide our clients with investment research and corporate access of the highest quality. Our award winning research includes fundamental research on most of Sub-Sahara Africas leading listed companies and sectors, as well as market data & analysis and market news & information services that span the whole continent. African Alliance Securities is part of the African Alliance Group, which provides investment banking and related services across the African continent. For more information please visit www.africanalliance.com.

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

In this week's issue Regional Emerging markets boost SABMiller; Africa set to be investment capital; Seychelles starts voting; S.Africa goes to the polls Southern Africa Angola: Emirates Airline to increase Dubai-Luanda flights; Alrosa may add mining projects as diamond prices advance; Investors wooed with law changes Botswana: Govt faces spending crisis, not revenue; Power tariffs to rise by between 15% and 30% in June; Inflation eases 30bp to 8.2% in April Lesotho: Lesotho looks to Malaysia for investments and expertise; Gem and Lucara end merger talks Malawi: Government adamant on devaluation; IMF boss toughens forex policy talk; General insurance deals by June-says NICO Mauritius: Tourist arrivals rise in 1Q11; Sun Resorts 1Q11 profits down 8.9%; MCB profit rises 47% in 3Q11; New Freeport Piacenza revived Namibia: Namibia April NCPI rose; NAAMSA Vehicle sales decreased; Namibia to introduce a minerals windfall tax Swaziland: Swaziland in 'severe fiscal crisis'; Central Bank leaves rates unchanged; Swaziland Electricity Company opens Maguga Hydro Power Station Zambia: Miners to pay 30% more for electricity; Zambia to decide on oil block awards in two months; Zambia Breweries profits soar to ZMK 45bn Zimbabwe: Lafarge Cement in USD 3.3m facelift; Caledonia posts 1Q11 profit, expects to reach targeted output by 3Q11; SA banks feel heat in Zim East Africa Kenya: GDP expands 5.6% for 2010; SCB posts 13.8% y/y rise in 1Q11 PAT; Safaricom FY11 results show increased revenues Rwanda: Central Bank targets inflation at below 7.5%; Bralirwa reports strong FY10 results; Rwandair launches Libreville, Gabon route Tanzania: April inflation up to 8.6%; TRA loses bid on Barclays and CRDB Bank Uganda: Museveni says police, courts lax on protests; Nestl Foods to process milk from Kenya and Uganda locally West Africa BRVM: IBM expands further, opens Senegal subsidiary; Cargill resumes cocoa operations in Cte dIvoire; Newcrest to resume Cte dIvoire ops Ghana: Policy rate down 50bp; Ghana records improved current account balance; Revenue for Road Fund up 33.8% y/y; WACS reaches Ghana Nigeria: Consumers see compressed gas as alternative; Finance Ministry to agree budget by the end of the week; GT Bank set to float USD 500m bond issue North Africa Egypt: Ezz Steel's embattled chairman quits board; Orascom Telecom announces new CEO; Orascom Telecom 1Q11 results Morocco: Residential property prices rise by 5% y/y in 1Q11; Moroccan banks in Cote dIvoire resume operations; Vehicle sales swell 20% y/y in April Tunisia: Result of TELNET IPO; FDI fell by 24.5% in first four months of 2011; Obama to seek aid; AfDB forecasts 1.1% growth of GDP in 2011

20 May 2011

MARKET MOVES Botswana Malawi Mauritius Namibia Zambia Zimbabwe Kenya Tanzania Uganda BRVM Ghana Nigeria Egypt Morocco Tunisia MSCI EM ex SA FTSE Johannesburg Nikkei S&P 500 CURRENCY MOVES BWP MWK MUR ZMK KES TZS UGX XOF GHS NGN EGP MAD TND EUR GBP JPY ZAR (NAD, SZL, LSL) * relative to USD WEEK % -0.5 0.1 -0.4 0.0 -2.2 -1.2 -0.1 0.5 -2.6 0.2 2.3 -0.1 4.9 0.0 0.9 1.4 0.2 0.7 -1.0 -0.4 YTD % 7.6 -1.0 6.5 7.3 23.5 6.2 -10.1 2.3 -0.6 -4.1 17.9 3.8 -26.5 -5.1 -19.0 -12.4 1.0 -0.6 -5.9 6.8

LEVEL* WEEK % 6.60 150.80 28.20 4750.0 86.15 1534.5 2385.0 459.37 1.51 156.63 5.95 7.92 1.38 0.70 0.62 81.74 6.88 -0.20 -0.56 0.38 -0.31 -0.02 0.76 -0.08 -0.51 0.38 -0.08 0.30 -0.42 -0.14 -0.51 0.59 1.14 -0.41

Randolph Oosthuizen CFA Head of Research +27 11 214 8384 oosthuizenr@africanalliance.com Chris Blaine Editor +27 11 214 8324 blainec@africanalliance.com Rob Brownlee Head of Group Sales +27 11 214 8464 brownleer@africanalliance.com

Refer to important terms of use, disclaimers and disclosures on back page.

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

TABLE OF CONTENT

Market Snapshot.....................................................................................................................3 Market Commentary ..............................................................................................................5 Company Results Summary ...................................................................................................7 Inflation and Interest Rate Summary ....................................................................................9 Regional ................................................................................................................................10 Nigeria...................................................................................................................................11 Kenya.....................................................................................................................................16 Egypt......................................................................................................................................20 Morocco.................................................................................................................................25 Tunisia ...................................................................................................................................28 Mauritius ...............................................................................................................................30 Zimbabwe ..............................................................................................................................32 Botswana ..............................................................................................................................35 BRVM .....................................................................................................................................38 Ghana ....................................................................................................................................40 Zambia...................................................................................................................................43 Tanzania ................................................................................................................................46 Namibia .................................................................................................................................48 Malawi ...................................................................................................................................50 Uganda ..................................................................................................................................52 Rwanda..................................................................................................................................54 Swaziland ..............................................................................................................................56 Angola ...................................................................................................................................58 Lesotho..................................................................................................................................59 Recently Published Research ..............................................................................................60 Regular Publications ............................................................................................................60

2 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

MARKET SNAPSHOT

MARKET Botswana Mauritius Malawi Namibia Swaziland Zambia Zimbabwe Kenya Tanzania Uganda BRVM Egypt Ghana Morocco Nigeria Tunisia South Africa INDEX NAME Domestic Companies Semdex (All Share) All Share Local All Share All Share Industrial Top 20 All Share All Share Composite EGX 30 All Share All Share All Share All Share All Share

2.30% Ghana Uganda: -2.55% Kenya -0.14% Tanzania 0.52% Nigeria -0.07% BRVM 0.22% Morocco 0.01% Egypt 4.88%

Weekly market moves (%chg local)

Tunisia 0.95%

Zambia -2.22% Namibia Namibia Zimbabwe Botswana -1.20% -0.49%

Malawi 0.12%

Mauritius -0.43%

South Africa 0.75%

Swaziland

Source: African Alliance database

3 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

AFRICAN AND GLOBAL MARKETS HEAT MAP (%CHG LOCAL)

Daily price changes (%) Date Botswana BRVM Egypt Ghana Kenya Malawi Mauritius Morocco Namibia Nigeria Swaziland Tanzania Tunisia Uganda Zambia Zimbabwe South Africa FTSE 100 Nikkei 225 S&P 500 Shanghai Composite MSCI World MSCI EFM Africa ex ZA MSCI EM Index 0.0 -2.8 -1.2 0.6 -0.2 0.5 -1.3 0.1 0.0 1.1

(08-May - 19-May 2011) 0.1 -0.2 -0.1 0.3 0.7 0.7 0.1 0.4 1.2 1.5 -0.3

Weekly chg (%) 12-May -0.2 -4.0 1.4 0.9 -1.0 0.9 2.6 -0.5 2.0 0.1 -1.7 -2.5 4.5 -0.2 0.3 0.4 -2.9 1.0 -1.0 -0.3 -0.7 -1.2 19-May -0.5 0.2 4.9 2.3 -0.1 0.1 -0.4 0.0 -0.1 0.5 0.9 -2.6 -2.2 -1.2 0.7 0.2 -1.0 -0.4 0.5 -0.4 1.4 -0.6

Year-to-date change 01-Jan-11 19-May-11 6,412.9 159.1 7,142.1 1,000.0 4,432.6 4,953.1 1,967.5 12,655.2 172.7 24,770.5 224.3 1,163.9 5,112.5 1,188.1 3,303.9 151.3 32,118.9 5,899.9 10,228.9 1,257.6 2,808.1 1,280.1 647.1 1,151.4 6,898.3 152.5 5,249.1 1,178.5 3,986.8 4,903.6 2,095.3 12,009.0 185.4 25,717.7 224.3 1,190.2 4,143.1 1,181.0 4,079.8 160.6 31,918.9 5,956.0 9,620.8 1,343.6 2,859.6 1,345.7 566.7 1,140.4 %ch 7.6 -4.1 -26.5 17.9 -10.1 -1.0 6.5 -5.1 7.3 3.8 2.3 -19.0 -0.6 23.5 6.2 -0.6 1.0 -5.9 6.8 1.8 5.1 -12.4 -1.0

08M 09M 10M 11M 12M 15M 16M 17M 18M 19M 0.0 -0.1 -0.2 -0.2 -0.1 1.3 1.1 0.5 0.9 0.0 0.1 0.4 0.5 1.0 1.1 0.3 0.1 0.2 0.3 0.0 0.4 0.4 0.9 - -0.4 -0.3 -0.6 -0.5 1.1 -0.8 -0.1 0.1 0.3 0.3 0.9 0.7 0.0 0.6

1.2 -0.9 0.0

0.1 -0.0 -0.7

0.1 -0.5 -0.1 -0.3 0.9 -0.1 0.2 -

0.4 -0.1 -0.0

0.2 -0.1 -0.5 -0.3 0.1 -0.4 0.2 0.8 0.6 0.0 0.2 0.5 0.2 0.3 0.3 0.2

0.1 -0.1

0.5 -0.8

0.3 -0.2

0.0 -0.0 -0.1 -0.3

0.3 -0.8 -0.4 -0.1 -0.7 0.9 -0.1 -1.2 -2.1 1.8 -0.2 -0.7 -0.4 -0.4 0.9 -0.8 1.0 -0.6 -1.4 -0.7 0.4 -0.3 0.5 0.3 0.1 0.8 2.8

1.0 -0.3 -0.6 0.4 -0.5 -0.4 0.2 -1.2 -0.6 0.6 -1.0 0.1 0.1 1.1 0.9 1.0

- -2.5

- -2.0 -0.2 -0.4

0.7 -0.1

1.5 -0.1 -1.2 0.2

1.3 -0.7 -0.5 -0.3 -0.0 -1.1 0.5 -1.5 -0.7 -0.9 0.9 -0.8 0.4 0.7 0.8 -1.1 0.5 -0.8 -0.6 -0.0

1.0 -0.4 0.7 -0.5

0.6 -0.2 -1.4 0.5 0.0 -0.2

0.3 -0.4 -0.5 -0.4 0.1 -0.1

0.9 -0.7 -0.5 -0.6 -0.5 -0.5 0.4 -0.1 -1.6 -0.3 -0.7 -0.3

0.7 -0.7

0.8 -0.2

4 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

MARKET COMMENTARY

In Nigeria the market drifted marginally lower (-0.1%) despite a good start, as the Nigeria, banking sector (-1.3%) saw some profit taking. Zenith Bank (-1.%), UBA (-3.6%), FCMB ( 4.8%) and Access Bank (-4.1%) were particularly affected, with only FBN (+0.7%) and Diamond Bank (+1.3%) being the only notable gainers. The financials pull back was largely offset, however, by renewed interest in Guinness Nigeria which surged by 10.3% after releasing its 3Q11 results last week; while Lafarge WAPCO climbed 3.6% at the expense of its rivals (Ashaka down by 6% and Dangote Cement ending flat). The consumer sector was mixed: PZ Cussons was up by 4.5% and Nestle Nigeria gained 1.3%, but Dangote Flour Mills (-3.7%) and Dangote Sugar (-5.8%) were in the red. In Kenya, The NSE20 index continues to remain stagnant, and closed the week at 3,986.78, down only 0.14%. Highly traded counters for the week included Equity Bank (flat), KPLC ( 3.4%), and EABL (+2.0%). Safaricom was not highly traded as it usually is, despite releasing its FY11 results during the week, which showed a 12.9% increase in revenue. It however gained 1.3% to KES 3.90. Standard Chartered released its 1Q11 results reflecting a 13.8% y/y increase in EPS. The share moved up slightly to KES 251.00 (+0.8%). Barclays Bank also released its 1Q11 showing an 11.6% y/y increase in earnings. The counter however remained flat at KES 66.00. NIC Bank's 1Q11 results showed a commendable 54.1% y/y increase in EPS. The share remained flat however at KES 46.00. The gainers for the week included ARM, which closed at KES 179.00 (+8.5%), DTB also rose 6.8% to KES 158.00. The top decliners included Pan Africa Insurance Holdings which closed at KES 53.50 (-46.5%) after going ex-dividend and ex-bonus. The bonus was a 1 for 1 share issue. CFC Insurance closed at KES 16.65 (-8.0%). EAPC was also among the week's top decliners, closing at KES 85.00 (-7.6%). The Egyptian market was strong throughout the week, with an exception of Wednesday, and the EGX index gained 4.9% for the week, with positive support coming from all sectors, but specifically from building materials (+4.4%), property (+17.0%) and telecom (+3.9%) sectors. Ezz Steel surged 18.3%, Orascom Construction was up by 3.2%, TMG spiked 25.8% while Orascom Telecom gained 7.7% for the week. The banking sector was mixed, with NSGB down by 1.3% while CIB managed to gain 2.3%. Morocco was flat for the week, with gains in the agricultural (+2.3%) and construction (+1%) sectors negated by losses in banks (-1%) and breweries (-9.3%). Both Consumar and Centrale Laitiere were up around 2.5%, and CGI was the star performed in the construction sector. Most banks ended the week lower, with Attijariwafa (-1.5%) and BMCE (02.4%) leading the pack. Brasseries du Maroc (-13.1%) fell heavily in very thin trading. Marco Telecom dominated trading (38% of weekly turnover), but it gained only marginally, up by 16bp. Tunisia ended on a positive note, up by 1%, as Poulina gained 4.5% and Carthage Cement surged by 9.4% for the week, the latter in very active trading 42% of the weekly turnover. Banks were up by 0.5% with good contributions from BT (+1.1%) and Tunisie Leasing (+11.5%). In Mauritius despite the strong performance from MCB which gained 0.5% and was Mauritius, the top trader at 37% of the total turnover, the market was dragged lower by SBM ( 0.5%) as well as the hotels sector (-2.5%, Naiade down 3.6%, NMH 2.8% lower and Sun Resorts giving up 1.5%). The ALSI was down 0.4% as a result.

5 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

The Zimbabwean market was pulled down 1.2% this week due to selling pressure in the large cap stocks: Delta gave up 2.4%, CBZ was down 10.6% and Econet fell by almost 5%. Only Barclays Bank Zimbabwe was a notable gainer, surging by 15.9%, but this happened on very low volumes. In Botswana, the Botswana DCI lost 0.5% on the back of price declines in Barclays Botswana, Botswana (2.5%), Letshego (-1.6%) and BIHL (-0.4%). Letshego was again the most actively traded stock, accounting for around 69% of total turnover, which declined 21% on the local board this week. Cresta (+55.2%), Primetime (+10.1%), and RDCP (4.9%) were the gainers for the week. The BRVM composite index edged up 0.2% this week, as a result of gains in CIE (+7.5%), SAPH (+3.6%), BOA CI (+3.6%) and ETI (+2.2%). SAPH was the most actively traded stock in a week which saw turnover dip around 10% from the previous week. Bollore Africa Logistics CI (-14.2%) and PALM CI (-4.2%) were the most notable decliners for the week. Ghanas GSE-CI gained 2.3% as nine equities recorded gains while three lost value. FML (+15.4%) led the gainers to close at a record high of GHS 3.00 and also recorded the highest value of trades, pushing market turnover to a 10-week high of GHS 8.28m. GCB reached an all-time high of GHS 3.03 during the week, but subsequently dropped to GHS 3.00, representing a w/w gain of 9.5%. The other gainers were UTB (+6.7%), SIC (+3.9%), BOPP (+3.7), UNIL (+3.4%), GGBL (+1.6%), TOTAL (+1.1%), and EBG (+0.3%). On the losing side were GOIL (-3.2%), CAL (-3.3%), and Cocoa Processing Company (-33.3%). In Zambia, The index shed 2.2% to close at 4,079.77. StanChart Zambia (-12.0%), Zambeef (-11.8%), and Investrust Bank (-5.9%) were behind the decline. Zambeef was also the most active stock, in a week in which turnover fell over 60% from the previous week. A number of stocks however managed to post gains, including Cavmont Capital Zambia (+20.0%), BAT (Zambia) (+18.5%), Bata Zambia (+9.7%), ZANACO (+8.9%), and Farmers House (+8.0%). The Tanzanian DSE gained 0.5% as a result of a 6.7% gain in the price of NMB and 1.1% gain in TWIGA. There were no price declines for the week. CRDB Bank was the most actively traded stock, followed by NMB; however turnover slumped compared to last weeks unusually heavy trading week. The Namibian local index was flat this week as no stocks registered price changes. FNB and TrustCo were the most active traders, as turnover improved marginally from last week. The Malawi all share index gained 0.1% due to a price gain in NITL (+8.9%). NITL was also the most actively traded stock, followed by NBM. Turnover more than doubled from the previous week, and no stocks recorded price declines.

6 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

In Uganda, there was a slight decline in the weekly turnover by 2% to UGX 342.6m with Stanbic generating the highest turnover, 36% of total turnover, followed by DFCU which generated 31%. Demand for Stanbic has increased this week to average 2m shares per session, while its price also rose mid-week from below UGX 265 to around UGX 270. In terms of news around Stanbic, it is expected to announce a bonus share issue soon. DFCU is still experiencing appetite from investors despite having hit a 12 month high of UGX 1,000 recently. The top gainer this week was NVL closing at UGX 810 which values it at a rolling PE of 28x. However, retail investors are still willing to buy into NVL which is expected to announce higher FY11 profits in September. BATU this week hit the UGX 1,000 mark from UGX 960 previously, though this was on low volumes. The market is bullish on Stanbic, DFCU and NVL while its bearish following announcement of a UGX 3.8bn loss for FY10. The market closed 2.6% lower for the week. In Rwanda Bralirwa gained a total of 8.8% to close at RWF 223, on the back of Rwanda, RWF 77.1m in turnover. There was no trading in Swaziland this week.

COMPANY RESULTS SUMMARY

COMPANY COUNTRY SECTOR DATE PERIOD EPS CHANGE(%)

Turnstar Ezz Dekheila Steel* Orascom Telecom* South Valley* Talaat Moustafa* GGBL PBC BBK DTB NIC Bank Safaricom SCB* Total Kenya* Illovo* Nico* Gamma Civic Harel Mallac Ireland Blyth MCB MUA NMH Phoenix Beverages Rogers Sun Resorts Maroc Telecom*

Botswana Egypt Egypt Egypt Egypt Ghana Ghana Kenya Kenya Kenya Kenya Kenya Kenya Malawi Malawi Mauritius Mauritius Mauritius Mauritius Mauritius Mauritius Mauritius Mauritius Mauritius Morocco

Property Construction Telco Construction Real Estate Breweries Cocoa Financial Financial Financial Telco Financial Energy Agriculture Financial Construction Investments Investments Financial Financial Tourism Breweries Investments Tourism Telco

May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11

FY11 FY10 1Q11 FY10 1Q11 3Q11 1H11 1Q11 1Q11 1Q11 FY11 1Q11 1Q11 FY11 FY10 1Q11 1Q11 3Q11 3Q11 1Q11 1H11 3Q11 2Q11 1Q11 1Q11

-23 Flat +1,313 -66 -38 +500 +86 +12 +60 +54 -13 +14 Flat -10 +22 Negative -91 +21 +26 -66 +15 -4 -70 -7 -7

7 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

COMPANY

COUNTRY

SECTOR

DATE

PERIOD EPS CHANGE(%)

Dangote Cement ETI* Ecobank Nigeria * Guinness Nigeria* Bralirwa African Barrick* Uganda Clays* Zambia Breweries*

Nigeria Construction Nigeria Nigeria Nigeria Rwanda Tanzania Uganda Zambia Financial Financial Breweries Breweries Mining Construction Breweries

May-11 May-11 May-11 May-11 May-11 May-11 May-11 May-11

1Q11 1Q11 1Q11 1Q11 FY10 1Q11 FY10 FY10

+11 +11 -60 +32 +63 -5 Negative Positive

Source: Company filings; *PAT not EPS

8 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

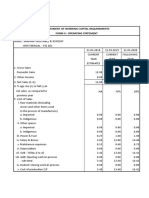

INFLATION AND INTEREST RATE SUMMARY

COUNTRY BOND RATE (%) MAT. DATE COMMENT PRIME (%) 17.00 7.95 9.00 8.23 8.01 8.35 8.00 15.40 Oct-18 Oct-15 Jul-20 Apr-15 Jan-20 Aug-13 Feb 21 BW005; 7.5yrs LS000A1A1T16; 4.5yrs 10 year; 9.3yrs GC15; 4.0yrs R207; 8.8yrs SG009; 2.3yrs 10 year; 9.8yrs 11.00 11.83 17.75 7.78 9.75 9.00 9.00 21.30 CPI (%) 14.76 8.20 3.30 7.20 6.96 4.80 4.20 5.53 8.80 2.70 11.10 11.12 11.00 Oct-20 Nov-15 Aug-20 FXD2/2010/10Yr; 9.5yrs FXD4/2010/5yr; 4.6yrs FXD 6/2010/10;7.3yrs 6.00 6.00 14.59 19.00 12.05 4.98 8.60 14.00 4.10 13.30 12.61 12.75 3.85 5.61 Oct-13 Oct-19 Feb-17 Mar-16 Mar-19 1191; 2.5yrs 6th FGN Series 4; 8.5yrs EGBGR00541F5; 6.8yrs 5 year; 4.9yrs 10 year; 9.9yrs 13.00 12.80 9.75 3.25 4.62 9.02 12.80 12.10 2.00 2.91 MONTH Mar Apr Feb Mar Apr Apr Apr Mar Apr Mar Apr Apr Apr Apr Jan Apr Mar Apr Feb Feb

Southern Africa Angola Botswana Lesotho Malawi Mauritius Namibia South Africa Swaziland Zambia Zimbabwe East Africa Kenya Rwanda Tanzania Uganda West Africa BRVM average Ghana Nigeria North Africa Egypt Morocco Tunisia

Source: Central banks, statistical agencies

9 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

REGIONAL

Pan-Africa

Emerging markets boost SABMiller

Strong growth in the emerging markets of Africa, Asia and Latin America helped brewing giant SABMiller beat forecasts with a 19% rise in annual earnings while Europe and North America proved tougher. The world's second-largest brewer and maker of Miller Lite, Peroni and Grolsch explained that as its emerging markets, which provide over 80% of its earnings, recovered strongly while tough economies in mature markets held back any upturn in beer sales. (Source: Fin24) Resource-rich Africa is set to be the world's next investment destination thanks to an array of reforms sweeping across many previously troubled countries, a former Nigerian leader noted. Olusegun Obasanjo, in office in Nigeria for eight years until 2007, noted that after many years of stagnation the continent's economies saw a sharp growth in the past decade. Real GDP increased by 5.2% annually, compared with 2.3% in the 1990s. "Thus with political and social issues properly settled and put behind us, Africa is all set to become the next big investment destination," Obasanjo explained. (Source: AFP)

Africa set to be investment capital

Southern Africa

Seychelles starts voting

Voters in the Seychelles have begun casting their ballots in a presidential election in which President James Michel is competing for a second full term at the helm of the Indian Ocean islands. Michel has overseen a raft of economic reforms to liberalise the economy after the palm-fringed archipelago faced an acute balance of payments crisis, boosting his popularity as he emerged from the shadow of his predecessor's 27-year rule. Observers expect his re-election would mean continuity for those reforms, which include the floating of the Seychelles rupee against major currencies, and pave the way for an overhaul of the tax system. (Source: Reuters) South Africas main opposition party consolidated its role as the only serious challenger to the ruling African National Congress 17-year dominance, taking support away from all its rivals in 18 May municipal elections. With 12.6m ballots counted, the ANC had 62.8% of the vote, while the Democratic Alliance won 24.3% support, the Independent Electoral Commission revealed. That compares with 65.9% and 16.6% respectively in the national election in 2009. None of the other 119 parties that contested the poll received more than 4% of the vote. The Congress of the People, formed in 2008 by a group of ANC dissidents, saw its share of the vote plummet to 2.3% from 7.4% in 2009, while that of the Inkatha Freedom Party slid to 3.6% from 4.6%. The DA, backed mainly by white and mixed-race voters, also took away support from the ANC in the countrys two biggest cities, Johannesburg and Cape Town. (Source: Bloomberg)

S.Africa goes to the polls

10 | African Alliance Pan-African Securities Research

20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

NIGERIA

Macroeconomic data

Nigeria Current account balance (% GDP) Govt gross debt (% GDP) Govt net debt (% GDP) Nominal GDP (USDbn) GDP growth (%, constant prices) GDP per capita (USD) Source: IMF WEO April 2011 2008 15.4 11.6 -3.2 207.1 6.0 1,401.2 2009 13.0 15.2 15.1 168.8 7.0 1,111.7 2010 6.4 16.4 18.3 216.8 8.4 1,389.3 2011E 14.6 16.2 10.9 267.8 6.9 1,670.0 2012F 13.3 18.5 5.5 288.8 6.6 1,753.1 2013F 11.4 21.1 1.8 309.7 6.3 1,829.3

Political and economic news

1,000 banks branches marked for demolition

The cordial relationship between the Lagos State government and commercial banks operating in the state may soon go sour, as the government is poised to demolish over 1,000 illegal structures serving as branches of the banks. Fielding questions from newsmen in Lagos, the state commissioner for physical planning and urban development, Mr. Francisco Abosede, revealed that out of 1,653 branches of banks operating in the state, only 100 have approved building plan, while 1,325 are still undergoing evaluation. Abosede, who claimed that the banks took the state physical planning laws for granted, added that the state government would not hesitate to appropriately sanction any of the affected banks. Sanctioning the erring banks [may] be misunderstood by the public and international community, but we urged management of the bank[s] that operate branches that do not comply with the State Model City Development Law of 2009 and the State Urban and Regional Planning Law of the state. If we are to go after over a thousand bank branches that fail to comply with developmental law in the state, what message would we be sending to the international community? They will not look at it from the angle of enforcing the law, rather they would look at it from an economic perspective. Abosede explained that the primary motive of enacting the state planning laws of 2009 and 2010 was to firm up all extant regulations on building control to ensure more professionalism on the part of staff, quality of building and wilful compliance with physical planning and building control regulations throughout the state. He argued that since the introduction of these laws, the state had witnessed a better planned environment, a healthier condition of living and an increase in life expectancy, noting that more emphasis will be placed on the conduct of officials of the state Building Control Agency and strict compliance with the development permit to ensure the aim of the planning laws is not defeated. The commissioner added that 7,393 building contraventions were detected across the state in 2010 alone, while 162 illegal structures were demolished, adding that out of the 12,804 building permit applications received the previous year, 7,600 had been processed and approved while 5,204 are still undergoing processing for approval, even as 90 lay out plans submitted and 31 had been approved.. (Source: Leadershipeditors.com)

NIGERIA

11 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Consumers see compressed gas as alternative

The clamour for a safer and cheaper alternative fuel for cars and domestic appliances is attracting more consumers to compressed natural gas (CNG) as source of fuel for their vehicles. CNG is a fossil fuel comprising mostly of ethane, or natural gas under high pressure with nearly zero emissions and is one of the cleanest burning alternative fuels for vehicles and automobiles. Since the Nigerian Independent Petroleum Company (NIPCO) Plc completed the construction of its multi-billion naira CNG plant in Benin City, Edo State, over 200 vehicle owners and taxi cab operators have turned up for the free conversion kits that would enable their vehicles ply on the alternative fuel. To encourage more vehicle owners embrace the new fuel, NIPCO announced it has commenced a free conversion programme that would see about 500 vehicles more being converted to CNG before the end of September. (Source: 234next.com)

Stock exchange to introduce corporate certification for operators

The management of the Nigerian Stock Exchange (NSE) says it is considering the introduction of a certification process that would help determine the level of compliance with established corporate governance and operational rules and regulations in the countrys capital market. NSE director general, Oscar Onyeama, who did not give details about when the proposed process would take off, announced that it would be an annual exercise, as part of efforts to restore the integrity of the capital market. In order to ensure compliance and ensure that on a year-in year-out basis firms are actually complying with their corporate governance standards, we will have a certification process, so that on an annual basis companies would be certified that they have met the policies and procedures they have subscribed to, Mr Onyeama announced. Though he acknowledged the negative activities of some operators in the recent past has taken a toll on the integrity of the stock market, the NSE boss argued that the starting point towards restoration would be to look inwards and take steps to establish and enforce proper corporate governance standards and operational efficiency by the regulator. Once that is done, one would have the moral high ground to go to the listed companies and broker dealers to let them appreciate the new standards, which they must buy in within an agreed time frame. Once everybody has bought into that idea about good corporate, good governance standards, we will be on our way, because we can actually use corporate governance as a competitive tool, which is good for business, (Source: 234next.com)

Gas operators to establish gas cylinder plants

The Nigerian Liquefied Petroleum Gas Association (NLPGA) says its members will soon set up assembly plants for gas cylinders in major cities in the country. President of the association, Auwalu Ilu, announced in Lagos this week that the aim was to increase the number of gas cylinders in circulation by about 100%. As soon as the market is saturated with cylinders, operators will embark on enlightenment campaigns on the use of gas as better means of cooking. Mr. Ilu announced that the investment, which would worth about NGN 12bn, would commence in 4Q11. According to him, the association is appealing to the Federal Government to make the sector more investor-friendly by removing the Value Added Tax on LPG. (Source: 234next.com)

NIGERIA

12 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Conflict over NITEL building sale lingers

The Bureau of Public Enterprises (BPE) spokesperson, Mr. Chukwuma Nwoko, announced this week that the agency has not commenced any investigation the sale of the Lagos head office building of the Nigeria Telecommunications Limited (NITEL). As far as I know, we did not issue any release stating that we are investigating anything. Mr. Nwoko, however, informed the press that the issue was in court already and that solution to the lingering crisis was in place. The liquidator of the NITEL/MTEL Pension Fund, Olusola Adekanola, had claimed that the board of NITEL approved the sale of the head office building. Mr Adekanola, in a statement by his media and communication consultant, Kazie Uko, two weeks ago, revealed that the list of NITELs non-core assets, which were transferred to NITEL/MTEL Staff Pension Fund, was prepared by a team of professionals working with NITEL management. The list of such non-core assets was prepared for the BPE by a professional team that worked in conjunction with NITEL Management, and was approved by NITELs Board before being handed over to me (liquidator), the statement added. (Source: 234next.com)

Local firm closes in on Shell Nigerian oil block

The consortium of Niger Delta E&P and Petrolin is in the final stages of talks to buy one of the Nigerian oil blocks Shell has up for sale, the CEO of one of the company's told Reuters on early this week. "We are still in talks and we are hopeful," announced Layi Fatona, chief executive of the local Nigerian firm Niger Delta Exploration and Production. The company bid in partnership with African-focused energy firm Petrolin for block OML 34 which has oil reserves of around 200m barrels, Fatona claimed. Many of the other oil companies bidding for Shell's Nigerian assets have already been informed that they were unsuccessful. (Source: Reuters) Nigeria's government is expected to agree on an amended 2011 budget with parliament by the end of this week. The minister of finance announced that the new version will have tighter spending plans than the proposal lawmakers set out last month. Once both houses of parliament are happy with the budget it will be sent to President Goodluck Jonathan for assent. "The executive and the national assembly have been engaging on the budget in the last two weeks, trying to come out with a budget that is workable and that both are happy with," Olusegun Aganga told Reuters following a weekly cabinet meeting in Abuja. "We are getting to the stage of finalising it now. If things move as we expect that by Friday it should be ready." (Source: Reuters)

Nigerian Finance Ministry expects to agree budget by the end of the week

Company news

GT Bank set to float USD 500m bond issue

As part of the efforts to consolidate its position in the Nigerian banking industry, Guaranty Trust Bank Plc has concluded plans to float a five-year USD 500m issue under its USD 2bn global medium term note program. The unsecured notes have been assigned a long term rating of B+ (Stable) by both Standard & Poors and Fitch, carry a coupon rate of 7.5% and will mature on 19 May-16. The proposed issue will mark the third time that GT Bank will be raising funds from the international capital markets.

NIGERIA

13 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

The bank had in Jul-07, became the first Nigerian company and first African bank to be listed on the main market of the London Stock Exchange (LSE) with the listing of its USD 750m Global Depository Receipts (GDR). This came on the heels of a USD 350m Eurobond issue in Jan-07, which made the financial institution, the first Nigerian company to issue a Eurobond and also, the first Nigerian institution to venture into the international capital markets without a sovereign guarantee or credit enhancement from any international financial institution. The securities will be listed on the LSE, and the proceeds from the placement will be used partly to refinance the Banks USD 350m Eurobond maturing in Jan-12 and partly for general corporate purposes. (Source: Thisdayonline)

Market activity

In Nigeria the market drifted marginally lower (-0.1%) despite a good start, as the Nigeria, banking sector (-1.3%) saw some profit taking. Zenith Bank (-1.%), UBA (-3.6%), FCMB ( 4.8%) and Access Bank (-4.1%) were particularly affected, with only FBN (+0.7%) and Diamond Bank (+1.3%) being the only notable gainers. The financials pull back was largely offset, however, by renewed interest in Guinness Nigeria which surged by 10.3% after releasing its 3Q11 results last week; while Lafarge WAPCO climbed 3.6% at the expense of its rivals (Ashaka down by 6% and Dangote Cement ending flat). The consumer sector was mixed: PZ Cussons was up by 4.5% and Nestle Nigeria gained 1.3%, but Dangote Flour Mills (-3.7%) and Dangote Sugar (-5.8%) were in the red. Nigerian Stock Exchange

TOP GAINER(S) Honeywell Flour Mills Guinness Nigeria GSK Consumer Nig. TOP TRADER Zenith Bank MARKET PERFORMANCE NIG ALSI (NGN) % CHG 10.7 10.2 10.0 NGN (M) 2,098.7 LEVEL 25,718 PRICE 5.07 226.01 27.18 USD (M) 13.4 NGN (%) -0.07 TOP LOSER(S) Unity Bank Ashaka Cement Dangote Sugar Refinery TOTAL TRADED NIG ALSI % CHG -8.8 -6.0 -5.8 NGN (M) 14,028.8 USD (%) NGN/USD 0.00 156.63 PRICE 1.03 25.20 13.50 USD (M) 89.5 % CHG 0.08

Source: African Alliance database

Dividends (NGN)

COMPANY YEAR TYPE AMOUNT

Conoil Plc Lafarge Cement W Skye Bank Plc Berger Paints Custodian And Al Greif Nigeria Pl Dangote Sugar Re Guaranty Trust Continental Rein Ag Leventis & Co United Bank Afr Rt Briscoe Plc Portland Paints

2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011

Final Final Regular Final Final Final Final Final Final Final Final Final Final

2.00 0.25 0.40 0.70 0.17 0.30 0.60 0.09 0.08 0.12 0.04 0.08 0.16

06-Jun-11 09-May-11 27-Apr-11 08-Jun-11 23-May-11 03-May-11 04-May-11 04-May-11 11-Jul-11 09-May-11 27-Apr-11 27-Apr-11 31-May-11

LAST CUM DATE

NIGERIA

14 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

COMPANY

YEAR

TYPE

AMOUNT

LAST CUM DATE 09-May-11 09-May-11 29-Apr-11 27-Apr-11 29-Apr-11 23-May-11 N.A. 04-May-11 26-Jul-11 11-Apr-11 16-May-11 16-May-11 N.A. 03-May-11 06-Jun-11 20-Apr-11 24-Jun-11 18-Jul-11 02-May-11 18-Jul-11 24-May-11 08-Apr-11 06-Apr-11 11-Apr-11 07-Apr-11 28-Apr-11

First Bank Nig Total Nigeria Pl Mobil Nigeria Fidelity Bank Chemical And All Uac Of Nigeria Nigerian Aviatio Dangote Cement Prestige Assuran Unilever Nigeria Uacn Property De Okomu Oil Palm Tantalizers Plc Oando Plc Capital Hotel Diamond Bank Julius Berger Trans Natwde Exp First City Monum Presco Plc Boc Gases Nigeri Stanbic Ibtc Ban Zenith Bank Plc Access Bank Plc Guaranty Trust Glaxosmithkline

Source: Company filings

2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011

Final Final Regular Final Final Final Final Final Final Final Final Final Final Final Final Final Final Final Final Final Final Final Regular Final Final Final

0.60 6.00 9.60 0.14 1.00 1.10 0.40 2.25 2.00 1.10 0.55 0.50 0.02 2.40 0.08 0.15 2.00 0.05 0.35 0.20 0.36 0.39 0.85 0.30 0.60 1.20

NIGERIA

15 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

KENYA

Macroeconomic data

Kenya Current account balance (% GDP) Govt gross debt (% GDP) Govt net debt (% GDP) Nominal GDP (USDbn) GDP growth (%, constant prices) GDP per capita (USD) Source: IMF WEO April 2011 2008 -6.7 46.2 41.2 30.0 1.6 801.4 2009 -5.6 49.4 44.3 29.4 2.6 761.5 2010 -7.9 50.5 45.5 32.2 5.0 809.3 2011E -9.3 52.3 47.2 35.8 5.7 874.8 2012F -7.9 50.9 45.9 40.6 6.5 964.8 2013F -7.9 49.6 44.5 45.5 6.8 1,049.7

Political and economic news

GDP expands 5.6% for 2010

Kenyas real GDP expanded by 5.6% in 2010 (2009: 2.6%). All sectors recorded positive growth. Financial intermediation led this growth at +8.8% followed by wholesale and retail trade (+7.8%) and transport and communication (+6.9%). Among the factors that influenced growth in 2010 were improved weather conditions, low inflationary pressure, low interest rates and increased credit to the private sector. The average annual inflation was 4.1% in 2010 down from a high of 10.5% recorded in 2009. The Central Bank Rate was lowered twice in 2010, with a view of lowering the cost of credit. The overall balance of payments deteriorated from a surplus of KES 75.2bn in 2009 to a surplus of KES 12.2bn in 2010. This deterioration was on account of decreased net capital inflows coupled with deterioration in the current account balance. For 2011, the domestic economy is likely to maintain a positive growth but at a decelerated rate of between 3.54.5%. Growth in 2011 is likely to be a challenge on the back of high international oil prices - which could remain high for the rest of the year (due to instability in the Middle East and North Africa), fluctuations in the exchange rate and inadequate rainfall. (Source: Kenya National Bureau of Statistics)

Company news

SCB posts 13.8% y/y rise in 1Q11 PAT

Standard Chartered Bank Kenya posted a 13.8% y/y (+52.8% q/q) rise in 1Q11 PAT, owing to increased loans and advances. The bank's PAT climbed to KES 1.64bn (USD 19.8m) from KES 1.4bn in 1Q10. EPS was also up 7.8% y/y (+46.0% q/q) to KES 5.71. Net interest income was up 7.9% y/y (-2.2% q/q) to KES 2.21bn. Loan book was up 41.5% y/y (+13.6% q/q) to KES 68.5bn, while net non-performing loans dropped 60% y/y to KES 86m. NIM was however below sector average as corporate loans dominate the bank's loan book. NIM was at 7.5% (-50bp q/q). The bank's total assets rose 17% to KES 145.2bn. There was strong q/q recovery for 1Q11. This was driven mainly by growth in NIR (+42.3% y/y; +52.1% q/q) and a dip in operating costs and provisioning. Operating costs were down to KES 1.3bn (+37.3% y/y, -7.6% q/q). The share currently trades at a PE of 11.16x, against the sector PE of 9.8x. SCB remains focused on servicing its corporate clients and middle to high income retail market. Its lean model (service provision mainly driven by IT platform) is expected to continue delivering below sector CTI. CTI declined by 1,100bp q/q, but rose 40bp y/y to 40.6%. To enhance its retail offering, SCB issued its first credit cards in the Kenyan market in February 2011. (Sources: African Alliance Research; Reuters)

KENYA

16 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Standard Chartered Bank Kenya

3M TO MARCH (KES M ) 1Q10 1Q11 % CHG

Net interest income Operating expenses Profit before bad debt Bad debt charge Profit/(loss) after tax

Source: Company report

2,046 -505 2,151 -77 1,441

2,207 -243 2,448 -135 1,639

-4.0 -51.9 13.8 76.4 13.8

BBK records 11.6% growth in earnings

Barclays Bank of Kenya (BBK) released its 1Q11 reporting EPS growth of 11.6%y/y ( 2%q/q) to KES 1.13. EPS growth was mainly driven by growth in fee income and continued cost containment. For the first quarter since 1Q09, BBK delivered positive growth in net loans and customer deposits (+4.1% and +4.3% q/q respectively). Management targets to grow its loan book through the mortgage and SME sectors. According to management, the recent removal of ATM transaction fees will have minimal impact on fee income. Management also guide that sustained cut in costs will have no direct impact on future earnings growth. While BBK has gradually been easing its exposure to the mass retail market, it has successfully built a strong franchise in the middle income segment mainly supported by its credit card business (BBK is the largest distributor of credit cards). (Source: African Alliance Research, Company filing) Barclays Bank of Kenya

3M TO MARCH (KES M ) 1Q10 1Q11 % CHG

Net interest income Operating expenses Profit before bad debt Bad debt charge Profit/(loss) after tax

Source: Company report

4,366 -3708 2,361 -359 1,372

3,862 -3,433 2,760 -354 1,532

-11.5 -7.4 16.9 -1.4 11.6

Safaricom FY11 results show increased revenues

Safaricom FY11 results (12m to Mar-11) reflected lower than expected earnings with revenue being in line, EPS of KES 0.33 down 12.9% y/y (29.5% h/h). Overall, total revenue grew at a faster rate than subscriber market share, which was positive. The weak performance was driven by higher than expected increase in operating expenses. DPS unchanged at KES 0.20. Total revenue climbed 12.9% to KES 94.8bn. Voice revenue declined 1.7% to KES 63.5bn outperforming our estimate of a 2.2% decline. Subscriber numbers rose to 17.2m, an 8.8% y/y increase against our estimate of 8.1%. Blended ARPU declined 4.8% to KES 437. Non-voice revenue contributed 33.0% of total revenue compared to our estimate of 35.5%. Costs came in higher, pushing EBITDA margin down to 37.7% from 43.6% in 2010. Operating expenses rose 25.3% to KES 45.8bn. However, selling, general and administrative expenses grew slower at KES 13.3bn. Depreciation came in a lot higher at 16.3bn. CAPEX rose +46.1% to KES 25.5bn with a CAPEX intensity rising to 26.9% up from 20.8%. Going forward, management will be looking to maintain voice revenue and grow non voice revenue. Costs will become an important area of focus but operating costs could still increase further as the company improves quality of service. Depreciation will increase in view of the higher CAPEX but this is inevitable due to the need to grow data revenue and enhance capacity with the higher minutes of use on voice. (Source: African Alliance Research)

KENYA

17 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Safaricom Ltd

3M TO MARCH (KES M ) 1Q10 1Q11 % CHG

Revenue Operating expenses Operating Profit Profit/(loss) before tax Profit/(loss) after tax

Source: Company report

83,961 -36,554 22,611 20,967 15,148

94,832 -45,795 19,390 18,361 13,159

12.9 25.3 -14.2 -12.4 -13.1

Market activity

In Kenya, the NSE20 index continues to remain stagnant, and closed the week at 3,986.78, down only 0.14%. Highly traded counters for the week included Equity Bank (flat), KPLC ( 3.4%), and EABL (+2.0%). Safaricom was not highly traded as it usually is, despite releasing its FY11 results during the week, which showed a 12.9% increase in revenue. It however gained 1.3% to KES 3.90. Standard Chartered released its 1Q11 results reflecting a 13.8% y/y increase in EPS. The share moved up slightly to KES 251.00 (+0.8%). Barclays Bank also released its 1Q11 showing an 11.6% y/y increase in earnings. The counter however remained flat at KES 66.00. NIC Bank's 1Q11 results showed a commendable 54.1% y/y increase in EPS. The share remained flat however at KES 46.00. The gainers for the week included ARM, which closed at KES 179.00 (+8.5%), DTB also rose 6.8% to KES 158.00. The top decliners included Pan Africa Insurance Holdings which closed at KES 53.50 (-46.5%) after going ex-dividend and ex-bonus. The bonus was a 1 for 1 share issue. CFC Insurance closed at KES 16.65 (-8.0%). EAPC was also among the week's top decliners, closing at KES 85.00 (-7.6%). Nairobi Stock Exchange

TOP GAINER(S) Athi River Mining Diamond Trust CFC Stanbic TOP TRADER Equity Bank MARKET PERFORMANCE NSE 20 (KES) % CHG 8.5 6.8 6.2 KES (M) 402.1 LEVEL 3,987 PRICE 179.00 158.00 60.00 USD (M) 4.67 KES (%) -0.14 TOP LOSER(S) Pan Africa Insurance EA Portland Cement EA Cables TOTAL TRADED NSE 20 % CHG -46.5 -7.6 -7.6 KES (M) 2,078.5 USD (%) KES/USD -0.12 86.15 PRICE 53.50 85.00 13.40 USD (M) 24.1 % CHG 0.02

Source: African Alliance database

KENYA

18 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Dividends (KES)

COMPANY YEAR TYPE AMOUNT

Housing Finance Diamond Trust Bank Scangroup Ltd CFC Stanbic Holdings Ltd Athi River Mining Nation Media Group Kakuzi Ltd Total Kenya Ltd Jubilee Holdings Ltd Kenya Re Ltd TPS Eastern Africa Ltd Safcom

Source: Company filings

2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011

Final Final Final Final Final Final Final Final Final Final Final Final

0.7 1.6 0.7 0.8 1.75 4 2.5 1.05 4.5 0.35 1.25 0.2

30-May-11 23-May-11 24-May-11 25-May-11 26-May-11 2-Jun-11 2-Jun-11 9-Jun-11 10-Jun-11 15-Jul-11 20-Jun-11 08-Sep-11

LAST CUM DATE

KENYA

19 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

EGYPT

Macroeconomic data

Egypt Current account balance (% GDP) Govt gross debt (% GDP) Govt net debt (% GDP) Nominal GDP (USDbn) GDP growth (%, constant prices) GDP per capita (USD) Source: IMF WEO April 2011 2008 0.5 74.7 60.0 162.4 7.2 2,160.0 2009 -2.3 75.6 61.4 188.6 4.7 2,455.8 2010 -2.0 73.8 60.6 218.5 5.1 2,788.8 2011E -2.7 74.9 63.1 231.1 1.0 2,892.4 2012F -2.3 73.7 63.5 251.9 4.0 3,090.4 2013F -2.0 70.9 62.0 273.3 5.0 3,287.9

Political and economic news

Obama to offer debt relief to Egypt

President Barack Obama is set to unveil an economic aid program for Egypt and Tunisia as part of a broad effort to support democratic reform in the Middle East and North Africa, U.S. officials reported. Senior advisers to Obama, previewing parts of his speech, announced the United States would offer debt relief totaling roughly USD 1bn over a few years to Egypt through a debt swap mechanism that would invest the money to boost youth employment and support entrepreneurs. Washington would also loan or guarantee loans totaling up to USD 1bn for Egypt to finance infrastructure development and boost jobs through the Overseas Private Investment Corp (OPIC), the officials told reporters. The administration would also seek to foster trade in the region and encourage private sector investment, they added. "We think these initiatives will help Egypt and Tunisia as they undertake the twin challenges of economic transformation and democratization," one official said. (Source: Reuters Africa) Egypt's anti-graft agency opened a new corruption investigation into ousted President Hosni Mubarak's former chief of staff, the day after a court ordered his release on bail, state media reported. Assem el-Gohari, the head of the Illicit Gains Authority, ordered that Zakaria Azmi return to detention after questioning him for about four hours, the state news agency MENA said. Investigators were questioning Azmi following reports by watchdog groups about additional and previously undisclosed wealth believed to have been accumulated unlawfully. Azmi, one of Mubarak's closest aides, was ordered released on bail of EGP 200,000 (USD 33,640) earlier in the week after nearly six weeks in detention. The decision came after Azmi's lawyer filed an appeal for his client's release. The anti-graft agency said it had informed the prosecutor it would appeal the ruling at the criminal court. (Source: Reuters Africa, MENA) Egypt's ruling military council dismissed speculation it would pardon former President Hosni Mubarak, who is under investigation for graft and abuse of power, and said it does not interfere in judicial affairs. Mubarak, 83, is detained in a hospital in the Red Sea resort of Sharm el-Sheikh after officials said he had heart problems. His wife, Suzanne, who also fell ill when ordered detained, was freed after giving up assets but faces a graft probe. The timing of the illnesses of Mubarak and his wife meant neither joined other officials in jail and has fuelled talk they were getting special treatment by the army. "The Supreme Council of the Armed Forces affirms that there is absolutely no truth in what was published by the media about the council moving to pardon the former president Hosni Mubarak and his family," it stated in a communiqu on its Facebook page. The council "does not intervene in any way in legal matters and particularly in holding to account

Former Mubarak aide faces new corruption probe

Egypt's army has no plans to pardon Mubarak

EGYPT

20 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

symbols of the previous regime", it noted, adding that legal steps were for the judiciary to handle and such "rumours" were aimed at dividing the nation. (Source: Reuters Africa)

Iraq, Egypt near USD 1bn deal on worker compensation

Egypt and Iraq are close to a deal on compensation estimated at USD 1bn for Egyptian workers who were not paid remittances during Iraq's 1990-1991 invasion of Kuwait, officials from both sides stated. Iraq had been in financial crisis then as it could not sell oil, its only export, according to Iraqi Labour Minister Nassar Rubaie. The two countries have been trying to resolve the issue involving about 900,000 Egyptians since Saddam Hussein was toppled in 2003. The row focuses on about USD 544m in interest on an original USD 408m owed to Egyptian workers. "We are close to reaching a solution to the issue of Egyptian compensation in Iraq," said Egyptian Manpower Minister Ahmed Hassan el-Borai after Rubaie held talks in Cairo. "We have set up a technical committee which will visit Iraq soon to sign an agreement in this regard," he added. Egypt says Iraqi banks withheld hundreds of millions of dollars in remittances earned before and just after Baghdad's invasion. It says banks stopped transferring the wages on 2 August 1990, the day of the invasion. Rubaie said Iraq wanted to speed up the workers' payments and that Prime Minister Nuri al-Maliki had invited his Egyptian counterpart, Essam Sharaf, to visit Iraq to discuss the matter. "The problem relates to the interest, which requires dialogue and talks on the technical issues between the two countries. A visit will resolve many of the problems related to the interests of the Egyptian workforce in Iraq," Rubaie added. (Source: Reuters Africa) Egypt's central bank accepted EGP 8.21bn (USD 1.38bn) in seven-day repurchase agreements in the money market CBES, less than the EGP 10bn it had asked for. The central bank introduced weekly repo offerings on 5 April 2011 to keep short-term interest rates under control after the political and economic unrest earlier in the year. (Source: Reuters Africa) Egypt's general prosecutor referred former housing minister Ibrahim Soliman and four of his deputies to trial for squandering public funds, the state news agency reported. Soliman, the second housing minister to face trial, was minister from 1993 to 2005 and has come under fire for his role in several controversial deals with real estate firms. Former SODIC chairman Magdi Rasekh stepped down from SODIC's board last week, adding to a list of resignations at property firms scrambling to distance themselves from the country's deposed president. SODIC, says all its land deals have been fair and legal. No charges have been brought against the firm. MENA reported that according to the charges, Soliman gave unwarranted privileges to business executives, in violation of contracts and financial commitments, and enabled Rasekh to make EGP 907.7m (USD 153m) profit in a single land purchase. Soliman is further accused of relieving Rasekh from paying EGP 13.8m in fees that would be due to the government. Rasekh was also given the right to sell a plot of land, in violation of regulations, the agency added. (Source: Reuters Africa)

Egypt cbank accepts repos worth EGP 8.2 bn

Egypt refers former housing minister for trial

Company news

Ezz Steel's embattled chairman quits board

Ahmed Ezz quit the board of Ezz Steel and its Ezz Dekheila Steel unit as he fights graft charges from prison, and has been replaced by managing director Paul Chekaiban, the company announced. Ezz, a top official in ousted Egyptian president Hosni Mubarak's party, is charged with illegally taking control of subsidiary Ezz Dekheila Steel which then supplied parent company Ezz with steel at reduced prices. Ezz has also resigned from the board of Ezz Dekheila Steel. A judicial source stated Ezz was also charged with monopolising Egypt's steel market. Ezz stated in a letter sent to media from jail that the charges against him were unfounded and a fair trial will prove his innocence. The

EGYPT

21 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

company's shares have tumbled 56% this year as a crisis in the property industry saps demand for its products and investors speculate that the charges against Ezz may damage the company's business or force him to sell his holdings.

Orascom Telecom announces new CEO

Orascom Telecom Holding (OTH) announced the appointment of Mr. Ahmed Abou Doma to the position of Chief Executive Officer reporting to Mr. Khaled Bichara, who is nominated to the position of Executive Chairman to ensure the smooth transition of the company within the newly formed VimpelCom merged entity, while overlooking the companys continued implementation of its strategy. In his new capacity as President and Chief Operating Officer of VimpelCom Ltd., the company created through the combination of VimpelCom Ltd. and WIND TELECOM SPA., Mr. Khaled Bichara, will also be focused on executing VimpelCom synergy roadmap and achieving the targets for technology procurement and commercial development, a key benefit resulting from the merger to OTH and its minority shareholders. Naguib Sawiris, Executive Chairman of OTH commented: I am pleased to welcome Ahmed Abou Doma in this new position. Ahmed has been with the group for thirteen years and has spearheaded the transformation of our operation in Bangladesh to where it is today, and he will be a great value for OTH while embarking on a new era of growth and development under the VimpelCom umbrella. (Source: Company Press Release) In related news, Orascom Telecom reported first quarter results for 2011. Highlights included subscribers surpassing 104m, an increase of 16% over the same period last year, the sale of the shareholding in Orascom Tunisia Holding and Carthage Consortium through which OTH owned 50% of Orascom Telecom Tunisia, and Earnings per GDR reaching USD 0.78/GDR. Commenting on the results Khaled Bichara, Executive Chairman said the eventful year of 2010 had been exceeded by a solid first quarter for 2011, meeting expectations for performance despite the difficulties we encountered in some of our operating countries. He added that political circumstances in Egypt had a noticeable impact on the performance for Egyptian subsidiary Mobinil, where the forced shut-down of voice and data services for several days led to declining ARPU and usage. In addition, OTH, which is based in Cairo witnessed business interruptions during the period of unrest, and continues to remain resilient and optimistic in light of the resulting country-wide economic and political pressures. Tension in Algeria continues to hinder the growth for Djezzy; restrictions on foreign currency transfers, import bans and advertising bans on government-owned television have been countered to the extent possible by effective cost management in the Algerian business unit. Nevertheless, subscribers still witnessed an increase capturing over 58% of the market in Algeria. Revenues showed a 6% growth compared to the first quarter of 2010, while EBITDA grew by 14%. Bichara noted some of the positives as well, emphasising that other operations displayed impressive growth for the quarter. North Korean business Koryolinks strong growth in customer base translated into solid revenue growth. In keeping with the high subscriber growth trend, OTHs Bangladeshi operation increased its customers by 42% compared to the previous year, and achieved revenue growth of 27% YoY. Mobilink remains as the market leader in Pakistan, growing its base by 4% compared to 1Q10. In Canada, WIND Mobile subscribers have exceeded a quarter of a million by the end of the first quarter of 2011, proving a testament to the uptake of the operations innovative plans and offers by the Canadian customers.

Orascom Telecom 1Q11 results

EGYPT

22 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

The company focuses its efforts on developing its operations to the fullest in order to fulfil its promise to maximize shareholder value. With EPS now reaching USD 0.78/GDR, a remarkable increase compared to 1Q10, OTH still upholds its aim to develop further growth through the opportunities offered by the combination of its parent company, WIND TELECOM, and VimpelCom Ltd. (Source: Company Press Release) Orascom Telecom Holdings

3M TO MARCH (USD 000) 1Q10 1Q11 % CHG

Revenue EBITDA Operating Income Profit/(loss) before tax Profit from continuing operations* Profit/(loss) after tax

901,574 392,875 203,551 59,777 15,022 58,158

949,249 436,600 239,522 128,906 67,342 821,761

5.3 11.1 17.7 115.6 348.3 1,313.0

Source: Company report, *Gains from consolidation of Mobinil (1Q10) and Orascom Tunisiana (1Q11)

Ezz Dekheila Steel unaudited 2010 net profit

Egypt's Ezz Dekheila Steel, a unit of Ezz Steel, announced its unaudited 2010 net profit was unchanged from a year earlier at EGP 724m (USD 122m). The firm reported in a brief statement to the stock exchange that its revenues rose 21% in the year to EGP 9.86bn. Talaat Moustafa Group released first quarter results for 2011. TMG posted a first quarter net profit of EGP 169.4m (USD 28.5m), a 48% slide from a year earlier. The firm made net profit of EGP 324.1m in the same period a year earlier, a statement posted on the stock exchange's website noted. Talaat Moustafa Group

3M TO MARCH (EGP 000) 1Q10 1,606,637 485,299 407,850 421,855 345,185 324,104 1Q11 1,377,279 247,804 222,727 170,976 151,474 169,437 % CHG -14.3 -48.9 -45.4 -59.5 -38.2 -47.7

Talaat Moustafa Group first quarter results

Revenue EBITDA Operating Income Profit/(loss) before tax Profit/(loss) after tax Profit/(loss) after tax and minorities

Source: Company report

Market activity

The Egyptian market was strong throughout the week, with an exception of Wednesday, and the EGX index gained 4.9% for the week, with positive support coming from all sectors, but specifically from building materials (+4.4%), property (+17.0%) and telecom (+3.9%) sectors. Ezz Steel surged 18.3%, Orascom Construction was up by 3.2%, TMG spiked 25.8% while Orascom Telecom gained 7.7% for the week. The banking sector was mixed, with NSGB down by 1.3% while CIB managed to gain 2.3%.

EGYPT

23 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Egyptian Stock Exchange

TOP GAINER(S) TMG Holding Palm Hills Development El Ezz Steel TOP TRADER CIB Egypt MARKET PERFORMANCE EGX 30 (EGP) % CHG 25.8 23.6 18.3 EGP (M) 361.2 LEVEL 5,249 PRICE 4.24 1.94 10.29 USD (M) 60.8 EGP (%) 4.9 TOP LOSER(S) Elswedy Cables Sinai Cement HandD Bank TOTAL TRADED EGX 30 % CHG -3.3 -0.8 -0.5 EGP (M) 2,318.0 USD (%) EGP/USD 4.6 5.95 PRICE 38.67 44.93 18.44 USD (M) 390.0 % CHG -0.30

Source: African Alliance database

Dividends (EGP)

COMPANY Oriental Weavers El Nasr Co For T Minapharm Pharaoh Tech For Gharbia Islamic Engineer Indust Source: Company filings YEAR 2011 2011 2011 2011 2011 2011 TYPE Cash Cash Cash Cash Cash Cash AMOUNT 2.00 0.09 0.58 0.28 0.70 0.40 LAST CUM 26-May-11 14-Jun-11 26-May-11 29-May-11 30-May-11 26-May-11

EGYPT

24 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

MOROCCO

Macroeconomic data

Morocco Current account balance (% GDP) Govt gross debt (% GDP) Govt net debt (% GDP) Nominal GDP (USDbn) GDP growth (%, constant prices) GDP per capita (USD) Source: IMF WEO April 2011 2008 -5.2 48.2 47.5 88.9 5.6 2,850.8 2009 -4.9 47.7 47.0 91.4 4.9 2,899.5 2010 -4.2 49.9 49.2 103.5 3.2 3,249.0 2011E -5.7 52.8 52.1 100.3 3.9 3,116.9 2012F -4.1 53.8 53.1 107.5 4.6 3,306.5 2013F -3.1 54.0 53.3 115.4 4.9 3,512.8

Political and economic news

Residential property prices rise by 5% y/y in 1Q11

Residential property prices increased 1.2% q/q in 1Q11 and by 5% y/y. However, the volume of transactions continued to decline given the difficult environment. (Source: Integra Bourse) Moroccan sugar beet farmers are threatening to boycott the delivery of next years crop to Consumar in a move intended to press the sole sugar refiner for better terms. If the boycott goes through the company, which has an annual refined sugar output of 1.2mt, could be forced to increase its raw sugar imports, which are mainly from Brazil. The grievances raised by three sugar beet farmers are focused on the amount Consumar pays for beet and the mechanisms by which the payment is calculated. Farmers are demanding a price increase, a minimum payment regardless of the sucrose content in their beet, more transparency about the cost of inputs supplied by Consumar, and an end to the refiners monopoly. The farmers involved in the protest are unanimous about the boycott if the refiner fails to meet their demands. Driss Ghezlaoui, a farmer from the Doukkala region and one of those leading the protests indicated that some 12,000 farmers from Doukkala and Abda regions of Morocco are participating in the protest, and that between them they produced 1mt of beet this year. Consumar, which is controlled by the National Investment Co. (SNI) an investment holding company in which Moroccos ruling family is the biggest shareholder, did not make reference any reference to any boycott in its statement. The company however acknowledged that there had been a disagreement over remuneration with farmers in the Boukkala region, which it highlighted accounted for 39% of Moroccos beet harvest in 2010. The company further indicated that this was the only region where there was problem, and that the issue had now been resolved. (Source: Reuters)

Farmers boycott delivery of beet to sugar refiner

Moroccan banks in Cote dIvoire resume operations

Moroccan banks operating in Cote dIoire have resumed their operations after a forced closure following the political turmoil that marked the country. A subsidiary of Bank of Africa, which is owned by BMCE is one of the banks that resumed operations. The bank has a healthy portfolio in relation to claims on the state, which were especially guaranteed by the Central Bank of the States of West Africa. (Source: Integra Bourse) The association of Moroccan vehicle importers, AIVAM, has published April figures pointing to an economic rally. According the association, vehicle sales shot up 20% y/y at 9.748 units. A total of 36,376 units were sold in 1Q11. Car sales rose by 24% y/y at 8,757 during April, but utility vehicle sales slid 4.6% to 991 units. (Source: Integra Bourse)

Vehicle sales swell 20% y/y in April

MOROCCO

25 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Company news

NYSE listed Lear Corp. opens electronics plant in Morocco

NYSE listed Lear Corporation has announced that it will officially open a new electronics facility in Rabat, Morocco. The company is a leader in developing complete electrical power management systems that support a full range of vehicle features. The company indicated that the new facility supplies world-class electronics such as battery charges and gateway modules to European carmakers including BMW, Renault and Volkswagen. The 14,340sqm plant employs 130 employees and is expected to employ over 230 employees by 2011. Its location is expected to enable easy shipment to the European market, which reduces travel time and costs, increases flexibility and allows for quicker response to customer preferences. (Source: News Bites) Credit du Maroc has lauched a private bank, which was inaugurated during the week. The bank will have 20 wealth advisers and three asset managers dedicated to working with clients to manage their portfolios. A minimum portfolio of MAD 1m (USD 125k) is required to open an account. (Source: Integra Bourse) Indian conglomerate, Gujarat Fluorochemicals, plans to invest USD 8m in a mining project in the northern region of Taourirt. According to the companys Director General, Dinesh Sardana, the company plans to build an integrated unit for extraction and transforming fluorosis acid, a key ingredient for making steel as well as optical flint, especially extra low dispersion lenses used for cameras and telescopes. The project caters for the production of 40,000t of this substance and the creation of over 150 direct jobs. The works of the project will start next September, and it falls within the framework of a recently signed memorandum of understanding. Ongoing feasibility studies amount to USD 200k. (Source: MAP)

Credit du Maroc launches a private bank

Indian firm invest USD 8m in a mining project

Market activity

Morocco was flat for the week, with gains in the agricultural (+2.3%) and construction (+1%) sectors negated by losses in banks (-1%) and breweries (-9.3%). Both Consumar and Centrale Laitiere were up around 2.5%, and CGI was the star performed in the construction sector. Most banks ended the week lower, with Attijariwafa (-1.5%) and BMCE (02.4%) leading the pack. Brasseries du Maroc (-13.1%) fell heavily in very thin trading. Marco Telecom dominated trading (38% of weekly turnover), but it gained only marginally, up by 16bp. Casablanca Stock Exchange

TOP GAINER(S) CIH CGI Afriquia Gaz TOP TRADER Maroc Telecom MARKET PERFORMANCE MORALSI (MAD) % CHG 8.6 6.8 5.6 MAD (M) 166.4 LEVEL 12,009 PRICE 288.00 1,420 1,670 USD (M) 21.0 MAD (%) 0.01 TOP LOSER(S) Brasseries Dumaroc Maroc Leasing Holcim (Maroc) TOTAL TRADED MORALSI % CHG -13.1 -10.3 -4.6 MAD (M) 432.7 USD (%) MAD/USD 0.43 7.92 PRICE 1,950 384.05 2,360 USD (M) 54.5 % CHG 0.42

Source: African Alliance database

MOROCCO

26 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Dividends (MAD)

COMPANY YEAR TYPE AMOUNT

Banque Marocaine Aluminium Du Mar Unimer Maghrebail Alliances Develo Eqdom Holcim Lydec Credit Immob Hot Zellidja Sa Compagnie Genera Snep Colorado Timar Stokvis N Afriq Realis Mecanique Disway Banque Marocaine Scepc Douja Prom Addoh Berliet Maroc Compagnie Minier Oulmes Etat Lesieur Cristal Auto Hall Delattre Levivie Salafin Promopharm Soc Metallurgic Credit Du Maroc Microdata Maghreb Oxygene Delta Holding Sa Agma-Lah Tazi Soc Des Brasser Ctm Acred Branoma Fenie Brossette Atlanta Managem Cnia Saada Assur Wafa Assurance Banque Centrale Centrale Laitier Ciments Du Maroc Cosumar Ib Maroc.Com Auto Nejma Sothema

Source: Company filings

2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010 2010

Regular Regular Regular Regular Regular Special Cash Regular Regular Regular Special Cash Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Special Cash Regular Regular Special Cash Special Cash Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular Regular

25.00 120.00 3.00 50.00 8.00 50.00 131.00 22.50 6.00 20.00 18.00 13.00 4.50 3.00 2.00 15.00 21.00 3.00 15.00 2.00 8.00 100.00 60.00 5.50 3.50 18.00 13.00 45.00 100.00 30.00 57.00 18.00 3.00 200.00 100.00 22.50 23.00 80.00 15.00 3.00 12.00 22.00 70.00 8.00 59.00 30.00 86.00 18.00 55.00 23.33

23-May-11 N.A. N.A. 23-Jun-11 N.A. N.A. N.A. N.A. 23-May-11 15-Jun-11 N.A. 20-Jun-11 14-Jul-11 N.A. 16-Jun-11 N.A. 28-Jun-11 30-Jun-11 N.A. N.A. 11-Jul-11 20-May-11 N.A. N.A. N.A. N.A. N.A. N.A. N.A. N.A. N.A. 20-Apr-11 N.A. N.A. N.A. N.A. N.A. N.A. 21-Jun-11 N.A. N.A. N.A. 02-Jun-11 N.A. N.A. 06-Jun-11 N.A. N.A. N.A. N.A.

LAST CUM DATE

MOROCCO

27 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

TUNISIA

Macroeconomic data

Tunisia Current account balance (% GDP) Govt gross debt (% GDP) Govt net debt (% GDP) Nominal GDP (USDbn) GDP growth (%, constant prices) GDP per capita (USD) Source: IMF WEO April 2011 2008 -3.8 43.3 44.9 4.5 4,345.9 2009 -2.8 42.9 43.5 3.1 4,170.9 2010 -4.8 40.4 44.3 3.7 4,200.5 2011E -7.8 42.8 46.6 1.3 4,375.9 2012F -5.8 42.8 49.0 5.6 4,555.0 2013F -4.0 41.6 52.5 5.6 4,827.9

Political and economic news

AfDB forecasts 1.1% growth of GDP in 2011

The African Development Bank (AfDB) has predicted a GDP growth rate of 1.1% for Tunisia in 2011, as the country seeks to recover after the 14 January revolution. At a meeting recently held in the Tunisian capital, Tunis, by the AfDB on the theme: "Tunisia's postrevolution: What is the economic outlook?" AfDB's Vice President and Chief Economist Mthuli Ncube remarked that Tunisia had potentials in small and medium enterprises (SMEs) that will enable the country to acquire a strong background in the field of technology. (Source: African Manager) US President Barack Obama will use his speech to the Arab world to call for billions of dollars in financial assistance to Egypt and Tunisia as part of a comprehensive approach to the Arab Spring movement that he hopes will boost democratic reforms and America's reputation in the region. The aid package, which would unfold over two to three years, would include an estimated USD 1bn in debt cancellation, USD 1bn in loan guarantees and several billion more in financing from multilateral institutions such as the World Bank, according to three senior administration officials who briefed reporters on the condition of anonymity under ground rules set by the White House. (Source: The Sacramento Bee) Foreign Direct Investment (FDI) declined by 24.5% at the end of the first four months of 2011, falling to TND 448.8m compared with TND 594m in the same period of 2010, according to statistics of the Foreign Investment Promotion Agency (FIPA). Investments are shared out as follows: TND 426.8m of foreign direct investment (FDI) and TND 21.6m in portfolio, compared with TND 569.3m and TND 24.7m, respectively in 2010. (Source: babnet)

Obama to seek aid

FDI fell by 24.5% in first four months of 2011

Corporate action

Result of TELNET IPO

TELNETs IPO result shows that the Offer was subscribed 3.3 times and asked by approximately 3,950 applicants. (Source: Tustex)

TUNISIA

28 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

Market activity

Tunisia ended on a positive note, up by 1%, as Poulina gained 4.5% and Carthage Cement surged by 9.4% for the week, the latter in very active trading 42% of the weekly turnover. Banks were up by 0.5% with good contributions from BT (+1.1%) and Tunisie Leasing (+11.5%). Tunis Stock Exchange

TOP GAINER(S) Tunisie Leasing Tunisie Lait Carthage Cement TOP TRADER Carthage Cement MARKET PERFORMANCE TUNIS Index (TND) % CHG 11.5 10.4 9.4 TND (M) 7.40 LEVEL 4,143 PRICE 27.20 4.45 2.90 USD (M) 5.35 TND (%) 0.9 TOP LOSER(S) Attijari Leasing SPDIT Tunis Re TOTAL TRADED TUNIS Index % CHG -7.0 -3.4 -3.0 TND (M) 20.0 USD (%) TND/USD 1.1 1.38 PRICE 39.00 5.99 9.89 USD (M) 14.4 % CHG 0.14

Source: African Alliance database

Dividends (TND)

COMPANY YEAR TYPE AMOUNT

Soc Tunsienne D' Adwya Soc Accum Tunis Cie Intl De Leas Soc Industrielle Cie D'assur-Astr Gif Filter

Source: Company filings

2011 2011 2011 2011 2011 2011 2011

Regular Regular Regular Regular Regular Regular Regular

1.80 0.20 0.37 0.75 0.07 1.60 0.15

N.A. 08-Jun-11 N.A. N.A. N.A. 01-Jun-11 N.A.

LAST CUM DATE

TUNISIA

29 | African Alliance Pan-African Securities Research 20 May 2011

The Africa Weekly

Equity research | Pan-Africa | News & Analysis

MAURITIUS

Macroeconomic data

Mauritius Current account balance (% GDP) Govt gross debt (% GDP) Govt net debt (% GDP) Nominal GDP (USDbn) GDP growth (%, constant prices) GDP per capita (USD) Source: IMF WEO April 2011 2008 -10.1 44.0 44.0 9.6 5.5 7,598.3 2009 -7.4 47.8 47.8 8.9 3.0 6,951.3 2010 -9.5 50.5 50.5 9.7 4.0 7,593.3 2011E -11.6 51.4 51.4 10.3 4.1 7,989.7 2012F -9.6 52.1 52.1 11.0 4.2 8,471.4 2013F -7.1 50.4 50.4 11.7 4.3 8,979.2

Political and economic news

New Freeport Piacenza revived