Escolar Documentos

Profissional Documentos

Cultura Documentos

Health Plan Benefits Brochure

Enviado por

coreysmith10Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Health Plan Benefits Brochure

Enviado por

coreysmith10Direitos autorais:

Formatos disponíveis

STUDENT HEALTH PLAN

Full-time DSU Undergraduates September 1, 2011 August 31, 2012

SUMMARY OF BENEFITS EXTENDED HEALTH, DENTAL, ACCIDENT

EXTENDED HEALTH CARE COVERAGE

Combined overall maximum EHC coverage of $5,000/benefit year/insured:

Prescription Drugs (80% Co-insurance)

Generic drugs that legally require a prescription and that have been approved by Health Canada prior to September 1, 2008, including oral contraceptives. You will receive the actual drug prescribed by your physician, however, the plan will cover the cost of the lowest priced generic equivalent. Claiming: For prescription drugs, you simply present your Pay Direct card to a pharmacist. (You are responsible for 20% of the cost and the Dispensing fee is capped at $6.00 per prescription) If claiming for the following prescription drug expenses, you need to claim reimbursement, using a 'Claim for Extended Health Benefits' form, as outlined under the 'Claiming Your EHC Benefits' section further below: Preventative vaccines at 80% co-insurance (except Gardasil, which is not covered) Drugs for erectile dysfunction at 50% co-insurance to a maximum of $600/year Direct2u Prescriptions will significantly lower your out-of-pocket costs. For more information, go on-line to www.studentvip.ca/dsu/vip_benefits/direct_2u_prescriptions

Extended Health Care (EHC) Benefits (80% Co-insurance)

Practitioner benefits (maximum $25 per visit / $500 per benefit year, per practitioner) for the following: Physiotherapist, Chiropractor, Chiropodist, Podiatrist, Acupuncturist, Naturopath, Osteopath, Speech Therapist, Registered Massage Therapist (RMT) (Physicians written prescription must accompany first RMT claim submission) Psychologist (maximum $500 per benefit year) Orthotic appliances, prescribed by a medical doctor, an orthopaedic surgeon or podiatrist (maximum $300/year) Surgical stockings (maximum 2 pair/year) Hearing aids (maximum $300 every 5 years) Medical equipment and supplies, (e.g. crutches, braces) with a physicians prescription (maximum $500/year) Ambulance to the nearest treating hospital

Vision Care (80% Co-insurance)

Vision Care (total maximum $150 per benefit year) includes frames, lenses, contact lenses and eye examinations.

HIV Prophylaxis Benefit (100% Co-insurance)

Only this benefit has a maximum of $6,000/benefit year/insured. You need to claim reimbursement, using a 'Claim for Extended Health Benefits' form, as outlined under the 'Claiming Your EHC Benefits' section below.

Claiming Your EHC Benefits

For EHC claims requiring reimbursement, the DSU Claim for Extended Health Benefits form may be downloaded on-line at www.studentvip.ca/dsu or obtained from the DSU Student Health Plan Office. Save time and paper! Students are encouraged to apply for Direct Deposit of benefit payments to your personal bank account. The Application for Direct Deposit form can be downloaded on-line at www.studentvip.ca/dsu . Otherwise EHC benefits will be paid by cheque. To avoid delays in processing your EHC claim, you must ensure that you attach ALL paid-in-full receipts and that the claim form is fully completed including your Student I.D.#, signed and dated. Note that instructions on the claim form allow for submission of your claim via e-mail & scan, fax, or regular mail. CLAIMS DEADLINE: All claims for EHC expenses incurred must be submitted to RWAM no later than 90 days after the date your Student EHC coverage terminates, or no later than one year from the date the expense was incurred, whichever comes first.

Emergency Out-of-Province/Canada (OOC) Travel Coverage (overall maximum $2,000,000):

This benefit will provide reimbursement for emergency hospital, surgical, and medical expenses to a maximum of $2,000,000 outside your Canadian home province of residence or outside Canada as follows: Hospital services in a public or general hospital and medical-surgical expenses for services of a legally qualified physician or surgeon rendered, when the fees for such services are in excess of the amounts allowed by the applicable Canadian provincial government health plan in which the patient is a resident. 'Travel Assist' Service: While travelling outside your Canadian home province of residence or outside Canada, 'Travel Assist' (a world-wide medical assistance service) will be available if a medical emergency or other personal emergency occurs. Travel Assist services are available 24 hrs/day, 7 days/week. Travel claim forms and Travel Assist brochures may be downloaded on-line at www.studentvip.ca/dsu OOC Limitations: Only hospital, surgical or medical services resulting from a medical emergency while the coverage is in force will be eligible. Coverage is limited to a trip duration not exceeding of 60 days from the date of departure from your province of residence. For students on Study/Work terms outside Canada, you may apply (before you leave, as prior approval is required) for an extension around your study/work term not exceeding 60 days, by downloading the 'Student Study/Work term Insurance Extension Request' form at www.studentvip.ca/dsu .

Page 1 of 5

STUDENT HEALTH PLAN

Full-time DSU Undergraduates September 1, 2011 August 31, 2012

DENTAL COVERAGE

Dental Benefits Combined maximum dental coverage of $500/year/insured

Current dental fee guide

Examinations (70%)

Complete oral examination (once every 5 yrs) Limited/recall examination (once every 12 mths) Specific oral examinations (once every 12 mths) Emergency oral examination (once every 12 mths) Complete series (once every 5 yrs) Periapical Bitewing (once every 12 mths) Panoramic (once every 5 yrs)

Minor Restorative (50%)

Fillings (limited to amalgam on molars) Caries/trauma control Retentive pins Pre-fabricated restorations

Extractions (50%)

Removal of erupted teeth Removal of impacted teeth Removal of residual roots Surgical exposure of teeth

Radiographs (70%)

Endodontics (50%)

- Pulpectomy - Root canal therapy - Apicectomy / apeal curettage - Retrofilling

Anaesthesia (50%)

If performed in conjunction with insured surgical services - General Anaesthesia - Deep Sedation - Conscious Sedation

Preventative Services (70%)

Dental polishing (1-15 minute units every 12 mths) Scaling (2-15 minute units every 12 months) Fluoride Treatment (once every 12 months) Space Maintainers (for children under age 12)

Periodontics (50%)

- Scaling in excess of two units in a 12 mth period (maximum 8 units per year) - Root planing - Surgery to treat the soft tissues (gums) & bone supporting the teeth

Limitations and exclusions to the dental plan: 1. Dental services not shown on the list of eligible expenses. 2. Expenses incurred for procedures or supplies used in Temporomandibular Joint Dysfunction (TMJ) and treatment rendered for full mouth reconstruction for vertical dimension correction including attrition, or for prosthetic splinting. 3. Dental services covered by any government agency. 4. Dental treatment for cosmetic purposes. 5. Charges for missed appointments, completion of claim forms, and advice by telephone. 6. Any dental treatment which is not yet approved by the Canadian Dental Association, or which is experimental in nature. 7. Expenses incurred for the replacement of appliances that are lost, mislaid, or stolen. 8. Dental supplies intended for sport use, such as mouth guards. Pre-Authorization: It is strongly recommended to advise your dentist to submit a pre-authorization form to RWAM with regards to extensive dental procedures performed. This is to prevent unexpected costs.

Claiming Your Dental Benefits

In most cases, your dentist can send your dental claim electronically (EDI). This convenient method is offered by many dentists and is a service supported by RWAM. Present your Pay Direct card with your Student I.D. and RWAM Group numbers on it. You may also be asked for a Carrier ID or BIN number, which is #610616 and is printed on your card. If EDI service is not provided by your dentist and you are claiming manually, download a DSU Dental Claim form at www.studentvip.ca/dsu to be completed, or ask your dental provider for a completed Standard Dental Claim form. (Note: the top right hand box of the form I hereby assign is only to be signed if you wish to have your claim reimbursement sent directly to your dental office.) Save time and paper! Students are encouraged to apply for Direct Deposit of benefit payments to your personal bank account. The Application for Direct Deposit form can be downloaded on-line at www.studentvip.ca/dsu . Otherwise dental benefits will be paid by cheque. CLAIMS DEADLINE: All claims for Dental expenses incurred must be submitted to RWAM no later than 90 days after the date your Student Dental coverage terminates, or no later than one year from the date the expense was incurred, whichever comes first.

Page 2 of 5

STUDENT HEALTH PLAN

Full-time DSU Undergraduates September 1, 2011 August 31, 2012

STUDENT ACCIDENT INSURANCE

Maximum reimbursement of $10,000 for eligible expenses incurred resulting from one Accident

Accidental Death & Dismemberment

Payment of a stipulated sum for loss of life or limb through accidental means. benefit payable for Accidental Death is $5,000. For example, the maximum

Accidental Dental Expense

Services of a dentist to repair or replace whole or sound teeth due to an accidental blow to the mouth while the individual was insured under this benefit, but not by an object wittingly or unwittingly placed in the mouth. Treatment must take place within 30 days from the date of the accident. Benefits will be paid for the reasonable treatment of expenses incurred within 156 weeks of the date of the accident. Biting or chewing accidents are not covered under this benefit. A maximum $1000.00 is payable for dental accident expenses incurred resulting from one dental accident.

Accident Ambulance Expense

When injury due to an accident requires immediate medical attention, the Insurer will pay the reasonable and customary charges for licensed ambulance services.

Accidental Medical Expense

Should the insured student or dependent suffer accidental bodily injury within Canada while this insurance is in force, he/she will be reimbursed by the Insurer for the following expenses, provided treatment takes place within 30 days from the date of the accident and the expenses are incurred within 52 weeks of the accident: crutches, braces, prosthetic appliances, rental of wheelchair or hospital-type bed, x-rays, treatment administered by a legally qualified physiotherapist, podiatrist, or speech therapist, services of a registered nurse, semi-private hospital accommodation. (Payment for hospital room is limited to the difference between public ward and semi-private accommodations). Accidental Medical Expenses: limited to a maximum reimbursement of $10,000.00.

Accident Tutorial Expense

If an accident causes the insured student to be disabled and confined to home or hospital and confinement continues for 15 consecutive school days, the Insurer will pay from the first day the actual expense incurred for the private tutorial services of a qualified teacher up to $10.00 per hour, limited to a maximum of $300.00.

Repatriation Expense

If the insured student or dependent suffers an accidental loss of life outside Canada while the policy is in effect, the Insurer will pay the expense of homeward carriage of the body of the Insured for burial, subject to a maximum payment of $1,000.00.

What is an Accident?

An Accident means an occurrence due to external, violent, sudden, fortuitous causes beyond the insured student's or dependent's control, which must occur while the student or dependent is insured under this policy.

Claiming Your Student Accident Benefits

Download the Accident Claim form on-line at www.studentvip.ca/dsu and follow the instructions on the form. Accident claims are paid on a reimbursement basis and are to be submitted via the DSU Student Health Plan Office.

Page 3 of 5

STUDENT HEALTH PLAN

Full-time DSU Undergraduates September 1, 2011 August 31, 2012

FREQUENTLY ASKED QUESTIONS

Am I automatically covered?

As a full-time student (taking 3 or more courses at Dalhousie), paying full time fees for the September semester at Dalhousie University, you are automatically covered under this plan provided you are covered by your provincial health plan or have an equivalent plan. Note: The following groups are not automatically covered: Students on Study Abroad Programs, Co-op students on work term, part-time students and/or those students registered for only the January semester. It is your responsibility to confirm your status with Student Accounts. International Students: Please note that you may be charged for two separate health plans by the university. These plans are not equivalent, but can be used in conjunction with each other to provide more complete coverage. For more information please contact International Student Services at (902) 494-1735.

When does my coverage begin and end?

For Fall enrolments your benefit year is: September 1, 2011 to August 31, 2012 For January enrolments your benefit year is: January 1, 2012 to August 31, 2012

If I am registered just for the winter term, how do I enrol in the Student Health Plan?

For January enrolments, you may enrol in the plan no later than January 27, 2012 in person at the DSU Health Plan office. Payment by cash, cheque or money order only, made payable to the Dalhousie Student Union must accompany your enrolment.

Is family coverage available for my dependents?

Yes, however, you must pay an additional fee (cost available by contacting the DSU Health Office). You must enrol your spouse/common-law spouse and/or dependent children by completing the Application for Family Coverage form available on-line at www.studentvip.ca/dsu and submitting it along with your payment (payable to Dalhousie Student Union) in person to the DSU Student Health Plan Office by the deadline of September 23, 2011. (For January enrolments, deadline is January 27, 2012)

What if I already have comparable coverage?

You should know that your DSU Student Health Plan offers benefits specifically designed for student needs. You may find it to your advantage to remain enrolled in this student health plan and your comparable health coverage.

Co-ordination of Benefits (COB)

If you remain enrolled in this student health plan in addition to your comparable health coverage, you may possibly increase your total benefits by claiming Coordination of Benefits (COB) between the plans. Benefits payable under this student plan will not exceed the combined total amount of eligible expenses incurred.

Who can Opt-out of the plan?

If you do have comparable coverage through a non-government plan, (for example comparable coverage might be through your parent or spouse as a dependent under their group plan) and decide you do not wish to keep the DSU Student Health Plan coverage, you are eligible to apply to "Opt-out" of this plan.

What is the Opt-out process?

If you decide to apply to Opt-out of the component of VIP Student Health Plan coverage for which you may already carry similar benefits, you must provide proof of your comparable coverage under the other plan to the DSU Student Health Plan Office and complete the Application to Opt-out of Student Health Coverage form, available on-line at DalOnline.ca by the Opt-out deadline of September 23, 2011 at 4:30PM sharp. NOTE: There are no exceptions or extensions to the Opt-out deadline. You must provide proof of alternative health insurance, which is NOT provincial health, but a privately purchased benefits plan. If your application to Opt-out is approved, your student account will be credited in the amount of the DSU Health Plan Fee after the Opt-out period ends September 23, 2011.

If I Opt-out of the plan, can I opt back in, in the event of a situation change?

No. You will not be eligible under any circumstance during the year to opt back into the plan. If you are still a full-time eligible student attending Dalhousie University next year, the first opportunity to re-enrol would be September 1st, 2012. Examples of situation changes are: Your comparable coverage as a dependent through your parent or spouse under their group plan gets terminated due to their termination of employment; or you no longer qualify under your parent's plan as a dependent child (numerous alternate plans expire once you turn age 21). These situations are other reasons to carefully consider your decision to Opt-out and check the details of your other plan's coverage.

Page 4 of 5

STUDENT HEALTH PLAN

Full-time DSU Undergraduates September 1, 2011 August 31, 2012

How do I obtain my Pay Direct benefit card?

Pay Direct benefit cards are available for pick up at the DSU Health Plan Office by mid-October. Meanwhile your Pay Direct benefit card is in printable format at www.studentvip.ca/dsu . You must indicate on the card your 9 digit Student ID# in the space provided.

NOTES: } Canadian students who are not residents of Nova Scotia are solely responsible for determining how they use their own home province's health insurance plan while studying at Dalhousie University. } In the event of any discrepancy between this document and the master policy or plan text, the applicable master policy or text will govern

PROVIDERS

Extended Health & Dental Plan provided by Extended Health & Dental Plan administered by Travel Assist serviced and administered by Student Accident Insurance underwritten by DSU Student Health Plan arranged by

DSU RWAM INSURANCE ADMINISTRATORS INC. Group #490005 MONDIAL ASSISTANCE CHARTIS INSURANCE COMPANY OF CANADA Policy #SRG9130703 C & C INSURANCE for STUDENT VIP

Visit or Contact the DSU Health Plan Office at:

Student Union Building, Lower Level 6136 University Ave. Halifax, NS B3H 4J2 Phone: (902) 494-2850 E-mail: dsuhealth@dal.ca www.dsu.ca

Dalhousie University and the Dalhousie Student Union are committed to protecting the privacy, confidentiality, accuracy and security of personal information it collects, uses, retains or exchanges in the necessary conduct of our business.

Page 5 of 5

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Forecasting of Nonlinear Time Series Using Artificial Neural NetworkDocumento9 páginasForecasting of Nonlinear Time Series Using Artificial Neural NetworkranaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- 48 Volt Battery ChargerDocumento5 páginas48 Volt Battery ChargerpradeeepgargAinda não há avaliações

- Building and Other Construction Workers Act 1996Documento151 páginasBuilding and Other Construction Workers Act 1996Rajesh KodavatiAinda não há avaliações

- T1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurningDocumento16 páginasT1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurninghosseinAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- CDKR Web v0.2rcDocumento3 páginasCDKR Web v0.2rcAGUSTIN SEVERINOAinda não há avaliações

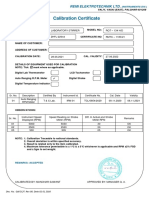

- Calibration CertificateDocumento1 páginaCalibration CertificateSales GoldClassAinda não há avaliações

- Lab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabDocumento7 páginasLab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabHayat AnsariAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Laporan Praktikum Fisika - Full Wave RectifierDocumento11 páginasLaporan Praktikum Fisika - Full Wave RectifierLasmaenita SiahaanAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- ACIS - Auditing Computer Information SystemDocumento10 páginasACIS - Auditing Computer Information SystemErwin Labayog MedinaAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- HRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesDocumento6 páginasHRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesAkosi EtutsAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDocumento9 páginasInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenAinda não há avaliações

- Sample Opposition To Motion To Strike Portions of Complaint in United States District CourtDocumento2 páginasSample Opposition To Motion To Strike Portions of Complaint in United States District CourtStan Burman100% (1)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Data Sheet WD Blue PC Hard DrivesDocumento2 páginasData Sheet WD Blue PC Hard DrivesRodrigo TorresAinda não há avaliações

- Use of EnglishDocumento4 páginasUse of EnglishBelén SalituriAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Rofi Operation and Maintenance ManualDocumento3 páginasRofi Operation and Maintenance ManualSteve NewmanAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Discover Mecosta 2011Documento40 páginasDiscover Mecosta 2011Pioneer GroupAinda não há avaliações

- Ingles Avanzado 1 Trabajo FinalDocumento4 páginasIngles Avanzado 1 Trabajo FinalFrancis GarciaAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Polytropic Process1Documento4 páginasPolytropic Process1Manash SinghaAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Oracle FND User APIsDocumento4 páginasOracle FND User APIsBick KyyAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDocumento27 páginasSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- BMA Recital Hall Booking FormDocumento2 páginasBMA Recital Hall Booking FormPaul Michael BakerAinda não há avaliações

- G.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARDocumento2 páginasG.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARTheodore DolarAinda não há avaliações

- Catalogo AWSDocumento46 páginasCatalogo AWScesarAinda não há avaliações

- DC Servo MotorDocumento6 páginasDC Servo MotortaindiAinda não há avaliações

- Food and Beverage Department Job DescriptionDocumento21 páginasFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- Year 9 - Justrice System Civil LawDocumento12 páginasYear 9 - Justrice System Civil Lawapi-301001591Ainda não há avaliações

- Social Media Marketing Advice To Get You StartedmhogmDocumento2 páginasSocial Media Marketing Advice To Get You StartedmhogmSanchezCowan8Ainda não há avaliações

- Javascript Applications Nodejs React MongodbDocumento452 páginasJavascript Applications Nodejs React MongodbFrancisco Miguel Estrada PastorAinda não há avaliações

- The Rise of Populism and The Crisis of Globalization: Brexit, Trump and BeyondDocumento11 páginasThe Rise of Populism and The Crisis of Globalization: Brexit, Trump and Beyondalpha fiveAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Oem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Documento43 páginasOem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Farhad FarajyanAinda não há avaliações