Escolar Documentos

Profissional Documentos

Cultura Documentos

APA Style Essay - Corporate Social Responsibility

Enviado por

CheapestPapersDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

APA Style Essay - Corporate Social Responsibility

Enviado por

CheapestPapersDireitos autorais:

Formatos disponíveis

Corporate Social Responsibility

CORPORATE SOCIAL RESPONSIBILITY

Name:

Grade Course: Tutors Name: (15, September, 2010)

Corporate Social Responsibility 2 Table of Contents Part I- Capitalism and human happiness........................................................................................3 Arguments supporting capitalism....................................................................................................4 Arguments against capitalism..........................................................................................................6 Conclusion........................................................................................................................................8 Part 2-Derivative Manageable Risk..................................................................................................9 Supporting Issues............................................................................................................................10 Opposing Issues..............................................................................................................................12 Conclusion......................................................................................................................................14 Part 3- Should price gouging be regulated?..................................................................................15 Supporting Issues............................................................................................................................17 Conclusion......................................................................................................................................19 References..........................................................................................................................................20

Corporate Social Responsibility 3 Corporate Social Responsibility Introduction The paper is about corporate social responsibility. It is discussed in three parts, part one critically analyzes whether capitalism can lead to human happiness, both advantages and disadvantages of capitalism are brought forth. Part two looks in detail the issue of managing risks of derivatives, both the supporting and opposing issues are also discussed and a conclusion at the end of this part. Finally, part three discusses in detail whether the price gouging should be regulated. The advantages and disadvantages of this idea are critically analyzed. In all these three parts, a conclusion is given. According to world business council for sustainable development publication by Holme and Watts, corporate social responsibility (CRS) refers to a continuous commitment by business to behave in ethical manner while contributing to economic growth and at the same time improving the quality of life of the employees and their families together with that of the entire community and society as a whole. CRS policies are in-built and serve as self regulating mechanism in which businesses do monitor and ensure it supports the existing laws, ethical standards as well as international norms. Generally, CRS is the deliberate inclusion of the public interest in the corporate decision making and honoring of a triple bottom line which include; people, p0lanet and profit. Part I- Capitalism and human happiness Capitalism according to Hunter (2007) refers to an economic system in which the means of production and distribution are privately owned and operated for a private profit. The decisions regarding supply, demand, price, distribution, and investments are made by private actors in the market rather than by central planning by the government; profit is distributed to owners who

Corporate Social Responsibility 4 invest in businesses, and wages are paid to workers employed by businesses. This system is attributed to more efficiency, lower prices for goods and services, rise in affluence and better products of high quality. On this issue Adam smith said if self interest people are alone to seek their own economic advantage, the result unintended by anyone of them, will be greater advantage for all (Hunter, 2007). According to Murrey, (1991) human happiness simply refers to lasting and justifies satisfaction with ones life as a whole. It is an edifice developed slowly and over time. Arguments supporting capitalism There are several reasons that scholars and those who are for capitalism use to defend their support for the system. To them, the balance between the pros and cons dictates their decision. Generally speaking, the system has been thought to promote economic growth and expansion, improving the human living standards, providing more employment and opportunities, a requisite of political freedom, fosters efficient allocation of resources, efficient production and it is a financial incentive. Deane (2005) he noted that capitalism gave persons with the ability to own property, which is central to human existence. When people privately own such properties as land, businesses, goods, services it gives such persons a sense of security and the potential to control his/her own deeds. Ownership of property bring with it responsibility and accountability and will ensure that such individuals carefully plan for the future so that they can be able to meet their own demands and more so that of the family. For instance, when one own a property, they can use such properties as security and borrow more money from financial institutions and expand their businesses which will definitely translate to more job opportunities, development of better services and products among other things. Lack

Corporate Social Responsibility 5 of property ownership has been linked to lack of economic growth especially in developing countries most of which are in Africa. Capitalism in its own sense allows any person or group of person to engage in businesses. It is worth noting that when more than one group ventures in the same business, competition will automatically occur. Economist have argued that competition bring about high quality products that are affordable. The fear of monopoly arising in this system is completely addressed by regulatory mechanisms. Very good examples exist especially in automobile industries and telecommunication and mobile industries. Competition basically leads to efficient production as well as dynamic efficiency in which firms are capable of responding to changes in customers preferences and needs. Additionally Hunter (2007) noted that the absence of government interference in this system creates diverse economies within a country. This is important because even if one of the economies completely fails, the adversities of this will be cushioned by the other remaining stable economies. When this is compared to a system where the government controls everything and diversity does not exist, then when the government gets things wrongs every person seriously suffers economically. Similarly, capitalism allows faster adoption of change; this ensures that innovation is not missed hence continual and gallant survival of businesses that will guarantee employees and consumers salaries and quality and affordable goods and services respectively. Capitalism also ensures that people work hard come a new day. This stems from the concept that those that are lazy, fear taking risks will be justifiably be punished while those that are creative and take risk will ripe the benefits. All these efforts will translate to a better society in which medical attention will be guaranteed, food supply be in plenty, proper infrastructure, better education systems and poverty reduction. The available chance due to freedom of doing business

Corporate Social Responsibility 6 coupled with the free will of corporation and working hard, every individual has a chance of becoming a millionaire. Capitalism also brings out the concept of financial incentive. It has been suggested that people work extra hard when there is a financial benefit. In Maslow hierarchy of need, self actualization can be attained only with a capitalism setup. We see entrepreneurs taking the risk and innovatively set up businesses because of the financial reward expected from the ventures. Considering the fact that the drive to be successful as an individual is what makes people feel motivated about their work, rewarding such people will equally make them feel satisfied and happier. This system also ensures that one can obtain cooperation of others voluntarily and not by force. Finally, the freedom associated with this system has made human beings to venture into various fields and mechanisms of solving problems; this in the long run has made their lives better, enjoyable and happier. Generally speaking capitalism leads to economic growth, high living standards, creates more opportunities, efficient allocation of resources, efficient production, financial incentives and fight corruption. Arguments against capitalism There is nothing in the entire world that does not have the bad side, not even capitalism. Critics of the system among them the socialist, anarchist, communist, technocrats have brought forth very strong argument against capitalism. The disadvantages of the system stems from what Karl Marx said, "If people are left to their own self-interested devices, those who own the means of production will rapidly reduce everyone else to virtual slaves. Although the few may be fabulously happy, all others would live in misery.

Corporate Social Responsibility 7 It has been suggested that capitalism bring about unequal distribution of resources, hence the notion that the wealthy will grow wealthier while the poor will be poorer. The skewed allocation of wealth brought about by the system will not only be felt by the current generation but by the subsequent once. This is because children of the less fortunate parents are at a disadvantage to fight in the free market as compared to those from wealthy parents who have the advantage of inheriting property and expanding it. This unequal distribution of wealth may heighten the level of poverty leading to homelessness, slums, poor medical services hence high rates of mortality and death rates, misery, high level of crimes, wars and civil unrest especially between the rich and the poor in the society. All these will stem from the fact that the wealthy in the society may misuse the less fortunate one, although corporation is voluntarily, the poor has no obligation to work for the rich to meet his/her need, and with this in mind the rich will mistreat the poor. The system has been attributed to constant accumulation of wealth to the already wealthy; this according to critics enhances servitude. In addition, when those that support the system argue that competitions will a rise leading to production of quality services and products at lower and affordable prices, they seem to forget that the businesses that will not survive in an environment will wither and die. Similarly monopolies tend to be formed under such a system. In this way, they are capable of being pernicious suggesting that business owners greatly profit by charging exorbitant prices as such services or products cannot be got elsewhere and they have the power to decide on the prices to be charged. This makes the poor poorer in the society-widening the poverty gap. Capitalism has been regarded to be irrational by socialist in that production and the direction of the economy is unplanned, creating many inconsistencies and internal contradictions

Corporate Social Responsibility 8 leading to economic crunch that produces depressions that damages lives of many. Due to lack of planning of the economy, potential future problems can not be foreseen and prevented. In event of the occurrence of economic depression, the poor individuals in the society will be left worse than they were before. Additionally, according to Rand (1982), capitalism has raised the issue of morality while individuals strive to better their lives. Although persons are accountable and responsible for their actions in this system, freedom and unregulated actions within a societal setting gives room to those that are venturing in various businesses to harm the environment. The system do not necessarily require them to stop their actions as it ruins the environment and the well being of others provided the business bring rewards. Similarly, capitalism calls for a continuous economic growth; this will inevitably deplete the environment. The critics argue that the system may be using very sweet language of human rights, equal employment opportunities, fair salaries and employees welfare but in reality, they respect the right of those not well placed in the society to starve in the sewer and the right of the strong and successful ones to maintain their position. This can be seen in unequal distribution of resources. Conclusion In conclusion, after closely evaluating the arguments for and against capitalism, I come to an agreement that capitalism as an economic system can lead to a happier human beings. It is worth mentioning that currently, we are not living in a pure capitalism scenario thought by Adam Smith. Happiness is derived from the fact that the society is continuously expanding the extension of personal judgment with regards to their future in the hands of the people leading to creation of more profit that when ploughed back fosters development in the economy.

Corporate Social Responsibility 9 Among the advantages of capitalism include promoting economic growth and expansion, improving the human living standards, providing more employment and opportunities, a requisite of political freedom, fosters efficient allocation of resources, efficient production and it is a financial incentive. Adam said that it gives room to those who are innovative, talented and risk takers a chance to fulfill their desires create wealth and at the same time justify the punishment of the cowards, lazy ones as well as those who refused rise above mediocrity. The system also establishes a liberating and a civilization system. Despite the mentioned pros of the system, capitalism has been attributed to inequality especially when it come to distribution of resources and employment opportunities, the systems seems to favor the rich while continuing to suppress the poor. Other problems associated with capitalism are immobility, irrational and monopoly behavior. Considering the fact that when some strategies will be put in place to curb this problems, capitalism still stands to offer mankind greater happiness as compared to all other existing systems especially socialism. Capitalism is practical and moral is the only system that completely accommodates and promotes the intrinsic worth indispensable for human life. It upholds the autonomy of the autonomous psyche and identifies the significance of human beings. My decision to hold the opinion that capitalism can lead to human happiness stems from Kants and Stuarts philosophies of Categorical Imperative and the concept of duty and greatest good for the greatest number (Rand, 1982). Part 2-Derivative Manageable Risk Directive products are articulated that they serve various imperative rationales for conglomerates, institutional and other final users. When well placed derivatives are very essential and proficient tools for various reasons such as declining funding costs, increases investment

Corporate Social Responsibility 10 returns and interest prevarication and disclosure of exchange rates. However, directive also are said to pose very critical issues of substantial risks. Usually directive risks which are vaguely understood usually project corporations, industries. Lawmakers, central bankers and others financial analyst to deliberate both on derivatives potential impacts which they portray on the financial market functioning stability and effective and also the importance of acquisitioning for more regulations (Taylor, 2000). This have made majority of various end users senior managers to reevaluate the derivatives suitability for their corporations. Market risk is the most critical risk which affects derivatives and changes the value, this usually occurs because there is documented change in underlying index or asset prices. This risk is also similar to forwards and options, this is also considered so because the essences of derivatives are mostly fostered by option and forwards bundles. Usually it is articulated that forward compels one principle to buy and the other to sell the principal at a given period and price. However, option usually grants the principle the right, although not the responsibility of whether to purchase or sell the principal asset at a given period and price. Supporting Issues Usually it has been derived at that risk in any organization cannot be fully mitigated. However, this has also been exemplified that risk can be transformed into rather manageable essence. This has been supported that when one is using guarantee, they ate attempting to transfer intangible counterparty credit risk to something which would be viewed tangible and manageable. However, guarantee it self opens doors for liquidity, settlement and valuation risk. Some of the fundamental which compliment and mitigate these issues are efficient collateralization

Corporate Social Responsibility 11 management process (Schwartz, 1997). This is usually achieved through reconciliation wholesale tool usage and collateral management enhancement automation level usage. Another factor which also supports manageable directives risk is economic model implication. Usually this occurs when the implication models are not well capacitated. In the industry although each and every model is perfected there are facts which allows this fall out such as all model adapts same usage of theoretical bias, and financial market and economy relationship are usually not known or vague, thus this usually lead to systemic risk pestering. Another support arises from the liquid risks which are usually never accounted for the model pricing which is executed in financial market dealing. This usually occur because not all model are projected to counter such scenarios and thus majority of the participants which are in the liquid market and have adapted this models are engulfed in systemic risks. However to mitigate this there has to be three forms of counter attack this includes regulation, diversification, and insurance by project transferring risk (Lowenstein, 2000). Diversification: directives manageable risk is also known as un-diversifiable risk which is usually viewed as security risk which cannot be minimized through diversification. Market participant in the market however like hedge funds are usually a source to enhance systematic risk, although risk transfer to them would paradoxically boost systemic risk exposure. Regulation: the main induction of regulation in the market place has been closely associated with systemic risk reduction. However, directives manageable risk will reoccur when regulation arbitrage which is the shift of business from a regulated segment to lees regulated one or un-regulated segment. Usually these occurrences of migration have prompted that the best mitigation which can be diagnosed in this case is through regulations.

Corporate Social Responsibility 12 Project risks: usually in the course of implementing a project there arises various risks which are not identifiable by the task team during these innovative periods. However these risks are usually managed through organization capabilities, project system and culture. Opposing Issues Some of the opposing issues registered in majority of the model used by the participants are usually aligned with each user having diverse objectives and thus they end up adapting alternative uses of directives. This is where the user usually is mostly centralized on the terminal value to be achieved from the derivative products. Fluctuation in the capital market has brought about new relationship with each variable in the market. According to McLaughlin (1994) notes that this usually occurs because derivatives are usually considered to be very complex instruments in the market. The derivatives market fluctuation has brought about hardship in prediction due to the chaotic nature of the market due to the constant changing conditions. Usually due to the myriad interaction of countless stakeholders the financial market usually experiences fluctuation on the prices of directives. Through this there is exposure of risks which project the organization to low company earning and low productivity and turn over. However, analyst have developed myriad diagnosis for cornering this epidemics as it could crumble even the world strongest economy come crawling to its knee. Usually historically it has been speculated that financial institution are instilled with committing one major error which usually cost them. This is that they place more emphasis and trust on counterpartys abilities that guarantees their past trades. This has been moistly accredited with the recent myriad of crisis in many financial institutions and organizations. Therefore it is essential to foster and adapt risk management into the project, from this approach all the benefit that are intended are gained with full effect. Threats within the organization are rampant are they

Corporate Social Responsibility 13 are bound to be encountered, and this is because of the result of several flawed approach. There are those projects that usually use no approach in any way while tackling directives risk management. This is usually deemed to be out of ignorance, if this is their first project or they have confidence in that there would not arise any risk within the scope of the project(this usually do occur in most cases). Another error that most of the pursuant of the risk management in directives do commit is that they tend to blindly commit all their trust into the project manager, this they usually do so by the physical appearance of the individual, especially if he is well build tough looking character like a war veteran, whom for several decades has been in the trenches. Risk management is actually absorbed in the day to day operation by most modern organization; they actually deliberate in their general staff meetings (Williams, 2010). The first step that is usually outlined by this rule of regulation in derivatives risk management is that the pursuant should first point out the threats. The focus here is mainly to deal with any forthcoming threats that may occur in the future; this usually is acquired through keeping keen interest on the subject. The two main source of risk identifiers are people and paper as the charge that can root out risk. For the project to fully materialize every member in the project has different capability and expertise while combating threats and conducting the project. If one decides to outsource then the best candidate to get the advice from would be qualified experts that have track record with the kind of project or work load that is present (Schwartz, 1997). While injecting a new directives risk assessment it is good to outsource, this is mainly that the person with a lot of expertise will inject a great amount of knowledge and point out threats that might have crossed the eyes of the project team members. However, for one to articulate and discover the various threats that may arise, the most advised method is through interviews while executing group works conferences. Paper here there is differentiation of theories and approach.

Corporate Social Responsibility 14 The threats that have been identified within the project they generate various numbers of documentation which are electronic. They usually do not have names but an intellectual will read between the lines and prune them out. In this sense the best start approach is usually obtained in the commerce case, planning of the project and planning of the resources as noted by Taylor (2000). Thus the risk are mitigated and ousted through simple means through the project implementation or after implementation, here the basic being able to pin point where derivatives risks can be managed best. Conclusion Usually the golden concepts that are instilled and are injected to the risk management of the directives for the sole purpose of submission and acceptance of threat management are executed for the benefit of initial derivatives suitability for the corporations (Lowenstein, 2000). All the rules pertaining how this vice can be rooted are designed to take different approaches that project managers or any pursuant that may indulge in risk maximization and complete diminishing would want to articulate adapting various imperative rationales which attempts to mitigate risk in derivatives. Derivatives risk management historically has been considered the most beneficial aspect of combating uncertainty in the organizations and adding value to the capital market. Therefore, it has bee proven that if the myriad of financial institutions while pursuant to project risk management of derivatives is able to pin point the uncertainty in the project then more resources can be allocated to them if they pursue it in a proactive manner. This is usually attained by opportunity seizure which usually is spotted when injecting the project with the aim of reducing the threat that is found within the project. These aspects are responsible for early delivery of project; on the budget and the

Corporate Social Responsibility 15 kind of quality results that are expected by the sponsors are achieved. This usually adds value to the initial product which is being utilized to be sold in the capital market. Part 3- Should price gouging be regulated? Price gouging refers to a situation in which sellers put a price tag on a good or service that is deemed much higher and thus not fair or reasonable. This normally occurs when demand for a product is very high while the supply is below threshold. In United States of American for instance have laws against price gouging. Opposing issues Regulating the price of goods and or services is nothing but price control mechanism which does bring about a myriad of negative implication to the economy. The argument here is that when emergencies coupled with regulation of prices will definitely cause the disappearance of important goods and services from the shelves. This is because those who will come first will be served; this scenario leaves those who were in dire need of the commodity at a disadvantage of not getting such products or services. But when the prices are set at a higher level, those individuals who do not strongly require the commodity will refrain from buying them this ensures that they are available for those who strongly need them. It is worth noting that higher prices at present tend to decrease utilization and increase inventories and thus reducing how much prices will rise in future. Thus in general raise in price will in fact be much less. According to (Lott, 2003). Opponents of regulating prices say that they support rising prices under certain conditions and they believe that when the government engages in activities of controlling prices is a violation of individual rights and or that the ability to raise prices has beneficial effects. This thus goes against the principles and concepts of capitalism. In addition,

Corporate Social Responsibility 16 when prices are regulated, good that were scarce will worsen the situation as the commodity may completely disappear from the market placing those who were in dire need of such commodity at risk and even loss of live and property. Similarly, laws against price increases only serves to restrict supplies of goods and services by reducing the incentive suppliers and producers have to undertake any additional costs, hazards or inconveniences that may be required. They further say that increase in prices forces consumers to ration commodities hence increasing the longevity of certain scares resources especially in emergency situations. Higher prices will help solve the problem of long queues. Controlled prices has been linked to very high demand for certain products, this rise in demand will put pressure on the selling points forcing people to wait in long lines to acquire the product, this seems to be fine to the proponents of regulating prices, who seem to have a lot of time to do that. Additionally, higher prices will help especially in areas or states where calamities such as floods, hurricane has occurred. With the quest to make a few more dollars, these greedy businesses will load trucks and planes and head to such areas. Thus, the higher the prices the faster the businesses will strive to take their products to the desperate consumers, this greed means less suffering considering the fact that the commodities were delivered on time. Higher prices bring about potential benefits to consumers. The absence of higher prices eliminates the prolonged sufferings (Lott, 2003). Generally speaking setting laws against price gouging will foster shortages of commodities and more sufferings.

Corporate Social Responsibility 17 Supporting Issues Major debates that usually arises in the case of price gouging regulation is that many concentrate on monopolies played by marketers in cases of disasters. Usually this is also centralized on man made disasters which goes beyond improper hiking of commodities to certain market which have higher demand for that particular commodity. Usually this occurs when a calamity triggers prices gouging because of the high demand for certain product in that particular region. Then outcry arise that this is ethical and inappropriate. However this efficient system of product supplication to one particular market segment at a higher price because of demand is was is termed fluctuation of prices due to high demand brought about by changes in the supply and demand chain. However, a trader taking advantage of this situation to get extra buck has been criticized and termed unethical citing flaunting of individual rights. This is also violation of the free market to the traders who sees an opportunity and seeks to make a profit from the regular price due to the high demand that has been create because of some unforeseen circumstances. This usually what one calls free market price mechanism that usually occur un-preceded or structured but natural and thus the traders usually commit no felony while taking charge of the opportunity. There is usually no alarming or felony committed in this condition of opportunities like this are never created but randomly occur due to unprecedented opportunity that the trader sees and seizes it. This usually also occur when certain commodity prices goes high then this also triggers supply to suit this area because demand is high thus the trader is only sourcing for market for their merchandise. This would be like the case that when the prices of wheat flour relatives sky rocket. Then this is to show that there is scarcity of wheat flour in the market. Thus the farmers would automatically spike up the prices of wheat, through this initiative they have not committed any

Corporate Social Responsibility 18 felony they have only taken advantage of the capital market to make an extra profit because there is fluctuation in the market and wheat has now been approved a scarce commodity. Now the price gouging in this case is mostly be affected by competition which may also play part in toning down the prices as each farmer would add up inceptives in their prices. This is engineered to suit the profit margin which the farmer intend to achieve during the short long run of the scarcity and when all return to normal the prices automatically regulate to normal. Every sound person would take advantage of such a situation of a free market price gouging given that they know that this is short lived and after the scarcity prices are toned to normalcy. This price spike would be assumed terrible however assume having to do without this commodity. There are many values which actually many people miss when criticizing price gouging like the scarcity could be even be on the trader and they are forced to import this commodity. The expenses incurred are mostly which majority of the traders usually hike prices because of this are to cater for that transportation, duty levies and shipping fees. This prices gouging enables the limited qualities of the scarce essential commodities from vanishing from the market. The market pricing atmosphere is very aggressive and sellers are always attempting to take advantage of the buyers and consumers. This is usually happens in our daily lives regardless of whether there are calamities or there going is normal. This can be well exonerated through the sales of shares to the stock market. When the buyer buys shares they then wait for the market shares to elevate then they can sell their shares. Well if this just then the traders have the right to also invest on the market price fluctuation on certain commodity to achieve also a profit from this expenditure. Policy makers have given this initiative a bad picture and names like price gouging, predatory pricing and ticket scalping. However, they themselves also participate in bonds and share buying or real estate business which also is another form of price gouging (Matt, 2008).

Corporate Social Responsibility 19 Conclusion Usually there are myriad of both positive and negative impact that price gouging have on the consumer and the traders. On the positive notes the market is a free entity which allows the seller and the buyer to take advantages of each other to suit or make a little saving and profit. However, people and policy makers have been detailing this epic on a negative side which details this being un-ethical and immoral. They centralize on these issues basing it on the calamity angle and how the minority are marginalized through prices fixing that they term unethical. Mostly this has been associated with the commodity being plenty in the supply and the prices will favor the minority. This they argue that some of the minority are unjustly priced out of the market due to emergencies. They further articulate that the supplier benefit unethically from the consumer in the pretence of high demand due to short supply. Actually this have been never the case and majority of this people would all say that they indulge in waiting for the shares market to go up and take advantage of the seller to earn an extra dollar. This profit margin which occurs with or without calamity are the one which the trader are accused of manipulating and thus argue that should be regulated however this regulation would also constrain free market policies as well as they violate human rights when not regulated. Thus this should be left to be the way they have been and the government intervene where some traders take excessive advantage.

Corporate Social Responsibility 20 References Ballor, J. (2005). The Ethics of Price Gouging. Retrieved on 13 September 2010 from http://blog.acton.org/archives/441-the-ethics-of-price-gouging.html Deane, A. (2005). Capitalism vs. Socialism. Retrieved on 13 September 2010 from http://www.idebate.org/debatabase/topic_details.php?topicID=400 Hunter, S. (2007). Is Capitalism the Best Route to Human Happiness? Retrieved on 13 September 2010 fromhttp://www.associatedcontent.com/article/185102/is_capitalism_the_best_route_to_hu man_pg10.html?cat=72 Lott, R.J (2003). In Defense of Prince Gouging. Retrieved on 13 September 2010 from http://www.lewrockwell.com/lott/lott45.html Lowenstein, R. (2000). When Genius Failed: the Rise and fall of Long-Term Capital Management. New York: Random House. Matt, Z. (2008). The Ethics of Price Gouging. Business Ethics Quarterly 18 (3):347-378. McLaughlin, R. (1994). Risks in derivatives products are substantial but manageable. New York: Penguin. Rand, A. (1982). Capitalism: The Unknown Ideal; What is Capitalism? New York: Signet. Schwartz, R. (1997). Derivatives Handbook: Risk Management and Control. New York: John Wiley & Sons. Taylor, F. (2000). Mastering Derivatives Markets. New York: Prentiss Hall. Williams, M. (2010). Uncontrolled Risk: The Lessons of Lehman Brothers and How Systemic Risk Can Still Bring Down the World Financial System. New York: McGraw-Hill.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Sample Monologues PDFDocumento5 páginasSample Monologues PDFChristina Cannilla100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Apexi Powerfc Instruction ManualDocumento15 páginasApexi Powerfc Instruction ManualEminence Imports0% (2)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Workbook Group TheoryDocumento62 páginasWorkbook Group TheoryLi NguyenAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Miniature Daisy: Crochet Pattern & InstructionsDocumento8 páginasMiniature Daisy: Crochet Pattern & Instructionscaitlyn g100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Audit of Non-Profit OrganizationsDocumento25 páginasAudit of Non-Profit OrganizationsCheapestPapers83% (6)

- Hans Belting - The End of The History of Art (1982)Documento126 páginasHans Belting - The End of The History of Art (1982)Ross Wolfe100% (7)

- Leadership Styles-Mckinsey EdDocumento14 páginasLeadership Styles-Mckinsey EdcrimsengreenAinda não há avaliações

- Differences Between Micro and MacroeconomicsDocumento5 páginasDifferences Between Micro and MacroeconomicsCheapestPapers100% (1)

- SWOT and PEST Analysis of WalmartDocumento6 páginasSWOT and PEST Analysis of WalmartCheapestPapersAinda não há avaliações

- IEC TC 56 Dependability PDFDocumento8 páginasIEC TC 56 Dependability PDFsaospieAinda não há avaliações

- Toeic: Check Your English Vocabulary ForDocumento41 páginasToeic: Check Your English Vocabulary ForEva Ibáñez RamosAinda não há avaliações

- Sources of Hindu LawDocumento9 páginasSources of Hindu LawKrishnaKousikiAinda não há avaliações

- Dermatology Skin in Systemic DiseaseDocumento47 páginasDermatology Skin in Systemic DiseaseNariska CooperAinda não há avaliações

- Cultural Differences and Nonverbal CommunicationDocumento7 páginasCultural Differences and Nonverbal CommunicationCheapestPapersAinda não há avaliações

- How Low Cost Airlines Gain Competitive AdvantageDocumento7 páginasHow Low Cost Airlines Gain Competitive AdvantageCheapestPapers100% (1)

- Ledership StylesDocumento5 páginasLedership StylesCheapestPapersAinda não há avaliações

- Running Head: Global Warming Is BeneficialDocumento4 páginasRunning Head: Global Warming Is BeneficialCheapestPapersAinda não há avaliações

- SummaryDocumento5 páginasSummaryCheapestPapersAinda não há avaliações

- Interpersonal CommunicationDocumento9 páginasInterpersonal CommunicationCheapestPapersAinda não há avaliações

- Differences Between Fiscal and Monetary PoliciesDocumento7 páginasDifferences Between Fiscal and Monetary PoliciesCheapestPapersAinda não há avaliações

- Cultural Diversity in The WorkplaceDocumento7 páginasCultural Diversity in The WorkplaceCheapestPapersAinda não há avaliações

- Causes and Consequences of The Great Depression in AmericaDocumento5 páginasCauses and Consequences of The Great Depression in AmericaCheapestPapers100% (2)

- SWOT and PEST Analysis of American AirwaysDocumento6 páginasSWOT and PEST Analysis of American AirwaysCheapestPapers0% (1)

- MC DonaldsDocumento12 páginasMC DonaldsCheapestPapersAinda não há avaliações

- Cultural Diversity in The WorkplaceDocumento6 páginasCultural Diversity in The WorkplaceCheapestPapers100% (1)

- SWOT and PEST Analysis of Apple Inc.Documento5 páginasSWOT and PEST Analysis of Apple Inc.CheapestPapers100% (1)

- Microsmart GEODTU Eng 7Documento335 páginasMicrosmart GEODTU Eng 7Jim JonesjrAinda não há avaliações

- Fast Track Design and Construction of Bridges in IndiaDocumento10 páginasFast Track Design and Construction of Bridges in IndiaSa ReddiAinda não há avaliações

- Gas Dynamics and Jet Propulsion 2marksDocumento15 páginasGas Dynamics and Jet Propulsion 2marksAbdul rahumanAinda não há avaliações

- 6GK74435DX040XE0 Datasheet enDocumento3 páginas6GK74435DX040XE0 Datasheet enLuis CortezAinda não há avaliações

- Durex 'S Marketing Strategy in VietnamDocumento45 páginasDurex 'S Marketing Strategy in VietnamPham Nguyen KhoiAinda não há avaliações

- Biography Thesis ExamplesDocumento7 páginasBiography Thesis Examplesreneewardowskisterlingheights100% (2)

- Wholesale Terminal Markets - Relocation and RedevelopmentDocumento30 páginasWholesale Terminal Markets - Relocation and RedevelopmentNeha Bhusri100% (1)

- Lesson 6 - Vibration ControlDocumento62 páginasLesson 6 - Vibration ControlIzzat IkramAinda não há avaliações

- The cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayDocumento7 páginasThe cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayMennatallah AliAinda não há avaliações

- Cyber Briefing Series - Paper 2 - FinalDocumento24 páginasCyber Briefing Series - Paper 2 - FinalMapacheYorkAinda não há avaliações

- What's New in CAESAR II: Piping and Equipment CodesDocumento1 páginaWhat's New in CAESAR II: Piping and Equipment CodeslnacerAinda não há avaliações

- QuexBook TutorialDocumento14 páginasQuexBook TutorialJeffrey FarillasAinda não há avaliações

- The Covenant Taken From The Sons of Adam Is The FitrahDocumento10 páginasThe Covenant Taken From The Sons of Adam Is The FitrahTyler FranklinAinda não há avaliações

- Radon-222 Exhalation From Danish Building Material PDFDocumento63 páginasRadon-222 Exhalation From Danish Building Material PDFdanpalaciosAinda não há avaliações

- Fertilization Guide For CoconutsDocumento2 páginasFertilization Guide For CoconutsTrade goalAinda não há avaliações

- Anatomy of the pulp cavity กย 2562-1Documento84 páginasAnatomy of the pulp cavity กย 2562-1IlincaVasilescuAinda não há avaliações

- Chapter 23Documento9 páginasChapter 23Javier Chuchullo TitoAinda não há avaliações

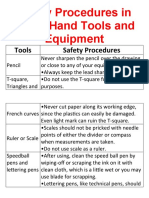

- Safety Procedures in Using Hand Tools and EquipmentDocumento12 páginasSafety Procedures in Using Hand Tools and EquipmentJan IcejimenezAinda não há avaliações

- Tutorial 5 SolvedDocumento3 páginasTutorial 5 SolvedAshutoshKumarAinda não há avaliações

- Webinar Gizi - Patho StuntingDocumento16 páginasWebinar Gizi - Patho StuntingMiftahul HikmahAinda não há avaliações