Escolar Documentos

Profissional Documentos

Cultura Documentos

Equity Valuation Book

Enviado por

ooppaaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Equity Valuation Book

Enviado por

ooppaaDireitos autorais:

Formatos disponíveis

Equity Asset Valuation: Valuation - Google Book Search

Page 1 of 3

equity valuation methods

Search Books

My library | Sign in

About this book

Preview this book

Equity Asset Valuation By John D. Stowe, Thomas R. Robinson, Jerald E. Pinto, Dennis W. McLeavey

Buy this book Wiley.com Amazon.com Barnes&Noble.com - $95.00 Books-A-Million Borders - $95.00

"Here is an essential tool for the investor: clear, practical, insightful, and concise. This book should have a long, useful life in a professional's library." Jeffrey P. Davis, CFA, Chief Investment Officer, Lee Munder Capital Group

Preview this book

IndieBound "This book provides a clear, Google Product Search comprehensive overview of equity valuation concepts and FNAC methods. It is well suited for Livraria Cultura finance practitioners who want to strengthen their Livraria Nobel understanding of equity asset Livraria Saraiva valuation and as a Submarino supplemental reading in advanced undergraduate and Borrow this book graduate courses addressing security analysis and business Find this book in a library valuation." Professor Robert Parrino, CFA, PhD, Department of Finance, Red McCombs School of Business, The University of Texas at Austin "CFA Institute has done it again. This will be a 'must' reference book for anyone serious about the nuances of equity investment valuation." Robert D. Arnott, Chairman, Research Affiliates "Equity Asset Valuation concisely and clearly explains the most widely used approaches to equity evaluation. In addition to thoroughly explaining the implementation of each valuation method, there is sophisticated discussion of the commonsense financial economics and accounting issues underlying the methods." David Blackwell, Head and RepublicBank/James W. Aston Professor of Finance, Mays Business School, Texas A&M University

More details Equity Asset Valuation: Valuation By John D. Stowe, Thomas R. Robinson, Jerald E. Pinto, Dennis W. McLeavey Contributor John D. Stowe, Jerald E. Pinto, Dennis W. McLeavey Edition: illustrated Published by John Wiley and Sons, 2007 ISBN 0470052821, 9780470052822 310 pages

(2)

Write review Add to my shared library

http://books.google.com/books?id=GGu1jTk9ewsC&dq=equity+valuation+methods&s... 13/4/2009

Equity Asset Valuation: Valuation - Google Book Search

Page 2 of 3

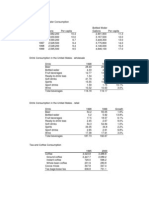

Contents

CHAPTER

equity valuation , free cash flow , dividend discount model 1

CHAPTER

dividend discount model , risk premium , free cash flow

37

CHAPTER

WACC , flow to equity , EBITDA

107 113 140 157

Forecasting Free Cash Flow

EBIT , preferred stock , FCFF

Free Cash Flow Model Variations

terminal value , FCFE , Net profit margin

CHAPTER

SK Telecom , BHP Billiton , Alcan more

Selected pages

Title Page

Table of Contents

Search in this book

Search

Popular passages

Regulations 108) define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. - Page 19 Appears in 75 books from 1938-2007 Techniques, prepared in 1954 by a joint committee of the American Psychological Association, the American Educational Research Association, and the National Council on Measurements Used in Education... - Page xviii Appears in 65 books from 1931-2007 The basic concept of present value is that an amount of cash to be paid or received in the future is worth less than the same amount of cash to be paid or received today. - Page 39

http://books.google.com/books?id=GGu1jTk9ewsC&dq=equity+valuation+methods&s... 13/4/2009

Equity Asset Valuation: Valuation - Google Book Search

Page 3 of 3

Equity Asset Valuation

by Thomas R Robinson, Inc NetLibrary, Thomas R. Robinson, CFA, John D Stowe, Jerald E Pinto, John D. Stowe, CFA, Dennis W McLeavey, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA - Business & Economics - 2007 - 336 pages "Here is an essential tool for the investor: clear, practical, insightful, and concise. No preview available - About this book - Add to my shared library

Key terms

free cash flow, dividend discount model, EBITDA, risk premium, book value, flow to equity, CFA Institute, NYSE, terminal value, dividend yield, present value, earnings per share, cost of equity, equity valuation, return on equity, income statement, rate of return, preferred stock, risk-free rate, CAPM Excel Financial Models Makes forecasting, budgeting, & analysis fast and easy. www.ustyleit.com Sponsored Links

Stocks With High Dividend 3 companies sending excess cash back to shareholders. Free report. www.InvestmentU.com/Dividend_Report

About Google Book Search - Book Search Blog - Information for Publishers - Provide Feedback - Google Home 2009 Google

http://books.google.com/books?id=GGu1jTk9ewsC&dq=equity+valuation+methods&s... 13/4/2009

Você também pode gostar

- Gary E. Clayton - Economics. Principles and Practices (2000, McGraw-Hill - Glencoe) PDFDocumento664 páginasGary E. Clayton - Economics. Principles and Practices (2000, McGraw-Hill - Glencoe) PDFVictor Camargo100% (2)

- K12 Financial Literacy GuideDocumento55 páginasK12 Financial Literacy GuideJuan Frivaldo100% (1)

- The Blue Line Imperative: What Managing for Value Really MeansNo EverandThe Blue Line Imperative: What Managing for Value Really MeansNota: 4 de 5 estrelas4/5 (2)

- Transactional Training Resource GuideDocumento27 páginasTransactional Training Resource GuideDamian KasprzykAinda não há avaliações

- Leibowitz - Franchise Value PDFDocumento512 páginasLeibowitz - Franchise Value PDFDavidAinda não há avaliações

- Rethinking The Equity Risk PremiumDocumento164 páginasRethinking The Equity Risk PremiumqutobolAinda não há avaliações

- Your Complete Guide To Factor-Based Investing (PDFDrive)Documento297 páginasYour Complete Guide To Factor-Based Investing (PDFDrive)Walter García Sandoval100% (1)

- Aircraft LeasingDocumento132 páginasAircraft LeasingBenchmarking84100% (1)

- Finance TextbooksDocumento3 páginasFinance TextbooksPrateek SrivastavaAinda não há avaliações

- Franchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Documento512 páginasFranchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Favio C. Osorio PolarAinda não há avaliações

- Entrepreneurship and Project ManagementDocumento128 páginasEntrepreneurship and Project Managementtulasinad123Ainda não há avaliações

- Modern Investment Management: An Equilibrium ApproachNo EverandModern Investment Management: An Equilibrium ApproachNota: 3.5 de 5 estrelas3.5/5 (4)

- Appendix VI: Hertz Corp. Case Study: Overview: The Hertz Buyout Is One of The Largest Private Equity Deals. ItDocumento5 páginasAppendix VI: Hertz Corp. Case Study: Overview: The Hertz Buyout Is One of The Largest Private Equity Deals. ItProutAinda não há avaliações

- The Incredible Shrinking Alpha 2nd edition: How to be a successful investor without picking winnersNo EverandThe Incredible Shrinking Alpha 2nd edition: How to be a successful investor without picking winnersNota: 4 de 5 estrelas4/5 (2)

- PMEGPDocumento260 páginasPMEGPsuryanathAinda não há avaliações

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskNo EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskNota: 3.5 de 5 estrelas3.5/5 (1)

- Ebook PDF Damodaran On Valuation Security Analysis For Investment and Corporate Finance 2nd Edition PDFDocumento41 páginasEbook PDF Damodaran On Valuation Security Analysis For Investment and Corporate Finance 2nd Edition PDFjamie.bouy60998% (40)

- Credit PolicyDocumento4 páginasCredit PolicyArslan AshfaqAinda não há avaliações

- Financial Statement Analysis - CPARDocumento13 páginasFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Strategic Corporate Finance: Applications in Valuation and Capital StructureNo EverandStrategic Corporate Finance: Applications in Valuation and Capital StructureAinda não há avaliações

- Fiscal Policy of The Philippines PDFDocumento4 páginasFiscal Policy of The Philippines PDFEmmanuel Jimenez-Bacud, CSE-Professional,BA-MA Pol Sci100% (1)

- Statement of Changes in Equity - Practice ExercisesDocumento2 páginasStatement of Changes in Equity - Practice ExercisesEvangeline Gicale25% (8)

- Honest Tea - Help SpreadsheetDocumento12 páginasHonest Tea - Help Spreadsheetvirgin51100% (1)

- Landau Company Draft1Documento4 páginasLandau Company Draft1cedric sevilla100% (2)

- Mastering Corporate Finance Essentials: The Critical Quantitative Methods and Tools in FinanceNo EverandMastering Corporate Finance Essentials: The Critical Quantitative Methods and Tools in FinanceAinda não há avaliações

- The Future of Value: How Sustainability Creates Value Through Competitive DifferentiationNo EverandThe Future of Value: How Sustainability Creates Value Through Competitive DifferentiationAinda não há avaliações

- ÒÇÉÚçÅÕîû èòÞÁäÒÇæYour Complete Guide To Factor-Based Investing by Andrew L. Berkin PDFDocumento323 páginasÒÇÉÚçÅÕîû èòÞÁäÒÇæYour Complete Guide To Factor-Based Investing by Andrew L. Berkin PDFcastjam100% (1)

- Literature Review On Housing FinanceDocumento5 páginasLiterature Review On Housing Financecuutpmvkg100% (1)

- ASAL Economics TR ch1 Teaching NotesDocumento5 páginasASAL Economics TR ch1 Teaching NotesyiAinda não há avaliações

- Dissertation Economie Developpement DurableDocumento8 páginasDissertation Economie Developpement DurableCustomPapersOnlineSingapore100% (1)

- Popular Personal Financial AdviceDocumento32 páginasPopular Personal Financial AdviceButterAinda não há avaliações

- Thesis in Financial ManagementDocumento7 páginasThesis in Financial Managementlidzckikd100% (2)

- Literature Review Example FinanceDocumento8 páginasLiterature Review Example Financeafdtxmwjs100% (1)

- Yorku ThesisDocumento4 páginasYorku Thesisfjfyj90y100% (1)

- Household Financial Management The Connection BetwDocumento15 páginasHousehold Financial Management The Connection BetwShaquille RobinsonAinda não há avaliações

- Advances in The Practice of Public Investment Management 1St Ed Edition Narayan Bulusu Full ChapterDocumento67 páginasAdvances in The Practice of Public Investment Management 1St Ed Edition Narayan Bulusu Full Chapterteresa.vanhorn907100% (6)

- The Function of Seo in Finance Problems: Subtitle As Needed (Paper Subtitle)Documento2 páginasThe Function of Seo in Finance Problems: Subtitle As Needed (Paper Subtitle)Jennifer WijayaAinda não há avaliações

- General Thesis of The Natural AttitudeDocumento6 páginasGeneral Thesis of The Natural AttitudeCheapestPaperWritingServiceGilbert100% (3)

- Quantitative Easing Research Paper PDFDocumento4 páginasQuantitative Easing Research Paper PDFpoypdibkf100% (1)

- Grable Kruger Fallaw 2017Documento17 páginasGrable Kruger Fallaw 2017EDurdo OlveraAinda não há avaliações

- Derivatives and Risk ManagementDocumento18 páginasDerivatives and Risk Managementsneha bhongadeAinda não há avaliações

- Portfolio Construction Literature ReviewDocumento8 páginasPortfolio Construction Literature Reviewdafobrrif100% (1)

- Finance FeaturesDocumento7 páginasFinance FeaturesBlackBunny103Ainda não há avaliações

- The Collaboration Economy: How to Meet Business, Social, and Environmental Needs and Gain Competitive AdvantageNo EverandThe Collaboration Economy: How to Meet Business, Social, and Environmental Needs and Gain Competitive AdvantageAinda não há avaliações

- Managerial Accounting 6th EditionDocumento61 páginasManagerial Accounting 6th Editionmaria.bowman208100% (47)

- SSRN Id1456543Documento35 páginasSSRN Id1456543jkh1100% (1)

- Managerial Accounting Creating Value in A Dynamic Business Environment 13Th Edition Hilton Full ChapterDocumento67 páginasManagerial Accounting Creating Value in A Dynamic Business Environment 13Th Edition Hilton Full Chaptercatherine.green419100% (7)

- Literature Review of Finance DepartmentDocumento8 páginasLiterature Review of Finance Departmentgpxmlevkg100% (1)

- Literature Review On Capacity UtilizationDocumento5 páginasLiterature Review On Capacity Utilizationgw259gj7100% (1)

- Finance Term Paper TopicsDocumento7 páginasFinance Term Paper Topicsaflsktofz100% (1)

- Quantitative Financial Analytics The Path To Investment Profits (Dobelman, John A.Williams, Edward E) (Z-Library)Documento621 páginasQuantitative Financial Analytics The Path To Investment Profits (Dobelman, John A.Williams, Edward E) (Z-Library)amitlkoyogaAinda não há avaliações

- Literature Review Financial LiteracyDocumento8 páginasLiterature Review Financial Literacyafmzsbzbczhtbd100% (1)

- Columbia Southern University Literature ReviewDocumento6 páginasColumbia Southern University Literature Reviewafmzubsbdcfffg100% (1)

- Literature Review On Financial LiteracyDocumento6 páginasLiterature Review On Financial Literacyc5haeg0n100% (1)

- Case 10 PDFDocumento28 páginasCase 10 PDFDuren JayaAinda não há avaliações

- A Review of Academic Literature On Active Management PDFDocumento29 páginasA Review of Academic Literature On Active Management PDFReyansh SharmaAinda não há avaliações

- Literature Review On Small Scale EnterprisesDocumento6 páginasLiterature Review On Small Scale Enterpriseskhkmwrbnd100% (1)

- Literature Review On Natural ProductDocumento6 páginasLiterature Review On Natural Producthyz0tiwezif3100% (1)

- Literature Review On Fund ManagementDocumento5 páginasLiterature Review On Fund Managementeubvhsvkg100% (2)

- Literature Review On Financial DeepeningDocumento5 páginasLiterature Review On Financial Deepeningafmzadevfeeeat100% (2)

- Dissertation Value InvestingDocumento8 páginasDissertation Value InvestingBestCollegePaperWritingServiceSingapore100% (2)

- Behavioural Economics Literature ReviewDocumento4 páginasBehavioural Economics Literature Reviewc5t9rejg100% (1)

- Literature Review On Stock ManagementDocumento7 páginasLiterature Review On Stock Managementafmzmrigwaeera100% (2)

- DBA Thesis SubjectsDocumento8 páginasDBA Thesis SubjectsPaperWritingHelpOnlineSingapore100% (2)

- Financial and Managerial Accounting 9Th Edition John Wild Full ChapterDocumento67 páginasFinancial and Managerial Accounting 9Th Edition John Wild Full Chaptercharles.chapman882100% (13)

- Micro V2 Chapter 1Documento57 páginasMicro V2 Chapter 1Momentum Press100% (1)

- Literature Review On Behavioural FinanceDocumento4 páginasLiterature Review On Behavioural Financefvhqqm3b100% (1)

- Thesis Jds FundDocumento8 páginasThesis Jds FundBuyEssaysTulsa100% (1)

- Bank ThesisDocumento6 páginasBank Thesismariestarsnorthlasvegas100% (1)

- SAP Basic ConceptsDocumento9 páginasSAP Basic Conceptsganesanmani1985Ainda não há avaliações

- JKR For Bloom & Blossom Intro 060219Documento70 páginasJKR For Bloom & Blossom Intro 060219Anonymous KzUEeCUVYAinda não há avaliações

- ATCapital Dubai HospitalityDocumento3 páginasATCapital Dubai HospitalityatcapitalsgAinda não há avaliações

- AB InBev RA2018 ENDocumento202 páginasAB InBev RA2018 ENKshitiz GuptaAinda não há avaliações

- EY-Integrated Business Planning PDFDocumento16 páginasEY-Integrated Business Planning PDFanweshaccAinda não há avaliações

- Mann V Hulme 106 CLR 136Documento6 páginasMann V Hulme 106 CLR 136David LimAinda não há avaliações

- A REPORT ON Working Capital Management IDocumento78 páginasA REPORT ON Working Capital Management IAriful Islam RonyAinda não há avaliações

- AB Bank Final ReportDocumento72 páginasAB Bank Final ReportShahjalal Sumon100% (1)

- Repurchase FormDocumento1 páginaRepurchase FormmanjubellurAinda não há avaliações

- Portfolio Management FundamentalsDocumento7 páginasPortfolio Management Fundamentalsriskmanagement recruitmentAinda não há avaliações

- Askri Bank Internship ReportDocumento52 páginasAskri Bank Internship ReportShahid MehmoodAinda não há avaliações

- Measuring TheDocumento20 páginasMeasuring Thedr_hsn57Ainda não há avaliações

- EO EncounterDocumento12 páginasEO EncounterMJ YaconAinda não há avaliações

- PortfolioDocumento3 páginasPortfoliojgb000Ainda não há avaliações

- Project Management: Generation & Screening of Project IdeasDocumento16 páginasProject Management: Generation & Screening of Project Ideasshital_vyas1987Ainda não há avaliações

- ASIC Regulatory Reporting Functional SpecificationDocumento18 páginasASIC Regulatory Reporting Functional SpecificationArun Kumar SikriAinda não há avaliações

- ESAPDocumento8 páginasESAPsimbarashe chitsaAinda não há avaliações

- Director Business Intelligence Analytics in Phoenix AZ Resume Tracy PowersDocumento2 páginasDirector Business Intelligence Analytics in Phoenix AZ Resume Tracy PowersTracyPowersAinda não há avaliações

- International Finance Homework SolutionDocumento34 páginasInternational Finance Homework SolutionRichard WestAinda não há avaliações

- Tech TP PrudenceDocumento6 páginasTech TP PrudenceAgus WijayaAinda não há avaliações