Escolar Documentos

Profissional Documentos

Cultura Documentos

India

Enviado por

Malik SaadoonDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

India

Enviado por

Malik SaadoonDireitos autorais:

Formatos disponíveis

India, Pakistan: a comparison

DR. ISHRAT HUSAIN

The author is the Director, Poverty and Social Policy Department, World Bank. The views expressed in this article are personal and do not represent those of the World Bank.

India and Pakistan are completing five decades of their independence. Since the partition, the relationship between the two countries has been uneasy and characterized by a set of paradoxes. There is a mixture of love and hate, a tinge of envy and admiration, bouts of paranoia and longing for cooperation, and a fierce rivalry but a sense of proximity, too. The heavy emotional overtones have made it difficult to sift the facts from the myths and make an objective assessment. There are in fact only two extreme types of reactions on each side. Either there are those who always find that the grass is greener on the other side of the pasture or those who are totally dismissive of the accomplishments of the other side.

This article attempts to present an objective, empirically-based and balanced view of the economic achievements and failures of both the countries during the span of the last five decades. The strict comparison becomes somewhat problematic because of the separation of East from West Pakistan in 1971 but, the analysis and conclusions drawn by and large remain valid.

First, the common successes shared by both the countries:

o

Despite the prophets of gloom and doom on both sides of the fence, both India and Pakistan have succeeded in more than doubling their per capita incomes. This is a remarkable feat considering that the population has increased fourfold in case of Pakistan and threefold in India. Leaving aside the countries in East Asia and China, very few large countries have been able to reach this milestone. The incidence of poverty (defined as $1 per day) has also been reduced significantly although the number of absolute poor remains astoundingly high. However, the level of poverty is lower in Pakistan.

Food production has not only kept pace with the rise in population but has surpassed it. Both countries, leaving aside annual fluctuations due to weather conditions, are self-sufficient in food. (Pakistan exports its surplus rice but imports small volumes of wheat). Food self-sufficiency has been accompanied by improved nutritional status. Daily caloric and protein intake per capita has risen by almost one-third but malnourishment among children is still high. The cracks in the dualistic nature of the economy -- a well-developed modern sector and a backward traditional sector -- are appearing fast in both the countries. A buoyant middle class is emerging. The use of modern inputs and mechanization of agriculture has been a leveling influence in this direction. But public policies have not always been consistent or supportive.

Second, the common failures of the two countries. The relatively inward-looking economic policies and high protection to domestic industry did not allow them to reap the benefits of integration with the fast-expanding and much larger world economy. This has changed particularly since 1991 but the control mind-set of the politicians and the bureaucrats has not changed. The centrally planned allocation of resources and "license raj" has given rise to an inefficient private sector that thrive more on contacts, bribes, loans from public financial institutions, lobbying, tax evasion and rent-seeking rather than on competitive behavior. Unless both the control mind-set of the government and the parasitic behavior of the private industrial entrepreneurs do not change drastically, the potential of an efficient economy would be hard to achieve. This can be accomplished by promoting domestic and international competition, reducing tariff and non-tariff barriers and removing constraints to entry for newcomers.

The weaknesses in governance in the legal and judicial system, poor enforcement of private property rights and contracts, preponderance of discretionary government rules and regulations and lack of transparency in decision making act as brakes on broadbased participation and sharing of benefits by the majority of the population.

In terms of fiscal management, the record of both the countries is less than stellar. Higher fiscal deficits averaging 7-8 percent of GDP have persisted for fairly long periods of time and crowded out private capital formation through large domestic

borrowing. Defense expenditures and internal debt servicing continue to pre-empt large proportion of tax revenues with adverse consequences for maintenance and expansion of physical infrastructure, basic social services and other essential services that only the government can provide. The congested urban services such as water, electricity, transport in both countries are a potential source of social upheaval. The state of financial sector in both countries is plagued with serious ills. The nationalization of commercial banking services, the neglect of credit quality in allocation decisions, lack of competition and inadequate prudential regulations and supervision have put the system under severe pressure and increased the share of nonperforming assets in the banks portfolio. The financial intermediation role in mobilizing and efficiently allocating domestic savings has been seriously compromised and the banking system is fragile. Both countries are now taking steps to liberalize the financial sector and open it up to competition from foreign banks as well as private banks.

Third, the areas where India has surpassed Pakistan. There is little doubt that the scientific and technological manpower and research and development institutions in India are far superior and can match those of the western institutions. The real breakthrough in the Indian export of software after the opening up of the economy in 1991 attests to the validity of the proposition that human capital formation accompanied by market-friendly economic policies can lift the developing countries out of low-level equilibrium trap.

Indian scientists working in India excel in the areas of defense technology, space research, electronics and avionics, genetics, telecommunications, etc. The number of Ph.Ds produced by India in science and engineering every year -- about 5,000 -- is higher than the entire stock of Ph.Ds in Pakistan. The premier research institutions in Pakistan started about the same time as India have become hotbed of internal bickerings and rivalries rather than generator of ideas, processes and products.

Related to this superior performance in the field of scientific research and technological development is the better record of investment in education by India. The adult literacy rate, female literacy rate, gross enrollment ratios at all levels, and education index of India have moved way ahead of Pakistan. Rapid decline in total

fertility rates in India has reduced population growth rate to 1.8 percent compared to 3.0 percent for Pakistan.

Health access to the population and infant mortality rates are also better in India and thus the overall picture of social indicators, although not very impressive by international standards, emerges more favorable. The two most important determinants of Pakistans dismal performance in social development are its inability to control population growth and the lack of willingness to educate girls in the rural areas.

Fourth, the areas where Pakistan has performed better than India. The economic growth rate of Pakistan has been consistently higher than India. Starting from almost the same level or slightly lower level in 1947, Pakistans per capita income today in US nominal dollar terms is one-third higher (430 versus 320) and in purchasing parity dollar terms is two-third higher (2,310 versus 1,280). The latter suggests that the average Pakistani has enjoyed better living standards and consumption levels in the past but the gap may be narrowing since early 1990s. Had the population growth rate in Pakistan been slower and equaled that of India, this gap would have been much wider and the per capita income in Pakistan today would have been twice as high and the incidence of poverty further down.

Although both India and Pakistan have pursued inward-looking strategies, the antiexport bias in case of Pakistan has been comparably lower and the integration with the world market faster. The trade-GDP ratio in PPP terms is twice that of all South Asian countries. Pakistans export growth has been stronger and the composition of exports has shifted from primary to manufactured goods; albeit the dominance of cotton-based products has enhanced its vulnerability.

Domestic investment rates in Pakistan have remained much below those of India over the entire span primarily due to the relatively higher domestic savings rates in the latter. But the efficiency of investment as measured by the aggregate incremental capital-output ratio or total factor productivity has been higher in case of Pakistan and, to some extent, compensated the lower quantity of investment.

CONCLUSION What is the bottom line then? The overall record looks mixed. Pakistan scores high on income and consumption growth, poverty reduction and integration with the world economy. India has done very well in developing its human resource base and excelled in the field of science and technology. Both countries face a set of common problems -- the inherited legacy of a control mind-set among the government and rent-seeking private sector, widespread corruption, poor fiscal management, weak financial system and congested and overcrowded urban services. But there is an important and perceptible positive shift in most of the indicators of India since 1991. Export growth rates have almost doubled, GDP growth is averaging 6 to 7 percent in recent years, current account deficit is down and foreign capital flows for investment have risen several fold. The edge that Pakistan has gained over India in most of these indicators until 1990 is fast eroding. Pakistan, on the other hand, has made greater progress in privatization of state owned enterprises and in attracting foreign investors to expand power generating capacity in the country. How does the future look like? Since 1991, both India and Pakistan have embarked on a policy of liberalization, outward orientation and faster integration with the global economy. The initial responses have been very positive. As outlined earlier, portfolio and foreign direct investment flows in the last few years have surpassed those accumulated over the last 20-25 years. Indian exports recorded an increase of 50 percent since 1991 while Pakistan, despite a setback due to failure of successive cotton crops, have expanded by two-thirds since 1990. The political uncertainty in India has been minimized after the elections and adoption by the coalition government of the Congress agenda on economic reforms. This combination of political stability, economic policy credibility and well developed human resource base places India at an advantage today. But there is no earthly reason as to why we in Pakistan cannot put our house in order, strike a consensus among the two major political parties on the contours of our economic policy direction, stop brickbating each other for the larger sake of the countrys interests and avoid promoting contrived and perceived sense of economic instability.

The imperatives of globalization and integration with the world economy dictate that the countries that are not agile and do not seize the opportunities at the right time are likely to be losers. What is encouraging is that the economic policy stance of both major parties in Pakistan is identical, i.e., liberalization of the economy. We have made a headstart and let us not lose this momentum by narrow-minded and purely

self-serving interests. The destiny of a nation depends upon the hard work, discipline and internal cohesion of its people and the vision of its leaders. Let our future generations not blame our leaders for failing to leave a legacy of prosperity and hope for them.

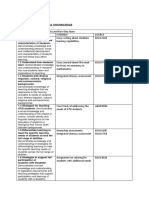

ECONOMIC PERFORMANCE INDICATORS India Per Capita Income, in US$ in PPP$ GDP Growth Rates, 1950-80 1980-94 Trade/GDP (PPP) Ratio Per Capita Trade, in US$ Average Annual Rate of Inflation, 1980-93 Overall Budget Deficit/GDP, 1980-94 1995 Current Account/GDP, 1980-94 1995 Export Growth Rate, 1980-90 1990-94 320.0 1,280.0 3.6 5.0 10.0 44.0 8.7 -6.5 -5.0 -1.7 -0.9 5.9 13.6 Pakistan 430.0 2,130.0 5.0 5.9 20.0 121.0 7.4 -7.3 -5.6 -4.4 -3.9 8.1 11.3

COMPARATIVE SOCIAL INDICATORS (Most Recent Estimates)

India Life Expectancy (in years) Adult Literacy (in percent) Female Literacy (in percent) Gross Enrollment Ratio (combined - in percent) Access to Health Services (in percent) Daily Caloric Supply Per Capita Underweight Children Under Five (in percent) Infant Mortality (per 000 births) Total Fertility Rate 2,395 53.0 81.0 3.8 60.7 50.6 36.0 55.0 85.0

Pakistan 61.8 36.4 23.0 37.0 55.0 2,316 40.0 89.0 6.2

http://users.erols.com/ziqbal/ih2.htm

India's economy is booming after China and as of 30th May 2008, the Indian economy is now worth $1 thrillion. Examining some of Indian economic indicators will provide a glimpse of what's in store for foreign exchange investors.

GDP

The Indian Gross Domestic Product (GDP) has come a long way since its balance of payment downturn in the 80's. This can be largely attributed to its open policies under prime minister Atal Bihari Vajpayee in 2003, attracting high influx of foreign investors. India's BPO sector and service industry has also benefited from its rapid growth of information technology, further strengthening its impressive growth and thus providing promising outlook for future growth. The most recent GDP records are as follows: GDP growth in 2002 - 3.8% GDP growth in 2003 - 8.5% GDP growth in 2004 - 7.5% GDP growth in 2005 - 9.0% GDP growth in 2006 - 9.4% GDP growth in 2007 - 9.0% GDP growth in 2008 - 8.5% (Projected)

GDP growth in 2009 - 8.81% (Projected) According to the CIA, India's GDP composition by sector can be broken down into 17.8% for agriculture, 29.4% for industries and a massive 52.8% for services as of 2007.

Inflation

India's projected a lower inflation rate in 2008 from the 5.77% reported in 2007. However, the rising price of global fuel, food and commodity rendered this impossible. Its inflation rate stand at 8.75% in May according to the wholesale-price index. By July, the Key Indian Inflation Rate has surpassed the 11% mark to become the highest rate recorded in 13 years, and almost three times as high as the 4.1% targeted by Reserve Bank of India (RBI) in 2007. The IMF estimates Indias consumer price inflation to be 6.7% in 2009 but this do not seem realistic in view of the U.S economy recession looming in October 2008 that will easily spill over to 2009.

Currency Exchange Rate

Rupee weakened against the dollar in Oct 2008 along with it's stock market crash while bond yield dropped to seven month lows, despite RBI's intervention. However, India is not alone in this as there is an apparent sign of the world economy slowing down, led by the U.S. India's substantial forex reserve does not seem to be working its charm this time around although the RBI's intervention in its managed float currency policy is common practice. In 2003, the Indian government with its $73 billion forex reserve was praised by the IMF citing that India does not need IMF's assistance.

Unemployment Rate 2003 - 8.80% 2004 - 9.50% 2005 - 9.20% 2006 - 8.90% 2007 - 7.80% 2008 - 7.20%

India is doing a good job at keeping unemployment rate down. The actual unemployment rate is lower because its labor force is outgrowing its employment rate (2.5% compared to 2.3% per annum).

Industrial Production

India's index of Industrial Production (IIP), publishes monthly composite of the value of industrial production in various sectors of industrial sectors of the economy. Currently, the IIP includes the mining, manufacturing and electricity industry. The mining and utility industries in India are especially worth noting. Although only a fragment of India's economic indicators are highlighted here, it is enough to see that its economy hold a lot of promise and will continue to prosper under good policies. While developed countries will be likely to experience recession, India will be better off by seeing less growth in the coming quarters

http://www.forexrealm.com/fundamental-analysis/india-economic-indicators.html

Você também pode gostar

- Licence FeesDocumento5 páginasLicence FeesMalik SaadoonAinda não há avaliações

- Superior University BBA Result Roll No bba10120Documento1 páginaSuperior University BBA Result Roll No bba10120Malik SaadoonAinda não há avaliações

- Tax Collection 2013 PAKISTANDocumento1 páginaTax Collection 2013 PAKISTANMalik SaadoonAinda não há avaliações

- Diploma TemplateDocumento1 páginaDiploma TemplateMalik SaadoonAinda não há avaliações

- International Standard On Auditing 220 Quality Control For An Audit of Financial StatementsDocumento19 páginasInternational Standard On Auditing 220 Quality Control For An Audit of Financial StatementsNicquainCTAinda não há avaliações

- Project CharterDocumento20 páginasProject CharterMalik SaadoonAinda não há avaliações

- Role of Marketing Research in Strategic Planning and Decision MakingDocumento4 páginasRole of Marketing Research in Strategic Planning and Decision MakingMalik SaadoonAinda não há avaliações

- According To The Government of Pakistan Over 70Documento1 páginaAccording To The Government of Pakistan Over 70Malik SaadoonAinda não há avaliações

- 1Documento1 página1Malik SaadoonAinda não há avaliações

- ReferencesDocumento1 páginaReferencesMalik SaadoonAinda não há avaliações

- Risk Management For Banks in PakistanDocumento7 páginasRisk Management For Banks in PakistanNajeeb KhanAinda não há avaliações

- Saad (Version 1)Documento6 páginasSaad (Version 1)Malik SaadoonAinda não há avaliações

- Data Entry Operators and Scanning Operators Vacancies Are Open in NOOR E AHADDocumento1 páginaData Entry Operators and Scanning Operators Vacancies Are Open in NOOR E AHADMalik SaadoonAinda não há avaliações

- Early HistoryDocumento3 páginasEarly HistoryMalik SaadoonAinda não há avaliações

- Hadith About ParentsDocumento14 páginasHadith About ParentsMalik SaadoonAinda não há avaliações

- Guide To UK Inflationary PressuresDocumento21 páginasGuide To UK Inflationary PressuresMalik SaadoonAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- 9.2.1 Unit Overview: "And Then A Plank in Reason, Broke, and I Dropped Down, and Down - "Documento168 páginas9.2.1 Unit Overview: "And Then A Plank in Reason, Broke, and I Dropped Down, and Down - "JackAinda não há avaliações

- Lesson PlanDocumento2 páginasLesson Planapi-253303059Ainda não há avaliações

- 21 - From Biliteracy To PluriliteraciesDocumento22 páginas21 - From Biliteracy To PluriliteraciesUk matsAinda não há avaliações

- LS202 - 2223 - Course SyllabusDocumento6 páginasLS202 - 2223 - Course SyllabusLim LisaAinda não há avaliações

- Decline and Fall of BuddhismDocumento198 páginasDecline and Fall of BuddhismParmit ChhasiyaAinda não há avaliações

- Five Guiding Principles For Music EducationDocumento5 páginasFive Guiding Principles For Music EducationRose Marie BalmoresAinda não há avaliações

- PMCF Ni AMA 22-23Documento4 páginasPMCF Ni AMA 22-23Amabelle Pagalunan Acleta100% (1)

- Mil WHLPDocumento9 páginasMil WHLPMary Joy Pagtakhan100% (1)

- Personal Branding DigitalDocumento26 páginasPersonal Branding DigitalBlue Mountain50% (2)

- K-6 Scope - SharonDocumento8 páginasK-6 Scope - SharonS TANCRED75% (4)

- Aimsweb PilotDocumento12 páginasAimsweb Pilotapi-357465278Ainda não há avaliações

- Writing 2 Project 2Documento6 páginasWriting 2 Project 2api-361092866Ainda não há avaliações

- Full SWOT Analysis Report BangladeshDocumento29 páginasFull SWOT Analysis Report Bangladeshpriyanka ramnaniAinda não há avaliações

- Unpackaging Literacy (Scribner, Cole)Documento23 páginasUnpackaging Literacy (Scribner, Cole)Michael John JamoraAinda não há avaliações

- Intro QLT v2Documento41 páginasIntro QLT v2api-310745939Ainda não há avaliações

- Civic Engagement 0Documento36 páginasCivic Engagement 0Rosel PatotoyAinda não há avaliações

- K-12 Education Program OverviewDocumento92 páginasK-12 Education Program OverviewJudy Panguito AralarAinda não há avaliações

- 3-5 Stong Passwords - AugustDocumento10 páginas3-5 Stong Passwords - Augustapi-378234656Ainda não há avaliações

- Worksheet No 2 Educ 321 Magcamit Reina Chiara G.Documento15 páginasWorksheet No 2 Educ 321 Magcamit Reina Chiara G.Carlo MagcamitAinda não há avaliações

- People as Resource Class 9 Extra QuestionsDocumento28 páginasPeople as Resource Class 9 Extra Questionsjamal khanAinda não há avaliações

- Ethiopian Education Development Roadmap 2018-2030Documento101 páginasEthiopian Education Development Roadmap 2018-2030amenu_bizuneh100% (2)

- Linguistics and TranslationDocumento8 páginasLinguistics and TranslationSharmaine Paragas FaustinoAinda não há avaliações

- EDUC4185 Assignment 2Documento9 páginasEDUC4185 Assignment 2DavidAinda não há avaliações

- Practice Test - 2Documento82 páginasPractice Test - 2Vincent BurdadoAinda não há avaliações

- JR Martin's Linguistics ResearchDocumento26 páginasJR Martin's Linguistics ResearchMarco Antonio AlarcónAinda não há avaliações

- Effective Writing by Judith HochmanDocumento7 páginasEffective Writing by Judith HochmanmegbhicksAinda não há avaliações

- Class Room ND NationDocumento7 páginasClass Room ND NationFaiza Khan100% (1)

- PA00N2KDDocumento83 páginasPA00N2KDMelkam tseganew TigabieAinda não há avaliações

- Importance of Mother TongueDocumento2 páginasImportance of Mother TongueSarika Chuni100% (1)

- Factors Hindering Effective Chemistry Teaching in Nigerian High SchoolsDocumento93 páginasFactors Hindering Effective Chemistry Teaching in Nigerian High SchoolsSirajudinAinda não há avaliações