Escolar Documentos

Profissional Documentos

Cultura Documentos

Nihan Affidavit in Support of Objection

Enviado por

Grant BosseDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Nihan Affidavit in Support of Objection

Enviado por

Grant BosseDireitos autorais:

Formatos disponíveis

Case 1:11-cv-00358-SM Document 50-32

Filed 09/23/11 Page 1 of 7

UNITED STATES DISTRICT COURT DISTRICT OF NEW HAMPSHIRE **************************************** Dartmouth-Hitchcock Clinic and Mary * Hitchcock Memorial Hospital * d/b/a Dartmouth-Hitchcock, et al., * Plaintiff * * v. * Nicholas A. Toumpas, in his official capacity * as Commissioner of the New Hampshire * Department of Health and Human Services, * Defendant * * * ****************************************

11-cv-358-SM

AFFIDAVIT OF MARILEE NIHAN IN SUPPORT OF THE DEFENDANTS OBJECTION TO MOTION FOR PRELIMINARY INJUNCTION I, Marilee Nihan declare as follows: I am currently employed by the New Hampshire Department of Health and Human Services (DHHS) as the Medicaid Finance Director in the Office of Medicaid Business and Policy (OMBP). I have been in this position since August 2004. I have held other positions with the State including the following: August 2004 to December 2005. Financial Manager, Department of Health and Human Services, Office of Medicaid Business and Policy, Concord, NH January 2003 to August 2004. Financial Manager, Department of Health and Human Services, Division for Juvenile Justice Services, Manchester, NH June 1999 to January 2003. Administrator of Programs, Department of Corrections, NH State Prison, Concord, NH August 1994 to June 1999. Quality Improvement Administrator, Department of Corrections, Concord, NH I received a Masters degree in Business Administration from Northeastern University in 1995. I also have the following educational background: Certificate of Completion, Senior Executives in State and Local Government, Harvard University, John F. Kennedy School of Government, as a New Hampshire Caroline L. Gross Fellow, July 2011 Certificate of Completion, Leadership New Hampshire, Class of 2002-2003 Bachelor of Science in Business, Cum Laude, Franklin Pierce College, Rindge, NH, 1989 Hesser College, Associates Degree in General Business Studies, Manchester, NH, 1980

Case 1:11-cv-00358-SM Document 50-32

Filed 09/23/11 Page 2 of 7

As the Medicaid Finance Director I assist the Commissioner and Medicaid State Director in regard to all matters that relate to the financial aspects of Medicaid, including preparation of budget requests relating to Medicaid, presenting the departments Medicaid budget and financial requests for items to the legislature, responding to requests from the legislature when budget reductions are required due to revenue shortfalls, implementing state and federal financial policy related to the Medicaid program, and other tasks related to the financial needs of administering the New Hampshire Medicaid program, as well as monitoring utilization by our clients and establishing relationships with our providers. I am personally familiar with the facts stated herein. 1. I am familiar with and oversee implementation to the various payment methods

under the Medicaid state plan. For most inpatient hospital services the NH Medicaid program uses the Medicare tables of DRG coding, consisting of Medicare grouper software, Medicare relative weights, mean lengths of stay and day outlier trim points. The rate (Price per Point) for each DRG is determined by NH Medicaid and differs based on the peer group that a hospital is assigned to in the New Hampshire Medicaid claims payment system. For example, general acute care hospitals without critical access designation are in Peer Group 01 and are paid $2,832.85 per DRG Point, and rehab hospitals and rehab units within general hospitals are in Per Group 03, and are paid $14,514.98 per DRG point. The Medicare tables are updated annually and notice is provided in the Federal Register. Notice that NH Medicaid is applying the update to its payments is published at <http://www.nhmedicaid.com/>. DRG reimbursement is calculated by multiplying relative weight assigned to the DRG times the price per point assigned to the peer group.

Case 1:11-cv-00358-SM Document 50-32

Filed 09/23/11 Page 3 of 7

2.

The Medicaid state plan methodology has always provided flexibility regarding the

price per point that allows the Department to apply a percentage reduction, as the language specifies that the allowed reimbursement amount determined through this method shall be based on rates and amounts established by the Department (OMBP) and that inpatient acute services are paid a pre-determined price in relation to a DRG taking into account state Medicaid defined budget neutrality factors. TN 89-007, 4.19-A, p. 1, Para 3 and TN 99-012, 4.19-A, p. 3, Para. c, (2). 3. The Medicaid state plan provides that most outpatient hospital services are paid on

a cost basis. As actual allowable costs are not known until an audit by the Medicare fiscal intermediary is completed after the completion of the hospitals fiscal year, interim payments are made on the basis of a percent of charges. The state plan has provided since 2006 that the actual cost will be reimbursed using the percent determined by the Department. TN 06-008, 4.19-B, page 1, para 1. The primary exceptions to this rule are hospital laboratory services that have historically been paid from a fee scheduled, and more recently radiology services and physical/speech/occupational therapies that are paid on a set fee for service. Likewise physicians office visits and professional services are paid on a fee for service basis. TN 92-9, 4.19-B, page 1-a, Para. 5. 4. New Hampshire Medicaid spending has grown consistently over time from a total

in FY1995 of $855,249,869 to a FY 2010 total of $1,418,273,017. A true and correct copy of the DHHS report referred to as the MA 80 report which has tracked State/Federal/county Medicaid spending is attached as Exh. MN-1. 5. New Hampshire does not fund its entire state portion of Medicaid from the

Medicaid Enhancement Tax (MET) to Hospitals. In FY2012, the total State budget for

Case 1:11-cv-00358-SM Document 50-32

Filed 09/23/11 Page 4 of 7

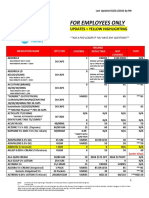

Medicaid, excluding administration, is $1,325,405,707. That budget is funded with a variety of federal, state, county, and other funds. . The budget assumes that $388,374,048 of state general funds will be used and $75,896,942 of Medicaid Enhancement Tax revenue will be used. A true and correct copy of the OMBP excel spreadsheet of Accounting units with Medicaid funds for SFY 2012 is attached as Exh. MN-2. 6. In July 2005, the Department requested a reduction in outpatient rates paid to

hospitals without Medicare critical access designation from 91.27% of Medicare allowable costs to 81.24% (hospitals with the Medicare critical access designation were not included in the rate reduction request). A true and correct copy of the fiscal committee request is attached hereto as Exh. MN-3, FIS 05-125. 7. In 2007, the current economic downturn began. By early 2008, DHHS was

projecting that its Medicaid spending would exceed its appropriations before the end of the biennium. In accordance with RSA 126-A:3, VII(a), DHHS submitted a request to the fiscal committee on April 11, 2008, proposing to reduce outpatient reimbursement rates from 81.24% to 62.82%. A true and correct copy of the fiscal committee request is attached hereto as Exh. MN-6, FIS 08-130. 8. The November 2008 inpatient and outpatient rates have been continued in the

FY2010-2011 budgets and again in the FY 2012-2013 budget. The FY2010-2011 budget process started in February 2009, only three months after the November 2008 fiscal committee hearing, as FY2010 would begin on July 1, 2009. The state budget processes are very open, with published budgets and extensive hearings at which the New Hampshire Hospital Association and the hospital stakeholders had full opportunity to comment and testify.

Case 1:11-cv-00358-SM Document 50-32

Filed 09/23/11 Page 5 of 7

9.

In April 2007, the Department first brought forward to the fiscal committee an

item, FIS 07-111, to eliminate the 510 billing code for hospital owned physician practices, following instructions from CMS. A true and correct copy of the fiscal committee request is attached hereto as Exh. MN-4, FIS 07-111. A true and correct copy of the CMS letter to Comm. Stephen, April 3, 2007 is attached as Exh. MN-5. 10. In the 2009, session the legislature also passed HB 30-FN-A requiring operating

budget reductions for FY 2009. HB 30 also contained a section adding to RSA 126-A:3,VII additional definitions for outpatient hospital services, which became effective on February 20, 2009. A true and correct copy of the statute is attached as Exh. MN-9, HB30-FN-A. 11. I was asked to present an explanation of the issues regarding Code 510 billing to

the legislature on several occasions. Attached is a true and correct copy of examples of the actual effect of the billing practices under Code 510, demonstrating five different ways hospitals were using the code 510 to bill more for the same services than non-hospital clinics or physicians practices were prepared by my in February 2007 for the legislature. Exh. MN-10, Examples of Revenue Code 510 Claims. 12. The New Hampshire State Plan 4.19-B page 1 provides that outpatient costs are

paid on an interim basis as a percent of charges and then, after final audit results are obtained from the fiscal intermediary for Medicare, a final settlement will be made at the percentage determined by the Department, using the fiscal intermediaries audited Medicare cost data. 13. However, I have been informed by CMS that the Medicare program has ordered a

delay in calculating the Medicare final settlements on hospitals cost reports beginning with provider fiscal years ending 9/30/2007. This delay was ordered pending resolution of issues relating to the calculation of Medicare DSH payments to hospitals. Therefore, since 2007 there

Case 1:11-cv-00358-SM Document 50-32

Filed 09/23/11 Page 6 of 7

have been no final audited cost reports from the Medicare fiscal intermediary for DHHS to rely on in making final Medicaid cost settlements. 14. New Hampshire uses National Government Services (NGS), the Medicare fiscal

intermediary, for New Hampshire to calculate the Medicaid settlements for New Hampshire. Although there is no legal obligation under the Medicaid state plan to do so, DHHS has had NGS continue to complete the Medicaid Settlement Worksheets with the best available data and, if settlements are due, which is not always the case as frequently the reverse is true and the hospital has been over paid, settlements have continued to be paid as set forth below. 15. Deferral of making interim settlement payments in FY 2010 and 2011 was

presented and approved in the February 5, 2010 fiscal committee meeting and public notice of that intent was given by newspaper publication on February 26, 2006. As this deferral did not change the methodology in the Medicaid state plan, particular in light of the fact that there are no final audited cost reports from the Medicare fiscal intermediary, no Medicaid state plan amendment was required. 16. Despite this intent and notice, in FY 2010 DHHS did have a unanticipated minor

budget surplus at the end of FY 2010, and sought and received permission from the DHHS Commissioner Toumpas and the Governor to proceed with making any interim settlement payments that they had received notices on from NGS. Therefore in FY 2009 and 2010 settlement payments were made as shown on the attached excel spreadsheet. Attached as Exh. MN-7, is a true and correct copy of the OMBP excel spreadsheet for FY 2008 through FY 2012YTD Cost Settlements. 17. DHHS does not have interim settlement data for FY 2012 from NGS for the

hospitals yet. Interim settlements are outstanding based on information received from NGS for

Case 1:11-cv-00358-SM Document 50-32

Filed 09/23/11 Page 7 of 7

only 3 for the ten plaintiff Hospitals. Attached hereto as Exh. MN-8, is a true and correct copy of the OMBP excel spreadsheet of FY 2008 to FY 2011 Cost Settlements on hold. 18. In FY 2012 2013 DHHS included in its budget request money to make interim

settlement payments as they were reconciled by NGS. However this money was eliminated from the budget during the budget development process. I declare under penalty of perjury that the foregoing is true and correct to the best of my personal knowledge and the information available to me.

Dated: 9/22/11

/s/ Marilee Nihan Marilee Nihan

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Federal Trade Commission PBM Model OrderDocumento27 páginasFederal Trade Commission PBM Model OrderHelen BennettAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- What Living As A Resident Can Teach Long-Term Care Staff: The Power of Empathy To Transform Care (Excerpt)Documento14 páginasWhat Living As A Resident Can Teach Long-Term Care Staff: The Power of Empathy To Transform Care (Excerpt)Health Professions Press, an imprint of Paul H. Brookes Publishing Co., Inc.Ainda não há avaliações

- Health Insurance Fronter Script 3.5Documento3 páginasHealth Insurance Fronter Script 3.5Jolly Silastre100% (2)

- ScriptDocumento3 páginasScriptEnrico Cayme100% (8)

- Stipulation and OrderDocumento3 páginasStipulation and OrderGrant BosseAinda não há avaliações

- Archaeus 4Documento107 páginasArchaeus 4terrythecensorAinda não há avaliações

- College of Nursing East Coast Institute of Medical Sciences, PondicherryDocumento16 páginasCollege of Nursing East Coast Institute of Medical Sciences, PondicherryRuby Sri100% (1)

- Dred - Bald Mileage EstimateDocumento1 páginaDred - Bald Mileage EstimateGrant BosseAinda não há avaliações

- Plaintiff's Objection To Defendant's Motion To DismissDocumento23 páginasPlaintiff's Objection To Defendant's Motion To DismissGrant BosseAinda não há avaliações

- Balboni Letter - Charter Schools 10-10-12Documento3 páginasBalboni Letter - Charter Schools 10-10-12Grant BosseAinda não há avaliações

- Fitch Bond Statement On NH GO Bond Sale 10-18-2011Documento3 páginasFitch Bond Statement On NH GO Bond Sale 10-18-2011Grant BosseAinda não há avaliações

- Peterson Affidavit in Support of ObjectionDocumento3 páginasPeterson Affidavit in Support of ObjectionGrant BosseAinda não há avaliações

- Objection To Motion For Preliminary InjunctionDocumento3 páginasObjection To Motion For Preliminary InjunctionGrant BosseAinda não há avaliações

- MTD MolDocumento12 páginasMTD MolGrant Bosse100% (1)

- Carrier Affidavit in Support of ObjectionDocumento2 páginasCarrier Affidavit in Support of ObjectionGrant BosseAinda não há avaliações

- Telemedicine After The COVID-19Documento61 páginasTelemedicine After The COVID-19ZAinda não há avaliações

- Cambridge University Press, The Society For Healthcare Epidemiology of America Infection Control and Hospital EpidemiologyDocumento24 páginasCambridge University Press, The Society For Healthcare Epidemiology of America Infection Control and Hospital EpidemiologyCarissa SulaimanAinda não há avaliações

- Swander Final Teaching PlanDocumento16 páginasSwander Final Teaching Planapi-259047759Ainda não há avaliações

- Weirich7e CasesDocumento18 páginasWeirich7e Casescuwekaza0% (1)

- Audit Planning: SGB & CDocumento17 páginasAudit Planning: SGB & CMelanie SamsonaAinda não há avaliações

- Times Leader 08-18-2012Documento56 páginasTimes Leader 08-18-2012The Times LeaderAinda não há avaliações

- OBH G FormDocumento52 páginasOBH G FormRMAinda não há avaliações

- Interim Report: Fraud and Error in Virginia's Medicaid ProgramDocumento81 páginasInterim Report: Fraud and Error in Virginia's Medicaid ProgramBeverly TranAinda não há avaliações

- Full Administrative Medical Assisting 8Th Edition French Solutions Manual PDF Docx Full Chapter ChapterDocumento36 páginasFull Administrative Medical Assisting 8Th Edition French Solutions Manual PDF Docx Full Chapter Chapterligsamcathodic.ovcb100% (26)

- Employee Only Pricing Sheet 02.11.22Documento10 páginasEmployee Only Pricing Sheet 02.11.22rickyAinda não há avaliações

- Tues., July 26, 2011Documento10 páginasTues., July 26, 2011The Delphos HeraldAinda não há avaliações

- Cooper Et Al., 2022 Geographical Variation in Health Spending Across The US Among Privately InsuredDocumento11 páginasCooper Et Al., 2022 Geographical Variation in Health Spending Across The US Among Privately InsuredDayn KirkseyAinda não há avaliações

- MedEnroll PECOS ProviderSup FactSheet ICN903767Documento14 páginasMedEnroll PECOS ProviderSup FactSheet ICN903767Bishyer AmitAinda não há avaliações

- Obamacare A Step BackwardsDocumento2 páginasObamacare A Step BackwardsGerardFVAinda não há avaliações

- Digest Insurance Fortune Medicare, Inc V Amorin, GR 195872, MArch 12, 2014Documento1 páginaDigest Insurance Fortune Medicare, Inc V Amorin, GR 195872, MArch 12, 2014reiAinda não há avaliações

- Upper Bucks Free Press - September 2013Documento20 páginasUpper Bucks Free Press - September 2013Christopher BetzAinda não há avaliações

- Hospice Care NursingDocumento23 páginasHospice Care NursingLee BuelaAinda não há avaliações

- Annual Report 2010Documento56 páginasAnnual Report 2010amatamesAinda não há avaliações

- Notice: Medicare and Medicaid: Program Issuances and Coverage Decisions Quarterly ListingDocumento41 páginasNotice: Medicare and Medicaid: Program Issuances and Coverage Decisions Quarterly ListingJustia.comAinda não há avaliações

- Remote Therapeutic Monitoring For 2022: Barbara Frances Kho, RN MANDocumento12 páginasRemote Therapeutic Monitoring For 2022: Barbara Frances Kho, RN MANBFKHOAinda não há avaliações

- Premium Support in MedicareDocumento4 páginasPremium Support in MedicareAi NurcahyaniAinda não há avaliações

- Do Certificate-of-Need Laws Increase Indigent Care?Documento32 páginasDo Certificate-of-Need Laws Increase Indigent Care?Mercatus Center at George Mason UniversityAinda não há avaliações

- OHP HandbookDocumento40 páginasOHP HandbookraAinda não há avaliações

- The Complete HSA GuidebookDocumento229 páginasThe Complete HSA GuidebookMichelle LumAinda não há avaliações