Escolar Documentos

Profissional Documentos

Cultura Documentos

Form S10 For Subscribers Havinga Tier IAccount-And-PRAN Card

Enviado por

Mandeep Singh SidhuDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Form S10 For Subscribers Havinga Tier IAccount-And-PRAN Card

Enviado por

Mandeep Singh SidhuDireitos autorais:

Formatos disponíveis

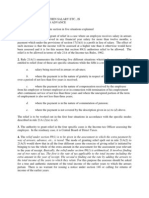

Annexure UOS-S10

Page - 1

Request for Activation of Tier-II account under New Pension System (NPS)

To be used by Subscribers having a pre-existing Tier I account under NPS

(To avoid mistake(s), please read the accompanying instructions carefully before filling up the form) For POP-SP use: POP-SP Registration No. :______________ Receipt No.: Entered By: ____________________ Date: __________________ Verified By: _____________________ Date: __________________

I hereby submit the following details for activation of Tier II account under NPS. Permanent Retirement Account Number (PRAN)*:

1. Subscribers Name:

___________________________________________________________________

(First Name) (Middle Name) (Last Name)

2. Bank Details (Mandatory): I have already provided bank details for Tier 1. The same may be used If NO, please fill in the details below:

Bank A/c Number* Bank Name* Bank Branch* Bank Address* Savings A/c Current A/c

YES

NO

Pin Code* IFS code (Wherever applicable)

Bank MICR Code

3. Subscribers Nomination Details (OPTIONAL - please refer to Sr. No. j of the instructions) Do you want to retain the same nomination as in your Tier I account? If NO, please fill in the details below.

Name of the Nominee: 1st Nominee First Name* 2nd Nominee First Name * First Name*

YES

NO

3rd Nominee

Middle Name

Middle Name

Middle Name

Last Name

Last Name

Last Name

Date of Birth (In case of a minor)*: 1st Nominee Relationship with the Nominee: 1st Nominee

2nd Nominee

3rd Nominee

2nd Nominee

3rd Nominee

Percentage Share: 1st Nominee Nominees Guardian Details (in case of a minor): 1st Nominees Guardian Details First Name*

% 2nd Nominee

3rd Nominee

2nd Nominees Guardian Details First Name *

3rd Nominees Guardian Details First Name*

Middle Name

Middle Name

Middle Name

Last Name

Last Name

Last Name

Annexure UOS-S10

Page 2

4. Subscriber Scheme Preference (Please refer to Sr. No. k of the instructions for further details): (i). PFM Selection for Active and Auto Choice (Select only one PFM)

PFM Name (in alphabetical order) Please tick only one

ICICI Prudential Pension Funds Management Company Limited IDFC Pension Fund Management Company Limited Kotak Mahindra Pension Fund Limited Reliance Capital Pension Fund Limited SBI Pension Funds Private Limited UTI Retirement Solutions Limited

(Selection of PFM is mandatory both in Active and Auto Choice. In case you do not indicate a choice of PFM, your application form shall be summarily rejected).

(ii). Investment Option Active Choice Note: Auto Choice (For details on Auto Choice, please refer to the Offer Document)

In case you do not indicate any investment option, your funds will be invested in Auto Choice In case you have opted for Auto Choice, DO NOT fill up section (iii) below relating to Asset Allocation. In case you do, the Asset Allocation instructions will be ignored and investment made as per Auto Choice.

(iii). Asset Allocation (to be filled up only in case you have selected the Active Choice investment option) Asset Class % share Note: E (Cannot exceed 50%) C G Total 100%

The allocation across E, C and G asset classes must equal 100%. In case, the allocation is left blank and/or does not equal 100%, the application shall be rejected by the POP.

5. Declaration & Authorization I hereby declare and agree that (a) I have read and understood the Offer Document, terms & conditions or the same was interpreted to me, and the answers entered in the application are mine. (b) I am a Citizen of India. (c) I have not been found or declared to be of an unsound mind under any law for the time being in force. (d) I am not an undischarged insolvent. (e) I hold a valid Tier I account under NPS. Declaration under the Prevention of Money Laundering Act, 2002 I hereby declare that: 1. The contribution paid has been derived from legally declared and assessed sources of income. 2. I understand that the PFRDA/NPS Trust has the right to peruse my financial profile and also agree that the PFRDA/NPS Trust has the right to close the NPS account in case I am found guilty of violating the provisions of any Law, directly or indirectly, by any Competent Court of Law, having relation to the laws governing prevention of money laundering in the country.

I _________________________________________________________________ , the applicant, do hereby declare that the information provided above is true to the best of my knowledge & belief. Date : To be filled by POP-SP (DD/MM/YYYY) Signature/Thumb Impression* of Subscriber

Signature of Authorized Signatory

Name : ___________________________________ Place : __________________ Date : __________________

POP-SP Seal

Designation : ________________________________

To be used by subscribers having a pre-existing Tier I account under NPS

Annexure UOS-S10 a) b)

c) d) e) f) g) h) i)

Page - 3 INSTRUCTIONS FOR FILLING THE FORM The form is to be filled by the Subscribers having a PRAN card and Tier 1 account under NPS. Form to be filled legibly in BLOCK LETTERS and in BLACK INK only. Please fill the form in legible handwriting so as to avoid errors in your application processing. Please do not overwrite. Corrections should be made by cancelling and re-writing and such corrections should be counter-signed by the applicant. Each box, wherever provided, should contain only one character (alphabet/number/punctuation mark) leaving a blank box after each word. The details marked with (*) are mandatory. The Subscriber shall provide copy of PRAN card alongwith the application form. Applications incomplete in any respect and/or not accompanied by required documents are liable to be rejected. The application is liable to be rejected if mandatory fields are left blank. Government employees (mandatorily covered under NPS) may submit their application to any POP-SP of their choice. The list of POP-SPs rendering services under NPS is available on CRA website http://www.npscra.nsdl.co.in Any Indian citizen (other than government employee mandatorily covered under NPS) may submit the application only to the POP-SP through which they have registered with CRA for Tier 1 account. Subscribers are advised to retain the acknowledgement slip signed/ stamped by the POP-SP where they submit the application. Bank Details : a. Bank details are mandatory for Tier-II. b. Subscriber shall provide copy of cancelled cheque, the details of which should matched with the details provided under Point No.2 on Page 1.

j)

Subscribers Nomination Details 1) Subscriber can nominate a maximum of three nominees. 2) Subscriber cannot fill the same nominee details more than once. 3) Percentage share value for all the nominees must be integer. Decimals/Fractional values shall not be accepted Percentage Share in the nomination(s). 4) Sum of percentage share across all the nominees must be equal to 100. If sum of percentage is not equal to 100, entire nomination will be rejected. Nominees Guardian Details If a nominee is a minor, then nominees guardian details shall be mandatory. The nomination exercised for Tier I shall not be automatically applicable to Tier II. A subscriber to Tier II is required to make a fresh nomination. In case, you want to retain the same nomination as in Tier I, please select Yes by putting tick a mark in the relevant box. Subscriber Scheme Preference Active choice 1. PFM selection is mandatory. The form shall be rejected if a PFM is not opted for. 2. Allocation under Equity (E) cannot exceed 50% 3. A subscriber opting for active choice may select the available asset classes (E, G, & C). However, the sum of percentage allocation across all the selected asset classes must equal 100. If the sum of percentage allocations is not equal to 100%, or the asset allocation table at Section C (iii) is left blank, the application shall be rejected. Auto choice 4. A subscriber opting for Auto Choice must also select a PFM. The application shall be rejected if the subscriber does not indicate his/her choice of PFM 5. In case both investment option and the asset allocation at Point No. 4 (ii) and Point No. 4 (iii) respectively are left blank, the subscribers funds will be invested as per Auto Choice.

k)

For more details on investment options and asset classes, please refer to the Offer Document.

GENERAL INFORMATION FOR SUBSCRIBERS The Subscriber can obtain the status of his/her application from the CRA website or through the respective POP-SP. For more information Visit us at http://www.npscra.nsdl.co.in Call us at 022-24994200 e-mail us at info.cra@nsdl.co.in Write to: Central Recordkeeping Agency, National Securities Depository Limited, 4th Floor, A Wing, Trade World, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel (W), Mumbai - 400 013.

To be used by subscribers having a pre-existing Tier I account under NPS

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Vault Guide To Investment ManagementDocumento125 páginasVault Guide To Investment Management0123456789ra100% (2)

- Gas Turbines A Manual PDFDocumento74 páginasGas Turbines A Manual PDFHenry Pannell100% (1)

- Employee WelfareDocumento15 páginasEmployee Welfaremunish2030Ainda não há avaliações

- Beginning Vibration Analysis FundamentalsDocumento96 páginasBeginning Vibration Analysis FundamentalsromadhinhoAinda não há avaliações

- PDF Question BankDocumento453 páginasPDF Question BankSyamil Sanusi100% (1)

- GSIS Ordered to Reinstate Retirement Benefits of Former Chief ProsecutorDocumento2 páginasGSIS Ordered to Reinstate Retirement Benefits of Former Chief ProsecutorRoger Pascual CuaresmaAinda não há avaliações

- PCL Chap 1 en CaDocumento42 páginasPCL Chap 1 en CaLaura100% (1)

- PBI Proposal To Provide Benefits - Actuarial and Investment Consulting Services V2Documento91 páginasPBI Proposal To Provide Benefits - Actuarial and Investment Consulting Services V2anas said100% (1)

- Oracle HRMS R12 ConceptsDocumento30 páginasOracle HRMS R12 Conceptsanamasra100% (1)

- Payment of BonusDocumento46 páginasPayment of BonusAnkur AroraAinda não há avaliações

- Key Differences of PFRS For Small Entities and PFRS For SMEsDocumento80 páginasKey Differences of PFRS For Small Entities and PFRS For SMEsMarkStephenAsido100% (3)

- NCCDGuidelines2014 15Documento100 páginasNCCDGuidelines2014 15Shailesh KhodkeAinda não há avaliações

- HUDA E Auction DetailsDocumento17 páginasHUDA E Auction DetailsMandeep Singh SidhuAinda não há avaliações

- Rti Point9Documento2 páginasRti Point9Mandeep Singh SidhuAinda não há avaliações

- M.tech. Thesis GuidelinesDocumento10 páginasM.tech. Thesis GuidelinesNishant JainAinda não há avaliações

- PE-523 MeeDocumento2 páginasPE-523 MeeMandeep Singh SidhuAinda não há avaliações

- Ex Summary 2012-13Documento14 páginasEx Summary 2012-13Mandeep Singh SidhuAinda não há avaliações

- Affidavit For MarriageDocumento1 páginaAffidavit For MarriageMandeep Singh SidhuAinda não há avaliações

- Kurukshetra CdapDocumento93 páginasKurukshetra CdapMandeep Singh SidhuAinda não há avaliações

- Operational - Guideline Rks HMODocumento21 páginasOperational - Guideline Rks HMOMandeep Singh SidhuAinda não há avaliações

- Reg Under Special Marriage ActDocumento2 páginasReg Under Special Marriage ActkadtansachinnAinda não há avaliações

- Funding Quirk Shields Community Colleges From CutsDocumento32 páginasFunding Quirk Shields Community Colleges From CutsSan Mateo Daily JournalAinda não há avaliações

- Questions On IAS 19Documento5 páginasQuestions On IAS 19banglauserAinda não há avaliações

- Final AR English 21-7-19 PDFDocumento222 páginasFinal AR English 21-7-19 PDFRahul DeyAinda não há avaliações

- Income Tax Summary BookDocumento40 páginasIncome Tax Summary BookMaithili SUBRAMANIANAinda não há avaliações

- News Sept 15Documento16 páginasNews Sept 15Hana Ari Setyawati, S.Pd.Ainda não há avaliações

- SALARY Format Dec - 2022Documento19 páginasSALARY Format Dec - 2022BuildingConstructionWelfareBoard MaharashtraAinda não há avaliações

- Contributory Pensions SchemeDocumento9 páginasContributory Pensions SchemeMohammed Ibrahim AdogaAinda não há avaliações

- 13-14. Commissioner of Internal Revenue Vs CA and GCL IncDocumento2 páginas13-14. Commissioner of Internal Revenue Vs CA and GCL IncEAAinda não há avaliações

- Advt - 06-2021Documento8 páginasAdvt - 06-2021mahesh vasaAinda não há avaliações

- Jeevan Shanthi - IllustrationDocumento3 páginasJeevan Shanthi - IllustrationPranav WarneAinda não há avaliações

- DCF and Pensions The Footnotes AnalystDocumento10 páginasDCF and Pensions The Footnotes Analystmichael odiemboAinda não há avaliações

- A Study of The Best Labor Practices of Selected Tourism Establishments in The PhilippinesDocumento19 páginasA Study of The Best Labor Practices of Selected Tourism Establishments in The PhilippinesChristine Carpio-aldeguerAinda não há avaliações

- PSRDocumento169 páginasPSRvitogbadosAinda não há avaliações

- Project Report BBA 4TH SEMDocumento82 páginasProject Report BBA 4TH SEMranaindia20110% (1)

- Chapter 18Documento5 páginasChapter 18Le QuangAinda não há avaliações

- Income From Other SourcesDocumento10 páginasIncome From Other SourcesHarsha VardhanaAinda não há avaliações

- Survivors Pension BenefitsDocumento2 páginasSurvivors Pension BenefitsmcooksbAinda não há avaliações

- Notes On Income From SalaryDocumento5 páginasNotes On Income From SalaryNarendra KelkarAinda não há avaliações

- Ra 10154Documento3 páginasRa 10154Cesar ValeraAinda não há avaliações

- Relief Us80Documento4 páginasRelief Us80Rajesh KumarAinda não há avaliações

- LIC S Jeevan Akshay VII - Policy Document - WebsiteDocumento22 páginasLIC S Jeevan Akshay VII - Policy Document - Websitechandra sekhar AAinda não há avaliações