Escolar Documentos

Profissional Documentos

Cultura Documentos

Commodity Outlook 04.10.11

Enviado por

Devang VisariaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Commodity Outlook 04.10.11

Enviado por

Devang VisariaDireitos autorais:

Formatos disponíveis

DAILY COMMODITY OUTLOOK

04 Oct, 11

th

NCDEX CHANA OCT. CONTRACT OPEN `3074.00

HIGH

`3215.00

LOW

`3041.00

CLOSE

`3193.00

NCDEX CHANA OCT Contract Technical Outlook & Trading Strategy The price of Chana fell sharply from the highs of `3700 levels during the last week. The correction took the price its key support levels established by the Fibonacci retracements and moving average clusters. One can clearly see from the chart above, that the price gave a smart bounce from these support levels and this led to the formation of a two bar bullish reversal pattern on the daily charts of Chana. These technical factors suggest that the price of Chana is likely to give a pullback and thus test levels of `3275 / `3355 levels over the upcoming week.

We recommend traders to buy 50% between `3200--`3180 levels and 50% on dips between ``3139--`3120 levels with a stop loss placed below `3089 levels for upside targets of `3275 / `3355 levels expected to be achieved over the upcoming 3-4 sessions of trade.

DAILY COMMODITY OUTLOOK

COMMODITIES TO WATCH

04 Oct, 11

th

MCX Crude Oct CMP`3835.00

Technical Outlook & Trading Strategy:-

We reiterate our bearish outlook on the price of crude. As mentioned in the previous update the price action of crude since 24th Aug, 2011 has been taking shape of a bearish Head & shoulders pattern on its daily charts. The price has now approached its neckline support levels placed around the `3820--`3800 levels. Sustenance below these levels will lead to severe corrections in the prices of crude oil. We recommend day / positional traders to take short positions between `3850--`3790 levels with a stop loss placed above `3889 levels for downside targets of `3740 / `3700 levels expected to be achieved over the upcoming 2-3 sessions of trade.

INVENTORY DATA

LME Warehouse Stocks (Inventory) and Volume

03 Oct 2011 METALS

Inventory MT 4,563,750 135,920 151,360 474,950 374,125 97,074 20,920 818,825 +/-3,575 0 -20 1,250 525 336 -430 -2,500

Volume MT 6,913,500 34,500 46,840 4,747,550 1,011,225 166,992 27,170 2,867,900 +/2,345,850 -119,980 -12,560 469,300 117,825 -33,792 -3,565 444,750

Aluminum Al Alloy NASAAC Copper Lead Nickel Tin Zinc

KEY SUPPORT RESISTANCE LEVELS

Commodity NCDEX Chana NCDEX Pepper NCDEX Soya Oil NCDEX Jeera NCDEX Guarseed Support 1 3084 35243 599 14608 4217 Support 2 2976 34902 589 14447 4110 CLOSE-PRICE 3193 35585 608.65 14769 4324 Resistance 1 3258 35783 614 14872 4394 Resistance - 2 3324 35982 620 14975 4464

DAILY COMMODITY OUTLOOK

MCX Copper MCX Nickel MCX Lead MCX Silver MCX Gold MCX Crude 333 880 95 51280 26463 3781 324 831 93 50516 26192 3726 343.25 929.20 97.35 52044 26733 3835 352 961 100 52804 26914 3914 361 993 102 53564 27094 3992

04 Oct, 11

th

Disclaimer

The views expressed are based purely on Technical studies. The calls made herein are for information purpose only. The information and views presented here are prepared by Matrix Solutions and his associates. The information contained herein is based on their analysis of the Charts and up on sources that are considered reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended on this Website may not be suitable for all investors. Past performance may not be indicative of future performance. Some of the securities/commodities presented herein should be considered speculative with a high degree of volatility and risk. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. You specifically agree to consult with a registered investment advisor, which we are not, prior to making any trading decision of any kind. While acting upon any information or analysis mentioned on this website, investors may please note that neither Matrix Solutions nor any person connected with him accepts any liability arising from the use of this information and views mentioned herein. Matrix Solutions and his affiliates may hold long or short positions in the securities/commodities discussed herein from time to time the services are intended for a restricted audience and we are not soliciting any action based on it. Neither the information nor any opinion expressed herein constitutes an offer or an invitation to make an offer, to buy or sell any securities/commodities, or any options, futures or other derivatives related to such securities/commodities. Part of this website may contain advertising and other material submitted to us by third parties. We do not accept liability in respect of any advertisements. You acknowledge that any warranty that is provided in connection with any of the products or services advertised on this website described herein is provided solely by the owner, advertiser, manufacturer or supplier of that product and/or service, and not by us. We do not warrant that your access to the Website and/or related services will be uninterrupted or error-free, that defects will be corrected, or that this site or the server that makes it available is free of viruses or other harmful components. Subscribers are advised to understand that the services can fail due to failure of hardware, software, and Internet connection. Access to and use of this site and the information is at your risk and we do not undertake any accountability for any irregularities, viruses or damage to any computer or Mobiles that results from accessing, availing or downloading of any information from this site. We do not warrant or make any representations regarding the use or the results of the use of any product and/or service purchased in terms of its compatibility, correctness, accuracy, reliability or otherwise. You assume total responsibility and risk for your use of this site and site-related services. A possibility exists that the site could include inaccuracies or errors. Additionally, a possibility exists that unauthorized additions, deletions or alterations could be made by third parties to the site. Although we attempt to ensure the integrity, correctness and authenticity of the site, it makes no guarantees whatsoever as to its completeness, correctness or accuracy. In the event that such an inaccuracy arises, please inform our staff so that it can be corrected. Price and availability of products and services offered on the site are subject to change without prior notice. To the extent we provide information on the availability of products or services you should not rely on such information. We will not be liable for any lack of availability of products and services you may order through the site. Transactions shall be governed by and construed in accordance with the laws of India, without regard to the laws regarding conflicts of law. Any litigation or any action at law or in equity arising out of or relating to these agreement or transaction shall be subject to Mumbai jurisdiction only and the customer hereby agrees consents and submits to the jurisdiction of such courts for the purpose of litigating any such action. A CALL ON SMS is a service given only to members with the sole intention to aid their information means. We do not guarantee any accuracy of generation, databases, delivery timings etc. while giving this facility. Depending on your location, service provider, medium of communication and delivery, the service may be at times slow or not there at all. We do not guarantee completion of delivery. We shall in no way be responsible for delays in receiving SMS on the mobile caused due to delivery methods chosen by the Service Provider, rush on the Service Providers Servers or any other reason whatsoever that may cause such a delay. Use of this website and its services constitutes acceptance of Disclaimer, Privacy Policy and Terms of Use.

Você também pode gostar

- Construction Report 1Documento15 páginasConstruction Report 1Faroo wazir78% (9)

- BS 6079-2019 - (2020-02-01 - 05-29-13 PM)Documento72 páginasBS 6079-2019 - (2020-02-01 - 05-29-13 PM)Michael Akpan100% (20)

- En 15198-2007 Methodology For The Risk Assessment of Non-Electrical Equipment and Components For Intended Use in Potentially Explosive AtmospheresDocumento22 páginasEn 15198-2007 Methodology For The Risk Assessment of Non-Electrical Equipment and Components For Intended Use in Potentially Explosive Atmospheresmem053840Ainda não há avaliações

- Independent Equity Research: How We Do It, and Why It Matters To InvestorsDocumento12 páginasIndependent Equity Research: How We Do It, and Why It Matters To InvestorsPutnam InvestmentsAinda não há avaliações

- Bartnding NC II-session PlanDocumento37 páginasBartnding NC II-session PlanChryz Santos100% (3)

- Chapter 12 - Structural RobustnessDocumento22 páginasChapter 12 - Structural RobustnessErnie ErnieAinda não há avaliações

- Commodity Outlook 10.10Documento3 páginasCommodity Outlook 10.10Mitesh ThackerAinda não há avaliações

- Commodity Outlook 05.10.11Documento3 páginasCommodity Outlook 05.10.11Devang VisariaAinda não há avaliações

- Commodity Outlook 03.10.11Documento3 páginasCommodity Outlook 03.10.11Devang VisariaAinda não há avaliações

- Commodity Outlook 28.09.11Documento3 páginasCommodity Outlook 28.09.11Devang VisariaAinda não há avaliações

- Commodity Outlook 13.10.11Documento3 páginasCommodity Outlook 13.10.11Devang VisariaAinda não há avaliações

- Commodity Outlook 29.09.11Documento3 páginasCommodity Outlook 29.09.11Devang VisariaAinda não há avaliações

- Commodity Outlook 27.09.11Documento3 páginasCommodity Outlook 27.09.11Devang VisariaAinda não há avaliações

- Commodity Outlook 07.10.11Documento3 páginasCommodity Outlook 07.10.11Devang VisariaAinda não há avaliações

- Commodity Outlook 23.09.11Documento3 páginasCommodity Outlook 23.09.11Devang VisariaAinda não há avaliações

- Commodity Outlook 16.09.11Documento2 páginasCommodity Outlook 16.09.11Devang VisariaAinda não há avaliações

- Commodity Outlook 30.09.11Documento3 páginasCommodity Outlook 30.09.11Devang VisariaAinda não há avaliações

- Commodity Outlook 25.10.11Documento3 páginasCommodity Outlook 25.10.11Devang VisariaAinda não há avaliações

- Commodity Outlook 28.10.11Documento3 páginasCommodity Outlook 28.10.11Devang VisariaAinda não há avaliações

- Commodity Outlook 14.10.11Documento3 páginasCommodity Outlook 14.10.11Devang VisariaAinda não há avaliações

- Commodity Outlook 02 Nov 2011Documento3 páginasCommodity Outlook 02 Nov 2011Mitesh ThackerAinda não há avaliações

- Commodity Outlook 22.09.11Documento3 páginasCommodity Outlook 22.09.11Devang VisariaAinda não há avaliações

- Commodity Outlook 11.10Documento3 páginasCommodity Outlook 11.10Devang VisariaAinda não há avaliações

- Commodity Outlook 21.09.11Documento3 páginasCommodity Outlook 21.09.11Devang VisariaAinda não há avaliações

- Daily Morning Update 21 Oct 2011Documento2 páginasDaily Morning Update 21 Oct 2011Devang VisariaAinda não há avaliações

- Daily Trading Note Commodity Outlook 28.07.11 From MatrixDocumento2 páginasDaily Trading Note Commodity Outlook 28.07.11 From MatrixMitesh Thacker100% (1)

- Daily Morning Update 28 Sept 2011Documento3 páginasDaily Morning Update 28 Sept 2011Devang Visaria100% (1)

- Daily Morning Update 15 Dec 2011Documento3 páginasDaily Morning Update 15 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 9dec 2011Documento3 páginasDaily Morning Update 9dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 28 Sept 2011Documento2 páginasDaily Morning Update 28 Sept 2011Mitesh ThackerAinda não há avaliações

- Daily Morning Update 19 Dec 2011Documento3 páginasDaily Morning Update 19 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 28 Dec 2011Documento2 páginasDaily Morning Update 28 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 23 Dec 2011Documento2 páginasDaily Morning Update 23 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 27sept 2011Documento2 páginasDaily Morning Update 27sept 2011Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento5 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Daily Morning Update 13 Dec 2011Documento3 páginasDaily Morning Update 13 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 14 Dec 2011Documento2 páginasDaily Morning Update 14 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 26 Oct 2011Documento2 páginasDaily Morning Update 26 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 30 Dec 2011Documento2 páginasDaily Morning Update 30 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 8dec 2011Documento3 páginasDaily Morning Update 8dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 26 Sept 2011Documento2 páginasDaily Morning Update 26 Sept 2011Mitesh ThackerAinda não há avaliações

- Daily Morning Update 12dec 2011Documento3 páginasDaily Morning Update 12dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 04 Oct 2011Documento2 páginasDaily Morning Update 04 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 24 Oct 2011Documento2 páginasDaily Morning Update 24 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 12 Oct 2011Documento2 páginasDaily Morning Update 12 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 28 July 2011 From MatrixDocumento2 páginasDaily Morning Update 28 July 2011 From MatrixDevang VisariaAinda não há avaliações

- Daily Morning Update 1dec 2011Documento3 páginasDaily Morning Update 1dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 28 Nov 2011Documento2 páginasDaily Morning Update 28 Nov 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 16 Dec 2011Documento3 páginasDaily Morning Update 16 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 20 Dec 2011Documento3 páginasDaily Morning Update 20 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 22 Sept 2011Documento2 páginasDaily Morning Update 22 Sept 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 14 Oct 2011Documento2 páginasDaily Morning Update 14 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 2dec 2011Documento2 páginasDaily Morning Update 2dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 09 Sept 2011Documento2 páginasDaily Morning Update 09 Sept 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 07 Oct 2011Documento2 páginasDaily Morning Update 07 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 21 Dec 2011Documento2 páginasDaily Morning Update 21 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 11 Oct 2011Documento2 páginasDaily Morning Update 11 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 5dec 2011Documento3 páginasDaily Morning Update 5dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 2 Jan 2012Documento2 páginasDaily Morning Update 2 Jan 2012Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Daily Morning Update 29 Sept 2011Documento2 páginasDaily Morning Update 29 Sept 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 29 Nov 2011Documento2 páginasDaily Morning Update 29 Nov 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 20 Oct 2011Documento2 páginasDaily Morning Update 20 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 03 Oct 2011Documento2 páginasDaily Morning Update 03 Oct 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 30nov 2011Documento2 páginasDaily Morning Update 30nov 2011Devang VisariaAinda não há avaliações

- How to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!No EverandHow to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!Nota: 3.5 de 5 estrelas3.5/5 (7)

- Daily Morning Update 2 Jan 2012Documento2 páginasDaily Morning Update 2 Jan 2012Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento5 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Weekly Update 31 Dec 2011Documento5 páginasWeekly Update 31 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 23 Dec 2011Documento2 páginasDaily Morning Update 23 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 29 Dec 2011Documento2 páginasDaily Morning Update 29 Dec 2011Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Daily Morning Update 30 Dec 2011Documento2 páginasDaily Morning Update 30 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 28 Dec 2011Documento2 páginasDaily Morning Update 28 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 22 Dec 2011Documento3 páginasDaily Morning Update 22 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 13 Dec 2011Documento3 páginasDaily Morning Update 13 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 16 Dec 2011Documento3 páginasDaily Morning Update 16 Dec 2011Devang VisariaAinda não há avaliações

- Daily Commodity Update 20-12-2011Documento6 páginasDaily Commodity Update 20-12-2011Devang VisariaAinda não há avaliações

- Daily Morning Update 21 Dec 2011Documento2 páginasDaily Morning Update 21 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 20 Dec 2011Documento3 páginasDaily Morning Update 20 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 19 Dec 2011Documento3 páginasDaily Morning Update 19 Dec 2011Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Weekly Update 17th Dec 2011Documento6 páginasWeekly Update 17th Dec 2011Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Daily Morning Update 15 Dec 2011Documento3 páginasDaily Morning Update 15 Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 14 Dec 2011Documento2 páginasDaily Morning Update 14 Dec 2011Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

- Daily Morning Update 12dec 2011Documento3 páginasDaily Morning Update 12dec 2011Devang VisariaAinda não há avaliações

- Weekly Update 10nd Dec 2011Documento5 páginasWeekly Update 10nd Dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 8dec 2011Documento3 páginasDaily Morning Update 8dec 2011Devang VisariaAinda não há avaliações

- Daily Morning Update 9dec 2011Documento3 páginasDaily Morning Update 9dec 2011Devang VisariaAinda não há avaliações

- Market Review & Outlook: Precious MetalsDocumento6 páginasMarket Review & Outlook: Precious MetalsDevang VisariaAinda não há avaliações

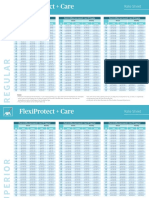

- Flexi+Care Rate SheetDocumento3 páginasFlexi+Care Rate SheetNeil MijaresAinda não há avaliações

- Institute of Actuaries of India: Subject SA1 - Health and Care InsuranceDocumento4 páginasInstitute of Actuaries of India: Subject SA1 - Health and Care InsuranceVignesh SrinivasanAinda não há avaliações

- 1624 - Corporate Transfer PolicyDocumento16 páginas1624 - Corporate Transfer PolicySyamsul ArifinAinda não há avaliações

- AAA INT MJ23 Examiner's ReportDocumento18 páginasAAA INT MJ23 Examiner's Reportsalwa waqarAinda não há avaliações

- Assignment 3Documento5 páginasAssignment 3MUQADAR RajpootAinda não há avaliações

- Low Back Pain Among Nurses in Slovenian Hospitals: Cross-Sectional StudyDocumento8 páginasLow Back Pain Among Nurses in Slovenian Hospitals: Cross-Sectional StudyMerieme SafaaAinda não há avaliações

- Samuel AsratDocumento88 páginasSamuel Asratbeno100% (1)

- DMDHEU PropertiesDocumento24 páginasDMDHEU PropertiesTrầnChíTrungAinda não há avaliações

- Families Count: Effects On Child and Adolescent DevelopmentDocumento26 páginasFamilies Count: Effects On Child and Adolescent DevelopmentmidoAinda não há avaliações

- Responsible Use of Media and Information and Evolution of MediaDocumento35 páginasResponsible Use of Media and Information and Evolution of MediaERICKA GRACE DA SILVAAinda não há avaliações

- 2023 Bust Jit Term 3 GR 12 Teacher Guide P2Documento80 páginas2023 Bust Jit Term 3 GR 12 Teacher Guide P2sbonisotshose2Ainda não há avaliações

- Isa 200Documento5 páginasIsa 200baabasaamAinda não há avaliações

- Pre-Announcement and Event-Period Private Information: Oliver Kim !, Robert E. Verrecchia"Documento25 páginasPre-Announcement and Event-Period Private Information: Oliver Kim !, Robert E. Verrecchia"Komang Aryagus WigunaAinda não há avaliações

- New Chapter 3 Homeopathy 7.7.18Documento14 páginasNew Chapter 3 Homeopathy 7.7.18riddhiAinda não há avaliações

- Risk Management Studies of Water Reticulation at Seksyen 8Documento45 páginasRisk Management Studies of Water Reticulation at Seksyen 8Iqmer LazuardiAinda não há avaliações

- Inequalities in Health-Definitions - Concepts and TheoriesDocumento12 páginasInequalities in Health-Definitions - Concepts and TheoriesElaine MachadoAinda não há avaliações

- TR Biomedical Equipment Servicing NC IIDocumento68 páginasTR Biomedical Equipment Servicing NC IIRinmawiiAinda não há avaliações

- Risk, Return and Opp - Cost of CapitalDocumento34 páginasRisk, Return and Opp - Cost of CapitalimadAinda não há avaliações

- Plant and Equipment Risk Assessment Checklist1Documento9 páginasPlant and Equipment Risk Assessment Checklist1peachykrista100% (1)

- Automated Trading Systems The Pros and ConsDocumento8 páginasAutomated Trading Systems The Pros and ConsGopi KrishnaAinda não há avaliações

- Risk in Sports and Challenges For Sports OrganizationsDocumento210 páginasRisk in Sports and Challenges For Sports OrganizationsHoa ThúyAinda não há avaliações

- Digital Transformation Cyber Security PDFDocumento40 páginasDigital Transformation Cyber Security PDFPrashant MahajanAinda não há avaliações

- Rics Guidance Note The Role of The Commercial Manager in Infrastructure 1st Edition 2017Documento25 páginasRics Guidance Note The Role of The Commercial Manager in Infrastructure 1st Edition 2017Tharaka Kodippily100% (1)

- Fundamentals of Hazard Management PDFDocumento226 páginasFundamentals of Hazard Management PDFMogana GunasigrenAinda não há avaliações