Escolar Documentos

Profissional Documentos

Cultura Documentos

Citi HAFA Elegibility Matrix

Enviado por

kwillsonDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Citi HAFA Elegibility Matrix

Enviado por

kwillsonDireitos autorais:

Formatos disponíveis

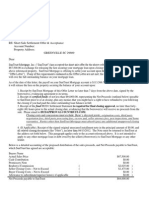

CitiMortgageHomeAffordableForeclosureAlternative(HAFA)Matrix

AllservicersthathavesignedagreementswiththeU.S.DepartmentoftheTreasury(Treasury)toparticipateintheHome Affordable Modification Program (HAMP) must consider eligible borrowers who do not qualify for HAMP for other foreclosurepreventionoptionsincludingHomeAffordableForeclosureAlternatives(HAFA)whichincludesshortsaleand deedinlieu (DIL). However, each servicer has some discretion in determining additional eligibility criteria and certain program rules. In order to assist borrowers and their representatives in understanding any unique components of a servicersHAFAPolicy,Treasury,hasdevelopedthisHAFAMatrix.Thesummaryinformationinthismatrixisprepared solelybyCitiMortgage(CMI)anddoesnotrepresentanydeterminationbytheTreasuryastotheservicer'scompliance withtheTreasury'spoliciesandguidanceforHAFA.Treasurydoesnotendorseanylanguageorpolicydescribedinthis matrix.AnyquestionsregardingtheinformationcontainedinthismatrixshouldbedirectedsolelytoCitiMortgage.

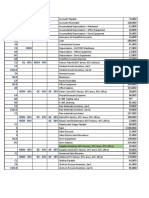

ELIGIBILITY REQUIREMENTS LastUpdated:8/24/11 TheloanmustbeownedbyCitiMortgageorbyaprivateinvestor(i.e.aNonGSELoan). ThemortgageloanisafirstlienmortgageoriginatedonorbeforeJanuary1,2009. Themortgageisdelinquent(>60dayspastdue)ordefaultisreasonablyforeseeable(imminent default).LoanscurrentlyinForeclosureandBankruptcyareeligible. Thecurrentunpaidprincipalbalanceoftheloanisequaltoorlessthan: o 1Unit$729,750 o 2Units$934,200 o 3Units$1,129,250 o 4Units$1,403,400 Theborrowerhasdocumentedafinancialhardship,evidencedbyasignedHardshipAffidavitor RequestforModificationandAffidavit(RMA),inwhichtheborrowerhasexpressedthatheor shedoesnothavesufficientliquidassetstomakethemonthlymortgagepayment. ForeclosureSaleDate: o Loansinforeclosurethathaveasaledatesetwhichis<60daysfromthedatethatthe borrowerrequestsconsiderationforHAFAareineligible. o Inaddition,onceaforeclosuresalehasoccurredtheloanisnolongereligible. CitiMortgagewillfirstevaluatetheborrowerforaHAMPmodificationpriortoany considerationbeinggiventoHAFAoptions.Borrowersthatmeettheeligibilitycriteriafor HAMPbutwhoarenotofferedaTrialPeriodPlan,donotsuccessfullycompleteaTrialPeriod Plan,ordefaultonaHAMPmodificationwillfirstbeconsideredfortheotherloanmodification orretentionprogramsofferedbyCitiMortgagepriortobeingevaluatedforHAFA. Thepropertyiscurrentlyorwasrecentlytheborrowersprincipalresidence: o HAFAallowsforvacancyofthepropertyforupto12monthspriortothedateofthe agreement,iftheborrowerprovidesdocumentationthatitwastheirprincipal residencepriortorelocationandthereisnoevidenceindicatingthattheborrowerhas purchasedaonetofourunitpropertywithin12monthspriortothedateoftheShort SaleAgreement(SSA),AlternativeRequestforApprovalofaShortSale(RASS)orDIL Agreement. Thepropertysecuringthemortgageloanisnotcondemned. SubordinateLiens o Itistheresponsibilityoftheborrowertodeliverclearmarketabletitletothepurchaser orinvestorandtoworkwiththelistingbroker,settlementagentand/orlienholdersto cleartitleimpediments.CitiMortgageispermittedtonegotiatewithsubordinatelien

holdersonbehalfoftheborrower. o Onbehalfoftheinvestor,CitiMortgagewillauthorizethesettlementagenttoallowup toanaggregateof$6,000ofthegrosssaleproceedsaspayment(s)tosubordinatelien holder(s)inexchangeforalienreleaseandfullreleaseofborrowerliability.Each subordinatemortgagelienholder(wherethelienissecuredbyamortgageonthe subjectproperty),inorderofpriority,willbepaidsixpercent(6%)oftheunpaid principalbalanceoftheirloan,untilthe$6,000aggregatecapisreached.Suchcap doesnotapplytononmortgagesubordinatelienholders(e.g.mechanic'sliens,liens associatedwithassessmentsowedtohomeowner'sassociations,etc). MortgageInsurance: o Forloansthathavemortgageinsurancecoverage,thetransactionmustcomplywith CitiMortgagesagreementwiththemortgageinsurer;otherwise,CitiMortgagemust submitthetransactiontothemortgageinsurerandobtainapprovalforHAFA foreclosurealternatives.AmortgageloandoesnotqualifyforHAFAunlessthe mortgageinsurerwaivesanyrighttocollectadditionalsums(cashcontributionora promissorynote)fromtheborrower. PrivateInvestors: o Eachprivateinvestormakesadecisionastowhetherornottheywillparticipatein HAFA.WhenCitiMortgagerecommendsaHAFAshortsaleonaloanservicedonbehalf ofaprivateinvestor,weseeksuchinvestorsapprovalonacasebycasebasis. DuringthetermoftheSSA,CMImayterminatetheSSAbeforeitsexpirationduetoanyofthe followingevents: o Theborrowersfinancialsituationimprovessignificantly,theborrowerqualifiesfora modification,ortheborrowerbringstheaccountcurrentorpaysthemortgageinfull. o Theborrowerorthelistingbrokerfailstoactingoodfaithinlisting,marketingand/or closingthesale,orotherwisefailstoabidebythetermsoftheSSA. o Asignificantchangeoccurstothepropertyconditionand/orvalue. o Thereisevidenceoffraudormisrepresentation. o TheborrowerfilesforbankruptcyandtheBankruptcyCourtdeclinestoapprovethe SSA. o Litigationisinitiatedorthreatenedthatcouldaffecttitletothepropertyorinterfere withavalidconveyance. o TheborrowerfailstomakethemonthlypaymentstipulatedintheSSA,ifapplicable.

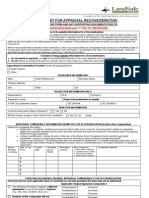

DOCUMENTATION PreapprovedShortSaleAgreement(SSA) REQUIREMENTS HardshipAffidavitorRequestforModificationandAffidavit(RMA) Evidenceofresidency: o CitiMortgagemayrequestoneormorethefollowingtoconfirmprincipal residence:taxreturn,taxbill,utilitybill,validpassport,driverslicense,Medicare card,permanentresidentcardorarmedforcesidentification. AnexecutedDoddFrankCertificationfromeachborrowerstatingtheyhavenotbeen convictedofanyoneofthefollowing,inconnectionwithamortgageorrealestate transaction,withinthelast10years: o felonylarceny,theft,fraudorforgery, o moneylaunderingor o taxevasion Subordinateliendocumentation(apayoffquotefromanysubordinatelienholder)

Formofincomeverification,iflessthan60dayspastdue(pleaseseeImminentDefault sectionbelow).

VALUATIONS

ExistingOfferSubmittedUsinganAlternativeRequestforApprovalofShortSale(AlternativeRASS) SamedocumentsasSSAplus: Acceptedpurchasecontract Buyersdocumentationoffundsorbuyerspreapprovalorcommitmentletteron letterheadfromalender Allinformationregardingthestatusofsubordinateliensand/ornegotiationswith subordinatelienholders ImminentDefaultIftheloanislessthan60dayspastdue,CitiMortgagewillrequestthefollowing financialdocuments(inadditiontothedocumentsrequestedforthePreapprovedShortSale agreement. Taxreturns(last2yearstaxreturns,ifnotyetfiledverificationofextensionletteris required) Paystubs/bankstatements(2paystubs/bankstatementsdatedwithinthelast60days) DebtDocumentation(hardshipletterstatingthereasonfordelinquencyandifpossible verification:suchashospitalbill,etc) EstablishingPropertyValueCitiMortgagewillassessthecurrentvalueofthepropertyusinga compliantevaluation. Thevaluationwillbeindependentoftheborrowerandanyotherpartiesto thetransaction.CitiMortgagewillnotrequiretheborrowertopayinadvanceforthevaluation,but willaddthecosttotheoutstandingdebtinaccordancewiththeborrowersmortgagedocuments andapplicablelawintheeventtheshortsaleorDILisnotcompleted.Thevaluationmustbeless thansixmonthsoldasofthedateoftheevaluation. DisputedValuationsThroughthelistingprocess,itiscriticalthatCitiMortgageandtheborrower agreeonthevalueofthehomeinordertogetthepropertylistedcorrectlytocompleteaHAFA shortsale.IfCitiMortgageisusingavaluethattheborrowerortheborrowersrealestatebroker disagreeswithsuchvaluemaybedisputedby: Contactingyourassignedsinglepointofcontactrepresentative(thisrepresentativewill bedeterminedatthetimeyouarereviewedforHAFAeligibility). Providinganyadditionalcomparablesintheareaincludingsales/listingsand/or providingexternalvaluationmethodssuchasBPOs,AVMs,orappraisals.These valuesshouldsupportthereasonforthedispute. Theestimatedevaluationtimeframeiswithin30days PriceReductionReviewDuringMarketingPeriodThelistpricewillbereviewed,ataminimum, every30dayswithinthemarketingperiod

PAYMENTS DURING MARKETING PERIOD DEEDINLIEU POLICY/SPECIAL PROGRAMS

CitiMortgagewillidentifyintheSSA,AlternativeRASSorDILAgreementtheamountofthemonthly mortgagepaymentthattheborrowerisrequiredtomakeduringthetermoftheapplicable agreementandpendingtransferofpropertyownership.CitiMortgagerequiresthemonthly paymenttobethelesseroftheborrowerscurrentmonthlypaymentor20%oftheborrowers grossmonthlyincome. CitiMortgagewillacceptaHAFADILafterthe120daySSAperiodhasexpiredwheretheproperty didnotselloriftheborrowerrefusestoconsiderashortsale.CitiMortgagemustprovideafull

releaseofthedebtandwaiverofallclaimsagainsttheborrower.Theborrowermustagreeto vacatethepropertyinnolessthan30days,asnegotiated,leavethepropertyinbroomclean conditionanddeliverclear,marketabletitletoCitiMortgage. ThefollowingtermsapplytoaHAFADIL: MarketableTitle.Theborrowermustbeabletoconveyclear,marketabletitletoCMI.The requirementsforextinguishmentofsubordinateliensasdescribedintheEligibility RequirementssectionofthismatrixapplytoDILtransactions. WrittenAgreement.TheconditionsforacceptanceofaDILmustbeinwritingandsignedby bothCitiMortgageandtheborrowerassetforthintheSSAorDILAgreement. VacancyDate.TheSSAorDILAgreementwillspecifythedatebywhichtheborrowermust vacatetheproperty,whichinnoeventshallbelessthan30calendardaysfromthedateofthe terminationdateoftheSSAorthedateofaseparateDILAgreement,unlesstheborrower voluntarilyagreestoanearlierdate.

AVERAGE TIMELINES

CitiMortgagewillconsiderpossibleHAMPeligibleborrowersforHAFAwithin30calendardays ofthedatetheborrower: DoesnotqualifyforaTrialPeriodPlan; DoesnotsuccessfullycompleteaTrialPeriodPlan; IsdelinquentonaHAMPmodificationbymissingatleasttwoconsecutive payments;or RequestsashortsaleorDIL.

WhenaHAFAshortsaleorDILisnotavailable,CitiMortgagewillcommunicatethisdecisionin writingtoanyborrowerthatrequestedconsideration.Thenoticewillbesentnolaterthan10 businessdaysfollowingthedeterminationthataHAFAshortsaleorDILisnotavailable. Within10businessdaysfollowingreceiptofarequestforashortsaleorDILorreceiptofan AlternativeRASS,CitiMortgagemustsendwrittenconfirmationtotheborroweracknowledging therequest.TheacknowledgmentmustincludeadescriptionoftheCMIHAFAevaluation processandatimelinefordecision,whichmustbenolaterthan45calendardaysfromthe dateoftherequest. CitiMortgagewillcompleteandsendtotheborroweranSSAnolaterthan45calendardays fromthedatetheborrowerrespondstotheHAFAsolicitation.Ifaborrowerinitiatesa requestsforconsiderationunderHAFA,CMImustevaluatetheborrowerseligibilityand,if eligible,completeandsendtheborroweranSSAnolaterthan45calendardaysfromthedate oftheborrowersrequest. TheborrowermustsignandreturntheSSAwithin14calendardaysfromitsEffectiveDate alongwithacopyoftherealestatebrokerlistingagreementandinformationregardingany subordinateliens. FailuretosignandreturntheSSAdoesnotprohibitfutureHAFAeligibility.For example,ifaborrowerreceivesanexecutedsalescontracttheymaybeevaluated andapprovedforaHAFAshortsaleusinganAlternativeRASS.

TheborrowermustcompleteanddelivertheRASStoCitiMortgagewithinthreebusinessdays ofreceivinganexecutedsalescontract. Nolaterthan45calendardaysfromthedateofreceiptfromtheborrowerofanexecutedsales contract,AlternativeRASS,andasignedHardshipAffidavitorRMA,CitiMortgagemust

communicateapprovalordisapprovalofthesaleorprovideacounterofferontheAlternative RASS. CONTACT INFORMATION ForHAFAprogramassessment,eligibilityorescalation 18662724749 ForgeneralHAFAquestionsandtransactionstatus o 18665205499oryourassignedsinglepointofcontactrepresentative ForhelpunderstandingHAFAeligibility(nocap)oradecision,youmaycontactTreasury's HOPEHotlineat o (888)995HOPE. Foranyadditionalinformation,pleasevisit: o www.citimortgage.com CMIdoesnotcurrentlyutilizevendorsthattheborroweroragentwillinterfacewith. o Theclosingwillnotbelessthan45calendardaysoftheSalesContractexecutiondate unlessCitiMortgageobtainsyourconsentotherwise.

THIRDPARTY VENDORS Disclaimer:Thecontentisintendedtoprovidegeneralinformationabouttheeligibilityrequirementsforashortsaleor deedinlieuofforeclosureundertheTreasury'sHomeAffordableForeclosureAlternativesprogram.Eligibilitymayvary basedonindividualloancharacteristicsandinvestorandmortgageinsurerrequirements.Certainrestrictionmayapply onallprograms.

Você também pode gostar

- Bank of America Cooperative Short Sale ApprovalDocumento3 páginasBank of America Cooperative Short Sale ApprovalkwillsonAinda não há avaliações

- 2012 at 1801 Wells FargoDocumento9 páginas2012 at 1801 Wells FargoDinSFLAAinda não há avaliações

- Real Time Resolutions Short Sale Approval (2nd Mortgage)Documento3 páginasReal Time Resolutions Short Sale Approval (2nd Mortgage)kwillsonAinda não há avaliações

- #BANKOFAMERICA FHA Pre-Foreclosure Sale Approval LetterDocumento2 páginas#BANKOFAMERICA FHA Pre-Foreclosure Sale Approval LetterkwillsonAinda não há avaliações

- Citi Short Sale Approval Letter (Non-GSE)Documento2 páginasCiti Short Sale Approval Letter (Non-GSE)kwillsonAinda não há avaliações

- Ocwen Short Sale Approval (2nd Mortgage)Documento6 páginasOcwen Short Sale Approval (2nd Mortgage)kwillsonAinda não há avaliações

- Greenville County, SC Subdivision Restrictions Prior To 1990Documento50 páginasGreenville County, SC Subdivision Restrictions Prior To 1990kwillsonAinda não há avaliações

- 5 RVT Nry-: - L TT RM L AelDocumento1 página5 RVT Nry-: - L TT RM L AelkwillsonAinda não há avaliações

- Bank of America HELOC Short Sale ApprovalDocumento2 páginasBank of America HELOC Short Sale ApprovalkwillsonAinda não há avaliações

- Webinar III HUD Loss Mitigation Disposition Options ParticipantDocumento45 páginasWebinar III HUD Loss Mitigation Disposition Options Participantkwillson100% (1)

- Navy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixDocumento2 páginasNavy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixkwillsonAinda não há avaliações

- SunTrust Short Sale Approval (Fannie Mae)Documento3 páginasSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- Bank of America HELOC Short Sale PackageDocumento7 páginasBank of America HELOC Short Sale PackagekwillsonAinda não há avaliações

- Bank of America - REQUEST FOR APPRAISAL OR REVIEW RECONSIDERATIONDocumento2 páginasBank of America - REQUEST FOR APPRAISAL OR REVIEW RECONSIDERATIONkwillsonAinda não há avaliações

- Webinar I HUD Early Delinquency Activities and Loss Mitigation Program Overview - ParticipantDocumento37 páginasWebinar I HUD Early Delinquency Activities and Loss Mitigation Program Overview - ParticipantkwillsonAinda não há avaliações

- HUD-90051 (Variance For 3% Closing Costs Approved)Documento2 páginasHUD-90051 (Variance For 3% Closing Costs Approved)kwillsonAinda não há avaliações

- BOA FHA PFS Incentive (HUD-1 OnDocumento2 páginasBOA FHA PFS Incentive (HUD-1 OnkwillsonAinda não há avaliações

- South Carolina Deficiency Judgments in Foreclosure ActionsDocumento7 páginasSouth Carolina Deficiency Judgments in Foreclosure ActionskwillsonAinda não há avaliações

- BOFA AddendumDocumento6 páginasBOFA AddendumkwillsonAinda não há avaliações

- Ocwen HAFA MatrixDocumento5 páginasOcwen HAFA MatrixkwillsonAinda não há avaliações

- Reconsideration Request Form - Rev 2010Documento2 páginasReconsideration Request Form - Rev 2010kwillsonAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- PNB Housing Finance Limited Legal Title Opinion Report: Pawan Kumar Advocate Civilcourt GorakhpurDocumento6 páginasPNB Housing Finance Limited Legal Title Opinion Report: Pawan Kumar Advocate Civilcourt GorakhpurMritunjai SinghAinda não há avaliações

- Dividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsDocumento17 páginasDividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsRitesh ChatterjeeAinda não há avaliações

- Account Statement PDF 1620001413032 12 April 2019Documento57 páginasAccount Statement PDF 1620001413032 12 April 2019elisgretyAinda não há avaliações

- 6Documento10 páginas6ampfcAinda não há avaliações

- Presentation About Financial Crisis 2008Documento16 páginasPresentation About Financial Crisis 2008Schanzae ShabbirAinda não há avaliações

- Medical System in RomaniaDocumento38 páginasMedical System in Romaniabogdan ciubucAinda não há avaliações

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDDocumento74 páginasPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBAinda não há avaliações

- Foreign Currency TransactionsDocumento4 páginasForeign Currency TransactionsDeo CoronaAinda não há avaliações

- Registration of Domestic Corporation - SecDocumento6 páginasRegistration of Domestic Corporation - SecJuan FrivaldoAinda não há avaliações

- Mobil Oil Philippines V DiocaresDocumento2 páginasMobil Oil Philippines V Diocarescmv mendozaAinda não há avaliações

- Article On Weather Index InsuranceDocumento3 páginasArticle On Weather Index InsuranceOmkar PandeyAinda não há avaliações

- Feb 2021Documento2 páginasFeb 2021AjayAinda não há avaliações

- AAA Accounting Standards Part 2Documento4 páginasAAA Accounting Standards Part 2Gauri WastAinda não há avaliações

- 2017 ADB Annual ReportDocumento104 páginas2017 ADB Annual ReportFuaad DodooAinda não há avaliações

- RR 10-76Documento4 páginasRR 10-76matinikkiAinda não há avaliações

- Unit 4 Dividend DecisionsDocumento17 páginasUnit 4 Dividend Decisionsrahul ramAinda não há avaliações

- Mco-7 emDocumento8 páginasMco-7 emKhundrakpam Satyabarta100% (3)

- ImpairmentDocumento45 páginasImpairmentnati100% (1)

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocumento1 páginaACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualAinda não há avaliações

- Hex NutsDocumento1 páginaHex NutsAgung SYAinda não há avaliações

- Apple Card Statement - December 2020Documento4 páginasApple Card Statement - December 2020SebastianGarciaVasquezAinda não há avaliações

- A Study On Financial Performance of Public Sector Banks in IndiaDocumento38 páginasA Study On Financial Performance of Public Sector Banks in IndiaMehul ParmarAinda não há avaliações

- Monetary Policies and It'S Impact On Indian Economy: Presented By-Sushil Maurya BBA-4 - CDocumento22 páginasMonetary Policies and It'S Impact On Indian Economy: Presented By-Sushil Maurya BBA-4 - CIshpreet Singh BaggaAinda não há avaliações

- THE 10th INTERNATIONAL CONFERENCE ON ISLAMIC ECONOMICS AND FINANCE (ICIEF) Institutional Aspects of Economic, Monetary and Financial ReformsDocumento21 páginasTHE 10th INTERNATIONAL CONFERENCE ON ISLAMIC ECONOMICS AND FINANCE (ICIEF) Institutional Aspects of Economic, Monetary and Financial ReformsKhairunnisa MusariAinda não há avaliações

- Angelo Wardana 349655122Documento5 páginasAngelo Wardana 349655122Green Sustain EnergyAinda não há avaliações

- Financial AccountingDocumento4 páginasFinancial AccountingManish KushwahaAinda não há avaliações

- Marat Terterov-Doing Business With Russia (Global Market Briefings) (2004)Documento417 páginasMarat Terterov-Doing Business With Russia (Global Market Briefings) (2004)addaaaAinda não há avaliações

- Rodrigo Rivera Vs Spouses Salvador Chua and Violeta SDocumento3 páginasRodrigo Rivera Vs Spouses Salvador Chua and Violeta SĽeońard ŮšitaAinda não há avaliações

- FIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedDocumento26 páginasFIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedTyka TrầnAinda não há avaliações

- Annual Equivalent MethodDocumento6 páginasAnnual Equivalent Methodutcm77100% (1)