Escolar Documentos

Profissional Documentos

Cultura Documentos

IRFC Tax Free Indicative Summary

Enviado por

Sahil Bhatt CfpDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IRFC Tax Free Indicative Summary

Enviado por

Sahil Bhatt CfpDireitos autorais:

Formatos disponíveis

Private Placement of Tax Free Bonds by Indian Railway Finance Corporation Ltd.

ISSUE TIME TABLE Issue Opening Date Issue Closing Date Pay-In Dates Deemed Date of Allotment

Monday Friday Monday to Friday Tuesday

October 10, 2011 October 21, 2011 October 10, 2011 to October 21, 2011 November 08, 2011

HIGHLIGHTS OF THE BONDS Issuer Indian Railway Finance Corporation Ltd. Issue Size Rs. 150 crore with an option to retain oversubscription (As per CBDT notification, IRFC can retain maximum subscription amount of upto Rs. 10,000 crore in FY 2011-12) Secured Redeemable Non-Convertible Non-Cumulative Tax-Free Bonds in the nature of Promissory Notes The income by way of interest will be entitled to exemption from income tax under section 10 (15) (iv) (h) of Income Tax Act, 1961 In dematerialized form Pari-passu first charge over the rolling stock assets of the Company AAA/Stable by CRISIL, LAAA by ICRA and CARE AAA by CARE Rs. 1,00,000/- per Bond At par i.e. Rs. 1,00,000/- per Bond 1 Bond (Rs. 1,00,000/-) and in multiples of 1 Bond (Rs. 1,00,000/-) thereafter Option -I 10 Years None At par on the expiry of 10th Year from the Deemed Date of Allotment 7.55% p.a. Annual October15, every year till maturity Option -II 15 Years None At par on the expiry of 15th Year from the Deemed Date of Allotment 7.77% p.a. Annual October 15, every year till maturity

Instrument Tax Benefits Instrument Form Security Credit Rating Face Value Issue Price Minimum Subscription Option Tenure Put & Call Option Maturity/ Redemption Coupon Rate Interest Payment Interest Payment Date Pre-Tax Yield Listing Trustee Interest on Application Money Who can apply

May be subjective and may vary from case to case. However some sample illustrations of pretax yield are given on the next page Proposed on the Wholesale Debt Market (WDM) Segment of National Stock Exchange of India Ltd. (NSE) Indian Bank At the respective coupon rate (subject to deduction of tax at source, as applicable) will be paid to the eligible investors from the date of realization of subscription money up to one date prior to the Deemed Date of Allotment Resident Individuals, Companies, Bodies Corporate, Scheduled Commercial Banks, Financial Institutions, Insurance Companies, Primary/ State/ District/ Central Co-operative Banks (subject to permission from RBI), Regional Rural Banks, Mutual Funds, Provident, Gratuity, Superannuation and Pension Funds, and any other investor authorised to invest in these bonds, subject to confirmation from the Issuer

IRFC BACKGROUND Financing arm of the Indian Railways Notified as a Public Financial Institution under Section 4A of the Companies Act, 1956 Registered as a NBFC-ND-IFC (Infrastructure Finance Company) with Reserve Bank of India 100% shareholding held by Government of India Consistently profit making Public Sector Undertaking Consistently rated AAA by CRISIL, ICRA and CARE Impeccable track record of funding rolling stock asset creation worth Rs. 60,163 crore (5,060 locomotives, 32,115 passenger coaches and 1,39,659 freight cars) for Indian Railways so far, besides providing funding support of Rs. 2,294 crore to other Railway entities such as Rail Vikas Nigam Ltd., Rail Tel Corporation of India Ltd. etc Capital Adequacy Ratio of 160.70% as on March 31, 2011 Return on Assets of 1.11% for the year ended March 31, 2011 (Rs. in crore) March 31, 2011 1602.00 2683.97 31256.74 6867.74 13.37 1339.64 3841.65 2943.30 898.34 898.35 485.20

IRFC FINANCIAL HIGHLIGHTS As on/ For the year ended Share Capital Reserve and Surplus Share Application Money (Pending Allotment) Secured Loans Unsecured Loans Net Block Current Assets, Loans & Advances Total Income Total Expenditure Profit for the Year Profit Before Tax Profit After Tax

March 31, 2009 500.00 1980.70 300.00 22600.25 4788.46 13.99 1799.33 3024.78 2367.05 657.73 657.69 180.79

March 31, 2010 1091.00 2314.48 27944.70 5663.88 13.69 2254.90 3483.94 2695.53 788.41 788.29 442.69

SAMPLE ILLUSTRATIONS FOR COMPUTATION OF PRE TAX YIELD (assuming that investment is made out of owned funds) 1. FOR BANKS & CORPORATES Tenure Coupon Rate Pre-Tax Yield (assuming tax rate of 33.15%) Income Tax @ 30%; Surcharge @ 7.50%; Education Cess @ 3.00% * 2. FOR INDIVIDUALS Tenure Coupon Rate Pre-Tax Yield a. Tax Slab @ 10% plus Surcharge @ 3% * b. Tax Slab @ 20% plus Surcharge @ 3% * c. Tax Slab @ 30% plus Surcharge @ 3% *

10 Years 7.55% 11.29%

15 Years 7.77% 11.62%

10 Years 7.55% 8.42% 9.51% 10.93%

15 Years 7.77% 8.66% 9.79% 11.24%

VALUATION GAIN FOR INVESTEMENT BY BANKS AS PER FIMMDA NORMS 10 Years 15 Years Tenure Current G-Sec Yield (semi-annual) (A) 8.56% 8.75% Current G-Sec Yield (annualized) (B) 8.74% 8.94% FIMMDA specified spread for AAA rated PSU Bonds (C) 0.98% 0.82% (as on 30-September-2011) Coupon Rate as per FIMMDA Valuation Norms (D) = (B+C) 9.72% 9.76% Pre-Tax Annualised Yield on IRFC Tax Free Bonds * (E) 11.29%. 11.62% Valuation Gain as per FIMMDA Norms (F) = (E-D) 1.57% 1.86% * The above calculations are illustrative only. As the tax slab and tax treatment is subjective and may vary from case to case, the potential investors are advised to consider in their own case, the tax implications in respect of subscription to these bonds after consulting their own tax advisors/ counsel/ authorities.

Você também pode gostar

- Exam 1 - 4 Revised Syllabus To Be Effective From 1st February, 2013 - 22.02Documento51 páginasExam 1 - 4 Revised Syllabus To Be Effective From 1st February, 2013 - 22.02Sahil Bhatt CfpAinda não há avaliações

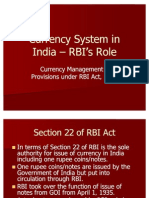

- Currency System in India RBI RoleDocumento11 páginasCurrency System in India RBI RoleSahil Bhatt CfpAinda não há avaliações

- Union - Budget - Ebook - Download - 2013 DPKMJN PDFDocumento24 páginasUnion - Budget - Ebook - Download - 2013 DPKMJN PDFdmahajan_2013Ainda não há avaliações

- Document 1Documento7 páginasDocument 1Sahil Bhatt CfpAinda não há avaliações

- Sbi Eq Application FormDocumento48 páginasSbi Eq Application FormSahil Bhatt CfpAinda não há avaliações

- Retirement Planning With PPFDocumento7 páginasRetirement Planning With PPFkeyur1975Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Neat Veg Report Final PDFDocumento50 páginasNeat Veg Report Final PDFshishirhomeAinda não há avaliações

- Construction Management Guideline (Provisional Edition)Documento97 páginasConstruction Management Guideline (Provisional Edition)Kaung Myat HtunAinda não há avaliações

- A Bibliography of China-Africa RelationsDocumento233 páginasA Bibliography of China-Africa RelationsDavid Shinn100% (1)

- Student-Led School Hazard MappingDocumento35 páginasStudent-Led School Hazard MappingjuliamarkAinda não há avaliações

- DEALCO FARMS vs. NLRCDocumento14 páginasDEALCO FARMS vs. NLRCGave ArcillaAinda não há avaliações

- The Princess AhmadeeDocumento6 páginasThe Princess AhmadeeAnnette EdwardsAinda não há avaliações

- Human Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksDocumento25 páginasHuman Rights and Human Tissue - The Case of Sperm As Property - Oxford HandbooksExtreme TronersAinda não há avaliações

- Effective Team Performance - FinalDocumento30 páginasEffective Team Performance - FinalKarthigeyan K KarunakaranAinda não há avaliações

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDocumento40 páginasPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshAinda não há avaliações

- Fe en Accion - Morris VendenDocumento734 páginasFe en Accion - Morris VendenNicolas BertoaAinda não há avaliações

- Understanding Culture, Society and PoliticsDocumento3 páginasUnderstanding Culture, Society and PoliticsแซคAinda não há avaliações

- SimpleDocumento3 páginasSimpleSinghTarunAinda não há avaliações

- ISO 50001 Audit Planning MatrixDocumento4 páginasISO 50001 Audit Planning MatrixHerik RenaldoAinda não há avaliações

- Student Majoriti Planing After GrdaduationDocumento13 páginasStudent Majoriti Planing After GrdaduationShafizahNurAinda não há avaliações

- Informative Speech OutlineDocumento5 páginasInformative Speech OutlineMd. Farhadul Ibne FahimAinda não há avaliações

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesDocumento24 páginasJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareAinda não há avaliações

- Customer Based Brand EquityDocumento13 páginasCustomer Based Brand EquityZeeshan BakshiAinda não há avaliações

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDocumento1 páginaIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarAinda não há avaliações

- Biffa Annual Report and Accounts 2022 InteractiveDocumento232 páginasBiffa Annual Report and Accounts 2022 InteractivepeachyceriAinda não há avaliações

- Place of Provision of Services RulesDocumento4 páginasPlace of Provision of Services RulesParth UpadhyayAinda não há avaliações

- (PALE) PP vs. DE LUNA PDFDocumento3 páginas(PALE) PP vs. DE LUNA PDF8111 aaa 1118Ainda não há avaliações

- Insurance Notes - TambasacanDocumento13 páginasInsurance Notes - TambasacanGeymer IhmilAinda não há avaliações

- United States v. Hernandez-Maldonado, 1st Cir. (2015)Documento9 páginasUnited States v. Hernandez-Maldonado, 1st Cir. (2015)Scribd Government DocsAinda não há avaliações

- Working While Studying in Higher Education: The Impact of The Economic Crisis On Academic and Labour Market Success (Preprint Version)Documento22 páginasWorking While Studying in Higher Education: The Impact of The Economic Crisis On Academic and Labour Market Success (Preprint Version)Vexie Monique GabolAinda não há avaliações

- Family Law Final Exam ReviewDocumento2 páginasFamily Law Final Exam ReviewArielleAinda não há avaliações

- Church Sacraments SlideshareDocumento19 páginasChurch Sacraments SlidesharelimmasalustAinda não há avaliações

- Disaster Management Aims To ReduceDocumento3 páginasDisaster Management Aims To ReduceFiyas BiAinda não há avaliações

- Week 1 and 2 Literature LessonsDocumento8 páginasWeek 1 and 2 Literature LessonsSalve Maria CardenasAinda não há avaliações

- Court rules on nullification of title in ejectment caseDocumento1 páginaCourt rules on nullification of title in ejectment caseNapolyn FernandezAinda não há avaliações

- ERP in Apparel IndustryDocumento17 páginasERP in Apparel IndustrySuman KumarAinda não há avaliações