Escolar Documentos

Profissional Documentos

Cultura Documentos

GOLD - Selected Specific Company Takeaways

Enviado por

Blake WhealeDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GOLD - Selected Specific Company Takeaways

Enviado por

Blake WhealeDireitos autorais:

Formatos disponíveis

Selected Specific Company Takeaways Great Basin Gold (GBG) : Average Daily Volume: NYSE: 2,370,000, Mrkt Cap:

1.1 bl Two Properties: Hollister Mine in Nevada and Burnstone Mine in Witwatersrand, South Africa. 100% ownership of both mines. -Hollister Mine: Average annual production of 88,600 gold oz in 2010 - Doubled from 2009 and expects 2011 production: 110,000 oz. -Burnstone Mine: Initially went through several delays which weighed on the stock while gold was running. All major capital projects are now completed and commissioned. Estimated annual production for 2011 = 110,000 oz and doubling to 220,000 by 2012. This is compared to zero oz of production in 2010 @ this site. - Installation of carbon regeneration systems @ both sites will continue to improve these recoveries. - Significant growth in revenue expected in line with increased production. - Project capital at both operations essentially completed, bulk of capital expenditure for 2011 relates to Burnstone underground development capital. Requires limited development and maintenance capex. Senior Secured Notes were settled in March 2011. - Based on Measured, Indicated and Inferred Resources the company trades at the very low end of peer groups. - Based on the standard model of mining company share price cycle from discovery to production both of GBG's Mining sites are in the "sweet spot" - Hollister Mine in Nevada having just entered phase 8- the production phase and Burnstone Mine in Witwatersrand finishing up stage 7- production start up. BOTH OF THE MINES ARE FINALLY ABOUT TO BE GENERATING CASH FLOW. Takeaway: Very bullish on this stock because of the company is entering the cycle of cash flow generation which usually leads to rapid share appreciation However, a sharp decline in gold bullion would crush margins for this company. Royal Gold: RGLD: Average Daily Volume: NASDAQ: 615,000 shs; Mrkt Cap: 3 bl. Royal Gold, Inc. acquires and manages precious metals royalties. The company seeks to acquire existing royalties or to finance projects that are in production or near production in exchange for royalty interests. -Company made four key acquisitions in 2010 that they believe will add to great future growth. A list of the acquisitions follows: 1) January 2010: Acquired gold royalty on the Andacollo mine in Chile from Teck Resources 2) February 2010: Acquired International Royalty Corporation (IRC), obtaining cornerstone Pascua-Lama and Voiseys Bay royalties 3) March, July and October 2010: Acquired additional Pascua-Lama royalty interests

4) October 2010: Acquired 25% of the payable gold from the Mt. Milligan project in British Columbia from Thompson Creek -Previous to the acquisitions the company only had one cornerstone production sitePenasquito. - The rationale behind these takeovers was the long life of each of these sites (all have estimates mine lives of over 20 years), near term production possibilities and all are located in attractive host countries. -Evenly distributed asset distribution throughout properties: 20 properties are in production stage, 20 properties in development stage, 25 properties in evaluation stage and 60 properties in the exploration stage. - Company's cash cost of gold production is only $452/oz vs industry avg of $532/oz. Favorable Geopolitical Distribution: currently 77% of production from United States, Mexico, Canada, Chileand Australia and 97% of reserves from United States, Mexico, Canada and Chile. -Acquisitions this year have added new long life mines replace maturing assets and provide future growth. -Economies of scale will lead to increasing margins primarily driven by cost control and revenue increases. Financials: Cash: $120M Total debt: $245M Credit availability: $110M CY2011 dividend: $0.44 per share Takeaway: The company was obviously very busy with some key acquisitions throughout 2010. Overall view on the stock is bullish but the stock has been on a significant run lately, outperforming all its peers so it might be wise to wait for a pullback (if there is one). Hecla Mining: HL: Avg Volume: 12.5 ml shs; Mrkt Cap: 2.5 bl Largest silver producer in the U.S. with 9 - 10 mm ounces annually -Two U.S. mines and two exploration properties with district sized land positions -Mining for almost 120 years with currently zero debt and strong balance sheet. - Silver reserves and resources have both grown year over year for past 5 years straight. - 2010 the company saw record cash flow of $198 ml, a 66% increase from 2009. -Coeur dAlene Basin Litigation has been weighing on the stock heavily. Stock has underperformed its peers by 30% since the announcement in early Feb. (This litigation has to do with Hecla paying for environmental effects/dumping of its mining from the 1970's and 1980's. While there were no environmental procedures that Hecla violated during that time period, the rules state that the company is still liable for the clean up. While almost all mining companies have already taken these charges, Hecla has continued to postpone addressing the issue until just this year. )

- Potential settlement in negotiation are currently taking place- Hecla is hopeful that a settlement can be achieved by the end of Q2/11. -Price/NAV: 2x vs 3-4x of majority of peers. Low cash costs and record margins. -Doubled silver production since 2007-2010 silver price increases have made mining deeper/lower grade silver economically feasible. -Attractive valuation and inexpensive on Price/Cash Flow metric. Management hinted at M/A in 2011. Takeaway: Even with the positives the company currently has going for it, I would not be a buyer here with this Environmental litigation overhanging the stock. While the company downplayed the significance of this issue, the stock has clearly been underperforming and in my view will continue to underperform until this litigation is cleared. While the negotiations are currently taking place, any delay or further costs than the company has already estimated could weigh on the shares even when/if silver prices continue to increase.

Você também pode gostar

- Stranded - Alpha Coal Project in Australia's Galilee BasinDocumento39 páginasStranded - Alpha Coal Project in Australia's Galilee BasinGreenpeace Australia PacificAinda não há avaliações

- Rio Tinto SWOT AnalysisDocumento3 páginasRio Tinto SWOT AnalysisPrashant OjasviAinda não há avaliações

- Historical Fuel Efficiencies of Regional AircraftDocumento26 páginasHistorical Fuel Efficiencies of Regional AircraftBrian XistosAinda não há avaliações

- Financial and Physical Performance Report FORMATDocumento9 páginasFinancial and Physical Performance Report FORMATJeremiah TrinidadAinda não há avaliações

- Case Analysis New - Earth - Mining - FinalDocumento29 páginasCase Analysis New - Earth - Mining - FinalImran100% (2)

- The Global Coal Industry, Nova Scotia's Energy Plan and The Donkin Coal ProjectDocumento39 páginasThe Global Coal Industry, Nova Scotia's Energy Plan and The Donkin Coal Projectmystery11Ainda não há avaliações

- GK Executive Summary 1.2Documento7 páginasGK Executive Summary 1.2kingdomtruck1Ainda não há avaliações

- New Earth Mining Inc.Documento16 páginasNew Earth Mining Inc.Asif Rahman100% (1)

- Goliath Resources Wealth Letter Analyst Report February 25, 2021Documento7 páginasGoliath Resources Wealth Letter Analyst Report February 25, 2021Chester Yukon GoldAinda não há avaliações

- Dynacor: Corporate Presentation April 2013Documento27 páginasDynacor: Corporate Presentation April 2013Dynacor Gold Mines Inc.Ainda não há avaliações

- 0275 - IBG Ironbark Zinc Presentation June 2012 (20 06 12)Documento22 páginas0275 - IBG Ironbark Zinc Presentation June 2012 (20 06 12)poitan2100% (1)

- Risk Management at Wellfleet Bank: Deciding About MegadealsDocumento26 páginasRisk Management at Wellfleet Bank: Deciding About MegadealsRishi Bajaj0% (1)

- Section 125 Digested CasesDocumento6 páginasSection 125 Digested CasesRobAinda não há avaliações

- Business Plan MagnetiteDocumento45 páginasBusiness Plan MagnetiteJuliano ConstanteAinda não há avaliações

- M&a Masterclass Presentation SlidesDocumento52 páginasM&a Masterclass Presentation SlidesnebonlineAinda não há avaliações

- YNG Hall Gar Ten and Company Oct11Documento24 páginasYNG Hall Gar Ten and Company Oct11Mariusz SkoniecznyAinda não há avaliações

- Cash Cost in MiningDocumento7 páginasCash Cost in Miningbatman_Ainda não há avaliações

- Abx SwotDocumento4 páginasAbx Swottony3350Ainda não há avaliações

- Focus On The Mining SectorDocumento2 páginasFocus On The Mining Sectortami_abadiAinda não há avaliações

- UPMDocumento6 páginasUPMHarold Kent HerediaAinda não há avaliações

- Daniel Ferris The Best Royalty Investment in The World TodayDocumento28 páginasDaniel Ferris The Best Royalty Investment in The World TodayValueWalk100% (3)

- V1.DRAFT - NWGC Research Sales Summary - jrs.11!08!2010Documento9 páginasV1.DRAFT - NWGC Research Sales Summary - jrs.11!08!2010jrswitzerAinda não há avaliações

- ASX Release: OZ Minerals To Defer Projects and Cut Operating CostsDocumento6 páginasASX Release: OZ Minerals To Defer Projects and Cut Operating CostsJendayiAinda não há avaliações

- KPG Research Report On Nova Minerals LimitedDocumento24 páginasKPG Research Report On Nova Minerals LimitedEli BernsteinAinda não há avaliações

- Dynacor Gold Mines 2012-07-24 ArticleDocumento3 páginasDynacor Gold Mines 2012-07-24 ArticleDynacor Gold MinesAinda não há avaliações

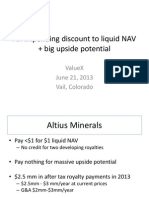

- ValueXVail 2013 - Dan FerrisDocumento14 páginasValueXVail 2013 - Dan FerrisVitaliyKatsenelsonAinda não há avaliações

- Bellevue Gold Project PDFDocumento85 páginasBellevue Gold Project PDFOzgur SonmezAinda não há avaliações

- Labrador Mining and Power:: How Much and Where From?Documento26 páginasLabrador Mining and Power:: How Much and Where From?labradoreAinda não há avaliações

- Trev AliDocumento33 páginasTrev AliJenny QuachAinda não há avaliações

- Rare Earth Report 1Documento9 páginasRare Earth Report 1andre313Ainda não há avaliações

- Lithium Stocks in 2021Documento11 páginasLithium Stocks in 2021FrankAinda não há avaliações

- Orporate ResentationDocumento25 páginasOrporate ResentationRayanAinda não há avaliações

- Sheikh Vs ShaleDocumento9 páginasSheikh Vs ShalevaibhavdschoolAinda não há avaliações

- HRA Journal: Bravo Ventures (BVG-V, B6I.F-Frnk)Documento6 páginasHRA Journal: Bravo Ventures (BVG-V, B6I.F-Frnk)raiderrAinda não há avaliações

- Ascot Mining - Investor Communication - 8 - April 09, 2012Documento5 páginasAscot Mining - Investor Communication - 8 - April 09, 2012atino_bannedAinda não há avaliações

- Golden Star 2003 Annual ReportDocumento24 páginasGolden Star 2003 Annual Reportbarkerdesign100% (1)

- FCX - Annual Report 2010Documento114 páginasFCX - Annual Report 2010dcpetersnAinda não há avaliações

- North of 60 Mining News - The Mining Newspaper For Alaska and Canada's NorthDocumento4 páginasNorth of 60 Mining News - The Mining Newspaper For Alaska and Canada's NorthAndrewAinda não há avaliações

- Investment Chilean Mining Industry 2013 2021Documento53 páginasInvestment Chilean Mining Industry 2013 2021AndreaRJCAinda não há avaliações

- EY Mining Eye Q2 2012Documento14 páginasEY Mining Eye Q2 2012milisteAinda não há avaliações

- WheatonPreciousMetals-AR 22Documento136 páginasWheatonPreciousMetals-AR 22wigidas889Ainda não há avaliações

- March 2020 Quarter and General Update: HighlightsDocumento2 páginasMarch 2020 Quarter and General Update: HighlightsFiona Gavriele KAinda não há avaliações

- Trevali Mining - Raymond JamesDocumento10 páginasTrevali Mining - Raymond JamesCarloss Valenzueela RamiirezAinda não há avaliações

- NovaGold Q2 CNE CallDocumento7 páginasNovaGold Q2 CNE CallRKT SOLUTION TP Help DeskAinda não há avaliações

- Iamgold 2006 Annual Report - FinalDocumento113 páginasIamgold 2006 Annual Report - FinalJesus SalamancaAinda não há avaliações

- 18 Share Tips - 29 November 2021Documento18 páginas18 Share Tips - 29 November 2021FrankAinda não há avaliações

- 2011 Annual Report FinalDocumento88 páginas2011 Annual Report FinalrusoexpressAinda não há avaliações

- EY Oints: Roduction IghlightsDocumento16 páginasEY Oints: Roduction Ighlightsreine1987Ainda não há avaliações

- Vale - Stock Report - 04jan14 - S&P CapitalDocumento11 páginasVale - Stock Report - 04jan14 - S&P Capitalbenjah2Ainda não há avaliações

- MediaDocumento69 páginasMediaArtem FedotovAinda não há avaliações

- Annual Report 2011 PDFDocumento68 páginasAnnual Report 2011 PDFdjokouwmAinda não há avaliações

- Annual Report 2011Documento68 páginasAnnual Report 2011djokouwm100% (1)

- Vedanta ResourcesDocumento6 páginasVedanta ResourcesKeokWee ChengAinda não há avaliações

- YNG The Drama Is About To End November 27 2011Documento16 páginasYNG The Drama Is About To End November 27 2011Mariusz SkoniecznyAinda não há avaliações

- YNG The Drama Is About To End November 27 2011Documento16 páginasYNG The Drama Is About To End November 27 2011Mariusz SkoniecznyAinda não há avaliações

- Red Rock Resources: UpdateDocumento12 páginasRed Rock Resources: UpdatethickskinAinda não há avaliações

- Denbury - High Level SWOT and Financial AnalysisDocumento13 páginasDenbury - High Level SWOT and Financial AnalysisrasulmrrAinda não há avaliações

- Alaxy Esources: Ompany ResentationDocumento15 páginasAlaxy Esources: Ompany ResentationMN Titas TitasAinda não há avaliações

- Nine (Rings) For Mortal Men: Janus AnalysisDocumento12 páginasNine (Rings) For Mortal Men: Janus AnalysisResearchtimeAinda não há avaliações

- GMI Presentation July 2011Documento24 páginasGMI Presentation July 2011Jonathan NowakAinda não há avaliações

- Sudbury Mayor Speech - Final DraftDocumento22 páginasSudbury Mayor Speech - Final DraftDon MacDonaldAinda não há avaliações

- Clean Industrial Revolution: Growing Australian Prosperity in a Greenhouse AgeNo EverandClean Industrial Revolution: Growing Australian Prosperity in a Greenhouse AgeNota: 4 de 5 estrelas4/5 (1)

- Soft Offer Canned Food-June10Documento3 páginasSoft Offer Canned Food-June10davidarcosfuentesAinda não há avaliações

- Cover Letter For Mayors MeetingDocumento6 páginasCover Letter For Mayors MeetingDallasObserverAinda não há avaliações

- Responsive Essay 1 ATM 634Documento2 páginasResponsive Essay 1 ATM 634Aditi BakshiAinda não há avaliações

- The Most Important Events in The History of The United StatesDocumento20 páginasThe Most Important Events in The History of The United StatesJuan Carlos Ponce ReyesAinda não há avaliações

- From Resistance To Renewal: A 12 Step Program For The California Economy by Manuel Pastor and Chris BennerDocumento118 páginasFrom Resistance To Renewal: A 12 Step Program For The California Economy by Manuel Pastor and Chris BennerProgram for Environmental And Regional Equity / Center for the Study of Immigrant IntegrationAinda não há avaliações

- Oceangoing Ships 2007 PDFDocumento102 páginasOceangoing Ships 2007 PDFaleventAinda não há avaliações

- Principles of Effective Governance ECOSOCDocumento3 páginasPrinciples of Effective Governance ECOSOCIsabella RamiaAinda não há avaliações

- Economic Impact of Beef Ban - FinalDocumento18 páginasEconomic Impact of Beef Ban - Finaldynamo vjAinda não há avaliações

- Wilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Documento2 páginasWilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Alvin Ryan KipliAinda não há avaliações

- Definition of Managerial EconomicsDocumento1 páginaDefinition of Managerial Economicsmukul1234Ainda não há avaliações

- EV Infrastructure Solutions DEA-524Documento8 páginasEV Infrastructure Solutions DEA-524tommyctechAinda não há avaliações

- Population GrowthDocumento3 páginasPopulation GrowthJennybabe PetaAinda não há avaliações

- EntrepDocumento2 páginasEntrepJersey RamosAinda não há avaliações

- Hegels Theory of The Modern State XYZDocumento10 páginasHegels Theory of The Modern State XYZMaría CastroAinda não há avaliações

- Senior Development Officer Principal Major Gifts in Dallas FT Worth TX Resume Sherri TaylorDocumento2 páginasSenior Development Officer Principal Major Gifts in Dallas FT Worth TX Resume Sherri TaylorSherriTaylor2Ainda não há avaliações

- Invoice 5Documento2 páginasInvoice 5PramodhAinda não há avaliações

- 16 PDFDocumento11 páginas16 PDFVijay KumarAinda não há avaliações

- Macro Unit 2 WorksheetDocumento5 páginasMacro Unit 2 WorksheetSeth KillianAinda não há avaliações

- Private Sector Development Task Force Final Report and Way ForwardDocumento11 páginasPrivate Sector Development Task Force Final Report and Way ForwardSobia AhmedAinda não há avaliações

- Business Taxation Made EasyDocumento2 páginasBusiness Taxation Made EasyNatsumi T. ViceralAinda não há avaliações

- Financial ServicesDocumento42 páginasFinancial ServicesGururaj Av100% (1)

- Export Invoice: Item Description: Qty: UOM: Curr Unit PriceDocumento4 páginasExport Invoice: Item Description: Qty: UOM: Curr Unit PriceAdam GreenAinda não há avaliações

- CPO-5 Block - Llanos Basin - Colombia, South AmericaDocumento4 páginasCPO-5 Block - Llanos Basin - Colombia, South AmericaRajesh BarkurAinda não há avaliações

- Gender Wise Classification of RespondentsDocumento34 páginasGender Wise Classification of Respondentspavith ranAinda não há avaliações

- Bata FactsDocumento3 páginasBata FactsPrashant SantAinda não há avaliações

- WWW - Referat.ro England5093366fDocumento13 páginasWWW - Referat.ro England5093366fJoanne LeeAinda não há avaliações

- Greenberg-Megaworld Demand LetterDocumento2 páginasGreenberg-Megaworld Demand LetterLilian RoqueAinda não há avaliações