Escolar Documentos

Profissional Documentos

Cultura Documentos

Mortgage Failure and Wall Street's Side Bet Casino

Enviado por

YourEminenceDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mortgage Failure and Wall Street's Side Bet Casino

Enviado por

YourEminenceDireitos autorais:

Formatos disponíveis

October 18, 2011 For more information contact: Richard F. Kessler Documentary Clearing House LLC.

941-924-5608, 941-926-5051 richardfkessler@verizon.net www.documentaryclearinghouse.com Mortgage Failure and The Wall Street Side Bet Casino

Richard F. Kessler

Conclusion The losses from the failure to make payments on substandard mortgages were dwarfed by the losses resulting from secondary market speculation by financial institutions that had no direct financial interests in the loans that failed. The financial collapse in the secondary mortgage market resulted from rampant speculation on mortgage derived securities by financial institutions deemed too large to fail which became unable to pay for the speculative losses they had incurred. A healthy housing market requires a healthy mortgage market. A healthy mortgage market requires a healthy secondary mortgage market. A healthy secondary mortgage market requires a safe and reliable securitization mechanism. The securitization mechanism broke down as a result of selling bad debt to investors as good debt. Stratified tiers of speculative investment were built upon the bad debt platform. When the ground floor of bad debts stopped paying, all the other floors above collapsed as well. The lions share of the ensuing destruction resulted from the collapse of the upper floors not from the non-payment by debtors of toxic mortgage debt. As Prohibition was a failed social experiment in reforming the behavior of American systems, curbing gambling on Wall Street seems equally futile at this time. There appears to be no political support at this time for breaking up the banks that are too large to fail. This means that the gambling needs to be regulated and the bank failures need to be anticipated just like floods, earthquakes and natural disasters. If we cannot stop floods, we can use casualty insurance to pay for repair and recovery. The financial collapse which led to the Great Recession was a function of speculative gambling in a Wall Street Side Bet Casino using mortgage derived securities. One necessary condition for the restoration of a healthy housing market requires the federal government to shut down the Side Bet Casino in the secondary mortgage market and replace it with an insurance/reinsurance model.

The other day Chris Mathews interviewed Michael Lewis, the author of Money Ball and The Big Short. Mathews said that the mortgage defaults on securitized mortgages had led to the collapse of financial markets, the secondary mortgage market and threatened global commercial credit. This is a commonly made mistake. Lewis knows better as the author of the Big Short but chose to remain silent. Mortgage defaults did not cause the collapse. Widespread originating, trading, buying and selling of side bets on mortgage portfolios by major Wall Street firms built a house of cards whose collapse caused a financial debacle. It converted an inventory driven recession from an oversupply of housing built in the housing bubble into a severe, deeper and longer-lasting banking and finance Great Recession. The financial collapse resulted from a predatory malfunctioning of the secondary mortgage market which developed from the absence of regulation and the indifference of the federal government. Permit me to explain. A healthy housing market requires a healthy mortgage market. A healthy mortgage market requires a healthy secondary mortgage market. A healthy secondary mortgage market requires a safe and reliable securitization mechanism. The securitization mechanism broke down as a result of selling bad debt to investors as good debt. When the last link of the chain broke, all the preceding links in the chain broke as well. This creates a paradox. The securitization mechanism broke down because too many bad loans had been sold to investors as good loans. However, the ensuing financial collapse and near embargo of global commercial credit did not result from the losses from the default of high risk mortgages. Losses did result from default in the payment of subprime and other high risk mortgages held in mortgage portfolios of mortgage backed securities trusts. These portfolio loses were dwarfed by the exponentially larger losses resulting from the side bets made on these mortgages by speculators. The financial, collapse was largely the result of the side bets made on mortgage portfolios instead of the losses incurred by payment defaults in the mortgage portfolios. This is the dirty little secret that no one wants Americans to find out. An illustration of this problem is in order. Joe and Bill are cowboys. Each bets the other $10.00 that his quarter horse is faster in a mile point-to-point race. There is a $10.)0 bet between the cowboys. Now Fred the Bookie hears about the race. Fred is a computer nerd. He uses the internet to make book on the race. Suddenly Fred organizes $1 million in side bets on a $10.00 race. Joe and Bill only have $10.00 at stake in the event of a loss. However, at the end of the race, there will be a one million dollar loss experienced by the losing bettors and a million dollar win by the winning bettors. Something like this happened behind closed doors on Wall Street. A Side Bet Casino was organized. The people organizing it were called Quants, Wall Street entrepreneurs and operators who were also math savants. So complicated were the toys they created 2

virtually no one understood how they operated but everyone decided to gamble for profits. The bet basically was whether or not a certain pool of mortgages will pay on time or default. Accordingly mortgages were collected and assembled into mortgage portfolios consisting of 2,00-9,000 mortgages. One or more pools were sold to a mortgage backed security trusts. The trusts raised money by selling certificates to investors. Every investor was entitled to some form of payment depending on the type of certificate purchased. The Quants sliced and diced the types of certificates in a mind numbing number of varieties. These mortgage backed securitities trust certificates were the first tier investments. Not satisfied with this, the Quants created a second tier of investments. Instead of a pool of mortgages, investors were offered a pool of mortgage certificates. This created an investment mlange of different mortgage pools. Think of a fund of funds mutual fund which only invests in other funds. Finally, the Quants organized a third tier of investments which created pools of certificates of the second tier investment. In other words, the pool consisted of a portfolio of mutual funds of funds type investments. Now here is where the fun really begins. For each investment, it was the practice to provide quasi-insurance payable if a mortgage in a specific portfolio defaulted by designating a hedge counterparty as insurer. The hedge counterparty would then buy, sell and trade in side bets on which mortgages would perform and which would fail. Such side bets called credit default swaps were issued, bought, sold and exchanged like lottery tickets. At the same time, the Quants also packaged side bets in the form of instruments so complex no one knew what they were buying called derivatives. Members of the public could not get into this casino. Admittance was limited to an inner circle of Wall Street players. Several points are significant. The players traded on credit so losses were adjusted after the bettors lost. In addition, there were multiple ways that a player could make bets without putting down much betting money and borrowing against inflated mortgages or mortgage derived securities bought with the loan as collateral. On Wall Street, this was referred to as leveraging. Such leveraging allowed an original loan to be bet and re-bet by the same player. The Big Short identifies one company that re-bet the same original loan 23 times into a 23 story pyramid investment. Here is the main point. It was a house of cards consisting of side bets on mortgage portfolios. The Quants had historic evidence that in the worst of times, mortgage defaults never exceeded 1 % and averaged %. The Quants never anticipated the possibility of a disorderly system or the intervention of unanticipated variables in their mathematical constructions. The Black Swan Event occurred in 1996 as mortgage defaults climbed in excess of 10%. When payment on the bets became due, bettors came up short and a 3

financial crisis occurred. Those bettors just happened to be those financial institutions which were too big to fail. The government had to intervene. And intervene it did, eventually transferring $4.3 trillion dollars from Main Street to Wall Street. In the meanwhile, no federal assistance was to provided to the homeowner unable to pay the mortgage. Americans silently witnessed the regressive transfer of wealth from the middle class to the wealthiest financial institutions to pay off bad gambling debts. Can this be documented? Yes, in deed! When the fit hit the Shan, AIG was caught short. Here was a legendary insurance Titan. AGg owned and ran approximately 80 insurance companies. It was highly profitable and awash in cash. However, management could not resist the sirens call of the Side Bet Casino. AIG abandoned its business model entering a new adventure of speculating in credit default swaps. It became the quasi insurer of first, second and third tier investments as well as a speculator in derivatives. AIG was so deeply compromised that when the bill came due, it lacked the funds to make payment. Uncle Sam had to ride in for the rescue. The Government Sponsored Enterprises (GSEs) offer an even more dramatic example. FNMA and FRMAC bought mortgages and sold investment certificates for mortgage trusts that each organized. The GSEs pioneered the mortgage backed security trust. By providing securitization, the GSEs provided a large amount of invested funds for mortgage loans, expanding the opportunity while lowering the cost of home ownership. The FNMA and FRMAC held five trillion dollars in mortgages which represented one half of the $10 trillion dollar mortgage market. The two GSEs held about $186 billion in subprime mortgages. FNMA and FRMAC have reported that the default rate on these mortgages did not exceed 12% Let us assume, the default rate, instead, was 30% or about $54 billion. Is it conceivable that $54 billion in defaults could financially sink a $5 trillion mortgage banking operation? The defaults-in fact, the number was significantly less- represented about 1% of the mortgage portfolio held. Moreover when the U.S initiated a financial rescue, it transferred $200 billion, almost four times as much, to the GSEs and it did not stop the financial hemorrhaging. Why-because the mortgage defaults by themselves did not sink the GSEs. It was the side bets in the exclusive Wall Street Side Bet Casino. The GDSEs failed because greed cause them to speculate and gamble. The GSEs had become heavy movers and shakers of credit default swaps and derivatives, spinning the rouklette wheel and rolling the dice.

Here is where this piece began for our discussion has returned to its point of departure: A healthy housing market requires a healthy mortgage market. A healthy mortgage market requires a healthy secondary mortgage market. A healthy secondary mortgage market requires a safe and reliable securitization mechanism. The securitization mechanism broke down as a result of selling bad debt to investors as good debt. Stratified tiers of speculative investment were built upon the bad debt platform. When the 4

when the ground floor bad debts stopped paying, all the other floors above collapsed as well. As Prohibition was a failed social experiment in reforming the behavior of American systems, curbing gambling on Wall Street seems equally futile at this time. There appears to be no political support at this time for breaking up the banks that are too large to fail. This means that the gambling needs to be regulated and the bank failures need to be anticipated just like floods, earthquakes and natural disasters. If we cannot stop floods, we can use casualty insurance to pay for repair and recovery. One necessary condition for the restoration of a healthy housing market requires the federal government to shut down the Side Bet Casino in the secondary mortgage market and replace it with an insurance/reinsurance model. Such an approach would: 1. Treat the cyclical occurrence of substantial mortgage default as a casualty compensable by insurance coverage. 2. Treat securitization as an insurable event enabling the parties to develop underwriting standards through private ordering in a contractual relationship between insurer and insured. 3. Close the door on speculation so that only an insurer could guaranty or insure all or a portion of mortgage payments as a hedge counterparty. 4. No side bets by any other party on mortgage default or payment by an insurer in the event of default. 5. All insurers to have adequate minimum reserves. Create rules to prevent self-dealing and sham insurance. For instance, this could occur when the parties creating a securitization of a mortgage portfolio also acted as its insurer. The same potential abuse exists with cross insurance agreements where one securitizer insure another securitizers portfolio in exchange for the second securitizer agreeing to provide reciprocal coverage for another securitization by the first party. 6. Prescription of audit standards for insurers and annual audits. 7. Full financial disclosure by auditors to investors, creditors, regulators and public of relevant financial information including reserves, contingent liability and a lsit of who and what has been insured and for how much.

The past 50 years has seen a cyclical recurrence of mortgage collapses resulting from financing uncreditworthy homebuyers. We seem never to learn from the lessons of the past and are forced to repeat our mistakes. The last event of this type was the worst since the Great Depression. What former Federal Chairman referred to as irrational enthusiasm seems to be an endemic trait of mortgage financing at some point in an economic cycle. It usually also involves passing on the risk of the loan (economists talk about Moral Hazzard) to another party which usually winds up in the end being the U.S. taxpayer.

To date, Wall Street has sent more than a thousand lobbyists and a billion dollars to Washington to make sure that the doors of the great Side Bet Casino remain open. To date, no one has attempted to close down its operation. At the moment, the sid bets attracting the most attention do not involve mortgage backed securities but European sovereign debt. One may well ask. If this bubble also collapses, will U.S. taxpayers again be asked to fund the debts, and if so, what will they answer this time?

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Life Insurance For The WealthyDocumento8 páginasLife Insurance For The WealthySherrel Lin67% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- New Bajaj Policies PDFDocumento11 páginasNew Bajaj Policies PDFexcel.syed0% (1)

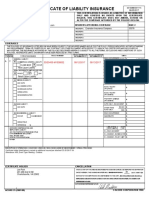

- Certificate of InsuranceDocumento2 páginasCertificate of InsuranceRobert LeeAinda não há avaliações

- Wanton and Willful Financial Misconduct in The OriginationDocumento5 páginasWanton and Willful Financial Misconduct in The OriginationYourEminenceAinda não há avaliações

- Eastern Shipping Lines v. Prudential GuaranteeDocumento4 páginasEastern Shipping Lines v. Prudential GuaranteeAnonChieAinda não há avaliações

- Bankers Blanket Bond PresentationDocumento2 páginasBankers Blanket Bond PresentationTeodora Kotevska100% (1)

- SOA Exam MLC - Yufeng Guo (Fall 2008)Documento292 páginasSOA Exam MLC - Yufeng Guo (Fall 2008)Joseph Guy Evans HilaireAinda não há avaliações

- Importance of Preliminaries Items in ConstructionDocumento95 páginasImportance of Preliminaries Items in Constructionvihangimadu70% (10)

- RIBA AgreementDocumento60 páginasRIBA AgreementMadhini Prathaban100% (1)

- Wärtsilä Invitation To Tender - Sulawesi 500MW Gas Engine Power PlantDocumento12 páginasWärtsilä Invitation To Tender - Sulawesi 500MW Gas Engine Power PlantindrasyifaiAinda não há avaliações

- Carriage of Goods by SeaDocumento58 páginasCarriage of Goods by SeaMarv-Vic SantosAinda não há avaliações

- MoreDocumento2 páginasMoreYourEminenceAinda não há avaliações

- The Treasure Trove of Toxic Foreclosures Short Article 5-26-10Documento2 páginasThe Treasure Trove of Toxic Foreclosures Short Article 5-26-10YourEminenceAinda não há avaliações

- Foreclosure Defense Strategy 10-4-09Documento6 páginasForeclosure Defense Strategy 10-4-09YourEminenceAinda não há avaliações

- Title Defects 3-2-10Documento2 páginasTitle Defects 3-2-10YourEminenceAinda não há avaliações

- COBRA - Initial Rights LetterDocumento2 páginasCOBRA - Initial Rights Lettersharmila boseAinda não há avaliações

- IRDADocumento8 páginasIRDABhagabat BarikAinda não há avaliações

- Policy ScheduleDocumento1 páginaPolicy Scheduleshabir ahmad loneAinda não há avaliações

- 1.8 HRD FunctionsDocumento10 páginas1.8 HRD FunctionsJeevan SthAinda não há avaliações

- ESI Rate ReducedDocumento2 páginasESI Rate Reducedvenkataramana vaddepalliAinda não há avaliações

- Business Studies Form 2 Topical QuestionsDocumento16 páginasBusiness Studies Form 2 Topical QuestionsMartin ThumbiAinda não há avaliações

- CA20191216Documento4 páginasCA20191216DonaldDeLeonAinda não há avaliações

- Affadivit For PMAYDocumento4 páginasAffadivit For PMAYAndrews ThanapragasamAinda não há avaliações

- LAW200 Assignment (SOHAG)Documento9 páginasLAW200 Assignment (SOHAG)Nazmur RahmanAinda não há avaliações

- Daftar Transaksi BankDocumento18 páginasDaftar Transaksi BankPascal FelimAinda não há avaliações

- CPD Guidelines PIAMDocumento9 páginasCPD Guidelines PIAMchorazAinda não há avaliações

- SEC Rigging Order Form: Event: Date: Stand Number: Hall NoDocumento2 páginasSEC Rigging Order Form: Event: Date: Stand Number: Hall NoSanu SanuAinda não há avaliações

- Travel Itinerary: T58GWFDocumento6 páginasTravel Itinerary: T58GWFMohd AjamainAinda não há avaliações

- Detailed - Lesson - Plan - in EntrepreneurshipDocumento7 páginasDetailed - Lesson - Plan - in EntrepreneurshipProf. Benjamin AndayaAinda não há avaliações

- Petitioner vs. vs. Respondents Regulus E. Cabote & Associates Benito P. FabieDocumento7 páginasPetitioner vs. vs. Respondents Regulus E. Cabote & Associates Benito P. FabieKaryl Eric BardelasAinda não há avaliações

- PKSDocumento11 páginasPKSPankaj SharmaAinda não há avaliações

- w4 - Group InsuranceDocumento23 páginasw4 - Group InsuranceNur AliaAinda não há avaliações

- Bed and Breakfast: Business Sourcing GuideDocumento15 páginasBed and Breakfast: Business Sourcing Guidebuckley1212085Ainda não há avaliações

- AFP Mutual Benefit Association vs NLRCDocumento5 páginasAFP Mutual Benefit Association vs NLRCKaryl Mae Bustamante OtazaAinda não há avaliações

- Introduction to Bangladesh's Gas Sector & Production Sharing ContractsDocumento94 páginasIntroduction to Bangladesh's Gas Sector & Production Sharing ContractsSadat RahmanAinda não há avaliações