Escolar Documentos

Profissional Documentos

Cultura Documentos

Raymond LTD

Enviado por

Swapnil KadamDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Raymond LTD

Enviado por

Swapnil KadamDireitos autorais:

Formatos disponíveis

Raymond Ltd.

BSE: 500330NSE: RAYMONDEQ58888: raym SMS STO raym to 58888 to get Stock quote on Your mobile IND: Textiles - Woollen/WorstedISIN code: INE301A01014SECT: Textiles

216

BSELIVE03:50 PM | 31 Oct 2011 389.30 Change:-3.35 (-0.85%)Volume:64,982 Open:391.50Prv. Close:392.65 Today: 388.25 52-Wk: 245.10

395.80 445.00 Bid: 389.30(45) Offer: 0.00(0) Click to see NSE detailed Quotes NSELIVE389.30-3.55 (-0.90%) NSELIVE03:44 PM | 31 Oct 2011 389.30 Change:-3.55 (-0.90%)Volume:194,971 Open:390.90Prv. Close:392.85 Today 387.05 52-Wk 242.30

395.85 445.00 Bid: 389.30(455) Offer: 0.00(0) Click to see BSE detailed Quotes BSELIVE389.30-3.35 (-0.85%) <a target="_blank" href="http://netspiderads2.indiatimes.com/ads.dll/clickthrough?slotid=37063"><img

alt="Advertisement" height="50" width="800" border="0" src="http://netspiderads2.indiatimes.com/ads.dll/photoserv?slotid=37063"></a>

Summary Prices Financials Reports Company Info News Competitors ET Buzz Tracker New

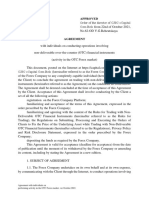

ManagementHistoryBackgroundListingLocationsBoard MeetingsAGM/EGMDividendsBonusRightsSplitsIPO You can view Announcement Date, Effective Date, Dividend Type (Interim, Final and Special), and Percentage of Dividend given information for Raymond Ltd. Dividends Declared Announcement Effective Date Dividend Type Dividend (%) Remarks Date 21/04/2011 18/05/2011 Final 10% 30/04/2008 30/05/2008 Final 25% 30/04/2007 30/05/2007 Final 50% AGM 04/05/2006 06/06/2006 Final 50% AGM 28/04/2005 30/05/2005 Final 40% 06/05/2004 14/06/2004 Final 55% AGM 24/04/2003 23/05/2003 Final 45% AGM 26/04/2002 29/05/2002 Final 45% AGM 23/04/2001 Final 30% 28/03/2000 Interim 15% 31/05/1999 Final 20% AGM & Dividend 08/05/1998 Final 15% 17/06/1997 Final 10% 14/02/1997 Interim N.A.%

Dividend Policy Are high dividends good or bad? The answer depends upon your personality, financial circumstances and the business itself. In Determining Dividend Payout: When Should Companies Pay Dividends?, you learned that, a company should only pay dividends if it is unable to reinvest its cash at a higher rate than the shareholders (owners) of the business would be able to if the money was in their hands. If company ABC is earning 25% on equity with no debt, management should retain all of the earnings because the average investor probably won't find another company or investment that is yielding that kind of return. At the same time, an investor may require cash income for living expenses. In these cases, he is not interested in long-term appreciation of shares; he wants a check with which he can pay the bills. Double taxation - the political debate over dividends Dividends, like interest, are taxed at a persons individual tax rate. Capital gain taxes, on the other hand, are assessed according to the length of time an investor held his investment and can be as low as half the rate levied on dividends income. This difference in tax treatment is another reason many investors opt for long-term equity holdings that reinvest capital into the business instead of paying it out in the form of a dividend; by avoiding the double-taxation, they can compound their wealth at a faster rate. There is a significant political controversy over the fact that profits paid out as dividends are subject to double-taxation. The corporation paid income taxes on the profit it earned (original tax). The owners of the business then take that profit out for their personal use in the form of a dividend and are taxed at personal income tax rates (second tax). In effect, they have paid the government twice. The proponents of the dividend tax argue that the wealthy, by definition, own significantly more investments than the poor. Therefore, it would be possible for someone to earn billions of dollars in dividend income and not pay a dime in Federal taxes. This, they say, is inherently unfair. The gap between the rich and the poor would explode over night. For more information and potential solutions, read Dividend Tax - The Political Debate: Understanding the Double Taxation Fuss. Dividend Payout Ratio The percentage of net income that is paid out in the form of dividend is known as the dividend payout ratio. This ratio is important in projecting the growth of company because its inverse, the retention ratio (the amount not paid out to shareholders in the form of dividends), can help project a companys growth. Calculating Dividend Payout Ratio Coca-Colas 2003 cash flow statement shows that the company paid $2.166 billion in dividends to shareholders. The income statement for the same year shows the business had reported a net

income of $4.347 billion. To calculate the divided payout ratio, the investor would do the following: $2,166,000,000 dividends paid ---------(divided by)--------$4,347,000,000 reported net income The answer, 49.8%, tells the investor that Coca-Cola paid out nearly fifty percent of its profit to shareholders over the course of the year. Dividend Yield The dividend yield tells the investor how much he is earning on a common stock from the dividend alone based on the current market price. Dividend yield is calculated by dividing the actual or indicated annual dividend by the current price per share. The Washington Post pays an annual dividend of $7 and trades at $910 per share; Altria Group (formerly Philip Morris) pays an annual dividend of $2.72 and trades at $49.75 per share. By calculating dividend yield, the investor can compare the amount he would earn in cash income annually from each security. Washington Post Dividend Yield Calculation $7.00 ----(divided by)---$910 = 0.0077 or 0.77% Altria Group Dividend Yield Calculation $2.72 ----(divided by)---$49.75 = 0.055 or 5.5% In other words, despite the fact that the Washington Post pays a higher per-share dividend, $100,000 invested in its common stock would yield only $770 in annual income as opposed to the same amount invested in Altria Group which would yield $5,500. An investor interested in dividend income and not capital gains should opt for the latter, all else being equal.

Reliance Communications Ltd. - Research Center

http://www.authorstream.com/Presentation/g aurav2360-173962-reliance-common-ppt1234842668988614-1-business-financepowerpoint/

532712 RCOM Group (A) BSE data Add to Portfolio | Watch List | Game

Quantity Cost/Share Date

Goes above Rs Goes below Rs

View Tips Add to : Portfolio | Watchlist | Game

Back to Company Page

Quarterly

Results

Half yearly Annual Balance sheet

Statement

P&L Cash flow

Dividend Share holding More Capital structures Ratio

Dividend

Year Month Dividend (%) 2011 May 2010 May 2009 Jul 2008 Apr 2007 Apr 10 17 16 15 10

Dividend

Year Month Dividend (%) 2011 Apr 2010 Apr 2009 Oct 2008 Apr 80 70 130 130

Year Month Dividend (%) 2007 Mar 2006 Apr 2005 Apr 2004 Apr 2003 Apr 2002 Sep 2001 Apr 2000 Mar 1999 Apr 1997 Apr 110 100 75 53 50 48 43 40 38 65

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Rules Governing Redeemable and Treasury SharesDocumento2 páginasRules Governing Redeemable and Treasury SharesmarjAinda não há avaliações

- Chapter Four: Mutual Funds and Other Investment CompaniesDocumento24 páginasChapter Four: Mutual Funds and Other Investment CompaniesnouraAinda não há avaliações

- Valuation of Bonds and Stock: Objectives: After Reading His Chapter, You WillDocumento23 páginasValuation of Bonds and Stock: Objectives: After Reading His Chapter, You WillAnkit PatnaikAinda não há avaliações

- Bodie Investments CH03Documento41 páginasBodie Investments CH03rafat.jalladAinda não há avaliações

- 5 Minute Opening Range Breakout ParkingpipsDocumento9 páginas5 Minute Opening Range Breakout ParkingpipsDeraAinda não há avaliações

- Project TopicDocumento7 páginasProject TopicmehmudAinda não há avaliações

- Internship ReportDocumento48 páginasInternship Reportansar67% (3)

- For ABE Use Only: Open-Book Exam Question and Answer BookletDocumento22 páginasFor ABE Use Only: Open-Book Exam Question and Answer BookletSandini Paramullage100% (1)

- Basel Disclouser Chaitra2070Documento2 páginasBasel Disclouser Chaitra2070Krishna Bahadur ThapaAinda não há avaliações

- R D T T: Eviewing Ifferent Ypes OF RadersDocumento2 páginasR D T T: Eviewing Ifferent Ypes OF RadersDebby Rahatta PutriAinda não há avaliações

- Resort Business Plan ExampleDocumento49 páginasResort Business Plan ExampleJoseph QuillAinda não há avaliações

- C01 The Efficient Market Hypothesis and Its Implications For Financial ReportingDocumento5 páginasC01 The Efficient Market Hypothesis and Its Implications For Financial ReportingBrooke CarterAinda não há avaliações

- 04 Comm 308 Final Exam (Winter 2009) SolutionDocumento18 páginas04 Comm 308 Final Exam (Winter 2009) SolutionAfafe ElAinda não há avaliações

- Chambal Fertiliser - Elara Securities - 7 February 2021Documento8 páginasChambal Fertiliser - Elara Securities - 7 February 2021Ranjan BeheraAinda não há avaliações

- Currency Report - June 28Documento2 páginasCurrency Report - June 28Julian ChackoAinda não há avaliações

- Introduction of Fundamental AnalysisDocumento3 páginasIntroduction of Fundamental AnalysisMuhammad Irwan ChongAinda não há avaliações

- Axis Mutual Fund Common Application FormDocumento16 páginasAxis Mutual Fund Common Application Formrkdgr87880Ainda não há avaliações

- Bitcoin Becoming Boring: Bloomberg Crypto Outlook - September 2019 EditionDocumento6 páginasBitcoin Becoming Boring: Bloomberg Crypto Outlook - September 2019 EditionTetouani ChamaliAinda não há avaliações

- Risks in Foreign ExchangeDocumento19 páginasRisks in Foreign ExchangeDivya BhadriAinda não há avaliações

- UITF Product GuideDocumento1 páginaUITF Product GuideMerl MPandoyAinda não há avaliações

- MCQ's On Financial ManagementDocumento22 páginasMCQ's On Financial ManagementsvparoAinda não há avaliações

- Candlestick PatternDocumento1 páginaCandlestick Patterndharunkumar257Ainda não há avaliações

- Division of Investment Management: Frequently Asked Questions About Form 13FDocumento19 páginasDivision of Investment Management: Frequently Asked Questions About Form 13FAlex WongAinda não há avaliações

- Accounting Standard (AS) 32: Financial Instruments: DisclosuresDocumento31 páginasAccounting Standard (AS) 32: Financial Instruments: DisclosuresDesaraju Seshagiri RaoAinda não há avaliações

- Mo Commodity BrochureDocumento4 páginasMo Commodity BrochureWealth FinmartAinda não há avaliações

- The Effects of Incorporating Memory and Stochastic Volatility Into GBM To Forcast Exchange Rates of EuroDocumento8 páginasThe Effects of Incorporating Memory and Stochastic Volatility Into GBM To Forcast Exchange Rates of EuroNur JannahAinda não há avaliações

- Portfolio Batch 6 PracticeDocumento12 páginasPortfolio Batch 6 PracticeRohitSuryaAinda não há avaliações

- Terms and Conditions v4 1 NBRB Capital ComDocumento42 páginasTerms and Conditions v4 1 NBRB Capital ComMaria ReyesAinda não há avaliações

- Foreign Exchange For Retail BankersDocumento4 páginasForeign Exchange For Retail Bankersssj7cjqq2dAinda não há avaliações

- ProblemsDocumento42 páginasProblemsVishnu PrasannaAinda não há avaliações