Escolar Documentos

Profissional Documentos

Cultura Documentos

Ratio Analysis: A Guide to Understanding Financial Ratios

Enviado por

Mohan RajDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ratio Analysis: A Guide to Understanding Financial Ratios

Enviado por

Mohan RajDireitos autorais:

Formatos disponíveis

RATIO ANALYSIS

Ratios may be classiIied in a number oI ways to suit any particular purpose. DiIIerent kinds oI

ratios are selected Ior diIIerent types oI situations. Mostly, the purpose Ior which the ratios are used

and the kind oI data available determine the nature oI analysis. The various accounting ratios can be

classiIied as Iollows:

The ratios analysis is the most powerIul tool oI Iinancial statement analysis. Ratios simply

mean one number expressed in terms oI another. A ratio is a statistical yardstick by means oI which

relationship between two or various Iigures can be compared or measured. Ratios can be Iound out by

dividing one number by another number. Ratios show how one number is related to another.

ADVANTAGES OF RATIOS ANALYSIS:

Ratio analysis is an important and age-old technique oI Iinancial analysis. The Iollowing are some oI

the advantages / BeneIits oI ratio analysis:

1. Simplifies financial statements: t simpliIies the comprehension oI Iinancial statements.

Ratios tell the whole story oI changes in the Iinancial condition oI the business

2. Facilitates inter-firm comparison: t provides data Ior inter-Iirm comparison. Ratios

highlight the Iactors associated with with successIul and unsuccessIul Iirm. They also reveal

strong Iirms and weak Iirms, overvalued and undervalued Iirms.

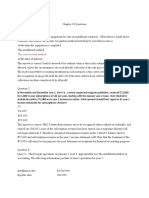

lassification of Accounting Ratios / Financial Ratios

(A)

Traditional ClassiIication or

Statement Ratios

(B)

Functional ClassiIication or

ClassiIication According to

Tests

(C)

SigniIicance Ratios or Ratios

According to mportance

O !roIit and loss account

ratios or revenue/income

statement ratios

O Balance sheet ratios or

position statement ratios

O Composite/mixed ratios

or inter statement ratios

O !roIitability ratios

O iquidity ratios

O Activity ratios

O everage ratios or long

term solvency ratios

O !rimary ratios

O Secondary ratios

. elps in planning: t helps in planning and Iorecasting. Ratios can assist management, in its

basic Iunctions oI Iorecasting. !lanning, co-ordination, control and communications.

4. akes inter-firm comparison possible: Ratios analysis also makes possible comparison oI

the perIormance oI diIIerent divisions oI the Iirm. The ratios are helpIul in deciding about their

eIIiciency or otherwise in the past and likely perIormance in the Iuture.

5. elp in investment decisions: t helps in investment decisions in the case oI investors and

lending decisions in the case oI bankers etc.

LIITATIONS OF RATIOS ANALYSIS:

The ratios analysis is one oI the most powerIul tools oI Iinancial management. Though ratios are

simple to calculate and easy to understand, they suIIer Irom serious limitations.

1. Limitations of financial statements: Ratios are based only on the inIormation which has been

recorded in the Iinancial statements. Financial statements themselves are subject to several

limitations. Thus ratios derived, there Irom, are also subject to those limitations. For example,

non-Iinancial changes though important Ior the business are not relevant by the Iinancial

statements. Financial statements are aIIected to a very great extent by accounting conventions

and concepts. !ersonal judgment plays a great part in determining the Iigures Ior Iinancial

statements.

2. omparative study required: Ratios are useIul in judging the eIIiciency oI the business only

when they are compared with past results oI the business. However, such a comparison only

provide glimpse oI the past perIormance and Iorecasts Ior Iuture may not prove correct since

several other Iactors like market conditions, management policies, etc. may aIIect the Iuture

operations.

. Ratios alone are not adequate: Ratios are only indicators; they cannot be taken as Iinal

regarding good or bad Iinancial position oI the business. Other things have also to be seen.

4. !roblems of price level changes: A change in price level can aIIect the validity oI ratios

calculated Ior diIIerent time periods. n such a case the ratio analysis may not clearly indicate

the trend in solvency and proIitability oI the company. The Iinancial statements, thereIore, be

adjusted keeping in view the price level changes iI a meaningIul comparison is to be made

through accounting ratios.

5. ack oI adequate standard: No Iixed standard can be laid down Ior ideal ratios. There are no

well accepted standards or rule oI thumb Ior all ratios which can be accepted as norm. t

renders interpretation oI the ratios diIIicult.

. Limited use of single ratios: A single ratio, usually, does not convey much oI a sense. To

make a better interpretation, a number oI ratios have to be calculated which is likely to conIuse

the analyst than help him in making any good decision.

7. !ersonal bias: Ratios are only means oI Iinancial analysis and not an end in itselI. Ratios have

to interpret and diIIerent people may interpret the same ratio in diIIerent way.

8. Incomparable: Not only industries diIIer in their nature, but also the Iirms oI the similar

business widely diIIer in their size and accounting procedures etc. t makes comparison oI

ratios diIIicult and misleading.

!ROFITABILITY RATIOS:

!roIitability ratios measure the results oI business operations or overall perIormance and

eIIectiveness oI the Iirm. Some oI the most popular proIitability ratios are as under:

ross proIit ratio

Net proIit ratio

Operating ratio

xpense ratio

Return on shareholders investment or net worth

Return on equity capital

Return on capital employed (ROC) Ratio

Dividend yield ratio

Dividend payout ratio

arnings !er Share (!S) Ratio

!rice earning ratio

GROSS !ROFIT RATIO

Gross profit ratio (G! ratio) is the ratio oI gross profit to net sales expressed as a

percentage. t expresses the relationship between gross proIit and sales.

omponents:

The basic components Ior the calculation of gross profit ratio are gross proIit and net sales.

Net sales mean total sales minus sales returns. ross proIit would be the diIIerence between net sales

and cost oI goods sold. Cost oI goods sold in the case oI a trading concern would be equal to opening

stock plus purchases, minus closing stock plus all direct expenses relating to purchases. n the case oI

manuIacturing concern, it would be equal to the sum oI the cost oI raw materials, wages, direct

expenses and all manuIacturing expenses. n other words, generally the expenses charged to proIit and

loss account or operating expenses are excluded Irom the calculation oI cost oI goods sold.

Formula:

Following Iormula is used to calculate gross proIit ratios:

Gross !rofit Ratio (Gross profit / Net sales) 100]

Example:

Total sales $520,000; Sales returns $ 20,000; Cost oI goods sold $400,000

Required: alculate gross profit ratio.

alculation:

Gross profit |(520,000 20,000) 400,000|

100,000

Gross !rofit Ratio (100,000 / 500,000) 100

20

Significance:

ross proIit ratio may be indicated to what extent the selling prices oI goods per unit may be

reduced without incurring losses on operations. t reIlects eIIiciency with which a Iirm produces its

products. As the gross proIit is Iound by deducting cost oI goods sold Irom net sales, higher the gross

proIit better it is. There is no standard ! ratio Ior evaluation. t may vary Irom business to business.

However, the gross proIit earned should be suIIicient to recover all operating expenses and to build up

reserves aIter paying all Iixed interest charges and dividends.

auses/reasons of increase or decrease in gross profit ratio:

t should be observed that an increase in the ! ratio may be due to the Iollowing Iactors.

1. ncrease in the selling price oI goods sold without any corresponding increase in the cost oI

goods sold.

2. Decrease in cost oI goods sold without corresponding decrease in selling price.

. Omission oI purchase invoices Irom accounts.

4. Under valuation oI opening stock or overvaluation oI closing stock.

On the other hand, the decrease in the gross proIit ratio may be due to the Iollowing Iactors.

1. Decrease in the selling price oI goods, without corresponding decrease in the cost oI goods

sold.

2. ncrease in the cost oI goods sold without any increase in selling price.

. UnIavorable purchasing or markup policies.

4. nability oI management to improve sales volume, or omission oI sales.

5. Over valuation oI opening stock or under valuation oI closing stock

Hence, an analysis oI gross profit margin should be carried out in the light oI the inIormation

relating to purchasing, mark-ups and markdowns, credit and collections as well as merchandising

policies.

NET !ROFIT RATIO

Net profit ratio is the ratio oI net proIit (aIter taxes) to net sales. t is expressed as percentage.

omponents of net profit ratio:

The two basic components oI the net profit ratio are the net proIit and sales. The net proIits are

obtained aIter deducting income-tax and, generally, non-operating expenses and incomes are excluded

Irom the net proIits Ior calculating this ratio. Thus, incomes such as interest on investments outside the

business, proIit on sales oI Iixed assets and losses on sales oI Iixed assets, etc are excluded.

Formula:

Net !rofit Ratio (Net profit / Net sales) 100

Example:

Total sales $520,000; Sales returns $ 20,000; Net proIit $40,000

alculate net profit ratio.

alculation:

Net sales (520,000 20,000) 500,000

Net !rofit Ratio |(40,000 / 500,000) 100|

8

Significance:

N! ratio is used to measure the overall proIitability and hence it is very useIul to proprietors.

The ratio is very useIul as iI the net proIit is not suIIicient, the Iirm shall not be able to achieve a

satisIactory return on its investment.

This ratio also indicates the Iirm's capacity to Iace adverse economic conditions such as price

competition, low demand, etc. Obviously, higher the ratio the better is the proIitability. But while

interpreting the ratio it should be kept in minds that the perIormance oI proIits also is seen in relation

to investments or capital oI the Iirm and not only in relation to sales.

O!ERATING RATIO

Operating ratio is the ratio oI cost oI goods sold plus operating expenses to net sales. t is

generally expressed in percentage.

Operating ratio measures the cost oI operations per dollar oI sales. This is closely related to the

ratio oI operating proIit to net sales.

omponents:

The two basic components Ior the calculation oI operating ratio are operating cost (cost oI

goods sold plus operating expenses) and net sales. Operating expenses normally include (a)

administrative and oIIice expenses and (b) selling and distribution expenses. Financial charges such as

interest, provision Ior taxation etc. are generally excluded Irom operating expenses.

Formula of operating ratio:

Operating Ratio |(Cost oI goods sold Operating expenses) / Net sales| 100

Example:

Cost oI goods sold is $180,000 and other operating expenses are $0,000 and net sales is $00,000.

alculate operating ratio.

alculation:

Operating ratio |(180,000 0,000) / 00,000| 100

|210,000 / 00,000| 100

70

Significance:

Operating ratio shows the operational eIIiciency oI the business. ower operating ratio shows

higher operating proIit and vice versa. An operating ratio ranging between 75 and 80 is generally

considered as standard Ior manuIacturing concerns. This ratio is considered to be a yardstick oI

operating eIIiciency but it should be used cautiously because it may be aIIected by a number oI

uncontrollable Iactors beyond the control oI the Iirm. Moreover, in some Iirms, non-operating

expenses Irom a substantial part oI the total expenses and in such cases operating ratio may give

misleading results.

EX!ENSE RATIO

Expense ratios indicate the relationship oI various expenses to net sales. The operating ratio

reveals the average total variations in expenses. But some oI the expenses may be increasing while

some may be Ialling. Hence, expense ratios are calculated by dividing each item oI expenses or group

oI expense with the net sales to analyze the cause oI variation oI the operating ratio.

The ratio can be calculated Ior individual items oI expense or a group oI items oI a particular

type oI expense like cost oI sales ratio, administrative expense ratio, selling expense ratio, materials

consumed ratio, etc. The lower the operating ratio, the larger is the proIitability and higher the

operating ratio, lower is the proIitability.

While interpreting expense ratio, it must be remembered that Ior a Iixed expense like rent, the

ratio will Iall iI the sales increase and Ior a variable expense, the ratio in proportion to sales shall

remain nearly the same.

Formula of Expense Ratio:

Following Iormula is used Ior the calculation oI expense ratio:

!articular xpense (!articular expense / Net sales) 100

Example:

Administrative expenses are $2,500, selling expenses are $,200 and sales are $25,00,000.

alculate expense ratio.

alculation:

Administrative expenses ratio (2,500 / 25,00,000) 100

0.1

Selling expense ratio (,200 / 25,00,000) 100

0.128

RETURN ON SAREOLDERS INVESTENT OR NET WORT RATIO

t is the ratio oI net proIit to share holder's investment. t is the relationship between net proIit

(aIter interest and tax) and share holder's/proprietor's Iund.

This ratio establishes the proIitability Irom the share holders' point oI view. The ratio is

generally calculated in percentage.

omponents:

The two basic components oI this ratio are net proIits and shareholder's Iunds. Shareholder's

Iunds include equity share capital, (preIerence share capital) and all reserves and surplus belonging to

shareholders. Net proIit means net income aIter payment oI interest and income tax because those will

be the only proIits available Ior share holders.

Formula of return on shareholder's investment or net worth Ratio:

|Return on share holder's investment Net proIit (aIter interest and tax) / Share holder's Iund} 100|

Example:

Suppose net income in an organization is $0,000 where as shareholder's investments or Iunds are

$400,000.

alculate return on shareholders investment or net worth

Return on share holders investment (0,000 / 400,000) 100

15

This means that the return on shareholders Iunds is 15 cents per dollar.

Significance:

This ratio is one oI the most important ratios used Ior measuring the overall eIIiciency oI a

Iirm. As the primary objective oI business is to maximize its earnings, this ratio indicates the extent to

which this primary objective oI businesses being achieved. This ratio is oI great importance to the

present and prospective shareholders as well as the management oI the company. As the ratio reveals

how well the resources oI the Iirm are being used, higher the ratio, better are the results. The inter Iirm

comparison oI this ratio determines whether the investments in the Iirm are attractive or not as the

investors would like to invest only where the return is higher.

RETURN ON EQUITY A!ITAL (ROE) RATIO

n real sense, ordinary shareholders are the real owners oI the company. They assume the

highest risk in the company. (!reIerence share holders have a preIerence over ordinary shareholders in

the payment oI dividend as well as capital.

!reIerence share holders get a Iixed rate oI dividend irrespective oI the quantum oI proIits oI

the company). The rate oI dividends varies with the availability oI proIits in case oI ordinary shares

only. Thus ordinary shareholders are more interested in the proIitability oI a company and the

perIormance oI a company should be judged on the basis oI return on equity capital oI the company.

Return on equity capital which is the relationship between proIits oI a company and its equity, can be

calculated as Iollows:

Formula of return on equity capital or common stock:

Formula oI return on equity capital ratio is:

Return on quity Capital |(Net proIit aIter tax !reIerence dividend) / quity share capital| 100

omponents:

quity share capital should be the total called-up value oI equity shares. As the proIit used Ior

the calculations are the Iinal proIits available to equity shareholders as dividend, thereIore the

preIerence dividend and taxes are deducted in order to arrive at such proIits.

Example:

alculate return on equity share capital from the following information:

quity share capital ($1): $1,000,000; 9 !reIerence share capital: $500,000; Taxation rate: 50 oI

net proIit; Net proIit beIore tax: $400,000.

alculation:

Return on Equity apital (ROE) ratio |(400,000 200,000 45,000) / 1000,000 ) 100|

15.5

Significance:

This ratio is more meaningIul to the equity shareholders who are interested to know proIits

earned by the company and those proIits which can be made available to pay dividends to them.

nterpretation oI the ratio is similar to the interpretation oI return on shareholder's investments and

higher the ratio better is.

RETURN ON A!ITAL E!LOYED RATIO (ROE RATIO)

The prime objective oI making investments in any business is to obtain satisIactory return on

capital invested. Hence, the return on capital employed is used as a measure oI success oI a business in

realizing this objective.

Return on capital employed establishes the relationship between the proIit and the capital

employed. t indicates the percentage oI return on capital employed in the business and it can be used

to show the overall proIitability and eIIiciency oI the business.

apital employed and operating proIits are the main items. Capital employed may be deIined

in a number oI ways. However, two widely accepted deIinitions are "gross capital employed" and

"net capital employed". ross capital employed usually means the total assets, Iixed as well as

current, used in business, while net capital employed reIers to total assets minus liabilities. On the

other hand, it reIers to total oI capital, capital reserves, revenue reserves (including proIit and loss

account balance), debentures and long term loans.

alculation of apital Employed:

ethod--1. I it is calculated Irom the assets side, t can be worked out by adding the Iollowing:

1. The Iixed assets should be included at their net values, either at original cost or at replacement

cost aIter deducting depreciation. n days oI inIlation, it is better to include Iixed assets at

replacement cost which is the current market value oI the assets.

2. nvestments inside the business

. All current assets such as cash in hand, cash at bank, sundry debtors, bills receivable, stock, etc.

4. To Iind out net capital employed, current liabilities are deducted Irom the total oI the assets as

calculated above.

ross capital employed Fixed assets nvestments Current assets

Net capital employed Fixed assets nvestments Working capital*.

*Working capital current assets current liabilities.

!recautions For alculating apital Employed:

While capital employed is calculated Irom the asset side, the Iollowing precautions should be taken:

Regarding the valuation oI Iixed assets, nowadays it is considered necessary to value the assets

at their replacement cost. This is with a view to providing Ior the continuing problem oI

inIlations during the current years. Under replacement cost methods the Iixed assets are to be

revalued on the basis oI their current market prices either by reIerence to reliable published

index numbers, or on valuation oI experts. When replacement cost method is used, the

provision Ior depreciation should be recalculated since depreciation charged might have been

calculated on original cost oI assets.

dle assetsassets which cannot be used in the business should be excluded Irom capital

employed. However, standby plant and machinery essential to the normal running oI the

business should be included.

ntangible assets, like goodwill, patents, trade marks, rights, etc. should be excluded. However,

iI they have sale value or iI they have been purchased they may be included. nvestments made

outside the business should be excluded.

All current assets should be properly valued. Any excess balance oI cash or bank than required

Ior the smooth running oI the business should be excluded.

Fictitious assets, like preliminary expenses, accumulated losses, discount on issue oI shares or

debentures, advertisement, suspense account, etc. should be excluded.

Obsolete assets which cannot be used in the business or obsolete stock which cannot be sold

should be excluded.

ethod--2. Alternatively, capital employed can be calculated Irom the liabilities side oI a balance

sheet. I it is calculated Irom the liabilities side, it will include the Iollowing items:

$are capital:

ssued share capital (quity !reIerence)

Reserves and $urplus:

eneral reserve, Capital reserve, !roIit and oss account, Debentures, Other long term loans

Some people suggest that average capital employed should be used in order to give eIIect oI the

capital investment throughout the year. t is argued that the proIit earned remain in the business

throughout the year and are distributed by way oI dividends only at the end oI the year. Average

capital may be calculated by dividing the opening and closing capital employed by two. t can also be

worked out by deducting halI oI the proIit Irom capital employed.

omputation of profit for return on capital employed:

The proIits Ior the purpose oI calculating return on capital employed should be computed

according to the concept oIcapital employed used". The proIits taken must be the proIits earned on

the capital employed in the business. Thus, net proIit has to be adjusted Ior the Iollowing:

Net proIit should be taken beIore the payment oI tax or provision Ior taxation because tax is

paid aIter the proIits have been earned and has no relation to the earning capacity oI the

business.

I the capital employed is gross capital employed then net proIit should be considered beIore

payment oI interest on long-term as well as short-term borrowings.

I the capital employed is used in the sense oI net capital employed than only interest on long

term borrowings should be added back to the net proIits and not interest on short term

borrowings as current liabilities are deducted while calculating net capital employed.

I any asset has been excluded while computing capital employed, any income arising Irom

these assets should also be excluded while calculating net proIits. For example, interest on

investments outside business should be excluded.

Net proIits should be adjusted Ior any abnormal, non recurring, non operating gains or losses

such as proIits and losses on sales oI Iixed assets.

Net proIits should be adjusted Ior depreciation based on replacement cost, iI assets have been

added at replacement cost.

Formula of return on capital employed ratio:

Return on Capital mployed(Adjusted net proIits*/Capital employed)100

*Net profit before interest and tax minus income from investments.

Significance of Return on apital Employed Ratio:

Return on capital employed ratio is considered to be the best measure oI proIitability in order

to assess the overall perIormance oI the business. t indicates how well the management has used the

investment made by owners and creditors into the business. t is commonly used as a basis Ior various

managerial decisions. As the primary objective oI business is to earn proIit, higher the return on capital

employed, the more eIIicient the Iirm is in using its Iunds. The ratio can be Iound Ior a number oI

years so as to Iind a trend as to whether the proIitability oI the company is improving or otherwise.

DIVIDEND YIELD RATIO

Dividend yield ratio is the relationship between dividends per share and the market value oI

the shares.

Share holders are real owners oI a company and they are interested in real sense in the earnings

distributed and paid to them as dividend. ThereIore, dividend yield ratio is calculated to evaluate the

relationship between dividends per share paid and the market value oI the shares.

Formula of Dividend Yield Ratio:

Following Iormula is used Ior the calculation oI dividend yield ratio:

Dividend Yield Ratio Dividend !er Share / Market Value !er Share

Example:

For example, iI a company declares dividend at 20 on its shares, each having a paid up value oI

$8.00 and market value oI $25.00.

alculate dividend yield ratio:

alculation:

Dividend !er Share (20 / 100) 8

$1.0

Dividend Yield Ratio (1.0 / 25) 100

.4

Significance of the Ratio:

This ratio helps as intending investor knows the eIIective return he is going to get on the proposed

investment.

DIVIDEND !AYOUT RATIO

Dividend payout ratio is calculated to Iind the extent to which earnings per share have been

used Ior paying dividend and to know what portion oI earnings has been retained in the business. t is

an important ratio because ploughing back oI proIits enables a company to grow and pay more

dividends in Iuture.

Formula of Dividend !ayout Ratio:

Following Iormula is used Ior the calculation oI dividend payout ratio

Dividend !ayout Ratio Dividend per quity Share / arnings per Share

A complementary oI this ratio is retained earnings ratio. Retained earning ratio is calculated by using

the Iollowing Iormula:

Retained arning Ratio Retained arning !er quity Share / arning !er quity Share

Example:

alculate dividend payout ratio and retained earnings Irom the Iollowing data:

Net !roIit

!rovision Ior taxation

10,000

5,000

No. oI equity shares

Dividend per equity share

,000

$0.40

!reIerence dividend 2,000

!ayout Ratio ($0.40 / $1) 100

40

Retained arnings Ratio ($0.0 /$1) 100

0

Significance of the Ratio:

The payout ratio and the retained earning ratio are the indicators oI the amount oI earnings that

have been ploughed back in the business. The lower the payout ratio, the higher will be the amount oI

earnings ploughed back in the business and vice versa. A lower payout ratio or higher retained

earnings ratio means a stronger Iinancial position oI the company.

EARNINGS !ER SARE (E!S) RATIO

Earnings per share ratio (E!S Ratio) is a small variation oI return on equity capital ratio and

is calculated by dividing the net proIit aIter taxes and preIerence dividend by the total number oI

equity shares.

Formula of Earnings !er Share Ratio:

The Iormula oI earnings per share is:

arnings per share (!S) Ratio (Net proIit aIter tax !reIerence dividend) / No. oI equity shares

(common shares)

Example:

quity share capital ($1): $1,000,000; 9 !reIerence share capital: $500,000; Taxation rate: 50 oI

net proIit; Net proIit beIore tax: $400,000.

alculate earnings per share ratio.

alculation:

!S 1,55,000 / 10,000

$15.50 per share.

Significance:

The earnings per share is a good measure oI proIitability and when compared with !S oI

similar companies, it gives a view oI the comparative earnings or earnings power oI the Iirm. !S ratio

calculated Ior a number oI years indicates whether or not the earning power oI the company has

increased.

!RIE EARNINGS RATIO (!E RATIO)

!rice earnings ratio (!/E ratio) is the ratio between market price per equity share and earning

per share.

The ratio is calculated to make an estimate oI appreciation in the value oI a share oI a company

and is widely used by investors to decide whether or not to buy shares in a particular company.

Formula of !rice Earnings Ratio:

Following Iormula is used to calculate price earnings ratio:

!rice arnings Ratio Market price per equity share / arnings per share

Example:

The market price oI a share is $0 and earning per share is $5.

alculate price earnings ratio.

alculation:

!rice earnings ratio 0 / 5

The market value oI every one dollar oI earning is six times or $. The ratio is useIul in

Iinancial Iorecasting. t also helps in knowing whether the share oI a company are under or over

valued. For example, iI the earning per share oI AB limited is $20, its market price $140 and earning

ratio oI similar companies is 8, it means that the market value oI a share oI AB imited should be $10

(i.e., 8 20). The share oI AB imited is, thereIore, undervalued in the market by $20. n case the

price earnings ratio oI similar companies is only , the value oI the share oI AB imited should have

been $120 (i.e., 20), thus the share is overvalued by $20.

Significance of !rice Earning Ratio:

!rice earnings ratio helps the investor in deciding whether to buy or not to buy the shares oI a

particular company at a particular market price.

enerally, higher the price earning ratio the better it is. I the !/ ratio Ialls, the management

should look into the causes that have resulted into the Iall oI this ratio.

LIQUIDITY RATIOS

iquidity ratios measure the short term solvency oI Iinancial position oI a Iirm. These ratios are

calculated to comment upon the short term paying capacity oI a concern or the Iirm's ability to meet its

current obligations. Following are the most important liquidity ratios.

Current ratio

iquid / Acid test / Quick ratio

URRENT RATIO

urrent ratio may be deIined as the relationship between current assets and current liabilities.

This ratio is also known as "orking capital ratio". t is a measure oI general liquidity and is most

widely used to make the analysis Ior short term Iinancial position or liquidity oI a Iirm. t is calculated

by dividing the total oI the current assets by total oI the current liabilities.

Formula:

Following Iormula is used to calculate current ratio:

Current Ratio Current Assets / Current iabilities

Or

Current Assets : Current iabilities

omponents:

The two basic components oI this ratio are current assets and current liabilities. Current assets

include cash and those assets which can be easily converted into cash within a short period oI time,

generally, one year, such as marketable securities or readily realizable investments, bills receivables,

sundry debtors, (excluding bad debts or provisions), inventories, work in progress, etc.

!repaid expenses should also be included in current assets because they represent payments made in

advance which will not have to be paid in near Iuture.

Current liabilities are those obligations which are payable within a short period oI tie generally

one year and include outstanding expenses, bills payable, sundry creditors, bank overdraIt, accrued

expenses, short term advances, income tax payable, dividend payable, etc. However, sometimes a

controversy arises that whether overdraIt should be regarded as current liability or not. OIten an

arrangement with a bank may be regarded as permanent and thereIore, it may be treated as long term

liability. At the same time the Iact remains that the overdraIt Iacility may be cancelled at any time.

Accordingly, because oI this reason and the need Ior conversion in interpreting a situation, it seems

advisable to include overdraIts in current liabilities.

Example:

Current assets are $1,200,000 and total current liabilities are $00,000.

alculate current ratio.

alculation:

Current Ratio 1,200,000 / 00,000

2

or

1200,000 : 00,000

2 : 1

Significance:

This ratio is a general and quick measure oI liquidity oI a Iirm. t represents the margin oI

saIety or cushion available to the creditors. t is an index oI the Iirms Iinancial stability. t is also an

index oI technical solvency and an index oI the strength oI working capital.

A relatively high current ratio is an indication that the Iirm is liquid and has the ability to pay

its current obligations in time and when they become due. On the other hand, a relatively low current

ratio represents that the liquidity position oI the Iirm is not good and the Iirm shall not be able to pay

its current liabilities in time without Iacing diIIiculties. An increase in the current ratio represents

improvement in the liquidity position oI the Iirm while a decrease in the current ratio represents that

there has been deterioration in the liquidity position oI the Iirm. A ratio equal to or near 2: 1 is

considered as a standard or normal or satisIactory. The idea oI having doubled the current assets as

compared to current liabilities is to provide Ior the delays and losses in the realization oI current assets.

However, the rule oI 2 :1 should not be blindly used while making interpretation oI the ratio. Firms

having less than 2 : 1 ratio may be having a better liquidity than even Iirms having more than 2 : 1

ratio. This is because oI the reason that current ratio measures the quantity oI the current assets and not

the quality oI the current assets. I a Iirm's current assets include debtors which are not recoverable or

stocks which are slow-moving or obsolete, the current ratio may be high but it does not represent a

good liquidity position.

Limitations of urrent Ratio:

This ratio is measure oI liquidity and should be used very careIully because it suIIers Irom many

limitations. t is, thereIore, suggested that it should not be used as the sole index oI short term

solvency.

1. t is crude ratio because it measures only the quantity and not the quality oI the current assets.

2. ven iI the ratio is Iavourable, the Iirm may be in Iinancial trouble, because oI more stock and

work in process which is not easily convertible into cash, and, thereIore Iirm may have less

cash to pay oII current liabilities.

. Valuation oI current assets and window dressing is another problem. This ratio can be very

easily manipulated by overvaluing the current assets. An equal increase in both current assets

and current liabilities would decrease the ratio and similarly equal decrease in current assets

and current liabilities would increase current ratio.

LIQUID OR LIQUIDITY OR AID TEST OR QUI RATIO

Liquid ratio is also termed as "Liquidity Ratio",Acid Test Ratio" or "Quick Ratio". t is

the ratio oI liquid assets to current liabilities. The true liquidity reIers to the ability oI a Iirm to pay its

short term obligations as and when they become due.

omponents:

The two components oI liquid ratio (acid test ratio or quick ratio) are liquid assets and liquid

liabilities. iquid assets normally include cash, bank, sundry debtors, bills receivable and marketable

securities or temporary investments. n other words they are current assets minus inventories (stock)

and prepaid expenses. nventories cannot be termed as liquid assets because it cannot be converted into

cash immediately without a loss oI value. n the same manner, prepaid expenses are also excluded

Irom the list oI liquid assets because they are not expected to be converted into cash. Similarly, iquid

liabilities means current liabilities i.e., sundry creditors, bills payable, outstanding expenses, short term

advances, income tax payable, dividends payable, and bank overdraIt (only iI payable on demand).

Some time bank overdraIt is not included in current liabilities, on the argument that bank overdraIt is

generally permanent way oI Iinancing and is not subject to be called on demand. n such cases

overdraIt will be excluded Irom current liabilities.

Formula of Liquidity Ratio / Acid Test Ratio:

Liquid Ratio Liquid Assets / urrent Liabilities]

Example:

From the Iollowing inIormation oI a company, calculate liquid ratio. Cash $180; Debtors $1,420;

inventory $1,800; Bills payable $270; Creditors $500 Accrued expenses $150; Tax payable $750.

iquid Assets 180 1,420 1.00

Current iabilities 270 500 150 750 1,70

Liquid Ratio 1,600 / 1,670

0.958 : 1

Significance:

The quick ratio/acid test ratio is very useIul in measuring the liquidity position oI a Iirm. t

measures the Iirm's capacity to pay oII current obligations immediately and is more rigorous test oI

liquidity than the current ratio. t is used as a complementary ratio to the current ratio. iquid ratio is

more rigorous test oI liquidity than the current ratio because it eliminates inventories and prepaid

expenses as a part oI current assets. Usually a high liquid ratio an indication that the Iirm is liquid and

has the ability to meet its current or liquid liabilities in time and on the other hand a low liquidity ratio

represents that the Iirm's liquidity position is not good. As a convention, generally, a quick ratio oI

"one to one" (1:1) is considered to be satisIactory.

Although liquidity ratio is more rigorous test oI liquidity than the current ratio , yet it should be

used cautiously and 1:1 standard should not be used blindly. A liquid ratio oI 1:1 does not necessarily

mean satisIactory liquidity position oI the Iirm iI all the debtors cannot be realized and cash is needed

immediately to meet the current obligations. n the same manner, a low liquid ratio does not

necessarily mean a bad liquidity position as inventories are not absolutely non-liquid. Hence, a Iirm

having a high liquidity ratio may not have a satisIactory liquidity position iI it has slow-paying

debtors. On the other hand, A Iirm having a low liquid ratio may have a good liquidity position iI it has

a Iast moving inventories. Though this ratio is deIinitely an improvement over current ratio, the

interpretation oI this ratio also suIIers Irom the same limitations as oI current ratio.

Absolute Liquid Ratio

Absolute liquidity is represented by cash and near cash items. t is a ratio oI absolute liquid

assets to current liabilities. n the computation oI this ratio only the absolute liquid assets are compared

with the liquid liabilities. The absolute liquid assets are cash, bank and marketable securities. t is to be

observed that receivables (debtors/accounts receivables and bills receivables) are eliminated Irom the

list oI liquid assets in order to obtain absolute4 liquid assets since there may be some doubt in their

liquidity.

Formula of Absolute Liquid Ratio:

Absolute iquid Ratio Absolute iquid Assets / Current Assets.

This ratio gains much signiIicance only when it is used in conjunction with the current and liquid

ratios. A standard oI 0.5: 1 absolute liquidity ratio is considered an acceptable norm. That is, Irom the

point oI view oI absolute liquidity, IiIty cents worth oI absolute liquid assets are considered suIIicient

Ior one dollar worth oI liquid liabilities. However, this ratio is not in much use.

ATIVITY RATIOS

Activity ratios are calculated to measure the eIIiciency with which the resources oI a Iirm have

been employed. These ratios are also called turnover ratios because they indicate the speed with which

assets are being turned over into sales. Following are the most important activity ratios:

nventory / Stock turnover ratio

Debtors / Receivables turnover ratio

Average collection period

Creditors / !ayable turnover ratio

Working capital turnover ratio

Fixed assets turnover ratio

Over and under trading

INVENTORY TURNOVER RATIO OR STO TURNOVER RATIO (ITR)

very Iirm has to maintain a certain level oI inventory oI Iinished goods so as to be able to

meet the requirements oI the business. But the level oI inventory should neither be too high nor too

low.

A too high inventory means higher carrying costs and higher risk oI stocks becoming obsolete

whereas too low inventory may mean the loss oI business opportunities. t is very essential to keep

suIIicient stock in business.

Stock turnover ratio and inventory turnover ratio are the same. This ratio is a relationship

between the cost oI goods sold during a particular period oI time and the cost oI average inventory

during a particular period. t is expressed in number oI times. $tock turnover ratio/Inventory turnover

ratio indicates the number oI time the stock has been turned over during the period and evaluates the

eIIiciency with which a Iirm is able to manage its inventory. This ratio indicates whether investment in

stock is within proper limit or not.

omponents of the Ratio:

Average inventory and cost oI goods sold are the two elements oI this ratio. Average inventory

is calculated by adding the stock in the beginning and at the end oI the period and dividing it by two.

n case oI monthly balances oI stock, all the monthly balances are added and the total is divided by the

number oI months Ior which the average is calculated.

Formula of Stock Turnover/Inventory Turnover Ratio:

The ratio is calculated by dividing the cost oI goods sold by the amount oI average stock at

cost.

(a) |nventory Turnover Ratio Cost oI goods sold / Average inventory at cost|

enerally, the cost oI goods sold may not be known Irom the published Iinancial statements. n

such circumstances, the inventory turnover ratio may be calculated by dividing net sales by average

inventory at cost. I average inventory at cost is not known then inventory at selling price may be taken

as the denominator and where the opening inventory is also not known the closing inventory Iigure

may be taken as the average inventory.

(b) |nventory Turnover Ratio Net Sales / Average nventory at Cost|

(c) |nventory Turnover Ratio Net Sales / Average inventory at Selling !rice|

(d) |nventory Turnover Ratio Net Sales / nventory|

Example:

The cost oI goods sold is $500,000. The opening stock is $40,000 and the closing stock is $0,000 (at

cost).

alculate inventory turnover ratio

alculation:

nventory Turnover Ratio (TR) 500,000 / 50,000*

10 times

This means that an average one dollar invested in stock will turn into ten times in sales

*($40,000 $0,000) / 2

$50,000

Significance of ITR:

nventory turnover ratio measures the velocity oI conversion oI stock into sales. Usually a high

inventory turnover/stock velocity indicates eIIicient management oI inventory because more Irequently

the stocks are sold; the lesser amount oI money is required to Iinance the inventory. A low inventory

turnover ratio indicates an ineIIicient management oI inventory. A low inventory turnover implies

over-investment in inventories, dull business, poor quality oI goods, stock accumulation, accumulation

oI obsolete and slow moving goods and low proIits as compared to total investment. The inventory

turnover ratio is also an index oI proIitability, where a high ratio signiIies more proIit; a low ratio

signiIies low proIit. Sometimes, a high inventory turnover ratio may not be accompanied by relatively

a high proIit. Similarly a high turnover ratio may be due to under-investment in inventories.

t may also be mentioned here that there are no rule oI thumb or standard Ior interpreting the

inventory turnover ratio. The norms may be diIIerent Ior diIIerent Iirms depending upon the nature oI

industry and business conditions. However the study oI the comparative or trend analysis oI inventory

turnover is still useIul Ior Iinancial analysis.

DEBTORS TURNOVER RATIO [ AOUNTS REEIVABLE TURNOVER

RATIO

A concern may sell goods on cash as well as on credit. Credit is one oI the important elements

oI sales promotion. The volume oI sales can be increased by Iollowing a liberal credit policy.

The eIIect oI a liberal credit policy may result in tying up substantial Iunds oI a Iirm in the

Iorm oI trade debtors (or receivables). Trade debtors are expected to be converted into cash within a

short period oI time and are included in current assets. Hence, the liquidity position oI concern to pay

its short term obligations in time depends upon the quality oI its trade debtors.

Debtors turnover ratio or accounts receivable turnover ratio indicates the velocity oI debt

collection oI a Iirm. n simple words it indicates the number oI times average debtors (receivable) are

turned over during a year.

Formula of Debtors Turnover Ratio:

Debtors Turnover Ratio Net Credit Sales / Average Trade Debtors

The two basic components oI accounts receivable turnover ratio are net credit annual sales and

average trade debtors. The trade debtors Ior the purpose oI this ratio include the amount oI Trade

Debtors & Bills Receivables. The average receivables are Iound by adding the opening receivables and

closing balance oI receivables and dividing the total by two. t should be noted that provision Ior bad

and doubtIul debts should not be deducted since this may give an impression that some amount oI

receivables has been collected. But when the inIormation about opening and closing balances oI trade

debtors and credit sales is not available, then the debtors turnover ratio can be calculated by dividing

the total sales by the balance oI debtors (inclusive oI bills receivables) given. and Iormula can be

written as Iollows.

Debtors Turnover Ratio Total Sales / Debtors

Example:

Credit sales $25,000; Return inwards $1,000; Debtors $,000; Bills Receivables $1,000.

alculate debtors turnover ratio

alculation:

Debtors Turnover Ratio Net Credit Sales / Average Trade Debtors

24,000* / 4,000**

Times

*25000 less 1000 return inwards, **000 plus 1000 B/R

Significance of the Ratio:

Accounts receivable turnover ratio or debtors turnover ratio indicates the number oI times the

debtors are turned over a year. The higher the value oI debtors turnover the more eIIicient is the

management oI debtors or more liquid the debtors are. Similarly, low debtors turnover ratio implies

ineIIicient management oI debtors or less liquid debtors. t is the reliable measure oI the time oI cash

Ilow Irom credit sales. There is no rule oI thumb which may be used as a norm to interpret the ratio as

it may be diIIerent Irom Iirm to Iirm.

AVERAGE OLLETION !ERIOD RATIO

The Debtors/Receivable Turnover ratio when calculated in terms oI days is known as Average

ollection !eriod or Debtors ollection !eriod Ratio.

The average collection period ratio represents the average number oI days Ior which a Iirm has

to wait beIore its debtors are converted into cash.

Formula of Average ollection !eriod:

Following Iormula is used to calculate average collection period:

(Trade Debtors No. oI Working Days) / Net Credit Sales

Example:

Credit sales $25,000; Return inwards $1,000; Debtors $,000; Bills Receivables $1,000.

alculate average collection period.

alculation:

Average collection period can be calculated as Iollows:

Average Collection !eriod (Trade Debtors No. oI Working Days) / Net Credit Sales

4,000* 0** / 24,000

0 Days

* Debtors and bills receivables are added.

**For calculating this ratio usually the number oI working days in a year is assumed to be 0.

Significance of the Ratio:

This ratio measures the quality oI debtors. A short collection period implies prompt payment

by debtors. t reduces the chances oI bad debts. Similarly, a longer collection period implies too liberal

and ineIIicient credit collection perIormance. t is diIIicult to provide a standard collection period oI

debtors.

REDITORS / AOUNTS !AYABLE TURNOVER RATIO:

This ratio is similar to the debtors turnover ratio. t compares creditors with the total credit

purchases.

t signiIies the credit period enjoyed by the Iirm in paying creditors. Accounts payable include

both sundry creditors and bills payable. Same as debtors turnover ratio, creditors turnover ratio can

be calculated in two Iorms, creditors turnover ratio and average payment period.

Formula:

Following Iormula is used to calculate creditors turnover ratio:

Creditors Turnover Ratio Credit !urchase / Average Trade Creditors

Average payment period ratio gives the average credit period enjoyed Irom the creditors. t can be

calculated using the Iollowing Iormula:

Average !ayment !eriod Trade Creditors / Average Daily Credit !urchase

Average Daily Credit !urchase Credit !urchase / No. oI working days in a year

Or

Average !ayment !eriod (Trade Creditors No. oI Working Days) / Net Credit !urchase

In case information about credit purchase is not available total purchases may be assumed to be

credit purchase.)

Significance of the Ratio:

The average payment period ratio represents the number oI days by the Iirm to pay its

creditors. A high creditors turnover ratio or a lower credit period ratio signiIies that the creditors are

being paid promptly. This situation enhances the credit worthiness oI the company. However a very

Iavourable ratio to this eIIect also shows that the business is not taking the Iull advantage oI credit

Iacilities allowed by the creditors.

WORING A!ITAL TURNOVER RATIO

Working capital turnover ratio indicates the velocity oI the utilization oI net working capital.

This ratio represents the number oI times the working capital is turned over in the course oI

year and is calculated as Iollows:

Formula of Working apital Turnover Ratio:

Following Iormula is used to calculate working capital turnover ratio

Working Capital Turnover Ratio Cost oI Sales / Net Working Capital

The two components oI the ratio are cost oI sales and the net working capital. I the

inIormation about cost oI sales is not available the Iigure oI sales may be taken as the numerator. Net

working capital is Iound by deduction Irom the total oI the current assets the total oI the current

liabilities.

Example:

Cash

Bills Receivables

Sundry Debtors

Stock

Sundry Creditors

Cost oI sales

10,000

5,000

25,000

20,000

0,000

150,000

alculate working capital turnover ratio

alculation:

Working Capital Turnover Ratio Cost oI Sales / Net Working Capital

Current Assets $10,000 $5,000 $25,000 $20,000 $0,000

Current iabilities $0,000

Net Working Capital Current assets Current liabilities

$0,000 $0,000

$0,000

So the working Capital Turnover Ratio 150,000 / 0,000

5 times

Significance:

The working capital turnover ratio measures the eIIiciency with which the working capital is

being used by a Iirm. A high ratio indicates eIIicient utilization oI working capital and a low ratio

indicates otherwise. But a very high working capital turnover ratio may also mean lack oI suIIicient

working capital which is not a good situation.

FIXED ASSETS TURNOVER RATIO

Fixed assets turnover ratio is also known as sales to Iixed assets ratio. This ratio measures the

eIIiciency and proIit earning capacity oI the concern.

Higher the ratio, greater is the intensive utilization oI Iixed assets. ower ratio means under-

utilization oI Iixed assets. The ratio is calculated by using Iollowing Iormula:

Formula of Fixed Assets Turnover Ratio:

Fixed assets turnover ratio turnover ratio is calculated by the Iollowing Iormula:

Fixed Assets Turnover Ratio Cost oI Sales / Net Fixed Assets

Over-trading and under-trading are Iacets oI over and under-capitalization. ver trading is a curse

to the business.

A company which is under-capitalized will try to do too much with the limited amount oI

capital which it has. For example it may not maintain proper stock oI stock. Also it may not extend

much credit to customers and may insist only on cash basis sales. t may also not pay the creditors on

time. One can detect cases oI overtrading by computing the current ratio and the various turnover

ratios. The current ratio is likely to be very low and turn over ratios is likely to be very higher than

normally in the industry concerned.

Under-trading is the reverse oI over-trading. t means keeping Iunds idle and not using them

properly. This is due to the under employment oI assets oI the business, leading to the Iall oI sales and

results in Iinancial crises. This makes the business unable to meet its commitments and ultimately

leads to Iorced liquidation. The symptoms in this case would be a very high current ratio and very low

turnover ratio. Under-trading is an aspect oI over-capitalization and leads to low proIit.

LONG TER SOLVENY OR LEVERAGE RATIOS

ong term solvency or leverage ratios convey a Iirm's ability to meet the interest costs and

payment schedules oI its long term obligations. Following are some oI the most important long term

solvency or leverage ratios.

Debt-to-equity ratio

!roprietary or quity ratio

Ratio oI Iixed assets to shareholders Iunds

Ratio oI current assets to shareholders Iunds

nterest coverage ratio

Capital gearing ratio

Over and under capitalization

DEBT TO EQUITY RATIO

Debt-to-Equity ratio indicates the relationship between the external equities or outsiders Iunds

and the internal equities or shareholders Iunds.

t is also known as external internal equity ratio. t is determined to ascertain soundness oI the

long term Iinancial policies oI the company.

Formula of Debt to Equity Ratio:

Following Iormula is used to calculate debt to equity ratio

|Debt quity Ratio xternal quities / nternal quities|

Or

|Outsiders Iunds / Shareholders Iunds|

As a long term Iinancial ratio it may be calculated as Iollows:

|Total ong Term Debts / Total ong Term Funds|

Or

|Total ong Term Debts / Shareholders Funds|

omponents:

The two basic components oI debt to equity ratio are outsiders Iunds i.e. external equities and

share holders Iunds, i.e., internal equities. The outsiders Iunds include all debts / liabilities to outsiders,

whether long term or short term or whether in the Iorm oI debentures, bonds, mortgages or bills. The

shareholders Iunds consist oI equity share capital, preIerence share capital, capital reserves, revenue

reserves, and reserves representing accumulated proIits and surpluses like reserves Ior contingencies,

sinking Iunds, etc. The accumulated losses and deIerred expenses, iI any, should be deducted Irom the

total to Iind out shareholder's Iunds

Some writers are oI the view that current liabilities do not reIlect long term commitments and

they should be excluded Irom outsider's Iunds. There are some other writers who suggest that current

liabilities should also be included in the outsider's Iunds to calculate debt equity ratio Ior the reason

that like long term borrowings, current liabilities also represents Iirm's obligations to outsiders and

they are an important determinant oI risk. However, we advise that to calculate debt equity ratio

current liabilities should be included in outsider's Iunds. The ratio calculated on the basis outsider's

Iunds excluding liabilities may be termed as ratio of long-term debt to share holders funds.

Example:

From the Iollowing Iigures calculate debt to equity ratio:

quity share capital

Capital reserve

!roIit and loss account

debentures

Sundry creditors

Bills payable

!rovision Ior taxation

Outstanding creditors

1,100,000

500,000

200,000

500,000

240,000

120,000

180,000

10,000

Required: alculate debt to equity ratio.

alculation:

xternal quities / nternal quities

1,200,000 / 18,000,000

0. or 4 :

t means that Ior every Iour dollars worth oI the creditors investment the shareholders have

invested six dollars. That is external debts are equal to 0. oI shareholders Iunds.

Significance of Debt to Equity Ratio:

Debt to equity ratio indicates the proportionate claims oI owners and the outsiders against the

Iirms assets. The purpose is to get an idea oI the cushion available to outsiders on the liquidation oI the

Iirm. However, the interpretation oI the ratio depends upon the Iinancial and business policy oI the

company. The owners want to do the business with maximum oI outsider's Iunds in order to take lesser

risk oI their investment and to increase their earnings (per share) by paying a lower Iixed rate oI

interest to outsiders. The outsiders creditors) on the other hand, want that shareholders (owners) should

invest and risk their share oI proportionate investments.

A ratio oI 1:1 is usually considered to be satisIactory ratio although there cannot be rule oI

thumb or standard norm Ior all types oI businesses. Theoretically iI the owners interests are greater

than that oI creditors, the Iinancial position is highly solvent. n analysis oI the long-term Iinancial

position it enjoys the same importance as the current ratio in the analysis oI the short-term Iinancial

position.

!RO!RIETARY RATIO OR EQUITY RATIO

This is a variant oI the debt-to-equity ratio. t is also known as equity ratio or net worth to total

assets ratio.

This ratio relates the shareholder's Iunds to total assets. !roprietary / Equity ratio indicates

the long-term or Iuture solvency position oI the business.

Formula of !roprietary/Equity Ratio:

!roprietary or quity Ratio Shareholders Iunds / Total Assets

omponents:

Shareholder's Iunds include equity share capital plus all reserves and surpluses items. Total

assets include all assets, including oodwill. Some authors exclude goodwill Irom total assets. n that

case the total shareholder's Iunds are to be divided by total tangible assets. As the total assets are

always equal to total liabilities, the total liabilities may also be used as the denominator in the above

Iormula.

Example:

Share holders Iunds are $1,800,000 and the total assets, which are equal to total liabilities are

$,000,000.

alculate proprietary ratio or Equity ratio.

alculation:

!roprietary or quity Ratio 1,800,000 / ,000,000

This means that out oI every $1 employed in the business, shareholders contribution is about 0

cents. Accordingly, the creditors contribution would be the remaining 40 cents.

Significance:

This ratio throws light on the general Iinancial strength oI the company. t is also regarded as a

test oI the soundness oI the capital structure. Higher the ratio or the share oI shareholders in the total

capital oI the company better is the long-term solvency position oI the company. A low proprietary

ratio will include greater risk to the creditors.

This ratio may be Iurther analyzed into the Iollowing two ratios:

Ratio oI Iixed assets to shareholders/proprietors' Iunds

Ratio oI current assets to shareholders/proprietors' Iunds

FIXED ASSETS TO !RO!RIETOR'S FUND RATIO

Fixed assets to proprietor`s fund ratio establish the relationship between Iixed assets and

shareholders Iunds.

The purpose oI this ratio is to indicate the percentage oI the owner's Iunds invested in Iixed

assets.

Formula:

Fixed Assets to !roprietors Fund Fixed Assets / !roprietors Fund

The Iixed assets are considered at their book value and the proprietor's Iunds consist oI the

same items as internal equities in the case oI debt equity ratio.

Example:

Suppose the depreciated book value oI Iixed assets is $ ,000 and proprietor's Iunds are

48,000 the relevant ratio would be calculated as Iollows:

Fixed assets to proprietor's Iund ,000 / 48,000

0.75 or 0.75: 1

Significance:

The ratio oI Iixed assets to net worth indicates the extent to which shareholder's Iunds are sunk

into the Iixed assets. enerally, the purchase oI Iixed assets should be Iinanced by shareholder's equity

including reserves, surpluses and retained earnings. I the ratio is less than 100, it implies that

owners Iunds are more than Iixed assets and a part oI the working capital is provide by the

shareholders. When the ratio is more than the 100, it implies that owners Iunds are not suIIicient to

Iinance the Iixed assets and the Iirm has to depend upon outsiders to Iinance the Iixed assets. There is

no rule oI thumb to interpret this ratio by 0 to 5 percent is considered to be a satisIactory ratio in

case oI industrial undertakings.

URRENT ASSETS TO !RO!RIETOR'S FUND RATIO

urrent Assets to !roprietors' Fund Ratio establishes the relationship between current assets

and shareholder's Iunds.

The purpose oI this ratio is to calculate the percentage oI shareholders Iunds invested in current

assets.

Formula:

Current Assets to !roprietors Funds Current Assets / !roprietor's Funds

Example:

This may be expressed either as a percentage , or as a proportion. To illustrate, iI the value oI

current assets is $,000 and the proprietors Iunds are $180,000 the relevant ratio would be calculated

as Iollows:

Current Assets to !roprietors Funds ,000 / 180,000

0.2

This may also be expressed as 20. t means that 20 oI the proprietors Iunds have been invested in

current assets.

Significance:

DiIIerent industries have diIIerent norms and thereIore, this ratio should be studied careIully

taking the history oI industrial concern into consideration beIore relying too much on this ratio.

DEBT SERVIE RATIO OR INTEREST OVERAGE RATIO

Interest coverage ratio is also known as debt service ratio or debt service coverage ratio.

This ratio relates the Iixed interest charges to the income earned by the business. t indicates

whether the business has earned suIIicient proIits to pay periodically the interest charges. t is

calculated by using the Iollowing Iormula.

Formula of Debt Service Ratio or interest coverage ratio:

nterest Coverage Ratio Net !roIit BeIore nterest and Tax / Fixed nterest Charges

Example:

I the net proIit (aIter taxes) oI a Iirm is $75,000 and its Iixed interest charges on long-term borrowings

are $10,000. The rate oI income tax is 50.

alculate debt service ratio / interest coverage ratio

alculation:

nterest Coverage Ratio (75,000* 75,000* 10,000) / 10,000

1 times

*ncome aIter interest is $7,5000 income tax $75,000

Significance of debt service ratio:

The interest coverage ratio is very important Irom the lender's point oI view. t indicates the

number oI times interest is covered by the proIits available to pay interest charges.

t is an index oI the Iinancial strength oI an enterprise. A high debt service ratio or interest

coverage ratio assures the lenders a regular and periodical interest income. But the weakness oI the

ratio may create some problems to the Iinancial manager in raising Iunds Irom debt sources.

A!ITAL GEARING RATIO

Closely related to solvency ratio is the capital gearing ratio. apital gearing ratio is mainly

used to analyze the capital structure oI a company.

The term capital structure reIers to the relationship between the various long-term Iorm oI

Iinancing such as debentures, preIerence and equity share capital including reserves and surpluses.

everage oI capital structure ratios are calculated to test the long-term Iinancial position oI a Iirm.

The term "capital gearing" or "leverage" normally reIers to the proportion oI relationship

between equity share capital including reserves and surpluses to preIerence share capital and other

Iixed interest bearing Iunds or loans. n other words it is the proportion between the Iixed interest or

dividend bearing Iunds and non Iixed interest or dividend bearing Iunds. quity share capital includes

equity share capital and all reserves and surpluses items that belong to shareholders. Fixed interest

bearing Iunds includes debentures, preIerence share capital and other long-term loans.

Formula of capital gearing ratio:

apital Gearing Ratio Equity Share apital / Fixed Interest Bearing Funds]

Example:

alculate capital gearing ratio from the following data:

quity Share Capital

Reserves & Surplus

ong Term oans

Debentures

1991 1992

500,000

00,000

250,000

250,000

400,000

200,000

00,000

400,000

alculation:

Capital earing Ratio 1992 (500,000 00,000) / (250,000 250,000)

8 : 5 (ow ear)

199 (400,000 200,000) / (00,000 400,000)

: 7 (High ear)

t may be noted that gearing is an inverse ratio to the equity share capital.

Highly eared------------ow quity Share Capital

ow eared---------------High quity Share Capital

Significance of the ratio:

Capital gearing ratio is important to the company and the prospective investors. t must be

careIully planned as it aIIects the company's capacity to maintain a uniIorm dividend policy during

diIIicult trading periods. t reveals the suitability oI company's capitalization.

OVER-A!ITALIZATION AND UNDER-A!ITALIZATION

The total amount oI Iunds available to an undertaking should be neither too much nor too low.

An important question, thereIore is the question oI capitalization oI the company, i.e., the

determination oI the amount which the company should have at least its disposal. The total amount oI

long term Iunds available to the company, thereIore, is the capitalization oI the company.

Under-apitalization

I the owned capital oI the business is much less than the total borrowed capital than it is a sign oI

under capitalization. This means that the owned capital oI the company is disproportionate to the

scale oI its operation and the business is dependent upon borrowed money and trade creditors. &nder-

capitali:ation may be the result oI over-trading. t must be distinguished Irom high gearing. ncase oI

capital gearing there is a comparison between equity capital and Iixed interest bearing capital (which

includes reIerence share capital also and excludes trade creditors) whereas in the case oI under

capitalization, comparison is made between total owned capital (both equity and preIerence share

capital) and total borrowed capital (which includes trade creditors also). Under capitalization is

indicated by:

O ow proprietary Ratio

O Current Ratio

O High Return on quity Capital

The eIIects oI under capitalization may be:

1. !ayment oI excessive interest on borrowed capital.

2. Use oI old and out oI date equipment because oI inability to purchase new plant etc.

. High cost oI production because oI the use oI old machinery

Over-apitalization

A concern is said to be over-capitalized iI its earnings are not suIIicient to justiIy a Iair return

on the amount oI share capital and debentures that have been issued. t is said to be over capitali:ed

when total oI owned and borrowed capital exceeds its Iixed and current assets i.e. when it shows

accumulated losses on the assets side oI the balance sheet.

An over capitalized company can be like a very Iat person who cannot carry his weight

properly. Such a person is prone to many diseases and is certainly not likely to be suIIiciently active.

Unless the condition oI overcapitalization is corrected, the company may Iind itselI in great

diIIiculties.

auses of Over apitalization:

Some oI the important reasons oI over-capitalization are:

1. Idle funds. The Company may have such an amount oI Iunds that it cannot use them properly.

Money may be living idle in banks or in the Iorm oI low yield investments.

2. ver-valuation. The Iixed assets, especially good will, may have been acquired at a cost much

higher than that warranted by the services which that asset could render.

. all in value. Fixed assets may have been acquired at a time when prices were high. With the

passage oI time prices may have been Iallen so that the real value oI the asset may also have

come down substantially even though in the balance sheet the assets are being shown at book

value less depreciation written oII. Then the book values will be much more than the economic

value.

4. Inadequate depreciation provision. Adequate provision may not have been provided on the

Iixed assets with the result the proIits shown by books may have been distributed as dividend,

leaving no Iunds with which to replace the assets at the proper time.

Remedies:

Over-capitalization can be remedied by reducing its capital so as to obtain a satisIactory

relationship between proprietors Iunds and net proIit. n case over-capitalization is the result oI over-

valuation oI assets then it can be remedied by bringing down the values oI assets to their proper values.

Você também pode gostar

- AccountsDocumento4 páginasAccountsAnita YadavAinda não há avaliações

- Chapter No-1: Definition of 'Ratio Analysis'Documento19 páginasChapter No-1: Definition of 'Ratio Analysis'Anonymous GMyUOkIWAAinda não há avaliações

- Theoretical Framework: Interpretation of The RatiosDocumento9 páginasTheoretical Framework: Interpretation of The Ratiosdurga deviAinda não há avaliações

- Accounting Ratios by AteeqDocumento4 páginasAccounting Ratios by AteeqAteejuttAinda não há avaliações

- Limitation of Ratio AnalysisDocumento5 páginasLimitation of Ratio AnalysisMir Wajahat AliAinda não há avaliações

- Finance Project For McomDocumento40 páginasFinance Project For McomSangeeta Rachkonda100% (1)

- Financial Statement Analysis: Business Strategy & Competitive AdvantageNo EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageNota: 5 de 5 estrelas5/5 (1)

- Analyzing Your Financial RatiosDocumento38 páginasAnalyzing Your Financial Ratiossakthivels08Ainda não há avaliações

- Gross Profit Net Sales - Cost of Goods Sold Net Sales Gross Sales - Sales ReturnsDocumento10 páginasGross Profit Net Sales - Cost of Goods Sold Net Sales Gross Sales - Sales ReturnsZeath ElizaldeAinda não há avaliações

- BHEL FinanceDocumento44 páginasBHEL FinanceJayanth C VAinda não há avaliações

- Definition and Explanation of Financial Statement AnalysisDocumento7 páginasDefinition and Explanation of Financial Statement Analysismedbest11Ainda não há avaliações

- Advantages: Home Current Ratio Analysis Debt Ratio Analysis Financial Ratio Analysis Quick Ratio AnalysisDocumento7 páginasAdvantages: Home Current Ratio Analysis Debt Ratio Analysis Financial Ratio Analysis Quick Ratio AnalysisSabiya MbaAinda não há avaliações

- Ratio SignificanceDocumento3 páginasRatio SignificanceJonhmark AniñonAinda não há avaliações

- Proj 3.0 2Documento26 páginasProj 3.0 2Shivam KharuleAinda não há avaliações

- Ratio AnalysisDocumento51 páginasRatio AnalysisSeema RahulAinda não há avaliações

- Ratio AnalysisDocumento9 páginasRatio AnalysisSushil RavalAinda não há avaliações

- Ratio AnalysisDocumento24 páginasRatio Analysisrleo_19871982100% (1)

- Managerial Focus On Ratios & ImportanceDocumento9 páginasManagerial Focus On Ratios & ImportanceMahima BharathiAinda não há avaliações

- Timbol, Kathlyn Mae V - Financial Analysis TechniquesDocumento4 páginasTimbol, Kathlyn Mae V - Financial Analysis TechniquesMae TimbolAinda não há avaliações

- Definition and Explanation of Financial Statement Analysis:: Horizontal Analysis or Trend AnalysisDocumento3 páginasDefinition and Explanation of Financial Statement Analysis:: Horizontal Analysis or Trend AnalysisrkumarkAinda não há avaliações

- Financial AnalysisDocumento14 páginasFinancial AnalysisTusharAinda não há avaliações

- Theoretical Framework of Ratio Analysis in Financial StudiesDocumento39 páginasTheoretical Framework of Ratio Analysis in Financial StudiesKurt CaneroAinda não há avaliações

- Module 2Documento27 páginasModule 2MADHURIAinda não há avaliações

- Financials RatiosDocumento25 páginasFinancials RatiosSayan DattaAinda não há avaliações

- FM PPT Ratio AnalysisDocumento12 páginasFM PPT Ratio AnalysisHarsh ManotAinda não há avaliações

- Understand Financial Statements with Ratio AnalysisDocumento5 páginasUnderstand Financial Statements with Ratio AnalysisDushyant ChouhanAinda não há avaliações

- Meaning of Accounting RatiosDocumento12 páginasMeaning of Accounting RatiosAkash PradhanAinda não há avaliações

- Meaning of Accounting RatiosDocumento12 páginasMeaning of Accounting RatiosAkash PradhanAinda não há avaliações

- MPADocumento24 páginasMPAanushkaanandaniiiAinda não há avaliações

- Accounting Ratios: Inancial Statements Aim at Providing FDocumento45 páginasAccounting Ratios: Inancial Statements Aim at Providing FNIKK KICKAinda não há avaliações

- Ratio analysis guideDocumento7 páginasRatio analysis guideShirsendu MondolAinda não há avaliações

- Liquidity RatiosDocumento7 páginasLiquidity RatiosChirrelyn Necesario SunioAinda não há avaliações

- Ratio Analysis in a NutshellDocumento15 páginasRatio Analysis in a NutshellAvneet Kaur Bedi100% (1)

- Analyze Financial Performance with Ratio AnalysisDocumento4 páginasAnalyze Financial Performance with Ratio AnalysisKartikeyaDwivediAinda não há avaliações

- 2M AmDocumento27 páginas2M AmMohamed AbzarAinda não há avaliações

- What is Financial Accounting and BookkeepingNo EverandWhat is Financial Accounting and BookkeepingNota: 4 de 5 estrelas4/5 (10)

- Introduction To Financial Statement AnalysisDocumento11 páginasIntroduction To Financial Statement AnalysisMark Anthony TibuleAinda não há avaliações

- Interpret Financial Statements (IFSDocumento30 páginasInterpret Financial Statements (IFSAkshata MasurkarAinda não há avaliações

- RATIODocumento11 páginasRATIOSireeshaAinda não há avaliações

- Ratio AnalysisDocumento4 páginasRatio AnalysisJohn MuemaAinda não há avaliações

- Analyze Profitability RatiosDocumento14 páginasAnalyze Profitability RatiosJayanta SarkarAinda não há avaliações

- Ratio AnalysisDocumento26 páginasRatio AnalysisPratibha ChandilAinda não há avaliações

- Literature ReviewDocumento8 páginasLiterature Reviewjopi60Ainda não há avaliações

- Classification of RatiosDocumento10 páginasClassification of Ratiosaym_6005100% (2)

- Financial & Ratio AnalysisDocumento46 páginasFinancial & Ratio AnalysisParvej KhanAinda não há avaliações

- Definition and Explanation of Financial Statement AnalysisDocumento9 páginasDefinition and Explanation of Financial Statement AnalysisadaktanuAinda não há avaliações

- Analyze Financial Performance with Accounting RatiosDocumento47 páginasAnalyze Financial Performance with Accounting Ratiosviswa100% (1)

- Financial Ratio Analysis GuideDocumento12 páginasFinancial Ratio Analysis GuideOmair AbbasAinda não há avaliações

- Synopsis Ratio AnalysisDocumento3 páginasSynopsis Ratio Analysisaks_swamiAinda não há avaliações

- Financial RatiosDocumento7 páginasFinancial RatiosVikram KainturaAinda não há avaliações

- Accounting Ratios PDFDocumento3 páginasAccounting Ratios PDFfrieda20093835Ainda não há avaliações

- Ratio AnalysisDocumento23 páginasRatio AnalysishbijoyAinda não há avaliações

- Ratio Analysis GuideDocumento5 páginasRatio Analysis GuideMarie Frances SaysonAinda não há avaliações

- Interpretation of AccountDocumento36 páginasInterpretation of AccountRomeo OOhlalaAinda não há avaliações

- ROEDocumento7 páginasROEfrancis willie m.ferangco100% (1)

- Paraphrasing 1Documento8 páginasParaphrasing 1Jai ValdezAinda não há avaliações