Escolar Documentos

Profissional Documentos

Cultura Documentos

1109 - Harmony

Enviado por

mbasgroupDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

1109 - Harmony

Enviado por

mbasgroupDireitos autorais:

Formatos disponíveis

HARMONY

AN E-MAGAZINE ON CSIR/GOI SERVICE & RELATED ISSUES

Founder-Editor Ch. Srinivasa Rao Formerly COA, NGRI (CSIR), Hyderabad Vol. XVIII September 2011

Compiling, Editing & Publishing

No. 200

Ch. Srinivasa Rao, Formerly COA, NGRI, Hyderabad

Review

B.J. Acharyulu, Head, Finance & Accounts, CDFD, Hyderabad

Secretarial assistance

D. Shanmuga Sundar, Jr. Steno., NGRI, Hyderabad

---------------------------------------------------------------------------------------------------------------GoI Orders reproduced in "HARMONY" which are yet get the CSIR endorsement may be applicable to Council employees to a larger extent unless otherwise objected. The opinions expressed or inferences drawn in the material published in HARMONY do not necessarily reflect the views of Editor nor CSIR/Swamy Publishers shall take any responsibility whatsoever for any inaccuracies or claims. Material published in HARMONY can be used for academic purpose with due acknowledgement. Articles on Service issues, Management, Behavioural attitude and related issues are welcome through E-mail or other means. HARMONY is transmitted through E-mail. Send your E-mail i.d. to harmony_csir@yahoo.co.in Residence: 91-9490462583

Please don't print this unless you really need to. Save Trees..

DOWN THE MEMORY LANE

HARMONY is 200 Issues young

It is still fresh in my memory, the day on which the HARMONY was launched over a good gathering on 1st January, 1993 by Dr. A.V. Rama Rao, the then Director, IICT, Hyderabad who not only created a conducive atmosphere but also provided for its sustenance. His st Foreword to the first issue of HARMONY on 1 January, 1993 makes us appreciate his foresightedness and vision. His observations are applicable even to this day, as they were way back in 1993. For the information of our esteemed readers, the Foreword is reproduced hereunder:

FOREWORD

Of late, there has been a tremendous information explosion on administrative functions. The very shape of administration compared to pre-independence era and subsequent decades had changed a lot. I have also been observing that the approach of administrators towards their functions has remarkably changed. It is conspicuous that the approach of administrators towards their personnel is becoming more and more positive. The atmosphere and the working conditions are becoming more conducive now than they used to be. In comparison with a Government Departments, Autonomous Bodies like CSIR, do enjoy certain amount of independence and have the necessary flexibility in its thinking and approach. Still many more things can be done to make the environment more congenial for a serious Scientist in the interest of research.

There is a good potential for running a Bulletin on service matters. While there appears to be no paucity of funds for such activity, we have been getting bogged down with the day-to-day administration. Even though CSIR HQs., have been conducting certain training courses for the new entrants, not many staff members are being exposed to such training. I consider the IICT House Bulletin "HARMONY" in itself is making a good start; however small in its stride may be. The aims and objectives are quite appropriate to the needs of the day and I am sure it would encompass the official activities of all the administrative staff and also attract talent. I would agree that imparting training to each and everyone in the House-keeping sections is a Herculean task. This medium is expected to fulfill that requirement at least to some extent. I am sure that the staff members of IICT and its sister Labs./Instts. will make this communication successful with their continued support and participation to their advantage. I assure my support to any such activity. My good wishes on this occasion.

Dec. 31, 1992

- Dr. A.V. Rama Rao

.o.

CSIR/GOI ORDERS

APPOINTMENT OF VICE-PRESIDENT, CSIR In pursuance of the proviso to Rule 3 (b) of the Rules & Regulations of CSIR, Shri Vilasrao Deshmukh, Minister of Science & Technology shall be the Ex Officio Vice-President of CSIR. Shri Deshmukh assumed the charge of his Office w.e.f. 12-7-2011. [CSIR O.M.No.1/2(1)/2011-PD dt. 22-7-2011]

NEW PENSION SCHEME A copy of Lr. No. AS/KV/RS/RP/201122217 dated 8-7-2011 regarding Subscribers Contribution File (SCF) pending for matching & Booking as received from the National Securities Depository Limited, Central Record- Keeping Agency, Mumbai was endorsed to all the CSIR Labs./Instts. for necessary action. The contents of the letter being: The Trustee Bank (TB) has reported discrepancy/not confirmed receipt of funds for the said SCFs and hence the Subscribers Individual Retirement Accounts have not been credited. As informed by the TB, it is not in a position to confirm the funds credited in the NPS Trust as the PAO registration number and the Transaction I.D. have not been provided at the time of remittance of funds or the discrepancy observed in the details of funds transfer in the Fund Transfer details window of NPSCAN. You are required to take necessary steps to enable the TB to confirm the receipt of funds. Along with the regular views and reports Dashboard is also made available in the CRA system to provide extensive and comprehensive information on status of SCFs uploaded, Subscribers Credit Analysis, Exceptional Reports, etc., CRA system site (www.cra-nsdl.com) can logged on through PrAO User ID and password and monitor the status of SCFs uploaded.

The following procedure needs to be followed while remitting the funds after uploading the SCF: * In case the funds are transferred by cheque: To submit the Contribution Submission Form generated from CRA system along with the cheque to the Trust Bank. In case the funds are transferred by RTGS/NEFT: To instruct the remitting Bank (Accredited Bank of your PAO) to write PAOFIN and quote the PAO Registration number and Transaction ID in field 7495 (Origination of remittance) of NEFT Message. The remitting bank should not put any space between the details. Provide the details of the fund transfer in the Fund Transfer Details window in NPSCAN. In case the SCF does not get Matched & Booked within 5 working days from the day the fund transfer details are provided, Bank of India at 022-2652 2975/976 maybe contacted to enable TB to confirm receipt of funds.

Further clarification can be had from Ms. Rashmi Sabbarwar (022-2499 4887 -- email id rashmis@nsdl.co.in) or Ms. Reena Pokle (022-2499 4730 -- email id reenap@nsdl.co.in) All the Labs./Instts. are required to send their follow up action report by 16-8-2011 to the FA, CSIR. [CSIR Lr. No.34-2(5)/CSIR-NPS/2011-12 dt. 27-7-2011; NSDL CRA Lr. No.AS/KV/RS/RP/201122217 dt. 8-7-2011]

ENCASHMENT OF LEAVE ON ABSORPTION IN CSIR With a view to clarify the queries raised by certain CSIR Labs./Instts. as to whether the Central/State Govt. employees absorbed in CSIR after issue of GOI, MOPPG&P, DOP&PW O.M.No.4(12)/85-PPW dated 31-3-1987 are entitled to encashment of Earned Leave up to the maximum limit prescribed from time to time for the service rendered in CSIR, the following is conveyed by CSIR.

The Department of Pension & Pensioners Welfare, GoI had clarified that all Govt. servants who have been absorbed in a Central Autonomous Body on or after 31-3-1987 re governed by the same terms and conditions of absorption as are applicable to Govt. servants on absorption in a Central Public Sector Undertaking. Accordingly, the quantum of leave encashment that has been received by an employee on absorption in a Central Autonomous Body/ PSU is not required to be linked with the leave encashment payable by the Autonomous Body/PSU on retirement of the absorbed employee. The encashment of Earned Leave to such employees as admissible under leave rules on their retirement from the Council service shall be in addition to the benefit of leave encashment already availed by them from their previous Govt. Departments. [CSIR No.34-1(1)/CSIR/Pen/2011-12 dt. 2-8-2011; GOI, MOPPG&P, DOP&PW O.M. No.4(12)/85-PPW dt. 31-3-1987; CSIR U.O No.4/75/90P&PW(D) dt. 3-12-1990; No. 7(19)/32/90-E.III dt. 16-9-1997 and ID No.14028/1/2006-Estt.I dt. 31-8-2006]

FORWARDING APPLICATIONS OF SECTIONS OFFICERS RECRUITED UNDER CASE: 2009-II The competent authority, CSIR has decided that applications of Section Officers who were recruited under Common Administrative Services Examination: 2009-II to outside posts cannot be forwarded during their probation period. [CSIR Lr.No.3-8(08)/15-2011.E.I dt. 5-8-2011]

FORWARDING OF APPLICATIONS FOR DEPUTATION AND RELIEF OF EMPLOYEES It is clarified that the Instructions communicated under CSIR letter No.5-1(50)/2008-PD dated 12-4-2010 on the above subject are not applicable to Common Cadre Officers. The applications of such Officers for outside posts would continue to be forwarded to borrowing organization through CSIR HQs. It may be that in case of selection to the post to outside departments on deputation basis for which

applications is forwarded, the Officer shall be relieved subject to exigencies of work where the concerned Officer is posted and with the approval of the competent authority at CSIR HQs. Further, the competent authority has decided to set a limit on the number of Officers who will be allowed to proceed on deputation to 10% of the filled up position of the respective cadre. [CSIR Lr.No.5-1(50)/2008-PD dt. 10-8-2011]

CSIR FOUNDATION DAY CELEBRATIONS As before, the CSIR Foundation Day Celebrations are planned. Besides holding usual programmes, and presentation of Mementoes on completing 25 years of service and also the retirees including those who retired voluntarily after 30 years of service, Shawls, Samman Patras; Studentship Awards to those children of staff members who join Professional Courses; Cash awards (upwardly revised) to the children of CSIR employees who secured 90% or above in each of minimum three Science subjects in the Sr. Secondary Examination (12th Class); separate cash award to the children of CSIR employees who had secured 100% marks in any Science subject in 2011, etc. [CSIR Lr.No.6-9(150)/2011-E.III dt. 18-8-2011]

NON-PRACTISING ALLOWANCE TO VETERINARY POSTS The Director-General, CSIR as Chairman, Governing Body, and with the concurrence of MOF, DOE has approved the grant of benefit of Non-Practicing Allowance (NPA) @ rate of 25% of the Basic Pay, subject to the condition that the BP + NPA does not exceed Rs.85,000/- w.e.f. the date of drawal of revised pay scales to all Gr. III employees working in Animal Houses of CSIR Labs./Instts., and possessing the qualification of B.V.Sc. & A.H. with registration in the Veterinary Council of India in accordance with DOPT O.M. F.No.7(19)/2008-E.III(A) dated 30-8-2008. The NPA will be treated as pay for the purpose of computing DA, entitlement of Travelling Allowance and other allowances as well as for calculation of retirement benefits.

[CSIR Lr.No.5-1(20)/2008-PD dt. 19-8-2011]

RESTRUCTURING OF CENTRAL OFFICE OF CSIR HQS. In order to streamline the functioning of the Central Office, CSIR HQs., the competent authority has decided as follows: 1. Shri R.K. Sharma, Sr. Dy. Secretary who is designated as the Sr. Controller of Administration, will be assisted by the Controller of Finance & Accounts/Finance & Accounts Officer and Controller of Stores & Purchase Officer/Stores & Purchase Officer and supported by an optimum number of subordinate staff. The duties and responsibilities will inter alia include Establishment, Financial and Stores & Purchase matters of CSIR HQs. and also include Engineering & Maintenance work including that of CSIR Guest Houses, procurement and maintenance of vehicles, Securityrelated matters, etc. Shri Sharma will be vested with such financial powers as are delegated to an Officer of similar status in CSIR Labs./Instts. The Central Office will be accommodated at a single floor in order to have better supervision and coordination among different functionaries.

2.

3.

4.

[CSIR Lr.No.5-1(115)/2011-PD dt. 16-8-2011] CLARIFICATIONS ON CHILDREN EDUCATION ALLOWANCE The following clarifications have been provided under CEA: 1. Reimbursement of Children Education Allowance (CEA) is admissible beyond two children due to failure of sterilization operation only for the first child born after failure of operation. A Govt. servant is allowed to get 50% of the total amount subject to the overall annual ceiling in the first quarter and the remaining amount in third and fourth quarter. Front-loading of the entire

2.

3.

amount in the first and second quarters is not allowed during the first quarter itself of the financial/academic year itself. A Govt. servant can claim full amount, subject to the annual ceiling of Rs.15,000/- in the last quarter. dt. 17-6-2011;

[GOI DOPT O.M. No. 21011/16/2009-Estt.(AL) Swamysnews, Aug. 2011, 18]

EXEMPTION FROM FURNISHING THE INCOME TAX RETURN An individual whose total income for the relevant Assessment Year does not exceed Rs.5.00 lakhs, and consists of only income chargeable to Income Tax under the following Heads are exempt from furnishing the Income Tax Return: A. B. Salaries; Income from other sources By way of interest from a savings account in a bank not exceeding ten thousand rupees. The individuals referred to above have: i) reported to his employer his Permanent Account Number (PAN); reported to his employer, the income mentioned in sub-para (B) above and the employer has deducted the tax thereon; received a certificate of tax deduction in Form 16 from his employer which mentions the PAN, details of income and the tax deducted at source and deposited to the credit of the Central Govt.; discharged his total tax liability for the Assessment Year through tax deduction at source and its deposit by the employer to the Central Govt.; no claim of refund of taxes due to him for the income of the Assessment Year; and

ii)

iii)

iv)

v)

10

vi)

received salary from only one employer for the Assessment Year.

The exemption from the requirement of furnishing a return of IT shall not be available where a notice under Section 142 (1) or 148 or 153-A or 153-C of the IT Act has been issued for filing a return of income for the relevant Assessment Year. [GOI MOF Notfn. No. 36/2011/F.No.142/09/2011(TPL) dt. 23-6-2011; Swamysnews, Aug. 2011, 22-23]

ENTITLEMENT OF CGHS FACILITY It has been decided to restore CGHS facilities to serving and retired Railway Audit Staff which were withdrawn. Those retired Railway Audit Staff who have already got pensioner CGHS cards made will not be required to pay any additional contribution for the renewal of the Pensioner CGHS cards. Those retired Railway Audit Staff who were contributing on a yearly basis will be required to contribute in the rate prevailing on the date of renewal. It has also been decided that retired Divisional Accounts Officers and retired Divisional Accountants maybe issued Pensioner CGHS cards on payment of the appropriate rate of contribution for renewal/issue of pensioner CGHS cards at the rate prevailing on the date of renewal/issue. [GOI MOH O.M. No. Z.15025/93/2008-CGHS Desk-I dt. 31-5-2011; Swamysnews, Aug. 2011, 24-25]

GUIDELINES FOR DOMICILLIARY REHABILITATION MEDICINE The guidelines for domiciliary rehabilitation medical intervention for reimbursement to CGHS beneficiaries have been provided as under: Domiciliary (home-based) care is medically justified in the practice of rehabilitation medicine which involves the care of the patient with

11

chronic diseases or temporary or permanent disability or functional limitation due to lack of health. It is justified as such persons find ambulation practically impossible or are significantly dependent on care-giver or the cost of visiting the hospitals become higher than the cost of treatment given. In view of this, it would be necessary to consider providing holistic domiciliary rehabilitation medicine service instead of piece-meal homebased physiotherapy only to CGHS beneficiaries as part of their routine health coverage. The following allied health services need to be consider for domiciliary care: (i) Physiotherapy; (ii) Occupational Therapy; and (iii) Speech Therapy (for patients of stroke/head injury). The decision for the above care should be based on thorough evaluation and specific prescription including the exact intervention and frequency by a PMR Specialist. In case of non-availability, the treating Govt. Specialist having allopathic Post-graduate qualification in Ortho/ Neurology/Neurosurgery/ENT may allow such benefits following the specific prescription criteria for the following conditions: 1. Orthopaedic disorders: Post-joint replacement surgery in acute phase; Physiotherapy up to two weeks, post-discharge. Neurological disorders (for up to six weeks): i) Post-stroke: Occupational Therapy (OT), Physiotherapy (PT) and Speech Therapy (ST); Traumatic brain injury: OT, PT and ST; Gullian-Barre Syndrome: OT and PT; Spinal cord injury with significant disability/deformity: OT and PT; and Motor neuron disease: OT, PT and ST.

ii) iii) iv)

v)

12

3. Locomotor disabilities, with a disability of over 80% or those who are totally dependent on care-giver based on the opinion of two Govt. Specialists by certified care-giver. Care-giver means Rehabilitation Council of India certified personnel + Physiotherapist and Occupational therapist (duly qualified diploma/degree holder. Prescription information The prescription for home-based rehabilitation programme should include the following descriptive specifics: i) The therapy to be used: a) b) c) d) e) f) ii) iii) iv) Electrotherapy; Active Exercise Therapy; ADL Training; Speech Therapy; Gait Training, and Passive Exercises

The technical person required to institute the therapy; The frequency of the therapy required by the patient; and Duration of the therapy programme. The following rates may be reimbursed: Physiotherapist: Occupational Therapist: Speech Therapist: Certified Care-Giver: .. .. .. .. Max. of Rs.300/Max. of Rs.300/Max. of Rs.300/Max. of Rs.150/- or Rs.3,000/Per month for long term requirement, whichever is less; and

v)

No reimbursement to be allowed for the purchase/hiring of therapy equipment/devices. dt. 1-6-2011;

[GOI MOH O.M. No. S.11011/24/2011-CGHS(P) Swamysnews, Aug. 2011, 25-27]

13

RECOGNITION OF ASARFI HOSPITAL PVT. LTD., DHANBAD The Asarfi hospital Pvt. Ltd., Dhanbad has been recognised for treatment at Dhanbad under CS (MA) Rules, 1944. The schedule of charges for the treatment under the CS (MA) Rules, 1944 will be the rates fixed for CGHS, Ranchi. The approved rates are available on the CGHS Website www.mohfw.nic.in//cghs.html. [GOI MOH O.M. No.S.14021/9/2009-MS dt. 6-6-2011; Swamysnews, Aug. 2011, 27-31]

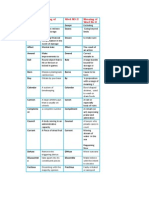

EMPANELMENT OF PRIVATE HOSPITALS UNDER CGHS, BENGALURU, CHANDIGARH, HYDERABAD, KOLKOTA, AHMEDABAD AND PUNE A list of hospitals which have qualified for short-listing for empanelment under CGHS in Bengaluru, Chandigarh, Hyderabad, Kolkata, Ahmedabad and Pune under different categories are notified: BENGALURU 1. Smiles Dental Care No.74/2, above Nagendra Medicals, 1st Floor, Nagavarapalya Main Road, C.V. Raman Nagar, Bengaluru 560 093 Dental care 2. Diagnostic Laboratory & Imaging Centre Supra Diagnostics, No.18, 5th Cross, Malleswaram Circle, Bengaluru 560 003 MRI

CHANDIGARH 1. Grover Laser Eye & ENT Hospital No.140, Sector 35-A, Chandigarh Eye care 2. Chandigarh Clinical Lab. Pvt. Ltd., SCF 9, Sector 8-C, Chandigarh Diagnostic Lab. -

14

HYDERABAD 1. Apollo Hospitals, Secunderabad General purpose including Joint replacement as a previously empanelled hospital 2. Geetha Multi-Speciality Hospital 10-1-5/C, Road No.4, West Marredpally, Secunderabad 500 026 General purpose

Super Speciality Yashoda Super-Speciality Hospital Rajbhawan Road, Somajiguda, Hyderabad 500 082 Super-speciality Super Speciality (Selective) Care Hospital H.No.1-4-908/7/1, Opp: Raja Deluxe Theatre Musheerabad, Hyderabad Cardiology and cardiothoracic surgery Diagnostic Lab. & Intensive Care Medwin Diagnostics of Medwin Hospitals 100, Raghava Ratna Towers, Chirag Ali Lane, Hyderabad 500001 Diagnostic Lab. KOLKATA Susrut Eye Foundation & Research Centre Eye care AHMEDABAD Shalby Hospitals Opp: Karnavati Club, S.G. Road, Ahmedabad 380 015 General purpose including cardiology and cardiothoracic surgery PUNE 1. Jehangir Hospital 32, Sassoon Road, Pune 411 001 General purpose

15

2.

Sadhu Vaswani Missions Medical Complex Inlaks and Budhrani Hospital, M.N. Budhrani Cancer Institute 7-9,Koregaon Park, Pune 411 001 General purpose Ranka Hospital Mukundnagar, Pune Orthopaedics National Institute of Opthalmology 187/30, Shivaji Nagar, Pune Eye care

3.

4.

[GOI MOH O.M.No.S.110011/23/2009-CGHS-D.II/Hospital Cell (Part IX) dt. 10-6-2011; Swamysnews, Aug. 2011, 32-34]

RECOGNITION OF WESTFORT HI-TECH. HOSPITAL LTD., THRISSUR The Westfort Hi-Tech Hospital Ltd., Thrissur has been recognised for treatment at Thrissur under CS (MA) Rules, 1944. The schedule of charges for the treatment of CG employees and the members of their family under the CS (MA) Rules, 1944 will be the rates fixed for CGHS, Thiruvananthapuram. The approved rates are available on the CGHS Website www.mohfw.nic.in//cghs.html. [GOI MOH O.M. No.S.14021/11/2009-MS dt. 16-6-2011; Swamysnews, Aug. 2011, 34-38]

RECOGNITION OF GOYAL HOSPITAL & RESEARCH CENTRE (P) LTD., JODHPUR The Goyal Hospital & Research Centre (P) Ltd. has been recognised for treatment at Jodhpur under CS (MA) Rules, 1944. The schedule of charges for the treatment of CG employees and the members of their family under the CS (MA) Rules, 1944 will be the

16

rates fixed for CGHS, Jaipur. The approved rates are available on the CGHS Website www.mohfw.nic.in//cghs.html. [GOI MOH O.M.No.S.14021/37/2003-MS dt. 16-6-2011; Swamysnews, Aug. 2011, 38-43]

EMPANELMENT OF EXCLUSIVE CANCER HOSPITALS/ UNITS, DELHI The CGHS had initiated action for fresh empanelment of Exclusive Private Cancer Hospitals/Units under CGHS, Delhi as detailed hereunder. The rates of Tata Memorial Hospital, Mumbai (2009) as mentioned under B category for Cancer surgical procedures are treated at CGHS rates are or treatment in Semi-private ward with 10% decrease for General Ward and 15% enhancement for Private ward entitled patients. The duration of treatment for different categories of surgery will be: Category I Category II 1-2 days 3-5 days (7-10 days in respect of operations involving abdominal/thoracic cavity) 14 days

Category III, IV & V

The Super-speciality rates of CGHS Delhi for Cancer Radiotherapy and Chemotherapy shall be applicable as per CGHS rates. Chemotherapy medicines shall be procured from CGHS wherever feasible, and as per available brand. In case, medicines are supplied by hospital, they shall provide on credit to pensioners and shall offer a discount of 10% on MRP. Consultation fee shall be as per CGHS rates for NABH Accredited hospitals. Accommodation charges are as follows: General ward Semi-private ward Private ward Rs.1000/- per day Rs.2000/- per day Rs.3000/- per day

17

No additional charge on account of extended period of stay shall be allowed, if that extension is due to infection on the consequences of surgical procedure or due to any other improper procedure, and is not justified. The CGHS beneficiaries taking treatment will be entitled for reimbursement of treatment on credit as per the package rates. The rates are for semi-private ward. If the beneficiary is entitled for General ward, there will be a decrease of 10% in the rates; for private Ward entitlement there will be an increase of15%. The rates shall be same for investigation irrespective of entitlement whether the patients admitted or not and the test per se does not require admission to hospital.

S.No. Name and address of the Cancer Hospital/Unit 1. SMH Curie Cancer Centre Shanti Mukund Hospital, 2, Institutional Area, Vikas Marg Extension, Karkardooma, Delhi Max Super Speciality Hospital 108-A, Indraprastha Extension, Patparganj, Delhi Max Super Speciality Hospital East Block, 2, Press Enclave Road, Saket, New Delhi Action Cancer Hospital H-2/FC-34, A-4 Paschim Vihar, New Delhi Dr. B.L. Kapur Memorial Hospital Pusa Road, New Delhi Batra Hospital & Medical Research Centre 1, Tughlakabad Institutional Area, Mehrauli Badarpur Road, New Delhi Metro Hospital & Cancer Institute 21, Community Centre, Preet Vihar, Delhi Moolchand Hospital Lajpat Nagar III, New Delhi Rajiv Gandhi Cancer Institute & Research Centre D-18, Sector-V, Rohini, New Delhi Dharamshila Cancer Hospital Dharamshila Marg, Vasundhara Enclave, Delhi

Whether NABH accredited No

2.

Yes

3.

Yes

4. 5. 6.

No Yes Yes

7. 8 9. 10.

Yes Yes No Yes

18

[GOI MOH O.M.No.REC-I/2008/JD(Gr.)/CGHS/CGHS(P) dt. 23-6-2011; Swamysnews, Aug. 2011, 43-48]

AMENDMENT TO RTI ACT In the Sub-Section (2) of Second Schedule to the Right to Information Act, 2005, the following organizations have been exempted from the operation of RTI Act, except in respect of information in cases pertaining to the allegations of corruption and human rights violation: i) ii) iii) Central Bureau of Investigation National Investigation Agency National Intelligence Grid

[GOI DOPT Notfn.No.1/3/2011-IR dt. 9-6-2011; Swamysnews, Aug. 2011, 55]

INCOME CEILING FOR GRANT OF MEDICAL FACILITIES IN RAILWAYS It has been decided that a dependent relative in relation to a Railway servant as defined in para 601 (6) of the Indian Railways Medical Manual, 2000 shall be considered eligible for entitlement of Medical facilities, if his/her income does not exceed minimum pension/family pension, i.e. Rs.3,500/- and Dearness Relief thereon or 15% of the basic pay of the Railway Servant, whichever is more. [GOI Rly. Bd. Lr.No.2-10/H-1/2/21 dt. 7-6-2011; 2011, 61] Swamysnews, Aug.

ENTITLEMENT OF HRA AT NEW STATION OF POSTING An Officer, on transfer, would be entitled to get HRA at the new station of posting up to a period of 8 months from the date of his transfer while retaining the Govt. accommodation at the old station, irrespective of his marital status.

19

[Swamysnews, Aug. 2011, 100-101]

REGULATION OF INCREMENT WHEN HOLIDAYS ARE SUFFIXED TO LEAVE An increment falling due on leave is to be drawn only from the date of resumption of duty on return from leave. But when holidays are suffixed to leave, the leave is to be treated as having terminated on the day on which the leave would have ended, if holidays had not been suffixed vide Rule 22 (3) (b) in Swamys Compilation of FR & SR, Part III, Leave Rules. [Swamysnews, Aug. 2011, 102]

.o.

NEWS & VIEWS

Thanks for the unfailing effort. I keep on waiting for the Newsletter as it has a selfless enterprise attached to it. The information provided keeps us updated and connected. We cherish and value the same. - Dr. A.K. Raina, Scientist, CIMFRI, Dhanbad

20

VIGILANCE CLEARANCE -- AN ENIGMA OR A SIMPLICITOR ?

Ch. Srinivasa Rao Founder-Editor, HARMONY Formerly COA, NGRI Hyderabad

The basic tenets enunciated by the policy formulators through statutes, acts, executive instructions on issue of Vigilance Clearance in respect of public servants are crystal clear. There is no scope to doodle around. These are well established and were further strengthened by the decisions of the Honble Supreme Court on various occasions. It goes without saying that no one is superior to the Supreme Court unless it is otherwise decided by the Parliament through a valid procedure. Sometimes, the Officers who are dealing with such subjects fail to apply their mind. Any interpretation without a human face would be worthless and ultimately makes such perpetrators pay dearly .

Introduction Any public action which is not governed by a set procedure and which is against the public good is considered to be a violation. The procedure to consider, investigate, and fix responsibility against erring Officials is explained through the Central Civil Services (Classification, Control & Appeal) Rules, 1965. These practices and procedures are well established, time-tested for their road-worthiness. An attempt is made hereunder to explain the procedure for issue of Vigilance Clearance to Council servants for various purposes. Each purpose has to be weighed carefully before according or denying

21

Vigilance Clearance. It is not proposed to delve upon other related issues with a view to accord due importance to the subject matter. What is Vigilance ? Vigilance in the context of any organisation would mean keeping a watchful eye on the activities of the officers and officials of the unit to ensure integrity of personnel in their official transactions. Vigilance, in other words, is to ensure clean and prompt Administrative action toward achieving efficiency and effectiveness of the employees in particular and the organisation in general, as lack of Vigilance leads to waste, losses and economic decline. What is Vigilance Angle ? Vigilance angle is obvious in the following acts: i) Demanding and/or accepting gratification other than legal remuneration in respect of an Official act or for using his influence with any other Official. Obtaining valuable thing, without consideration or with inadequate consideration from a person with whom he has or likely to have official dealings or his subordinates have official dealings or where he can exert influence Obtaining for himself or for any other person any valuable thing or pecuniary advantage by corrupt or illegal means or by abusing his position as a public servant Possession of assets disproportionate to his known sources of income Cases of misappropriation, forgery or cheating or other similar criminal offences.

ii)

iii)

iv)

v)

Besides the above, the following shall have to be considered before issuing Vigilance Clearance: i) commission of criminal offences like demand and acceptance of illegal gratification, possession of disproportionate assets,

22

forgery, cheating, abuse of official position with a view to obtain pecuniary advantage for self or for any other person; or ii) irregularities reflecting adversely on the integrity of the public servant; lapses involving any of the following: a) b) c) gross negligence; recklessness; failure to report to competent authorities, exercise of discretion/ powers without or in excess of powers/jurisdiction; cause of undue loss or a concomitant gain to an individual or a set of individuals/a party or parties; and Flagrant violation of systems and procedures.

iii)

d) e)

Guidelines for issue of Vigilance Clearance The Guidelines regarding issue of Vigilance Clearance to those belonging to the Central Civil Services/Posts were issued by the Department of Personnel Training, Govt. of India vide its O.M. No.11012/11/2007-Estt.(A) dt. 14-12-2007 which were duly endorsed by CSIR vide its letters No.15-6(82)/98-O&M-II dt. 19-3-2008 and 17-6-2008. These Orders shall be applicable to (a) empanelment (b) any deputation for which clearance is necessary, and (c) appointments to sensitive posts and assignments to training programmes (except mandatory training). Vigilance Clearance shall not be withheld under the following circumstances: i) due to the filing of a complaint, unless it is established on the basis of at least a preliminary inquiry or on the basis of any information that the concerned Department may already have in its possession, that there is prima facie, substance to verifiable allegations regarding (i) corruption, (ii) possession of assets disproportionate to known sources of income (iii) moral turpitude (iv) violation of the CCS (Conduct) Rules, 1964;

23

ii)

if a preliminary inquiry mentioned above takes more than three months to be completed; unless: a) b) the Officer is under suspension, a charge sheet has been issued against the Officer in a disciplinary proceeding and the proceeding is pending orders for instituting disciplinary proceeding against the Officer have been issued by the Disciplinary Authority, provided that the charge sheet served within three months from the date of passing such order charge sheet has been filed in a Court by an Investigating Agency in a criminal case and the case is pending orders for instituting a criminal case against an Officer have been issued by the Disciplinary Authority, provided that the charge sheet is served within three months from the date of initiating proceedings sanction of investigation or prosecution has been granted by the competent authority in a case under the Penal Code Act or any other criminal matter an FIR has been filed or a case registered by the concerned Department against the Officer, provided that the charge sheet is served within three months from the date of filing/registering the FIR/case; and the Officer is involved in a trap/raid case on charges of corruption and investigation is pending;

c)

d)

e)

f)

g)

h)

iv)

Vigilance Clearance shall not be withheld due to an FIR filed on the basis of a private complaint unless a charge sheet has been filed by the Investigating Agency, provided that there are no directions to the contrary by a competent Court of Law; and Vigilance Clearance shall not be withheld even after sanction for prosecution, if the Investigating Agency has not been able to complete its investigations and file charges within a period of two

v)

24

years. However, such Vigilance Clearance will entitle the Officer to be considered only to be appointed to non-sensitive posts and premature repatriation to the parent cadre in case he is on deputation and not for any other dispensation listed in para 1 above. In cases where complaints have been referred to the Administrative Authority concerned and no substantive response has been received from such an authority within three months from the date on which the reference was made, the Disciplinary Authority may provide a copy of the complaint to the Officer concerned to seek his comments. If the comments are found to be prima facie satisfactory by the competent authority, Vigilance Clearance shall be accorded. Vigilance Clearance shall be decided on a case-by-case basis by the competent authority keeping in view the sensitivity of the purpose, the gravity of the charges and the facts and circumstances in the following situations: i) where the investigating agency has found no substance in the allegation but the Court refuses to permit closure of the FIR, and where the investigating agency/Inquiry Officer holds the charges as proved but the competent administrative authority differs, or the converse.

ii)

While considering cases for grant of Vigilance Clearance for the purpose of empanelment of members of the Central Civil Services/Posts of a particular batch, the Vigilance Clearance/status will continue to be ascertained from the respective Cadre Authority. In all such cases, the comments of the CVC will be obtained. However, if no comments are received within a period of three months, it will be presumed that there is nothing adverse against the Officer on the records of the body concerned. Vigilance Clearance will be issued in all cases with the approval of the Head of Vigilance Division for Officers up to one level below their seniority in service. In the case of Officers of the level of Addl. Secretary/Secretary, this will be issued with the approval of the Secretary. In case of doubt, orders of the Secretary will be obtained

25

keeping in view the purpose for which the Vigilance Clearance is required by the indenting authority. Vigilance Clearance in r/o promotion The procedure to be followed in promotion of a Council servant against whom disciplinary proceedings are pending or whose conduct is under investigation is well-established. A Council servant who is recommended for promotion by the DPC but in whose case any of the following circumstances: i) ii) Govt. servants under suspension; Govt. servants in r/o whom a charge sheet has been issued and the disciplinary proceedings are pending; and Govt. servants in r/o whom prosecution for a criminal charge is pending

iii)

arise after the recommendations of the DPC are received but before he is actually promoted will be considered as if his case had been placed in a sealed cover by the DPC. He shall not be promoted until he is completely exonerated of the charges against him and the provisions contained in O.M. dated 14-9-1992 will be applicable in his case also. Vigilance status is sought before considering the eligible Officers for promotion. Subsequently the promotion orders are issued subject to Vigilance Clearance. The process between consideration of names for promotion and issue of order of promotion takes some time. During the interim period, there may be instances in which disciplinary proceedings may be initiated or there may be some other developments after the vigilance status had been informed. Though, even after issuance of the order of promotion, it is requested to relieve the Officer concerned only if he is clear from vigilance angle. When to deny Vigilance Clearance Absence of vigilance angle in various acts of omission and commission does not mean that the concerned Official is not liable to face consequences of his actions. All such lapses not attracting vigilance

26

angle would indeed have to be dealt with appropriately as per the disciplinary procedure. Cases falling in the specified categories, along with those of Officers who are undergoing a penalty when the clearance is sought, are the ones which require Vigilance Clearance to be withheld, such as: i) ii) Govt. servants under suspension Govt. servants in respect of whom disciplinary proceedings are pending or a decision has been taken to initiate disciplinary proceedings. Govt. servants in respect of whom prosecution for a criminal charge is pending or sanction for prosecution has been issued or a decision has been taken to accord sanction for prosecution. Govt. servants against whom an investigation, serious allegation of corruption, bribery or similar grave misconduct is in progress either by the CBI or by any other agency, departments or otherwise.

iii)

iv)

Vigilance Clearance will not be accorded to employees who are undergoing a penalty imposed by a Disciplinary Authority or sentence ordered by a court of law. In cases where the employee has been placed under suspension, is being prosecuted or has been issued with a charge sheet, the Chief Vigilance Officer is to withhold Vigilance Clearance informing the competent authority about the circumstances that are applicable to the employee concerned. Analyzing the issues In case of irregularities where circumstances prevailing then and also the circumstantial evidence will have to be weighed carefully to take a view whether the Officers integrity is in doubt. Gross or willful negligence; recklessness in decision making; blatant violations of systems and procedures; exercise of discretion in excess, where no ostensible public interest is evident; failure to keep the controlling

27

authority/superiors informed in time these are some of the irregularities where the disciplinary authority with the help of the CVO should carefully study the case and weigh the circumstances to come to a conclusion whether there is reasonable ground to doubt the integrity of the Officer concerned. However, pending investigation or inclusion in Agreed List/List of Officers of Doubtful Integrity will not bar the CVO to accord unqualified Vigilance Clearance to such employees. Any delay resulting in issue of Vigilance Clearance to the Council servant shall be construed as a deliberate attempt to derive undue and unintended advantage from the ruling of the Honble Supreme Court. This is for strict compliance by all CVOs.

References 1. Honble Supreme Court ruling in K.V. Janakiraman (AIR 1991 SC 2010) a case in UOI vs.

2.

CSIR Lr. No.15-1(60)/81-Vig.(Vol.II) dt. 20-5-2002; CVC Lr. No. 3S/ DSP/1 dt. 28-3-2002 CSIR Lr. No. 15-6(82)/98-O&M dt. 22-11-2004; GOI MPPG&P DOPT O.M. No. 22012/1/99-Estt(D) dt. 25-10-2004; Vigilance Manual Vol. I (Sixth Edn., 2005), Central Vigilance Commission, New Delhi Vigilance Book, Central Vigilance Commission, New Delhi GOI DOPT O.M. No. 109/2/2006-AVD.I Swamysnews, Feb. 2008, 31-32 dt. 10-10-2007;

3.

5. 6.

7.

CSIR Lrs. No.15-6(82)/98-O&M-II dt. 19-3-2008 & 17-6-2008; GOI DOPT O.M. No.11012/11/2007-Estt.(A) dt. 14-12-2007; Swamysnews, Feb. 2008, 37-39 .o.

Você também pode gostar

- Harmony 1111Documento36 páginasHarmony 1111arvind-khanna-2954Ainda não há avaliações

- TOR Sajjad PDFDocumento3 páginasTOR Sajjad PDFSajjad SiddiqueAinda não há avaliações

- Recruitment Procedure 3.1 Classification of PostsDocumento20 páginasRecruitment Procedure 3.1 Classification of PostsvivektripathimbaAinda não há avaliações

- Cadre Review ReportDocumento14 páginasCadre Review ReportvadrevusriAinda não há avaliações

- Accounting Handbook For Regional Controllers PDFDocumento66 páginasAccounting Handbook For Regional Controllers PDFAntara DeyAinda não há avaliações

- Empanelment of Retired Government Officers As Inquiry Officers For Conducting Departmental InquiriesDocumento3 páginasEmpanelment of Retired Government Officers As Inquiry Officers For Conducting Departmental InquiriesYahooAinda não há avaliações

- Central Electricity Regulatory CommissionDocumento11 páginasCentral Electricity Regulatory CommissionPt Akash SharmaAinda não há avaliações

- LIC of India - Financial Service Executive Recruitment Notification 2013Documento7 páginasLIC of India - Financial Service Executive Recruitment Notification 2013GN ReddyAinda não há avaliações

- Director (Finance), Hindustan Newsprint Limited (HNL) : 29 July, 2011Documento5 páginasDirector (Finance), Hindustan Newsprint Limited (HNL) : 29 July, 2011pdjayasAinda não há avaliações

- PESB vacancy for Member (Finance) in Damodar Valley CorporationDocumento4 páginasPESB vacancy for Member (Finance) in Damodar Valley CorporationAshok AAinda não há avaliações

- NCDRC Vacancy CircularDocumento4 páginasNCDRC Vacancy CircularNila TravelsAinda não há avaliações

- KribhcoDocumento18 páginasKribhcoNutush MishraAinda não há avaliações

- Vacancy CircularDocumento3 páginasVacancy CircularRitik Ranjan NayakAinda não há avaliações

- DLF Ar 201112Documento204 páginasDLF Ar 201112mayank1_vermaAinda não há avaliações

- Annual Report 2011: Swaraj Engines LimitedDocumento47 páginasAnnual Report 2011: Swaraj Engines Limitedsubodh_purohit7258Ainda não há avaliações

- Cbec HR ManualDocumento158 páginasCbec HR Manualsatish kumarAinda não há avaliações

- GOs & Circular 2009Documento319 páginasGOs & Circular 2009kalkibook100% (1)

- Andhra Pradesh Government Guidelines on Employee TransfersDocumento4 páginasAndhra Pradesh Government Guidelines on Employee TransfersAE videosAinda não há avaliações

- SPB Annual Report 2011 - 2012Documento47 páginasSPB Annual Report 2011 - 2012Palanivelu ThangavelAinda não há avaliações

- Income-tax-Recruitment-2024Documento3 páginasIncome-tax-Recruitment-2024ramnath86Ainda não há avaliações

- Filling Up The One Post of Registrar Appellate Tribunal 11-7-23Documento15 páginasFilling Up The One Post of Registrar Appellate Tribunal 11-7-23Khushal ChoudharyAinda não há avaliações

- Gap Analysis of Queuing System of ABC CompanyDocumento13 páginasGap Analysis of Queuing System of ABC CompanyTracy AdraAinda não há avaliações

- 1il !FFTN Ti'I: D.O. No. 33/2019-Eq (MM.!!) Dated: I2December, 2018Documento19 páginas1il !FFTN Ti'I: D.O. No. 33/2019-Eq (MM.!!) Dated: I2December, 2018smAinda não há avaliações

- Hand Book For Personnel Officers (2013)Documento401 páginasHand Book For Personnel Officers (2013)Sandeep Rana100% (1)

- BBBGGGDocumento8 páginasBBBGGGMerritta RakeshAinda não há avaliações

- Government Accounting 2018 Questions AnswersDocumento158 páginasGovernment Accounting 2018 Questions AnswersElea Morata100% (1)

- Proposal - Payroll Outsourcing Services: Romainor Consulting (002133250-K)Documento11 páginasProposal - Payroll Outsourcing Services: Romainor Consulting (002133250-K)HR100% (1)

- Minutes of Meeting With HRD CbecDocumento12 páginasMinutes of Meeting With HRD CbecVigneshwar Raju PrathikantamAinda não há avaliações

- Advertisement No.: IPPB/CO/HR/RECT./2023-24/04Documento5 páginasAdvertisement No.: IPPB/CO/HR/RECT./2023-24/04P S ShahilAinda não há avaliações

- Indian Statistical Institute 203 B.T. Road, Kolkata - 108: (An Autonomous Institute Under Mospi, Government of India)Documento4 páginasIndian Statistical Institute 203 B.T. Road, Kolkata - 108: (An Autonomous Institute Under Mospi, Government of India)Abhishekhar BoseAinda não há avaliações

- Leave Policy English PDFDocumento20 páginasLeave Policy English PDFdopvisionAinda não há avaliações

- SME Smart ScoreDocumento35 páginasSME Smart Scoremevrick_guyAinda não há avaliações

- AAO On Deputation - 09.12.2022Documento4 páginasAAO On Deputation - 09.12.2022Vivek paswanAinda não há avaliações

- HRM Revised Manual 2011 12Documento1.078 páginasHRM Revised Manual 2011 12Ajay Gupta50% (4)

- Project Policy 2018Documento13 páginasProject Policy 2018ibrahim khan100% (6)

- Summer Training Project On FinanceDocumento62 páginasSummer Training Project On FinanceGholap SachinAinda não há avaliações

- I. Name of The Post: Finance OfficerDocumento4 páginasI. Name of The Post: Finance Officergalib raoAinda não há avaliações

- NLLLL: CommissionDocumento9 páginasNLLLL: CommissionYusefAinda não há avaliações

- Group B de Pu 13052014Documento3 páginasGroup B de Pu 13052014Dok MiAinda não há avaliações

- NTRO Recruitment for Accounts and Audit PositionsDocumento8 páginasNTRO Recruitment for Accounts and Audit PositionsKiran RaniAinda não há avaliações

- Letter by SG To Member (P&V)Documento8 páginasLetter by SG To Member (P&V)hydexcustAinda não há avaliações

- Go.22 Da Arrears of CPS Account in CashDocumento4 páginasGo.22 Da Arrears of CPS Account in CashVenkatadurgaprasad GopamAinda não há avaliações

- Incentive QualificationDocumento4 páginasIncentive QualificationMani Kumar SarvepalliAinda não há avaliações

- RKTZR WET: Employees' Provident Fund OrganisationDocumento6 páginasRKTZR WET: Employees' Provident Fund Organisationswan4uAinda não há avaliações

- SEBI Amends ICDR Regulations to Ease Rights Issue ProcessDocumento48 páginasSEBI Amends ICDR Regulations to Ease Rights Issue ProcessDinesh GadkariAinda não há avaliações

- NTPC Recruitment PolicyDocumento36 páginasNTPC Recruitment PolicypctmtstAinda não há avaliações

- Cash Handling AllowanceDocumento3 páginasCash Handling AllowanceJennifer RaiAinda não há avaliações

- JLM 2014 Notification Dt. 28.02 - 2Documento18 páginasJLM 2014 Notification Dt. 28.02 - 2PERFECTPARDHUAinda não há avaliações

- Cadre Review AdministrationDocumento157 páginasCadre Review AdministrationRashid AbbasAinda não há avaliações

- NSDL Handbook Provides Guidance on Business Partners and Depository OperationsDocumento55 páginasNSDL Handbook Provides Guidance on Business Partners and Depository OperationsmhussainAinda não há avaliações

- AP Meat DevelopmetDocumento26 páginasAP Meat Developmetahmed02_99Ainda não há avaliações

- Case Studies in Not-for-Profit Accounting and AuditingNo EverandCase Studies in Not-for-Profit Accounting and AuditingAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionAinda não há avaliações

- Statement of Cash Flows: Preparation, Presentation, and UseNo EverandStatement of Cash Flows: Preparation, Presentation, and UseAinda não há avaliações

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionAinda não há avaliações

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018No EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Ainda não há avaliações

- 6th Central Pay Commission Salary CalculatorDocumento15 páginas6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Confusing WordsDocumento2 páginasConfusing WordsmbasgroupAinda não há avaliações

- ReceiptDocumento24 páginasReceiptmbasgroupAinda não há avaliações

- Conflict PDFDocumento7 páginasConflict PDFArif KhanAinda não há avaliações

- PetitionForChangeofRegisteredNameDueToMarriage eDocumento2 páginasPetitionForChangeofRegisteredNameDueToMarriage esherwinAinda não há avaliações

- Schutt Paginile 53 87Documento36 páginasSchutt Paginile 53 87Roxana UngureanuAinda não há avaliações

- People vs. Baltazar, G.R. No. 129933, Feb. 26, 2001Documento6 páginasPeople vs. Baltazar, G.R. No. 129933, Feb. 26, 2001Rey Almon Tolentino AlibuyogAinda não há avaliações

- Paritala RaviDocumento7 páginasParitala Ravibhaskarchow100% (4)

- Plea BargainDocumento4 páginasPlea BargainAw LapuzAinda não há avaliações

- Rivera V ComelecDocumento2 páginasRivera V ComelecArlene Q. SamanteAinda não há avaliações

- Kathy Cummings v. City of ChicagoDocumento14 páginasKathy Cummings v. City of ChicagoJohn A. ViramontesAinda não há avaliações

- Caterpillar Financial Services Corporation v. Charter Connection Corporation Et Al - Document No. 9Documento2 páginasCaterpillar Financial Services Corporation v. Charter Connection Corporation Et Al - Document No. 9Justia.comAinda não há avaliações

- King Alfred's Preface To The TranslationDocumento17 páginasKing Alfred's Preface To The TranslationEn TAinda não há avaliações

- 008 Barrioquinto vs. FernandezDocumento5 páginas008 Barrioquinto vs. FernandezKelsey Olivar MendozaAinda não há avaliações

- The 44-day torture of Junko FurutaDocumento2 páginasThe 44-day torture of Junko Furutajayr1287Ainda não há avaliações

- Memorandum: To: From: Date: Subject: Attachment To Complaint Regarding Attorneys Timothy N. Smith, EdDocumento4 páginasMemorandum: To: From: Date: Subject: Attachment To Complaint Regarding Attorneys Timothy N. Smith, EdLeah GordonAinda não há avaliações

- Short History of Mexican Drug Cartels: Part ADocumento14 páginasShort History of Mexican Drug Cartels: Part AJames Creechan100% (3)

- In The High Court of Gujarat at Ahmedabad R/Special Civil Application No. 15278 of 2018Documento38 páginasIn The High Court of Gujarat at Ahmedabad R/Special Civil Application No. 15278 of 2018Devanshi ThackerAinda não há avaliações

- Criminal justice system and correction approachesDocumento2 páginasCriminal justice system and correction approachesBersekerAinda não há avaliações

- PDFDocumento187 páginasPDFTony AnandaAinda não há avaliações

- Sample Closing Argument For OVI DUI Attorney Ohio ColumbusDocumento3 páginasSample Closing Argument For OVI DUI Attorney Ohio Columbusmakeitsimple247Ainda não há avaliações

- Alarilla v. SandiganbayanDocumento2 páginasAlarilla v. SandiganbayanKing BadongAinda não há avaliações

- RTC Branch 87 Answer Denies Plaintiff's ClaimsDocumento6 páginasRTC Branch 87 Answer Denies Plaintiff's ClaimsConcepcion CejanoAinda não há avaliações

- Soccer Equipment and SuppliesDocumento24 páginasSoccer Equipment and Suppliesdangerdan97Ainda não há avaliações

- Amendments To US ConstitutionDocumento2 páginasAmendments To US ConstitutionЛана ШаманаеваAinda não há avaliações

- Jarco Marketing Corporation V Court of AppealsDocumento2 páginasJarco Marketing Corporation V Court of AppealsDarwinAngeles100% (2)

- Motion To Release VehicleDocumento3 páginasMotion To Release VehicleXhain Psypudin100% (1)

- PP vs. Velasco GR No. 190318 Nov. 27, 2013Documento1 páginaPP vs. Velasco GR No. 190318 Nov. 27, 2013Nyla100% (1)

- Barisal Conspiracy Case, Indian Freedom MovementDocumento2 páginasBarisal Conspiracy Case, Indian Freedom MovementraghavbawaAinda não há avaliações

- Chillicothe Police Reports For April 11th, 2013Documento26 páginasChillicothe Police Reports For April 11th, 2013Andrew AB BurgoonAinda não há avaliações

- MOTION TO QUASH (Final)Documento14 páginasMOTION TO QUASH (Final)jessasanchezAinda não há avaliações

- Immigration and Customs Enforcement - Detainer Form (June 2011)Documento3 páginasImmigration and Customs Enforcement - Detainer Form (June 2011)J CoxAinda não há avaliações

- Remulla, Estrella & Associates For Petitioners Exequil C. Masangkay For RespondentsDocumento45 páginasRemulla, Estrella & Associates For Petitioners Exequil C. Masangkay For RespondentsLhowellaAquinoAinda não há avaliações

- Sample Opposition To Motion To Strike For CaliforniaDocumento3 páginasSample Opposition To Motion To Strike For CaliforniaStan Burman100% (3)