Escolar Documentos

Profissional Documentos

Cultura Documentos

Joe Guaracino Government Memorandum On Eligibility of CJA Counsel

Enviado por

The Straw BuyerTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Joe Guaracino Government Memorandum On Eligibility of CJA Counsel

Enviado por

The Straw BuyerDireitos autorais:

Formatos disponíveis

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 1 of 11

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA CASE NO. 10-60194-CR-Cohn UNITED STATES OF AMERICA v. JOSEPH GUARACINO et al., Defendants. ______________________________/ GOVERNMENTS MEMORANDUM ON DEFENDANTS ELIGIBILITY FOR APPOINTMENT OF CJA COUNSEL Comes Now the United States of America, and files the above-styled pleading, as directed by Magistrate Judge Seltzer by order entered in open court on October 17, 2011. It is the position of the United States Attorneys Office for the Southern District of Florida (hereinafter, the government), that it does not oppose the appointment of defense counsel, pursuant to the Criminal Justice Act (CJA), Title 18, United States Code, 3006A, et seq., to represent defendant Guaracino in this continuing prosecution. The government does, however, respectfully urge this Court to vacate its previous order appointing CJA counsel for defendant Guaracino entered on March 7, 2011 (D.E. 958). The government sets out below its reasons for these positions. PROCEDURAL BACKGROUND 1. The indictment in this case was returned on June 30, 2010. Defendant Guaracino

(hereinafter, defendant) made an initial appearance on July 1, 2010. Attorney Michael Walsh made a permanent appearance at that proceeding on behalf of defendant as his retained counsel. (D.E. 41 and 46). Thereafter, on February 9, 2011, defendant filed a motion to have attorney Walsh appointed to represent him under the CJA, claiming that he, the defendant, has exhausted all

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 2 of 11

available funds towards the defense of this case, and has no money whatsoever to defend himself. (D.E. 822). On March 1, 2011 Magistrate Judge Seltzer conducted a hearing on this motion. It was an ex parte and in camera proceeding that did not include the presence of any government representative. On March 7, 2011, Magistrate Judge Seltzer entered an order granting defendants motion. (D.E. 958). Magistrate Judge Seltzer made several factual findings in the order regarding the scope and breadth of the pending case, the fees received at that point by attorney Walsh, and that defendant was no longer financially able to pay counsel for the legal services rendered. (D.E. 958 at 2). Magistrate Judge Seltzer also made his order prospective in application, and authorized CJA payments only for those fees and costs incurred following entry of this order. (D.E. 958 at 3). 2. Thereafter, the government filed a sealed ex parte motion on July 12, 2011, requesting

that the district court conduct an in camera examination of a transcript of the March 1, 2011, proceeding on defendants motion for appointment of CJA counsel, on the grounds that the transcript may contain misrepresentations, distortions, and false statements of the financial condition of defendant Joseph Guaracino, and seeking the disclosure to the government of any such transcript, for its use at trial. In support of its motion, the government attached as an exhibit Sun Trust bank records of a company owned and operated by defendant named Realvesta, Inc. Those bank records showed that in the period of May 30, 2010, through May 31, 2011, a total of $217, 944 was deposited into the Realvesta account. The government argued that such a sum called into question the veracity and accuracy of defendants showing to Magistrate Judge Seltzer on March 1, 2011 about his inability to pay for defense counsel and any trial costs. 3. On July 20, 2011, District Court Judge James Cohn entered a sealed order granting

the governments above-referenced motion. The order found that good cause has been shown for

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 3 of 11

disclosure to the government of Joseph Guaracinos sworn testimony regarding his assets and liabilities ... and in this instance appears to provide admissible impeachment evidence should Joseph Guaracino elect to testify. The government was consequently provided a six-page redacted transcript of the March 1, 2011, hearing. 4. At the trial of defendants Steven Stoll, Dennis Guaracino, and Joseph Guaracino,

defendant did elect to testify on his own behalf. During his cross-examination, government counsel requested a sidebar conference, and there moved the Court to unseal the governments ex parte motion, and the Courts sealed order, and the redacted transcript of the March 1, 2011, indigency hearing before Magistrate Judge Seltzer. Judge Cohn granted the governments motion to unseal those documents; copies were immediately furnished to all defense counsel. Judge Cohn also granted permission for the government to make use of the redacted transcript in its crossexamination of defendant. (Trial transcript, hereinafter TT, at 10838-40). The government did so, by first asking about the circumstances of the closed indigency hearing of March 1, 2011. The government asked specifically, Q: Well, isnt it correct you had to make representations under oath about your income and assets and liabilities? A: Yes, sir. Q: Isnt it true that you were not accurate in your answers on those subjects? A: I dont believe so, no, sir. (Trial transcript, 10844). ARGUMENT 5. In fact defendant was not accurate in his answers to Magistrate Juge Seltzer on March

1, 2011. Defendant repeatedly omitted disclosing pertinent information about his sources of income, and continuously underestimated the amounts of income he did disclose. 6. From the outset of the hearing defendant gave false answers to questions about his

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 4 of 11

income, assets, and liabilities. He was first asked about his occupation and how much he earned from it. Defendant answered that he worked for American Legal as an investigator, and made $1,000 per week. (Initial Indigency Hearing Transcript at 19; hereinafter, IIHT). This amount of income was, however, grossly minimized, and plus, defendant had other sources of income he did not reveal. 7. After providing the above false information, defendant was next asked about bank

accounts. Magistrate Judge Seltzer asked him: Do you have any bank accounts, checking or savings? Defendant answered: I have a checking account with my wife. (IIHT at 20). This answer was knowingly false by omission, because defendant had two other bank accounts that he failed to disclose. 8. Defendant admitted at the second indigency hearing (hereinafter SIH) on October

17, 2011, that he had failed to disclose these other two accounts, identified as the HART account, and the Realvesta account, but only as a result of having been confronted with their existence on cross-examination at trial. (Trial transcript at 10847, hereinafter TT). To confound things more, at trial defendant explained that the checking account with my wife that he was referring to at the IIH was his Suntrust account that he had maintained in his and his wifes name for a number of years. (TT at 10849). However, at the SIH, he changed his testimony and said that it was a financial institution called Flagstar Bank in the area around his Cummings, GA, rental house. (SIH at 14).1 9. Defendant at the SIH tried to explain to the Court his failure to mention these

other two accounts, by claiming that:

Defendant did not furnish any records of this bank account at the SIH, and the government has none, since it was unaware of the existence of this account. It is conceivable that defendant did not furnish the Court or the government with records of this account because such records would have further identified additional funds and sources of income not heretofore known to the government. 4

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 5 of 11

The Witness: Yes, Your Honor. I certainly was not trying to hide any of my other bank accounts. In fact, I thought that you would have access to them. I turned all of my financials, all of my bank accounts, including Realvesta and HART over to the government several years prior to this case started. It wasnt until Mr. Walsh explained to me that you didnt have access to it, you would only have access to what I had brought with me on the hearing, and I didnt realize that. I thought you had all of my - - you, know I thought you were up to date on everything involved in this case, including all of the stuff previously provided. It was my understanding when I provided it in discovery that it was fielded by all parties, not just the government. So that was a misunderstanding on my part. SIH at 71. 10. Defendants disingenuous explanation that he thought at the time that the Magistrate

Judge would have access to all discovery materials in the case, to include his financials, all of my bank accounts, is unbelievable for numerous reasons. While it is true that defendant discovered to the government pre-trial a disc that had a quickbooks file labeled Realvesta, Inc. on it, the government was never able to open that file without the proper software and password, so had to learn of the significance of Realvesta through its own investigative efforts. But why an experienced police officer would reasonably harbor the belief that a judicial officer would be familiar with hundreds of thousands of pages of discovery material, particularly one who would not be presiding over the trial of the case, is simply baffling. Besides, defendants explanation is internally contradictory. If he honestly thought the Magistrate Judge was already familiar with the evidence of his three bank accounts, why would defendant tell the Magistrate Judge about only one of the three? An unbiased observer could only conclude that defendant simply did not want to reveal the existence of the other two accounts, because he feared their revelation would also disclose how much money he really had at his disposal. 11. Defendant had an additional opportunity at the IIH on March 1, 2011 to disclose the

existence of the Realvesta account. When defendant told Magistrate Judge Seltzer that he was an investigator for American Legal, and that he brought home $1,000 a week, he could have more 5

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 6 of 11 candidly stated he owned a company called Realvesta that was paid as a sub-contractor for investigative work by American Legal, just as he later did at the SIH. (See SIH at 24 and 25). 12. This conclusion that defendant was less than candid is buttressed by the

circumstances of the closed hearing; defendant knew he had discovered a file referencing Realvesta to the government, but he could observe that the government was not represented at the closed hearing, so had no opportunity to challenge defendants failure to reveal the existence of any other bank account. Defendant therefore knew he could get away with his failure to reveal the HART and the Realvesta accounts. 13. The records of those two accounts do refute defendants claim both in his original

motion for appointment of CJA counsel, and at the IIH on March 1, 2011, that he did not have sufficient funds to continue paying retained counsel. At the SIH on October 17, 2011, the government entered into evidence several summary exhibits that more fairly and accurately portrayed defendants financial status in the period immediately leading up to the IIH. Exhibits 1, 6, and 7 were summaries of the financial activity occurring in defendants HART and Realvesta accounts in the approximate period of summer 2010 through summer 2011. 14. Exhibit 1 shows all deposits to those two accounts from June 30, 2010 through May

31, 2011. That figure for total deposits is $288,569. If the date of the IIH, March 1, 2011, is used as a pertinent cut-off point, then total deposits for both accounts as of March 1, 2011 was $244,034.2 This would seem to be a sufficient sum in order to pay retained counsel. It also tends to prove that defendant had more resources available to him than he admitted to Magistrate Judge Seltzer.

2

If the $50,500 loan from Scott Fistel and $20,000 loan from defendants mother are eliminated, since as loans they do not necessarily qualify as income (although still available to pay retained counsel), then deposits to both accounts up to March 1, 2011 would be $173,534. 6

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 7 of 11

15.

Government exhibit 6 is also persuasive evidence to prove that defendant had

sufficient funds to pay for counsel and that defendant was not truthful in his answers to Magistrate Judge Seltzer. Exhibit 6 is a break-down of the sources of the deposits that are otherwise displayed in exhibit 1. Exhibit 6 is entitled Deposits Sorted by Payor into the Realvesta account, starting from various dates in summer, 2010, and running through various dates in May, 2011. It identifies seven different payors. The main ones are American Legal, CASH, Daniel James Plate, HALT, and HART. 16. An examination of the payments by American Legal, defendants only employer after

November 2010, shows a total of 15 different deposits for $42,000, from December 1, 2010 until May 23, 2011. Despite defendants claim at the IIH, on March 1, 2011 of making only $1,000 per week, or $4,000 per month, from American Legal, in each of the six months reflected in the exhibit, he always received more than $4,000.00 per month. Payments by month are, December 2010: $7,000; January 2011: $5,000; February 2011: $8,000; March 2011: $8,000; April 2011: $8,000; May 2011: $6,000. Defendants assertion that he was only paid $4,000 per month by American Legal is belied by his own bank records. 17. More telling is the proof provided by examination of the payments grouped under

CASH; these were simply cash deposits made by defendant to his Realvesta account from July 9, 2010 through May 6, 2011. There were 21 separate deposits of cash, totaling $38,150. The largest deposit was $4,500 on three occasions, and the smallest deposits were $300, $400, and $500. The monetary breakdown of cash deposits by month is, as follows: December 2010: $10,950; January 2011: $7,300; February 2011: $3,100; March 2011: $5,300; April 2011: $5,300; May 2011: $2,300. What is particularly pertinent to this analysis is that defendant could not explain the source or 7

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 8 of 11

sources of all of this cash, neither in his trial testimony, nor in his testimony at the SIH on October 17, 2011. (SIH at 55-57). Nor did his estimations of his monthly income ever reference even the receipt of this cash-money. 18. Exhibit 1 also demonstrates how defendant underestimated his receipt of funds from

his company HART, when questioned about it at the SIH on October 17, 2011 by Magistrate Judge Seltzer, who asked the following series of questions on that subject: Q: Okay. Now in terms of let me go back then to HART. You were the sole owner of HART? A: I was. Q: In March, was HART earning any money? A: The only income HART has earned, and I believe this is accurate, on March 31s of 2011, we had an outstanding check for $8,333.32 and $4,800 of that was used as a profit to me, and I transferred that to Realvesta. SIH at 25. Q: All right. Now, prior to receiving that $4,800 from HART, when was the time prior that you received any money from HART? A: The loan from Scott Fistel, and I dont recall before that, but it had been quite a while. It was my understanding the case is the invoices I had left at HART and HALT, there was very, very little if any left over. So when we got this check in, it was kind of surprise to me. SIH at 26. Q: And before that, say in 2011, what is the most amount of money you received from HART in any way, shape or form? A: Just the loan from Scott Fistel and the $8,333 check, and I have in front of me a statement from February 28, 2011 through September 30, 2011. Q: And what was the total income or the total deposits? A: The $50,000 which was just prior to this date and then the $8,333.32. SIH at 27. 19. Exhibit 1 contradicts defendants testimony that prior to receiving the Fistel loan and

the check for $8,333.32, HART had no income. The Fistel loan was deposited into the HART account on February 18, 2011 (SIH at 38) and the $8,333.32 check was deposited sometime in March 2011. Defendant never told Magistrate Judge Seltzer that there had been other deposits into the HART account prior to those two, and in fact gave the distinct impression there had been none. Yet 8

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 9 of 11

there had been. Exhibit 1 shows that prior to the Fistel loan there had been total deposits into the HART account of $65,599 from June 30, 2010 through January 31, 2011.3 20. Another element of lack of candor displayed by defendant was his complete failure

at the IIH on March 1, 2011, to disclose his receipt of rental income prior to that date. Defendant owned at least five homes in Broward County in his own name, although he was not paying the mortgages on any of them. (SIH at 46, and 59). Defendant tried to explain that the rental money he obtained from his properties was not really income to him, because he used it to pay back his mother for loans she had made to him. (SIH at 46). In response to a question from Magistrate Judge Seltzer, defendant estimated that he had made $2,000 per month from rental properties, and had repaid his mother approximately $7,000 (SIH at 47, 48). 21. Defendant also admitted that he collected rent from two renters of properties owned

by his mother and his brother-in-law (SIH 57, 58). These two renters, according to defendant, paid him the rent, which he deposited into his Realvesta account, and then delivered in some fashion to his mother and brother-in-law. Governments exhibit 6 shows the deposit of some checks of these renters. Daniel James Plate wrote seven checks in the time period of November 2010 through May 6, 2011 for $4,300. In the time period of November 2010 through March 4, 2011 he wrote checks totaling $3,500. Someone named Jeffrey Parady wrote one check for $1,000 that was deposited into the Realvesta account on November 15, 2010. On the memo section of the check was written Nov. Rent. 22.

3

The government considers defendants explanation that he deposited these other

The Fistel loan was the only deposit into HART in February 2011. At trial under cross-examination defendant actually testified that there had been no deposits at all into the HART account. (TT, 10849). 9

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 10 of 11

renters checks into his own account, and then somehow transferred that money to the owner of the rental house, either his mother, or his brother-in-law, to be highly implausible. If defendant were really managing these rental properties for relatives, it would have been far more convenient, and more business-like, for defendant to have just delivered the rental checks to the relative, rather than running them through his Realvesta account, because that action gives the checks the appearance of being income to him, which the government believes they are. There are no records that corroborate or support defendants version. Governments exhibit 8 is to the contrary. Exhibit 8 is a schedule of all transactions of the Realvesta account from June 1, 2010 through May 31, 2011. It shows that there are no checks written by defendant to his mother, Mary Guaracino, and only one check written to his brother-in-law Barry Blyth, on October 21, 2010 for $200. Defendant therefore was not delivering the rental money from these renters to his relatives by check, which, again, would have been a more business-like procedure for a property manager to utilize. The government submits that the circumstantial evidence supports a conclusion that defendant used this rent money as personal funds, and should have disclosed it at the IIH. 23. Other funds involving defendants relatives also should have been disclosed to

Magistrate Judge Seltzer at the IIH. Those funds were monies supplied by defendants mother-inlaw and brother-in-law to help pay for the rent and other living expenses associated with defendants mansion in Cummings, GA.4 At the SIH defendant stated that his mother-in-law and brother-in-law helped out when they could with expenses at the Georgia house; Barry Bltyh provided a couple hundred dollars here and there. (SIH at 18, 19). Even if these income-supplements were small, they

4

At trial the government proved that the defendant signed a lease on this residence in 2009. The rent was originally $6500 per month, later reduced to $3,500 per month by the time of the IIH. (IIHT at 27). Defendant was living in the lap of luxury through this period. 10

Case 0:10-cr-60194-JIC Document 1604 Entered on FLSD Docket 10/26/2011 Page 11 of 11

should have been disclosed at the IIH. 24. In conclusion the government urges the Court to find from all of the evidence that

defendants original motion for appointment of CJA counsel was improvidently granted, due to defendants misrepresentations and false statements made at the IIH on March 1, 2011. On the other hand, the government concedes that defendant has made a sufficient showing of his current financial inability to pay retained counsel, and this time is entitled under the CJA to the appointment of attorney Walsh to represent him henceforth. Respectfully submitted, WIFREDO A. FERRER UNITED STATES ATTORNEY By: /s/ Michael P. Sullivan MICHAEL P. SULLIVAN Assistant United States Attorney Florida Bar No.134814 99 N.E. 4th Street, 8th Floor Miami, Florida 33132-2111 Telephone: (305) 961-9274 Facsimile: (305) 536-4675 Email: Pat.Sullivan@usdoj.gov CERTIFICATE OF SERVICE I hereby certify that on October 26, 2011, I electronically filed the foregoing Governments Memorandum on Defendants Eligibility for Appointment of CJA Counsel with the Clerk of the Court using CM/ECF. I further certify that on this 26th day of October, 2011, I mailed a copy of the foregoing memorandum to Michael Dennis Walsh, Esq., 46 N.E. 6th Street, Miami, FL 33132, counsel for Joseph Guaracino, via United States regular mail. /s/ Michael P. Sullivan MICHAEL P. SULLIVAN Assistant United States Attorney 11

Você também pode gostar

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsNo EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsNota: 4.5 de 5 estrelas4.5/5 (14)

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimNo EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimNota: 5 de 5 estrelas5/5 (21)

- United States v. Peter Collorafi, 876 F.2d 303, 2d Cir. (1989)Documento5 páginasUnited States v. Peter Collorafi, 876 F.2d 303, 2d Cir. (1989)Scribd Government DocsAinda não há avaliações

- Response in Hamilton Co., Wilkey, McRae LawsuitDocumento22 páginasResponse in Hamilton Co., Wilkey, McRae LawsuitNewsChannel 9 StaffAinda não há avaliações

- Notice of Opposition & Opposition Evidence, Fraud Evidence ...Documento30 páginasNotice of Opposition & Opposition Evidence, Fraud Evidence ...Albertelli_LawAinda não há avaliações

- Home Disclaimer Site Map Email A Tip Support Subscribe AdvertiseDocumento16 páginasHome Disclaimer Site Map Email A Tip Support Subscribe AdvertisemarlontteeAinda não há avaliações

- Petition For Writ of ProhibitionDocumento134 páginasPetition For Writ of ProhibitioncottonmouthblogAinda não há avaliações

- Foreclosure Overturned Due To Faulty AssignmentDocumento3 páginasForeclosure Overturned Due To Faulty Assignmentdivinaw100% (1)

- IRS Tax Court Reply To Motion To Dismiss-CompleteDocumento97 páginasIRS Tax Court Reply To Motion To Dismiss-CompleteJeff Maehr100% (1)

- LPS - Ron Wilson - Memo of Law Supporting Motion For ReliefDocumento20 páginasLPS - Ron Wilson - Memo of Law Supporting Motion For ReliefForeclosure Fraud100% (1)

- $42B Lawsuit - Harihar V US Bank Brings Allegations Against 5 Federal Judges and Separate Lawsuit Against United StatesDocumento52 páginas$42B Lawsuit - Harihar V US Bank Brings Allegations Against 5 Federal Judges and Separate Lawsuit Against United StatesMohan HariharAinda não há avaliações

- Micheal Goland Litigation Terrorist / Vexatious LitigantDocumento114 páginasMicheal Goland Litigation Terrorist / Vexatious LitigantDaniel Cooper100% (1)

- Rinehart v. Fannie MaeDocumento19 páginasRinehart v. Fannie MaeMortgage Compliance Investigators100% (1)

- Marina Vs American HomeDocumento5 páginasMarina Vs American HomeAlyssa joy TorioAinda não há avaliações

- (Digest) Modequillo v. BrevaDocumento2 páginas(Digest) Modequillo v. BrevaKarla BeeAinda não há avaliações

- Law Enforcement in The Philippines PDFDocumento4 páginasLaw Enforcement in The Philippines PDFJaysheil BolimaAinda não há avaliações

- Nario v. Philippine American Life InsuranceDocumento1 páginaNario v. Philippine American Life InsuranceFrancis Xavier Sinon100% (1)

- Samuel M. Alvarado v. Ayala Land, Inc.Documento2 páginasSamuel M. Alvarado v. Ayala Land, Inc.MARIA KATHLYN DACUDAOAinda não há avaliações

- Motion Bill ParticularsDocumento11 páginasMotion Bill ParticularsAldoSolsaAinda não há avaliações

- United States v. Francis J. Paxton and Milton Hecht, Milton Hecht, 403 F.2d 631, 3rd Cir. (1969)Documento3 páginasUnited States v. Francis J. Paxton and Milton Hecht, Milton Hecht, 403 F.2d 631, 3rd Cir. (1969)Scribd Government DocsAinda não há avaliações

- United States v. E.V., 10th Cir. (2012)Documento5 páginasUnited States v. E.V., 10th Cir. (2012)Scribd Government DocsAinda não há avaliações

- United States v. Shirley Lorraine Lattimore, 902 F.2d 902, 11th Cir. (1990)Documento5 páginasUnited States v. Shirley Lorraine Lattimore, 902 F.2d 902, 11th Cir. (1990)Scribd Government DocsAinda não há avaliações

- Report and Recommendation of United States Magistrate JudgeDocumento16 páginasReport and Recommendation of United States Magistrate JudgeSt. Louis Public RadioAinda não há avaliações

- Albert G. Anaya v. Felix Rodriguez, Acting Warden, New Mexico State Penitentiary, 372 F.2d 683, 10th Cir. (1967)Documento4 páginasAlbert G. Anaya v. Felix Rodriguez, Acting Warden, New Mexico State Penitentiary, 372 F.2d 683, 10th Cir. (1967)Scribd Government DocsAinda não há avaliações

- United States v. Honorable James T. Foley, United States District Judge, 283 F.2d 582, 2d Cir. (1960)Documento4 páginasUnited States v. Honorable James T. Foley, United States District Judge, 283 F.2d 582, 2d Cir. (1960)Scribd Government DocsAinda não há avaliações

- Deutsche Bank National Trust Co. v. WilsonDocumento6 páginasDeutsche Bank National Trust Co. v. WilsonrichdebtAinda não há avaliações

- Jonathan Holdeen v. Riley J. Ratterree, As Late District Director of Internal Revenue, and Fulton D. Fields, As Late Acting Director of Internal Revenue, 270 F.2d 701, 2d Cir. (1959)Documento9 páginasJonathan Holdeen v. Riley J. Ratterree, As Late District Director of Internal Revenue, and Fulton D. Fields, As Late Acting Director of Internal Revenue, 270 F.2d 701, 2d Cir. (1959)Scribd Government DocsAinda não há avaliações

- United States v. Sebaggala, 256 F.3d 59, 1st Cir. (2001)Documento11 páginasUnited States v. Sebaggala, 256 F.3d 59, 1st Cir. (2001)Scribd Government DocsAinda não há avaliações

- 73 - Gov - Uscourts.ord.124749.73.0Documento14 páginas73 - Gov - Uscourts.ord.124749.73.0Freeman LawyerAinda não há avaliações

- United States v. Anthony Accetturo, 858 F.2d 679, 11th Cir. (1988)Documento6 páginasUnited States v. Anthony Accetturo, 858 F.2d 679, 11th Cir. (1988)Scribd Government DocsAinda não há avaliações

- United States v. Robert A. Leventhal, Personally and in His Representative Capacity As Partner/officer of Leventhal & Slaughter, P.A., 961 F.2d 936, 11th Cir. (1992)Documento9 páginasUnited States v. Robert A. Leventhal, Personally and in His Representative Capacity As Partner/officer of Leventhal & Slaughter, P.A., 961 F.2d 936, 11th Cir. (1992)Scribd Government DocsAinda não há avaliações

- M.B. v. Andrea Quarantillo, Immigration and Naturalization Service, 301 F.3d 109, 3rd Cir. (2002)Documento11 páginasM.B. v. Andrea Quarantillo, Immigration and Naturalization Service, 301 F.3d 109, 3rd Cir. (2002)Scribd Government DocsAinda não há avaliações

- Filed: Patrick FisherDocumento13 páginasFiled: Patrick FisherScribd Government DocsAinda não há avaliações

- Supervising Judge Paula Hepner and Brooklyn Family Court CorruptionDocumento18 páginasSupervising Judge Paula Hepner and Brooklyn Family Court CorruptionSLAVEFATHERAinda não há avaliações

- United States v. First National Bank of Circle, 732 F.2d 1444, 1st Cir. (1984)Documento11 páginasUnited States v. First National Bank of Circle, 732 F.2d 1444, 1st Cir. (1984)Scribd Government DocsAinda não há avaliações

- United States v. Chen, 1st Cir. (2016)Documento22 páginasUnited States v. Chen, 1st Cir. (2016)Scribd Government DocsAinda não há avaliações

- UNITED STATES of America, Plaintiff-Appellant-Cross-Appellee, v. John H. WILLIAMS, JR., Defendant-Appellee-Cross - AppellantDocumento10 páginasUNITED STATES of America, Plaintiff-Appellant-Cross-Appellee, v. John H. WILLIAMS, JR., Defendant-Appellee-Cross - AppellantScribd Government DocsAinda não há avaliações

- United States v. Eastern Air Lines, Inc., 923 F.2d 241, 2d Cir. (1991)Documento6 páginasUnited States v. Eastern Air Lines, Inc., 923 F.2d 241, 2d Cir. (1991)Scribd Government DocsAinda não há avaliações

- 3:09-cv-05456 Doc#319Documento34 páginas3:09-cv-05456 Doc#319Equality Case Files100% (1)

- Louis Ostrer v. United States, 577 F.2d 782, 2d Cir. (1978)Documento12 páginasLouis Ostrer v. United States, 577 F.2d 782, 2d Cir. (1978)Scribd Government DocsAinda não há avaliações

- Holloway v. United States, 1st Cir. (2017)Documento13 páginasHolloway v. United States, 1st Cir. (2017)Scribd Government DocsAinda não há avaliações

- Heil v. Wells Fargo Bank N.A., 10th Cir. (2008)Documento10 páginasHeil v. Wells Fargo Bank N.A., 10th Cir. (2008)Scribd Government DocsAinda não há avaliações

- Order On Denying MotionsDocumento4 páginasOrder On Denying MotionsStephen DibertAinda não há avaliações

- Shayesteh v. Raty, 10th Cir. (2010)Documento14 páginasShayesteh v. Raty, 10th Cir. (2010)Scribd Government DocsAinda não há avaliações

- United States v. Albert H. Rothrock and Vivian S. Rothrock, 806 F.2d 318, 1st Cir. (1986)Documento8 páginasUnited States v. Albert H. Rothrock and Vivian S. Rothrock, 806 F.2d 318, 1st Cir. (1986)Scribd Government DocsAinda não há avaliações

- United States v. Albert A. Cortellesso, United States of America v. Ralph Altieri, 663 F.2d 361, 1st Cir. (1981)Documento6 páginasUnited States v. Albert A. Cortellesso, United States of America v. Ralph Altieri, 663 F.2d 361, 1st Cir. (1981)Scribd Government DocsAinda não há avaliações

- Gary James Joslin v. Secretary of The Department of The Treasury and The United States of America, 832 F.2d 132, 10th Cir. (1987)Documento5 páginasGary James Joslin v. Secretary of The Department of The Treasury and The United States of America, 832 F.2d 132, 10th Cir. (1987)Scribd Government DocsAinda não há avaliações

- United States v. Jules W. Wertheimer, 434 F.2d 1004, 2d Cir. (1970)Documento5 páginasUnited States v. Jules W. Wertheimer, 434 F.2d 1004, 2d Cir. (1970)Scribd Government DocsAinda não há avaliações

- United States v. Fontaine, 106 F.3d 383, 1st Cir. (1997)Documento7 páginasUnited States v. Fontaine, 106 F.3d 383, 1st Cir. (1997)Scribd Government DocsAinda não há avaliações

- United States v. Halliday, 665 F.3d 1219, 10th Cir. (2011)Documento11 páginasUnited States v. Halliday, 665 F.3d 1219, 10th Cir. (2011)Scribd Government DocsAinda não há avaliações

- Fritz W. Hintze Ledagole R. Hintze v. Internal Revenue Service Jeffrey Breault, Special Agent United States of America, (Two Cases), 879 F.2d 121, 4th Cir. (1989)Documento13 páginasFritz W. Hintze Ledagole R. Hintze v. Internal Revenue Service Jeffrey Breault, Special Agent United States of America, (Two Cases), 879 F.2d 121, 4th Cir. (1989)Scribd Government DocsAinda não há avaliações

- Mitchell v. Figueroa, 10th Cir. (2012)Documento5 páginasMitchell v. Figueroa, 10th Cir. (2012)Scribd Government DocsAinda não há avaliações

- United States v. Ben J. Slutsky and Julius S. Slutsky D/B/A "The Nevele,", 514 F.2d 1222, 2d Cir. (1975)Documento13 páginasUnited States v. Ben J. Slutsky and Julius S. Slutsky D/B/A "The Nevele,", 514 F.2d 1222, 2d Cir. (1975)Scribd Government DocsAinda não há avaliações

- Cornelisen v. Gunnarson, 162 F.3d 1172, 10th Cir. (1998)Documento5 páginasCornelisen v. Gunnarson, 162 F.3d 1172, 10th Cir. (1998)Scribd Government DocsAinda não há avaliações

- United States v. Springer, 10th Cir. (2011)Documento22 páginasUnited States v. Springer, 10th Cir. (2011)Scribd Government DocsAinda não há avaliações

- United States v. Clinton O. McMullin McMullin Family Trust, and Laura J. McMullin, 948 F.2d 1188, 10th Cir. (1991)Documento6 páginasUnited States v. Clinton O. McMullin McMullin Family Trust, and Laura J. McMullin, 948 F.2d 1188, 10th Cir. (1991)Scribd Government DocsAinda não há avaliações

- United States v. Harry J. Alker, JR., 255 F.2d 851, 3rd Cir. (1958)Documento4 páginasUnited States v. Harry J. Alker, JR., 255 F.2d 851, 3rd Cir. (1958)Scribd Government DocsAinda não há avaliações

- Kellett v. United States, 21 F.3d 419, 1st Cir. (1994)Documento4 páginasKellett v. United States, 21 F.3d 419, 1st Cir. (1994)Scribd Government DocsAinda não há avaliações

- United States v. ChittyDocumento10 páginasUnited States v. ChittyMichael_Lee_RobertsAinda não há avaliações

- CREW v. EOP: Regarding Missing WH Emails: 3/18/08 - CREW's Reply To Opposition To Motion For Order To Show CauseDocumento14 páginasCREW v. EOP: Regarding Missing WH Emails: 3/18/08 - CREW's Reply To Opposition To Motion For Order To Show CauseCREWAinda não há avaliações

- United States v. Joseph E. Todaro, 744 F.2d 5, 2d Cir. (1984)Documento7 páginasUnited States v. Joseph E. Todaro, 744 F.2d 5, 2d Cir. (1984)Scribd Government DocsAinda não há avaliações

- In Re: Grand Jury Subpoena, 223 F.3d 213, 3rd Cir. (2000)Documento10 páginasIn Re: Grand Jury Subpoena, 223 F.3d 213, 3rd Cir. (2000)Scribd Government DocsAinda não há avaliações

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)No EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)Ainda não há avaliações

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Ainda não há avaliações

- Robert Welsh Lawsuit Against Valeria Newman and Josh Liebman For SlanderDocumento3 páginasRobert Welsh Lawsuit Against Valeria Newman and Josh Liebman For SlanderThe Straw BuyerAinda não há avaliações

- City of South Miami Former Mayor and Current Candidate For City Commissioner, Horace Feliu, Accused of Stealing Campaign Signs.Documento2 páginasCity of South Miami Former Mayor and Current Candidate For City Commissioner, Horace Feliu, Accused of Stealing Campaign Signs.The Straw BuyerAinda não há avaliações

- South Miami Police Officer Richard Munoz Federal IndictmentDocumento4 páginasSouth Miami Police Officer Richard Munoz Federal IndictmentThe Straw Buyer0% (1)

- Trooper Donna Watts Lawsuit Against The City of South Miami and Orlando Martinez de CastroDocumento69 páginasTrooper Donna Watts Lawsuit Against The City of South Miami and Orlando Martinez de CastroThe Straw BuyerAinda não há avaliações

- South Miami Police Department Crime Clearance RatesDocumento1 páginaSouth Miami Police Department Crime Clearance RatesThe Straw BuyerAinda não há avaliações

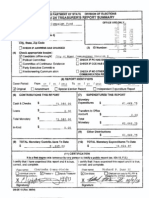

- Richard P. Dunn Campaign Treasurer's Report Summary PDFDocumento49 páginasRichard P. Dunn Campaign Treasurer's Report Summary PDFThe Straw BuyerAinda não há avaliações

- Nacivre Charles Federal Indictment Operation Skychefs PDFDocumento110 páginasNacivre Charles Federal Indictment Operation Skychefs PDFThe Straw BuyerAinda não há avaliações

- Michelle Spence-Jones Lawsuit Against Katherine Fernandez Rundle and Tomas RegaladoDocumento114 páginasMichelle Spence-Jones Lawsuit Against Katherine Fernandez Rundle and Tomas RegaladoThe Straw BuyerAinda não há avaliações

- City of South Miami City Manager Steven Alexander Relieves Orlando Martinez de Castro From DutyDocumento1 páginaCity of South Miami City Manager Steven Alexander Relieves Orlando Martinez de Castro From DutyThe Straw BuyerAinda não há avaliações

- City of South Miami Police Chief Orlando Martinez de Castro Employment ContractDocumento17 páginasCity of South Miami Police Chief Orlando Martinez de Castro Employment ContractThe Straw BuyerAinda não há avaliações

- Scott Saidel, Kimberly Rothstein, Stacie Weisman, Patrick Daoud Criminal InformationDocumento23 páginasScott Saidel, Kimberly Rothstein, Stacie Weisman, Patrick Daoud Criminal InformationThe Straw BuyerAinda não há avaliações

- John Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentDocumento19 páginasJohn Arthur Romney Aka John Romney Owner of Folio Ventures Federal Mortgage Fraud IndictmentThe Straw BuyerAinda não há avaliações

- Camillo Padreda Testimony Against Hialeah Mayor Raul MartinezDocumento269 páginasCamillo Padreda Testimony Against Hialeah Mayor Raul MartinezThe Straw Buyer0% (1)

- Mayor Stoddard Burglary Police ReportDocumento1 páginaMayor Stoddard Burglary Police ReportThe Straw BuyerAinda não há avaliações

- Florida Department of Highway Safety and Motor Vehicles Guide For Government VehiclesDocumento3 páginasFlorida Department of Highway Safety and Motor Vehicles Guide For Government VehiclesThe Straw BuyerAinda não há avaliações

- Roger Besu Judgement of GuiltDocumento3 páginasRoger Besu Judgement of GuiltThe Straw BuyerAinda não há avaliações

- Tyler Weinman Lawsuit Against Miami Dade CountyDocumento52 páginasTyler Weinman Lawsuit Against Miami Dade CountyThe Straw BuyerAinda não há avaliações

- Warren Papove Order of DismissalDocumento1 páginaWarren Papove Order of DismissalThe Straw BuyerAinda não há avaliações

- Marc Sarnoff Reid Welch Assault Close Out MemoDocumento2 páginasMarc Sarnoff Reid Welch Assault Close Out MemoThe Straw Buyer100% (1)

- Warren Papove Arrest ReportDocumento1 páginaWarren Papove Arrest ReportThe Straw BuyerAinda não há avaliações

- Sally Sawh Disbarment Sally Ann de La CasaDocumento11 páginasSally Sawh Disbarment Sally Ann de La CasaThe Straw BuyerAinda não há avaliações

- Veldora Arthur RestitutionDocumento6 páginasVeldora Arthur RestitutionThe Straw BuyerAinda não há avaliações

- Joe Guaracino Superseding InformationDocumento7 páginasJoe Guaracino Superseding InformationThe Straw BuyerAinda não há avaliações

- Reid Welch Arrest ReportDocumento2 páginasReid Welch Arrest ReportThe Straw BuyerAinda não há avaliações

- Reid Welch Motion To Disqalify George Wysong DeniedDocumento8 páginasReid Welch Motion To Disqalify George Wysong DeniedThe Straw BuyerAinda não há avaliações

- PLD 1962 Lah 558Documento88 páginasPLD 1962 Lah 558Judicial AspirantAinda não há avaliações

- CRPC 154 &161Documento8 páginasCRPC 154 &161saad rasheedAinda não há avaliações

- Taswald Theo July Versus Motor Vehicle Accidents FundDocumento17 páginasTaswald Theo July Versus Motor Vehicle Accidents FundAndré Le RouxAinda não há avaliações

- Labiano Succession DigestDocumento2 páginasLabiano Succession DigestKrishianne LabianoAinda não há avaliações

- N 400 QuestionnaireDocumento6 páginasN 400 QuestionnaireionutdanciuAinda não há avaliações

- CASE OF MARKT INTERN VERLAG GMBH AND KLAUS BEERMANN v. GERMANYDocumento27 páginasCASE OF MARKT INTERN VERLAG GMBH AND KLAUS BEERMANN v. GERMANYneritanAinda não há avaliações

- Week 2B - CompiledDocumento12 páginasWeek 2B - CompiledKarla BeeAinda não há avaliações

- 1987 Philippine ConstitutionDocumento36 páginas1987 Philippine ConstitutionSanny Jean Rosa-utAinda não há avaliações

- Role of Courts in Granting Bails and Bail Reforms: TH THDocumento1 páginaRole of Courts in Granting Bails and Bail Reforms: TH THSamarth VikramAinda não há avaliações

- PopMatters Motion For Attorney FeesDocumento21 páginasPopMatters Motion For Attorney FeesbrancronAinda não há avaliações

- Indian Stamp (Haryana Amendment) Act, 2018 PDFDocumento4 páginasIndian Stamp (Haryana Amendment) Act, 2018 PDFsandeep kumarAinda não há avaliações

- Ordinario Vs People - RapeDocumento5 páginasOrdinario Vs People - RapegeorjalynjoyAinda não há avaliações

- Campanilla Crim PreWeek 2018Documento42 páginasCampanilla Crim PreWeek 2018Beau Masiglat100% (2)

- Felonies and Circumstances Which Affect Criminal Liability Chapter One FeloniesDocumento93 páginasFelonies and Circumstances Which Affect Criminal Liability Chapter One FeloniesPots SimAinda não há avaliações

- Doe 1 Et Al v. Ciolli Et Al - Document No. 30Documento2 páginasDoe 1 Et Al v. Ciolli Et Al - Document No. 30Justia.comAinda não há avaliações

- Employment of Educators ActDocumento25 páginasEmployment of Educators ActRailo NongAinda não há avaliações

- NISCE, Alyssa Angela R. 12081000 - G06 Legal Writing Assignment #1Documento5 páginasNISCE, Alyssa Angela R. 12081000 - G06 Legal Writing Assignment #1Ally NisceAinda não há avaliações

- Tolentino v. CatoyDocumento2 páginasTolentino v. CatoyCarissa CruzAinda não há avaliações

- Torts: Vicarious Liability of StateDocumento37 páginasTorts: Vicarious Liability of StateNamita GargAinda não há avaliações

- Trial by Jury Vs Trial by Bench - EditedDocumento3 páginasTrial by Jury Vs Trial by Bench - EditedNixonAinda não há avaliações

- 10-08-22 Samaan V Zernik (SC087400) at The Los Angeles Superior Court - Civil Case Summary SDocumento34 páginas10-08-22 Samaan V Zernik (SC087400) at The Los Angeles Superior Court - Civil Case Summary SHuman Rights Alert - NGO (RA)Ainda não há avaliações

- Tolentino Vs COMELECDocumento18 páginasTolentino Vs COMELECBenjie PiaAinda não há avaliações

- What Is Republic Act 9048?Documento4 páginasWhat Is Republic Act 9048?Ghee MoralesAinda não há avaliações

- Malaysia Legal DigestDocumento18 páginasMalaysia Legal DigestshahrinieAinda não há avaliações