Escolar Documentos

Profissional Documentos

Cultura Documentos

Annual Report Project W2011 - ACCO310 CC

Enviado por

Abu HayyanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Annual Report Project W2011 - ACCO310 CC

Enviado por

Abu HayyanDireitos autorais:

Formatos disponíveis

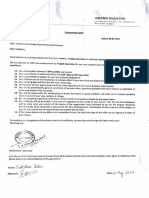

Concordia University John Molson School of Business Annual Report Project W2011 Professor Mark Sellors ACCO 310

Section CC

Objective To provide students with an opportunity to apply knowledge and develop analytical, research and written communication skills. The project is designed as a group project to afford an opportunity for teamwork.

The Project You have recently joined an investment advisory firm as a financial analyst. One of the firms clients, a wealthy private investor, wishes to add agriculture-related exposure to her stock portfolio. Upon consulting the clients account-opening form, you note that, with respect to equity investments, she has a risk tolerance level of medium, a growth investment objective (increase in stock price), no income (dividends) requirement, and an investment time horizon of 4-5 years. You have conducted an initial screening process and have narrowed the search down to the following shortlist of potential investments: Potash Corporation of Saskatchewan Inc. (PotashCorp) Agrium Inc.

The term project requires you to perform a financial analysis evaluation of the abovementioned companies and to make a reasoned investment recommendation. (Your analysis may lead you to recommend both companies, one of the companies, or neither company.) Students are encouraged to incorporate as much of the course material as possible in their reports.

Project teams Students will be assigned to a group to work on this project and submit one report for the group. The project must be completed in teams to facilitate the exchange of different opinions among team members.

Format, Length and Content of the Report The project should be submitted in written form in a paper of 13 (minimum) to 15 (maximum) pages in length (13 point type, 1.5 line spacing, 1 inch margin on all four sides). Your report should include all of the Required Report Elements specified below.

Project due date One copy of your report must be submitted at the beginning of class on Tuesday, March 29. No due-date extensions will be granted. This copy will not be returned to you but will be available for your review once it has been graded. Keep an original copy of your report for your files. No electronic submissions will be accepted.

Sources of information Obtain the annual reports of the companies and search the corporate websites. Also use news items from business periodicals and other library and internet reference sources in performing your analysis. In addition you may wish to consult the following investor services:

www.bigcharts.com www.bloomberg.com www.fpinfomart.ca www.hoovers.com http://moneycentral.msn.com/investor www.investor.reuters.com www.mergentonline.com (Members only - ask for a free trial subscription)

Required Report Elements

Your report should include all of the following sections and content:

1. Introduction:

Introduce your report by explaining its purpose.

2. The companies: Provide a brief description of each companys primary business activities. This description should include a brief historical summary.

3.

The industry: Carry out an industry analysis including an assessment of the industrys attractiveness from an investment point of view: Threats, opportunities, and prospects for the future.

4. Stock performance:

PotashCorp (Stock market symbol: POT) (Reports in US dollars) Agrium Inc. (Stock market symbol: AGU) (Reports in US dollars)

Compare the stock market performance of the two companies with the S&P/TSX Composite stock market index over a five-year period using a trend analysis of growth in the stock prices and the index. Which company shows a better trend?

5. Ratio analysis: For the most recent fiscal year analyze each companys financial statements using financial ratios (Liquidity, activity, profitability, and coverage ratios). Compare the ratios for the two companies. How does this analysis influence your investment decision? Use only those ratios that are relevant to the companys business. Focus on ratios that will help you make an investment decision. You do not have to analyze every ratio mentioned in the accounting textbook.

6. Trend analysis: Compare the growth in Net Income and Operating Cashflow for the two companies over a five-year period using trend analysis. Which measure, net income or operating cashflow, appears to have more influence on the price of the companys stock. Which company shows a better trend? Consult the information posted on the class website in the Term Project folder regarding the preparation and use of trend analysis.

7. Common size analysis: Use common size (vertical) analysis to examine how the relative size of each companys Cost of Goods Sold and Gross Margin has changed over the last five years, and comment on why these changes have occurred. How does this analysis influence your investment decision? Consult the information posted on the class website in the Term Project folder regarding the preparation and use of common size analysis.

8. Non-GAAP financial measures: Discuss the non-GAAP financial measures used by each company and explain why the companies include these measures.

9. Conclusion: Conclude by stating your recommendation and the reasons for such recommendation: It should tie in the conclusions reached from the analysis carried out in the individual report sections mentioned above.

10. Table of contents at the front; Appendices at the back: The appendices should include: the financial statements from the companys annual report. DO NOT INCLUDE THE COMPLETE ANNUAL REPORT; any graphs, tables or other numerical information used in your analysis; a bibliography of reference sources used.

Você também pode gostar

- Business Plan Checklist: Plan your way to business successNo EverandBusiness Plan Checklist: Plan your way to business successNota: 5 de 5 estrelas5/5 (1)

- Trustees Under IndenturesDocumento233 páginasTrustees Under IndenturesPaul9268100% (6)

- Equity Research Report Writing ProcessDocumento6 páginasEquity Research Report Writing ProcessQuofi SeliAinda não há avaliações

- Financial Statement Analysis: Business Strategy & Competitive AdvantageNo EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageNota: 5 de 5 estrelas5/5 (1)

- (EMERSON) Loop CheckingDocumento29 páginas(EMERSON) Loop CheckingDavid Chagas80% (5)

- The Balanced Scorecard: Turn your data into a roadmap to successNo EverandThe Balanced Scorecard: Turn your data into a roadmap to successNota: 3.5 de 5 estrelas3.5/5 (4)

- Strategic Management Paper SummaryDocumento6 páginasStrategic Management Paper SummaryRiza FanilaAinda não há avaliações

- Financial Analysis (BIBLE) PDFDocumento23 páginasFinancial Analysis (BIBLE) PDFlampard230% (1)

- Business Plan Handbook: Practical guide to create a business planNo EverandBusiness Plan Handbook: Practical guide to create a business planNota: 5 de 5 estrelas5/5 (1)

- Case Study Analysis FrameworkDocumento4 páginasCase Study Analysis Frameworkanupama8Ainda não há avaliações

- MBA Project Report On Financial AnalysisDocumento73 páginasMBA Project Report On Financial AnalysisShainaDhiman79% (24)

- Lesson 3 - Materials That Undergo DecayDocumento14 páginasLesson 3 - Materials That Undergo DecayFUMIKO SOPHIA67% (6)

- MMPX 403 Parametr ListDocumento30 páginasMMPX 403 Parametr ListOğuz Kağan ÖkdemAinda não há avaliações

- Sec of Finance Purisima Vs Philippine Tobacco Institute IncDocumento2 páginasSec of Finance Purisima Vs Philippine Tobacco Institute IncCharlotte100% (1)

- CH 4 - Consolidated Techniques and ProceduresDocumento18 páginasCH 4 - Consolidated Techniques and ProceduresMutia WardaniAinda não há avaliações

- Blum2020 Book RationalCybersecurityForBusineDocumento349 páginasBlum2020 Book RationalCybersecurityForBusineJulio Garcia GarciaAinda não há avaliações

- Su13 Mgmt449 Term Project GuidelinesDocumento4 páginasSu13 Mgmt449 Term Project GuidelinesEllie Trang NguyenAinda não há avaliações

- 12 - MWS96KEE127BAS - 1research Project - WalmartDocumento7 páginas12 - MWS96KEE127BAS - 1research Project - WalmartashibhallauAinda não há avaliações

- Group Project Guidelines - Monsoon 2023 - UG - FAC 102Documento3 páginasGroup Project Guidelines - Monsoon 2023 - UG - FAC 102Krrish BosamiaAinda não há avaliações

- SA 5 Financial Statement AnalysisDocumento6 páginasSA 5 Financial Statement AnalysisMoona AwanAinda não há avaliações

- Project GuidelinesDocumento4 páginasProject GuidelinesHamza AsifAinda não há avaliações

- Financial Research Project T Mobile Valuation and AnalysisDocumento24 páginasFinancial Research Project T Mobile Valuation and Analysisalka murarka100% (1)

- Group Assignment - Financial Statement Analysis: Good Luck!Documento4 páginasGroup Assignment - Financial Statement Analysis: Good Luck!Quỳnh GiangAinda não há avaliações

- Analyzing Comcast's Financials and Competitive EnvironmentDocumento8 páginasAnalyzing Comcast's Financials and Competitive Environmentumar0% (1)

- Project 2Documento4 páginasProject 2kipkemei ezekielAinda não há avaliações

- Equity Analyst ReportDocumento3 páginasEquity Analyst Reportমেহের আব তমালAinda não há avaliações

- A Suggested Format For The Company Analysis ReportDocumento4 páginasA Suggested Format For The Company Analysis ReportPrasanth VngAinda não há avaliações

- Group Assignment - Financial AnalysisDocumento4 páginasGroup Assignment - Financial AnalysisAN THÁI THỊ THANHAinda não há avaliações

- NEW Stock Project Guidelines-3Documento16 páginasNEW Stock Project Guidelines-3Ragav Sasthri0% (1)

- Group Project Guidelines - Monsoon 2023 - UG - FAC 102Documento3 páginasGroup Project Guidelines - Monsoon 2023 - UG - FAC 102Dhruv SidanaAinda não há avaliações

- Annexure Detailed Guideline On Project ReportDocumento4 páginasAnnexure Detailed Guideline On Project Reportmohamed firdousAinda não há avaliações

- FSA 19-21 Group Assignment Expectations Phase-IDocumento2 páginasFSA 19-21 Group Assignment Expectations Phase-IAnishaSapraAinda não há avaliações

- Corporate Analysis Project InsightsDocumento6 páginasCorporate Analysis Project InsightsfredmanntraAinda não há avaliações

- TEAM ASSIGNMENT BUS 420 Fraser Valley INDIA 2022 WinterDocumento4 páginasTEAM ASSIGNMENT BUS 420 Fraser Valley INDIA 2022 WinterRithik KhannaAinda não há avaliações

- 1.) Research Paper (220 Points) (Course Final Assessment)Documento5 páginas1.) Research Paper (220 Points) (Course Final Assessment)ladycontesaAinda não há avaliações

- Final Project Guidelines1Documento3 páginasFinal Project Guidelines1Đạt TrầnAinda não há avaliações

- Assignment 6Documento2 páginasAssignment 6nurikgamer46Ainda não há avaliações

- Teamwork Project - Valuation K18404CADocumento2 páginasTeamwork Project - Valuation K18404CANgọc Dương Thị BảoAinda não há avaliações

- Acf 302Documento8 páginasAcf 302Zaish MahmoodAinda não há avaliações

- Stock Pitch Guidelines - OriginalDocumento4 páginasStock Pitch Guidelines - Originaloo2011Ainda não há avaliações

- Essentials For Financial Statement AnalysisDocumento5 páginasEssentials For Financial Statement AnalysisVIRTUAL UNIVERSITYAinda não há avaliações

- DL Corporate Finance AssessmentDocumento2 páginasDL Corporate Finance Assessmentsarge1986Ainda não há avaliações

- Guidelines: Financial Statements Analysis (Group Project)Documento1 páginaGuidelines: Financial Statements Analysis (Group Project)Sahil GargAinda não há avaliações

- Project Guide (AFS 2013)Documento2 páginasProject Guide (AFS 2013)syed HassanAinda não há avaliações

- Work Sample - Space TechDocumento2 páginasWork Sample - Space TechSrishti MittalAinda não há avaliações

- Analysis and Use of Financial Statements ProjectDocumento3 páginasAnalysis and Use of Financial Statements ProjectRishiaendra CoolAinda não há avaliações

- Annex C: Guidelines For Participants: Questions or Actions A Team Should ConsiderDocumento8 páginasAnnex C: Guidelines For Participants: Questions or Actions A Team Should ConsiderjetaloAinda não há avaliações

- Financial-Statement-Analysis-Project-ModifiedDocumento12 páginasFinancial-Statement-Analysis-Project-Modifiedbody.helal2001Ainda não há avaliações

- UK Soft Drink AnalysisDocumento11 páginasUK Soft Drink AnalysisThara DasanayakaAinda não há avaliações

- YFAC 2024 Competition BriefDocumento12 páginasYFAC 2024 Competition Briefnguyenhagiathinh050Ainda não há avaliações

- Financial Ratio Analysis ProjectDocumento4 páginasFinancial Ratio Analysis Projectmani chawla0% (1)

- Financial Analysis Case O01 and OA01Documento2 páginasFinancial Analysis Case O01 and OA01sothearith sokAinda não há avaliações

- FSA AssignmentDocumento5 páginasFSA AssignmentKarthik ArumughamAinda não há avaliações

- Project Report PreparationDocumento8 páginasProject Report PreparationSudhansu Shekhar panda100% (1)

- Business Management Report TemplateDocumento16 páginasBusiness Management Report TemplateJennifer LinAinda não há avaliações

- Annual Report AnalysisDocumento3 páginasAnnual Report AnalysisAvishek GhosalAinda não há avaliações

- Types of Business ReportsDocumento4 páginasTypes of Business Reportsmohitha_srpAinda não há avaliações

- Acc 599 Week 10 Assignment 3 Capstone Research ProjectDocumento2 páginasAcc 599 Week 10 Assignment 3 Capstone Research ProjectKevin0% (1)

- UntitledDocumento2 páginasUntitledAatif JanjuaAinda não há avaliações

- Edgar L KsDocumento22 páginasEdgar L KsProsenjit BhowmikAinda não há avaliações

- Financial Statements Analysis - Dhaka Stock ExchangeDocumento49 páginasFinancial Statements Analysis - Dhaka Stock ExchangeShubhagata ChakrabortyAinda não há avaliações

- Interpretation of AccountDocumento36 páginasInterpretation of AccountRomeo OOhlalaAinda não há avaliações

- EFAAC InstructionsDocumento1 páginaEFAAC InstructionsbharathAinda não há avaliações

- Ratio Analysis Conceptual QuestionsDocumento4 páginasRatio Analysis Conceptual Questionsbinder86400% (1)

- Chapter 07 The Business Plan - Creating and Star - Version1Documento24 páginasChapter 07 The Business Plan - Creating and Star - Version1abbas alSaihatiAinda não há avaliações

- Mgt489 Project Report GuidelineDocumento6 páginasMgt489 Project Report GuidelineSyedSalmanRahmanAinda não há avaliações

- Ielts Band 9 Sample Essay NoDocumento5 páginasIelts Band 9 Sample Essay NoNhã NguyễnAinda não há avaliações

- Draft of The English Literature ProjectDocumento9 páginasDraft of The English Literature ProjectHarshika Verma100% (1)

- Difference Between Knowledge and SkillDocumento2 páginasDifference Between Knowledge and SkilljmAinda não há avaliações

- Alexander Lee ResumeDocumento2 páginasAlexander Lee Resumeapi-352375940Ainda não há avaliações

- Afar Partnerships Ms. Ellery D. de Leon: True or FalseDocumento6 páginasAfar Partnerships Ms. Ellery D. de Leon: True or FalsePat DrezaAinda não há avaliações

- 【4DI+4DO】MA01+-AXCX4040 UserManual EN v1.1Documento36 páginas【4DI+4DO】MA01+-AXCX4040 UserManual EN v1.1RioNorte LojaAinda não há avaliações

- Instruction/Special Maintenance Instruction (IN/SMI)Documento2 páginasInstruction/Special Maintenance Instruction (IN/SMI)ANURAJM44Ainda não há avaliações

- Stellar Competent CellsDocumento1 páginaStellar Competent CellsSergio LaynesAinda não há avaliações

- Youtube AlgorithmDocumento27 páginasYoutube AlgorithmShubham FarakateAinda não há avaliações

- Warranty Information Emea and CisDocumento84 páginasWarranty Information Emea and CisHenriques BrunoAinda não há avaliações

- Major Swine BreedsDocumento1 páginaMajor Swine BreedsDana Dunn100% (1)

- Parasim CADENCEDocumento166 páginasParasim CADENCEvpsampathAinda não há avaliações

- High Frequency Voltage Probe Non-Availability on GeMDocumento2 páginasHigh Frequency Voltage Probe Non-Availability on GeMjudeAinda não há avaliações

- cp2021 Inf03p02Documento242 páginascp2021 Inf03p02bahbaguruAinda não há avaliações

- 2016 04 1420161336unit3Documento8 páginas2016 04 1420161336unit3Matías E. PhilippAinda não há avaliações

- Easyjet Group6Documento11 páginasEasyjet Group6Rishabh RakhechaAinda não há avaliações

- ADC Driver Reference Design Optimizing THD, Noise, and SNR For High Dynamic Range InstrumentationDocumento22 páginasADC Driver Reference Design Optimizing THD, Noise, and SNR For High Dynamic Range InstrumentationAdrian SuAinda não há avaliações

- Iqvia PDFDocumento1 páginaIqvia PDFSaksham DabasAinda não há avaliações

- Namal College Admissions FAQsDocumento3 páginasNamal College Admissions FAQsSauban AhmedAinda não há avaliações

- Guardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicDocumento110 páginasGuardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicTarun BharadwajAinda não há avaliações

- AssDocumento9 páginasAssJane SalvanAinda não há avaliações

- 20220720-MODIG-Supply Chain Manager (ENG)Documento2 páginas20220720-MODIG-Supply Chain Manager (ENG)abhilAinda não há avaliações

- Telangana Budget 2014-2015 Full TextDocumento28 páginasTelangana Budget 2014-2015 Full TextRavi Krishna MettaAinda não há avaliações