Escolar Documentos

Profissional Documentos

Cultura Documentos

CH 5 Crash of DSE

Enviado por

Rahat Ul AminDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CH 5 Crash of DSE

Enviado por

Rahat Ul AminDireitos autorais:

Formatos disponíveis

Chapter 5: The Market crash of 2010

The qualitative indicators of the bubbles submitted by the rickshaw pullers which also reminds the famous quote of the Joseph. P. Kennedy Sr. when even the shoeshine boys are giving you the stock tips, its time to sell. Situation was quite similar with our capital market, where most of the retail investors were lack of minimum investment knowledge. Reasons behind formation of bubbles are discussed below Trading on the Dhaka Stock Exchange index was halted after it fell by 660 points, or 9.25%, in less than an hour. It was the biggest one-day fall in its 55-year history. The result in impact fall Of DGEN BY 6.7%.

The shedding of index by 600 points in five minutes in DSE by crashing the market circuit breaker limit of 225 points, has led to the conclusion that inevitable has happened and marketcrash has, no doubt, occurred on 20 January, 2011. Now it is the right time to make an exploration on why this crash has occurred. Thousands of angry investors vandalised cars, blocked roads around the country's main bourse and fought a violent battle with police following Share trading stopped only 50 minutes into the opening of transactions, when prices went into free fall.

The regulator instructed the exchanges to suspend the trading after General Index of Dhaka Stock Exchange slumped by 660 points and Selective Categories Index of Chittagong Stock Exchange by 914 points. the collapse of the stockmarket yesterday. It was the steepest singled-day fall in the bourses' history.

5.2 Reason for market Crash:

Harsh Steps taken by Bangladesh Bank: At the end bubble started to shake with the year end selling pressure from the institutions due to liquidity crisis and as well as comments from recent IMF mission to minimize the exposure of the bank to capital market. BB tightened its stance on compliance at 10% of total liabilities by banks to the capital market exposure and also on calculation of capital market exposure at market price, tight surveillance

regarding diversion of industrial loans to the capital market. All these triggered the sale of shares on the part of banks.

Moreover, weak growth of remittance inflows, alongside high outflows, for strong import operations and other commercial payments abroad increased the demand for greenback and, thereby, lowered supply of taka in the market. This can be evidenced by the fact that Taka depreciated against USD, with the weighted average inter bank rate at Taka 70.75 per USD on December 30, 2010, against Taka 69.44 per USD on June 30, 2010. In January, 2011 alone, taka depreciated against greenback by 2.5%. As many leading merchant banks finance the margin loans through borrowing from the money market at call money rate, instability in the call money market stopped the window for merchant banks for further borrowing to lend in the capital market. Tight monetary policy was applied by BB in October, 2010 to pull the rising inflation. Auction of Treasury bill cash out the 3000 crores, increase in CRR ratio forced more 3200 crore to go out from the market. It was also aimed at stopping credit-flow to non- productive sectors. Apart from this discontinuation of Repo lending by BB, the impact of reduced money supply demonstrated later. The central bank also issued another directive asking financial institutions to adjust their stock investment exposure by December. From January, no institution will be allowed to invest more than 10 percent of its total liabilities in the stock market, and the exposure will be calculated based on market price, not cost price. The Bangladesh Bank announced the 6 months monetary policy in July last year and was continuously asking the Banks to minimize the capital market exposure. Bangladesh Bank pushed the scheduled commercial banks to bring down their capital market exposure and comply with the AD ratio. At the end of the year BB has started execution by triggering their money market tools and surveillance at the end of monetary policy implementation period. This made the banks to realize their capital market gains and use that fund in the money market operation. At the beginning of the 2011, because of the crisis in the money market and pressure of

Bangladesh bank to reduce capital market exposure, institutional investors did not buy back shares. Beside this BBs roaring directives to adjust the diverted term loan by 15th February, 2011. The quick response from the borrower by realizing the profit has led the fund out from the capital market further. The problem of excess liquidity in the market turned exactly opposite direction and made the market crash. The strength of the growth of capital market might have fueled the overheated market but does not have the capacity to absorb the massive correction.

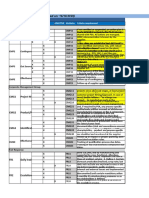

Table 1: Recent monetary policy changes

Date 06-May-10 01-Aug-10 01-Dec-10 13-Mar-11 26-Apr-11 15-Jun-11

Policy Changes Cash reserve ratio increase by 50 bps to 5.50% Repo/Reverse repo rate increased by 50 bps to 5.50% Cash reserve ratio increase by 50 bps to 6.00% Repo/Reverse repo rate increased by 50 bps to 6.00% Repo/Reverse repo rate increased by 25 bps to 6.25% Repo/Reverse repo rate increased by 50 bps to 6.75%

Sale pressure from institution and big parties:

Besides, as the accounting year-end of most banks and NBFIs' falls in December, these institutions usually dispose a great portion of their shareholding. This caused the selling pressure further. It is also alleged that many of the so-called big gamblers come out of market with a big amount of funds. Furthermore, to add salt to the fire, many of the merchant banks and brokerage house started offloading their holdings which aggravated the situation further. It has also been observed some leading security houses' selling pressure was so severe that they sold the shares below the market price which caused the index to shed more than 600 points with five to six minutes of trading. As a result, the market has been suffering severe liquidity crisis for last two months. This has led to a crisis of confidence as many of the efforts, already made did last longer time.

Weak and inconsistent SEC as Regulator Although the market was termed as overheated by excess liquidity, SEC played very controversial role. The change of face value, split, changes nothing in the value of the company but only increases the supply of no. of shares which enhanced the liquidity. SEC permitted many stocks to split which irrationally overheated the share prices. In the case of loan ratio, SEC was never consistent and it interrupted

the market system very frequently.

SEC was operated with limited office staff, with lawyers of inadequate competence and no chartered accountant available. There were 134 staffs in the SEC of which only 47 were officers. There are four persons currently working in the law department of the SEC to support the lawyers on different legal issues.)

Its limited human resource capacity allows SEC to monitor only two brokerage houses in a month. Moreover, SEC has no surveillance software of its own, rather it uses the software of DSE and CSE to monitor the market. Proper surveillance of transactions often becomes difficult because of dependence on others. (The automated trading was initiated on 10 August, 1998, while DSE 20 Index was introduced on 1 January 2001. The Central Depository System was initiated on 24 January 2004.) SEC is yet to initiate the project titled Improvement of Capital Market which has a component of purchasing high-powered computer software for monitoring and surveillance operation. (Asian Development Bank (ADB) has allocated USD 3 million for this project. The main objective of this project is to improve technical, operational and management capability of the stock and insurance markets. The project includes, among others, purchase of high-powered computer software for monitoring and surveillance operation in the market (which costs USD0.3 million). The project is supposed to be started in 2007 and to be ended in 2011.)

The nature of relationship maintained by the SEC with the Ministry of Finance (SEC is a statutory body and is attached to the Ministry of Finance.) is sometime found to be erroneous for the market (e.g. face value harmonization issue). (A consultative committee of SEC proposed to harmonise the face value of all listed securities at Tk.10. However, the proposal was in limbo because of no guideline for few months from the Standing Committee of the Ministry of Finance. The proposal was revised several times, and it was finally decided that all new companies will off load their shares at Tk.10 while the existing listed companies may fix the face value at Tk.10 upon receiving the approval of the board of directors of the company.) The Parliamentary Standing Committee for the Ministry of Finance in some instances has taken "adversarial position", thus creating unwarranted pressure in the operation of the SEC and the capital market. Market Manipulation: A number of irregular practices have been reported in the national dailies which indicate market manipulation by a number of bull cartels. (According to newspaper reports the number of bull cartel operated in the stock market is more than ten. These kinds of bull cartels were operational in 1996 as well and played a major to

crash the market.) It is alleged that these bull cartels comprise limited number of people including some members of DSE/CSE, officials of SEC, political leaders, big businessmen, officials of financial institutions, and owners of brokerage houses. Various incidence has been reported in the newspapers as regards manipulating practices such as operation of curb market in case of offering placement shares of IPOs, lifting lock-in period in favor of selected companies, speculative trading of 'Z' category shares to artificially raising the share prices, use of book building system through syndicated practices, fake transactions through brokerage houses, and access to price sensitive information prior to public announcement. (There are rumors that these bull cartels with the support of share departments of the respective companies have access to undisclosed and secret information of the company such as information on buying and selling of shares by a large quantity.) Because of weak surveillance and monitoring system, SEC is usually unable to prevent such illegal practices.

5.3.3 Funeral March of the Stock Bubble

The funeral march of the stock bubble started from the irresponsible comments by the Ministers and Advisors. The result in depressing disappointment, lack of confidence in the investors, has expedited the rally of the bearish market. The fear factors intensified in investors when the perceived last resorts BB, SEC, Govt. itself failed to come up with a timely remedy for restoring the systematic breakdown in the investors confidence. Aftermath of the bursting of bubble is the sufferings of the so called innocent investors. It is said that when a doctor makes mistake a family will cry but when the regulator makes mistake the whole country will cry.

Comments: "What we have in Bangladesh is a 'casino', not a capital market, where people are running in totally a crazy way," said Rehman Sobhan, chairman of CPD, a private think tank, while speaking a dialogue on 'Growth, Inflation and Monetary Policy: Challenges for Bangladesh in FY 2011' at CIRDAP auditorium.

Source: Financial Express, VOL 1818 NO -98 REGD NO DA 1589 | Dhaka, Monday February 14 2011

A look-back at 1996 The 1996 stock market crash was the largest ever in the history of DSE. At that time there was no electronic trading system and the scripts were all paper share. Increased activity of retail investors at the curb market created a bubble in the market during that period. Large scale irregularities and gross manipulation eventually led to bursting of the bubble. Following the collapse, the market remained in virtual hibernation for a couple of years. The 96 correction at that time raised a number of questions which eventually led to a more systematic structure of trading. The regulatory bodies chalked out some reforms in the market which saw the introduction of automated trading system in 1998. Under the supervision of Asian Development Bank, a central depository system was also introduced to facilitate trading activities electronically. Bangladeshi capital market has already experienced market crashes in 1996 and 2010. In 1996, the picture of the countrys capital market was totally different than today. Paper shares were sold in front of the Dhaka Stock Exchange (DSE) at that time. So, it was difficult for investors to differentiate

between

fake

share

and

original

shares.

The fourth quarter of the year 1996 witnessed feverish activities on the DSE and on the comparatively smaller Chittagong Stock Exchange (CSE). In September, October and the first half of November, new records were recorded everyday on the bourses as share prices soared. Up to 300,000 first-time buyers joined in the bonanza, driving the shares of a total of 210 listed companies to an all-time-high on 16 November, 1996.

At that time the all-share index of the DSE reached 3,627 points, up from around 1,000 in June the same year. By November 4, market capitalisation had reached an unsustainable $6 billion, equivalent to some 20 per cent of the country's GDP.

The government began to cool down the market by selling off state-owned enterprises. In late December, the central bank announced that Taka 2 billion ($47 million) would be available to the state-run Investment Corporation of Bangladesh to buy shares and give some support to the market, but the market crashed despite these preventative measures. In 1997, 37 stock brokers were charged with market manipulation in the DSE boom and crash of 1996.

Similar things happened in 2010-2011 when the DSE lost 660 points (9.25 per cent) in just one hour. As a result average daily trading suffered a loss of about 6.7 per cent. The CSE also met a similar fate. An abrupt crash of the market sparked violent protests from the Bangladeshi investors.

On January 10 this year, we saw a huge selling pressure and a record fall, 600 points, in the general index of DSE within just 50 minutes of trading. Again the next day we saw the other side of the coin when almost no seller was found to sell of their portfolios. At the end of the day's trading, the

DGEN, the main DSE index, gained 1,012 points, taking into consideration the previous day's loss. Before the incident, the highest single-day gain of 701 points was witnessed when Grameenphone hit the market. Thus we witnessed both the record gain and record decline in indices on January 10 and January 11 respectively. Indian stock market crash in 2008 Indian stock market also faced significant market correction in the recent past. The Bombay Stock Exchange (BSE) Sensitive Index (SENSEX or BSE 30) experienced a steep fall during 2008 - the index lost almost 60% within ten months. From its peak value (till then) of 21,078 points as on January 8, 2010, SENSEX crippled to 8,701.07 points as on October 24, 2008. Prior to the market crash, SENSEX saw a sustained bull run in the previous five years - gaining 47% in 2007, 46% in 2006, 42% in 2005, 13% in 2004, and 73% in 2003; in 2008 it lost 52% - more than half of its value from the beginning of the year The fall in the market started in January together with other markets around the world, following weak global cues amid fears of a recession in the US. The fall soon realized into a deep crash that stretched throughout 2008, the main reason being Global Financial Crisis and the dismal corporate earnings outlook in the domestic market. The recovery started from the second half of 2009 and by November 2010, SENSEX hit 21,000 points once more. Chart 3, above, shows the index movement in the last five years. During its peak value in January, 2008 the market P/E of SENSEX hit all time high at 28.1x; it went down to 13.9x by the end of the year. MCAP to GDP ratio of the index also went down in the same period from 180% to 50%. Market Capitalization of DSE is relatively small in comparison with the GDP of Bangladesh. During its peak value on December, 2010, the market P/E went

up to 31.3x while the MCAP to GDP ratio was 52%. However at present, following the market correction, the market P/E went down to 16.1x while the MCAP to GDP ratio is at 42%. For SENSEX, the present MCAP to GDP ratio and market P/E stands at 107% and 19.7x respectively (as on March, 2011).

Você também pode gostar

- Price Data of DSE - 21-08-16Documento1.516 páginasPrice Data of DSE - 21-08-16Rahat Ul AminAinda não há avaliações

- DescoDocumento1 páginaDescoRahat Ul AminAinda não há avaliações

- Stress Testing of Jamuna Bank LTDDocumento15 páginasStress Testing of Jamuna Bank LTDRahat Ul AminAinda não há avaliações

- CCL Ratio Analysis and Bangladesh Cement Industry OverviewDocumento4 páginasCCL Ratio Analysis and Bangladesh Cement Industry OverviewRahat Ul AminAinda não há avaliações

- Final ReportDocumento13 páginasFinal ReportRahat Ul AminAinda não há avaliações

- Internship Report HSBCDocumento43 páginasInternship Report HSBCsheikhgiAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- 9 External Environment Factors That Affect BusinessDocumento5 páginas9 External Environment Factors That Affect BusinessHasan NaseemAinda não há avaliações

- Investment Practice ProblemsDocumento14 páginasInvestment Practice ProblemsmikeAinda não há avaliações

- Application OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedDocumento50 páginasApplication OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedShokry AminAinda não há avaliações

- Business Impact AssessmentDocumento10 páginasBusiness Impact Assessmentदीपक सैनीAinda não há avaliações

- Chapter1 5 FVDocumento33 páginasChapter1 5 FVDanica Dela CruzAinda não há avaliações

- 12 Accountancy Lyp 2017 Foreign Set3Documento41 páginas12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalAinda não há avaliações

- MEBS Call Center PH Company OverviewDocumento9 páginasMEBS Call Center PH Company OverviewMEBS PresidentAinda não há avaliações

- Trade Union-SEUSL-2Documento41 páginasTrade Union-SEUSL-2dinukadamsith_287176Ainda não há avaliações

- Checklist For DSA - DOADocumento2 páginasChecklist For DSA - DOAkhriskammAinda não há avaliações

- Rsik ManagementDocumento221 páginasRsik ManagementNirmal ShresthaAinda não há avaliações

- Aus Tin 20104493Documento166 páginasAus Tin 20104493david_llewellyn_smithAinda não há avaliações

- LeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENDocumento13 páginasLeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENSocialMedia NewLifeAinda não há avaliações

- International Economics MCQDocumento119 páginasInternational Economics MCQTaTa100% (1)

- Dragon Fruit Jam Marketing PlanDocumento31 páginasDragon Fruit Jam Marketing PlanLara Rinoa LarrozaAinda não há avaliações

- Deed of HypothecmionDocumento6 páginasDeed of HypothecmionspacpostAinda não há avaliações

- Retail Management: A Strategic Approach: 11th EditionDocumento9 páginasRetail Management: A Strategic Approach: 11th EditionMohamed El KadyAinda não há avaliações

- HTTP WWW - Aiqsystems.com HitandRunTradingDocumento5 páginasHTTP WWW - Aiqsystems.com HitandRunTradingpderby1Ainda não há avaliações

- Bhakti Chavan CV For HR ProfileDocumento3 páginasBhakti Chavan CV For HR ProfileADAT TestAinda não há avaliações

- Ciencia, Tecnología y Educación Al Servicio Del PaísDocumento3 páginasCiencia, Tecnología y Educación Al Servicio Del PaísAdrian JácomeAinda não há avaliações

- Technical DetailsDocumento3 páginasTechnical DetailsKimberly NorrisAinda não há avaliações

- CBCS Guidelines For B.comh Sem VI Paper No - BCH 6.1 Auditing and Corporate GovernanceDocumento2 páginasCBCS Guidelines For B.comh Sem VI Paper No - BCH 6.1 Auditing and Corporate GovernanceJoel DinicAinda não há avaliações

- Qip QSB v4.2 - Trad P Anotaçôes Rev02Documento17 páginasQip QSB v4.2 - Trad P Anotaçôes Rev02Yasmin BatistaAinda não há avaliações

- STAFF INSTRUCTIONSDocumento56 páginasSTAFF INSTRUCTIONSBatjargal EnkhbatAinda não há avaliações

- Textileetp Sira 2016Documento64 páginasTextileetp Sira 2016Andrei PopescuAinda não há avaliações

- Chapter 1: Introduction: 1.1 The Construction ProjectDocumento10 páginasChapter 1: Introduction: 1.1 The Construction ProjectamidofeiriAinda não há avaliações

- Financial Accounting Report (Partnership - Group 2)Documento20 páginasFinancial Accounting Report (Partnership - Group 2)syednaim0300Ainda não há avaliações

- Financial InvestmentDocumento7 páginasFinancial InvestmentGerald de BrittoAinda não há avaliações

- Fuel Supply Agreement - LNG - UI 2021 (407769612.1)Documento54 páginasFuel Supply Agreement - LNG - UI 2021 (407769612.1)Edmund KhoveyAinda não há avaliações

- Ifrs 2: Share Based PaymentsDocumento7 páginasIfrs 2: Share Based PaymentsNomanAinda não há avaliações

- Week 6-7 Let's Analyze Acc213Documento5 páginasWeek 6-7 Let's Analyze Acc213Swetzi CzeshAinda não há avaliações