Escolar Documentos

Profissional Documentos

Cultura Documentos

Taxbreaksummary 110911

Enviado por

WFSEc28Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Taxbreaksummary 110911

Enviado por

WFSEc28Direitos autorais:

Formatos disponíveis

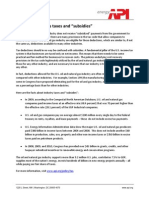

27 WAYS TO CUT THE DEFICIT BY CUTTING TAX BREAKS

Here are just 27 tax breaks that six groups propose cutting. The special legislative session could raise $2.3 billion by closing them. Thats more than enough to cover the $2 billion budget deficit. There may be some overlap. WFSE/AFSCME members may not support them all. But we can all agreecutting tax breaks is better than devastating cuts to public safety, public services and higher education.

GROUP/IDEA Economic Opportunity Institute1

Repeal 1 mortgage deduction st Repeal 1 mortgage deduction for banks in more than 10 states Sales tax exemption on custom software Sales tax on financial planning, investment advising, securities trading B&O pop syrup credit/increase pop syrup tax B&O tax exemption for farmers with gross income above $200,000 Sales tax exemption for non-organic fertilizers, sprays and washes Use tax exemption on extracted fuel Non-resident sales tax exemption Motor vehicle fuel sales tax exemption Public Utility Taxes (PUT) (modernize interpretation of Interstate Commerce Clause)

st

SAVINGS

$ 50.8 million 20.0 million 31.2 million 46.9 million 16.7 million 32.7 million 44.6 million 25.6 million 19.3 million 803.2 million 248.5 million

Our Economic Future Coalition2

Private jets Display items/trade shows Elective cosmetic surgery Out-of-state coal Out-of-state shoppers Consumer services Christmas tree production Fish tax exemption B&O tax exemption/fish cleaning services 5.0 million .5 million 8.0 million 11.0 million 44.0 million 100.0 million .5 million .340 million .011 million

Sightline (progressive green think tank)3

Trade-ins to car dealerships sales tax exemption

344.0 million

WFSE/AFSCME4

3% furlough on corporate tax breaks 450.0 million

Citizen Commission on Performance Measurement of Tax Preferences5

Hog fuel Renewable energy machinery 3.2 million 40.8 million

SB 5947 (An act relating to repealing certain tax exemptions to provide funding for essential government services)6

Bull semen used for artificial insemination; chicken bedding; propane or natural gas to heat chicken structures 7.041 million

TOTAL:

$2,353,892,000

SOURCES: 1. http://www.eoionline.org/state_economy/index.htm; Revenues to Rebuild Washingtons Economy; A Jobs and Economic Recovery Plan for Washington. 2. http://oureconomicfuture.org/; http://www.wfse.org/taxgiveaways.pdf 3. http://daily.sightline.org/2011/10/27/washingtons-450-million-tax-giveaway-for-cars/; http://publicola.com/2011/10/27/sightline-heres-a-tax-loophole-that-could-save-450-million/. 4. http://seattletimes.nwsource.com/html/dannywestneat/2016643494_danny30.html. 5. http://www.citizentaxpref.wa.gov/reports.htm. 6. http://apps.leg.wa.gov/billinfo/summary.aspx?bill=5947&year=2011. 7. Passed by voters as I-464 in 1984; it was opposed by WFSE/AFSCME.

Washington Federation of State Employees | AFSCME Council 28 | AFL-CIO

www.wfse.org

800-562-6002

info@wfse.org

Você também pode gostar

- The Economic Agenda For Barak ObamaDocumento5 páginasThe Economic Agenda For Barak ObamaGaurav GuptaAinda não há avaliações

- Policy Matters Ohio - Tax Breaks For Wealthy and Special InterestsDocumento4 páginasPolicy Matters Ohio - Tax Breaks For Wealthy and Special InterestsProgressOhio251Ainda não há avaliações

- IPA's 75 Point List For AbbottDocumento2 páginasIPA's 75 Point List For AbbottJohn MaguireAinda não há avaliações

- 4478 Fact Sheet 061010Documento4 páginas4478 Fact Sheet 061010Steve CouncilAinda não há avaliações

- Tax Breaks To EliminateDocumento4 páginasTax Breaks To Eliminatedacoda204Ainda não há avaliações

- Scott Hodge, President Will Mcbride, Chief EconomistDocumento20 páginasScott Hodge, President Will Mcbride, Chief EconomistTax FoundationAinda não há avaliações

- 11-24-10 Hunt - Removing The Carbon Tax Will Not Be Difficult AFRDocumento3 páginas11-24-10 Hunt - Removing The Carbon Tax Will Not Be Difficult AFRLatika M BourkeAinda não há avaliações

- Tax Avoidance &tax Havens Undermining Democracy: Created by Alok (8) Dinesh (21) Diwakar (23) Naveen (36) PramodDocumento49 páginasTax Avoidance &tax Havens Undermining Democracy: Created by Alok (8) Dinesh (21) Diwakar (23) Naveen (36) PramodPramod JuyalAinda não há avaliações

- Chapter 1 Taxation 2 Onsite Bba3 June To August 2021Documento20 páginasChapter 1 Taxation 2 Onsite Bba3 June To August 2021hamidAinda não há avaliações

- PLCB Alternatives MemoDocumento47 páginasPLCB Alternatives MemoCommonwealth FoundationAinda não há avaliações

- The MRTP Act. & The New Competition LawDocumento32 páginasThe MRTP Act. & The New Competition LawAkshay GroverAinda não há avaliações

- The Facts About Oil and Natural Gas Taxes and "Subsidies"Documento1 páginaThe Facts About Oil and Natural Gas Taxes and "Subsidies"Energy TomorrowAinda não há avaliações

- Tax Incentives For Businesses in Latin America and The CaribbeanDocumento29 páginasTax Incentives For Businesses in Latin America and The Caribbean82628Ainda não há avaliações

- Lab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application AssignmentDocumento4 páginasLab Sandeep Kumar Raina b54 Roll No 27 10 - Lab - Week5 - s7 9 - Application Assignmentsandeepraina0% (1)

- Prices, Outputs, Strategy and Market RegulationDocumento21 páginasPrices, Outputs, Strategy and Market RegulationNoor NadiahAinda não há avaliações

- The Budget 2014 For Corporate LawyersDocumento2 páginasThe Budget 2014 For Corporate LawyersLexisNexis Current AwarenessAinda não há avaliações

- 5 - 04 European-Semester - Thematic-Factsheet - Curbing-Agressive-Tax-Planning - enDocumento9 páginas5 - 04 European-Semester - Thematic-Factsheet - Curbing-Agressive-Tax-Planning - enFoegle Jean-PhilippeAinda não há avaliações

- Dr. Felipe Medalla Financial SectorDocumento104 páginasDr. Felipe Medalla Financial SectorLianne Carmeli B. Fronteras100% (1)

- McCain Cuts Big Oil's Taxes by $4 BillionDocumento2 páginasMcCain Cuts Big Oil's Taxes by $4 BillionProtect Florida's BeachesAinda não há avaliações

- Policy Recommendations: The Reform ProgrammeDocumento12 páginasPolicy Recommendations: The Reform ProgrammeManoranjan DashAinda não há avaliações

- The WorkbookDocumento10 páginasThe WorkbookJohnCarneyDEAinda não há avaliações

- This Content Downloaded From 27.54.123.95 On Sat, 24 Apr 2021 20:17:37 UTCDocumento28 páginasThis Content Downloaded From 27.54.123.95 On Sat, 24 Apr 2021 20:17:37 UTCkhizar ahmadAinda não há avaliações

- Taxation of Cooperatives PDFDocumento110 páginasTaxation of Cooperatives PDFJaquelyn RaccaAinda não há avaliações

- Module 3.2 - Preferential Taxation Keyworded Lecture NotesDocumento8 páginasModule 3.2 - Preferential Taxation Keyworded Lecture NotesGabs SolivenAinda não há avaliações

- Government PoliciesDocumento8 páginasGovernment Policieser_ankurpareekAinda não há avaliações

- IndustryDocumento14 páginasIndustryMohd ShahidAinda não há avaliações

- Agriculture Law: RL33572Documento14 páginasAgriculture Law: RL33572AgricultureCaseLawAinda não há avaliações

- 17 Stavins FINALDocumento21 páginas17 Stavins FINALapi-3747949Ainda não há avaliações

- 2006 Question and AnswerDocumento8 páginas2006 Question and AnswerHaRry PeregrinoAinda não há avaliações

- Salient Features: BUDGET 2021-22 Sales Tax Act 1990Documento11 páginasSalient Features: BUDGET 2021-22 Sales Tax Act 1990sundasAinda não há avaliações

- Backgrounder: Note On Scope of ReportingDocumento6 páginasBackgrounder: Note On Scope of ReportingedsunonlineAinda não há avaliações

- India Power Sector: Challenges & Investment OpportunitiesDocumento23 páginasIndia Power Sector: Challenges & Investment OpportunitiesYasir HamidAinda não há avaliações

- Tax Cuts and Jobs Act Will Cost $1.5 Trillion - Committee For A Responsible Federal BudgetDocumento2 páginasTax Cuts and Jobs Act Will Cost $1.5 Trillion - Committee For A Responsible Federal BudgetTan SoAinda não há avaliações

- LEITI 2nd Reconciliation ReportDocumento112 páginasLEITI 2nd Reconciliation ReportLiberiaEITIAinda não há avaliações

- FN 008 Understanding The Inflation ReductionDocumento5 páginasFN 008 Understanding The Inflation ReductionHollyAinda não há avaliações

- Reconstruction of U.S. Tax Policy Proposal For ConsiderationDocumento8 páginasReconstruction of U.S. Tax Policy Proposal For Considerationapi-286241068Ainda não há avaliações

- TRAIN LAW - 3.9.18 - Laguna ChapterDocumento408 páginasTRAIN LAW - 3.9.18 - Laguna ChapterDeoshel AlagonAinda não há avaliações

- Canadite ComparisonDocumento42 páginasCanadite Comparisonds92jzAinda não há avaliações

- Liberty Index 2012 General Acts 1 Through 33Documento21 páginasLiberty Index 2012 General Acts 1 Through 33Bob GuzzardiAinda não há avaliações

- Capital Allowances Manual-HmrcDocumento52 páginasCapital Allowances Manual-HmrcDarren FamAinda não há avaliações

- L1 p2 Budget Without SchemesDocumento90 páginasL1 p2 Budget Without Schemesatul.vivAinda não há avaliações

- Community Papers Preserve Ad DeductDocumento4 páginasCommunity Papers Preserve Ad DeductjmhaighAinda não há avaliações

- Tutorial 5 FAT Solution (Unimelb)Documento25 páginasTutorial 5 FAT Solution (Unimelb)Ahmad FarisAinda não há avaliações

- Deficit Committee PaperDocumento5 páginasDeficit Committee PaperRyan DeCaroAinda não há avaliações

- Basic Economic Ideas and Resource AllocationDocumento54 páginasBasic Economic Ideas and Resource AllocationShaurya SaksenaAinda não há avaliações

- Conference Committee Agenda: February 23Documento20 páginasConference Committee Agenda: February 23kyamamuraAinda não há avaliações

- Answers To Questions On Notice: Senate Economics References CommitteeDocumento4 páginasAnswers To Questions On Notice: Senate Economics References Committeescsa31619Ainda não há avaliações

- Jul20 ErDocumento5 páginasJul20 Errwmortell3580Ainda não há avaliações

- Personal Income Tax Under The New Regime and Old RegimeDocumento4 páginasPersonal Income Tax Under The New Regime and Old RegimeAiswarya BAinda não há avaliações

- Category Current (RS) Proposed (RS) Savings P.A. (RS) : Direct TaxDocumento16 páginasCategory Current (RS) Proposed (RS) Savings P.A. (RS) : Direct TaxshwetakuppanAinda não há avaliações

- Carbon Finance: The Financial Implications of Climate ChangeNo EverandCarbon Finance: The Financial Implications of Climate ChangeNota: 5 de 5 estrelas5/5 (1)

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsAinda não há avaliações

- C Corp V Flow Thru 3-26-12Documento5 páginasC Corp V Flow Thru 3-26-12JimcasartAinda não há avaliações

- Agenda Item 8 Oct 21 2010Documento58 páginasAgenda Item 8 Oct 21 2010srust2792Ainda não há avaliações

- 1.kieso 2020-1184-1249Documento66 páginas1.kieso 2020-1184-1249dindaAinda não há avaliações

- Lecture Notes:: ECON 635: Public EconomicsDocumento45 páginasLecture Notes:: ECON 635: Public EconomicstilahunthmAinda não há avaliações

- Financial Services and General Government, 2021Documento2 páginasFinancial Services and General Government, 2021FedSmith Inc.Ainda não há avaliações

- Congressional Budget Office: Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Documento16 páginasCongressional Budget Office: Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515editorial.onlineAinda não há avaliações

- LC Legal Feed Annual Edition 2021Documento59 páginasLC Legal Feed Annual Edition 2021vishal rajputAinda não há avaliações

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchNo EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchNota: 5 de 5 estrelas5/5 (1)

- Washington State Employee 8/2016Documento8 páginasWashington State Employee 8/2016WFSEc28Ainda não há avaliações

- Washington State Employee 5/2016Documento8 páginasWashington State Employee 5/2016WFSEc28Ainda não há avaliações

- How Your Legislators Voted On Key State Employee Issues in 2015 and 2016Documento12 páginasHow Your Legislators Voted On Key State Employee Issues in 2015 and 2016WFSEc28Ainda não há avaliações

- Washington State Employee - June 2016Documento8 páginasWashington State Employee - June 2016WFSEc28Ainda não há avaliações

- WFSE MBR Card 2016Documento2 páginasWFSE MBR Card 2016WFSEc28Ainda não há avaliações

- Tate Mployee: You Can't Change Anything Until You Admit A Problem'Documento8 páginasTate Mployee: You Can't Change Anything Until You Admit A Problem'WFSEc28Ainda não há avaliações

- Washington State Employee 11/2015Documento8 páginasWashington State Employee 11/2015WFSEc28Ainda não há avaliações

- WFSE/AFSCME Membership CardDocumento2 páginasWFSE/AFSCME Membership CardWFSEc28Ainda não há avaliações

- Washington State Employee 5/2015Documento8 páginasWashington State Employee 5/2015WFSEc28Ainda não há avaliações

- PSM Poster 18x24Documento1 páginaPSM Poster 18x24WFSEc28Ainda não há avaliações

- All About WFSE: Tag Line HereDocumento13 páginasAll About WFSE: Tag Line HereWFSEc28Ainda não há avaliações

- Washington State Employee (WSE) 10/2015Documento8 páginasWashington State Employee (WSE) 10/2015WFSEc28Ainda não há avaliações

- Washington State Employee, 1/2015Documento8 páginasWashington State Employee, 1/2015WFSEc28Ainda não há avaliações

- Rebuilding The Middle Class: End Wage Theft Statewide Minimum WageDocumento2 páginasRebuilding The Middle Class: End Wage Theft Statewide Minimum WageWFSEc28Ainda não há avaliações

- WSE SmartHealth PosterDocumento1 páginaWSE SmartHealth PosterWFSEc28Ainda não há avaliações

- All About WFSEDocumento24 páginasAll About WFSEWFSEc28Ainda não há avaliações

- Washington State Employee 12/2014Documento8 páginasWashington State Employee 12/2014WFSEc28Ainda não há avaliações

- Tate Mployee: StewardDocumento8 páginasTate Mployee: StewardWFSEc28Ainda não há avaliações

- ENT 300 Individual Assessment-Personal Entrepreneurial CompetenciesDocumento8 páginasENT 300 Individual Assessment-Personal Entrepreneurial CompetenciesAbu Ammar Al-hakimAinda não há avaliações

- Random Variables Random Variables - A Random Variable Is A Process, Which When FollowedDocumento2 páginasRandom Variables Random Variables - A Random Variable Is A Process, Which When FollowedsdlfAinda não há avaliações

- NABARD R&D Seminar FormatDocumento7 páginasNABARD R&D Seminar FormatAnupam G. RatheeAinda não há avaliações

- Amendments To The PPDA Law: Execution of Works by Force AccountDocumento2 páginasAmendments To The PPDA Law: Execution of Works by Force AccountIsmail A Ismail100% (1)

- Kosher Leche Descremada Dairy America Usa Planta TiptonDocumento2 páginasKosher Leche Descremada Dairy America Usa Planta Tiptontania SaezAinda não há avaliações

- Financial Management 2E: Rajiv Srivastava - Dr. Anil Misra Solutions To Numerical ProblemsDocumento5 páginasFinancial Management 2E: Rajiv Srivastava - Dr. Anil Misra Solutions To Numerical ProblemsParesh ShahAinda não há avaliações

- Introduction - Livspace - RenoDocumento12 páginasIntroduction - Livspace - RenoMêghnâ BîswâsAinda não há avaliações

- Dwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFDocumento35 páginasDwnload Full Beckers World of The Cell 9th Edition Hardin Solutions Manual PDFgebbielean1237100% (12)

- Native VLAN and Default VLANDocumento6 páginasNative VLAN and Default VLANAaliyah WinkyAinda não há avaliações

- EGurukul - RetinaDocumento23 páginasEGurukul - RetinaOscar Daniel Mendez100% (1)

- PP Master Data Version 002Documento34 páginasPP Master Data Version 002pranitAinda não há avaliações

- TESTDocumento27 páginasTESTLegal CheekAinda não há avaliações

- Comparative Study Between Online and Offilne Learning With Reference of Tutedude E-LearningDocumento61 páginasComparative Study Between Online and Offilne Learning With Reference of Tutedude E-LearningDeeksha Saxena0% (2)

- CiscoDocumento6 páginasCiscoNatalia Kogan0% (2)

- Account Statement 250820 240920 PDFDocumento2 páginasAccount Statement 250820 240920 PDFUnknown100% (1)

- Soujanya Reddy (New)Documento6 páginasSoujanya Reddy (New)durgaAinda não há avaliações

- Curriculum Guide Ay 2021-2022: Dr. Gloria Lacson Foundation Colleges, IncDocumento9 páginasCurriculum Guide Ay 2021-2022: Dr. Gloria Lacson Foundation Colleges, IncJean Marie Itang GarciaAinda não há avaliações

- Lesson Plan For Implementing NETSDocumento5 páginasLesson Plan For Implementing NETSLisa PizzutoAinda não há avaliações

- Cetie Guide No1 EngDocumento55 páginasCetie Guide No1 EngJose Manuel Sepulveda RomanAinda não há avaliações

- Ring and Johnson CounterDocumento5 páginasRing and Johnson CounterkrsekarAinda não há avaliações

- Epreuve Anglais EG@2022Documento12 páginasEpreuve Anglais EG@2022Tresor SokoudjouAinda não há avaliações

- Dreaded Attack - Voyages Community Map Rules v1Documento2 páginasDreaded Attack - Voyages Community Map Rules v1jAinda não há avaliações

- Draft PDFDocumento166 páginasDraft PDFashwaq000111Ainda não há avaliações

- GE 7 ReportDocumento31 páginasGE 7 ReportMark Anthony FergusonAinda não há avaliações

- BackgroundsDocumento13 páginasBackgroundsRaMinah100% (8)

- AssignmentDocumento47 páginasAssignmentHarrison sajorAinda não há avaliações

- Project Management TY BSC ITDocumento57 páginasProject Management TY BSC ITdarshan130275% (12)

- Design and Analysis of Modified Front Double Wishbone Suspension For A Three Wheel Hybrid VehicleDocumento4 páginasDesign and Analysis of Modified Front Double Wishbone Suspension For A Three Wheel Hybrid VehicleRima AroraAinda não há avaliações

- Santu BabaDocumento2 páginasSantu Babaamveryhot0950% (2)

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDocumento8 páginasTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotAinda não há avaliações