Escolar Documentos

Profissional Documentos

Cultura Documentos

AF617 Syl Update 6.25.11

Enviado por

落海无潮Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AF617 Syl Update 6.25.11

Enviado por

落海无潮Direitos autorais:

Formatos disponíveis

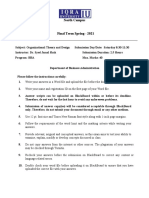

Management Accounting and Control AF617 Course Outline continued Wednesday, June 29 Topic: Using Financial Controls in the

presence of Uncontrollable Factors. Source: Text p. 533 In-class discussion; Case 1 Hoffman Discount Drugs Source: Text-p. 549 Assignment questions: 1. Evaluate the HDDI Store Management Bonus Plan. What if anything will you change. Explain. Homework Assignment: Write a brief answer to question 1. Case 2: Beifang Chuang Ye Vehicle Group Source: Text-p.573 Assignment Questions: 1. To what extent should Mr. Zhou compensate his employees, even though his company is losing money? Why? What factors did you take into consideration in making your judgment? Homework Assignment: Write a brief answer to question 1. Note: The take home individual case will be announced today on the website (probably available after class). This complete case write-up will need to be uploaded by midnight on Sunday, July 3. Monday, July 4 NO CLASS HOLIDAY

Wednesday, July 6 Topic: Corporate Governance and Board of Directors Source: Text Chapter 13 Case 1- Pacific Sunwear of California, Inc. Assignment Questions: 1. Evaluate the process that PacSun went through to comply with SOX, and particularly with Section 404. What that process as effective and efficient as it could have been? 2. Are the significant deficiencies that were identified in each of the two years of audit evidence of control system flaws or largely irrelevant technical violations? In other words, should the disclosure of these deficiencies have had a negative effect on PacSuns stock price? 3. PacSun executives seem convinced that the costs of complying with SOX are greater than the benefits to the company. Why did PacSun not benefit from the compliance process to the same extent as some other companies? Or were their compliance costs too high? Note: No homework question from this case but please read up about the Sarbanes Oxley Act of 2002 so you can understand the issues in this case. Case 2- Golden Parachutes Source: Text-p.620 Assignment questions: 1. Is the proposed severance package in the best interests of: a. The executives included in it? b. Database Technologies, Inc. (DTI) and its shareholders? c. A company that is acquiring DTI? 2. Should the compensation committee approve the severance agreement as is? Should some of the elements of the agreement be modify? Or should DTI not have a severance agreement? 3. Suppose that you, as Dennis Feingold, object strongly to at least some of the elements of the severance agreement but that the other two members of DTI compensation committee recommend adopting the agreement as it is written. Would it be worthwhile for you to voice your objections forcefully and, perhaps, to take the issue to the full board of directors? Or would you consider it adequate just to cast a negative vote when the issue comes up in the compensation committee? Homework: Give a brief answer to Question 2.

Monday, July 11 Topic 1: Controllers and Auditors Source: Text Chapter 14 Topic 2: Management control Related Ethical issues and Analysis Source: Text Chapter 15 In-class discussion: Case Don Russell: Experiences of a Controller CFO Source: Text: p.641 Assignment questions: 1. Was Don Russell a good controller for Cook and Spector, Inc.? Why or why not? 2. Does Don have the power to force ETI top management to make a correcting accounting entry? If not what should he do? If so, should he fore the entry to be made, and how large should it be? 3. Are earnings management practices such as took place at C&S and ETI smart? Are they ethical? Homework assignment: Write brief answer to question 1. Wednesday, July 13 Last Day of Class In-class Case Write-up Please be prompt, as the exam will begin promptly at 1:30 to allow the three hours needed for the write-up.

Você também pode gostar

- W1 Assignments: Case Analysis, Reviews & Final Project PrepDocumento4 páginasW1 Assignments: Case Analysis, Reviews & Final Project PrepblairAinda não há avaliações

- P6 ACCA Examiner ReportDocumento7 páginasP6 ACCA Examiner ReportMadhuChohanAinda não há avaliações

- 01 Task Performance 1 (Answer)Documento2 páginas01 Task Performance 1 (Answer)Arrah mae SantiagoAinda não há avaliações

- Analyzing Comcast's Financials and Competitive EnvironmentDocumento8 páginasAnalyzing Comcast's Financials and Competitive Environmentumar0% (1)

- Group2 Case1 4241-6241Documento8 páginasGroup2 Case1 4241-6241slexicAinda não há avaliações

- Kasus Kasus AuditDocumento4 páginasKasus Kasus Auditfaldy331Ainda não há avaliações

- Auditing Cases Solutions Guide for Public CompaniesDocumento143 páginasAuditing Cases Solutions Guide for Public CompaniesJasmin Feliciano50% (2)

- Kumpulan Jawaban Case LakesideDocumento133 páginasKumpulan Jawaban Case Lakesiderizal100% (1)

- MGT523 SPR (A) DL AY21-22 RequirementDocumento7 páginasMGT523 SPR (A) DL AY21-22 RequirementAbdullahAinda não há avaliações

- Examiners' Reports 2019: LA3021 Company Law - Zone ADocumento17 páginasExaminers' Reports 2019: LA3021 Company Law - Zone AdaneelAinda não há avaliações

- LW ENG S20-A21 Examiner's ReportDocumento5 páginasLW ENG S20-A21 Examiner's Reportscribd tempAinda não há avaliações

- Case QuestionsDocumento13 páginasCase QuestionsMañuel É PrasetiyoAinda não há avaliações

- MGT 611 Case Analysis GuideDocumento2 páginasMGT 611 Case Analysis GuideMahmoud Elhaj50% (2)

- Case Method Learning ModelDocumento3 páginasCase Method Learning ModelBrady ShipletAinda não há avaliações

- Financial Management Case Studies Fall 2003Documento6 páginasFinancial Management Case Studies Fall 2003adhi_nub0% (1)

- 1 An Overview of Financial ManagementDocumento14 páginas1 An Overview of Financial ManagementSadia AfrinAinda não há avaliações

- MGT 701 Strategic Management Mumbai Jan 2021Documento9 páginasMGT 701 Strategic Management Mumbai Jan 2021Sumeet MadwaikarAinda não há avaliações

- Organizational Behaviour & Human Resource Management-Term1 AnswerDocumento10 páginasOrganizational Behaviour & Human Resource Management-Term1 AnswerNaushaba ParveenAinda não há avaliações

- OTD PaperDocumento3 páginasOTD PaperMuhammad AshhadAinda não há avaliações

- LW GLO S20-A21 examiner's reportDocumento6 páginasLW GLO S20-A21 examiner's reportS RaihanAinda não há avaliações

- Assignment Sheet Tuesday, January 17, 2012 Class 1 - Introduction and Goals For The SemesterDocumento29 páginasAssignment Sheet Tuesday, January 17, 2012 Class 1 - Introduction and Goals For The SemesterRosie KrauseAinda não há avaliações

- 7 Steps Case StudyDocumento2 páginas7 Steps Case StudySachin Kumar SakriAinda não há avaliações

- Gbermic ReqsDocumento3 páginasGbermic ReqsJosh EspirituAinda não há avaliações

- Mid-Term Exam Take-Home Fall 2020Documento6 páginasMid-Term Exam Take-Home Fall 2020Zaara HassanAinda não há avaliações

- Business Analysis and JudgementDocumento9 páginasBusiness Analysis and JudgementhimanshuAinda não há avaliações

- SilabuDocumento9 páginasSilabufranky1000Ainda não há avaliações

- 7 Effective Steps To Solve Case StudyDocumento2 páginas7 Effective Steps To Solve Case Studyalejandra riveraAinda não há avaliações

- 1 - An Overview of Financial ManagementDocumento14 páginas1 - An Overview of Financial ManagementFawad Sarwar100% (5)

- Examiner's Report: F4 Corporate and Business Law (GLO) December 2011Documento4 páginasExaminer's Report: F4 Corporate and Business Law (GLO) December 2011Leonard BerishaAinda não há avaliações

- Finance Assignment Sheet 2007-2008 John PDFDocumento4 páginasFinance Assignment Sheet 2007-2008 John PDFPrince Digital ComputersAinda não há avaliações

- Examiner's Report on P6 Advanced Taxation (UK) December 2011 ExamDocumento6 páginasExaminer's Report on P6 Advanced Taxation (UK) December 2011 ExamAdnan QureshiAinda não há avaliações

- updated_INS1016-HK2 2023-2024-Mid term with KEY9_4Documento12 páginasupdated_INS1016-HK2 2023-2024-Mid term with KEY9_4thuynganAinda não há avaliações

- HRPD 709 001 S - 2023 SAR 2 NewDocumento2 páginasHRPD 709 001 S - 2023 SAR 2 NewangeliaAinda não há avaliações

- CASE ANALYSIS: DMX Manufacturing: Property of STIDocumento3 páginasCASE ANALYSIS: DMX Manufacturing: Property of STICarmela CaloAinda não há avaliações

- Examiners' Reports 2016: LA3017 Commercial Law - Zone BDocumento15 páginasExaminers' Reports 2016: LA3017 Commercial Law - Zone BFahmida M RahmanAinda não há avaliações

- Assessment IV - Group Work 3 (WorldCom)Documento2 páginasAssessment IV - Group Work 3 (WorldCom)Teebora FrancisAinda não há avaliações

- Business Management Quiz 1Documento4 páginasBusiness Management Quiz 1saraAinda não há avaliações

- The Case Study Method of Learning 2022-23Documento3 páginasThe Case Study Method of Learning 2022-23Ayaan ZaiAinda não há avaliações

- TopicDocumento1 páginaTopicYajanyAinda não há avaliações

- IM Chapter01Documento13 páginasIM Chapter01Carese Lloyd Llorente BoylesAinda não há avaliações

- KSG Prelims Test CSAT 1 QuestionDocumento28 páginasKSG Prelims Test CSAT 1 Questionuniversal Internet SattenapalliAinda não há avaliações

- 1 An Overview of Financial Management PDFDocumento14 páginas1 An Overview of Financial Management PDFMirwaise Abdul QayyumAinda não há avaliações

- Shui Fabrics Case Study differences in perspectives between Chinese and American companiesDocumento4 páginasShui Fabrics Case Study differences in perspectives between Chinese and American companiestitanchengAinda não há avaliações

- How to write law exam answersDocumento2 páginasHow to write law exam answersNisen ShresthaAinda não há avaliações

- AWA Practice 123Documento8 páginasAWA Practice 123bcd LAinda não há avaliações

- Institute and Faculty of Actuaries: Subject SA3 - General Insurance: Specialist ApplicationsDocumento18 páginasInstitute and Faculty of Actuaries: Subject SA3 - General Insurance: Specialist Applicationsdickson phiriAinda não há avaliações

- Professional Judgement Workpaper TemplateDocumento2 páginasProfessional Judgement Workpaper TemplateMark S.PAinda não há avaliações

- Hewlett Packard Case StudyDocumento4 páginasHewlett Packard Case StudyfarahAinda não há avaliações

- Examiners’ reports 2017 - Company law exam questionsDocumento20 páginasExaminers’ reports 2017 - Company law exam questionsdaneelAinda não há avaliações

- Examiners' Reports 2016: LA3021 Company Law - Zone BDocumento18 páginasExaminers' Reports 2016: LA3021 Company Law - Zone BdaneelAinda não há avaliações

- Question Bank Xii B.st. 2022 23Documento52 páginasQuestion Bank Xii B.st. 2022 23KavoAinda não há avaliações

- Financial Statements Analysis, Part 1 - DiscussionDocumento13 páginasFinancial Statements Analysis, Part 1 - DiscussionMark Angelo BustosAinda não há avaliações

- Overview Study Material Foundations of Business Law Lecture 2016-2017 Recap LectureDocumento7 páginasOverview Study Material Foundations of Business Law Lecture 2016-2017 Recap LecturePepijn SchaffersAinda não há avaliações

- Answering The Law PaperDocumento5 páginasAnswering The Law PaperMay Myoe MyatAinda não há avaliações

- Introduction To The CaseDocumento4 páginasIntroduction To The CaseHarshad MujumdarAinda não há avaliações

- This Exam Consists of 7 Pages Please Ensure You Have A Complete PaperDocumento7 páginasThis Exam Consists of 7 Pages Please Ensure You Have A Complete Paperudai sidhuAinda não há avaliações

- Roadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideNo EverandRoadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideAinda não há avaliações

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueAinda não há avaliações

- Managerial Finance in a Canadian Setting: Instructor's ManualNo EverandManagerial Finance in a Canadian Setting: Instructor's ManualAinda não há avaliações

- Chap 001Documento29 páginasChap 001frankmarson100% (1)

- A Count Ant ManagerDocumento107 páginasA Count Ant ManagergeneralgataAinda não há avaliações

- R. Kelly Rainer - Brad Prince - Casey G. Cegielski-Introduction To Information Systems - Supporting and Transforming Business-Wiley - PDF (1) - 40275Documento40 páginasR. Kelly Rainer - Brad Prince - Casey G. Cegielski-Introduction To Information Systems - Supporting and Transforming Business-Wiley - PDF (1) - 40275yuki's mix channelAinda não há avaliações

- Intermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerDocumento27 páginasIntermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerMelissaAinda não há avaliações

- Chap04 Tutorial QuestionsDocumento5 páginasChap04 Tutorial QuestionsKim Anh TruongAinda não há avaliações

- Questionable Accounting Leads to Enron CollapseDocumento8 páginasQuestionable Accounting Leads to Enron CollapseRodel Ramos DaquioagAinda não há avaliações

- Accounting ERP SOXDocumento13 páginasAccounting ERP SOXPatel KashyapAinda não há avaliações

- Examination Practice Questions 80Documento31 páginasExamination Practice Questions 80Amit SinghAinda não há avaliações

- Learn Business EthicsDocumento79 páginasLearn Business EthicseBooks DPF DownloadAinda não há avaliações

- Risk Based Internal AuditingDocumento89 páginasRisk Based Internal AuditingGun Gunawan100% (4)

- 2015 04 29 - EIGI - Follow-Up To 'A Web of Deceit'Documento6 páginas2015 04 29 - EIGI - Follow-Up To 'A Web of Deceit'gothamcityresearchAinda não há avaliações

- Financial Reporting Manager in Washington DC Resume Stella NtahoDocumento3 páginasFinancial Reporting Manager in Washington DC Resume Stella NtahoStellaNtahoAinda não há avaliações

- Ankur Khandelwal: Kotak Mahindra Bank LTD, MumbaiDocumento3 páginasAnkur Khandelwal: Kotak Mahindra Bank LTD, MumbaiHarshit BhatiaAinda não há avaliações

- An Investigation of Whether Auditors' Independence Is A Reality or Is Just A Perception A Case Study of Nkayi Rural District CouncilDocumento6 páginasAn Investigation of Whether Auditors' Independence Is A Reality or Is Just A Perception A Case Study of Nkayi Rural District CouncilDynamic Research JournalsAinda não há avaliações

- Adelphia CommunicationsDocumento16 páginasAdelphia CommunicationsMazhar Ul HaqAinda não há avaliações

- Emerging Issues in Corporate GovernanceDocumento19 páginasEmerging Issues in Corporate GovernanceDiah KrismawatiAinda não há avaliações

- The Fraud Triangle As A Predictor ofDocumento14 páginasThe Fraud Triangle As A Predictor ofZulfaneri PutraAinda não há avaliações

- Test Bank For Bank Management and Financial Services 9th Edition by Rose PDFDocumento48 páginasTest Bank For Bank Management and Financial Services 9th Edition by Rose PDFSamiun TinyAinda não há avaliações

- Discussion QuestionsDocumento121 páginasDiscussion QuestionsDnyaneshwar KharatmalAinda não há avaliações

- Real Earnings Management and Firm Value: Examination of Costs of Real Earnings ManagementDocumento23 páginasReal Earnings Management and Firm Value: Examination of Costs of Real Earnings ManagementatikaAinda não há avaliações

- SEC Code of Corporate GovernanceDocumento47 páginasSEC Code of Corporate GovernanceVenus Charisse MabilingAinda não há avaliações

- Cyber Security RoadmapDocumento11 páginasCyber Security RoadmapLuis BarretoAinda não há avaliações

- Internal Financial Controls Practical Approach by CA. Murtuza Kachwala 1Documento89 páginasInternal Financial Controls Practical Approach by CA. Murtuza Kachwala 1Lakshmi Narayana Murthy KapavarapuAinda não há avaliações

- ITRA Standard and Methods of AuditingDocumento6 páginasITRA Standard and Methods of AuditingOpie OmAinda não há avaliações

- SOX Audit For Beginners: March 30Documento17 páginasSOX Audit For Beginners: March 30Jemimah Burgas100% (1)

- Corporate & Business EthicsDocumento17 páginasCorporate & Business Ethicspapu_jhappuAinda não há avaliações

- Sarbanes Oxley ActDocumento3 páginasSarbanes Oxley ActMary Grace CiervoAinda não há avaliações

- Manoj Upadhayay DissertationDocumento17 páginasManoj Upadhayay DissertationdidwaniasAinda não há avaliações

- ValeoDocumento2 páginasValeoRe WindAinda não há avaliações

- Naresh Chandra Committee ReportDocumento118 páginasNaresh Chandra Committee Reportrahul_singh1288544360% (1)