Escolar Documentos

Profissional Documentos

Cultura Documentos

CANCEL Bank Guarantee Application

Enviado por

Nhi NguyễnDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CANCEL Bank Guarantee Application

Enviado por

Nhi NguyễnDireitos autorais:

Formatos disponíveis

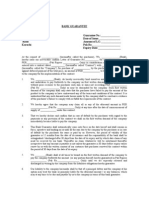

Application for a Bank Guarantee

Please complete this form in BLOCK CAPITALS and in black ink, referring to the attached guidance notes for assistance. Upon completion, please send to your Relationship Manager or Trade Centre. 1. Customers details Customers name

Customers reference number Address line 1 Address line 2 Address line 3 Address line 4 OR country Postal code Contact name Position held Preferred daytime contact number (including extension if applicable) Fax number

Address for service*

*An address for service in England or Wales is required if the Customers address is not in England, Wales or Scotland. 2. Type of Guarantee required - please select one of the following options Bid/Tender Performance Advance/Progress Payment

Warranty

ABTA/CAA

HM Customs & Excise

Trade Debt

Other

Please specify

RBS86194UKCB (01/07/2010) Page 1 of 5

51861941

3. Method of issue Please issue by: To be delivered to the: Mail Customer OR OR Courier Beneficiary OR Other

If Other, please specify OR Guarantee advised through an overseas bank via SWIFT OR Request to an overseas bank to issue their Guarantee in favour of the beneficiary via SWIFT Preferred overseas issuing/advising bank and branch details (if known) 4. Format of Guarantee - please select one of the following options Banks standard wording OR (Please ensure that all details required for completion are provided) OR If the format required has already been submitted and reviewed, please enter the reference 5. Guarantee amount Currency (in words) Amount (in words) D W R In the format attached V

Currency code

Amount (in figures)

For HM Customs & Excise deferred payment guarantees, the amount stated above will normally be the amount of the monthly deferred payment to be guaranteed by the Bank. Please note that the maximum liability to HM Customs & Excise under the guarantee exceeds this sum. Currently it is twice the monthly deferred amount. This maximum liability may change. Reference should be made to the form of HM Customs & Excise deferred payment guarantee which the Bank is asked to issue to ascertain the Banks maximum liability. 6. Beneficiary details Beneficiarys name

Address line 1 Address line 2 Address line 3 Address line 4 OR country Postal code Contact name Position held Preferred daytime contact number (including extension if applicable) Fax number RBS86194UKCB (01/07/2010) Page 2 of 5

7. Brief description of goods/services covered by this Guarantee

8. Guarantee value Guarantee value Tender/Contract date Tender/Contract number 9. Bid/Tender Bond - only complete this section if a Bid/Tender Bond is required Tender closing date (if known) 10. Trade Debt Guarantee - only complete this section if a Trade Debt Guarantee is required Transport documentation type (e.g. Bill of Lading/Airway Bill/CMR/Delivery Note)

(As a percentage of full tender/contract value)

Payment terms (e.g. 30 days from invoice date)

11. Expiry Expiry date OR Expiry event

Document to be used to evidence expiry event 12. Special instructions - Please enter any special instructions here (e.g any additional delivery instructions for the Guarantee)

13. Account details Sterling account number Currency account number (if applicable) Please debit all charges to: Sterling account X X OR OR Currency account Currency account X X Sort code

Please debit all payments to: Sterling account

RBS86194UKCB (01/07/2010) Page 3 of 5

14. Bank Guarantee Agreement THIS APPLICATION AND THE BANKS TRADE SERVICES TERMS TOGETHER FORM AN IMPORTANT AGREEMENT. YOU SHOULD TAKE LEGAL ADVICE BEFORE SIGNING. The Trade Services Terms are available to be read and printed online. To access the Terms go to www.rbs.co.uk/terms and enter tst0710 Alternatively, a copy can be obtained from the Customers Relationship Manager. By signing:

the Customer confirms the details on the Application are correct. the Customer agrees to the Trade Services Terms.

Signed in accordance with the authority held by the Bank For (name of company/firm) Customer signature(s)

Name

Name

Date The last page should be retained by the Customer.

Date

RBS86194UKCB (01/07/2010) Page 4 of 5

The Royal Bank of Scotland plc, Registered in Scotland No 90312. Registered Office : 36 St Andrew Square, Edinburgh EH2 2YB

For Relationship Manager use only Please note that the standard tariff, as detailed on the Intranet, will be taken from the date of issue (payable quarterly in advance). If a non-standard tariff has been agreed, via your GTS Sales Business Development Manager with Product Management, this will be held by the relevant Trade Centre and will take precedence. Counter indemnity Is an Omnibus Counter Indemnity currently held for this customer? OR Is a Third Party Indemnity required?

Yes Yes

No No

Name(s) of party(s) e.g. company/individual (if a Third Party Indemnity is required)

Cash cover If cash is held/to be held, is it legally charged? Confirmation A product limit covering all liabilities of under RMP Facility ID Please indicate if the Facility is a MOF Company details.

Yes

No

has been sanctioned

PRISM Facility ID or Group Facility and if applicable please advise the Parent

I confirm the application has been completed in accordance with the current Bank Account Mandate and recommend its acceptance by the Bank. Please issue the Guarantee in accordance with the customer instructions. Relationship Managers signature Name Branch/Unit Location Contact number Fax number ISV number

Date

For Retail Credit use only Credit Sanctioners signature and approved stamp

RBS86194UKCB (01/07/2010) Page 5 of 5

GUIDANCE NOTES The numbering below corresponds to the sections on the form. Please complete all sections ensuring the information reflects your contract terms. 2. Type of Guarantee required Specify the exact type of Guarantee required. If this Guarantee is being issued under the terms of a Letter of Credit, please provide a copy. For overdraft or loan Guarantees, Section 12, Special instructions, must state whether the amount specified includes interest payments and bank charges or whether these are to be in addition. If in addition, specify a maximum time limit, usually six months, for the interest payments and bank charges that may become payable in addition to the amount shown. Please note that, as the total amount payable under the Guarantee cannot readily be ascertained, additional sanction will be required. The Bank must also be advised of the name of the account holder to whom the facility is being provided if this differs from the customer. 3. Method of issue Please select one of the following options: Guarantee by Mail OR Courier If the Guarantee is to be issued by the Bank and the beneficiary needs to be advised by fax that the Guarantee has been issued, please indicate this in Section 12, Special instructions. Please include the beneficiarys fax number and a contact point. OR Guarantee advised through an overseas bank. OR Request to an overseas bank to issue their Guarantee in favour of the beneficiary You should only select this option if local law or the beneficiarys preference prevents the acceptance of a Guarantee direct from a UK bank. The Bank can issue Guarantees, or can instruct an overseas bank to issue a Guarantee. The Banks own direct Guarantees are widely acceptable throughout the world, and offer you several distinct advantages: i) greater control over the Guarantee, as you will be dealing only with your own bank and the beneficiary under the Guarantee, without the involvement of a second bank. ii) avoidance of the additional charges, which an overseas bank would make for issuing their Guarantee. Preferred Overseas Issuing/Advising Bank If known, the name and branch address of the overseas issuing/advising bank, should be entered here. If left blank, the Bank will select the overseas issuing/advising bank. 4. Format of Guarantee Please select one of the following options: Banks standard wording If this box is marked, the Bank will endeavour to incorporate your details into one of its standard texts (copies of which are available on request). However, if this box is marked in conjunction with the Request to an overseas bank to issue their Guarantee in favour of the beneficiary box, the Bank will instruct an overseas bank to issue its standard Guarantee using the details provided. OR In the format attached When a non-standard text is needed, more time is required before the Guarantee can be issued. It is, therefore, important to submit your application as early as possible. The Bank will examine the text and if satisfactory, will issue the Guarantee. If the wording is not satisfactory, the Bank will amend the text. Prior to issuing the Guarantee, the Bank will advise you of any amendments and any other understandings as to how the Guarantee is to be interpreted and under what circumstances a claim would be paid. Additional charges may be levied for approving/issuing non-standard text Guarantees. This charge is dependent on time taken and complexity. If the box is marked in conjunction with the Request to an overseas bank to issue their Guarantee in favour of the beneficiary box, the Bank will examine your text and if the wording appears satisfactory, will instruct an overseas bank to issue its Guarantee in the required format. The Bank will advise you where experience has shown that a particular overseas bank, or banks in general in a particular country, are not prepared to issue Guarantees in wordings other than their standard formats. 7. Brief description of goods/services covered by this Guarantee Please enter the details to identify the transaction to which the Guarantee relates.

8. Guarantee value This helps to identify the tender or contract involved and provides a check that the amount of the Guarantee is correct e.g. if the total contract value is 100,000 and the Guarantee value is for 10,000, the percentage entered should be 10%. The Tender/Contract number and date ensure that the Guarantee applies to one transaction only. 9. Bid/Tender Bond Please note - The Bank and its customers assume a liability under a Guarantee from the time it is issued. However, the date upon which the Guarantee becomes operative can be determined in various ways. A Bid/Tender Bond can be worded to become operative from a specified date - usually the date on which tenders close. 11. Expiry The expiry date ensures that liability ceases at a fixed and predetermined date. However, complications can arise: i) If the Guarantee is not stated to be subject to English Law and the exclusive jurisdiction of the English Courts, the local country law of the beneficiary may apply. In many countries, especially in the Middle East, local law does not necessarily uphold expiry dates. If a Guarantee is stated to be subject to local law, your liability may continue even though the expiry date has passed. In such cases, it is usual that your liability under the Guarantee will only be cancelled upon return of the original Guarantee to the Bank. Alternatively, your liability may be cancelled on the beneficiarys written confirmation to the Bank (if it is our own direct Guarantee) or confirmation from the overseas bank (if the Guarantee is issued by them) that the Guarantee is cancelled. ii) Even where the Guarantee is stated to be subject to English Law and the expiry date is included, you must also state the date by which claims must be submitted. This must be no later than the expiry date. Failure to do so may mean that a valid claim could be received after the expiry date. 12. Special instructions All instructions must be clear and comprehensive, e.g. where an agent is to be advised of receipt of or is to collect a Guarantee from an overseas bank, you must include the agents full name, address, telephone number and means of identification e.g. passport number. Where receipt of the Guarantee is intended to trigger further events (such as where a Documentary Letter of Credit is to be made operative), you must include the full names, addresses and reference numbers of the parties to be notified, as well as instructions on how they should be notified. If there is insufficient space to incorporate all special instructions on the application form, they should be detailed on a separate sheet and attached to the form. Make sure that you indicate on the form that special instructions are attached.

Please note: Amendment and cancellation Once issued, a Guarantee cannot be amended or cancelled, other than within the terms of the Guarantee, except with the consent of the Issuing Bank and beneficiary. Assignment The benefit of the Guarantee will not be transferable by the beneficiary. Charges The Bank charges for providing Guarantees. Please refer to your Relationship Manager for details. In addition, there may be overseas issuing/advising bank and/or other charges for telex, postage, amendments, legal fees etc., together with local Stamp Duty/Taxes and such charges, all of which will be for your account.

Customer to Retain

Bank Guarantee Agreement

THIS APPLICATION AND THE BANKS TRADE SERVICES TERMS TOGETHER FORM AN IMPORTANT AGREEMENT. YOU SHOULD TAKE LEGAL ADVICE BEFORE SIGNING. The Trade Services Terms are available to be read and printed online. To access the Terms go to www.rbs.co.uk/terms and enter tst0710 Alternatively, a copy can be obtained from the Customers Relationship Manager. By signing:

the Customer confirms the details on the Application are correct. the Customer agrees to the Trade Services Terms.

RBS86194UKCB (01/07/2010)

Você também pode gostar

- Discharge of Public Debts 2Documento39 páginasDischarge of Public Debts 2CK in DC100% (16)

- Federal Reserve Notes Not Taxable IncomeDocumento6 páginasFederal Reserve Notes Not Taxable Incomepr0metheu5100% (5)

- The Federal Reserve ActDocumento121 páginasThe Federal Reserve Actjram64100% (2)

- Affidavit THAT all accounts ARE PREPAIDDocumento3 páginasAffidavit THAT all accounts ARE PREPAIDRoberto Monterrosa96% (25)

- The Doñ Quijoté School of Law: By: Don Quijote, JDDocumento84 páginasThe Doñ Quijoté School of Law: By: Don Quijote, JDEL Heru Al AmenAinda não há avaliações

- Letters of Credit and Documentary Collections: An Export and Import GuideNo EverandLetters of Credit and Documentary Collections: An Export and Import GuideNota: 1 de 5 estrelas1/5 (1)

- 20-Bank Guarantee FormatDocumento3 páginas20-Bank Guarantee Formatskantaraj100% (2)

- Banking Law Notes From Dean Abella's Lectures AY 2018-2019: New Central Bank ActDocumento14 páginasBanking Law Notes From Dean Abella's Lectures AY 2018-2019: New Central Bank ActDeanne ViAinda não há avaliações

- UTI - New Editable Transaction Application Form For Purchase Redemption and SwitchDocumento2 páginasUTI - New Editable Transaction Application Form For Purchase Redemption and SwitchAnilmohan Sreedharan0% (1)

- Remitly Matteo MazzaDocumento4 páginasRemitly Matteo MazzahkbiguivgAinda não há avaliações

- How Obligations Are ExtinguishedDocumento14 páginasHow Obligations Are Extinguishedtepi7wepiAinda não há avaliações

- Wire Transfer Request FormDocumento1 páginaWire Transfer Request FormRamón TruzzardiAinda não há avaliações

- Electronic Funds Transfer Application: WWW - Rakbank.aeDocumento2 páginasElectronic Funds Transfer Application: WWW - Rakbank.aeMehran KhanAinda não há avaliações

- (Please Specify) : Fedwire CH Chips BIC Bank Identifier CodeDocumento1 página(Please Specify) : Fedwire CH Chips BIC Bank Identifier CodeThirdxkie Solosa RamosAinda não há avaliações

- Mrunal Full NotesDocumento425 páginasMrunal Full Notesakki71196Ainda não há avaliações

- Documentary Letter of CreditDocumento6 páginasDocumentary Letter of CreditFrederic Le Moing100% (1)

- Invoice - Payment PrintDocumento2 páginasInvoice - Payment PrintJithuJohnAinda não há avaliações

- Commercial Account FormDocumento19 páginasCommercial Account FormSimonAinda não há avaliações

- Deutsche Bank FinalDocumento26 páginasDeutsche Bank FinalBoy NormanAinda não há avaliações

- HSBC Bank London FraudDocumento3 páginasHSBC Bank London FraudArush Nagpal100% (1)

- Application For A Bank Guarantee: Please SelectDocumento6 páginasApplication For A Bank Guarantee: Please SelectGulrana AlamAinda não há avaliações

- The Legal Concept of Money (Simon Gleeson) (Z-Library)Documento257 páginasThe Legal Concept of Money (Simon Gleeson) (Z-Library)邹成广Ainda não há avaliações

- HSBC RTGS PDFDocumento2 páginasHSBC RTGS PDFSamir Choudhry100% (2)

- Bank Guarantee (FormatDocumento2 páginasBank Guarantee (Formatmsadhanani3922Ainda não há avaliações

- Outward Payment Form PDFDocumento3 páginasOutward Payment Form PDFGrehim IT consulting and Training LtdAinda não há avaliações

- Notification of Payment: Payer DetailsDocumento1 páginaNotification of Payment: Payer Detailsjohn theronAinda não há avaliações

- NatWest Current Account Application Form Non UK EU ResDocumento17 páginasNatWest Current Account Application Form Non UK EU ResL mAinda não há avaliações

- United States V Steven Michael RubinsteinDocumento9 páginasUnited States V Steven Michael RubinsteinpunktlichAinda não há avaliações

- Your Finance Agreement Arranged Through Right PDFDocumento12 páginasYour Finance Agreement Arranged Through Right PDFSchipor Danny MagdaAinda não há avaliações

- Application Form - Funds Transfer (SWIFT) / Demand Draft: Indian Overseas Bank, BangkokDocumento2 páginasApplication Form - Funds Transfer (SWIFT) / Demand Draft: Indian Overseas Bank, Bangkokdhanaraj4uAinda não há avaliações

- Lottery Prize Claim FormDocumento2 páginasLottery Prize Claim FormMaria100% (1)

- ContractsDocumento15 páginasContractsNnAinda não há avaliações

- BG SBLC With Zero DepositDocumento2 páginasBG SBLC With Zero DepositchristianAinda não há avaliações

- KRA Tax Compliance CertificateDocumento1 páginaKRA Tax Compliance Certificateyasmin contractingcoltdAinda não há avaliações

- PDFDocumento1 páginaPDFKumar SamyappanAinda não há avaliações

- Sanjeev Itf-2187-A - SBLC - SCB To Saudi Arabiausd 100000 - 261118 - Sanitized IssuedDocumento4 páginasSanjeev Itf-2187-A - SBLC - SCB To Saudi Arabiausd 100000 - 261118 - Sanitized IssuedAndrew RivelinAinda não há avaliações

- Alpari Uk Bank DetailsDocumento3 páginasAlpari Uk Bank DetailsreniestessAinda não há avaliações

- Standard Tender Document For Procurement of Works (Electrical and Mechanical Works)Documento95 páginasStandard Tender Document For Procurement of Works (Electrical and Mechanical Works)Access to Government Procurement Opportunities100% (2)

- Swift Transfer # For Cibc BankDocumento5 páginasSwift Transfer # For Cibc Bank1CRYPTICAinda não há avaliações

- DIGITAL DIRECT BANKINGDocumento10 páginasDIGITAL DIRECT BANKINGKyle Robert100% (1)

- Screenshot 2021-06-25 at 05.38.49Documento24 páginasScreenshot 2021-06-25 at 05.38.49gentot yulianto100% (1)

- MoneyDocumento49 páginasMoneyShalini Singh IPSAAinda não há avaliações

- RHB Bank Online Banking MalaysiaDocumento1 páginaRHB Bank Online Banking MalaysiaKhan AhmedAinda não há avaliações

- Notes - Obli 2Documento14 páginasNotes - Obli 2Matthew WittAinda não há avaliações

- Barclays Bank United Kingdom Re Confirmation of Payment FundDocumento2 páginasBarclays Bank United Kingdom Re Confirmation of Payment FundromizahAinda não há avaliações

- Sending A Payment To Europe Gibraltar Nwi68546Documento3 páginasSending A Payment To Europe Gibraltar Nwi68546jamalazoz05Ainda não há avaliações

- Subject: Letter For List of Principal & Interest Calculation of MOA Home Saver A/C Ref.: Account, No.-22506136317'VDocumento3 páginasSubject: Letter For List of Principal & Interest Calculation of MOA Home Saver A/C Ref.: Account, No.-22506136317'VvipinkumarAinda não há avaliações

- Uco Bank: Zonal Office: Hyderabad Revised Format Weekly Key Parameter Statement Branch: DateDocumento3 páginasUco Bank: Zonal Office: Hyderabad Revised Format Weekly Key Parameter Statement Branch: Datesuresh2323Ainda não há avaliações

- British Ministry of Finance UkDocumento5 páginasBritish Ministry of Finance UkManish TiwariAinda não há avaliações

- Chapter 1 - Money, Credit, and BankingDocumento34 páginasChapter 1 - Money, Credit, and BankingLhara Senioritha95% (20)

- Raiffeisen BankDocumento2 páginasRaiffeisen BankLavdimEminiAinda não há avaliações

- InternationalPaymentFM 20161122 0106Documento1 páginaInternationalPaymentFM 20161122 0106Nathalia SilvaAinda não há avaliações

- Change Bank Mandate FormDocumento3 páginasChange Bank Mandate Formshekar6886Ainda não há avaliações

- Final Example-Long MessageDocumento2 páginasFinal Example-Long MessageJanette LabbaoAinda não há avaliações

- VIBHS - Funds Withdrawal RequestDocumento3 páginasVIBHS - Funds Withdrawal RequestAkhil HussainAinda não há avaliações

- Attach 5023947 1 PDFDocumento2 páginasAttach 5023947 1 PDFLawal HamedAinda não há avaliações

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDocumento1 páginaThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoAinda não há avaliações

- Transferring Funds : International Personal BankDocumento4 páginasTransferring Funds : International Personal BankGarbo BentleyAinda não há avaliações

- Online Funds TransferDocumento2 páginasOnline Funds TransferKarthi kk mobileAinda não há avaliações

- Demand Draft Application FormDocumento2 páginasDemand Draft Application FormKamran Atif PechuhoAinda não há avaliações

- MyBSN - Bill Payment - Bank Simpanan NasionalDocumento1 páginaMyBSN - Bill Payment - Bank Simpanan NasionalyeezhengxinAinda não há avaliações

- Request Bank Draft 2 Million PKRDocumento1 páginaRequest Bank Draft 2 Million PKRirfanAinda não há avaliações

- Application For Bank Guarantee Standby Letter of CreditDocumento2 páginasApplication For Bank Guarantee Standby Letter of CreditJayanth Sri PavanAinda não há avaliações

- Bank Islam IB Fund Transfer StatusDocumento1 páginaBank Islam IB Fund Transfer StatusMuhammad Khairul HafiziAinda não há avaliações

- HMRC Plans For Northern Ireland Brexit ChecksDocumento11 páginasHMRC Plans For Northern Ireland Brexit Checkslisaoc100% (2)

- How To Wire Money ToDocumento13 páginasHow To Wire Money ToscrewyouregAinda não há avaliações

- Wire Transfer DetailsDocumento1 páginaWire Transfer Detailsjose gabriel izaguirre DuqueAinda não há avaliações

- Change of Ownership OnlineDocumento2 páginasChange of Ownership OnlineFlorin Alexandru StoicaAinda não há avaliações

- Legal Anti Money Laundering enDocumento1 páginaLegal Anti Money Laundering enannaAinda não há avaliações

- Rent Receipt: (Signature)Documento1 páginaRent Receipt: (Signature)Akhil RaviAinda não há avaliações

- This Is A First-to-Market' Fraud Prevention Method Offered by FNBDocumento2 páginasThis Is A First-to-Market' Fraud Prevention Method Offered by FNBanzaniAinda não há avaliações

- PDS Equity Home Financing-IDocumento8 páginasPDS Equity Home Financing-IAlan BentleyAinda não há avaliações

- Product Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving LoanDocumento4 páginasProduct Disclosure Sheet: HSBC Bank Malaysia Berhad Revolving Loanthong_wheiAinda não há avaliações

- Role of Money in Our Economic SystemDocumento52 páginasRole of Money in Our Economic SystemRodel Novesteras ClausAinda não há avaliações

- General Banking Law of 2000 (RA8791) Key ProvisionsDocumento22 páginasGeneral Banking Law of 2000 (RA8791) Key ProvisionsMark DigaAinda não há avaliações

- Assisgnment No 4 Contract Management PDFDocumento39 páginasAssisgnment No 4 Contract Management PDFNizar AhamedAinda não há avaliações

- Lecture - Extinguishment of Obligations Part IDocumento10 páginasLecture - Extinguishment of Obligations Part IChristina GattocAinda não há avaliações

- Commercial Banking Laws ReviewDocumento67 páginasCommercial Banking Laws ReviewVenice Jamaila DagcutanAinda não há avaliações

- Debre Markos University College of Business and Economics Department of EconomicsDocumento484 páginasDebre Markos University College of Business and Economics Department of EconomicsYeshiwas EwinetuAinda não há avaliações

- Test Bank For Theories of Personality 9th Edition Jess Feist Gregory Feist Tomi Ann RobertsDocumento36 páginasTest Bank For Theories of Personality 9th Edition Jess Feist Gregory Feist Tomi Ann Robertsemersiongrime2hs4u100% (29)

- Arrieta Vs NRCCDocumento6 páginasArrieta Vs NRCCgiboAinda não há avaliações

- EnglishmagazinesDocumento148 páginasEnglishmagazinesSwati JainAinda não há avaliações

- 08 Chapter 3Documento79 páginas08 Chapter 3Oii SaralAinda não há avaliações

- Moot PDFDocumento26 páginasMoot PDFAishwarya SudhirAinda não há avaliações

- PdfjoinerDocumento947 páginasPdfjoinerBijoyBanikAinda não há avaliações

- Philippine Airlines payment dispute over checks issued to absconding sheriffDocumento27 páginasPhilippine Airlines payment dispute over checks issued to absconding sheriffSheena Reyes-BellenAinda não há avaliações

- China Bank V CADocumento1 páginaChina Bank V CANicole KalingkingAinda não há avaliações

- Notes of Business Environment Class 12Documento5 páginasNotes of Business Environment Class 12s o f t a e s t i cAinda não há avaliações

- Demonetisation in India 2016Documento21 páginasDemonetisation in India 2016Hrishikesh Mahapatra100% (2)

- Budget2 FC To FRBMDocumento37 páginasBudget2 FC To FRBMbhavyaAinda não há avaliações