Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax Laws

Enviado por

puneetjain_111Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax Laws

Enviado por

puneetjain_111Direitos autorais:

Formatos disponíveis

PAPER 3: TAX LAWS To tax is to impose a financial charge or other levy upon a taxpayer (an individual or legal entity)

by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes consist of direct tax or indirect tax, and may be paid in money. A tax may be defined as a "pecuniary burden laid upon individuals or property owners to support the government; a payment exacted by legislative authority. A tax is not a voluntary payment or donation, but an enforced contribution, exacted pursuant to legislative authority and is contribution imposed by government whether under the name of toll, impost, duty, customs, excise, subsidy, aid, supply, or other name. In modern taxation systems, taxes are levied in money; but, in-kind taxation is characteristic of traditional or pre-capitalist states and their functional equivalents. The method of taxation and the government expenditure of taxes raised is often highly debated in politics and economics. Direct Taxes are those taxes like Income Tax Wealth Tax

Which are collected by the government directly from the tax payer. There may be a medium like a bank or internet for completing the transaction. But there is no intermediary. Indirect taxes are those taxes, which are indirectly collected by the government, such as Sales Tax/VAT Excise Duty Service Tax Customs Duty

Another feature of indirect taxes is that these are visibly passed on to the transferee/consumer/taxsufferer The government is forced by circumstances to collect levy & taxes. The government has various developmental programmes & geo-political factors, which need to be addressed. If the government could sell natural resources & earn huge income from such sales, then the government would not levy any taxes middle east countries have no taxes because Sheikhs have oil wells to support their sovereign ambitions. Other countries are forced to levy & collect taxes. Taxes actually make the government unpopular, but these are necessary evils of development process.

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

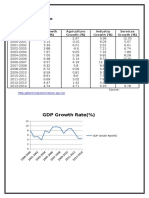

Tax:GDP ratio is a relevant indicator for determining the level of taxation in a country. India stands at 13% - far beyond top 50 in the world. You can expect taxes to rise in the future. Such efforts will come in the form of rate increase, new taxation mechanism such as DTC, GST & tightening the revenue administration Income Tax This is one of the most fundamental of taxes. The scheme of income tax provides is built around the following skeleton Basis of charge Exclusions from Income Computation of Income from Salaries Computation of Income from House Property Computation of Profits & Gains of Business or Profession Capital Gains Income from other Sources Clubbing of Income Set-Off & Carry Forward of Losses Deductions from Income Double Taxation Avoidance Measures Transfer Pricing Sector Specific Provisions Income Tax Authorities & their powers Assessment Procedure TDS & TCS Advance Ruling Offences & Penalties

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Basis of charge According to the Income Tax Act, 1961 & the annual budgets, read together, the rates of taxes are announced for the past periods. In other words, if I earn income of Rs.3.00 lacs in the financial year 2009-10, then the rate of tax on my income will be announced 28th February 2010, when the annual budget exercise commences & confirmed by approval of the parliament sometime in May/June 2010. That means that while I am earning income I am not sure how much of it would be taken away by the government. Then how does the TDS/TCS mechanism work? We will see later Income may be either received or accrued. Received is easy to understand. I receive income when my employer gives me a cheque or when he credits it into my bank account. But accrued is a concept. I work for my boss from 1st March to 25th March. My salary is due to me, from him. He will pay it on 31st March or perhaps even 5th April. Until I receive the money the salary is said to have accrued to me but not yet paid. Both the forms of income ie received & accrued are taxable in the hands of the assessee. But, if income is taxed in accrual form, then it cannot be taxed in received form, once again double taxation is prohibited Taxation also has another dimension status of the assessee. An assessee could be either: Resident & Ordinarily Resident in India Resident but Not Ordinarily Resident in India Non-Resident

What do these terms mean? We will see in a while. The first category is the most general form of assessee. Income arising to a Resident & Ordinarily Resident assessee is taxable on all fronts, as follows Income received or deemed to be received in India by or on behalf of such person Income accrued or arisen or deemed to accrue or arise to him in India Income accrued or arisen to him outside India

All income earned by Resident & Ordinarily Resident assessee is exposed to tax. But an assessee who is Resident but Not Ordinarily Resident in India enjoys a little concession. His tax coverage is as follows: Income received or deemed to be received in India by or on behalf of such person Income accrued or arisen or deemed to accrue or arise to him in India

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

What about Income accrued or arisen to him outside India? It will be taxed only if it is derived from a business/profession controlled or setup in India Non-Resident assessee will be taxed by the following formula: Income received or deemed to be received in India by or on behalf of such person Income accrued or arisen or deemed to accrue or arise to him in India

How do I determine residential status of the assessee? In order to help me in choosing from the above 3 categories of coverage? The following rules will help If a person has been in India for 182 days or more in the financial year, he is resident in India for that financial/previous year In case of a frequent flyer, in & out of the country: If a high flying business executive or professional or businessman has been in India for 365 days or more in 4 years preceding the financial/previous year in question + is in India for 60 days or more during the year in question. Not easy? If a businessman is in India for > 365 days during FY 2005-06 + 2006-07 + 2007-08 + 2008-09 & also for > 60 days in 2009-10, then he is resident in India in 2009-10 What happens to someone who goes to Dubai for work. The rule about frequent flyer will be tweaked as follows In case of a citizen who goes abroad for employment: If he has been in India for 365 days or more in 4 years preceding the financial/previous year in question + is in India for 60 182 days or more during the year in question. If he is in India for > 365 days during FY 2005-06 + 200607 + 2007-08 + 2008-09 & also for > 60 182 days in 2009-10, then he is resident in India in 2009-10. So first time immigrants must leave before 30th September (because 30th September is 183 days into the FY) Same provisions apply even to tandels - member of the crew of an Indian ship. What about people coming to India for vacation? In case of a citizen who is abroad & comes to India for visit: If he has been in India for 365 days or more in 4 years preceding the financial/previous year in question + is in India for 60 182 days or more during the year in question, he will be treated as Resident in India for the previous year in question Exclusions from Income Some incomes are stated for the purposes of record, but do not enter into the computation of taxable income. how is that different from Deductions? Incomes which are first added to arrive at the total

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

income & then some deductions are made to arrive at the taxable income phenomenon of Deductions Income Expense Includible Exclusions Deductions

Salary

Yes

Business

Yes

Rental

Yes

Agriculture

Yes

Dividend

Yes

Gross Total Income

Mediclaim

Yes

Export profits

Yes

LIC/PF/units Some of the exclusions are as follows: (Conditions Apply) Agricultural income Sum received by HUF member Share of a partner, when firm is separately assessed to tax Leave Travel Concession offered by employer to employee

Yes

Allowances paid by the Government of India to a citizen for services rendered abroad Death-cum-Retirement Gratuity

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Commuted value of Pension Encashment of Earned Leave at the time of Retirement Retrenchment Compensation Amount received under Voluntary Retirement Scheme Sum received under a Life Insurance Policy Payment from Provident Fund House Rent Allowance granted by an Employer Special Allowance intended to meet the cost of living at place of work to meet expenses wholly, necessarily and exclusively incurred in the performance of the duties of an office

Wet Lease Payments made for Aircrafts by Indian Airline Operator to a foreign company/government

Scholarships for education Daily Allowances of MPs, MLAs, MLCs Pension received by war widows & orphans Income of Public Charitable Trust, PM National Relief Fund Dividends & Capital Gains of VC Funds Income of Union from House Property & Other Sources

Heads of Income There are only 5 heads of income Salaries Income from House Property Profits & Gains from Business or Profession Capital Gains Income from Other Sources

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Salary includes: any salary due from an employer or a former employer to an assessee in the previous year, whether paid or not any salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer though not due or before it became due to him any arrears of salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer, if not charged to income-tax for any earlier previous year where any salary paid in advance is included in the total income of any person for any previous year it shall not be included again in the total income of the person when the salary becomes due. Any salary, bonus, commission or remuneration, by whatever name called, due to, or received by, a partner of a firm from the firm shall not be regarded as "salary" for the purposes of this section Salary also includes: wages pension gratuity any fees, commissions, perquisites or profits in lieu of or in addition to any salary or wages advance salary encashment of leave accretion to PF

Perks include rent-free/concessional accommodation any sum paid by the employer in respect of any obligation which, but for such payment, would have been payable by the assessee payment towards annuity sweat equity

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Profits in lieu of Salary the amount of any compensation due to or received by an assessee from his employer or former employer at or in connection with the termination of his employment or the modification of the terms and conditions relating thereto any amount due to or received, whether in lump sum or otherwise, by any assessee from any person before his joining any employment with that person; or after cessation of his employment with that person. Deductions from Salary Entertainment Allowance Profession Tax

Income from House Property The annual value of property consisting of any buildings or lands appurtenant thereto of which the assessee is the owner, other than such portions of such property as he may occupy for the purposes of any business or profession carried on by him the profits of which are chargeable to income-tax, shall be chargeable to income-tax under the head Income from house property Add Unrealised rent received subsequently Arrears of rent received

Deductions from House Property 30% of Annual Value Interest on borrowed capital excluding interest payable abroad

Profits & Gains of Business or Profession The following income shall be chargeable to income-tax under the head Profits and gains of business or profession: the profits and gains of any business or profession which was carried on by the assessee at any time during the previous yea any compensation or other payment due to or received towards termination of managing agency

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

income derived by a trade, professional or similar association from specific services performed for its members

profits on sale of a licence granted under the Foreign Trade Policy cash assistance received or receivable by any person against exports under any scheme of the Government of India

drawback against exports any profit on the transfer of the Duty Entitlement Pass Book Scheme, being the Duty Remission Scheme under the Foreign Trade Policy

any profit on the transfer of the Duty Free Replenishment Certificate, being the Duty Remission Scheme under the Foreign Trade Policy

the value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession

any interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by, a partner of a firm from such firm

any sum, whether received or receivable, in cash or kind, in restraint of trade or secrecy of technology, know-how, patent, etc

any sum received under a Keyman insurance policy including the sum allocated by way of bonus on such policy

Deductions from Profits & Gains of Business or Profession Rent, rates, taxes, repairs and insurance for buildings Repairs and insurance of machinery, plant and furniture Depreciation Rehabilitation allowance Expenditure on scientific research Expenditure on acquisition of patent rights or copyrights Expenditure on know-how Expenditure for obtaining licence to operate telecommunication services

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Expenditure by way of payment to associations and institutions for carrying out rural development programmes

Expenditure by way of payment to associations and institutions for carrying out programmes of conservation of natural resources

Amortisation of certain preliminary expenses Amortisation of expenditure incurred under voluntary retirement scheme Deduction for expenditure on prospecting, etc., for certain minerals

Certain deductions to be only on actual payment tax, duty, cess or fee, by whatever name called, under any law for the time being in force contribution to any provident fund or superannuation fund or gratuity fund or any other fund for the welfare of employees interest on any loan or borrowing from any public financial institution or a State financial corporation or a State industrial investment corporation, in accordance with the terms and conditions of the agreement governing such loan or borrowing interest on any loan or advances from a scheduled bank in accordance with the terms and conditions of the agreement governing such loan or advances sum payable by the assessee as an employer in lieu of any leave at the credit of his employee Every person carrying on legal, medical, engineering or architectural profession or the profession of accountancy or technical consultancy or interior decoration or any other profession as is notified by the Board in the Official Gazette shall keep and maintain such books of account and other documents as may enable the Assessing Officer to compute his total income in accordance with the provisions of this Act Every person (a) carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds sixty lakh rupees in any previous year; or (b) carrying on profession shall, if his gross receipts in profession exceed fifteen lakh rupees in any previous year;

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

get his accounts of such previous year audited by an accountant before the specified date and furnish by that date the report of such audit in the prescribed form duly signed and verified by such accountant and setting forth such particulars as may be prescribed Capital Gains Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections, be chargeable to income-tax under the head "Capital gains", and shall be deemed to be the income of the previous year in which the transfer took place Transactions not regarded as transfer any distribution of capital assets on the total or partial partition of a Hindu undivided family any transfer of a capital asset under a gift or will or an irrevocable trust any transfer of a capital asset by a company to its subsidiary company any transfer of a capital asset by a subsidiary company to the holding company any transfer, in a scheme of amalgamation, of a capital asset by the amalgamating company to the amalgamated company if the amalgamated company is an Indian company any transfer, in a scheme of amalgamation, of a capital asset being a share or shares held in an Indian company, by the amalgamating foreign company to the amalgamated foreign company any transfer, in a demerger, of a capital asset by the demerged company to the resulting company, if the resulting company is an Indian company any transfer in a demerger, of a capital asset, being a share or shares held in an Indian company, by the demerged foreign company to the resulting foreign company any transfer of agricultural land in India effected before the 1st day of March, 1970 any transfer of a capital asset, being any work of art, archaeological, scientific or art collection, book, manuscript, drawing, painting, photograph or print, to the Government or a University or the National Museum, National Art Gallery, National Archives or any such other public museum or institution as may be notified by the Central Government in the Official Gazette to be of national importance or to be of renown throughout any State or States any transfer by way of conversion of bonds or debentures, debenture-stock or deposit certificates in any form, of a company into shares or debentures of that company

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

any transfer made on or before the 31st day of December, 1998 by a person (not being a company) of a capital asset being membership of a recognised stock exchange to a company in exchange of shares allotted by that company to the transferor

any transfer of a capital asset, being land of a sick industrial company, made under a scheme prepared and sanctioned under the Sick Industrial Companies (Special Provisions) Act, 1985 (1 of 1986) where such sick industrial company is being managed by its workers' co-operative

any transfer of a capital asset or intangible asset by a firm to a company as a result of succession of the firm by a company in the business carried on by the firm, or any transfer of a capital asset to a company in the course of demutualisation or corporatisation of a recognised stock exchange in India as a result of which an association of persons or body of individuals is succeeded by such company

where a sole proprietary concern is succeeded by a company in the business carried on by it as a result of which the sole proprietary concern sells or otherwise transfers any capital asset or intangible asset to the company

any transfer of a capital asset in a transaction of reverse mortgage under a scheme made and notified by the Central Government

Computation of Capital Gains The income chargeable under the head "Capital gains" shall be computed, by deducting from the full value of the consideration received or accruing as a result of the transfer of the capital asset the following amounts, namely: (i) (ii) expenditure incurred wholly and exclusively in connection with such transfer; the cost of acquisition of the asset and the cost of any improvement thereto

where long-term capital gain arises from the transfer of a long-term capital asset, the provisions of clause (ii) shall have effect as if for the words "cost of acquisition" and "cost of any improvement", the words "indexed cost of acquisition" and "indexed cost of any improvement" had respectively been substituted Special provision for computation of capital gains in case of slump sale Any profits or gains arising from the slump sale effected in the previous year shall be chargeable to income-tax as capital gains arising from the transfer of long-term capital assets and shall be deemed to be the income of the previous year in which the transfer took place

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Any profits or gains arising from the transfer under the slump sale of any capital asset being one or more undertakings owned and held by an assessee for not more than thirty-six months immediately preceding the date of its transfer shall be deemed to be the capital gains arising from the transfer of short-term capital assets Profit on sale of property used for residence Where, in the case of an assessee being an individual or a Hindu undivided family, the capital gain arises from the transfer of a long-term capital asset , being buildings or lands appurtenant thereto, and being a residential house, the income of which is chargeable under the head "Income from house property" (hereafter in this section referred to as the original asset), and the assessee has within a period of one year before or two years after the date on which the transfer took place purchased, or has within a period of three years after that date constructed, a residential house, then, instead of the capital gain being charged to income-tax as income of the previous year in which the transfer took place, it shall be dealt with in accordance with the following provisions of this section, that is to say if the amount of the capital gain is greater than the cost of the residential house so purchased or constructed (hereafter in this section referred to as the new asset), the difference between the amount of the capital gain and the cost of the new asset shall be charged under section 45 as the income of the previous year; and for the purpose of computing in respect of the new asset any capital gain arising from its transfer within a period of three years of its purchase or construction, as the case may be, the cost shall be nil; f the amount of the capital gain is equal to or less than the cost of the new asset, the capital gain shall not be charged under section 45; and for the purpose of computing in respect of the new asset any capital gain arising from its transfer within a period of three years of its purchase or construction, as the case may be, the cost shall be reduced by the amount of the capital gain Capital gain on transfer of certain capital assets not to be charged in case of investment in residential house Where, in the case of an assessee being an individual or a Hindu undivided family, the capital gain arises from the transfer of any long-term capital asset, not being a residential house (hereafter in this section referred to as the original asset), and the assessee has, within a period of one year before or two years after the date on which the transfer took place purchased, or has within a period of three years after that date constructed, a residential house (hereafter in this section referred to as the new

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

asset), the capital gain shall be dealt with in accordance with the following provisions of this section, that is to say if the cost of the new asset is not less than the net consideration in respect of the original asset, the whole of such capital gain shall not be charged if the cost of the new asset is less than the net consideration in respect of the original asset, so much of the capital gain as bears to the whole of the capital gain the same proportion as the cost of the new asset bears to the net consideration, shall not be charged Other Income Income of every kind which is not to be excluded from the total income under this Act shall be chargeable to income-tax under the head "Income from other sources", if it is not chargeable to income-tax under any of the heads specifically included in law. In particular, and without prejudice to the generality of the provisions, the following incomes, shall be chargeable to income-tax under the head "Income from other sources", namely dividends lotteries, crossword puzzles, races including horse races, card games and other games of any sort or from gambling or betting of any form or nature whatsoever interest on securities income from machinery, plant or furniture belonging to the assessee and let on hire sum received under keyman insurance policy interest received on compensation or on enhanced compensation

Deductions from Other Income The income chargeable under the head "Income from other sources" shall be computed after making the following deductions, namely in the case of dividends, or interest on securities, any reasonable sum paid by way of commission or remuneration to a banker or any other person for the purpose of realising such dividend or interest on behalf of the assessee any other expenditure (not being in the nature of capital expenditure) laid out or expended wholly and exclusively for the purpose of making or earning such income.

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

in the case of income of interest received on compensation or on enhanced compensation, a deduction of a sum equal to fifty per cent. of such income and no deduction shall be allowed under any other clause of this section.

Deductions from Total Income

In computing the total income of an assessee, there shall be allowed from his gross total income, in accordance with and subject to the provisions of this Chapter, the deductions specified in sections 80C to 80U. The aggregate amount of the deductions under this Chapter shall not, in any case, exceed the gross total income of the assessee. Where any deduction is required to be made or allowed under any section included in this Chapter under the heading "C.Deductions in respect of certain incomes" in respect of any income of the nature specified in that section, then, for the purpose of computing the deduction, the amount of income of that nature shall alone be deemed to be the amount of income of that nature which is derived or received by the assessee and included in his gross total income. Where in computing the total income of an assessee of the previous year relevant to the assessment year, any deduction is admissible, no such deduction shall be allowed to him unless he furnishes a return of his income for such assessment year on or before the due date specified under law. "gross total income" means the total income computed in accordance with the provisions of this Act, before making any deduction under this Chapter Deductions in respect of certain payments

Life Insurance Premia Contributions towards Annuity/Pension Plans PF Contributions Notified Government Securities Contribution towards ULIPs Subscription to Mutual Funds Subscription to Schemes of National Housing Banks Tuition Fees Installments of Housing Loan Approved Equity or Debentures Issue Fixed Deposit in Scheduled Bank for > 5 years Senior Citizen Savings Account Deposits in National Savings Scheme

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Equity Linked Savings Schemes

The above deductions cannot exceed Rs.1.00 lacs in a year. The following additional deductions are available beyond the limit of 1.00 lacs in a year 20 thd in Long Term Infrastructure Bonds 15 thd towards Health Insurance; 20thd if senior citizen is part of family 50 thd towards Medical Treatment Cost of Disabled Family Member; 1.00 lac in case of severe disability Interest on loan taken for higher education Donations to Public Charitable Trusts Rent

Deduction in respect of certain donations for scientific research or rural development Contributions to Political Parties

Deductions in respect of certain incomes

Deduction in respect of earnings in convertible foreign exchange Deduction in respect of profits from export of computer software, etc Deduction in respect of profits and gains from export or transfer of film software, etc Deductions in respect of profits and gains from industrial undertakings or enterprises engaged in infrastructure development, etc

Deductions in respect of profits and gains by an undertaking or enterprise engaged in development of Special Economic Zone

Deduction in respect of profits and gains from certain industrial undertakings other than infrastructure development undertakings

Special provisions in respect of certain undertakings or enterprises in certain special category States Deduction in respect of profits and gains from business of hotels and convention centres in specified area

Special provisions in respect of certain undertakings in North-Eastern States Deduction in respect of profits and gains from business of collecting and processing of bio-degradable waste

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Deduction in respect of employment of new workmen Deductions in respect of certain incomes of Offshore Banking Units and International Financial Services Centre

Deduction in respect of profits and gain from the business of publication of books Deduction in respect of professional income of authors of text books in Indian languages Deduction in respect of royalty income, etc., of authors of certain books other than text-books Deduction in respect of royalty on patents

Wealth Tax Definitions

assessee means a person by whom wealth-tax or any other sum of money is payable under this Act, and includes every person in respect of whom any proceeding under this Act has been taken for the determination of wealth-tax payable by him or by any other person or the amount of refund due to him or such other person, every person who is deemed to be an assessee under this Act & every person who is deemed to be an assessee in default under this Act assessment year means a period of twelve months commencing on the 1st day of April, every year "assets" means a. any building or land appurtenant thereto (hereinafter referred to as house), whether used for residential or commercial purposes or for the purpose of maintaining a guest house or otherwise including a farm house situated within twenty-five kilometres from local limits of any municipality (whether known as Municipality, Municipal Corporation or by any other name) or a Cantonment Board, but does not include b. a house meant exclusively for residential purposes and which is allotted by a company to an employee or an officer or a director who is in whole-time employment, having a gross annual salary of less than five lakh rupees; c. d. any house for residential or commercial purposes which forms part of stock-in-trade; any house which the assessee may occupy for the purposes of any business or profession carried on by him; e. any residential property that has been let-out for a minimum period of three hundred days in the previous year; f. any property in the nature of commercial establishments or complexes;

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

g.

motor cars (other than those used by the assessee in the business of running them on hire or as stock-in-trade);

h.

jewellery, bullion, furniture, utensils or any other article made wholly or partly of gold, silver, platinum or any other precious metal or any alloy containing one or more of such precious metals :

Provided that where any of the said assets is used by the assessee as stock-in-trade, such asset shall be deemed as excluded from the assets specified in this sub-clause ; i. j. k. yachts, boats and aircrafts (other than those used by the assessee for commercial purposes) ; urban land ; cash in hand, in excess of fifty thousand rupees, of individuals and Hindu undivided families and in the case of other persons any amount not recorded in the books of account. jewellery includes ornaments made of gold, silver, platinum or any other precious metal or any alloy containing one or more of such precious metals, whether or not containing any precious or semi-precious stones, and whether or not worked or sewn into any wearing apparel ; precious or semi-precious stones, whether or not set in any furniture, utensils or other article or worked or sewn into any wearing apparel ; urban land means land situate in any area which is comprised within the jurisdiction of a municipality (whether known as a municipality, municipal corporation, notified area committee, town area committee, town committee, or by any other name) or a cantonment board and which has a population of not less than ten thousand according to the last preceding census of which the relevant figures have been published before the valuation date ; or in any area within such distance, not being more than eight kilometres from the local limits of any municipality or cantonment board, as the Central Government may, having regard to the extent of, and scope for, urbanisation of that area and other relevant considerations, specify in this behalf by notification in the Official Gazette, but does not include land on which construction of a building is not permissible under any law for the time being in force in the area in which such land is situated or the land occupied by any building which has been constructed with the approval of the appropriate authority or any unused land held by the assessee for industrial purposes for a period of two years from the date of its acquisition by him [or any land held by the assessee as stock-in-trade for a period of ten years from the date of its acquisition by him.

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

net wealth means the amount by which the aggregate value computed in accordance with the provisions of this Act of all the assets, wherever located, belonging to the assessee on the valuation date, including assets required to be included in his net wealth as on that date under this Act, is in excess of the aggregate value of all the debts owed by the assessee [on the valuation date which have been incurred in relation to the said assets

principal officer, used with reference to a company, means the secretary, manager, managing agent or managing director of the company, and includes any person connected with the management of the affairs of the company upon whom the Assessing Officer has served a notice of his intention of treating him as the principal officer thereof

valuation date means the last day of the previous year as defined in [section 3] of the Income-tax Act, if an assessment were to be made under that Act for that year : Provided that in the case of a person who is not an assessee within the meaning of the Income-tax Act, the valuation date for the purposes of this Act shall be the 31st day of March immediately preceding the assessment year ; where an assessment is made in respect of deceased person, the valuation date shall be the same valuation date as would have been adopted in respect of the net wealth of the deceased if he were alive

Subject to the other provisions contained in this Act, there shall be charged for every assessment year, wealth-tax in respect of the net wealth on the corresponding valuation date of every individual, Hindu undivided family and company, at the rate of one per cent of the amount by which the net wealth exceeds thirty lakh rupees.

Net wealth to include certain assets In computing the net wealth of an individual, there shall be included, as belonging to that individual, the value of assets which on the valuation date are held by the spouse of such individual to whom such assets have been transferred by the individual, directly or indirectly, otherwise than for adequate consideration or in connection with an agreement to live apart, or by a minor child, not being a minor child suffering from any disability of the specified nature specified or a married daughter, or by a person or association of persons to whom such assets have been transferred by the individual directly or indirectly otherwise than for adequate consideration for the immediate or deferred benefit of the individual, his or her spouse, or

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

by a person or association of persons to whom such assets have been transferred by the individual otherwise than under an irrevocable transfer, or

by the sons wife, to whom such assets have been transferred by the individual, directly or indirectly, otherwise than for adequate consideration, or

by a person or association of persons to whom such assets have been transferred by the individual, directly or indirectly, otherwise than for adequate consideration for the immediate or deferred benefit of the sons wife whether the assets referred to in any of the sub-clauses aforesaid are held in the form in which they were transferred or otherwise :

where the assets held by a minor child are to be included in computing the net wealth of an individual, such assets shall be included, where the marriage of his parents subsists, in the net wealth of that parent whose net wealth (excluding the assets of the minor child so includible under this sub-section) is greater ; or where the marriage of his parents does not subsist, in the net wealth of that parent who maintains the minor child in the previous year as defined and where any such assets are once included in the net wealth of either parent, any such assets shall not be included in the net wealth of the other parent in any succeeding year unless the Assessing Officer is satisfied, after giving that parent an opportunity of being heard, that it is necessary so to do

Exemptions in respect of certain assets Wealth-tax shall not be payable by an assessee in respect of the following assets], and such assets shall not be included in the net wealth of the assessee any property held by him under trust or other legal obligation for any public purpose of a charitable or religious nature in India : the interest of the assessee in the coparcenary property of any Hindu undivided family of which he is a member ; any one building in the occupation of a Ruler, being a building which was his official residence jewellery in the possession of any Ruler, which has been recognised as his heirloom Provided that in the case of jewellery recognised by the Central Government as aforesaid, such recognition shall be subject to the following conditions, namely : that the jewellery shall be permanently kept in India and shall not be removed outside India except for a purpose and period approved by the Board ;

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

that reasonable steps shall be taken for keeping the jewellery substantially in its original shape ;

that reasonable facilities shall be allowed to any officer of Government authorised by the Board in this behalf to examine the jewellery as and when necessary

For the purposes of clause (iv) of the foregoing proviso, the fair market value of any jewellery on the date of the withdrawal of the recognition in respect thereof shall be deemed to be the fair market value of such jewellery on each successive valuation date relevant for the assessment years referred to in the said proviso: The aggregate amount of wealth-tax payable in respect of any jewellery for all the assessment years referred to therein shall not in any case exceed fifty per cent of its fair market value on the valuation date relevant for the assessment year in which recognition was withdrawn; in the case of an assessee, being a person of Indian origin or a citizen of India (hereafter in this clause referred to as such person) who was ordinarily residing in a foreign country and who, on leaving such country, has returned to India with the intention of permanently residing therein, moneys and the value of assets brought by him into India and the value of the assets acquired by him out of such moneys [within one year immediately preceding the date of his return and at any time thereafter. This exemption shall apply only for a period of seven successive assessment years commencing with the assessment year next following the date on which such person returned to India. A person shall be deemed to be of Indian origin if he, or either of his parents or any of his grand-parents, was born in undivided India. one house or part of a house or a plot of land belonging to an individual or a Hindu undivided family. Provided that wealth-tax shall not be payable by an assessee in respect of an asset being a plot of land comprising an area of five hundred square metres or less Exclusion of assets and debts outside India. In computing the net wealth of an individual [who is not a citizen of India or of an individual] or a Hindu undivided family not resident in India or resident but not ordinarily resident in India, or of a company not resident in India during the year ending on the valuation date the value of the assets and debts located outside India ; and the value of the assets in India represented by any loans or debts owing to the assessee in any case where the interest, if any, payable on such loans or debts is not to be included in the total income of the assessee under section 10 of the Income-tax Act shall not be taken into account.

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Rules for Determining Value of Assets Value of assets how to be determined. Immovable Property The value of any immovable property, being a building or land appurtenant thereto, or part thereof, shall be the amount arrived at by multiplying the net maintainable rent by the figure 12.5. Provided that in relation to any such property which is constructed on leasehold land, this rule shall have effect as if for the figure 12.5, (a) where the unexpired period of the lease of such land is fifty years or more, the figure 10.0 had been substituted ; and (b) where the unexpired period of the lease of such land is less than fifty years, the figure 8.0 had been substituted : Net maintainable rent how to be computed. For the purposes of rule 3, "net maintainable rent" in relation to an immovable property referred to in that rule, shall be the amount of gross maintainable rent as reduced by (i) (ii) the amount of taxes levied by any local authority in respect of the property ; and a sum equal to fifteen per cent of the gross maintainable rent.

Gross maintainable rent how to be computed. "Gross maintainable rent", in relation to any immovable property means (i) where the property is let, the amount received or receivable by the owner as annual rent or the annual value assessed by the local authority in whose area the property is situated for the purposes of levy of property tax or any other tax on the basis of such assessment, whichever is higher; (ii) where the property is not let, the amount of annual rent assessed by the local authority in whose area the property is situated for the purpose of levy of property tax or any other tax on the basis of such assessment, or, if there is no such assessment or the property is situated outside the area of any local authority the amount which the owner can reasonably be expected to receive as annual rent had such property been let. In this rule, (1) (a) "annual rent" means, where the property is let throughout the year ending on the valuation date (hereinafter referred to as "previous year"), the actual rent received or receivable by the owner in respect of such year; (b) where the property is let for only a part of the previous year, the amount which bears the same proportion to the amount of actual rent received or receivable by the owner for the period for which the

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

property is let as the period of twelve months bears to the number of months (including part of a month) during which the property is let during the previous year : Provided that in the following cases, such actual rent under sub-clauses (a) and (b) shall be increased in the manner specified below : (i) where the property is in the occupation of a tenant and taxes levied by any local authority in respect of the property are borne wholly or partly by the tenant, by the amount of the taxes so borne by the tenant ; (ii) where the property is in the occupation of a tenant and expenditure on repairs in respect of the property is borne by the tenant, by one-ninth of the actual rent ; (iii) where the owner has accepted any amount as deposit (not being advance payment towards rent for a period of three months or less), by the amount calculated at the rate of 15 per cent per annum on the amount of deposit outstanding from month to month, for the number of months (excluding part of a month) during which such deposit was held by the owner in the previous year, and if the owner is liable to pay interest on such deposit, the increase to be made under this clause shall be limited to the sum by which the amount calculated as aforesaid exceeds the interest actually paid; (iv) where the owner has received any amount by way of premium or otherwise as consideration for leasing of the property or any modification of the terms of the lease, by the amount obtained by dividing the premium or other amount by the number of years of the period of the lease; (v) where the owner derives any benefit or perquisite, whether convertible into money or not, as consideration for leasing of the property or any modification of the terms of the lease by the value of such benefit or perquisite; Assets of Business Global valuation of assets of business. Where the assessee is carrying on a business for which accounts are maintained by him regularly, the net value of the assets of the business as a whole, having regard to the balance-sheet of such business on the valuation date after the following specified adjustments (a) the value of any asset as disclosed in the balance-sheet shall be taken to be, (i) (ii) (iii) in the case of an asset on which depreciation is admissible, its written-down value; in the case of an asset on which no depreciation is admissible, its book value; in the case of closing stock its value adopted for the purposes of assessment under the Income-tax Act for the previous year relevant to the corresponding assessment year; (b) the value of an asset not disclosed in the balance-sheet, shall be taken to be the value determined in accordance with the provisions of this Schedule as applicable to that asset;

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

(d)

the value of the following assets which are disclosed in the balance sheet shall not be taken into account, namely : (i) (ii) any amount paid as advance tax under the Income-tax Act; the debt due to the assessee according to the balance-sheet or part thereof which has been allowed as a deduction under the Income-tax Act, for the purposes of assessment for the previous year relevant to the corresponding assessment year under that Act; (iii) (iv) the value of any asset in respect of which wealth-tax is not payable under this Act; any amount shown in the balance-sheet including the debit balance in the profit and loss account or profit and loss appropriation account which does not represent the value of any asset; (v) any asset shown in the balance-sheet not really pertaining to the business;

(e)

the following amounts shown as liabilities in the balance-sheet shall not be taken into account, namely : (i) (ii) (iii) (iv) (v) capital employed in the business other than that attributable to borrowed money; reserves by whatever name called; any provision made for meeting any future or contingent liability; any liability shown in the balance-sheet not really pertaining to the business; any debt owed by the assessee to the extent to which it has been specifically utilised for acquiring an asset in respect of which wealth-tax is not payable under this Act:

Provided that where it is not possible to calculate the amount of debt so utilised, it shall be taken as the amount which bears the same proportion to the total of the debts owed by the assessee as the value of that asset bears to the total value of the assets of the business. Interest in firm or association of persons Valuation of interest in firm or association of persons. The value of the interest of a person in a firm of which he is a partner or in an association of persons of which he is a member shall be determined in the following manner The net wealth of the firm or association of persons on the valuation date shall first be determined as if it were the assessee and, thereafter, (i) that portion of the net wealth of the firm or association as is equal to the amount of its capital shall be allocated among the partners or members in the proportion in which capital has been contributed by them;

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

(ii)

the residue of the net wealth of the firm or association shall be allocated amongst the partners or members in accordance with the agreement of partnership or association for the distribution of assets in the event of dissolution of the firm or association or, in the absence of such agreement, in the proportion in which the partners or members are entitled to share the profits,

and the sum total of amounts so allocated to a partner or member under clause (i) and clause (ii) shall be treated as the value of the interest of that partner or member in the firm or association: Jewellery The value of the jewellery shall be estimated to be the price which it would fetch if sold in the open market on the valuation date (hereafter in this rule referred to as fair market value). The return of net wealth furnished by the assessee shall be supported by, (i) a statement in the prescribed form, where the value of the jewellery on the valuation date does not exceed rupees five lakhs; (ii) a report of a registered valuer in the prescribed form, where the value of the jewellery on the valuation date exceeds rupees five lakhs. Notwithstanding anything mentioned above, the Assessing Officer may, if he is of opinion, that the value of the jewellery declared in the return, (a) is less than its fair market value by such percentage or such amount as is prescribed under sub-clause (i) of clause (b) of sub-section (1) of section 16A; (b) is less than its fair market value as referred to in clause (a) of sub-section (1) of section 16A,

he may refer the valuation of such jewellery to a Valuation Officer under sub-section (1) of the said section and the value of such jewellery shall be the fair market value as estimated by the Valuation Officer. Residuary Valuation of assets in other cases. The value of any asset, other than cash, being an asset which is not covered above, shall be estimated to be the price which, in the opinion of the Assessing Officer, it would fetch if sold in the open market on the valuation date. Where the valuation of any asset is referred by the Assessing Officer to the Valuation Officer, the value of such asset shall be estimated to be the price which, in the opinion of the Valuation Officer, it would fetch if sold in the open market on the valuation date. Where the value of any asset cannot be estimated because it is not saleable in the open market, the value shall be determined in accordance with such guidelines or principles as may be specified by the Board from time to time by general or special order.

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Restrictive covenants to be ignored in determining market value. The price or other consideration for which any property may be acquired by or transferred to any person under the terms of a deed of trust or through or under any restrictive covenant in any instrument of transfer shall be ignored for the purposes of determining under any provision of this Schedule, the price such property would fetch if sold in the open market on the valuation date. Service Tax The Government believes & rightly so that Services constitute a good portion of the GDP & yet contribute a measly amount towards tax revenues. Therefore in 1994 the Government made a humble beginning by introducing Service Tax on 3 services: Telephones Insurance Stock Broking

In that year the Government collected Rs.500 crores by way of service tax revenues. Thereafter the Government has kept widening the net by adding more & more services into the net, ever year. Today, in 2011 the Service Tax net spreads to over 120 services & the government expects to collect over Rs.75 thousand crores. Service Tax is applicable upon the following major sectors: Telecommunication Insurance Stock Exchange related Services Banking Healthcare Personal Care Professionals CS/CA/CWA/Lawyers/Architects Transport of Goods by Road, Rail, Air, Waterways, Couriers, Cargo Handling Construction Marketing & Sales Promotion Port & Airport related Services Travel related Services Photography, Manpower Recruitment, Event Management, Fashion Designing, Warehousing Broadcasting & Entertainment related Services

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Exemption

Majority of services are exempt upto a limit of Rs.10.00 lacs in a year. Beyond this limit service tax becomes payable. Upon reaching a service charges limit of Rs.9.00 lacs, registration becomes compulsory.

Registration

Assessees liable for service tax payment are also obliged to seek registration, in any of the following 2 modes: Centralised Registration Stand Alone Registration

Yet another form of registration know as Input Service Distributor enables a head office to transmit Cenvat credit to its manufacturing & service providing units Invoice Assessees are obliged to issue an invoice in respect of their service charges within 14 days of completion of their services. However, some assessees are completely exempt from issuing invoices: Banks Airline Companies Goods Transport Agencies

An invoice should normally contain the name & address & registration number of the assessee, name & address of the clients, name & classification of services provided, amount of service charges, rate of service tax & amount of service tax Payment of Tax Assessees are obliged to meet their service tax liabilities either through Cenvat Credit or Cash Payment or a combination of both. The liability of service tax must be met by: 5th of next month, in case of corporate assessees 5th of the month after the quarter in case of non-corporate assessees Net savvy assessees get one more day of grace in either case Net banking is compulsory for assessees paying > Rs.10.00 lacs during the FY

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Return of Service Tax Assessees are obliged to submit returns by the 25th of month following the half year in form ST-3. The government encourages assessees to file returns by electronic mode over its site aces.gov.in Reverse Charge Mechanism Normally, the burden of service tax is always borne by the service recipient a fundamental feature of indirect taxation. However, the tax is collected by the Service Provider from his client ie the Service Recipient & paid over to the government this is also normal. However, in case of service providers being Goods Transport Agency Insurance Auxiliary Service Providers vis--vis Insurance Companies Sponsorship Import of Services

The Service Recipient is obliged to pay the tax to the government Pure Agent Normally, the service provider would bill the client for all costs incurred by him in relation to providing the service. This would include his service charges + reimbursement of incidentals. Whether service tax must be paid upon incidental would depend upon the following question Whether the Service Provider had stake in the incidentals If yes, the incidentals would form part of the assessable value & be included in the taxable amount; otherwise not Cenvat Credit Cenvat Credit is a mechanism for providing credit of: All eligible inputs All eligible input services All eligible capital goods

For use in payment of excise duty or service tax in respect of final products or output services

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Value Added Tax Cascading effect of sales tax had prompted state governments to switch over to Value Added Tax. The mechanism for value added tax is designed around credits for input taxes for payment of out tax liability. All states have switched over to VAT in lieu of Sales Tax. The states had earlier apprehended that switch over would lead to loss of revenue. But their subsequent experience is contrary to their fears. They have experienced buoyancy in tax revenues & have immensely benefited from the switch over. However, certain concerns have eroded the beneficial aspect of VAT, namely: Non-availability of credits on inter-state transactions Discordant rates of tax leading to rate wars among states Carousel frauds Credit returns

VAT is therefore likely to be replaced by Goods & Service Tax in 2010, with intent to clear all these drawbacks

ExecutiveShortNotesTaxLaws ICSIeLearningCoachingProgram

GOLS 2011

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- State Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionDocumento11 páginasState Comptroller's Audit of The The Hendrick Hudson School District's Financial ConditionCara MatthewsAinda não há avaliações

- What Is PEDocumento12 páginasWhat Is PEKogree Kyaw Win OoAinda não há avaliações

- The New Barn-Raising: A Toolkit For Citizens, Politicians, and Businesses Looking To Sustain Community and Civic AssetsDocumento192 páginasThe New Barn-Raising: A Toolkit For Citizens, Politicians, and Businesses Looking To Sustain Community and Civic AssetsGerman Marshall Fund of the United StatesAinda não há avaliações

- MSC - A&F - Kerry Asumwisye Mwansele - 2014 PDFDocumento78 páginasMSC - A&F - Kerry Asumwisye Mwansele - 2014 PDFChaza PriscaAinda não há avaliações

- 1 1226585891Documento76 páginas1 1226585891marcelamfAinda não há avaliações

- How Government Spends and Accounts For Public Money in ZambiaDocumento145 páginasHow Government Spends and Accounts For Public Money in ZambiaMichael MbangwetaAinda não há avaliações

- Budget AnalysisDocumento13 páginasBudget AnalysisRamneet ParmarAinda não há avaliações

- Budget Formulation: Challenges For The Health SectorDocumento10 páginasBudget Formulation: Challenges For The Health SectoranaAinda não há avaliações

- Cost of Manuf ScheduleDocumento2 páginasCost of Manuf Scheduleebat11Ainda não há avaliações

- 10 - MARCH 5, 2016 Vol LI No 10Documento105 páginas10 - MARCH 5, 2016 Vol LI No 10RAHULAinda não há avaliações

- One Ohio Now - Top Ten LoopholesDocumento1 páginaOne Ohio Now - Top Ten LoopholesoneohionowAinda não há avaliações

- Answer SEVEN (7) Questions: Part A: Structured Questions (60 MARKS)Documento4 páginasAnswer SEVEN (7) Questions: Part A: Structured Questions (60 MARKS)navimala85Ainda não há avaliações

- Public ExpenditureDocumento15 páginasPublic ExpenditureVikas Singh100% (1)

- Gadgil-Mukherjee Formula 1992Documento2 páginasGadgil-Mukherjee Formula 1992Bhaskar Rao GopisettiAinda não há avaliações

- Ey Grasping The Thistle - Adding Energy To The Debate November 2013Documento12 páginasEy Grasping The Thistle - Adding Energy To The Debate November 2013Russell AllisonAinda não há avaliações

- P 63Documento1 páginaP 63penelopegerhardAinda não há avaliações

- Remedies For Overcoming The Present Financial Crisis: Titus SUCIU Transilvania University of BrasovDocumento16 páginasRemedies For Overcoming The Present Financial Crisis: Titus SUCIU Transilvania University of BrasovRoxanaT22Ainda não há avaliações

- Mankiw Economics Chapter 12 OutlineDocumento2 páginasMankiw Economics Chapter 12 OutlinenolessthanthreeAinda não há avaliações

- House Hearing, 109TH Congress - The Economic Outlook and Current Fiscal IssuesDocumento53 páginasHouse Hearing, 109TH Congress - The Economic Outlook and Current Fiscal IssuesScribd Government DocsAinda não há avaliações

- How Countries CompeteDocumento137 páginasHow Countries CompeteJim Freud100% (3)

- Lecture 4 Budgeting & Financial ManagementDocumento112 páginasLecture 4 Budgeting & Financial Managementchaudhry ahmad100% (2)

- The Barangay Budget and The Budget ProcessDocumento19 páginasThe Barangay Budget and The Budget ProcessJonathan100% (1)

- Public ExpenditureDocumento2 páginasPublic ExpenditureVin Gudluck Kadunco100% (2)

- Earnings Statement: Non-NegotiableDocumento1 páginaEarnings Statement: Non-Negotiablesivajyothi1973Ainda não há avaliações

- Subsidy Vs Voucher in EducationDocumento4 páginasSubsidy Vs Voucher in Educationikutmilis0% (1)

- Bruff-Rise of Authoritarian NeoliberalismDocumento19 páginasBruff-Rise of Authoritarian NeoliberalismArmando MuyolemaAinda não há avaliações

- Local Government - Their FinancingDocumento15 páginasLocal Government - Their FinancingHenry M. Macatuno Jr.100% (2)

- Expansionary & Contractionary Fiscal PolicyDocumento4 páginasExpansionary & Contractionary Fiscal PolicyShwetabh SrivastavaAinda não há avaliações

- Role of Public Financial Management in Risk Management For Developing Country GovernmentsDocumento31 páginasRole of Public Financial Management in Risk Management For Developing Country GovernmentsFreeBalanceGRPAinda não há avaliações