Escolar Documentos

Profissional Documentos

Cultura Documentos

Members Circle, November 2011 Newsletter

Enviado por

Alliant Credit UnionDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Members Circle, November 2011 Newsletter

Enviado por

Alliant Credit UnionDireitos autorais:

Formatos disponíveis

members circle

www.alliantcreditunion.org a newsletter for Alliant Credit Union members November 2011

contents

1 Five smart holiday shopping tips 2 Take the Holiday Shopping Quiz

Five smart holiday shopping tips

Its that time again time to complete or at least begin your holiday season shopping. This year, how about giving a gift to yourself by taking it easy on yourself and your wallet? Here are some tips on how to have fun shopping and bring joy to others, while avoiding bah-humbug shopping hassles and overspending. 1. Be smart at the outset and develop a budget. Take a realistic look at your finances and determine your overall spending limit. Then, decide how much you can afford to spend on each individual gift. Next to each persons name, write the maximum you will spend on him or her. Also, remember to include any essentials, such as entertainment, decorations, cards and tips or small gifts for coworkers, babysitters, dog walkers, teachers, etc. Consider including a few extra generic gifts, such as picture frames, to have on hand if someone unexpectedly gives you a gift and you want to reciprocate. Do the math and, if need be, adjust your plan to stay within your budget. Costs can add up quickly so know your bottom line and stick to it. 2. Develop a gift checklist. Get a pen and paper, and brainstorm ideas for what to buy individuals within the amount you have budgeted for them. Refer to your checklist when you shop so you dont forget anything. Meanwhile, stick closely to your list. Beware of impulse-buy specials and deals you encounter that may tempt you to blow your budget. Be sure to ask yourself, Would I buy this if it werent on sale? 3. Shop at stores during off-peak times. Waiting until the last minute to do your shopping is a recipe for stress and overspending, while shopping early gives you time to comparison shop for the best prices. To avoid crowds and long lines, get started today, if you havent already. Good times to shop: in the morning or late at night. Bad times: right after work or on weekends. If you have a specific item in mind to buy, consider calling the store first to make sure its available there.

Beware of new stealth charges from banks (Enjoy a free Alliant checking account instead) Earn a 2011 tax deduction by prepaying your Alliant mortgage

DIVIDEND

December Savings Dividend DECLARED OCTOBER 20, 2011

The December 2011 Savings and IRA dividend, declared 10/20/11, provides a Compounded Annual Percentage Yield of

1.15% APY

Dividends are paid on the last day of the month to accountholders who have maintained an average daily balance of $100 or more. Savings dividend is subject to change monthly.

December Checking Dividend DECLARED OCTOBER 20, 2011

4. Go online to research the best product at the best price and to buy. Lets say you want to buy your son a digital camera, but are unsure which one to get. Go online and study reputable user reviews and ratings. When you select the product you want, visit sites such as mysimon.com or pricegrabber.com, to find the best price. Also, check delivery charges and ship by dates to ensure your gift will get to the recipient in time. Many online retailers will offer free shipping at least for standard ground shipping. 5. Save your receipts. Check a stores refund or exchange policy and keep your receipts. Whenever possible, also get a gift receipt for items. That little piece of paper makes it easier for a person to return a gift if he or she forbid doesnt like it or if its defective.

Sources: realsimple.com, money.cnn.com, cbsnews.com, christmas-celebrations.com, loanbased.com and goodmoneyhabits.wordpress.com

The December 2011 High Rate Checking dividend, declared 10/20/11, provides a Compounded Annual Percentage Yield of

1.10% APY

Checking dividends are paid on the last day of each month to accountholders who meet the requirements of the account. Checking dividend is subject to change monthly.

Heads up: Starting in February 2012, Alliant will have a new address for you to use to mail in your deposits and payments. Stay tuned to learn the details in our newsletters and website.

2 shopping trivia and not so trivia

Take the Holiday Shopping Quiz

You know the drill. The winter holidays approach and its time to buy gifts. But, how well do you know some of the finer points of holiday shopping? Take this quiz to find out. 1) What percentage of U.S. adults say they start their holiday shopping before Thanksgiving? a) 15 percent b) 35 percent c) 50 percent 2) On Black Friday (the day after Thanksgiving), whom do the majority shop for? a) Their kids b) Themselves c) Gift recipients 3) How many Americans say they want to get a gift card this season? a) 30% b) 45% c) 60% 4) How much is the average U.S. household expected to spend on gifts and seasonal merchandise this holiday? a) $704 b) $804 c) $904 5) Generally, what shopping day generates the most sales all year? a) Black Friday b) Cyber Monday c) The last Saturday before Christmas 6) True or False: Mothers Day and Christmas generate the most sales for perfume a) True b) False 7) What was the first toy to be advertised on TV? a) Etch-A-Sketch b) Mr. Potato Head c) Slinky 8) What percent of Americans are expected to purchase holiday items online this year? a) 35% b) 50% c) 65% 9) What continent did the actual living St. Nicholas live on? a) Africa b) Europe c) Asia 10) What is the most popular type of products people buy during their holiday shopping? a) Electronics b) Toys/games c) Clothing/shoes

How well did you do on the quiz. Lets see. 1) b; 2) b; 3) c; 4) a, down from $719 last year, according to the National Retail Federation; 5) c; 6) false (Christmas and Valentines Day generate the most sales); 7) b; 8) b, up from 44% last year; 9) c, the real St. Nicholas was a bishop in Myra in Asia Minor; 10) b, 31% buy toys/games, 28% buy electronics and 27% buy clothing/shoes.

Sources: usatoday.com, compete.com and howstuffworks.com

Beware of new stealth charges from banks (Enjoy a free Alliant checking account instead)

Americans are increasingly using debit cards, instead of cash, to make routine purchases. Recently, many banks planned to use this habit as a gotcha and start charging their customers a fee for using debit cards. This move was prompted by a new law effective October 1, 2011, that cut the amount of money a bank can charge a business when it accepts payment with a debit card from 44 cents a swipe to 21 cents a swipe. The result: banks will lose about $9.4 billion annually. When Bank of America, Wells Fargo, JPMorgan Chase and other banks announced they would try to recoup their lost revenue by charging customers $3 to $5 a month for using debit cards, a public outcry ensued. President Obama criticized the debit card charges as a way for banks to expand their profits at the expense of customers. And a Bank of America customer gathered more than 300,000 signatures on a petition protesting the debit card charges. In response to the backlash, Bank of America and many banks abandoned their debit card charge plan. So, is it time to rejoice? Not yet. As Bank of America spokesperson Anne Pace put it, We will continue to initiate actions to mitigate lost revenue where and whenever possible. Expect banks to find stealth ways to increase expenses that may fly under the radar, says Bill Hardekopf of Lowcards.com. Likely actions banks will take, according to Bankrate.com, include: nactivity fees on debit cards (so youll have to use them at least I a few times a month) Fees for getting paper statements Fees to speak to a teller Higher charges for bounced checks The elimination of debit card reward programs Meanwhile, Alliant members, like you, can continue to enjoy one of the benefits of The Alliant Advantage. Alliant does not charge monthly maintenance fees for checking nor does Alliant charge a fee for our VISA Debit Card whether you use it or not.

Sources: The Washington Post, smartmoney.com, gobankingrates.com and businessweek.com

Earn a 2011 tax deduction by prepaying your Alliant mortgage

Want a 2011 tax deduction for a January 2012 Alliant mortgage payment? Then, we must receive your payment by Friday, December 30, 2011. The December interest charge included in the January installment may be eligible for a 2011 tax year itemized deduction. Consult your financial advisor about potential tax savings.

office closings

Alliant will be closed in observance of the following holidays:

Day after Christmas Day Monday, December 26, 2011 Day after New Years Monday, January 2, 2012

dial direct: Alliant is there when you need us Mortgage Hotline Member Contact Center 800-365-7003 800-328-1935 MonFri, 6am7pm CT 24/7 personal assistance Sat, 8am12pm CT tdd/tty 773-462-2300 Self Service Telephone (SST) 800-482-5328 24/7 automated account access VISA Debit Card 800-328-1935 VISA Credit Cards 24/7 Member Service/ Account Info/Lost or Stolen: 866-444-8529 VISA Gift Card Purchase: 800-328-1935 Support Center: 866-466-2362 Auto/Home Insurance 888-380-9287 MonFri, 6am10pm CT Sat, 6am 8pm CT GreenPath Debt Solutions 877-337-3399 MonThur, 7am9pm CT Fri, 7am6pm CT Sat, 8am5pm CT

Alliant Headquarters 11545 W. Touhy Avenue Chicago, IL 60666

Alliant Retirement and Investment Services Financial Advisors are available to serve members in AZ, CA, CO, FL, HI, IL, NJ, NY, TX, VA, WA, WI. Call 800-328-1935, option 9 . Deposits/Payments Print-without shadow P.O. Box 60050 City of Industry, CA 91716-0050 Credit Card Payments P.O. Box 60051 City of Industry, CA 91716 All Other Correspondence and IRA and HSA deposits P.O. Box 66945, Chicago, IL 60666-0945

For Alliant Service Center locations, Alliant Online Banking, and product and Your savings federally insured to least $250,000 Your savings insured servicebacked by the full faith andatcredit of the our website: federallyfull faith and information, visit and backed by the United States Government United States Gov www.alliantcreditunion.org

This newsletter is for members personal use only. Reproducing National contents of this newsletter without priorNational Credit Union A and/or selling theCredit Union Administration, writtenGovernmen a U.S. Government Agency a U.S. permission from Alliant Credit Union is prohibited. Copyright Alliant. Articles are prepared as an educational service for Alliant members. They should not be relied on as a substitute for individual financial or legal research. Articles in this newsletter are not intended to be used (and may not be relied on) for penalty avoidance.

Convenient 24/7/365 account access Online banking at www.alliantcreditunion.org Mobile banking app for Android and iPhone Member Contact Center at 800-328-1935 Self Service Telephone at 800-482-5328 Over 80,000 surcharge-free ATMs nationwide

Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government

P.O. Box 66945, 11545 W. Touhy Avenue Chicago, IL 60666-0945 National Credit Union Administration, a U.S. Government Agency

www.alliantcreditunion.org

Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government

National Credit Union Administration, a U.S. Government Agency

NEW250-R11/11

Você também pode gostar

- Connections September 2013Documento2 páginasConnections September 2013Alliant Credit UnionAinda não há avaliações

- Connections June2013Documento2 páginasConnections June2013Alliant Credit UnionAinda não há avaliações

- Twenty4ever June2013Documento2 páginasTwenty4ever June2013Alliant Credit UnionAinda não há avaliações

- Kidz Klub March2013Documento2 páginasKidz Klub March2013Alliant Credit UnionAinda não há avaliações

- Member Circle, November 2012 NewsletterDocumento2 páginasMember Circle, November 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Members Circle May 2013Documento2 páginasMembers Circle May 2013Alliant Credit UnionAinda não há avaliações

- Members Circle February 2013Documento2 páginasMembers Circle February 2013Alliant Credit UnionAinda não há avaliações

- Twenty4ever March2013Documento2 páginasTwenty4ever March2013Alliant Credit UnionAinda não há avaliações

- Kidz Klub News June2013Documento2 páginasKidz Klub News June2013Alliant Credit UnionAinda não há avaliações

- Connections March 2013Documento2 páginasConnections March 2013Alliant Credit UnionAinda não há avaliações

- Members Circle, January 2013 NewsletterDocumento2 páginasMembers Circle, January 2013 NewsletterAlliant Credit UnionAinda não há avaliações

- Financial Well-Being, Fourth Quarter 2012 NewsletterDocumento4 páginasFinancial Well-Being, Fourth Quarter 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Alliant Advisor January 2013Documento2 páginasAlliant Advisor January 2013Alliant Credit UnionAinda não há avaliações

- Members Circle April 2013Documento2 páginasMembers Circle April 2013Alliant Credit UnionAinda não há avaliações

- Members Circle July 2013Documento2 páginasMembers Circle July 2013Alliant Credit UnionAinda não há avaliações

- Twenty4ever, September 2012 NewsletterDocumento2 páginasTwenty4ever, September 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Kidz Klub News, September 2012 NewsletterDocumento2 páginasKidz Klub News, September 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Members Circle, October 2012 NewsletterDocumento2 páginasMembers Circle, October 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Connections, September 2012 NewsletterDocumento2 páginasConnections, September 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- The Alliant Advisor, Summer 2012 NewsletterDocumento2 páginasThe Alliant Advisor, Summer 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Members Circle, August 2012 NewsletterDocumento2 páginasMembers Circle, August 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Kidz Klub, June 2012 NewsletterDocumento2 páginasKidz Klub, June 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Connections, June 2012 NewsletterDocumento2 páginasConnections, June 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Members Circle, May 2012 NewsletterDocumento4 páginasMembers Circle, May 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Kidz Klub, March 2012 NewsletterDocumento2 páginasKidz Klub, March 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Members Circle, July 2012 NewsletterDocumento2 páginasMembers Circle, July 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Financial Well-Being, Spring 2012 EnewsletterDocumento4 páginasFinancial Well-Being, Spring 2012 EnewsletterAlliant Credit UnionAinda não há avaliações

- Members Circle, April 2012 NewsletterDocumento2 páginasMembers Circle, April 2012 NewsletterAlliant Credit UnionAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Blood Culture & Sensitivity (2011734)Documento11 páginasBlood Culture & Sensitivity (2011734)Najib AimanAinda não há avaliações

- MyiasisDocumento29 páginasMyiasisihsanAinda não há avaliações

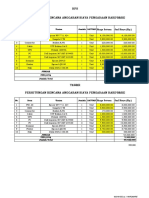

- HPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANDocumento2 páginasHPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANYanto AstriAinda não há avaliações

- #1 HR Software in Sudan-Khartoum-Omdurman-Nyala-Port-Sudan - HR System - HR Company - HR SolutionDocumento9 páginas#1 HR Software in Sudan-Khartoum-Omdurman-Nyala-Port-Sudan - HR System - HR Company - HR SolutionHishamAinda não há avaliações

- Intermediate Unit 3bDocumento2 páginasIntermediate Unit 3bgallipateroAinda não há avaliações

- Costco Case StudyDocumento3 páginasCostco Case StudyMaong LakiAinda não há avaliações

- DepEd K to 12 Awards PolicyDocumento29 páginasDepEd K to 12 Awards PolicyAstraea Knight100% (1)

- Successfull Weight Loss: Beginner'S Guide ToDocumento12 páginasSuccessfull Weight Loss: Beginner'S Guide ToDenise V. FongAinda não há avaliações

- Critical Growth StagesDocumento3 páginasCritical Growth StagesSunil DhankharAinda não há avaliações

- Midland County Board of Commissioners Dec. 19, 2023Documento26 páginasMidland County Board of Commissioners Dec. 19, 2023Isabelle PasciollaAinda não há avaliações

- General Ethics: The Importance of EthicsDocumento2 páginasGeneral Ethics: The Importance of EthicsLegendXAinda não há avaliações

- Diagnosis of Dieback Disease of The Nutmeg Tree in Aceh Selatan, IndonesiaDocumento10 páginasDiagnosis of Dieback Disease of The Nutmeg Tree in Aceh Selatan, IndonesiaciptaAinda não há avaliações

- Waiver: FEU/A-NSTP-QSF.03 Rev. No.: 00 Effectivity Date: Aug. 10, 2017Documento1 páginaWaiver: FEU/A-NSTP-QSF.03 Rev. No.: 00 Effectivity Date: Aug. 10, 2017terenceAinda não há avaliações

- Eurythmy: OriginDocumento4 páginasEurythmy: OriginDananjaya PranandityaAinda não há avaliações

- ICE Learned Event DubaiDocumento32 páginasICE Learned Event DubaiengkjAinda não há avaliações

- Onkyo TX NR555 ManualDocumento100 páginasOnkyo TX NR555 ManualSudhit SethiAinda não há avaliações

- Dead Can Dance - How Fortunate The Man With None LyricsDocumento3 páginasDead Can Dance - How Fortunate The Man With None LyricstheourgikonAinda não há avaliações

- LESSON 2 - Nguyễn Thu Hồng - 1917710050Documento2 páginasLESSON 2 - Nguyễn Thu Hồng - 1917710050Thu Hồng NguyễnAinda não há avaliações

- Marchetti-How The CIA Views The UFO PhenomenonDocumento7 páginasMarchetti-How The CIA Views The UFO PhenomenonAntonio De ComiteAinda não há avaliações

- Teacher swap agreement for family reasonsDocumento4 páginasTeacher swap agreement for family reasonsKimber LeeAinda não há avaliações

- Saic P 3311Documento7 páginasSaic P 3311Arshad ImamAinda não há avaliações

- Infinitive Clauses PDFDocumento3 páginasInfinitive Clauses PDFKatia LeliakhAinda não há avaliações

- The RF Line: Semiconductor Technical DataDocumento4 páginasThe RF Line: Semiconductor Technical DataJuan David Manrique GuerraAinda não há avaliações

- Hac 1001 NotesDocumento56 páginasHac 1001 NotesMarlin MerikanAinda não há avaliações

- Cycling Coaching Guide. Cycling Rules & Etiquette Author Special OlympicsDocumento20 páginasCycling Coaching Guide. Cycling Rules & Etiquette Author Special Olympicskrishna sundarAinda não há avaliações

- MT 1 Combined Top 200Documento3 páginasMT 1 Combined Top 200ShohanAinda não há avaliações

- Bhushan ReportDocumento30 páginasBhushan Report40Neha PagariyaAinda não há avaliações

- English FinalDocumento321 páginasEnglish FinalManuel Campos GuimeraAinda não há avaliações

- Perilaku Ramah Lingkungan Peserta Didik Sma Di Kota BandungDocumento11 páginasPerilaku Ramah Lingkungan Peserta Didik Sma Di Kota Bandungnurulhafizhah01Ainda não há avaliações