Escolar Documentos

Profissional Documentos

Cultura Documentos

Starbucks Valuation: An Analyst's Perspective On The Past, Present and Future of America's Coffee Giant

Enviado por

AizhasDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Starbucks Valuation: An Analyst's Perspective On The Past, Present and Future of America's Coffee Giant

Enviado por

AizhasDireitos autorais:

Formatos disponíveis

STARBUCKS VALUATION

An analysts perspective on the past, present and future of

Americas coffee giant.

Prepared by Gavin Virgo

Prepared for Professor Michael Reynolds

ADM 4350 Equity Valuation

8 April 2009

2

Tab|e of Contents

Tab|e of Contents.............................................................................................. z

Executive 5ummary .......................................................................................... q

Note About 5ources ..........................................................................................

Academic Integrity............................................................................................

Introduction ..................................................................................................... 6

Boom and Bust .................................................................................................................................................... 6

Brief Company History....................................................................................................................................... 7

Praise and Criticism............................................................................................................................................. 8

Environment..................................................................................................... j

Global .................................................................................................................................................................... 9

The United States .............................................................................................................................................. 10

Industry ............................................................................................................................................................... 11

Competition ....................................................................................................z

Direct Competition ........................................................................................................................................... 12

McDonalds Corp. ............................................................................................................................................. 12

Peets Coffee & Tea Inc. ................................................................................................................................... 13

Tim Hortons Inc. .............................................................................................................................................. 13

Indirect Competition......................................................................................................................................... 13

Nestle S.A. ...................................................................................................................................................... 13

Yum! Brands Inc. ............................................................................................................................................. 13

Competitive Forces ........................................................................................................................................... 13

Bargaining Power of Suppliers ........................................................................................................................... 14

Bargaining Power of Customers ......................................................................................................................... 14

Threat of New Entrants.................................................................................................................................... 15

Threat of Substitute Products............................................................................................................................. 15

Competitive Rivalry Within an Industry............................................................................................................ 15

Operationa| Risks.............................................................................................6

Strategic Transformation Initiatives ............................................................................................................... 16

Reduced Customer Traffic.................................................................................................................................. 16

Commodity Costs .............................................................................................................................................. 16

Economic Crisis ................................................................................................................................................ 17

Competition....................................................................................................................................................... 17

3

Perceived Brand Value...................................................................................................................................... 17

Ana|ysis...........................................................................................................)

Abso|ute Va|uation: Oiscounted Free Cash F|ow ................................................ 8

Free Cash Flow to the Firm (FCFF) Projections ......................................................................................... 18

Cost of Equity.................................................................................................................................................... 18

Risk-free Rate of Return ................................................................................................................................... 18

Beta .................................................................................................................................................................. 19

Market Risk Premium ..................................................................................................................................... 19

Capital Asset Pricing Model (CAPM) ............................................................................................................. 19

Cost of Debt....................................................................................................................................................... 19

Weighted Average Cost of Capital (WACC) ................................................................................................. 19

Growth Rate....................................................................................................................................................... 19

Valuation Application and Sensitivity Analysis............................................................................................. 20

Implications ........................................................................................................................................................ 20

Re|ative Va|uation............................................................................................zo

Price-To-Earnings (P/E) Multiple Valuation ............................................................................................... 20

Implied Share Price ........................................................................................................................................... 21

Price-To-Book (P/B) Multiple Valuation...................................................................................................... 22

Implied Share Price ........................................................................................................................................... 22

Enterprise Value (EV) Multiple Valuation.................................................................................................... 22

Integrated Ana|ysis ..........................................................................................z

Recommendation ............................................................................................zq

Appendix A: 5tarbucks Historica| Ba|ance 5heet.................................................z

Appendix B: 5tarbucks Historica| Income 5tatement ..........................................z)

Appendix C: 5tarbucks Historica| Cash F|ow 5tatement...................................... zj

Appendix C: Oiscounted Free Cash F|ow to the Firm ~ Oetai|ed Pro|ections...........

Appendix O: Va|uation App|ication....................................................................

4

Executive 5ummary

The Seattle-based Starbucks Corporation (Nasdaq:

SBUX) is the worlds leading roaster and retailer of speciality coffee. There

are more than 16,680 Starbucks stores located around the world, of

which approximately 8,536 are company owned and operated.

After enjoying years of phenomenal growth and high margins, the

company appears to have hit a stumbling block

in the mid 2000s with the simple realization that such high growth is

not sustainable. The stock, which had reached a high of nearly $40 per

share in May 2006, nosedived, touching a low of $7.83 per share in

November 2008. The stock is currently hovering around $11.19 as of April 7, 2009.

After a shake-up in the executive ranks of the company, Starbucks announced

several transformation and restructuring initiatives to slow the

companys growth and trim costs. This included the closing of 600 stores in the United

States, another 61 in Australia, and the elimination of 600 administrative and support

positions.

In addition, the company is facing significant competitive threats from major

U.S quick-service restaurants, the most apparent being McDonalds. It is expected that

competition from McDonalds, which has recently announced plans to open cafes within

their existing restaurants, will increase pressure on profit margins and reduced Starbucks

market share in the future.

In the following analyst report, a number of methodologies have been applied to assess the

value of Starbucks current share price and make a sound recommendation to investors.

Together, these methodologies support the conclusion that Starbucks shares are

presently relatively undervalued. A weighted blend of absolute and relative

valuation methods implies that the intrinsic value of the stock is

approximately $14.24 per share. This represents are 27 per cent

premium over the April 7, 2009 close price of $11.19.

It is likely that the share price will converge to this intrinsic value in the long-term. Given

that the target price represents a substantial premium over the current price of the stock,

Starbucks has been assigned a buy recommendation.

Target:

$14.24

Recommendation:

BUY

5

Note About 5ources

Please note that this document refers to information from many sources. Where direct or

indirect references have been made, they are carefully documented in the footnotes found at

the bottom of each page. In some instances I have referred to the source directly within the

text. All financial information within this document and used in the analysis was obtained

through Starbucks financial statements, Yahoo! Finance, Mergent Online or Research

Insight. Yahoo! Finance is a public data repository, which can be accessed at

http://finance.yahoo.com. Mergent Online is a subscription-based database, which is

available to students at the University of Ottawa. Research Insight is a subscription-based

software that uses Standard & Poors COMPUSTAT database, and is also available to

students at the University of Ottawa.

Academic Integrity

This assignment conforms to the rules and regulations on academic integrity at the

University of Ottawa.

6

Introduction

The Seattle-based Starbucks Corporation (Nasdaq: SBUX), formed in 1985, is the worlds

leading roaster and retailer of specialty coffee.

1

There are more than 16,680 stores operating

under the Starbucks banner in regions all over the world, including the Americas, Europe,

Middle East, Africa and the Asia Pacific. Of these, approximately 8,536 stores are company-

owned and are disproportionately located in the United States.

The companys self-stated business description, according to the 2009 annual report is as

follows:

Starbucks purchases and roasts high-quality whole bean coffees and sells them,

along with fresh, rich-brewed coffees, Italian-style espresso beverages, cold blended

beverages, a variety of complementary food items, a selection of premium teas, and

coffee-related accessories and equipment, primarily through Company-operated retail

stores.

2

Boom and Bust

Notwithstanding the financial environment that is wreaking havoc on U.S. markets and the

global economy, Starbucks is in the midst of a crisis of its own. Having reached a high of

nearly $40 per share in May 2006, the stock has since plummeted falling as low as $7.83 in

November of 2008.

While much of this can be attributed to the U.S. economic meltdown and deteriorating

business conditions, Starbucks is also in the midst of a great transformational challenge.

Once thought to be a hot growth stock, expectations have plunged as analysts, investors,

and management have come to realize that some markets have become super-saturated with

Starbucks stores.

3

There has been a revelation in the investment community and awakening

to the fact that there is a limit to the demand for coffee, espresso, lattes, and Frappucinos

which was once thought to be insatiable.

4

In addition, Starbucks is now facing major

competitive threats from much bigger rivals seeking to enter the lucrative gourmet coffee

market.

As a result, the beleaguered company has responded with a number of changes and

transformational initiatives. In January 2008, Starbucks announced a surprise change in

leadership as Chairman and company founder Howard Schultz fired Chief Executive Officer

Jim Donald and took on that role himself. Schultz announced a back-to-the-basics long-

1

Starbucks 2009 Annual Report

2

Starbucks 2009 Annual Report

3

Karen Blumenthal, Grande Expectations: A Year in the Life of Starbucks Stock, Crown Business: New York, 2007, p. 12

4

Frapuccino is a Starbucks trademark, referring to a line-up of cold-blended coffee-based beverages.

7

term approach for the company that would deliberate slow the companys growth and

attempt to rekindle customers emotional attachment to Starbucks.

5

While it is too early to see whether this gamble will pay off, it is clear that many investors

have opted not to stick around and find out. Given the high degree of uncertainty

surrounding the company and the stated long-term approach to building shareholder value,

is it possible that Starbucks has become an investment opportunity for value investors?

This is the very question that this report sets out to address. By attempting to identify the

intrinsic value of the Starbucks Corporation and comparing this value to the current share

price, it is possible to determine whether this security represents a valuable opportunity for

investors.

Brief Company History

Starbucks has an epic and storied history, which has been documented extensively in

company literature, on the Internet and in many books that have been written about the

company. Reborn into its modern, more recognizable form in 1985, the first Starbucks was

located in the heart of the Pikes Place fish market in Seattle in 1971. Founded by three

partners, the company sold dark-roasted, high-quality whole bean Arabica coffee. The store,

which did not sell prepared coffee beverages, was moderately successful and popular among

locals.

In 1982, Starbucks current Chairman and Chief Executive Officer, Howard Schultz, joined

the company. Working in the capacity of Director of Retail Operations and Marketing,

Schultz travelled to Italy in 1983 where he witnessed the romance of Italian espresso, and

became determined to bring this experience to Starbucks.

6

However, the three original Starbucks partners stood in Schultz way and resisted to the

changes that he proposed: namely, that Starbucks begin selling prepared coffee and espresso

beverages in-store. Then, with the support of Starbucks, Schultz began his own company

called Il Giornale to test his idea. Il Giornale offered customers prepared coffee beverages

made from Starbucks own beans, and was an instant success. Looking to expand his new

company, Schultz acquired Starbucks and its assets in 1987 and changed the companys

name to Starbucks Corporation. In 1991, Starbucks completed an initial public offering

(IPO) and began trading on the Nasdaq under the symbol SBUX.

Over the years, Starbucks continued to expand at a supersonic growth rate, both in the U.S.

and abroad. The company and its stock, by extension, continuously outperformed the

5

In a jolt, Starbucks fires CEO, replaces him with Schultz, Seattlepi.com. Retrieved from

http://www.seattlepi.com/business/346397_sbuxdonald08.html on 7 April 2009.

6

Howard Schultz, Pour Your Heart Into It, Hyperion: New York, 1997, p. 56

8

market and surpassed the expectations of analysts and investors. In 2005 the stock was so

hot that it was widely regarded as a must-have for fund managers and often used to

window-dress portfolios.

7

Shortly after this, however, the Starbucks engine began to sputter. The first indication came

in the form of declining comps referring to comparable same-store sales a key

organizational health indicator for analysts. This was regarded as a sign that Starbucks was

approaching (if it had not already reached) the peak of its growth, which was previously

thought to be limitless.

In January 2008, Howard Schultz, the company founder and chairman, returned to the role

of CEO after an eight-year hiatus, announcing a renewed focus on building brand loyalty

and rekindling the emotional attachment with customers.

8

Nearly simultaneously, Schultz

announced plans to close more than 600 underperforming U.S. company-operated retail

stores and 61 more stores in Australia.

9

Soon after, the company announced plans to

eliminate more than 600 administrative and support non-store positions in an effort to

trim costs.

10

In fiscal 2008 and first quarter 2009, Starbucks reported $342.4 million in

restructuring costs related to these measures resulting in a substantial decline in year-over-

year earnings.

Praise and Criticism

Over the many years of operations, Starbucks has received its share of praise and criticism.

The company has strived to build a reputation for caring for employees and community

involvement. Some initiatives to this effect include:

granting health benefits to full and part-time staff;

offering employee stock option and purchase programs to full and part-time staff;

promoting child and adult literacy through numerous book drives and the Starbucks

Foundation, which supports local literacy programs;

forming Urban Coffee Opportunities, a joint-venture with celebrity Earvin Magic

Johnson to introduce the Starbucks brand to underdeveloped urban and suburban

communities;

introducing coffee sourcing guidelines and committing to make some purchases of fair

trade coffee.

7

Window-dressing refers to a strategy used by portfolio managers to enhance the appearance of performance. Fund managers purchase the

hottest and best performing stocks to literally dress-up their portfolios (especially toward the end of a reporting period), so that it

appears that they were insightful enough to purchase these high-performing securities.

8

In a jolt, Starbucks fires CEO, replaces him with Schultz, Seattlepi.com. Retrieved from

http://www.seattlepi.com/business/346397_sbuxdonald08.html on 7 April 2009.

9

Starbucks Coffee Company, Announcement to Customers. Retrieved from http://www.starbucks.com/australia/ on 7 April 2009

10

Starbucks turns to customer ideas, BBC News. Retrieved from http://news.bbc.co.uk/2/hi/business/7338448.stm on 7 April 2009

9

However, on the other side of the coin, the company is a popular target for criticism and has

been denounced for its labour practices and alleged unethical conduct with regard to its

purchasing practices and supply chaining. Criticism related to labour practices is often made

with respect to the fact that the company is decidedly anti-union, and has engaged in

mischievous, and at times illegal, behaviour in order to discourage or stomp out employees

efforts to form unions. Starbucks has been accused of the mistreatment and exploitation of

coffee farmers, who are overwhelmingly representative of the poorest parts of the world.

While the company has committed to purchasing some fair-trade certified coffee, this

amount represents a tiny fraction of Starbucks total coffee purchases. In addition, the

company and its representatives have, at times, publically lambasted the fair trade model of

business, asserting that this business model distorts incentives for farmers and results in the

purchase of poor quality coffee beans.

Environment

G|oba|

As of the end of the first quarter of 2009, the outlook for the global economy is bleak.

According to the IMF, world growth is expected to fall to just 0.5 per cent, the lowest rate

seen since the Second World War.

11

Increasingly, the effects of the U.S.-born subprime

meltdown and credit crisis are being felt around the globe, hammering both advanced and

emerging economies. In 2009, output in advanced economies is expected to contract by 2

per cent, while growth in emerging economies will slow sharply from 6 per cent in 2008

to 3 per cent in 2009.

12

In addition, the IMF notes, the current economic environment has produced dampened

inflation pressures and some advanced economies are expected to experience a period of

very low (or even negative) consumer prices increases.

13

Financial markets are in freefall

around the world, and virtually all industrialized nations are pursuing fiscal and monetary

stimulus packages in order to curb this sharp and painful recession.

Furthermore, the financial crisis has created a pernicious feedback loop between the

financial and real economy.

14

Uncertainty and fear in the face of reduced wealth and asset

11

January 28, 2009 World Economic Outlook Update, International Monetary Fund. Retrieved from

http://www.imf.org/external/pubs/ft/weo/2009/update/01/ on 7 April 2009

12

Ibid.

13

Ibid.

14

Ibid.

10

values has prompted households and businesses to postpone expenditures, reducing

demand for consumer and capital goods.

15

The IMF notes that the most recent World Economic Outlook Update is characterized by

an unusually large amount of uncertainty.

16

It is clear that Strong and complementary

policy efforts are needed, which should lead to a gradual recovery beginning in 2010.

17

The United 5tates

The United States, which has lead the economic collapse among more advanced economies,

continues to bear the brunt of the financial crisis. All indicators imply that the economy

continues to be battered, despite the efforts of the administration of a new Democratic

president: Barack Obama. According to a March 2009 Country Report, authored by the

Economist Intelligence Unit, GDP growth contracted by 6.2 per cent in the fourth quarter

of 2008 and Indicators have remained poor in recent months, suggesting that the

contraction will continue.

18

It is expected that president Obama, who was warmly welcomed to the White House in

January, will generally seek to co-operate more with allies opting for more multi-lateral

solutions as opposed to the solo approach preferred by the previous administration.

19

The

new administration will primarily focus on containing the financial and economic crisis,

beginning with a $787 billion stimulus package that was signed into law in February.

20

A financial rescue package put forward by the Obama administration received a cold

response from financial markets and it appears that some major financial institutions will

have to be nationalized in the coming months.

21

There are indeed some signs of increased

stabilization in the financial system, although this is primarily a result of policy measures and

financial conditions remain very tight.

22

Current US stock market performance is characterized by extreme volatility. Every key index

has lost value since the beginning of the year. As of March 31, the Dow Jones Industrial

Average has retreated nearly 16 per cent in 2009. The S&P 500 index and Nasdaq

Composite index have shaved 14 per cent and 6 per cent of their respective values. Market

performance is illustrated in Figure 1, below.

15

Ibid.

16

Ibid.

17

Ibid.

18

March 2009 Country Report: United State of America, The Economist Intelligence Unit.

19

Ibid.

20

Ibid.

21

Ibid.

22

Ibid.

11

Figure 1 - Performance of Broad U.S. Market Indices, First Quarter 2009

Optimism seems to be fading among investors who have so far remained largely

unresponsive to the economic stimulus package and efforts of the Obama administration.

This seeming lack of confidence is reflected in the fact that a disproportionate number of

U.S. stocks are trading below their 200-day moving average, a key technical indicator for

investors. It is now clear that U.S. markets have not yet reached the trough and the question

investors are asking is just how far can they fall?

Industry

The food-service industry has been especially hard hit by the ongoing severe global

recession. The performance of restaurants and specialty eateries, like Starbucks, are heavily

dependent on consumer discretionary spending. Consumers, who are growing concerned

about the safety of their jobs and retirement savings, are spending significantly less and it is

showing up in the form of reduced revenues.

In the coffee-retailing industry, Starbucks is facing increased competitive pressures. Major

fast-food retailers and other quick-service restaurants have awakened to the high demand

for, and lucrative margins from sales of gourmet coffee.

Coffee costs have remained relatively stable in recent times (shown in Figure 2) and have not

had a substantial price impact on coffee-retailers and quick-service restaurants in 2008.

63

70

73

80

83

90

93

100

01/02/09 03/31/09

U.S. Market Index erformance

I|rst uarter 2009

uow !ones lndusLrlal

Average

S& 300

nasdaq ComposlLe

12

Figure 2 Average Monthly Coffee Prices based on the International Coffee Organization Composite, U.S. Cents

per Pound

Competition

Starbucks faces stiff competition that has only been heating up even further in recent times.

In the past, the company has made attempts to differentiate and stand out, which can make

comparison difficult. Starbucks competition consists of both direct and indirect

competition.

Oirect Competition

Starbucks competed directly against competitors that offer similar product offerings

namely, prepared coffee beverages.

McOona|ds Corp.

McDonalds Corp. (NYSE: MCD) represents the number one threat to Starbucks at this

point in time. The globally recognized fast-food heavyweight has recently announced its

foray into the specialty coffee segment, and its intention to take Starbucks on headfirst. In

what is being characterized as the American latte wars, McDonalds is rapidly adding coffee

capabilities to select locations of its more than 30,000 restaurants around the world, and

attempting to mimic the Starbucks model.

23

McDonalds is a highly successful organization with resources that cannot be matched by

Starbucks. There is no question that a successful entry into this market would significantly

eat away at Starbucks profits and margins.

23

The Latte Wars, Newsweek. Retrieved from http://www.newsweek.com/id/91497 on 7 April 2009

C

o

e

e

r

|

c

e

s

,

U

.

S

.

C

e

n

t

s

p

e

r

o

u

n

d

ICC Compos|te r|ce, Month|y

Average

13

Peet's Coffee 8 Tea Inc.

Peets Coffee and Tea (NASDAQ: PEET) is a coffee roaster and market of coffee with a

moderate presence in the mid-West and West United States. The company sells coffee, tea,

brewing equipment, mugs and accessories through many channels including company

operated retail stores, grocery stores and foodservice accounts. As of the end of 2008, Peets

had 188 retail stores and reported revenues of $284.8 M.

Tim Hortons Inc.

Tim Hortons Inc. (NYSE: THI) is engaged in the development and franchising of quick-

service restaurants that serve food such as hot and cold coffee, baked goods, sandwiches and

soups. The company has a significant presence in Canada, with more than 2,800 stores, and

approximately 400 more located in the U.S. While the company does not focus on gourmet

coffees and espresso sought by coffee aficionados, it nonetheless remains and important

competitor to Starbucks. Tim Hortons revenue in 2008 was in excess of $2.04 billion.

Indirect Competition

Nest|e 5.A.

Nestle S.A. (SIX: NESN) is a Switzerland based holding company with 2007 revenues of

more than $107.6 billion. Nestle is primarily engaged in food processing. The company

produces Nescafe coffee, which is sold at grocery stores all over the world. This company

competes indirectly with Starbucks since it offers coffee through a different distribution

channel, but is an important competitor, nonetheless.

Yum! Brands Inc.

Yum! Brands (NYSE: YUM) is a quick-service restaurant company that operates and

franchises companies such as KFC, Pizza Hut, Taco Bell, Long John Silvers, and A&W All-

American Food Restaurants. Although the company does not compete in the gourmet

coffee business, it competed with Starbucks and others for a portion of consumers

discretionary spending. Yum Brands reported 2008 revenues of $11.3 billion.

Competitive Forces

While it useful to have an understanding of the competitive environment that Starbucks

currency faces, it is important to recognize that the competitive landscape is dynamic, rather

than static, and constantly changing. Thus, it would be prudent to identify trends and

possible outcomes in this environment. Porters Five Forces Analysis model is applied below

to provide insight to this environment:

14

Bargaining Power of 5upp|iers

Starbucks purchases high quality Arabica coffee from coffee growing regions throughout the

world, with the majority of supply coming from Latin America, Africa and the Asia/Pacific

regions. However unfortunate, the traditional and basic nature of the work often entails

farmers working in poverty conditions or at subsistence wages. Thus, historically, coffee

farmers have not been able to exercise a great deal of bargaining power in negotiations with

Starbucks.

Rising awareness of the plight of coffee farmers in the last decade has resulted in the

increasing popularity of social movements encouraging ethical purchasing and consumption

of coffee. At times, Starbucks has been targeted and criticized for its alleged exploitation of

coffee farmers and unethical purchase practices. The company has taken some steps to

address this including a attempting to develop and implement ethical coffee purchasing

guidelines and sustainability plans. However, these efforts have been unexceptional and will

do little to appease Starbucks harshest critics.

Looking down the road, it is likely that supplier bargaining power will continue to increase

marginally in the future as social movements continue to attract the attention of consumers,

and coffee farmers become more advanced and able to collaborate. However, it is unlikely

that this bargaining power will be significant enough to have a material impact on Starbucks

cost of goods.

Bargaining Power of Customers

Historically, Starbucks marketing machine has been highly successful at attracting and

retaining customers with the promise of a high-quality product and customer service

experience. In addition, the company has resorted to efforts such as promotion of gift cards

in order to win the loyalty of consumers. However, the company must continue to innovate

in this area in order to retain the loyalty of increasingly fickle consumers. Today, consumers

have an increasing number of options when it comes to their morning coffee namely, the

aforementioned competitors. Consumers are especially sensitive to price and will likely take

their business where they can get the most value for money. The recessionary pressures of

the current financial environment will only serve to exacerbate this.

In the retail environment, buyer power is high and will only continue to increase as the

competition heats up. Looking foreword, this represents a moderate threat and will likely put

downward pressure on Starbucks margins as customers demand lower prices or threaten to

switch to a competitor.

15

Threat of New Entrants

The barriers to entry in the coffee-retailing business are relatively low. As a commodity,

coffee is typically purchased on a per pound basis meaning that Starbucks cannot benefit

significantly from economies of scale. Furthermore, while the company does possess a

number of patented products and trade secrets, it is not in possession of significant

proprietary technologies that cannot be easily duplicated.

Starbucks uses commercially available equipment such as coffee brewers, espresso machines,

blenders, etc. which can be easily acquired by any competing operation. Indeed, many major

competitors and smaller chains have thrived by adopting or mimicking Starbucks strategy.

In the long-term, the threat of new entrants represents a possible and probable risk to

Starbucks. Rivals, attracted by the high margins that Starbucks has historically obtained, are

quickly moving into coffee retailing and putting downward pressure on Starbucks margins.

Threat of 5ubstitute Products

As a retailer of a product derived from a commodity, there is little that Starbucks can do to

differentiate its physical product. The physical properties of the product are largely derived

from the quality of the ingredients used and how they are processed only some of which

are under Starbucks own control. The quality of coffee, for instance, may depend on the

growing, harvesting, processing, roasting and brewing stages. Here, only roasting and

brewing are directly under Starbucks control. Coffee growing, harvesting, and processing

stages are carried out by the individual farmers.

Consequently, Starbucks has attempted to differentiate its products on the basis of customer

service and the in-store experience, which has often been characterized as the Starbucks

Experience.

24

The threat of substitute products from competitors and other retailers poses a serious threat

to Starbucks future revenue and profitability.

Competitive Riva|ry Within an Industry

As a purveyor of a commodity-based product, Starbucks does not benefit from product

differences that typically influence competitive rivalry. This is especially true given the

increasingly popularity and availability of premium coffees, which has been Starbucks

basis for differentiating itself in the past. While the company has previously benefitted from

a very strong brand identity, there is some evidence suggesting that brand loyalty is eroding.

24

The essence of the Starbucks Experience is outlined in a book of the same name.

16

Competitor rivalry represents a serious threat for Starbucks. As more competitors attempt to

capitalize on the growing demand for gourmet coffee and lucrative profit margins,

Starbucks own market share and margins are likely to be diminished.

Operationa| Risks

Starbucks is subject to a number of operational risks that may have an adverse impact on the

companys performance if they were to materialize. A detailed list of conceivable risks facing

the company is discussed at length in the Starbucks annual report. Some of the most

important and most probable risks are outlined and discussed briefly below.

5trategic Transformation Initiatives

When Howard Schultz returned as the Starbucks CEO in 2008, the company soon after

announced a number of strategic transformational initiatives to bring the company back to

the basics and build long-term shareholder value. This included, but was not limited to, a

plan to close 600 underperforming stores in the U.S. market and a corporate-level

restructuring that would eliminate about 700 non-store jobs. The company also spent

considerable resources developing and implementing a new special coffee Pikes Place

Roast and revised brewing methods and standards for stores around the world. This was

intended to represent the beginning of a renewed focus on coffee that management hopes

will translate to higher sales and loyalty.

These, and other, changes that the company is pursuing come with a myriad of risks. For

instance, the company may not realize the expected cost savings from the restructuring

efforts in the desired time frame, or perhaps at all. Management expects that investments in

the business and development of new offerings like Pikes Place Roast will yield a stream of

future benefits for the company. It is possible that these benefits have been overstated or

that these efforts will not be enough to reinvigorate the brand.

Reduced Customer Traffic

Starbucks may suffer from reduced customer traffic to the increased presence of

competitors, the declining demand of gourmet coffee, or negative publicity regarding the

company. Any of these factors, none of which can be predicted with certainty, would have

an adverse affect on Starbucks business performance.

Commodity Costs

Starbucks purchases large amounts of green coffee and dairy products, which are often

subject to wide price fluctuations.

25

Although risk exposure to volatile coffee prices can be

25

Green coffee refers to the coffee beans that Starbucks purchases from its suppliers in its raw green state, before it is roasted.

17

effectively hedged, it is much more difficult to hedge against commodities such as fluid milk.

Thus, Starbucks is exposed to volatility in dairy prices.

Economic Crisis

A severe global recession is currently in progress. As a retailer that is dependent on

consumer discretionary spending, Starbucks business is likely to suffer in the near future

since consumers will have less discretionary income available. Management expects that this

will negatively impact the Companys financial performance, though it is difficult to

estimate the extent.

Competition

As noted previously, Starbucks is presently facing a serious competitive threat from

McDonalds a fast-food giant with a strong global presence. McDonalds has comparatively

more resources and quick-service experience than Starbucks. Even a semi-successful foray

into gourmet coffee would have significant adverse effects for Starbucks.

Perceived Brand Va|ue

The Starbucks brand is highly valued and it is necessary for the company to maintain this

perception of brand value going forward in order to take on emerging competitive threats.

As a result, incidents or scandals that erode consumer trust or perceived brand-value of

Starbucks would be disastrous for the company.

Ana|ysis

Considering the current economic turmoil and unique transformational circumstances

specific to Starbucks, placing a valuation on this company is a challenging and complex task.

In the following section, multiple methods have been applied for the purpose of determining

the intrinsic value of Starbucks including:

an analysis of the discounted free cash flow to the firm;

an examination of relevant valuation comparables;

a review of performance metrics and organizational health indicators.

Given the enormity of the task at hand, in some instances, it is necessary to make certain

assumptions. These assumptions are based on the views of company management, analysts,

or are otherwise backed up by supporting material. In instances where assumptions have

been made, they are carefully identified and justified.

18

Abso|ute Va|uation: Oiscounted Free Cash F|ow

As a non-dividend paying company, the only suitable absolute model to use in the valuation

of Starbucks is a discounted free cash flow model. Since Starbucks has had relatively volatile

earnings and cash flow in the recent past, a model analyzing the free cash flow to the firm

(FCFF) is the best choice for valuation.

Free Cash F|ow to the Firm (FCFF) Pro|ections

A summary of Starbucks FCFF calculations, five years forward, is presented in the table

below:

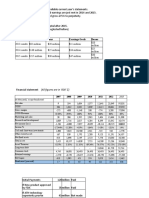

Table 1 - 5-Year FCFF Projections for Starbucks Corp.

2008 A 2009 E 2010 E 2011 E 2012 E 2013 E

EBI T( 1- T) 535, 423 214, 708 214, 708 225, 443 236, 715 248, 551

+ Dep 549, 300 518, 682 504, 401 534, 291 576, 418 621, 627

- FCI nv 626, 029 - 419, 224 - 145, 871 305, 316 430, 305 461, 790

- WCI nv 31, 517 26, 848 36, 731 49, 357 65, 407 85, 716

FCFF = 427, 177 1, 125, 765 828, 249 405, 061 317, 422 322, 672

A close look at Table 1 reveals that EBIT is expected to continue to decline through 2010 as

Starbucks faces increased competition and the effects of the global recession. Depreciation

will continue to increase at a steady rate as the company continues to invest in fixed assets,

which, in turn are a function of sales revenue.

Note that capital expenditure, as a percentage of sales, will continue to decrease in the future

as the company deliberately attempts to slow the growth of company-operated retail stores,

in accordance with its transformational strategy (previously discussed.)

Full details on the Starbucks FCFF calculation can be found in Appendix A.

Cost of Equity

Risk-free Rate of Return

As a U.S. based public corporation, the relevant risk-free rate of return is that of short-term

(3-month) U.S. Treasury bills.

19

As of April 2009, that rate is 0.2%, annually.

26

Beta

Starbucks beta is 0.93, indicating a relatively strong covariance with broad market indices.

Market Risk Premium

The market risk premium applied to the valuation is 6.5 per cent. This risk premium is based

on an academic survey of more than 1000 professors in 2008.

27

Capita| Asset Pricing Mode| (CAPM)

Based on the above-listed inputs, a simple application of CAPM reveals that Starbucks cost

of equity is approximately 8.05 per cent.

Cost of Oebt

Starbucks Corp. has historically had a very clean balance sheet. In 2007 the company issued

$550 million in senior notes at 6.25 per cent. The notes are due on August 15, 2017. Once

the tax shield provided by the tax deductibility of interest is taken into account, the after tax

cost of debt is approximately 4.26 per cent.

Weighted Average Cost of Capita| (WACC)

Starbucks long-term debt to total capital ratio is approximately 18.08 per cent. The company

has not announced any plans to change the capital structure in the foreseeable future, so it is

assumed that this will remain constant. Based on this assumption, Starbucks WACC is

approximately 7.36 per cent.

Growth Rate

The estimated FCFF growth rate is a key determinant of the intrinsic value in a discounted

cash flow analysis due to the important of the terminal value. It is difficult to estimate this

growth rate in such a turbulent environment, and therefore, it would be prudent to be

mindful of the valuations sensitivity to this estimate.

Consequently, a table has been prepared below using a range of growth rates with 4 per cent

identified as the most likely outcome.

26

Note that this rate is relatively low by historical standards. The financial and economic crisis has resulted in a flight to safety in the form

of U.S. government bonds.

27

Pablo Fernandez, Market Risk Premium Used in 2008: A Survey of More than a 1,000 Professors. Retrieved from

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1344209 on 7 April 2009.

20

Va|uation App|ication and 5ensitivity Ana|ysis

Table 2 - Discounted Free Cash Flow to the Firm Valuation and Sensitivity Analysis for Starbucks Corp

Gr owt h Rat e

3% . 4% 5%

Fir m Value 7, 904, 048 9, 561, 959 12, 624, 868

Equit y Value 7, 354, 448 9, 012, 359 12, 075, 268

I mplied Shar e Value

Basic $10. 05 $12. 32 $16. 51

Dilut ed $9. 92 $12. 15 $16. 28

Imp|ications

The above table indicates a range of possible intrinsic values for Starbucks stock, given

various growth assumptions. A close look at the table reveals that the implied share price is

indeed quite sensitive to the growth rate. At a four per cent free cash flow growth rate, the

estimated intrinsic value of the share price is $12.15.

As of April 7, 2009, Starbucks ended the trading day at $11.19. Therefore, the stock is only

slightly relatively undervalued in comparison to the estimate. This amount is so marginal that

we would consider the stock to be priced near perfectly.

Re|ative Va|uation

Methods of absolute valuation can and should be supplemented by relative valuation

techniques. By analyzing comparables and multiples, it is possible to refine and develop

support for the conclusions using absolute valuation methods.

Price-To-Earnings (PjE) Mu|tip|e Va|uation

A table illustrating the trailing and forward P/E ratios for Starbucks and select competitors

is shown below in Table 3.

21

Table 3 - Forward and Trailing P/E Ratios for Starbucks Corp. and Select Competitors

Company Tr ai l i ng P/ E

28

For w ar d

P/ E

29

McDonalds 14. 72 13. 29

Nest le - -

Peet ' s Coffee and Tea 26. 94 19. 91

St ar bucks 48. 23 13. 32

Tim Hor t ons 20. 91 15. 39

Yum! Br ands 14. 66 12. 46

Compet i t or Av er age 25. 092 14. 874

An analysis of the above table reveals that Starbucks has a comparatively high P/E ratio than

that of all competitors and the industry average. Starbucks, which has a trailing P/E ratio of

48.23, could be relatively overvalued as investors have paid more for each dollar of earnings.

One possible reason for this has been the poor and volatile performance of the company,

especially in the last twelve months. In 2008, profit dropped more than 53 per cent as the

company incurred more than $266.9 million in restructuring costs. Note, however, that other

competitors (also competing for consumer discretionary spending) faced the same

deteriorating economic conditions meaning that these effects should be factored into their

P/E ratios.

For these reasons, it may be prudent to refer to the forward P/E multiple when conducting

a relative valuation. Comparing Starbucks forward P/E multiple to those of its competitors

reveals that Starbucks is relatively on part with its competitors with a forward P/E ratio of

13.32.

Imp|ied 5hare Price

Based on the industry average trailing P/E of 25.092, the implied share price of Starbucks is

$23.34.

30

However, adjusting for the fact that Starbucks own exceptionally high trailing P/E

28

Trailing, 12 months moving

29

Forward, fiscal year-end 2010

30

Based on reported 2008 EPS of 0.93 (basic and diluted)

22

ratio has undue influence on the industry average, the share price estimate declines to

$17.96.

31

Price-To-Book (PjB) Mu|tip|e Va|uation

A table illustrating the price-to-book ratios for Starbucks and select competitors is shown

below in Table 4. Note that Yum! Brands has been excluded from this calculation since it

has an exceptional P/B ratio of -127, reflecting the unique conditions of that company.

Table 4 - Price-to-book Ratios for Starbucks Corp. and Select Competitors

Company Pr i ce- t o- book

McDonalds 4. 62

Nest le -

Peet ' s Coffee and Tea 1. 97

St ar bucks 3. 2

Tim Hor t ons 5. 16

Yum! Br ands -

Compet i t or Av er age 3. 738

An analysis of the table above reveals that Starbucks may be relatively undervalued when

compared to it two largest competitors and the competitor average.

Imp|ied 5hare Price

Using the competitor average P/B ratio, the estimated value of a Starbucks share is $10.99

(basic) and $10.88 (diluted.)

Enterprise Va|ue (EV) Mu|tip|e Va|uation

A table illustrating the EV/EBITDA ratios for Starbucks and select competitors is shown

below in Table 5.

31

Industry average trailing P/E multiple is 19.31 when Starbucks is excluded

23

Table 5 - EV/EBITDA Ratios for Starbucks Corp. and Select Competitors

Company EV/ EBI TDA

McDonalds 9. 00

Nest le -

Peet ' s Coffee and Tea 8. 76

St ar bucks 8. 18

Tim Hor t ons 9. 21

Yum! Br ands 8. 22

Compet i t or Av er age 8. 67

An analysis of the table above reveals that Starbucks is approximately in line with

EV/EBITDA ratios of other firms in its industry. Starbucks EV/EBITDA is slightly lower

than the competitor average indicating that the firm may be slightly undervalued based on its

EBITDA.

Integrated Ana|ysis

The various conclusions reached using absolute and relative valuation methods can be

blended to reach a single target price for the stock and the basis for a recommendation.

Below, in Table 6, conclusions from prior analysis are blended to reach a single share price.

Table 6 - Blended Target Share Price for Starbucks Corp.

Anal y si s Met hod Di scount ed Fr ee Cash

Fl ow t o t he Fi r m

P/ E I mpl i ed Shar e

Pr i ce

P/ B I mpl i ed Shar e

Pr i ce

Est imat ed I nt r insic

Value

$12. 32 $23. 34 $10. 88

Weight Given t o

Met hod

60% 40% 40%

Bl ended Tar get Pr i ce = $14. 24

24

Based on the blended analysis, using the estimated share prices and weights shown above,

the target price for shares of Starbucks Corp. is $14.24. This represents a 27 per cent

premium over the April 7, 2009 close price of $11.19.

Recommendation

STRONG BUY

BUY

HOLD

SELL

$14.24

STRONG SELL

A through analysis of Starbucks Corp. indicates that the stock is currently undervalued at

11.19 (close price as of April 7, 2009.) It is probable that the stock price is currently being

battered by economic uncertainty and investor risk-aversion to the potential for further

losses in the stock market. Also, the current stock price may be an overreaction to

disappointing results in the first quarter of 2009.

However, these results have been taken into consideration in the discounted cash flow

analysis accompanied by very modest growth expectations for the future. It should also be

noted that while recent financial results have been somewhat concerning, the company is

taking strides to address this through a number of restructuring and transformation

initiatives.

As the company faces increasing competition in the future, Starbucks will likely experience

reduced sales and earning growth, with margins lower than the company has typically

achieved in the past. However, this is the new reality for this company. No longer a hot

growth stock, Starbucks is making a rapid transition into its mature phase. Investors have

penalized the company heavily during this transition, making it a valuable investment

opportunity.

25

Appendix A: 5tarbucks Historica| Ba|ance 5heet

Starbucks Corp.

As Reported Annual Balance Sheet 10/03/2004 10/02/2005 10/01/2006 09/30/2007 09/28/2008

Currency USD USD USD USD USD

Auditor Status

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Consolidated No No No No No

Scale Thousands Thousands Thousands Thousands Thousands

Operating funds & interest bearing

deposits 219,809 62,221 84,943 - -

Money market funds 79,319 111,588 227,663 - -

Cash & cash equivalents 299,128 173,809 312,606 281,261 269,800

Short-term investments - available-for-sale

securities 329,082 95,379 87,542 83,845 3,000

Short-term investments - trading securities 24,799 37,848 53,496 73,588 49,500

Accounts receivable, gross 142,457 193,841 228,098 291,125 334,000

Less: allowance for doubtful accounts 2,231 3,079 3,827 3,200 4,500

Accounts receivable, net 140,226 190,762 224,271 287,925 329,500

Unroasted coffee 233,903 319,745 328,051 339,434 377,700

Roasted coffee 46,070 56,231 80,199 88,615 89,600

Other merchandise held for sale 81,565 109,094 146,345 175,489 120,600

Packaging & other supplies 61,125 61,229 81,627 88,120 104,900

Inventories 422,663 546,299 636,222 691,658 692,800

Prepaid expenses & other current assets 71,347 94,429 126,874 148,757 169,200

Deferred income taxes, net 81,240 70,808 88,777 129,453 234,200

Total current assets 1,368,485 1,209,334 1,529,788 1,696,487 1,748,000

Long-term investments - available-for-sale

securities 135,179 60,475 5,811 21,022 71,400

Equity method investments 152,511 189,735 205,004 234,468 267,900

Cost method investments 16,430 8,920 11,283 24,378 34,700

Other investments 2,806 2,806 2,806 - -

Equity & other investments 171,747 201,461 219,093 258,846 -

Equity & cost investments - - - - 302,600

Land 13,118 13,833 32,350 56,238 59,100

Buildings 66,468 68,180 109,129 161,730 217,700

Leasehold improvements 1,497,941 1,947,963 2,436,503 3,103,121 3,363,100

Store equipment - 646,792 784,444 1,002,289 1,045,300

Roasting equipment - 168,934 197,004 208,816 220,700

Roasting & store equipment 683,747 - - - -

Furniture, fixtures & other property, plant &

equipment 415,307 476,372 523,275 559,077 517,800

Work in progress - - - - 293,600

Property, plant & equipment, at cost 2,676,581 3,322,074 4,082,705 5,091,271 5,717,300

Less: accumulated depreciation &

amortization 1,298,270 1,625,564 1,969,804 2,416,142 2,760,900

Property, plant & equipment before work-

in-progress 1,378,311 1,696,510 2,112,901 2,675,129 -

Work in progress 93,135 145,509 174,998 215,304 -

Property, plant & equipment, net 1,471,446 1,842,019 2,287,899 2,890,433 2,956,400

Other assets 85,561 72,893 186,917 219,422 261,100

Other intangible assets 26,800 35,409 37,955 42,043 66,600

26

Goodwill 68,950 92,474 161,478 215,625 266,500

Total assets 3,328,168 3,514,065 4,428,941 5,343,878 5,672,600

Commercial paper & short-term

borrowings - - - 710,248 713,000

Accounts payable 199,346 220,975 340,937 390,836 324,900

Accrued compensation & related costs 208,927 232,354 288,963 332,331 253,600

Accrued occupancy costs 65,873 44,496 54,868 74,591 136,100

Accrued taxes 63,038 78,293 94,010 92,516 76,100

Insurance reserves - - - - 152,500

Other accrued expenses 123,684 198,082 224,154 257,369 164,400

Deferred revenue 121,377 175,048 231,926 296,900 368,400

Current portion of long-term debt 735 748 762 775 700

Short-term borrowings - 277,000 700,000 - -

Total current liabilities 782,980 1,226,996 1,935,620 2,155,566 2,189,700

Deferred income taxes, net 46,683 - - - -

Senior notes - - - - 549,200

Other long-term debt - - - - 400

Long-term debt - - - - 549,600

Long-term debt 3,618 2,870 1,958 550,121 -

Deferred rent - - 203,903 271,736 303,900

Unrecognized tax benefits - - - - 60,400

Asset retirement obligations - - 34,271 43,670 44,600

Minority interest - - 10,739 17,252 18,300

Other long-term liabilities - - 13,944 21,416 15,200

Other long-term liabilities - - 262,857 354,074 442,400

Other long-term liabilities 8,132 193,565 - - -

Total liabilities - - 2,200,435 3,059,761 3,181,700

Common stock 956,685 90,968 756 738 700

Other additional paid-in capital 39,393 39,393 39,393 39,393 39,400

Retained earnings (accumulated deficit) 1,461,458 1,939,359 2,151,084 2,189,366 2,402,400

Net unrealized holding gains (losses) on

available-for-sale securities - - -254 1 -4,100

Net unrealized holding gains (losses) on

hedging instruments - - -6,416 -27,051 -22,200

Translation adjustment - - 43,943 81,670 74,700

Accumulated other comprehensive income

(loss) 29,219 20,914 37,273 54,620 48,400

Total shareholders' equity 2,486,755 2,090,634 2,228,506 2,284,117 2,490,900

27

Appendix B: 5tarbucks Historica| Income 5tatement

As Reported Annual Income Statement 10/03/2004 10/02/2005 10/01/2006 09/30/2007 09/28/2008

Currency USD USD USD USD USD

Auditor Status

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Consolidated No No No No No

Scale Thousands Thousands Thousands Thousands Thousands

Company-operated retail revenue 4,457,378 5,391,927 6,583,098 7,998,265 8,771,900

Specialty licensing revenue 565,798 673,015 860,676 1,026,338 1,171,600

Specialty foodservice & other revenue 271,071 304,358 343,168 386,894 439,500

Total specialty revenue 836,869 977,373 1,203,844 1,413,232 1,611,100

Total net revenues 5,294,247 6,369,300 7,786,942 9,411,497 10,383,000

Cost of sales including occupancy costs 2,198,654 2,605,212 3,178,791 3,999,124 4,645,300

Store operating expenses 1,790,168 2,165,911 2,687,815 3,215,889 3,745,100

Other operating expenses 171,648 197,024 260,087 294,136 330,100

Depreciation & amortization expenses 280,024 340,169 387,211 467,160 549,300

General & administrative expenses 304,293 357,114 473,023 489,249 456,000

Restructuring charges - - - - 266,900

Total operating expenses 4,744,787 5,665,430 6,986,927 8,465,558 9,992,700

Income from equity investees 60,657 76,745 93,937 108,006 113,600

Operating income (loss) 610,117 780,615 893,952 1,053,945 503,900

Interest & other income, net 14,140 15,829 12,291 2,419 9,000

Interest expense - - - - 53,400

Earnings (loss) before income taxes 624,257 796,444 906,243 1,056,364 459,500

Current federal income taxes provision

(benefit) 188,647 273,178 332,202 326,725 180,400

Current state income taxes provision

(benefit) 36,383 51,949 57,759 65,308 34,300

Current foreign income taxes provision

(benefit) 10,218 14,106 12,398 31,181 40,400

Deferred income taxes provision (benefit),

net -2,766 -37,256 -77,589 -39,488 -111,100

Income taxes 232,482 301,977 324,770 383,726 144,000

Earnings before cumulative effect of

change in accounting principle - - 581,473 672,638 315,500

Cumulative effect of accounting change

for FIN 47, net of taxes - - -17,214 - -

Net earnings (loss) 391,775 494,467 564,259 672,638 315,500

Weighted average shares outstanding -

basic 794,346 789,570 766,114 749,763 731,500

Weighted average shares outstanding -

diluted 822,930 815,417 792,556 770,091 741,700

Year end shares outstanding 794,811.69 767,442.11 756,602.07 738,285.29 735,500

Earnings (loss) per share from continuing

operations - basic - - 0.76 0.9 0.43

Earnings (loss) per share - effect of

accounting change - basic - - -0.02 - -

Net earnings (loss) per share - basic 0.495 0.63 0.74 0.9 0.43

Earnings (loss) per share from continuing

operations - diluted - - 0.73 0.87 0.43

Earnings (loss) per share - effect of

accounting change - diluted - - -0.02 - -

Net earnings (loss) per share - diluted 0.475 0.61 0.71 0.87 0.43

Total number of employees 96,700 115,000 145,800 172,000 176,000

Number of common stockholders 13,095 13,900 16,653 18,500 21,000

28

Starbucks Corp.

As Reported Annual Retained Earnings 10/03/2004 10/02/2005 10/01/2006 09/30/2007 09/28/2008

Currency USD USD USD USD USD

Auditor Status

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Consolidated No No No No No

Scale Thousands Thousands Thousands Thousands Thousands

Previous retained earnings (accumulated

deficit) 1,069,683 1,444,892 1,938,987 2,151,084 2,189,400

Cumulative impact for adoption of FIN 48 - - - - -1,700

Repurchase of common stock - - 352,162 634,356 100,800

Retained earnings (accumulated deficit) 1,461,458 1,939,359 2,151,084 2,189,366 2,402,400

29

Appendix C: 5tarbucks Historica| Cash F|ow 5tatement

As Reported Annual Cash Flow 10/03/2004 10/02/2005 10/01/2006 09/30/2007 09/28/2008

Currency USD USD USD USD USD

Auditor Status

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Not

Qualified

Consolidated No No No No No

Scale Thousands Thousands Thousands Thousands Thousands

Net earnings (loss) 391,775 494,467 564,259 672,638 315,500

Cumulative effect of accounting change

for FIN 47, net of income taxes - - 17,214 - -

Depreciation & amortization 304,820 367,207 412,625 491,238 604,500

Provision for impairments & asset

disposals 13,568 20,157 19,622 26,032 325,000

Deferred income taxes, net -3,073 -31,253 -84,324 -37,326 -117,100

Equity in loss (income) of investees -33,387 -49,633 -60,570 -65,743 -61,300

Distributions of income from equity

investees - 30,919 49,238 65,927 52,600

Stock-based compensation - - 105,664 103,865 75,000

Tax benefit from exercise of nonqualified

stock options 63,405 109,978 - - -

Tax benefit from exercise of stock options - - 1,318 7,705 3,800

Excess tax benefit from exercise of stock

options - - -117,368 -93,055 -14,700

Net accretion of discount & amortization of

premium on marketable securities 11,603 10,097 - - -

Net amortization of premium on securities - - 2,013 653 -

Other adjustments - - - - -100

Accounts receivable - -49,311 - - -

Inventories -77,662 -121,618 -85,527 -48,576 -600

Prepaid expenses & other current assets -16,621 - - - -

Accounts payable 27,948 9,717 104,966 36,068 -63,900

Accrued compensation & related costs 54,929 22,711 54,424 38,628 -

Accrued occupancy costs 8,900 - - - -

Accrued taxes - - 132,725 86,371 7,300

Deferred revenue 47,590 53,276 56,547 63,233 72,400

Other accrued expenses 16,465 - - - -

Other operating assets & liabilities -16,412 56,894 -41,193 -16,437 60,300

Net cash flows from operating activities 793,848 923,608 1,131,633 1,331,221 1,258,700

Purchase of available-for-sale securities -566,645 -643,488 -639,192 -237,422 -71,800

Maturity of available-for-sale securities 163,814 469,554 269,134 178,167 20,000

Sale of available-for-sale securities 190,748 626,113 431,181 47,497 75,900

Acquisitions, net of cash acquired - -21,583 -91,734 -53,293 -74,200

Net purchases of equity, other

investments & other assets -64,747 -7,915 -39,199 -56,552 -52,000

Net additions to property, plant &

equipment -386,176 -643,989 -771,230 -1,080,348 -984,500

Purchase of Seattle Coffee Company, net -7,515 - - - -

Distributions from equity investees 38,328 - - - -

Net cash flows from investing activities -632,193 -221,308 -841,040 -1,201,951 -1,086,600

Repayments of commercial paper - - - -16,600,841 -66,068,000

Proceeds from issuance of commercial

paper - - - 17,311,089 65,770,800

Repayments of short-term borrowings - - - -1,470,000 -228,800

30

Proceeds from short-term borrowings - - - 770,000 528,200

Proceeds from issuance of common stock 137,590 163,555 159,249 176,937 112,300

Excess tax benefit from exercise of stock

options - - 117,368 93,055 14,700

Principal payments on long-term debt -722 -735 -898 -784 -600

Proceeds from issuance of long-term debt - - - 548,960 -

Repurchase of common stock -203,413 -1,113,647 -854,045 -996,798 -311,400

Borrowings under revolving credit facility - 277,000 423,000 - -

Other financing activities - - - -3,505 -1,700

Net cash flows from financing activities -66,545 -673,827 -155,326 -171,887 -184,500

Effect of exchange rate changes on cash

& cash equivalents 3,111 283 3,530 11,272 900

Net increase (decrease) in cash & cash

equivalents 98,221 28,756 138,797 -31,345 -11,500

Cash & cash equivalents, beginning of

period 200,907 145,053 173,809 312,606 281,300

Cash & cash equivalents, end of period 299,128 173,809 312,606 281,261 269,800

Cash paid during the period for interest,

net of capitalized interest 370 1,060 10,576 35,294 52,700

Cash paid during the period for income

taxes 172,759 227,812 274,134 342,223 259,500

31

Appendix C: Oiscounted Free Cash F|ow to the Firm ~ Oetai|ed

Pro|ections

2004 A 2005 A 2006 A 2007 A 2008 A

(Estimated) Company-operated

retail revenue 4,457,378 5,391,927 6,583,098 7,998,265 8,771,900

(Estimated) Company-operated

retail revenue growth - 0.209663394 0.220917494 0.21496976 0.096725352

(Estimated) Speciality licensing

revenue 565,798 673,015 860,676 1,026,338 1,171,600

(Estimated) Specialty licensing

revenue growth - 0.189496958 0.278836282 0.192478935 0.14153427

(Estimated) Speciality foodservice

and other revenue 271,071 304,358 343,168 386,894 439,500

(Estimated) Specialty foodservice

and other revenue growth - 0.122798086 0.127514309 0.12741864 0.135970059

(Estimated) Total net revenues 5,294,247 6,369,300 7,786,942 9,411,497 10,383,000

(Estimated) Total net revenues

growth - 0.203060605 0.222574223 0.208625543 0.10322513

(Estimated) Cost of sales including

occupancy costs 2,198,654 2,605,212 3,178,791 3,999,124 4,645,300

(Estimated) Cost of sales including

occupancy costs - 0.184912224 0.22016596 0.258064465 0.161579386

(Estimated) Total operating

expenses 4,744,787 5,665,430 6,986,927 8,465,558 9,725,800

(Estimated) Total operating

expenses growth - 0.194032525 0.233256258 0.211628231 0.148866974

(Estimated) EBIT 624,257 796,444 906,243 1,056,364 779,800

(Estimated) EBIT growth - 0.275827103 0.137861545 0.165652038 -0.261807483

(Estimated) Net earnings 391,775 494,467 564,259 672,638 315,500

(Estimated) Net earnings growth - 0.262119839 0.141145921 0.192073144 -0.530951269

(Estimated) Gross margin 0.584708836 0.590973576 0.591779289 0.575080989 0.55260522

(Estimated) EBIT Margin 0.11791233 0.125044196 0.116379832 0.112241868 0.075103535

(Estimated) Profit margin 0.074000136 0.077632864 0.072462207 0.07146982 0.030386208

(Estimated) Depreciation &

amortization expenses 280,024 340,169 387,211 467,160 549,300

(Estimated) Depreciation &

amortization expenses growth - 0.214785161 0.138290085 0.20647399 0.17582841

% of PP&E 0.104620036 0.102396575 0.094841778 0.091757048 0.096076819

Effect Income Tax Rate 0.372413926 0.379156601 0.358369665 0.363251682 0.313384113

Weight 0.1 0.1 0.1 0.3 0.4

Weighted Effective Tax Rate 0.037241393 0.03791566 0.035836966 0.108975505 0.125353645

32

2009 E 2010 E 2011 E 2012 E 2013 E

(Estimated) Company-operated retail

revenue

(Estimated) Company-operated retail

revenue growth

(Estimated) Speciality licensing

revenue

(Estimated) Specialty licensing revenue

growth

(Estimated) Speciality foodservice and

other revenue

(Estimated) Specialty foodservice and

other revenue growth

(Estimated) Total net revenues 9,811,252 9,541,120 10,495,232 11,544,755 12,699,231

(Estimated) Total net revenues growth -0.055065761 -0.02753288 0.1 0.1 0.1

(Estimated) Cost of sales including

occupancy costs

(Estimated) Cost of sales including

occupancy costs

(Estimated) Total operating expenses

(Estimated) Total operating expenses

growth

(Estimated) EBIT 327,948 327,948 344,346 361,563 379,641

(Estimated) EBIT growth -0.676265271 0 0.05 0.05 0.05

(Estimated) Net earnings

(Estimated) Net earnings growth

(Estimated) Gross margin

(Estimated) EBIT Margin

(Estimated) Profit margin

(Estimated) Depreciation &

amortization expenses 518,682 504,401 534,291 576,418 621,627

(Estimated) Depreciation &

amortization expenses growth

% of PP&E 0.0979 0.0979 0.0979 0.0979 0.0979

Effect Income Tax Rate

Weight

Weighted Effective Tax Rate

33

Analysis of Fixed Capital Investment 2004 A 2005 A 2006 A 2007 A 2008 A

(Estimated) Property, plant &

equipment, at cost 2,676,581 3,322,074 4,082,705 5,091,271 5,717,300

(Estimated) Property, plant &

equipment, at cost growth - 0.24116326 0.22896269 0.247033768 0.122961241

Change in PP&E 645,493 760,631 1,008,566 626,029

% of Net Revenues 0.505564058 0.521575997 0.524301452 0.540962931 0.55064047

Analysis of Net Working Capital

2004 2005 2006 2007 2008

Current Assets - Cash 770,229 861,716 904,576 1,415,226 1,478,200

Current Liab - ST Debt 782,245 949,248 1,234,858 1,444,543 1,476,000

NWC -12,016 -87,532 -330,282 -29,317 2,200

NWC_Change - -75,516 -242,750 300,965 31,517

CAGrowth 0.118778961 0.049737965 0.564518625 0.044497487

CLGrowth 0.213491937 0.300880276 0.169804949 0.021776437

0.1 0.1 0.3 0.5

Weighted_CAGrowthRate 0.011877896 0.004973796 0.169355588 0.022248743

Weighted_CLGrowthRate 0.021349194 0.030088028 0.050941485 0.010888219

FCFF from EBIDTA

EBIT(1-T) 391,775 494,467 581,473 672,638 535,423

+Dep 280,024 340,169 387,211 467,160 549,300

-FCInv - 645,493 760,631 1,008,566 626,029

-WCInv - -75,516 -242,750 300,965 31,517

FCFF = 264,659 450,803 -169,733 427,177

FCFF from CFO

(Estimated) Cash flow from

operations 793,848 923,608 1,131,633 1,331,221 1,258,700

(Estimated) Cash flow from

operations growth 0.163456984 0.225230834 0.176371668

-

0.054477055

+ Int(1-Tax Rate) 34,961

-FCInv - 645,493 760,631 1,008,566 626,029

FCFF = 278,115 371,002 322,655 667,632

34

Analysis of Fixed Capital Investment 2009 E 2010 E 2011 E 2012 E 2013 E

(Estimated) Property, plant & equipment, at

cost 5,298,076 5,152,205 5,457,521 5,887,825 6,349,615

(Estimated) Property, plant & equipment, at

cost growth

Change in PP&E -419,224 -145,871 305,316 430,305 461,790

% of Net Revenues 0.54 0.54 0.52 0.51 0.5

Analysis of Net Working Capital

2009 2010 2011 2012 2013

Current Assets - Cash 1,765,562 2,108,787 2,518,736 3,008,378 3,593,206

Current Liab - ST Debt 1,736,514 2,043,009 2,403,600 2,827,835 3,326,948

NWC 29,048 65,779 115,136 180,543 266,258

NWC_Change 26,848 36,731 49,357 65,407 85,716

CAGrowth 0.1944 0.1944 0.1944 0.1944 0.1944

CLGrowth 0.1765 0.1765 0.1765 0.1765 0.1765

Weighted_CAGrowthRate

Weighted_CLGrowthRate

FCFF from EBIDTA

EBIT(1-T) 214,708 214,708 225,443 236,715 248,551

+Dep 518,682 504,401 534,291 576,418 621,627

-FCInv -419,224 -145,871 305,316 430,305 461,790

-WCInv 26,848 36,731 49,357 65,407 85,716

FCFF = 1,125,765 828,249 405,061 317,422 322,672

FCFF from CFO

(Estimated) Cash flow from operations 1,080,846 1,004,484 1,024,574 1,055,311 1,097,523

(Estimated) Cash flow from operations

growth -0.1413 -0.07065 0.02 0.03 0.04

+ Int(1-Tax Rate) 34,961 34,961 34,961 34,961 34,961

-FCInv -419,224 -145,871 305,316 430,305 461,790

FCFF = 1,535,030 1,185,316 754,219 659,967 670,694

35

Appendix O: Va|uation App|ication

2009 2010 2011 2012 2013 Terminal

FCFF From

EBIT 1,125,765 828,249 405,061 317,422 322,672

FCFF From

CFO 1,535,030 1,185,316 754,219 659,967 670,694

Target D/E Ratio: 0.180759743

Cost of Equity:

Risk Free Rate: 0.02

Beta: 0.93

Market Risk Premium: 0.065

0.08045

Cost of Debt: 0.0425555

WACC: 0.0736002

FCFF Growth Rate: 0.04

PV of FCFF

(EBIT) 1,048,589 718,581 327,335 238,928 226,229 7,002,296

Value of the Firm: 9,561,959

Less: Debt 549,600

Value of Equity: 9,012,359

Weighted average shares oustanding:

Basic: 731,500

Diluted: 741,700

Intrinsic Value:

Basic: 12.32038187

Diluted: 12.15094963

PV of FCFF

(CFO) 1,429,797 1,028,369 609,494 496,766 470,231 14,554,691

Value of the Firm: 18,589,349

Less: Debt 549,600

Value of Equity: 18,039,749

Weighted average shares oustanding:

Basic: 731,500

Diluted: 741,700

Intrinsic Value:

Basic: 24.66131145

Diluted: 24.32216439

36

Growth Rate

3% 4% 5%

Firm Value 7,904,048 9,561,959 12,624,868

Equity Value 7,354,448 9,012,359 12,075,268

Implied Share Value

Basic $10.05 $12.32 $16.51

Diluted $9.92 $12.15 $16.28

Você também pode gostar

- Game Rules PDFDocumento12 páginasGame Rules PDFEric WaddellAinda não há avaliações

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNo EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsAinda não há avaliações

- Group-13 Case 12Documento80 páginasGroup-13 Case 12Abu HorayraAinda não há avaliações

- M&ADocumento7 páginasM&AAntónio CaleiaAinda não há avaliações

- Financial Analysis Case StudyDocumento14 páginasFinancial Analysis Case StudyPratik Prakash BhosaleAinda não há avaliações

- How Venture Capital Funds Determine Startup ValuationsDocumento35 páginasHow Venture Capital Funds Determine Startup ValuationsДр. ЦчатерйееAinda não há avaliações

- C6 RS6 Engine Wiring DiagramsDocumento30 páginasC6 RS6 Engine Wiring DiagramsArtur Arturowski100% (3)

- Non Circumvention Non Disclosure Agreement (TERENCE) SGDocumento7 páginasNon Circumvention Non Disclosure Agreement (TERENCE) SGLin ChrisAinda não há avaliações

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Documento7 páginasCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- MFS case study on compensation strategyDocumento2 páginasMFS case study on compensation strategyTushar ChaudhariAinda não há avaliações