Escolar Documentos

Profissional Documentos

Cultura Documentos

4478 Fact Sheeet 061010

Enviado por

Steve CouncilDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

4478 Fact Sheeet 061010

Enviado por

Steve CouncilDireitos autorais:

Formatos disponíveis

FACT SHEET

South Carolina Policy Council

1323 Pendleton St., Columbia, SC 29201 803-779-5022 scpolicycouncil.com

Economic Development Bill Rewards Special Interests Over Independent Businesses

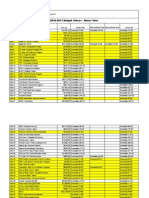

Issue Summary Even as legislators fret over massive budget cuts, they have passed an omnibus economic development tax credit act that provides an array of targeted credits and subsidies ostensibly aimed at stimulating South Carolinas ailing economy. Recipients of the credits range from alternative energy producers to start-ups to waste-grease biodiesel producers. In effect, new and unproven industries are getting the nod over established, independent businesses left to pick up the tab. Analysis The so-called Economic Development Competitiveness Act of 2010 (H 4478) is the brainchild of House Speaker Bobby Harrell and a team of high-powered consultants from Nelson Mullins, Nexsen Pruet, and the S.C. Association of Realtors, among others. According H 4478 is purported to to Harrells office, the bill represents a proactive economic development strategy that includes stimulate the economy such recommendations as eliminating the corporate income tax and restoring the Closing both by enacting broadFund. The strategy, in other words, is to stimulate based tax cuts and by the economy both by enacting broad-based tax cuts and by doling out subsidies to special doling out subsidies to interests. Except there are no broad-based cuts. Legislators reject fundamental tax reform As we wrote earlier this year, plans to eliminate there are no broad-based the corporate income tax were clearly the cuts. sweetener being used to force down the bitter pill of more government-driven economic development. The Senate moved quickly to delete the corporate income tax cut, arguing that its too expensive right now. Never mind that the incremental tax cut would not have been implemented until FY13-2014 at a cost of only $16.8 million. Or that no tax cut was ever envisioned for FY10-2011. Or that the full tax of 5.0 percent would not have been reduced to 0.0 percent until 2022. Currently, the tax brings in only a fraction of General Fund revenue, or an estimated $134.5 million for FY10-2011.

special interestsexcept

FACT SHEET: H 4478 and Special Interest Incentives

South Carolina Policy Council

Of course, eliminating both the corporate income tax and the 5 percent flat tax on small businesses would have been an even better idea. Ninety-seven percent of South Carolinas employers run small businesses, accounting for 50 percent of private sector jobs. Special interests benefit most Not a few lawmakers have wondered about which special interests are benefitting from H 4478. The bills key sponsors are trying to please somebody probably from out of state, commented Sen. Glenn Reese (D-Spartanburg) to The State. I think there are many, many rabbits The bills key throughout this whole bill. This impression was sponsors are trying seconded by a statement in the Senate journal by Senators Glenn McConnell (R-Charleston) and Lee to please somebody Bright (R-Spartanburg) calling H 4478 a Christmas tree. probably from out of As if to confirm these suspicions, House Ways & state. Means Committee Chairman Dan Cooper (R-Anderson) acknowledged that a new renewable energy tax incentive program inserted into H 4478 was designed for a significant business prospect looking at investing $500 million in Greenville. Possible candidates would seem to be BMW or GE. (BMW has been experimenting with hydrogen vehicles for some time, whereas GEs Greenville plant is a major producer of wind turbine generators.) The top beneficiaries of H 4478 include: Renewable energy companies As dictated by the South Carolina Renewable Energy Tax Incentive Program, firms in the renewable energy industry will receive a five-year, 10 percent tax credit. The threshold for the credit is low, requiring a minimum $500,000 investment that results in the creation of at least 1.5 full-time positions. The S.C. Board of Economic Advisors (BEA) anticipates only one company will be eligible for the credit at a cost of $40,000. This calculation, however, seems to have no basis in prior and anticipated investment patterns for the renewable energy industry in South Carolina, meaning the costs will likely be much higher. Under the newly titled, S.C. Life Sciences and Renewable Energy Manufacturing Act, manufacturers of solar and wind turbine products, as well as manufacturers of lithium ion and other batteries used in alternative energy vehicles, will receive job development credits and other subsidies as authorized by the Enterprise Zone Act of 1995. Such companies are likewise eligible for various income tax breaks and a 20 percent depreciation allowance on manufacturing property taxes. As highlighted in The Nerve, Proterra of Greenville, S.C., may be one of the beneficiaries of this credit.

FACT SHEET: H 4478 and Special Interest Incentives

South Carolina Policy Council

The bill also extends fee-in-lieu of property tax (FILOT) benefits to nuclear plant facilities an industry not even billions in federal aid has been able to sustain. H 4478 provides a 10 percent income tax credit for waste-grease biodiesel producers (see also H 3997). BEA analysis of this credit acknowledged the industry is in its infancy and the technology is unproven. In other words, its a risky investment for taxpayers.

Firms planning on hiring anyway As amended by the Senate, H 4478 includes an unemployment tax credit. The credit is not likely to encourage new job growth, as its too narrow and too temporary. But it will pad the pockets of businesses looking to expand anyway. Analysis by the BEA indicates the two-year credit would reduce revenue by $132.2 million in the first year (FY10-2011) and $175.8 million in the second year (FY11-2012). But its unclear whether this provision will survive in conference committee. Start-ups H 4778 extends license tax liability credits to entities developing incubator buildings for use by small start-up firms. Oddly enough, BEA analysis of this provision presumes only one company will take advantage of the new credit. In any case, contenders for the credit ($300,000 per company) would seem to be the South Carolina Research Authority Innovation Centers and a proposed wet-lab incubation facility at the near-empty Innovista complex. Agribusiness companies Agribusiness operations are being added to the list of activities (manufacturing, tourism, processing, warehousing, distribution, research and development, corporate office, qualifying service-related facilities, extraordinary retail establishment, and qualifying technology intensive facilities, and banks) eligible for annual job tax credits. Cargo carriers/distributors An existing $8 million tax credit for state port users is being expanded to include a credit against employee withholdings up to $4 million maximum for all taxpayers. A $1 million cap on the amount of credits claimed by each recipient is also being eliminated (to the benefit of Boeing, BMW and other large manufacturers, it would seem). Finally, the credit is being amended to permit the Coordinating Council for Economic Development to give a $1 million credit to a new warehouse or distribution facility which commits to expending at least forty million dollars at a single site and creating one hundred new full-time jobs. Military employers Previous versions of H 4478 repealed job tax credits (5 percent of individual income tax withholding) allocated to redevelopment authorities located at Charleston Naval Complex, the Savannah River Site, and Myrtle Beach Air Force

FACT SHEET: H 4478 and Special Interest Incentives

South Carolina Policy Council

Base. The Senate not only retained the credit, at a cost of $4.3 million annually, but extended it to 2017. The tourism industry Sections 35 and 36 authorize the use of up to 50 percent of accommodations and hospitality tax revenue on the construction of tourism-related buildings including, but not limited to, civic centers, coliseums, and aquariums. Developers, architects and a host of others will benefit from this change as well. Small manufacturers Instead of lowering taxes for everyone, lawmakers are continuing to pursue a strategy of offering incentives and subsidies to select companies. Toward this end, H 4778 creates the Small Manufacturers Retention and Growth Fund, which will be administered by the S.C. Manufacturing Partnership Extension. The fund will be used to subsidize various activities of manufacturers that employ less than 250 persons. H 4778 offers several tax credits to taxpayers who contribute to the fund. See also S 1066, which would grant a 100 percent (instead of 50 percent) credit. Other beneficiaries of H 4478 include: manufacturers and others that tend to rely on FILOT agreements, with one change ( 2) lowering the threshold from $10 million to $5 million (see also 7, 10, 11); firms eligible for State Rural Infrastructure Fund grants ( 14); and businesses that pay taxes on manufacturing and productive equipment property ( 21). Especially as regards the latter credit, it is worth noting that, at 3.73 percent, South Carolina has the highest effective manufacturing property tax in the country. But instead of slashing the tax, lawmakers are continuing to pick winners and losers by offering targeted tax credits.

Instead of reducing the tax burden on all South Carolina businesses, lawmakers are continuing to pick winners and losers by offering targeted tax credits.

Nothing in the foregoing should be construed as an attempt to aid or hinder passage of any legislation. Copyright 2010 South Carolina Policy Council.

South Carolina Policy Council

1323 Pendleton St., Columbia, SC 29201 803-779-5022 scpolicycouncil.com

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Data Visvilization Project Boston-Condo-SalesDocumento61 páginasData Visvilization Project Boston-Condo-SalesKATHIRVEL SAinda não há avaliações

- Oecd Model Treaty Commentary PDFDocumento2 páginasOecd Model Treaty Commentary PDFAntheaAinda não há avaliações

- Business Ethics and Social Responsibility: Quarter 4 - Module 1: Responsibilities and Accountabilities of EntrepreneursDocumento20 páginasBusiness Ethics and Social Responsibility: Quarter 4 - Module 1: Responsibilities and Accountabilities of EntrepreneursYannah Longalong100% (1)

- Test Bank - Chapter15 Capital Budgeting2Documento29 páginasTest Bank - Chapter15 Capital Budgeting2Aiko E. Lara100% (1)

- Taxation Law Green Notes 2015Documento45 páginasTaxation Law Green Notes 2015KrisLarr100% (1)

- CE22 13 DepreciationDocumento59 páginasCE22 13 DepreciationHahns Anthony GenatoAinda não há avaliações

- Mployment Security Organization of Southern StatesDocumento6 páginasMployment Security Organization of Southern StatesSteve CouncilAinda não há avaliações

- Exec Summ Recorded Votes 082610Documento1 páginaExec Summ Recorded Votes 082610Steve CouncilAinda não há avaliações

- Exec Summ Shorten The Session 082610Documento1 páginaExec Summ Shorten The Session 082610Steve CouncilAinda não há avaliações

- Chapter 7Documento20 páginasChapter 7Steve CouncilAinda não há avaliações

- Chapter 8Documento22 páginasChapter 8Steve CouncilAinda não há avaliações

- Chapter 10Documento24 páginasChapter 10Steve CouncilAinda não há avaliações

- Fact Sheet: Which Counties Spend The Most of Your Tax Dollars?Documento7 páginasFact Sheet: Which Counties Spend The Most of Your Tax Dollars?Steve CouncilAinda não há avaliações

- Chapter 2Documento28 páginasChapter 2Steve CouncilAinda não há avaliações

- Workforce Development Requires Educational Reform: by L. Brooke ConawayDocumento14 páginasWorkforce Development Requires Educational Reform: by L. Brooke ConawaySteve CouncilAinda não há avaliações

- Chapter 3Documento22 páginasChapter 3Steve CouncilAinda não há avaliações

- Best/Worst of 2010: South Carolina Policy CouncilDocumento47 páginasBest/Worst of 2010: South Carolina Policy CouncilSteve CouncilAinda não há avaliações

- Chapter 5Documento21 páginasChapter 5Steve CouncilAinda não há avaliações

- Chapter 6Documento19 páginasChapter 6Steve CouncilAinda não há avaliações

- Chapter 1Documento14 páginasChapter 1Steve CouncilAinda não há avaliações

- Aiken Fact SheetDocumento2 páginasAiken Fact SheetSteve CouncilAinda não há avaliações

- Budget Watch I95 052510Documento3 páginasBudget Watch I95 052510Steve CouncilAinda não há avaliações

- Best Worst 2011Documento20 páginasBest Worst 2011Steve CouncilAinda não há avaliações

- BudgetWatchObesityMandate 052710Documento2 páginasBudgetWatchObesityMandate 052710Steve CouncilAinda não há avaliações

- Senate Budget Veto VotingDocumento2 páginasSenate Budget Veto VotingSteve CouncilAinda não há avaliações

- The $21 Billion State Budget: South Carolina's Three Spending CategoriesDocumento25 páginasThe $21 Billion State Budget: South Carolina's Three Spending CategoriesSteve CouncilAinda não há avaliações

- HealthcareDocumento2 páginasHealthcareSteve CouncilAinda não há avaliações

- Sat Scores Report 091010Documento5 páginasSat Scores Report 091010Steve CouncilAinda não há avaliações

- BudgetDocumento2 páginasBudgetSteve CouncilAinda não há avaliações

- House Budget Veto VotingDocumento3 páginasHouse Budget Veto VotingSteve CouncilAinda não há avaliações

- 4478 Fact Sheet 061010Documento4 páginas4478 Fact Sheet 061010Steve CouncilAinda não há avaliações

- UpdateDocumento1 páginaUpdateSteve CouncilAinda não há avaliações

- Budget Veto HouseDocumento4 páginasBudget Veto HouseSteve CouncilAinda não há avaliações

- The Role and Environment of Managerial Finance: True/FalseDocumento23 páginasThe Role and Environment of Managerial Finance: True/FalseKenjiAinda não há avaliações

- RA Sushi Bar RestaurantDocumento1 páginaRA Sushi Bar Restaurantkartheeka3Ainda não há avaliações

- Hindu Undivided Family (HUF) Tax Benefits: 1. What Is A HUF?Documento4 páginasHindu Undivided Family (HUF) Tax Benefits: 1. What Is A HUF?ashankarAinda não há avaliações

- 861 EvidenceDocumento5 páginas861 Evidencelegalmatters100% (1)

- Mark Scheme (Results) October 2019Documento21 páginasMark Scheme (Results) October 2019유리Ainda não há avaliações

- Sources of Revenues of Local Government Units Sources of Revenues of Local Government UnitsDocumento73 páginasSources of Revenues of Local Government Units Sources of Revenues of Local Government Unitsaige mascodAinda não há avaliações

- 519 986 1 SMDocumento17 páginas519 986 1 SMvenipin416Ainda não há avaliações

- Register Compny in PakDocumento8 páginasRegister Compny in PakMuhammad SaadAinda não há avaliações

- Taxation CasesDocumento296 páginasTaxation CasesshelAinda não há avaliações

- MGFP BrochureDocumento26 páginasMGFP BrochureAbhinesh KumarAinda não há avaliações

- Financial Performance Analysis of Power Generating Companies in IndiaDocumento305 páginasFinancial Performance Analysis of Power Generating Companies in IndiaWilliam PyneAinda não há avaliações

- Saleem Ahmed (ACCA Member New)Documento3 páginasSaleem Ahmed (ACCA Member New)Saleem AhmedAinda não há avaliações

- List of PI Questions For Bcom StudentsDocumento2 páginasList of PI Questions For Bcom StudentsAdyasha SahuAinda não há avaliações

- MQT (En) KMC01K46 Ga3 G03Documento20 páginasMQT (En) KMC01K46 Ga3 G03Bao PhamAinda não há avaliações

- Dabur NepalDocumento19 páginasDabur Nepalbajracharyasandeep100% (1)

- Illustration Ratio AnalysisDocumento6 páginasIllustration Ratio AnalysisMUINDI MUASYA KENNEDY D190/18836/2020Ainda não há avaliações

- Balakrishnan NotesDocumento14 páginasBalakrishnan NotesDIYA KEEZHISSERYAinda não há avaliações

- Accounting Voucher 1Documento1 páginaAccounting Voucher 1Daksh BavawalaAinda não há avaliações

- TallyDocumento38 páginasTallyDhananjay RokadeAinda não há avaliações

- Tanzania Warehouse License Board and TechDocumento38 páginasTanzania Warehouse License Board and TechGurisha AhadiAinda não há avaliações

- Computer Service Quotation TemplateDocumento1 páginaComputer Service Quotation TemplateNguyen Thanh SangAinda não há avaliações

- India and China: A Special Economic Analysis: New Tigers of AsiaDocumento60 páginasIndia and China: A Special Economic Analysis: New Tigers of AsiaLiang WangAinda não há avaliações

- W1 Principles of TaxationDocumento9 páginasW1 Principles of TaxationChristine Joy MondaAinda não há avaliações

- Ajio FN0334206010 1655992237774Documento1 páginaAjio FN0334206010 1655992237774Deepak RaguAinda não há avaliações