Escolar Documentos

Profissional Documentos

Cultura Documentos

Manuel L Real Financial Disclosure Report For 2010

Enviado por

Judicial Watch, Inc.Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Manuel L Real Financial Disclosure Report For 2010

Enviado por

Judicial Watch, Inc.Direitos autorais:

Formatos disponíveis

I

AO IO Rev. 1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization CENTRAL DISTRICT OF CALIFOR.NIA 5a. Report Type (check appropriate type) Nomination, ] [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) REAL, MANUEL L. 4. Title (Article Ili judges indicate active or senior status; magistrate judges indicate full- or part-time) U.S. DISTRICT JUDGE - ACTIVE

3. Date of Report 04/29/20 6. Reporting Period 01/01/2010 to 12/31/2010

5b. [] Amended Report 7. Chambers or Office Address 312 N. SPRING ST. LOS ANGELES, CA 90012 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. P OSITI ON S. (Repor~n~ individual only; see pp. 9-13 of filing instructions.)

D

NONE (No reportablepositions.)

POSITION

NAME OF ORGANIZATION/ENTITY

Trust #1

1. 2. 3. 4. 5.

Trustee - no beneficial interest

II. AGREEMENTS. (gepor~ng individual only; seepp. 14-16 of filing instruction&)

~] NONE (No reportable agreements.)

DATE

PARTIES AND TERMS

Real, Manuel L.

FINANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Person Reporting REAL, MANUEL L.

Date of Report 04/29/2011

IlL N O N-INVESTMENT IN COME. (Reporting individual and spouse; see pp. 17-24 of filing instructions.)

A. Filers Non-Investment Income ~ NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

INCOME

(yours, not spouses)

B. Spouses Non-Investment Income - If you were married during any portion of the reporting year, complete this section.

(Dollar omount not required except for honoraria.)

~]

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

1. 2. 3. 4.

IV. REIMBURSEMENTS - transportation, lodglng, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 Drilling instructions.)

NONE (No reportable reimbursements.)

SOURCE

DATES July 18-22 September 23-26 LOCATION Gallatin Gateway, !9IT Alexandria, VA PURPOSE Seminar Seminar

ITEMS PAID OR PROVIDED

meals, lodging & transportation meals, lodging & transportation

1. FREE 2. 3. 4. 5. George Mason University

FINANCIAL DISCLOSURE REPORT Page 3 of 8

Name of Person Reporting REAL, MANUEL L.

Date of Report 04/29/2011

V. GIFTS. aneludes those to spouse und dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4.

DESCRIPTION

VALUE

5.

VI. LIABILITIES. ancludes those of spo~e and dependent children; see pp. 32-33 of filing )nstructions.) NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5.

DE SCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 4 of 8

Name of Person Reporting REAL, MANUEL L.

Date of Report 04/29/2011

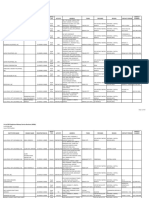

VII. INVESTMENTS and TRUSTS - income, vulue, transactions (Includes those of spouse and dependent children; seepp. 34-60 of fillng instructions.)

~] NONE (No reportable income, assets, or transactions.)

Wells Fargo Bank, San Pedro, CA

2.

A B A A A A A

Interest Interest Interest Interest Interest Interest Interest

M K J K K J J

T T T T T T T

Bay Cities Natl Bank, RPV, CA San Pablo Muni Bond, San Pablo, CA Rockland Cal. Uni School Dist., Rockland, CA California St. Ambac CRC American Express - CD Morgan Stanley - Money Market

3.

4.

5.

6.

7.

8. 9. Trust #1 - Trustee, no beneficial interest Bonds: Sears Roebuck Acceptance Corp. GMAC LLC

13.

C B C C C B C

Int./Div. Interest Interest Interest Interest Interest Interest

K K L K K L K

T T T T T T T

Buy Redeemed

05/21 06/01

K L

Ford Motor Credit Co. Ford Motor Co. Del Hertz Corp. Lehman Bros. Mtn. Var.

14.

15.

Sold Buy

06/08 06/02

K K

17.

Sprint Capital Corp.

1. Income Gain Codes: [See.Columns BI and 2. Value Codes (See Columns Cl and D3) Value Method Codes (See Column C2)

A:=$1,000 or less F =$50~001, $I00,000 .... J =$15.000 or less N =$250,001 - $500,000 P3 =$25.000,001 - $50,000,000 Q =Appraisal U =Book Value

B =$t.001 - $2.500 O =$100,001 - $1,000,000 K =$15.001 - $50.000 O =$500.001 - $1.000.000 R =Cost [Real Estale Only) V =Other

C =$2.501 - $5.000 HI --$ L000,001 - $5.000,000 L =$50.001 - $100.000 PI =$1.000.001 - $5.000.000 P4 =More than $50,000.000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000.000 M =$100.001 - $250.000 P2 =$5.000,001 - $25.000,000 T --Cash Market

E =$15.001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Person Reporting REAL, MANUEL L.

Date of Report 04/29/2011

VII. INVESTMENT S and TRU STS - income, volue, tro~nctions aucludes those of spouse and dependent children; see pp. 34-60 of f!ling instructions.)

[]

NONE (No reportable income, assets, or transactions.)

18. 19. 20. 21. 22.

California State General Obligation California State General Obligation California State General Obligation Califomia State General Obligation Los Angeles County Calif Sch Reg

Interest

Matured (part) Redeemed (part) Redeemed (part) Matured (part)

03/01 04/29 09/01 10/01 04/07

K K K M K

Interest

Buy

23.

Penn West Energy - stock

B B B C C C C C

Interest Interest Interest Interest Interest Interest Interest Int./Div. Int./Div.

K K J K L L K K K K K K

T T T T

T T T T T T T T

24. Provident Energy - stock 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. Enerplus Resources Fund - stock Energy Transfer Partners - stock Kinder Morgan Energy - stock Windstream Corp - stock Williams Pipelin Partners - stock Boardwalk Pipeline Partners - stock Boardwalk Pipeline Partners - stock Genesis Energy - stock Senior Housing Prop Tr Reit - stock Verizon Communications - stock

Buy (addl)

05/20

Buy Buy (addl) Buy Buy Buy

05/19 10/05 09/14 09/28 09/28

K K K K K

C B B

Interest Interest Interest

1. Income:Gain Codes: tSee:Coltmms BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Mlhod Codes (See Column C2)

A y$1.000 ol tess F =$50,001 - $100.000 1 =$15.000 or less N =$250,001 - $500.000 P3 =$25.000.001 - $50.000,000 Q =Appraisal U =Book Value

=$t.001 - $2.500 =$100.001 - $1,000,000 =$t5.001 - $50.000 =$500.001 - $1.000.000 =Cost (Real Estate Only) =Olher

C =$2,501 - $5.000 H 1 =$1,000.001 - $5,000.000 L =$50,001 - $100.000 P1 =$1.000.001 - $5.000.000 p4 =More than $50.000.000 S =Assessment W =Estimated

D =$5.001 - $15.000 H2 =More than $5.000.000 M =$100.001 - $250.000 P2 =$5.000.001 - $25.000,000 T =Cash Market

E =$15,001- $50.000

FINANCIAL DISCLOSURE REPORT Page 6 of 8

Name of Person Reporting REAL, MANUEL L.

Date of Report 04/29/2011

VII. INVESTMENTS and TRU S TS - income, value, ~u.sactlo.s ;.cludes those olspouse u.d depende.t children; see pp. 34-60 offillng instructions.)

NONE (No reportable income, assets, or transactions.)

35. 36. 37. 38. 39. 40.

Health Care Reit, Inc. - stock Plains all American Pipeline - stock Money Market - SDIT Govt II Fund Ticker: 33 Bank of America (accounts) Los Angeles Cnty Calif Sch Reg

Interest Interest Interest None Interest

K K J M K

T T T T T

Buy Buy

09/30 11/17

K K

Sold

05/26

2. Value Codes (See Columns C1 and 03) 3. Value Method Codes (See Column C2)

J =$15,000 Or less K =$15,001 : $50,000 N =$2~0~001. $500,000 0 ~$500;001 - $1.000,000 P3 =$25,000,001 - $50,000.000 R =Cost (Real Estate Only) Q =Appraisal V =Other U =Book ValUe

L =$50,06 : $i~i000 PI P4 =M0r~ than $50~000i000 S =Assessment

M ~i0~ ~i ~2~0

: "F~h Mfirk~t

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting REAL, MANUEL L.

Date of Report 04/29/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndicatepartofreport.)

FINANCIAL DISCLOSURE REPORT Page 8 of 8

Name of Person Reporting REAL, MANUEL L.

Date of Report 04/29/2011

IX. CERTIFICATION.

1 certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure.

I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/MANUEL L. REAL

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- SANTANDER STATEMENtDocumento1 páginaSANTANDER STATEMENtАнечка Бужинская50% (2)

- HRM HW1Documento2 páginasHRM HW1lex_jungAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 2161 DocsDocumento133 páginas2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Documento17 páginas1878 001Judicial Watch, Inc.100% (5)

- 11 1271 1451347Documento29 páginas11 1271 1451347david_stephens_29Ainda não há avaliações

- 1488 09032013Documento262 páginas1488 09032013Judicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocumento38 páginasCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Ainda não há avaliações

- Stamped ComplaintDocumento4 páginasStamped ComplaintJudicial Watch, Inc.Ainda não há avaliações

- State Dept 13-951Documento4 páginasState Dept 13-951Judicial Watch, Inc.Ainda não há avaliações

- CVR LTR SouthCom Water Safety ProductionDocumento2 páginasCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Ainda não há avaliações

- SouthCom Water Safety ProductionDocumento30 páginasSouthCom Water Safety ProductionJudicial Watch, Inc.Ainda não há avaliações

- Gitmo Freezer Inspection ReportsDocumento4 páginasGitmo Freezer Inspection ReportsJudicial Watch, Inc.Ainda não há avaliações

- September 2004Documento24 páginasSeptember 2004Judicial Watch, Inc.Ainda não há avaliações

- Stamped Complaint 2Documento5 páginasStamped Complaint 2Judicial Watch, Inc.Ainda não há avaliações

- Gitmo Freezer Inspection ReportsDocumento4 páginasGitmo Freezer Inspection ReportsJudicial Watch, Inc.Ainda não há avaliações

- July 2007 BulletinDocumento23 páginasJuly 2007 BulletinJudicial Watch, Inc.Ainda não há avaliações

- JTF GTMO Water Safety App W ExhDocumento13 páginasJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Ainda não há avaliações

- June 2004Documento17 páginasJune 2004Judicial Watch, Inc.Ainda não há avaliações

- Model UNDocumento2 páginasModel UNJudicial Watch, Inc.Ainda não há avaliações

- Cover Letter To Requester Re Response Documents130715 - 305994Documento2 páginasCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Ainda não há avaliações

- December 2005Documento7 páginasDecember 2005Judicial Watch, Inc.Ainda não há avaliações

- 13-1150 Responsive Records 2 - RedactedDocumento29 páginas13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Ainda não há avaliações

- July 2006Documento24 páginasJuly 2006Judicial Watch, Inc.Ainda não há avaliações

- LAUSD Semillas AckDocumento1 páginaLAUSD Semillas AckJudicial Watch, Inc.Ainda não há avaliações

- Atlanta IntraregionalDocumento4 páginasAtlanta IntraregionalJudicial Watch, Inc.Ainda não há avaliações

- 13-1150 Response Re Judicial WatchDocumento1 página13-1150 Response Re Judicial WatchJudicial Watch, Inc.Ainda não há avaliações

- December 2005 Bulletin 2Documento14 páginasDecember 2005 Bulletin 2Judicial Watch, Inc.Ainda não há avaliações

- STAMPED ComplaintDocumento4 páginasSTAMPED ComplaintJudicial Watch, Inc.Ainda não há avaliações

- Ga CH26Documento55 páginasGa CH26Radleigh MercadejasAinda não há avaliações

- Legal Forum: Legally SpeakingDocumento4 páginasLegal Forum: Legally SpeakingA_bognerAinda não há avaliações

- Credit Risk Grading Manual: NOVEMBER, 2005Documento45 páginasCredit Risk Grading Manual: NOVEMBER, 2005linconAinda não há avaliações

- Federal BankDocumento7 páginasFederal BankDakshita AgrawalAinda não há avaliações

- UBS Wealth Insights 2013 E2B Booklet FinalDocumento21 páginasUBS Wealth Insights 2013 E2B Booklet FinalGuozheng ChinAinda não há avaliações

- Impact of Covid 19 On Digital Transaction in IndiaDocumento55 páginasImpact of Covid 19 On Digital Transaction in IndiapiyushAinda não há avaliações

- Ats Final 394-8Documento5 páginasAts Final 394-8Girish SharmaAinda não há avaliações

- Credit Management Procedures of Mercantile Bank Limited (A Study at Gareeb-e-Newaz Branch)Documento62 páginasCredit Management Procedures of Mercantile Bank Limited (A Study at Gareeb-e-Newaz Branch)Rayan Bin RifatAinda não há avaliações

- Equitable PCI Bank V Ong - Del RosarioDocumento1 páginaEquitable PCI Bank V Ong - Del RosarioEdz Votefornoymar Del RosarioAinda não há avaliações

- "Cardless Atm Using Biometric": Bachelor of Engineering IN Electronics and TelecommunicationDocumento24 páginas"Cardless Atm Using Biometric": Bachelor of Engineering IN Electronics and TelecommunicationKaustubh DeshpandeAinda não há avaliações

- Special SPADocumento37 páginasSpecial SPAjosefAinda não há avaliações

- Adeyemi Adeola CV1 - 1620243247000Documento2 páginasAdeyemi Adeola CV1 - 1620243247000abrahamdavidchukwuma1Ainda não há avaliações

- Classification of Accounts and Accounting ProcessDocumento5 páginasClassification of Accounts and Accounting ProcessBoobalan RAinda não há avaliações

- A Thesis On Correlation Between Customer Services and Its Satisfaction Level in HDFC BankDocumento52 páginasA Thesis On Correlation Between Customer Services and Its Satisfaction Level in HDFC Bankbittu jain100% (1)

- Negotiable Instruments Act NotesDocumento14 páginasNegotiable Instruments Act Notesshashank guptaAinda não há avaliações

- Securities Lending Best Practices Mutual Funds 2012Documento20 páginasSecurities Lending Best Practices Mutual Funds 2012swinki3Ainda não há avaliações

- LenderDocumento6 páginasLenderANSARI MOHD MOKARRAM ZAINUL ABD-CSE SORTAinda não há avaliações

- Regulatory Framework For Foreign Investments in India Part I An OverviewDocumento4 páginasRegulatory Framework For Foreign Investments in India Part I An OverviewRaviAinda não há avaliações

- CURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Documento7 páginasCURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Jack RyanAinda não há avaliações

- Cash BookDocumento26 páginasCash Booksagiinfo1100% (1)

- Sample - Gap Analysis IndonesiaDocumento101 páginasSample - Gap Analysis IndonesiapalmkodokAinda não há avaliações

- Deed of PartnershipDocumento8 páginasDeed of PartnershipysnetservicesAinda não há avaliações

- Rahmat Ullah Rahmat Ullah: Siddique Abad Colony Near Railway Station D G KHAN. Abad Colony Near Railway Station D G KHANDocumento4 páginasRahmat Ullah Rahmat Ullah: Siddique Abad Colony Near Railway Station D G KHAN. Abad Colony Near Railway Station D G KHANTALHA KHANAinda não há avaliações

- Activity Based Consent FaqsDocumento1 páginaActivity Based Consent FaqsSai GollaAinda não há avaliações

- Methods of PaymentDocumento5 páginasMethods of PaymentJoeina MathewAinda não há avaliações

- Partner of Our N.C.V.T / Approved Co Partner of Our N.C.V.T / M.HRD Approved Courses M.HRDDocumento6 páginasPartner of Our N.C.V.T / Approved Co Partner of Our N.C.V.T / M.HRD Approved Courses M.HRDQhsef Karmaveer Jyoteendra VaishnavAinda não há avaliações

- MSBsDocumento435 páginasMSBsSophieAinda não há avaliações