Escolar Documentos

Profissional Documentos

Cultura Documentos

Ronald E Longstaff Financial Disclosure Report For 2010

Enviado por

Judicial Watch, Inc.Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ronald E Longstaff Financial Disclosure Report For 2010

Enviado por

Judicial Watch, Inc.Direitos autorais:

Formatos disponíveis

AO!

O ;

i/2oii

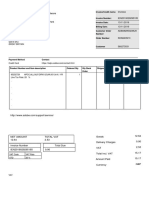

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization Southern/Iowa

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Gove?nment Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) Longstaff, P, onald E.

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 5/4/201 I

6. Reporting Period 01/01/2010 to 12/31/2010

Article III (Senior)

5b. [] Amended Report

7. Chambers or Office Address 123 E. Walnut St.; Suite 115 Des Moines IA 50309

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. <Rc, oor~ing

~]

individual only; seepp. 9-13 of:llng instructions.)

NONE (No reportable positions.) POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. mcportlng inaivlauat only; scc pp. 14-16 of filing instructions.)

~] NONE (No reportable agreements.)

DATE

PARTIES AND TERMS

Lon staff, Ronald E.

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting Longstaff, Ronald E.

Date of Report 5/4/2011

III. NON-INVESTMENT INCOME. (Reporting individual andspouse; seepp. 17-24 of filing instructions.)

A. Filers Non-Investment Income

~] NONE (No reportable non-investment income.)

DATE

SOURCE AND TYPE

INCOME (yours, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE

!. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS --transportation, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing inst~uctions.)

NONE (No reportable reimbursements.)

SOURCE

1. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting Longstaff, Ronald E.

Date of Report 5/4/2011

V. GIFTS. anetudes those to spouse und dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. ane~,des those ols, ouse and dependent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting Longstaff, Ronald E.

Date of Report 5/4/2011

VII. INVESTMENTS and TRU STS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE(No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (I) Amount Code 1 (A-H) (2) Type (e.g., div., rent. or int.) C. Gross value at end of reporting period (1) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) (1) Type (e.g., buy, sell, redemption) D. Transactions during reporting period (2) Date mm/dd/yy (3) (4) Value Gain Code 2 Code 1 (J-P) (A-H) (5) Identity of buyer/seller (if private transaction)

Franklin US Govt[] Securities - Class I

2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13.

14.

C C

Dividend Dividend

L L

Nuveen Tax Free Reserves[]

15.

16.

17.

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns CI and D3) 3. Value Mcthod Codes (Scc Column C2)

A =$ 1,000 or less F =$ 50,001 - $ 100,000 J =$15,000 or less N =$250,001 - $500,000 P3 =$25,000,001 o $50,000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Othcr

C =$2,501 - $5,000 H 1 =$ 1,000,001 - $ 5,000,000 L =$50,001 - $100.000 PI =$1,000,001 - $5,000,000 P4 -More than $50,000,000 S =Assessment W =Estimated

D =$5.001- $15,000 H2 =More~an $5,000,000 M=$100,001- $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting Longstaff, Ronald E.

Date of Report 5/4/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndlcate part of report.)

FINANCIAL DISCLOSURE REPORT Page 6 of 6

Name of Person Reporting Longstaff, Ronald E.

Date of Report 5/4/201 I

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Ronald

E. Longstaff

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Você também pode gostar

- Lacey A Collier Financial Disclosure Report For 2010Documento6 páginasLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Philip M Pro Financial Disclosure Report For 2010Documento6 páginasPhilip M Pro Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Malcom J Howard Financial Disclosure Report For 2010Documento6 páginasMalcom J Howard Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Sam A Lindsay Financial Disclosure Report For 2010Documento6 páginasSam A Lindsay Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Lee R West Financial Disclosure Report For 2010Documento6 páginasLee R West Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Robert C Broomfield Financial Disclosure Report For 2010Documento6 páginasRobert C Broomfield Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Scott O Wright Financial Disclosure Report For 2010Documento6 páginasScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Edward Leavy Financial Disclosure Report For 2010Documento6 páginasEdward Leavy Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Eric F Melgren Financial Disclosure Report For 2010Documento6 páginasEric F Melgren Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Damon J Keith Financial Disclosure Report For 2010Documento6 páginasDamon J Keith Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Leonard D Wexler Financial Disclosure Report For 2010Documento6 páginasLeonard D Wexler Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Carol E Jackson Financial Disclosure Report For 2010Documento6 páginasCarol E Jackson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- William B Enright Financial Disclosure Report For 2010Documento6 páginasWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Kenneth A Marra Financial Disclosure Report For 2010Documento6 páginasKenneth A Marra Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Raymond J Dearie Financial Disclosure Report For 2010Documento7 páginasRaymond J Dearie Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Delwen L Jensen Financial Disclosure Report For 2010Documento6 páginasDelwen L Jensen Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Terry J Hatter JR Financial Disclosure Report For 2010Documento6 páginasTerry J Hatter JR Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Michael A Chagares Financial Disclosure Report For 2010Documento6 páginasMichael A Chagares Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Robert C Jones Financial Disclosure Report For 2010Documento6 páginasRobert C Jones Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Charles N Clevert Financial Disclosure Report For 2010Documento6 páginasCharles N Clevert Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Vanessa D Gilmore Financial Disclosure Report For 2010Documento6 páginasVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Royce C Lamberth Financial Disclosure Report For 2010Documento6 páginasRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Carolyn R Dimmick Financial Disclosure Report For 2010Documento6 páginasCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Donald W Molloy Financial Disclosure Report For 2010Documento6 páginasDonald W Molloy Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Stanley T Anderson Financial Disclosure Report For 2010Documento6 páginasStanley T Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Brian S Miller Financial Disclosure Report For 2010Documento6 páginasBrian S Miller Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Richard L Nygaard Financial Disclosure Report For 2010Documento7 páginasRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Glen H Davidson Financial Disclosure Report For 2010Documento6 páginasGlen H Davidson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Henry F Floyd Financial Disclosure Report For 2010Documento6 páginasHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- JR Louis Guirola Financial Disclosure Report For 2010Documento6 páginasJR Louis Guirola Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Ralph R Beistline Financial Disclosure Report For 2010Documento6 páginasRalph R Beistline Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- John F Keenan Financial Disclosure Report For 2010Documento6 páginasJohn F Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Rosemary S Pooler Financial Disclosure Report For 2010Documento7 páginasRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Donetta W Ambrose Financial Disclosure Report For 2010Documento7 páginasDonetta W Ambrose Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Garland E Burrell JR Financial Disclosure Report For 2010Documento6 páginasGarland E Burrell JR Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Gregory M Sleet Financial Disclosure Report For 2010Documento6 páginasGregory M Sleet Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- William C Lee Financial Disclosure Report For 2010Documento6 páginasWilliam C Lee Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Michael R Murphy Financial Disclosure Report For 2010Documento6 páginasMichael R Murphy Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Roberto A Lange Financial Disclosure Report For Lange, Roberto ADocumento7 páginasRoberto A Lange Financial Disclosure Report For Lange, Roberto AJudicial Watch, Inc.Ainda não há avaliações

- Alan D Lourie Financial Disclosure Report For 2010Documento7 páginasAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Robert R Crane Financial Disclosure Report For 2010Documento12 páginasRobert R Crane Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Marcia S Krieger Financial Disclosure Report For 2010Documento14 páginasMarcia S Krieger Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- James R Hall Financial Disclosure Report For 2010Documento6 páginasJames R Hall Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Janis L Sammartino Financial Disclosure Report For Sammartino, Janis LDocumento6 páginasJanis L Sammartino Financial Disclosure Report For Sammartino, Janis LJudicial Watch, Inc.Ainda não há avaliações

- James L Edmondson Financial Disclosure Report For 2010Documento6 páginasJames L Edmondson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Samuel Conti Financial Disclosure Report For 2010Documento7 páginasSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Rebecca F Doherty Financial Disclosure Report For 2010Documento7 páginasRebecca F Doherty Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Roslynn R Mauskopf Financial Disclosure Report For 2010Documento6 páginasRoslynn R Mauskopf Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Christopher F Droney Financial Disclosure Report For 2010Documento6 páginasChristopher F Droney Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Joel Pisano Financial Disclosure Report For 2010Documento6 páginasJoel Pisano Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Jerome A Holmes Financial Disclosure Report For 2010Documento6 páginasJerome A Holmes Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- David R Proctor Financial Disclosure Report For 2010Documento6 páginasDavid R Proctor Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Roger L Hunt Financial Disclosure Report For 2010Documento6 páginasRoger L Hunt Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Alicemarie Stotler Financial Disclosure Report For 2010Documento6 páginasAlicemarie Stotler Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Garland E Burrell JR Financial Disclosure Report For 2009Documento6 páginasGarland E Burrell JR Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Maurice M Paul Financial Disclosure Report For 2010Documento22 páginasMaurice M Paul Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- William C Canby JR Financial Disclosure Report For 2010Documento6 páginasWilliam C Canby JR Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Mary A McLaughlin Financial Disclosure Report For 2010Documento12 páginasMary A McLaughlin Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Jeffrey S Sutton Financial Disclosure Report For 2010Documento8 páginasJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Attorney Drafted Immigration Petitions O-1 Visa: For the Person with Extraordinary Ability or AchievementNo EverandAttorney Drafted Immigration Petitions O-1 Visa: For the Person with Extraordinary Ability or AchievementAinda não há avaliações

- 2161 DocsDocumento133 páginas2161 DocsJudicial Watch, Inc.83% (12)

- CC 081213 Dept 14 Lapp LDocumento38 páginasCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Ainda não há avaliações

- 1488 09032013Documento262 páginas1488 09032013Judicial Watch, Inc.100% (1)

- Stamped ComplaintDocumento4 páginasStamped ComplaintJudicial Watch, Inc.Ainda não há avaliações

- 11 1271 1451347Documento29 páginas11 1271 1451347david_stephens_29Ainda não há avaliações

- State Dept 13-951Documento4 páginasState Dept 13-951Judicial Watch, Inc.Ainda não há avaliações

- 1878 001Documento17 páginas1878 001Judicial Watch, Inc.100% (5)

- SouthCom Water Safety ProductionDocumento30 páginasSouthCom Water Safety ProductionJudicial Watch, Inc.Ainda não há avaliações

- CVR LTR SouthCom Water Safety ProductionDocumento2 páginasCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Ainda não há avaliações

- Stamped Complaint 2Documento5 páginasStamped Complaint 2Judicial Watch, Inc.Ainda não há avaliações

- Gitmo Freezer Inspection ReportsDocumento4 páginasGitmo Freezer Inspection ReportsJudicial Watch, Inc.Ainda não há avaliações

- Gitmo Freezer Inspection ReportsDocumento4 páginasGitmo Freezer Inspection ReportsJudicial Watch, Inc.Ainda não há avaliações

- September 2004Documento24 páginasSeptember 2004Judicial Watch, Inc.Ainda não há avaliações

- LAUSD Semillas AckDocumento1 páginaLAUSD Semillas AckJudicial Watch, Inc.Ainda não há avaliações

- Cover Letter To Requester Re Response Documents130715 - 305994Documento2 páginasCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Ainda não há avaliações

- JTF GTMO Water Safety App W ExhDocumento13 páginasJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Ainda não há avaliações

- July 2007 BulletinDocumento23 páginasJuly 2007 BulletinJudicial Watch, Inc.Ainda não há avaliações

- Model UNDocumento2 páginasModel UNJudicial Watch, Inc.Ainda não há avaliações

- December 2005Documento7 páginasDecember 2005Judicial Watch, Inc.Ainda não há avaliações

- June 2004Documento17 páginasJune 2004Judicial Watch, Inc.Ainda não há avaliações

- 13-1150 Responsive Records 2 - RedactedDocumento29 páginas13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Ainda não há avaliações

- July 2006Documento24 páginasJuly 2006Judicial Watch, Inc.Ainda não há avaliações

- December 2005 Bulletin 2Documento14 páginasDecember 2005 Bulletin 2Judicial Watch, Inc.Ainda não há avaliações

- Atlanta IntraregionalDocumento4 páginasAtlanta IntraregionalJudicial Watch, Inc.Ainda não há avaliações

- 13-1150 Response Re Judicial WatchDocumento1 página13-1150 Response Re Judicial WatchJudicial Watch, Inc.Ainda não há avaliações

- STAMPED ComplaintDocumento4 páginasSTAMPED ComplaintJudicial Watch, Inc.Ainda não há avaliações

- Education As An Agent of ChangeDocumento6 páginasEducation As An Agent of ChangeHammad Nisar100% (1)

- Tax Invoice UP1222304 AA46663Documento1 páginaTax Invoice UP1222304 AA46663Siddhartha SrivastavaAinda não há avaliações

- Hogan'S Heroes March: Arranged by JOHNNIE VINSONDocumento11 páginasHogan'S Heroes March: Arranged by JOHNNIE VINSONRuby Waltz100% (1)

- First Year Phyiscs Ipe Imp Q.bank 2020-2021 - (Hyderad Centres)Documento26 páginasFirst Year Phyiscs Ipe Imp Q.bank 2020-2021 - (Hyderad Centres)Varun Sai SundalamAinda não há avaliações

- (ORDER LIST: 592 U.S.) Monday, February 22, 2021Documento39 páginas(ORDER LIST: 592 U.S.) Monday, February 22, 2021RHTAinda não há avaliações

- Fares Alhammadi 10BB Death Penatly Argumentative EssayDocumento7 páginasFares Alhammadi 10BB Death Penatly Argumentative EssayFares AlhammadiAinda não há avaliações

- California Code of Civil Procedure Section 170.4 Striking 170.3Documento1 páginaCalifornia Code of Civil Procedure Section 170.4 Striking 170.3JudgebustersAinda não há avaliações

- Flash Cards & Quiz: Berry Creative © 2019 - Primary PossibilitiesDocumento26 páginasFlash Cards & Quiz: Berry Creative © 2019 - Primary PossibilitiesDian CiptaningrumAinda não há avaliações

- Pre Counseling Notice Jexpo Voclet17Documento2 páginasPre Counseling Notice Jexpo Voclet17Shilak BhaumikAinda não há avaliações

- Public Prosecutor: Section 24 Provides As UnderDocumento12 páginasPublic Prosecutor: Section 24 Provides As UnderAkasa SethAinda não há avaliações

- Final Managerial AccountingDocumento8 páginasFinal Managerial Accountingdangthaibinh0312Ainda não há avaliações

- Report On Employee Communications and ConsultationDocumento29 páginasReport On Employee Communications and Consultationakawasaki20Ainda não há avaliações

- 4.31 T.Y.B.Com BM-IV PDFDocumento7 páginas4.31 T.Y.B.Com BM-IV PDFBhagyalaxmi Raviraj naiduAinda não há avaliações

- PreviewDocumento9 páginasPreviewVignesh LAinda não há avaliações

- Marijuana Prohibition FactsDocumento5 páginasMarijuana Prohibition FactsMPPAinda não há avaliações

- Guide To Confession: The Catholic Diocese of PeoriaDocumento2 páginasGuide To Confession: The Catholic Diocese of PeoriaJOSE ANTONYAinda não há avaliações

- Harvey Vs Defensor Santiago DigestDocumento5 páginasHarvey Vs Defensor Santiago DigestLeo Cag0% (1)

- Cruise Control System CcsDocumento2 páginasCruise Control System CcsciroAinda não há avaliações

- 1 Fundamental Concepts of Fluid Mechanics For Mine VentilationDocumento29 páginas1 Fundamental Concepts of Fluid Mechanics For Mine VentilationRiswan RiswanAinda não há avaliações

- 01 Stronghold Insurance v. CADocumento2 páginas01 Stronghold Insurance v. CANat DuganAinda não há avaliações

- Invoice: VAT No: IE6364992HDocumento2 páginasInvoice: VAT No: IE6364992HRajAinda não há avaliações

- Isa 620Documento15 páginasIsa 620baabasaamAinda não há avaliações

- Payroll Procedures: For Work Within 8 HoursDocumento2 páginasPayroll Procedures: For Work Within 8 HoursMeghan Kaye LiwenAinda não há avaliações

- Pressure Vessel CertificationDocumento3 páginasPressure Vessel CertificationYetkin ErdoğanAinda não há avaliações

- 11 PDF Original PDFDocumento5 páginas11 PDF Original PDFMEKTILIA MAPUNDAAinda não há avaliações

- Configure Quota Arrangement in SAP MM - SCNDocumento9 páginasConfigure Quota Arrangement in SAP MM - SCNArchana Ashok100% (1)

- Tumang V LaguioDocumento2 páginasTumang V LaguioKarez MartinAinda não há avaliações

- Bullet Proof G WashingtonDocumento5 páginasBullet Proof G Washingtonapi-239094488Ainda não há avaliações

- In Modern BondageDocumento221 páginasIn Modern BondageetishomeAinda não há avaliações