Escolar Documentos

Profissional Documentos

Cultura Documentos

George M Marovich Financial Disclosure Report For 2009

Enviado por

Judicial Watch, Inc.Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

George M Marovich Financial Disclosure Report For 2009

Enviado por

Judicial Watch, Inc.Direitos autorais:

Formatos disponíveis

ao~o

, Rev. I/2010

[

[

FINANCIAL DISCLOSURE REPORT

FOR CALENDAR YEAR 2009

2. Court or Organization N.D. of Illinois 5a. Report Type (check appropriate type) [] Nomination, Date

Report Required by the Ethics

in GovetT~ment Act of 1978

:5 u.s.c, app. ff IO1-111)

! 3. Date of Report 03/26/2010 6. Reporting Period 01/01/2009

I. Person Reporting (last name, first, middle initial) Marovich, George M. 4. Title (Article l]] judges indicate active or sertior status; magistrate judges indicate full- or patt-t~.me)

,~,~ticl~ IH Judge (Senio0

7. Chambers or Office Address 219 S. Dearborn Street; #1900 Chicago, |L 60604

[] ~,~a~

[] ~ua~

[] ~ioa~

to

12/31/2009

5b. [~] Amended Report 8. On the basis of the information contained in this Report and any modifications pertaining theretu, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer I)ate

13/IPOR TANT NO TES: The instructions accompanying this form must be followed Complete all parts, checking the NONE box for each part where you have no reportable btformatlon. Sign on lastpage.

I. POSITIONS. (Reporting individual only; seepp. 9-13 off!ling instructions.)

~ NONE (No reportable positions.)

POSITION

1.

NAMF~ OF ORGANIZATION/ENTITY

2.

"~;

~ ~~

II. AG REEMENTS. mw,,ra,g ~,ai~ia,,~; o~ly; ~,,, pp. ~4-~6 ,,/~t;,g

NONE (No reportable agreements.)

DATE_

1.

pARTIES AND TERMS

Marovich, George M.

FINANCIAL DISCLOSURE REPORT Page 2 of 6

N~m~ ot e~rson Repo.i~

Maro~ch, George M.

]

]

~e of R~po~

03/26/2010

III. NON-IN~STMENT INCOME. (Reporting i~ividual anaspot,~e; ~eepp. 17-24 of filing ins~uctie~O

A. Filers Non-Investment Income ~ NO~E (No reportable non-investment income.) DATE 1. 2. 3. 4. SOURCE A~ TYyE Stale of Illinois--Judicial Pension INC~E (yours, not s~uses) $51,968.40

B. Spouses Non-lnvestment Income - 1/you were married during any porfion of the reporfing year, complete this sectiom

(Dollar amount n~ requiredexcept for honoraria.)

[~

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

1. 2. 3. 4.

IV.

(includes those 1o spouse and dependent children; ~ee pp, 25-27 offiling instructions.)

NONE (No reportable reimbursements.) SOIYRCE 1. 2. 3. 4. 5. DATES LOCATION pURPOSE ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT

N .....f P .... Reporting

Page 3 of 6

Maro~Sch, George M.

03/26/2010 Date of Repor!

V. GIFTS. a~t,,d,~ ,hose to sp ...... d dependent children; see pp. 28-31 of fiting instructions.)

NONE (No reportable gifts.) .~URCE

I. 2. 3. 4.

DESCRIPTION

V__~LUE

5.

VI. LIA33ILITIES. anc~ud,~- ~o~, o;,po~ o,d d,p~,d,,t o~Ud~,,; ~**Pl. 32-~3 offiling instructions.)

NONE (No reportable liobilities.) CREDITOR

1. 2. 3. 4. 5.

DFSCRIPTION

VALUE, CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 6

r~n=, of Person Report|ng Marovich, George M.

Date afRepor~ 03/26/2010

VII. INVESTMENTS an d TRUSTS - income, value, transactions (Includes those of spo ..... d dependent chitdrem, seepp. 34-60 of filing instruction~)

NONE ~o reportable income, assets, or transactions.)

A. Description of Assets (including txust assets) B. Income during repor~ng period C. Gross value at end of reporting period D. Transactions during reporting period

Date exempt from prior disclosure I t.uuc x ] div.,renl, (A-l-i) or int.) j C Interest Code2 (.l-P) Me~od I [ Code 3 ! (Q-W) buy, sell, redemption) [~ _ " ~ .....

ICode 2

Value

Gain Code !

i(J-P)i (A-H) { [

Identity of buyer/seller (if private transaction)

1. 2. 3.

AIG--Annuity

N I

T T T

Great Lakes Bank: Savings, checking and money market 1NG-vafiable armuity

Interest None

M O

4. 5.

MB Finandal Bank--IRA LaSalle Street Securities

[" A

Distribution Interest

K N

T T

i0,

12. 13.

17.

I. Income Gai~ Codes: [See Colurrms B t and D4) 2. Value Code (See Coluams CI and D3) 3. Value Mell~od Co~s ISee Celuma~ C2)

A =$1,000 or le~ F =$50,001 - $1()0,000 J =$15,000 or leas N =$250,001 - $500,000 P3 =$25,000,001 - $50,000,000 Q =Appraisal U =Book Value

B -$1,001 - $2,500 G =$I00,001 - $ t,000,000 K =$15,001. $50,tKI0 O =$500,001 - $1,000,090 R -M~osl (Real ~slate O~Iy) V =Other

C =$2,50 i - $5.000 HI =$1,000,00! - $5,000,000 L =$50,001 - $ ! 00,000 PI P4 ~More than $50,0~0,000 S =Assessmem W =F~timated

D =$5,001 - $15,000 H2 =More t~m $5,000,000 M =-$100,001 . $250,000

g =$15,001 -$50,000

T =U.ash Mzxket

FINANCIAL DISCLOS URE REPORT Page 5 of 6

N.~e o~Per,on ~epo~g ~,o~kh, George M.

03126/2010

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

VII. The IRA account is a cash-equlvalent fund. No stocks, bonds or mutual ftmds are involved. VII. Line 5: "II~e LaSalte Street Securities consists entirely of bank certificates of deposit.

FINANCIALDISCLOSURE REPORT

Page 6 of 6

IX. CERTIFICATION.

Name of Person Reporting

Dal~e of Report

[ Marovlch, ~eorge M.

o3/26/2OlO

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true~ and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside emplo)maent and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

NOTE: AN~ INDIVIDUAL WHO KNOWINGLY AND AND CRIMENAL SANCTIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Mai! signed original and 3 additional copies to: Committee on Financial Disclosure A&zainistrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Você também pode gostar

- Thomas N ONeill JR Financial Disclosure Report For 2009Documento6 páginasThomas N ONeill JR Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Donald E OBrien Financial Disclosure Report For 2009Documento6 páginasDonald E OBrien Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- JR Louis Guirola Financial Disclosure Report For 2010Documento6 páginasJR Louis Guirola Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Lee R West Financial Disclosure Report For 2010Documento6 páginasLee R West Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Henry F Floyd Financial Disclosure Report For 2009Documento6 páginasHenry F Floyd Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Frederick J Kapala Financial Disclosure Report For 2010Documento7 páginasFrederick J Kapala Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Garland E Burrell JR Financial Disclosure Report For 2009Documento6 páginasGarland E Burrell JR Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Laura T Swain Financial Disclosure Report For 2009Documento7 páginasLaura T Swain Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Roger L Hunt Financial Disclosure Report For 2010Documento6 páginasRoger L Hunt Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- James L Edmondson Financial Disclosure Report For 2010Documento6 páginasJames L Edmondson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Lawrence E Kahn Financial Disclosure Report For 2009Documento6 páginasLawrence E Kahn Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Richard A Schell Financial Disclosure Report For 2009Documento6 páginasRichard A Schell Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Grant M Snow Financial Disclosure Report For 2009Documento6 páginasGrant M Snow Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- John F Keenan Financial Disclosure Report For 2010Documento6 páginasJohn F Keenan Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Clark Waddoups Financial Disclosure Report For 2010Documento13 páginasClark Waddoups Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Malcom J Howard Financial Disclosure Report For 2010Documento6 páginasMalcom J Howard Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Alicemarie Stotler Financial Disclosure Report For 2010Documento6 páginasAlicemarie Stotler Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Lacey A Collier Financial Disclosure Report For 2010Documento6 páginasLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Sam A Lindsay Financial Disclosure Report For 2010Documento6 páginasSam A Lindsay Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Donald W Molloy Financial Disclosure Report For 2010Documento6 páginasDonald W Molloy Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Robert C Broomfield Financial Disclosure Report For 2009Documento6 páginasRobert C Broomfield Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Dennis M Cavanaugh Financial Disclosure Report For 2010Documento6 páginasDennis M Cavanaugh Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Elaine E Bucklo Financial Disclosure Report For 2010Documento6 páginasElaine E Bucklo Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Stanley T Anderson Financial Disclosure Report For 2010Documento6 páginasStanley T Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Scott O Wright Financial Disclosure Report For 2010Documento6 páginasScott O Wright Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Blanche M Manning Financial Disclosure Report For 2009Documento6 páginasBlanche M Manning Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Carol E Jackson Financial Disclosure Report For 2010Documento6 páginasCarol E Jackson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Ricardo M Urbina Financial Disclosure Report For 2010Documento6 páginasRicardo M Urbina Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- James L Ryan Financial Disclosure Report For 2009Documento6 páginasJames L Ryan Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Kenneth M Karas Financial Disclosure Report For 2010Documento7 páginasKenneth M Karas Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Patricia A Seitz Financial Disclosure Report For 2010Documento7 páginasPatricia A Seitz Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Robert C Jones Financial Disclosure Report For 2010Documento6 páginasRobert C Jones Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Carolyn R Dimmick Financial Disclosure Report For 2010Documento6 páginasCarolyn R Dimmick Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- James Robertson Financial Disclosure Report For 2010Documento7 páginasJames Robertson Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- William C Lee Financial Disclosure Report For 2010Documento6 páginasWilliam C Lee Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Donetta W Ambrose Financial Disclosure Report For 2010Documento7 páginasDonetta W Ambrose Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Leonard I Garth Financial Disclosure Report For 2009Documento8 páginasLeonard I Garth Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Richard G Kopf Financial Disclosure Report For 2009Documento6 páginasRichard G Kopf Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Gregory M Sleet Financial Disclosure Report For 2010Documento6 páginasGregory M Sleet Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Jeffrey S Sutton Financial Disclosure Report For 2010Documento8 páginasJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Clark Waddoups Financial Disclosure Report For 2009Documento6 páginasClark Waddoups Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Delwen L Jensen Financial Disclosure Report For 2010Documento6 páginasDelwen L Jensen Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Dean Whipple Financial Disclosure Report For 2009Documento7 páginasDean Whipple Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- James T Trimble Financial Disclosure Report For 2010Documento12 páginasJames T Trimble Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Eugene E Siler Financial Disclosure Report For 2010Documento7 páginasEugene E Siler Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Richard A Jones Financial Disclosure Report For 2010Documento7 páginasRichard A Jones Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Virginia M Kendall Financial Disclosure Report For 2010Documento6 páginasVirginia M Kendall Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Rosemary S Pooler Financial Disclosure Report For 2010Documento7 páginasRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Robert J Timlin Financial Disclosure Report For 2009Documento6 páginasRobert J Timlin Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- William P Johnson Financial Disclosure Report For 2009Documento8 páginasWilliam P Johnson Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Robert E Jones Financial Disclosure Report For 2009Documento7 páginasRobert E Jones Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Michael A Telesca Financial Disclosure Report For 2009Documento6 páginasMichael A Telesca Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- William C OKelley Financial Disclosure Report For 2010Documento14 páginasWilliam C OKelley Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Ronald E Longstaff Financial Disclosure Report For 2010Documento6 páginasRonald E Longstaff Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Martin K Reidinger Financial Disclosure Report For 2009Documento8 páginasMartin K Reidinger Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Royce C Lamberth Financial Disclosure Report For 2010Documento6 páginasRoyce C Lamberth Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Christopher F Droney Financial Disclosure Report For 2010Documento6 páginasChristopher F Droney Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Terry J Hatter JR Financial Disclosure Report For 2010Documento6 páginasTerry J Hatter JR Financial Disclosure Report For 2010Judicial Watch, Inc.Ainda não há avaliações

- Stephan P Mickle Financial Disclosure Report For 2009Documento7 páginasStephan P Mickle Financial Disclosure Report For 2009Judicial Watch, Inc.Ainda não há avaliações

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerAinda não há avaliações

- 1488 09032013Documento262 páginas1488 09032013Judicial Watch, Inc.100% (1)

- State Dept 13-951Documento4 páginasState Dept 13-951Judicial Watch, Inc.Ainda não há avaliações

- CC 081213 Dept 14 Lapp LDocumento38 páginasCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Ainda não há avaliações

- 11 1271 1451347Documento29 páginas11 1271 1451347david_stephens_29Ainda não há avaliações

- 2161 DocsDocumento133 páginas2161 DocsJudicial Watch, Inc.83% (12)

- Gitmo Freezer Inspection ReportsDocumento4 páginasGitmo Freezer Inspection ReportsJudicial Watch, Inc.Ainda não há avaliações

- Stamped Complaint 2Documento5 páginasStamped Complaint 2Judicial Watch, Inc.Ainda não há avaliações

- 1878 001Documento17 páginas1878 001Judicial Watch, Inc.100% (5)

- Stamped ComplaintDocumento4 páginasStamped ComplaintJudicial Watch, Inc.Ainda não há avaliações

- Gitmo Freezer Inspection ReportsDocumento4 páginasGitmo Freezer Inspection ReportsJudicial Watch, Inc.Ainda não há avaliações

- June 2004Documento17 páginasJune 2004Judicial Watch, Inc.Ainda não há avaliações

- December 2005Documento7 páginasDecember 2005Judicial Watch, Inc.Ainda não há avaliações

- CVR LTR SouthCom Water Safety ProductionDocumento2 páginasCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Ainda não há avaliações

- SouthCom Water Safety ProductionDocumento30 páginasSouthCom Water Safety ProductionJudicial Watch, Inc.Ainda não há avaliações

- July 2007 BulletinDocumento23 páginasJuly 2007 BulletinJudicial Watch, Inc.Ainda não há avaliações

- Cover Letter To Requester Re Response Documents130715 - 305994Documento2 páginasCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Ainda não há avaliações

- JTF GTMO Water Safety App W ExhDocumento13 páginasJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Ainda não há avaliações

- Model UNDocumento2 páginasModel UNJudicial Watch, Inc.Ainda não há avaliações

- 13-1150 Responsive Records 2 - RedactedDocumento29 páginas13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.Ainda não há avaliações

- LAUSD Semillas AckDocumento1 páginaLAUSD Semillas AckJudicial Watch, Inc.Ainda não há avaliações

- July 2006Documento24 páginasJuly 2006Judicial Watch, Inc.Ainda não há avaliações

- September 2004Documento24 páginasSeptember 2004Judicial Watch, Inc.Ainda não há avaliações

- STAMPED ComplaintDocumento4 páginasSTAMPED ComplaintJudicial Watch, Inc.Ainda não há avaliações

- December 2005 Bulletin 2Documento14 páginasDecember 2005 Bulletin 2Judicial Watch, Inc.Ainda não há avaliações

- Atlanta IntraregionalDocumento4 páginasAtlanta IntraregionalJudicial Watch, Inc.Ainda não há avaliações

- 13-1150 Response Re Judicial WatchDocumento1 página13-1150 Response Re Judicial WatchJudicial Watch, Inc.Ainda não há avaliações

- Case Study On India Cements Limited & CSKDocumento24 páginasCase Study On India Cements Limited & CSKRahul SttudAinda não há avaliações

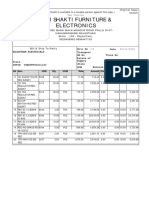

- Shri Shakti Furniture & Electronics: Credit OrginalDocumento1 páginaShri Shakti Furniture & Electronics: Credit OrginalRahul BansalAinda não há avaliações

- Discurs LeninDocumento2 páginasDiscurs LeninGeanina IchimAinda não há avaliações

- Effect of Nigerian Border ClosureDocumento5 páginasEffect of Nigerian Border Closuretundescribd1Ainda não há avaliações

- Master Plan BecDocumento54 páginasMaster Plan BecJelena Mitrovic SimicAinda não há avaliações

- Welcome To Indian Railway Passenger Reservation EnquiryDocumento2 páginasWelcome To Indian Railway Passenger Reservation EnquiryChhaviAinda não há avaliações

- Application Form For BusinessesDocumento1 páginaApplication Form For Businessesentabs20160% (1)

- Guide To Top 50 Consulting Firms (2006)Documento903 páginasGuide To Top 50 Consulting Firms (2006)Interrobang90Ainda não há avaliações

- Sole Proprietary: According To B.D. Wheeler, "The Sole Proprietorship Is That From of BusinessDocumento12 páginasSole Proprietary: According To B.D. Wheeler, "The Sole Proprietorship Is That From of Businessapi-19729505Ainda não há avaliações

- ROAD TO BASEL III - An International Banking Event - EgyptDocumento4 páginasROAD TO BASEL III - An International Banking Event - Egyptديفولوبرز للإستشارات والتدريبAinda não há avaliações

- SLA Lead Goal CalculatorDocumento20 páginasSLA Lead Goal CalculatorRejoy RadhakrishnanAinda não há avaliações

- AFLT-14 QAMT-14 Mock AMCATDocumento3 páginasAFLT-14 QAMT-14 Mock AMCATsrijani palAinda não há avaliações

- Murano Road WheelsDocumento111 páginasMurano Road WheelsalexAinda não há avaliações

- The Danish Asia Trade 1620 1807Documento26 páginasThe Danish Asia Trade 1620 1807zargis1Ainda não há avaliações

- On The Legacy of TATA in IndiaDocumento18 páginasOn The Legacy of TATA in IndiaanupojhaAinda não há avaliações

- DCPD Editorial Ebook Till Sep 29, 19Documento181 páginasDCPD Editorial Ebook Till Sep 29, 19segnumutraAinda não há avaliações

- Paper One Exam Practice Questions - Tragakes 1Documento12 páginasPaper One Exam Practice Questions - Tragakes 1api-260512563100% (1)

- Pakistan Next Generation Report Part 02Documento23 páginasPakistan Next Generation Report Part 02ZafarH100% (1)

- Samahan NG Manggagawa Sa Hanjin Shipyard V Hanjin Heavy IndustriesDocumento3 páginasSamahan NG Manggagawa Sa Hanjin Shipyard V Hanjin Heavy IndustriesTippy Dos SantosAinda não há avaliações

- BCPC Functionality - Dilg MC 2008-126Documento1 páginaBCPC Functionality - Dilg MC 2008-126Barangay Panoloon100% (1)

- Chapter 3Documento4 páginasChapter 3AkhmadajahahaAinda não há avaliações

- Project On VST TillersDocumento7 páginasProject On VST TillersrajeshthumsiAinda não há avaliações

- Keshonda SSWH7 Middle Ages WebquestDocumento2 páginasKeshonda SSWH7 Middle Ages WebquestKe'Shonda JacksonAinda não há avaliações

- Profit Sharing Standardized 401k Adoption AgreementDocumento2 páginasProfit Sharing Standardized 401k Adoption AgreementYiZhangAinda não há avaliações

- Establishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesDocumento7 páginasEstablishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesJean Placide BarekeAinda não há avaliações

- Multiplier-Accelerator IntroductionDocumento2 páginasMultiplier-Accelerator Introductiongnarayanswami82Ainda não há avaliações

- Kilo Meter Sheet - 01-02-23 TO 15-2-23Documento6 páginasKilo Meter Sheet - 01-02-23 TO 15-2-23Vijay chauhanAinda não há avaliações

- JBC Travel and ToursDocumento15 páginasJBC Travel and ToursArshier Ching0% (1)

- Notice: Applications, Hearings, Determinations, Etc.: Gas Transmission Northwest Corp.Documento2 páginasNotice: Applications, Hearings, Determinations, Etc.: Gas Transmission Northwest Corp.Justia.comAinda não há avaliações

- Agricultural Leasehold Agricultural Tenancy Definition and Nature of Agricultural TenancyDocumento17 páginasAgricultural Leasehold Agricultural Tenancy Definition and Nature of Agricultural TenancyCarla VirtucioAinda não há avaliações