Escolar Documentos

Profissional Documentos

Cultura Documentos

Sample Exam Question

Enviado por

Muhammad Yousaf AttaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sample Exam Question

Enviado por

Muhammad Yousaf AttaDireitos autorais:

Formatos disponíveis

ZCZC6103

QUESTION 1 (30 MARKS) Part A (12 marks) Assume Amir Affandi has just been promoted to product manager at Perodua Kancil. Although he is an accomplished sales representative and well versed in market research, his accounting background is limited to financial accounting. He commented that while financial accounting is no doubt useful to investors, he just doesnt see how accounting can help him to be a good product manager. Required: Explain some of the important differences between financial and management accounting and suggests some ways management accounting can helps Amir Affandi be a better product manager.

Part B (18 marks) Tahan Company specializes in manufacturing motorcycle helmets. Tahans monthly manufacturing cost and other expenses data are as follows: Maintenance cost on factory building Factory managers salary Advertising for helmets Sales commissions Depreciation on factory building Rent on factory equipment Insurance on factory building Raw materials (plastic, polystyrene, etc.) Utility costs for factory Supplies for general office Wages for assembly line workers Depreciation on office equipments Miscellaneous material (glue, thread, etc.) Finished good inventory Required: a. Compute each of the following cost i) Prime costs (i.e. direct material and direct labour) ii) Manufacturing overhead costs iii) Product costs iv) Period costs (15 marks) b. Which of the costs listed above is sunk costs, and explains why it is a sunk cost? (3 marks) RM 300 4,000 10,000 3,000 700 6,000 3,000 20,000 800 200 44,000 500 2,000 70,400

ZCZC6103

QUESTION 2 (20 MARKS) Lee & Ali Co. , a law firm, uses a job order costing to accumulate costs chargeable to each client and it organized into two departments (1) Research and Document Department and (2) Litigation Department. The firm uses predetermined overhead rates to charge the costs of these departments to its clients. At the beginning of the year, the firms management made the following estimates for the year: Department Research and Document 24,000 9,000 RM16,000 RM450,000 RM840,000 Litigation 18,000 RM5,000 RM900,000 RM360,000

Research hours Direct attorney hours Legal forms and supplies Direct attorney cost Departmental overhead cost

The predetermined overhead rate in the Research and Document Department is based on research hours, and the rate in the Litigation Department is based on direct attorney costs. The costs charged to each client are made up of three elements: legal forms and supplies used, direct attorney costs incurred and an applied amount of overhead from each department in which work is performed on the case. Case 418-3 was initiated on February 23 and completed May 16. During this period the following cost and time were recorded on the case: Department Research and Document 26 7 RM80 RM350 Litigation 114 RM40 RM5,700

Research hours Direct attorney hours Legal forms and supplies Direct attorney cost Required:

a. Why most companies prefer using predetermined overhead rate in their product costing? (4 marks) b. Determine the two departmental overhead rates. (4 marks) c. Determine the total costs charged to Case 418-3. (8 marks) d. Explain why Lee & Ali Co. uses different cost drivers rates in its job costing system. (4 marks)

ZCZC6103

QUESTION 3 (25 MARKS) Serenade Sound manufactures and sells compact discs. Price and costs data are as follows: Selling price per unit (package of four CDs) Variable cost per unit Direct material Direct labour Manufacturing overhead Selling expenses Total variable costs per unit Annual fixed costs Manufacturing overhead Selling and administrative Total fixed costs Forecasted annual sales volume (120,000 units) The company is subjected to 35% tax rate. Required: a. Determine Serenade Sounds break even point in unit and sales. (4 marks) b. How many units would Serenade Sound have to sell in order to earn a profit after taxes of RM169,000? (5 marks) c. Management estimates that direct labour costs will increase by 8 percent next year. How many units will the company have to sell next year to reach its break even point? (5 marks) d. If the companys direct labour costs do increase by 8 percent, how many units will have to be sold to earn the same profit after taxes of RM169,000? (5 marks) e. If the company want to main the same contribution margin ratio, what selling price per unit of product must it charge to cover the increased direct labour costs? (6 marks) RM25.00 RM10.50 5.00 3.00 1.30 RM19.80 RM192,000 276,000 RM468,000 RM3,000,000

QUESTION 5 (25 MARKS) Profits has been decreasing for several years at Peguh Airlines. In an effort to improve the companys performance, consideration is being given to dropping several flights that appear to be unprofitable including Flight 151. The current income statement for Flight 151, for one round trip is as follows:

3

ZCZC6103

Total revenue (175 seats x 40% occupancy x RM200 ticket price) Variable expenses (RM15 per person) Contribution margin Flight expenses: Salaries, flight crew Flight promotion Depreciation of aircraft Fuel of aircraft Liability insurance Salaries, flight assistants Baggage loading and flight preparation Overnight costs for flight crew and assistant at destination Total flight expenses Net operating incomes The following additional information is available for Flight 151:

RM14,000 1,050 RM12,950

1,800 750 1,550 5,800 4,200 1,500 1,700 300 RM17,600 (RM4,650)

Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete. One-third of the liability insurance is a special charge assessed against Flight 151 beause in the opinion of the insurance company, the destination of the flight is a high-risk area. The remaining two-thirds would be unaffected b a decision to drop Flight 151. The baggage loading and flight preparation expenses is an allocation of ground crews salaries and depreciation of ground equipment. Dropping Flight 151 would have no effect on the companys total baggage loading and flight preparation expenses. If Flight 151 is dropped, Peguh Airlines has no authorization at present to replace it with another flight. Aircraft depreciation is due entirely to obsolescence. Depreciation due to wear and tear is negligible. Dropping Flight 151 would not allow Peguh Airlines to reduce the number of aircraft in the fleet or the number of flight crew on its payroll.

Required a. Prepare an analysis showing what impact dropping Flight 151would have on the airlines profits. (20 marks) b. What other factors should be considered by management before making final decision on dropping or retaining a flight? (5 marks) Good Luck

Você também pode gostar

- Chapter 24-Money, The Price Level, and InflationDocumento33 páginasChapter 24-Money, The Price Level, and InflationBin WangAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- UNDP Covid-19 and Human Development 0Documento35 páginasUNDP Covid-19 and Human Development 0sofiabloemAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Student Placement Tracker Batch 2017 - 19Documento10 páginasStudent Placement Tracker Batch 2017 - 19nsrivastav1Ainda não há avaliações

- WP392 PDFDocumento41 páginasWP392 PDFnapierlogsAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- CM1 Flashcards Sample - Chapter 14Documento56 páginasCM1 Flashcards Sample - Chapter 14Bakari HamisiAinda não há avaliações

- Change Management Final VersionDocumento13 páginasChange Management Final VersionZheng LinAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- SupplyDocumento19 páginasSupplykimcy19Ainda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Intermediate Macro Mankiw Ch.7 12 Questions PDFDocumento143 páginasIntermediate Macro Mankiw Ch.7 12 Questions PDFYusuf ÇubukAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Example Application LetterDocumento12 páginasExample Application LetterDewa Atra100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Only Technical Analysis Book You Will Ever NeedDocumento143 páginasThe Only Technical Analysis Book You Will Ever Needasadmurodov00100% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Problem Set I For International Trade # Partial Solutions ... - CER-ETH PDFDocumento14 páginasProblem Set I For International Trade # Partial Solutions ... - CER-ETH PDFJGAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- pc1 Resuelta PDFDocumento15 páginaspc1 Resuelta PDFWilliam Vasquez SanchezAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- SSE 107 Macroeconomics SG 5Documento8 páginasSSE 107 Macroeconomics SG 5Aila Erika EgrosAinda não há avaliações

- Ryerson Finance 601 Test BankDocumento4 páginasRyerson Finance 601 Test BankKaushal BasnetAinda não há avaliações

- What Is Corporate Restructuring?: Any Change in A Company's:,, or That Is Outside Its Ordinary Course of BusinessDocumento22 páginasWhat Is Corporate Restructuring?: Any Change in A Company's:,, or That Is Outside Its Ordinary Course of BusinessRidhima SharmaAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Chapter 11: Public Goods and Common Resource Learning ObjectivesDocumento5 páginasChapter 11: Public Goods and Common Resource Learning ObjectivesGuru DeepAinda não há avaliações

- 40 Marketing Interview Questions and AnswersDocumento8 páginas40 Marketing Interview Questions and AnswersAnonymous C5MZ11rK13Ainda não há avaliações

- Materi 1 Engineering Economic DecisionsDocumento16 páginasMateri 1 Engineering Economic DecisionsnoixieAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Valuation - NotesDocumento41 páginasValuation - NotessreginatoAinda não há avaliações

- RF Bhansali Negative Interest RatesDocumento116 páginasRF Bhansali Negative Interest RatesOwm Close CorporationAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Sticky Prices Notes For Macroeconomics by Carlin & SoskiceDocumento13 páginasSticky Prices Notes For Macroeconomics by Carlin & SoskiceSiddharthSardaAinda não há avaliações

- Economics Questionnaire SampleDocumento2 páginasEconomics Questionnaire SamplekinikinayyAinda não há avaliações

- Chapter 11 PDFDocumento8 páginasChapter 11 PDFJulie HuynhAinda não há avaliações

- Property CyclesDocumento16 páginasProperty CyclesMarta NowakowskaAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Essay About GlobalizationDocumento5 páginasEssay About GlobalizationJackelin Salguedo FernandezAinda não há avaliações

- How To Record Opening and Closing StockDocumento5 páginasHow To Record Opening and Closing StockSUZANAMIKEAinda não há avaliações

- 2010 12 Applying A Risk Budgeting Approach To Active Portfolio ConstructionDocumento7 páginas2010 12 Applying A Risk Budgeting Approach To Active Portfolio Constructionjeete17Ainda não há avaliações

- (Catherine M. Price (Auth.) ) Welfare Economics PDFDocumento179 páginas(Catherine M. Price (Auth.) ) Welfare Economics PDFNino PapachashviliAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Chapter 1 Derivatives An IntroductionDocumento10 páginasChapter 1 Derivatives An Introductiongovindpatel1990Ainda não há avaliações

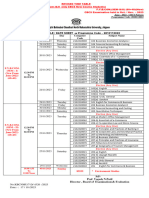

- Revised Time Table of FY-SY-TYBCom Sem I To VI New Old CBCS-CGPA Exam - To Be Held in Oct Nov-2023Documento5 páginasRevised Time Table of FY-SY-TYBCom Sem I To VI New Old CBCS-CGPA Exam - To Be Held in Oct Nov-2023Viraj SharmaAinda não há avaliações